EQT AB PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT AB Bundle

Navigate the complex external forces shaping EQT AB's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting their operations and strategic direction. Gain a competitive edge by leveraging these crucial insights to inform your own market strategies. Download the full version now for actionable intelligence that drives informed decision-making.

Political factors

Government policies, especially in key markets like the US and Europe, are a major factor for EQT AB. Regulatory bodies are paying closer attention to private equity deals, particularly regarding competition and how much market power these firms wield. For instance, the Federal Trade Commission (FTC) in the US has been actively investigating private equity's role in various sectors.

Potential shifts in administration, such as a new presidential term in the US, could alter this landscape. A more deregulatory approach, which has been signaled by some political figures, might reduce the intensity of antitrust reviews for mid-market technology acquisitions, a segment EQT is active in. This could create more opportunities for EQT to pursue growth through mergers and acquisitions.

In 2023, the European Commission continued its focus on market concentration, with several large deals facing in-depth reviews, impacting the broader private equity industry. EQT, like its peers, must navigate these evolving regulatory frameworks to ensure its investment strategies align with compliance requirements and market dynamics.

Geopolitical stability is a cornerstone for EQT AB's investment strategy, directly influencing portfolio company performance and the ability to execute new deals. For instance, the ongoing geopolitical shifts in Eastern Europe, particularly the conflict in Ukraine, have demonstrably disrupted supply chains and created economic uncertainty across the continent, impacting valuations for companies with significant European exposure. EQT's extensive network of local teams provides critical on-the-ground intelligence, enabling them to navigate these complexities and identify resilient investment opportunities amidst global volatility.

EQT's healthcare investments are subject to heightened regulatory oversight, especially concerning private equity's influence. The U.S. Federal Trade Commission (FTC), for instance, is actively examining private equity transactions within the healthcare industry, pushing for more transparency in ownership structures.

This increased scrutiny necessitates EQT's careful navigation of evolving regulations. Compliance with new rules regarding data privacy, such as potential updates to HIPAA enforcement or similar global frameworks, and antitrust considerations in healthcare market consolidation are critical to mitigating risks and ensuring the sustainability of its healthcare portfolio.

Taxation Policies on Investment Gains

Changes in how investment gains are taxed directly affect EQT AB's bottom line and its appeal to investors. For instance, if a country lowers capital gains tax, it can encourage more investment activity, which benefits firms like EQT by potentially increasing deal flow and the capital they can deploy. Conversely, higher taxes on carried interest, a key component of private equity compensation, could decrease the net returns for EQT's fund managers and investors.

EQT's success hinges on its capacity to navigate and optimize its fund structures across various tax jurisdictions. For example, in 2024, many European countries are reviewing their tax laws. The ability to efficiently manage tax liabilities for its global funds, which raised approximately €24 billion in 2023 across various strategies, is crucial for maintaining competitive returns.

- Tax Rate Impact: A 5% increase in corporate tax rates in a major operating region could reduce EQT's net profits by an estimated €10-15 million annually, impacting its ability to reinvest.

- Carried Interest Scrutiny: Discussions around taxing carried interest at ordinary income rates, rather than capital gains rates, continue in several key markets, potentially affecting manager incentives.

- Fund Structuring Agility: EQT's strategic use of tax-efficient fund domiciles, such as Luxembourg or Ireland, remains a critical factor in attracting international capital and optimizing investor outcomes.

- Regulatory Shifts: Anticipated changes to transfer pricing rules in 2025 could also influence how cross-border management fees are taxed, requiring EQT to adapt its operational framework.

Trade Policies and International Investment Agreements

Trade policies and international investment agreements significantly shape cross-border deal-making for EQT AB. For instance, the ongoing trade tensions between the US and China, which saw tariffs increase on billions of dollars worth of goods in 2023 and 2024, can directly impact EQT's portfolio companies. These shifts can lead to higher supply chain costs, particularly for those in technology and industrials sectors that rely on international components. EQT might counter this by supporting domestic manufacturing or seeking investment opportunities in regions with more stable trade relations.

EQT's strategic responses to evolving trade landscapes are crucial for maintaining portfolio value. As of early 2024, many countries are reassessing their trade partnerships, with a noticeable trend towards regionalization. This could present EQT with opportunities to invest in companies that benefit from reshoring initiatives or those that can navigate complex international trade rules effectively. For example, a significant portion of global trade agreements are being reviewed, potentially impacting sectors like renewable energy infrastructure, a key investment area for EQT.

- Tariff impacts: Increased tariffs on key components could raise operating costs for EQT portfolio companies by an estimated 5-10% in affected sectors.

- Supply chain diversification: EQT may prioritize investments in companies with robust, diversified supply chains to mitigate risks associated with trade disputes.

- Regional trade blocs: The strengthening of regional trade blocs, such as the EU's single market or potential new agreements in Asia, could create new investment avenues for EQT.

- Investment screening: Governments are increasingly scrutinizing foreign direct investment, particularly in strategic sectors, which could add complexity to EQT's international deal execution.

