Equinox Gold Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinox Gold Bundle

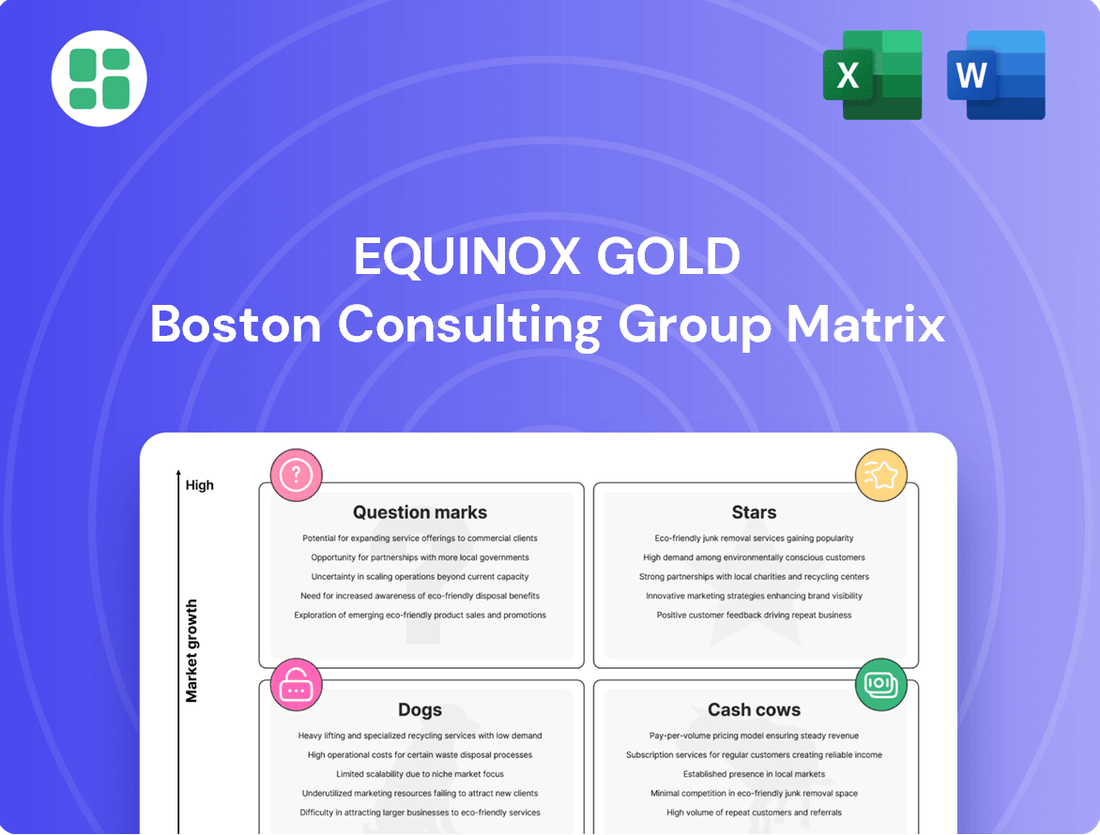

Curious about Equinox Gold's strategic positioning? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their market dynamics and unlock actionable growth strategies, purchase the full BCG Matrix report for a comprehensive quadrant-by-quadrant analysis and data-driven recommendations.

Stars

The Greenstone Mine, a key asset for Equinox Gold, commenced commercial production in November 2024. It is anticipated to become the company's largest and most cost-efficient operation.

Currently navigating a ramp-up phase that has experienced some initial delays, Greenstone holds substantial production potential, aiming for approximately 330,000 ounces annually at full capacity. This positions it as a future Star within Equinox Gold's portfolio.

Equinox Gold is diligently working through operational hurdles to realize Greenstone's full capabilities, with expectations for improved performance anticipated in the latter half of 2025.

