EQT AB Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT AB Bundle

Curious about EQT AB's strategic positioning? This glimpse into their BCG Matrix reveals how their portfolio stacks up, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix report for a detailed breakdown and actionable insights to optimize EQT AB's market performance.

Stars

EQT's infrastructure funds, exemplified by EQT Infrastructure VI, are firmly positioned as stars within the BCG framework. This fund recently achieved a significant milestone, closing at its hard cap of €21.5 billion, underscoring its substantial market share and high growth potential.

The success of EQT Infrastructure VI highlights these funds' leadership in the infrastructure investment space. They attract considerable investor capital, directly boosting EQT's fee-generating assets and demonstrating strong market confidence in their strategy and execution.

Focusing on critical sectors such as digital infrastructure and the energy transition, these funds are tapping into powerful secular growth trends. This strategic alignment ensures sustained expansion and reinforces their dominant market position, making them a key driver of EQT's overall performance.

The Private Capital Asia segment, exemplified by BPEA Private Equity Fund IX, showcases EQT's robust standing in the Asian private equity landscape. This fund's impressive fundraising, surpassing $10 billion in commitments, underscores EQT's significant market penetration and growth trajectory in the region.

Asia represents a key growth frontier for private equity, and EQT's established expertise and expanding operational footprint position its Asia-focused funds to capture a substantial market share. These investments are vital for diversifying EQT's global portfolio and fueling its long-term expansion.

EQT AB's healthcare investments are firmly positioned as a Star in its BCG Matrix. The firm actively pursues thematic opportunities within healthcare, evidenced by strategic moves like the launch of EQT Healthcare Growth. This focus is further solidified by recent acquisitions, including Europa Biosite and Adalvo, demonstrating EQT's commitment to expanding its footprint in this vital sector.

The healthcare market itself is characterized by robust, sustained growth and inherent resilience, making it an attractive area for investment. EQT's operational strategy, which emphasizes active ownership and a keen focus on digitalization and service enhancements within healthcare companies, provides a significant competitive advantage. This approach allows EQT to capture and grow market share within this specialized and dynamic industry.

Technology and Digitalization-focused Funds

EQT's focus on technology and digitalization is a key driver of its growth, with significant investments in software and tech-enabled businesses. The firm's strategy leverages megatrends like digital transformation to identify and capitalize on high-potential companies.

Recent transactions highlight this commitment. EQT's sale of a minority stake in IFS at a €15 billion valuation underscores the value creation in enterprise software. Additionally, the acquisition of Fortnox, a leading cloud-based business software provider in the Nordics, further strengthens EQT's position in the digitalization space.

- Technology and Digitalization Funds: EQT actively invests in funds dedicated to technology, digitalization, and software companies, recognizing their substantial growth potential.

- Strategic Acquisitions: The acquisition of Fortnox exemplifies EQT's strategy to secure leading positions in rapidly expanding digital markets.

- Valuation Success: The €15 billion valuation achieved in the IFS stake sale demonstrates EQT's ability to generate significant returns through strategic investments in technology.

- Market Positioning: These initiatives ensure EQT maintains a robust presence in a dynamic market driven by continuous technological advancement.

Global Private Wealth Initiatives

EQT's strategic push into the private wealth sector is demonstrating significant momentum. The firm's introduction of evergreen investment vehicles, such as EQT Nexus Infrastructure, and its plans for U.S.-based evergreen offerings highlight this segment as a key growth engine, capturing a larger market share.

This expansion is crucial for EQT as it diversifies its investor base and capital streams. By catering to the rising demand for alternative investments from both individual and institutional investors, EQT is positioning itself for consistent, large-scale capital raising activities in the coming years.

- EQT Nexus Infrastructure launched as a flagship evergreen product.

- U.S. evergreen products are planned, indicating a geographic expansion.

- Private wealth segment is identified as a high-growth area for EQT.

- Broadened client base and capital sources are direct benefits of this strategy.

EQT's infrastructure funds are clear stars, with EQT Infrastructure VI reaching its €21.5 billion hard cap. This success reflects strong investor demand and EQT's leadership in infrastructure, driving fee-generating assets and market confidence.

The firm's strong presence in Asia, exemplified by BPEA Private Equity Fund IX surpassing $10 billion in commitments, highlights significant market penetration and growth potential in this key region.

EQT's healthcare investments, including the launch of EQT Healthcare Growth and acquisitions like Europa Biosite, position it as a star in a resilient and growing market. Its active ownership strategy, focusing on digitalization, provides a competitive edge.