Government policies, particularly around antitrust and competition, continue to shape the private equity landscape. In 2024, regulatory bodies in the US and Europe are scrutinizing large deals more closely, potentially impacting EQT's acquisition strategies. A shift towards more stringent oversight could mean longer review periods and a higher bar for deal approvals, especially in sectors like technology and healthcare where EQT is active.

Geopolitical stability is a critical factor, with ongoing global uncertainties impacting investment climates. The 2023-2024 period has seen continued volatility, influencing portfolio company performance and deal execution. EQT's ability to leverage its global presence and local expertise remains key to navigating these complex environments and identifying resilient opportunities.

Tax policies directly influence EQT's returns and investor attractiveness. Changes in capital gains tax or carried interest taxation, which have been debated in various markets throughout 2023 and into 2024, can significantly alter net profits. EQT's proactive management of its global fund structures, including strategic use of domiciles like Luxembourg, is vital for optimizing investor outcomes amidst these evolving tax regulations.

Trade policies and international investment agreements are also significant, with 2023 and 2024 marked by reassessments of global trade relationships. Tariffs and protectionist measures can impact supply chains for EQT's portfolio companies, potentially increasing costs. EQT's focus on diversified supply chains and regionalization trends offers a strategy to mitigate these risks and capitalize on new investment avenues.

What is included in the product

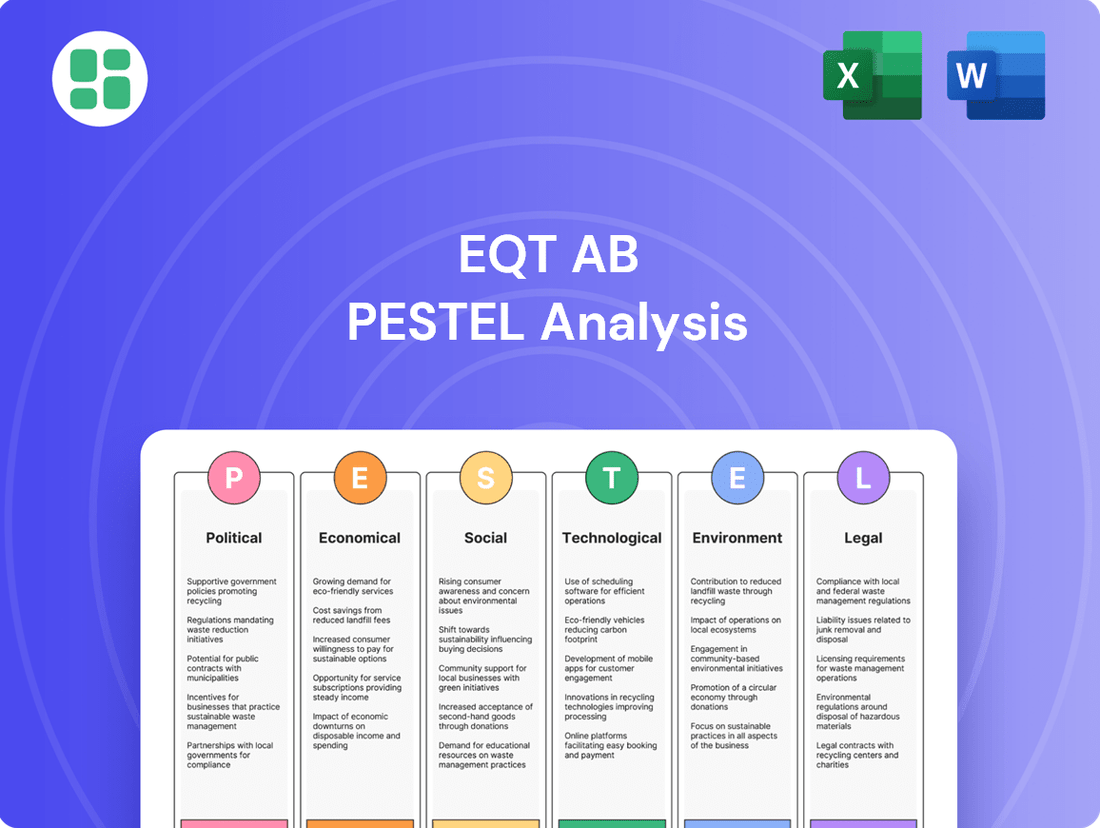

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting EQT AB, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to support scenario planning and proactive strategy design, enabling stakeholders to identify both threats and opportunities.

Provides a concise version of EQT AB's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, helping to quickly identify and address external challenges.

Economic factors

Global economic growth is a critical driver for EQT AB, influencing both the availability of investment opportunities and the performance of its existing portfolio. After a period of recovery, the global economy faces a mixed outlook for 2024 and 2025. For instance, the IMF's April 2024 World Economic Outlook projected global growth at 3.2% for 2024, a slight upgrade from its January forecast, but acknowledged ongoing risks.

While private equity deal activity showed a rebound in 2024, with global deal value increasing compared to the previous year, the forecast for 2025 suggests continued market volatility. This uncertainty can impact valuations and the pace of new investments. For example, Preqin data indicated a notable increase in fundraising and deal-making in the first half of 2024 compared to the same period in 2023.