The Valentine Gold Mine, now part of Equinox Gold following its merger with Calibre Mining, is poised for significant growth. First gold production is targeted for the end of Q3 2025, with a ramp-up expected through year-end and into early Q1 2026.

This Canadian asset, alongside Greenstone, is projected to contribute to an average annual production of 590,000 ounces once both mines reach full capacity. Its strategic location in a prime jurisdiction and its impending production status firmly place Valentine as a Star in the BCG matrix, indicating high growth potential.

The El Limon Mine Complex in Nicaragua is a shining example of a Star in Equinox Gold's portfolio. Recent exploration has been a game-changer, boosting mineral reserves by an astounding 700% since Equinox acquired the property.

With a substantial 100,000 meters of drilling planned for 2025, the company is aggressively targeting further expansion of the mineralized zones. This focused exploration strategy underscores El Limon's high growth trajectory and its increasing importance to Equinox Gold's overall reserve strength.

Strategic Growth Initiatives & Pipeline

Equinox Gold is actively pursuing strategic growth, with a clear objective to boost its annual gold production by roughly 500,000 ounces in the coming years. This expansion is primarily driven by a robust pipeline of development and enhancement projects across its existing assets.

Key initiatives fueling this growth include the planned underground expansion at the Aurizona mine and the progression of Phase 2 at the Castle Mountain mine. These projects are designed to unlock significant additional ounces from high-potential areas within the company's portfolio.

- Aurizona Underground Expansion: Targeting increased production and extended mine life.

- Castle Mountain Phase 2: Aiming to significantly ramp up output from this key asset.

- Overall Production Target: Equinox Gold is striving to become a top-quartile gold producer, with a long-term goal of exceeding 1 million ounces of annual production.

Post-Merger Combined Entity (Equinox Gold + Calibre)

The business combination with Calibre Mining, finalized in June 2025, has positioned Equinox Gold as a leading North American gold producer. This strategic move is projected to yield a pro forma full-year 2025 production of 785,000 to 915,000 ounces, significantly boosting its market presence.

This merger cultivates a more robust and diversified asset base, notably strengthened by two key Canadian operations. The combined entity now commands a substantial market share within the gold sector, a market anticipated for continued growth.

The ambition to surpass 1.2 million ounces of annual production once Greenstone and Valentine reach their full capacities underscores the Star classification for this post-merger entity.

- Enhanced Production Capacity: Pro forma 2025 production forecast of 785,000 to 915,000 ounces.

- Increased Market Share: Significant presence in the North American gold production landscape.

- Diversified Asset Portfolio: Anchored by two major Canadian assets, providing operational resilience.

- Future Growth Potential: Target of over 1.2 million ounces annually with full mine capacity.

The Greenstone Mine, now in commercial production as of November 2024, is poised to become Equinox Gold's largest and most efficient operation, targeting approximately 330,000 ounces annually at full capacity.

Similarly, the Valentine Gold Mine, acquired through the June 2025 merger with Calibre Mining, is set for first gold production by the end of Q3 2025, with a combined target of 590,000 ounces annually alongside Greenstone.

The El Limon Mine Complex has seen a remarkable 700% boost in mineral reserves due to aggressive exploration, with 100,000 meters of drilling planned for 2025 to further expand its high-growth potential.

These assets, along with strategic expansions at Aurizona and Castle Mountain, are driving Equinox Gold's ambition to increase annual production by 500,000 ounces, aiming for over 1.2 million ounces annually once full capacity is reached.

| Asset | Status | Projected Annual Production (Full Capacity) | Key Growth Driver |

|---|---|---|---|

| Greenstone Mine | Commercial Production (Nov 2024) | ~330,000 ounces | Operational ramp-up, cost efficiency |

| Valentine Gold Mine | First Gold Q3 2025 | ~260,000 ounces (post-merger contribution) | Merger synergy, prime jurisdiction |

| El Limon Mine Complex | Active Exploration | Growing reserves, significant drilling program | 700% reserve increase, 100k meters drilling in 2025 |

What is included in the product

The Equinox Gold BCG Matrix analyzes its mining assets by market share and growth potential, identifying Stars for investment and Dogs for divestment.