Investments in technology and digitalization, such as the IFS stake sale at a €15 billion valuation and the Fortnox acquisition, demonstrate EQT's ability to capitalize on digital transformation trends and generate substantial returns.

The expansion into private wealth, with offerings like EQT Nexus Infrastructure and planned U.S. evergreen products, is a strategic move to diversify capital sources and capture a larger market share in alternative investments.

What is included in the product

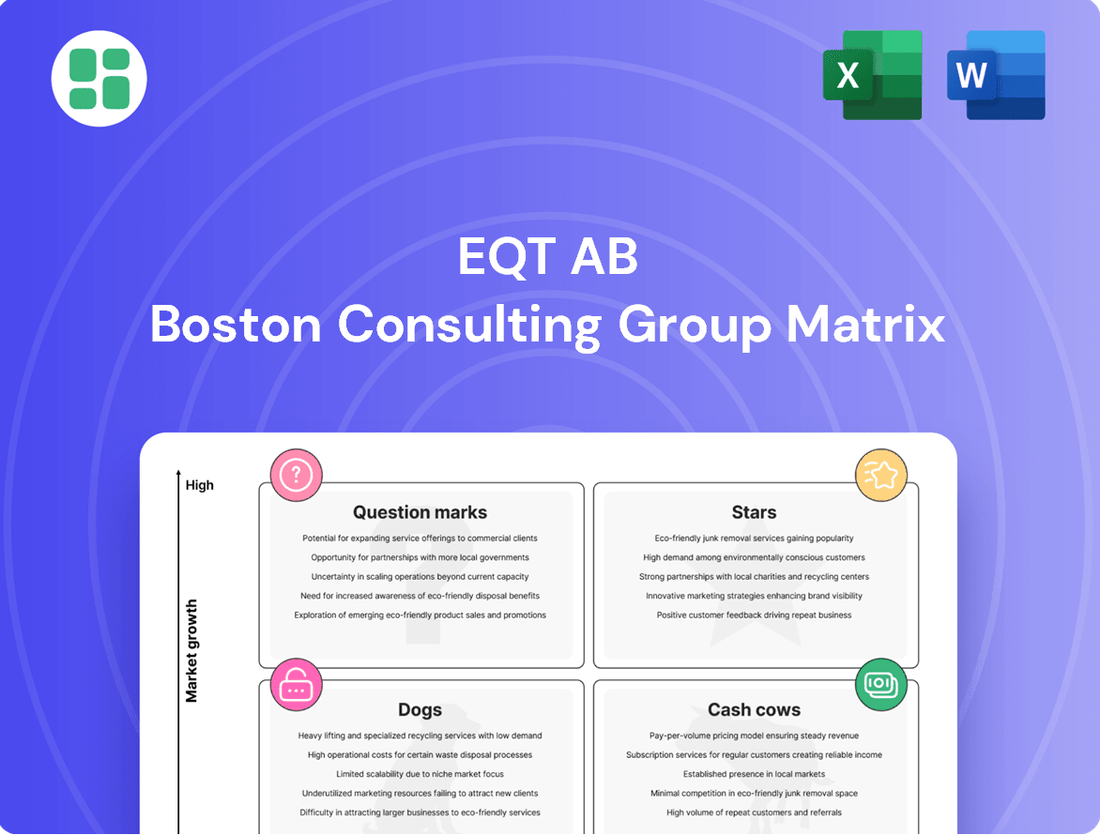

EQT AB's BCG Matrix analysis identifies Stars for growth, Cash Cows for stable returns, Question Marks for potential investment, and Dogs for divestment.

Clear visualization of EQT AB's portfolio, simplifying strategic decision-making.

Cash Cows

Mature private equity funds, exemplified by EQT VIII, are prime examples of cash cows within the BCG framework. These funds have successfully navigated their investment lifecycle, with notable realizations including a partial sale of IFS and a complete exit from Karo Healthcare.

This maturity signifies a strong competitive advantage, allowing EQT VIII to now focus on harvesting returns. The fund is likely generating substantial carried interest and investment income, requiring minimal new capital deployment.

EQT's core infrastructure assets, often in essential services within mature markets, are prime examples of cash cows. These investments, like their stake in the German energy grid operator Gasunie, consistently generate predictable cash flows. For instance, in 2023, EQT's infrastructure segment reported strong performance, contributing significantly to the firm's overall fee-generating AUM.

EQT AB's successful exits, such as Nord Anglia Education and EdgeConneX, exemplify the realization of cash cow potential, generating substantial capital gains. These divestments, like the 2022 sale of EdgeConneX for an estimated €2.5 billion, provide crucial liquidity for EQT's new investment initiatives and distributions to its shareholders.