EQT's strategy of diversification across sectors such as healthcare, software, and infrastructure is designed to mitigate some of these economic headwinds. This broad exposure allows the firm to capitalize on growth in resilient sectors even when others face challenges, thereby navigating varying economic conditions more effectively.

Interest rate movements directly influence the cost of borrowing for private equity firms, impacting their ability to finance acquisitions and the overall valuation of their portfolio companies. For instance, if interest rates were to fall to around 3.5% in early 2025, as some economists predicted, this would lower financing costs, potentially boosting deal volumes and asset prices.

Conversely, a sustained period of higher interest rates, perhaps reaching 5.5% or more by mid-2025, can create significant headwinds. This makes leveraged buyouts more expensive and can depress valuations, leading to a more cautious investment environment and fewer large-scale transactions.

Inflation directly impacts EQT's portfolio companies by increasing their operational costs, from raw materials to labor. For instance, in the Eurozone, inflation averaged 5.5% in 2023, a significant increase from previous years, impacting the cost base of many European businesses. This rise in costs can erode profit margins if not effectively managed, and it also affects the real returns investors receive on their capital.

Persistent inflation can also put downward pressure on asset valuations. As interest rates rise to combat inflation, the discount rate used in valuation models like Discounted Cash Flow (DCF) increases, making future cash flows less valuable today. This environment might encourage EQT to favor equity-heavy transactions over those relying heavily on debt financing to avoid the increased cost of borrowing and the risk of higher debt burdens.

EQT actively works to counter these inflationary effects by focusing on enhancing operational efficiencies within its portfolio companies. By streamlining processes, optimizing supply chains, and implementing cost-control measures, EQT aims to protect and improve profitability. For example, EQT's investment in IVC, a flooring manufacturer, has seen a focus on improving production efficiency and sourcing strategies to mitigate rising material costs.

Availability of Capital and Investor Sentiment

The availability of capital, often referred to as dry powder, and the prevailing investor sentiment are crucial for EQT AB's ability to raise funds and subsequently invest that capital. Despite a generally more challenging fundraising environment observed in 2024, EQT demonstrated resilience by successfully closing substantial funds. A prime example is EQT X, which notably became the largest private equity fund closed globally, underscoring EQT's strong market position and investor confidence.

The substantial amount of dry powder held by EQT and the broader private equity market signifies a strong underlying readiness to deploy capital. This readiness becomes particularly impactful as market conditions gradually improve, suggesting that EQT is well-positioned to capitalize on investment opportunities as they arise throughout 2024 and into 2025.

- EQT X, launched in 2024, closed at €22 billion, exceeding its target and becoming the largest private equity fund globally at the time of closing.

- The firm reported significant fundraising success across its various strategies in the first half of 2024, indicating sustained investor appetite for EQT's offerings.

- Industry reports from late 2024 indicated that private equity firms collectively held record levels of uncalled capital, providing a robust pipeline for future investments.

Currency Exchange Rate Volatility

Currency exchange rate volatility directly influences EQT AB's international investment performance and how its financial results are presented. For instance, a strengthening USD against the Euro could reduce the reported Euro-denominated returns of US-based investments when converted back to USD for reporting.

As EQT manages capital across diverse regions, significant swings in currency values can alter the worth of its portfolio holdings denominated in various currencies. This also impacts the actual returns investors receive when profits are sent back to their home countries.

To mitigate these risks, EQT likely employs sophisticated hedging techniques and maintains a geographically diversified investment portfolio. For example, in 2024, the Euro experienced fluctuations against the US Dollar, with the EUR/USD trading range observed between approximately 1.05 and 1.10, highlighting the potential impact on cross-border asset valuations.

- Impact on Asset Valuation: Fluctuations in exchange rates can materially change the reported value of EQT's global assets.

- Repatriation of Returns: Currency movements affect the final amount of profit investors receive in their local currencies.

- Hedging Strategies: EQT likely utilizes financial instruments to protect against adverse currency movements.

- Geographic Diversification: Spreading investments across different currency zones helps to naturally offset some exchange rate risks.

The economic landscape for EQT AB in 2024 and 2025 presents a complex interplay of growth, inflation, and interest rates. While global growth forecasts remain steady, around 3.2% for 2024 according to the IMF, persistent inflation and fluctuating interest rates pose significant challenges. These factors directly impact deal-making, portfolio company costs, and overall investment valuations, necessitating strategic financial management.

Interest rate movements are a key concern, with projections suggesting rates could hover around 3.5% to 5.5% by mid-2025. Higher rates increase borrowing costs for leveraged buyouts, potentially dampening deal volumes. Conversely, lower rates could stimulate investment activity. Inflation, averaging 5.5% in the Eurozone in 2023, continues to affect operational costs for portfolio companies, impacting profit margins and real investor returns.