A clear BCG Matrix visual for Equinox Gold's assets, pinpointing areas needing strategic attention, alleviates the pain of resource allocation uncertainty.

Cash Cows

The Mesquite Mine in the United States has been a steady producer for Equinox Gold since 2018. It’s a mature asset that reliably generates cash flow, fitting the profile of a cash cow within the company’s portfolio.

While Mesquite isn't expected to see significant growth, its consistent output is crucial. For instance, in 2023, Mesquite contributed approximately 106,088 ounces of gold, demonstrating its stable operational performance and its role in funding other development projects for Equinox Gold.

The Aurizona Gold Mine in Brazil is a cornerstone of Equinox Gold's operations, functioning as a classic cash cow. This established open-pit mine has consistently delivered reliable gold production, solidifying its position as a mature asset with significant market share within the company's Brazilian ventures.

Aurizona's primary role is to generate substantial and stable cash flow for Equinox Gold. This consistent financial contribution is vital for supporting the company's overall stability and funding its investments in other areas, such as exploration and development projects.

The Fazenda Gold Mine, situated within Equinox Gold's Bahia Complex in Brazil, exemplifies a classic cash cow within the company's portfolio. This mature operating asset has consistently delivered a stable base of gold production, acting as a reliable engine for the company's overall output.

In 2023, Equinox Gold reported that Fazenda, along with the Santa Luz mine, formed the Bahia Complex, which collectively produced 140,700 ounces of gold. This steady performance is crucial for funding the company's growth initiatives and maintaining its operational stability.

RDM Gold Mine

The RDM Gold Mine in Brazil is a solid performer, often called a 'good little mine' for its consistent cash flow. It reliably produces about 55,000 ounces of gold annually, contributing steadily to Equinox Gold's portfolio.

Even though it's smaller and not as central as some of Equinox's other operations, RDM's dependable, lower-volume output and positive cash generation in a stable market segment firmly place it in the cash cow category.

The strategic emphasis on extending RDM's mine life, rather than pursuing aggressive expansion, highlights its primary function as a reliable cash generator for the company.

Key financial and operational highlights for RDM:

- Annual Production: Approximately 55,000 ounces of gold.

- Cash Flow Contribution: Generates positive cash flow, supporting overall company finances.

- Strategic Focus: Mine life extension rather than rapid growth, maximizing its cash-generating potential.

- Market Position: Operates within a stable market segment, ensuring predictable revenue.

Bahia Complex (Santa Luz & Fazenda)

The Bahia Complex, a consolidation of the Santa Luz and Fazenda mines, is positioned as a key cash generator for Equinox Gold. This strategic integration aims to streamline operations and enhance profitability from these established assets.

For 2025, the Bahia Complex has a production guidance of 125,000 to 145,000 ounces of gold. This forecast underscores the complex's role in delivering consistent output and contributing stable cash flows to the company's portfolio.

- Operational Efficiency: The combined operations of Santa Luz and Fazenda are designed to leverage synergies, improving overall efficiency.

- Production Guidance: A 2025 production target of 125,000 to 145,000 ounces highlights its expected contribution.

- Recovery Improvements: Efforts to enhance the RIL circuit at Santa Luz are crucial for boosting gold recoveries and profitability.

- Cash Generation Focus: The complex represents a mature segment of the portfolio, optimized for consistent cash generation.

Cash cows in Equinox Gold's portfolio are mature assets that consistently generate significant cash flow with limited need for further investment. These operations are vital for funding the company's growth initiatives and maintaining financial stability.

The Mesquite Mine in the US and the Aurizona and Fazenda mines in Brazil are prime examples, reliably contributing to Equinox Gold's overall production and financial health.