Management Fee-Generating Assets Under Management (FAUM)

EQT's fee-generating assets under management, or FAUM, stood at an impressive €141 billion by the first half of 2025. This significant pool of capital is a cornerstone of EQT's financial strength, functioning as a reliable cash cow for the firm.

These assets are crucial because they generate steady management fees. This revenue stream remains consistent, largely insulated from the ups and downs of market performance. It provides EQT with a predictable income to manage its day-to-day operations and invest in future growth opportunities.

- €141 billion: EQT's total fee-generating assets under management as of H1 2025.

- Stable Revenue: FAUM provides a consistent management fee income stream.

- Operational Funding: These fees cover operational costs and support new ventures.

- Resilience: The revenue generated is largely independent of market volatility.

Established Real Estate Logistics Funds (e.g., EQT Exeter)

EQT Exeter's established logistics real estate funds, such as those holding mature, income-producing assets like the Northern California logistics portfolio acquired in late 2023, are prime examples of cash cows within the EQT AB BCG Matrix. These portfolios benefit from the logistics sector's stable rental income and consistently high occupancy rates, which are characteristic of mature market segments.

The focus for these cash cow assets shifts from aggressive expansion to optimizing existing operations and generating consistent cash flow. While the broader logistics market continues to see growth, these established funds tap into the steadier, more predictable revenue streams.

- Mature Logistics Portfolios: EQT Exeter's established funds, like the one holding assets from the Northern California acquisition, are characterized by stable rental income and high occupancy.

- Reduced Reinvestment Needs: Unlike high-growth segments, these mature logistics assets require less capital for aggressive new development, allowing for significant cash generation.

- Consistent Cash Flow: The predictable nature of rental income from these established properties makes them reliable sources of cash for the broader EQT AB portfolio.

EQT's established infrastructure funds, holding mature assets like stakes in energy grids, are key cash cows. These investments, such as their holding in Gasunie, generate consistent and predictable cash flows, a hallmark of mature, stable businesses. This reliable income stream is vital for EQT's overall financial health.

The firm's substantial fee-generating assets under management, reaching €141 billion by H1 2025, also function as cash cows. These assets provide a steady stream of management fees, insulating EQT from market volatility and funding daily operations. This consistent revenue is a bedrock of EQT's financial stability.

Mature logistics real estate portfolios, like those managed by EQT Exeter, represent another significant cash cow. These established properties benefit from stable rental income and high occupancy rates, delivering predictable returns with minimal need for aggressive reinvestment. This allows for efficient cash generation.

| Asset Type | Example | BCG Category | Key Characteristic | Financial Impact |

|---|---|---|---|---|

| Mature Private Equity Funds | EQT VIII | Cash Cow | Harvesting returns, minimal new capital | Substantial carried interest, investment income |

| Core Infrastructure | Gasunie stake | Cash Cow | Predictable, stable cash flows | Significant contribution to fee-generating AUM |

| Fee-Generating AUM | Total FAUM | Cash Cow | Consistent management fee income | €141 billion (H1 2025), covers operational costs |

| Established Logistics Real Estate | Northern California portfolio | Cash Cow | Stable rental income, high occupancy | Reliable cash flow generation |

Preview = Final Product

EQT AB BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully completed report you will receive immediately after completing your purchase. This means no watermarks, no demo content, and no missing sections – just the comprehensive, professionally formatted analysis ready for your strategic decision-making. You can be confident that the insights and structure you see now are precisely what will be delivered to you, enabling immediate application for your business planning and competitive strategy.

Dogs

Certain earlier private capital vintages, particularly those from the 2018-2020 period, are exhibiting signs of underperformance. While a substantial portion of investments within these funds have been realized, some segments are showing modest returns, falling short of initial projections. For instance, EQT's own reports from late 2023 indicated that a few of its older funds, while profitable overall, had specific portfolio companies that did not meet internal rate of return (IRR) targets, impacting the blended performance.

Legacy niche investments with limited growth, often termed 'Dogs' in the BCG matrix, represent older assets within EQT's portfolio that no longer fit its forward-looking growth themes. These might be in sectors experiencing stagnation or decline, offering minimal potential for future expansion. For instance, a small stake in a traditional manufacturing firm facing obsolescence, even if profitable, would likely be classified here if it doesn't align with EQT's focus on digital transformation or sustainability.

EQT AB has strategically divested assets that were underperforming or no longer aligned with its core strategy. These actions, while not always explicitly labeled as such by EQT, effectively place them in the 'Divested or Fully Exited Underperforming Assets' category of a BCG matrix. For instance, in 2023, EQT completed the sale of its stake in IFS, a software company, which was part of its portfolio but no longer a strategic priority, freeing up significant capital.