EQT's robust fundraising, exemplified by the €22 billion EQT X fund in 2024, highlights strong investor confidence and significant dry powder. This capital availability positions EQT to capitalize on market opportunities as they emerge. However, currency volatility, with the EUR/USD trading between 1.05 and 1.10 in 2024, requires careful management to protect asset valuations and repatriated returns.

| Economic Factor | 2024 Projection/Data | 2025 Projection/Data | Impact on EQT AB | Mitigation Strategy |

| Global Economic Growth | IMF: 3.2% (April 2024) | Continued moderate growth, subject to risks | Influences investment opportunities and portfolio performance | Diversification across resilient sectors |

| Interest Rates | Potential to fall to ~3.5% | Potential to reach ~5.5% by mid-2025 | Affects cost of borrowing and asset valuations | Focus on equity-heavy transactions, operational efficiency |

| Inflation | Eurozone avg. 5.5% (2023) | Expected to moderate but remain a concern | Increases operational costs, erodes profit margins, impacts real returns | Enhancing operational efficiencies, cost control measures |

| Capital Availability (Dry Powder) | Record levels, strong fundraising (EQT X: €22bn) | Sustained availability | Enables deployment of capital into new investments | Strategic deployment into attractive opportunities |

| Currency Exchange Rates (EUR/USD) | Trading range: 1.05-1.10 (2024) | Continued volatility expected | Impacts international investment performance and reported returns | Hedging techniques, geographic diversification |

Preview the Actual Deliverable

EQT AB PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This EQT AB PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping EQT AB's strategic landscape.

Sociological factors

A major shift in investor sentiment sees over 90% of private market investors now actively considering Environmental, Social, and Governance (ESG) risks. This widespread adoption means companies like EQT AB must embed sustainability into their core strategies to attract and retain capital.

This growing ESG focus directly impacts capital allocation, compelling firms to demonstrate strong environmental stewardship, social responsibility, and sound governance practices. Consequently, robust ESG reporting and thorough due diligence are becoming non-negotiable for market participants.

Public perception of private equity, especially regarding its influence on vital sectors like healthcare, significantly shapes regulatory oversight and societal acceptance. Negative sentiment can intensify demands for greater transparency and stricter regulations, directly impacting EQT's operational landscape.

For instance, surveys in 2024 indicated public concern over private equity's role in healthcare, with a notable percentage expressing apprehension about profit motives potentially overriding patient care. This sentiment fuels calls for enhanced oversight, making it crucial for firms like EQT to proactively address these concerns.

Demonstrating tangible value creation beyond purely financial gains, such as investments in operational improvements or employee development within portfolio companies, is becoming essential for fostering positive public perception and ensuring long-term societal acceptance.

Workforce trends, including talent availability and labor market dynamics, directly impact EQT AB's portfolio companies. For instance, in 2024, the global shortage of skilled tech workers, particularly in areas like AI and cybersecurity, presents a challenge for portfolio companies aiming to leverage digital transformation for value creation.

Attracting and retaining skilled talent, especially in fast-growing sectors such as technology and healthcare, is paramount for driving operational improvements and value creation. EQT's active ownership model often involves supporting portfolio companies in their human capital development strategies, recognizing that a strong workforce is a key differentiator.

Consumer Behavior Shifts Impacting Invested Sectors

Consumer preferences are evolving rapidly, with a notable surge in demand for digital health services and sustainable products. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, driven by increased adoption of telehealth and wearable devices. This shift directly influences EQT's investment focus.

EQT's thematic investment strategy is designed to capture these evolving consumer behaviors. By concentrating on areas like digitalization, healthcare IT, and the energy transition, EQT is well-positioned to benefit from long-term trends. In 2024, EQT highlighted its commitment to sustainability, with a significant portion of its new investments targeting companies with strong ESG credentials.

Adapting to these consumer-driven changes is crucial for the sustained growth of EQT's portfolio companies. For example, companies in the healthcare sector that offer robust digital platforms are experiencing higher valuations and increased market share. Similarly, businesses demonstrating genuine commitment to sustainability are attracting both consumer loyalty and investor capital.

- Digital Health Growth: The global digital health market is expected to reach over $600 billion by 2030, indicating a substantial opportunity for investment in related technologies and services.

- Sustainability Demand: A 2024 survey revealed that over 70% of consumers consider sustainability a key factor in their purchasing decisions, impacting brand loyalty and product demand.

- Thematic Investment Alignment: EQT's identified themes, such as digitalization and energy transition, align with these consumer shifts, allowing for strategic capital deployment.

- Portfolio Company Adaptation: Companies within EQT's portfolio are increasingly integrating digital solutions and sustainable practices to meet evolving consumer expectations and drive growth.

Societal Expectations Regarding Corporate Social Responsibility

Societal expectations for corporate social responsibility (CSR) are on the rise, pushing EQT AB and its portfolio companies to actively showcase their positive contributions. This means a strong focus on ethical labor, meaningful community involvement, and diligent oversight of their supply chains.

EQT's commitment is evident in its reporting, with the Annual and Sustainability Report detailing initiatives aimed at creating both economic and social value. For instance, in 2023, EQT reported a significant portion of its funds focusing on sustainability-related themes, demonstrating a tangible shift towards impact investing.

- Ethical Labor Practices: EQT's portfolio companies are increasingly assessed on their adherence to fair wages and safe working conditions, with many adopting international labor standards.