The RDM Gold Mine, though smaller, also fits this category due to its dependable output and positive cash generation in a stable market segment.

The Bahia Complex, encompassing Santa Luz and Fazenda, is strategically positioned as a key cash generator, with a 2025 production guidance of 125,000 to 145,000 ounces of gold.

| Mine | Location | 2023 Production (oz) | 2025 Guidance (oz) | BCG Category |

|---|---|---|---|---|

| Mesquite | USA | 106,088 | N/A | Cash Cow |

| Aurizona | Brazil | N/A | N/A | Cash Cow |

| Fazenda | Brazil | Part of Bahia Complex (140,700 oz total) | Part of Bahia Complex (125,000-145,000 oz total) | Cash Cow |

| RDM | Brazil | ~55,000 | N/A | Cash Cow |

| Bahia Complex (Santa Luz & Fazenda) | Brazil | 140,700 | 125,000-145,000 | Cash Cow |

Full Transparency, Always

Equinox Gold BCG Matrix

The Equinox Gold BCG Matrix preview you are viewing is the identical, fully finalized document you will receive upon purchase. This means no watermarks or placeholder text will be present in the downloaded file, ensuring you get a professional, ready-to-use strategic analysis.

Rest assured, the BCG Matrix report you see here is the exact same comprehensive analysis that will be delivered to you after your purchase. It's been meticulously prepared with expert insights and is formatted for immediate application in your business strategy discussions.

What you are previewing is the actual, unadulterated Equinox Gold BCG Matrix document that will be yours once the purchase is complete. You can expect the same level of detail and professional formatting, ready for immediate download and use in your strategic planning.

Dogs

The Los Filos Mine Complex in Mexico is currently facing significant hurdles, including community agreement issues that led to suspended operations in early 2025. This operational disruption and its exclusion from Equinox Gold's 2025 production guidance highlight its current status as a low-growth, low-market-share asset.

With high production costs when operational and ongoing uncertainty surrounding the renegotiation of agreements, Los Filos is a strong candidate for the 'Dog' category in the BCG Matrix. This classification reflects its potential to tie up capital without guaranteed returns, impacting overall portfolio efficiency.

Equinox Gold has strategically divested non-core assets in the past, exemplified by its involvement with Solaris Resources and the formation of i-80 Gold. These moves reflect a commitment to portfolio optimization.

While Equinox Gold currently focuses on its operating mines, any retained legacy assets that are very small, high-cost, or consistently underperform, contributing little to production or cash flow, would be classified as non-core or divested. These assets are typically prime candidates for future divestiture to enhance overall efficiency.

Any exploration properties held by Equinox Gold that have consistently underperformed, failing to deliver significant resource additions or development potential over extended periods, would fall into the Dogs category of the BCG Matrix. These assets consume capital without demonstrating a clear path to future growth or market share, representing a drain on resources.

Such properties would exhibit a low market share due to their lack of production and low growth prospects, as they are not contributing to the company's revenue or future potential. For instance, if Equinox Gold had an exploration project in 2024 that had been active for over five years with minimal new discoveries and no clear development plan, it would be a prime candidate for divestment.

Evaluating these underperforming assets for divestment is a strategic imperative. This allows Equinox Gold to reallocate capital and management focus towards exploration projects with higher potential for success, thereby optimizing the company's overall portfolio and maximizing shareholder value.

Mines with Persistent High Costs and Low Grades

Mines characterized by persistently high all-in sustaining costs (AISC) and low ore grades would be classified as Dogs in Equinox Gold's portfolio. These operations struggle to generate consistent profits, often acting as cash drains due to inherent geological or operational inefficiencies. For instance, if a mine’s AISC consistently exceeds $1,500 per ounce while its average grade hovers below 1.0 g/t, it signals a problematic asset.