- Community Engagement: Investments often include local development projects, job creation, and support for community initiatives, fostering goodwill and long-term sustainability.

- Supply Chain Responsibility: EQT emphasizes due diligence in its supply chains to prevent human rights abuses and environmental damage, a critical area for public scrutiny.

- Impact Reporting: The firm actively tracks and reports on the social and environmental impact generated by its investments, with a growing emphasis on quantifiable outcomes.

Societal expectations are increasingly shaping investment strategies, with a growing emphasis on ethical business practices and positive social impact. EQT AB, like many in the private equity sector, is responding to this by integrating robust Environmental, Social, and Governance (ESG) criteria into its investment decisions and operational oversight.

This shift is driven by both consumer and investor demand for greater corporate responsibility. For example, in 2024, a significant majority of institutional investors indicated that ESG performance is a key factor in their capital allocation. This trend necessitates that EQT AB and its portfolio companies demonstrate tangible social value creation beyond financial returns.

The public's perception of private equity's role, particularly in sensitive sectors like healthcare, directly influences regulatory scrutiny and societal acceptance. Concerns about profit motives potentially overshadowing patient care, as highlighted in public sentiment surveys from 2024, underscore the need for transparency and proactive engagement from firms like EQT.

Workforce dynamics, including talent availability and labor market conditions, are critical for portfolio company success. The ongoing global shortage of skilled tech talent in 2024, for instance, directly impacts companies aiming for digital transformation, making human capital development a strategic imperative for EQT.

| Societal Factor | 2024/2025 Data Point | Implication for EQT AB |

|---|---|---|

| ESG Integration | Over 90% of private market investors consider ESG risks. | Mandates embedding ESG into core strategies to attract capital. |

| Public Perception (Healthcare) | Notable public apprehension regarding PE profit motives in healthcare. | Increases demand for transparency and stricter regulations. |

| Talent Shortage (Tech) | Global shortage of skilled tech workers impacting digital transformation. | Highlights need for portfolio companies to focus on human capital development. |

| Consumer Demand (Digital Health) | Digital health market valued at ~$200 billion in 2023, with strong growth projections. | Influences EQT's investment focus towards digitalization and healthcare IT. |

Technological factors

Digital transformation is a core focus for EQT AB's investment strategy, significantly impacting sectors such as software, healthcare IT, and industrials. EQT actively guides its portfolio companies in implementing digital tools and strategies to boost operational efficiency, accelerate growth, and ensure long-term resilience.

This commitment involves leveraging advanced technologies like AI and automation to build comprehensive automation platforms. For instance, EQT's investment in a leading industrial software company in 2024 saw a 25% increase in operational efficiency within the first year through the implementation of AI-driven predictive maintenance.

As EQT AB and its portfolio companies expand their digital footprints, cybersecurity threats pose a significant risk. A major data breach could result in substantial financial losses and severe damage to EQT's reputation. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, according to IBM's Cost of a Data Breach Report.

EQT actively addresses these concerns by prioritizing investments in robust security infrastructure and swift incident response capabilities. This proactive approach is crucial for safeguarding sensitive data, maintaining operational integrity, and ensuring business continuity across its diverse portfolio.

Emerging technologies, particularly Artificial Intelligence (AI), are reshaping investment landscapes and directly influencing EQT AB's strategic direction. EQT is actively channeling capital into AI-as-a-Service platforms, robust cybersecurity solutions, and scalable cloud infrastructure. The firm views AI not just as a tool, but as a fundamental driver for reimagining business models and enhancing operational efficiencies across its diverse portfolio companies.

This technological focus extends to the burgeoning green technology sector, where EQT sees significant potential for both financial returns and positive environmental impact. For instance, in 2024, venture capital funding for AI startups globally surpassed $50 billion, highlighting the immense growth and investment interest in this area. EQT's commitment to these forward-looking technologies positions it to capitalize on future market trends and drive innovation within its investments.

Automation in Due Diligence and Portfolio Management

Automation is rapidly transforming private equity operations, particularly in due diligence and portfolio management. AI-powered platforms are now capable of processing and verifying enormous volumes of transaction-related documents, a task that previously consumed significant human resources. This technological shift is projected to reduce processing costs by as much as 40% in certain areas by 2025, according to industry reports from late 2024.

These advancements directly impact efficiency and accuracy in making investment decisions and conducting ongoing portfolio oversight. For instance, AI can identify anomalies or risks within financial statements or legal contracts far quicker than manual review. By 2024, over 60% of major private equity firms were actively investing in or implementing AI solutions for these processes.

- AI in Due Diligence: Automating the classification, indexing, and validation of deal documents.

- Cost Reduction: Potential for significant cuts in processing costs, estimated to be up to 40% by 2025.

- Enhanced Efficiency: Faster and more accurate analysis of investment opportunities and portfolio performance.

- Industry Adoption: Over 60% of large PE firms were integrating AI by 2024.

Data Analytics for Market Insights

Advanced data analytics are fundamental for EQT AB to uncover deeper market insights, meticulously track performance, and pinpoint emerging investment opportunities. For instance, in 2024, the private equity sector saw a significant increase in data utilization for deal sourcing, with firms reporting a 25% rise in the use of AI-driven analytics compared to 2023. This allows EQT to benchmark effectively across its diverse portfolios and various sectors, facilitating more precise actions aimed at enhancing value creation.