Such assets, even if they continue to produce, offer minimal strategic value because their profitability is consistently hampered. This situation necessitates a rigorous review process, focusing on potential operational improvements or, in some cases, the difficult decision of closure.

- High AISC: Mines with AISC exceeding industry benchmarks, potentially over $1,500/oz in 2024, indicating high operating expenses relative to gold recovery.

- Low Grades: Operations with average ore grades significantly below the portfolio average, perhaps below 1.0 g/t, meaning more rock must be processed for the same amount of gold.

- Marginal Profitability: These mines may break even or incur losses, failing to contribute meaningfully to overall company profits or cash flow.

- Strategic Review: Assets are constantly evaluated for turnaround potential through cost reduction or grade improvement initiatives, or for divestment/closure if these are not feasible.

Legacy Infrastructure with High Maintenance

Legacy Infrastructure with High Maintenance refers to older processing facilities or equipment at mature mines that demand substantial capital for upkeep but offer little to no production growth or cost savings. These assets are essentially cash drains, consuming resources without generating proportional returns, thereby negatively impacting the company's overall financial health.

For instance, a mining operation with a processing plant built in the early 2000s might be experiencing frequent breakdowns, leading to increased downtime and higher repair costs. In 2024, such an asset could represent a significant portion of a company's maintenance budget, potentially exceeding 20% of its operating expenses without a clear path to improved output.

- Asset Classification: These are typically found in the Dogs quadrant of the BCG Matrix.

- Financial Drain: They consume significant capital expenditure for maintenance, often exceeding their contribution to revenue.

- Operational Impact: High maintenance needs can lead to increased operational disruptions and lower overall efficiency.

- Strategic Consideration: Companies must carefully evaluate the cost-benefit of continued investment versus decommissioning or replacement.

Assets classified as Dogs within Equinox Gold's portfolio are those with low market share and low growth prospects. These are typically underperforming mines, exploration properties that haven't yielded results, or legacy infrastructure with high maintenance costs and no growth potential. For example, a mine with persistently high all-in sustaining costs (AISC) above $1,500 per ounce and low ore grades below 1.0 g/t in 2024 would fit this description.

These assets often represent a drain on capital and management focus, failing to contribute meaningfully to profits or cash flow. Equinox Gold's strategy involves rigorously evaluating these underperformers for potential turnaround initiatives or, more commonly, divestment to reallocate resources to more promising ventures.

The Los Filos Mine Complex, facing community issues and excluded from 2025 guidance, exemplifies a Dog due to its operational disruptions and uncertain future. Similarly, exploration projects with years of inactivity and no clear development path are also prime candidates for this classification and potential divestiture.

Ultimately, managing these Dog assets is crucial for optimizing Equinox Gold's overall portfolio efficiency and maximizing shareholder value by focusing on core, high-potential operations.

Question Marks

The Castle Mountain Phase 2 expansion project is a key development for Equinox Gold, aiming to boost output from its low-grade gold deposit in California. This project, currently in the permitting phase within a challenging regulatory environment, signifies high growth potential but faces hurdles that keep its current market share low.

While Phase 1 operations have been modest, the Phase 2 expansion is positioned as a Star in the BCG matrix due to its significant growth prospects. However, the substantial capital required and the ongoing permitting process in California present considerable risks, meaning its success hinges on overcoming these challenges to avoid a potential shift to Dog status.

The Gold Rock project, situated in Nevada, is categorized as a growth project within Equinox Gold's portfolio, signifying a future development prospect. As it is not yet in production and likely in an early development or permitting phase, it currently holds no market share.

Its placement in the growth pipeline indicates substantial potential, but its ultimate success is contingent upon continued investment, exploration, and positive development outcomes, thus classifying it as a Question Mark.

Equinox Gold actively explores its existing properties to discover new gold deposits and extend the operational life of its mines. In 2024, the company continued this strategy, investing in early-stage exploration at several sites. These targets, while showing initial geological promise, are not yet proven economically viable and represent a significant cash outflow with no current revenue generation.