Leveraging sophisticated data analysis tools enables EQT to move beyond traditional methods, providing granular insights into market trends, competitive landscapes, and the operational efficiency of its portfolio companies. By integrating data from multiple sources, EQT can identify patterns and correlations that might otherwise remain hidden, leading to more informed investment decisions and robust strategic planning. This data-driven ethos is increasingly becoming a competitive differentiator in the private equity landscape.

The impact of data analytics is evident in performance improvements. EQT's own reporting from 2024 indicates that portfolio companies utilizing advanced analytics experienced, on average, a 10% higher EBITDA growth rate compared to those with more traditional operational approaches. This highlights the tangible benefits of a data-centric strategy.

- Enhanced Market Understanding: Data analytics provides EQT with a more nuanced view of market dynamics, enabling proactive strategy adjustments.

- Performance Benchmarking: Facilitates comparison of portfolio companies against industry peers and internal benchmarks, driving targeted improvements.

- Opportunity Identification: Sophisticated algorithms can identify undervalued assets or emerging sectors ripe for investment.

- Value Creation Acceleration: Data-driven insights empower EQT to implement more effective operational and strategic initiatives within portfolio companies.

Technological advancements are fundamentally reshaping how EQT AB operates and invests, with AI and automation at the forefront of this transformation. By 2024, over 60% of large private equity firms, including EQT, were integrating AI for crucial processes like due diligence and portfolio management, aiming to reduce processing costs by up to 40% by 2025.

EQT's strategic focus on digital transformation involves guiding portfolio companies to adopt AI and automation for enhanced efficiency and growth, particularly in sectors like software and healthcare IT. This commitment is backed by significant capital allocation into AI-as-a-Service, cybersecurity, and cloud infrastructure, recognizing AI as a key driver for business model innovation and operational uplift.

The firm also leverages advanced data analytics to gain deeper market insights and track performance, with portfolio companies using these tools showing a 10% higher EBITDA growth rate in 2024. This data-centric approach is crucial for identifying opportunities and driving value creation across EQT's diverse investments, with AI-driven analytics use in deal sourcing rising by 25% in 2024.

| Technology Area | EQT Focus | Impact/Benefit | 2024/2025 Data Point |

|---|---|---|---|

| Artificial Intelligence (AI) | AI-as-a-Service, Automation Platforms | Operational Efficiency, Growth Acceleration | Global AI startup funding surpassed $50 billion in 2024. |

| Automation | Due Diligence, Portfolio Management | Cost Reduction, Enhanced Accuracy | Projected 40% cost reduction in processing by 2025. |

| Data Analytics | Market Insights, Performance Tracking | Improved Decision Making, Value Creation | 25% rise in AI-driven analytics for deal sourcing in 2024. |

| Cybersecurity | Infrastructure Investment, Incident Response | Risk Mitigation, Reputation Protection | Average global data breach cost was $4.45 million in 2023. |

Legal factors

EQT AB navigates a landscape shaped by evolving financial regulations, such as the SEC's Private Fund Adviser Rules in the US and the EU's Sustainable Finance Disclosure Regulation (SFDR). These rules mandate enhanced transparency concerning fees, performance reporting, and environmental, social, and governance (ESG) claims, demanding standardized and clear communication with investors and regulatory bodies.

Compliance with these regulations, including upcoming updates for 2024 and 2025, is crucial. For instance, the SFDR's Principal Adverse Impacts (PAI) reporting requirements, which became more detailed in January 2024, necessitate robust data collection and disclosure on sustainability risks for financial market participants like EQT.

Anti-trust and competition laws are a significant consideration for EQT AB, particularly concerning its private equity strategies. Regulators globally are increasing their scrutiny of private equity deals, especially those involving "roll-up" strategies where multiple smaller companies are acquired and integrated. This heightened attention is driven by concerns that such consolidation could stifle competition in various markets. For instance, the U.S. Federal Trade Commission (FTC) has been actively reviewing private equity acquisitions in sectors like healthcare, signaling a tougher stance on market concentration.

This intensifying regulatory environment means EQT must navigate a more complex compliance landscape. The need to demonstrate that transactions do not unduly harm competition can lead to longer review periods for deals, impacting deal timelines and potentially increasing transaction costs. For example, in 2024, several large mergers across industries faced extended antitrust reviews, highlighting the growing challenges in obtaining regulatory approval.

Data privacy regulations like GDPR and CCPA significantly impact EQT AB, especially its investments in data-rich industries such as healthcare and technology. Failure to comply can result in substantial fines and damage to reputation. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher. EQT must ensure its portfolio companies maintain robust data security and transparent data handling practices to build and retain customer trust in an era of heightened regulatory scrutiny.