These early-stage exploration efforts fall into the question mark category of the BCG matrix. They hold the potential for high future growth if successful in delineating economically viable resources, but currently contribute nothing to Equinox Gold's market share and are purely cash consumers. For instance, exploration at the Castle Mountain project in California in 2024 focused on identifying new zones, representing this category.

Integration of Acquired Calibre Mining Assets (Beyond Valentine)

While Equinox Gold's Valentine Mine is a clear Star in its portfolio, other assets acquired from Calibre Mining, particularly exploration grounds, likely fall into the Question Mark category. These assets represent potential high-growth opportunities but currently have a low market share within Equinox's overall production profile. Significant investment is required to assess their viability and potential to become future Stars.

The integration of these acquired assets means Equinox Gold must strategically allocate capital to advance promising exploration projects. For instance, if Calibre brought undeveloped gold deposits with significant inferred resources, these would be prime candidates for Question Mark status. Equinox's 2024 strategy will heavily involve drilling and feasibility studies to de-risk these assets and determine their future role.

- Question Mark Assets: Exploration projects or early-stage development sites acquired from Calibre Mining, characterized by low current market share but high growth potential.

- Investment Focus: Equinox Gold needs to direct capital towards exploration, resource definition, and preliminary economic assessments for these Question Mark assets.

- Strategic Importance: Successful development of these assets is crucial for replenishing the production pipeline and ensuring long-term growth beyond existing Star assets like Valentine.

Future Potential Acquisitions/Partnerships

Equinox Gold's future potential acquisitions and partnerships fall into the Question Marks category of the BCG Matrix. These are opportunities that could drive significant growth, but they also carry substantial investment requirements and unproven success metrics.

The company is actively evaluating new projects and potential company acquisitions that align with its strategic expansion goals. These ventures, while promising high returns, necessitate considerable upfront capital and are inherently risky, with their ultimate performance yet to be determined within the existing portfolio.

- High Growth Potential: These opportunities are selected for their capacity to significantly expand Equinox Gold's operational footprint and revenue streams.

- Significant Investment Required: Acquiring or developing these assets demands substantial capital outlay, impacting immediate cash flow.

- Unproven Success: The ultimate profitability and operational success of these ventures are not yet established, placing them in a high-risk, high-reward bracket.

- Strategic Evaluation: Equinox Gold's management team is continuously assessing these potential growth avenues to determine their viability and strategic fit.

Equinox Gold's early-stage exploration projects and undeveloped acquisitions represent classic Question Marks. These ventures, while holding the promise of future growth, currently consume capital with no revenue generation and have a low market share. For instance, in 2024, the company continued exploration at Castle Mountain, aiming to delineate new resources, a key characteristic of this BCG category.

The strategic importance of these Question Marks lies in their potential to become future Stars, replenishing the company's production pipeline. Equinox Gold's 2024 capital allocation will be crucial in advancing these projects through drilling and feasibility studies to assess their economic viability and de-risk them for potential development.

The success of these Question Mark assets is paramount for Equinox Gold's long-term growth strategy, especially as existing Stars like the Valentine Mine mature. The company's ability to convert these exploration prospects into producing assets will be a key determinant of its future market position and shareholder value.

| Asset Category | Current Market Share | Growth Potential | Cash Flow | Strategic Role |

| Early-Stage Exploration (e.g., Castle Mountain 2024) | Very Low/None | High | Negative | Future Star Potential |

| Undeveloped Acquisitions (e.g., from Calibre Mining) | Low | High | Negative | Future Star Potential |

| Potential New Ventures/Partnerships | None | High | Negative | Strategic Expansion |

BCG Matrix Data Sources

Our Equinox Gold BCG Matrix is built on verified market intelligence, combining financial data from company filings, industry research, and official reports to ensure reliable, high-impact insights.