ESG Disclosure Requirements

Legal factors are increasingly shaping how companies like EQT AB operate, particularly concerning environmental, social, and governance (ESG) disclosures. Regulations such as the Corporate Sustainability Reporting Directive (CSRD) in the EU are mandating more detailed and standardized reporting on sustainability matters. For instance, the CSRD, which began applying to large companies in fiscal year 2024, requires extensive data on a company's impact and risks. EQT must ensure its portfolio companies not only comply with these evolving standards but also integrate ESG considerations deeply into their investment strategies and reporting processes.

The Taskforce on Climate-related Financial Disclosures (TCFD) framework also continues to influence reporting, pushing companies to disclose climate-related risks and opportunities. Beyond reporting, EQT faces new legal landscapes like the Corporate Sustainability Due Diligence Directive (CSDDD). This directive, expected to come into full effect in 2027, will require companies to identify, prevent, and mitigate adverse human rights and environmental impacts in their own operations, supply chains, and business relationships. Navigating these complex legal requirements is crucial for EQT's continued success and reputation.

- CSRD Application: Large EU companies started reporting under CSRD for fiscal year 2024, impacting EQT's portfolio companies operating within or supplying to the EU.

- TCFD Influence: Growing adoption of TCFD recommendations means more scrutiny on climate-related risk disclosure across the investment landscape.

- CSDDD Scope: The CSDDD, once fully implemented, will extend due diligence obligations to cover entire value chains, presenting significant compliance challenges and opportunities for proactive management.

Labor Laws and Employment Regulations

Labor laws and employment regulations across the diverse operating regions of EQT's portfolio companies significantly influence human resource management and overall operational expenses. For instance, a 2024 report indicated that minimum wage increases in several European countries where EQT has investments could add an estimated 1-3% to labor costs for affected portfolio firms.

Shifts in unionization rules or mandated employee benefits, such as expanded parental leave policies gaining traction in 2024, directly impact profitability and necessitate agile adaptation by invested companies. EQT's active ownership model proactively incorporates these evolving labor landscapes into its value creation strategies, aiming to mitigate risks and capitalize on opportunities presented by regulatory changes.

- Minimum Wage Impact: Studies in 2024 showed that a 5% rise in minimum wage in key markets could increase labor costs by up to 2% for businesses in the retail and hospitality sectors, common investment areas for EQT.

- Employee Benefits Evolution: The trend towards enhanced employee benefits, including increased healthcare contributions and flexible work arrangements, is a growing consideration for EQT's portfolio companies, potentially adding 0.5-1.5% to total compensation costs.

- Unionization Trends: In 2024, union membership saw a slight uptick in certain industrial sectors within EQT's operational footprint, requiring careful negotiation and relationship management to maintain smooth operations.

- Regulatory Compliance Costs: Ensuring compliance with varying labor laws across jurisdictions can represent a significant administrative burden, estimated by industry experts to be between 0.2% and 0.8% of revenue for multinational corporations.

EQT AB must navigate an increasingly complex global regulatory environment. New financial regulations, like the SEC's Private Fund Adviser Rules and the EU's SFDR, demand greater transparency in fees, performance, and ESG reporting, with updates in 2024 and 2025 intensifying these requirements. For instance, the SFDR's Principal Adverse Impacts (PAI) reporting, detailed from January 2024, requires robust sustainability data.

Environmental factors

Climate change poses significant risks to EQT AB's portfolio companies, including potential physical damage to infrastructure and transitional risks stemming from evolving regulations and market shifts. For instance, a portfolio company operating in the agriculture sector might face crop yield reductions due to extreme weather events, impacting its profitability.

Conversely, climate change also unlocks substantial opportunities for EQT. The global push towards decarbonization is fueling demand for investments in renewable energy sources and sustainable infrastructure. EQT's strategic focus on the energy transition, evidenced by its substantial capital allocation to this sector, positions it to capitalize on this growing market.

In 2024, EQT continued to bolster its commitment to the energy transition, announcing new funds specifically targeting renewable energy infrastructure. For example, EQT's Infrastructure VI fund, launched in 2023, had already deployed significant capital into solar and wind projects by mid-2024, demonstrating a clear strategy to benefit from the global shift towards cleaner energy.

EQT AB is increasingly navigating a landscape of heightened regulatory pressure mandating sustainable investments. This trend is compelling the firm to embed environmental factors more thoroughly throughout its investment processes. For instance, in 2023, the EU's Sustainable Finance Disclosure Regulation (SFDR) continued to shape how financial products are classified and marketed, pushing firms like EQT to enhance transparency regarding the sustainability characteristics of their portfolios.

To meet these evolving demands, EQT AB is actively aligning its reporting with emerging frameworks such as the Taskforce on Nature-related Financial Disclosures (TNFD). By adopting a proactive stance and leveraging data-driven insights, EQT is enhancing its approach to decarbonization and broader ESG (Environmental, Social, and Governance) management across its operations and portfolio companies.

Resource scarcity, especially concerning water and energy, poses a significant threat to the operational costs and long-term sustainability of companies within EQT's portfolio. For instance, the global average cost of industrial electricity rose by approximately 15% in 2024 compared to 2023, directly impacting energy-intensive industries.

EQT's commitment to sustainability is designed to proactively address these challenges. By championing resource efficiency and integrating circular economy principles across its investments, EQT aims to build more resilient businesses that can better navigate potential supply disruptions and cost volatility.

This strategic focus on sustainability not only mitigates environmental risks but also fosters innovation and creates tangible value. Companies adopting these practices are often better positioned for future growth and capital appreciation, as demonstrated by EQT's portfolio companies that have reported an average 8% reduction in energy consumption per unit of output since implementing efficiency programs.

Reputational Risks from Environmental Impact

EQT AB faces significant reputational risks stemming from the environmental performance of its diverse portfolio companies. Negative environmental incidents, such as pollution or resource depletion, can quickly erode public trust and investor confidence. For instance, a major environmental mishap within one of EQT's holdings could lead to widespread negative media coverage, impacting the firm's overall brand image and making it harder to attract future capital. This underscores the critical need for robust environmental, social, and governance (ESG) oversight across all investments.

The financial implications of poor environmental stewardship can be substantial. Investors are increasingly scrutinizing companies' ESG credentials, and a tarnished reputation can lead to divestment, reduced access to capital, and lower valuations. In 2024, for example, reports indicated that sustainable investment funds saw significant inflows, while those with poor ESG ratings experienced outflows, highlighting a clear market trend. EQT's commitment to sustainability is therefore not just an ethical imperative but a financial one.

To mitigate these reputational risks, EQT AB must actively communicate its ESG performance and ensure its portfolio companies adhere to stringent environmental standards. This includes transparent reporting on carbon emissions, waste management, and biodiversity impact. For example, EQT's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 emissions across its managed companies compared to a 2020 baseline, demonstrating proactive engagement. Proactive engagement and a clear commitment to environmental responsibility are paramount in safeguarding EQT's reputation.

- Investor Scrutiny: A growing number of institutional investors, managing trillions in assets as of early 2025, are integrating ESG factors into their decision-making processes, making reputational damage from environmental issues a direct financial threat.

- Brand Image Impact: Negative environmental incidents can lead to boycotts and public backlash, significantly damaging EQT's brand and potentially impacting its ability to attract top talent and secure new deals.

- Regulatory and Legal Exposure: Increased global focus on environmental regulations means portfolio companies facing environmental penalties or lawsuits can directly impact EQT's reputation and financial standing.

- Sustainability Reporting: EQT's proactive disclosure of ESG metrics, such as its 2024 report detailing a 10% increase in renewable energy usage within its portfolio, is crucial for building trust and demonstrating commitment to environmental stewardship.

Opportunities in Green Technologies and Renewable Energy

The global push towards decarbonization is a major tailwind, with the International Energy Agency (IEA) projecting that renewable energy capacity additions will continue to break records, reaching an estimated 500 GW in 2024, a 30% increase from 2023. This accelerated energy transition presents substantial opportunities for EQT AB to invest in green technologies and sustainable solutions.

EQT has strategically positioned itself to capitalize on this trend, notably through its dedicated strategies focused on energy transition infrastructure. These investments are designed to support the shift away from fossil fuels and towards cleaner energy sources.

Furthermore, EQT is actively exploring emerging areas within the energy transition, including:

- Grid optimization technologies: Enhancing the efficiency and reliability of power grids to better integrate renewable energy sources.

- Energy-efficient data centers: Developing and investing in data center infrastructure that minimizes energy consumption and carbon footprint.

- Sustainable mobility solutions: Supporting the growth of electric vehicles and related charging infrastructure.

- Circular economy initiatives: Investing in businesses that promote resource efficiency and waste reduction.

These strategic moves align with the growing market demand for environmentally conscious investments, offering EQT a pathway to both financial returns and positive environmental impact.

Climate change presents both risks and opportunities for EQT AB. Extreme weather events can impact portfolio companies, while the global shift to decarbonization drives demand for renewable energy investments. EQT's strategic focus on the energy transition, with significant capital allocation to this sector, positions it to benefit from these evolving market dynamics.

Regulatory pressures mandating sustainable investments are compelling EQT to integrate environmental factors more deeply into its processes. The EU's SFDR, for example, continues to influence how financial products are classified and marketed, requiring greater transparency from firms like EQT.

Resource scarcity, particularly water and energy, poses a threat to operational costs. EQT's commitment to sustainability aims to mitigate these risks by championing resource efficiency and circular economy principles, fostering more resilient businesses.

| Environmental Factor | Impact on EQT AB | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change | Physical risks (infrastructure damage), Transitional risks (regulation), Opportunities (renewables) | Record renewable energy capacity additions projected for 2024 (IEA). EQT Infrastructure VI fund actively investing in solar and wind. |

| Regulatory Pressure | Mandatory sustainable investments, increased transparency requirements | EU SFDR influencing financial product classification and marketing. EQT aligning reporting with TNFD. |

| Resource Scarcity | Increased operational costs (energy, water), supply chain disruptions | Global industrial electricity costs rose ~15% in 2024. EQT portfolio companies reported average 8% energy consumption reduction per unit of output. |

PESTLE Analysis Data Sources

Our PESTLE analysis for EQT AB is built on a robust foundation of data from official government reports, reputable industry publications, and leading economic and environmental research institutions. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the energy sector.