By shedding these lower-growth, lower-market-share holdings, EQT enhances its overall portfolio health and financial flexibility. This proactive approach allows the firm to redeploy capital into more promising growth areas. For example, capital realized from previous divestments has been channeled into new investments, such as its significant backing of the cybersecurity firm, Rapid7, in late 2023.

Less Scalable or Niche Geographies

EQT AB's strategy prioritizes global scale and thematic investments, meaning that smaller, isolated, or stagnant regional markets are less appealing. Historical investments in geographies or highly specific local markets where EQT has not achieved significant scale, or where growth prospects have diminished, fall into this category. These niche geographies represent less scalable opportunities within EQT's broader investment framework.

For example, while EQT has a strong presence in major European and North American markets, investments in highly localized or emerging markets with limited potential for expansion might be classified here. The firm’s focus on sectors like technology, healthcare, and infrastructure globally means that regional plays without a clear path to scale are less likely to be prioritized. As of early 2024, EQT's commitment to its core strategies means that resources are directed towards areas offering greater potential for significant returns through scale.

- Niche Markets: Geographies or local markets where EQT's investment size does not allow for significant influence or operational leverage.

- Diminished Growth Prospects: Regions experiencing economic stagnation or facing structural challenges that limit future investment upside.

- Strategic Misalignment: Investments that do not align with EQT's overarching themes or global scale objectives.

Discontinued Fund Initiatives (e.g., US Multifamily fund initiative)

The discontinuation of initiatives such as the US Multifamily fund initiative by EQT AB clearly places it within the 'Dog' quadrant of the BCG Matrix. This strategic move indicates that the fund likely experienced underperformance or failed to align with EQT's overarching growth and profitability objectives. Such ventures, often characterized by low market share in slow-growing or declining markets, are typically divested or wound down to reallocate resources to more promising areas.

Discontinued efforts like the US Multifamily fund represent ventures that struggled to gain significant market traction or achieve their targeted market share. These initiatives often operate in mature or saturated markets with limited potential for substantial expansion, making them less attractive for continued investment. EQT's decision to cease these operations underscores a commitment to optimizing its portfolio by exiting segments that are not contributing positively to overall performance or strategic direction.

- Underperformance: The US Multifamily fund likely demonstrated weak returns or failed to meet projected financial targets, a common characteristic of 'Dog' category assets.

- Low Market Share: In the context of the multifamily real estate sector, the fund may have struggled to capture a significant portion of the market, especially in a competitive landscape.

- Strategic Reallocation: Discontinuing such initiatives allows EQT to redirect capital, management attention, and expertise towards business units or funds with higher growth potential and market share, thereby improving overall portfolio efficiency.

- Market Dynamics: The decision may also reflect shifts in market conditions or regulatory environments within the US multifamily sector that made the initiative less viable.

Dogs in EQT AB's portfolio represent legacy investments with limited growth potential and market share. These are often older assets that no longer align with EQT's strategic focus on global scale and thematic investments. For instance, investments in niche geographies or stagnant sectors, lacking significant expansion prospects, are categorized as Dogs. EQT's proactive divestment strategy aims to shed these underperforming assets, thereby enhancing portfolio health and freeing up capital for more promising opportunities.

The discontinuation of initiatives like the US Multifamily fund clearly illustrates EQT's approach to managing 'Dogs'. This fund likely faced underperformance and failed to gain substantial market traction, leading to its cessation. Such moves are crucial for reallocating resources to areas with higher growth potential, as seen with EQT's increased investment in cybersecurity firms in late 2023.

| Category | Description | EQT AB Example/Context |

|---|---|---|

| Dogs | Low market share, low growth | Legacy niche investments, US Multifamily fund |

| Characteristics | Stagnant sectors, limited scalability, diminished growth prospects | Traditional manufacturing stakes, localized regional plays |

| Strategic Action | Divestment, discontinuation, resource reallocation | Sale of IFS stake, focus on tech/healthcare/infrastructure |

Question Marks

EQT XI, the latest flagship private equity fund from EQT AB, can be viewed as a Question Mark within the BCG Matrix framework. Launched with an ambitious target fund size of €23 billion, it operates within the high-growth private equity market.

As a newly launched fund, EQT XI's market share is inherently low, and its future performance and ability to capture significant market share are still developing. This position necessitates substantial capital investment to establish its presence and prove its investment strategy.

The EQT Transition Infrastructure fund, currently in its fundraising phase, is positioned as a Question Mark within the BCG framework. This classification stems from its operation in the rapidly expanding energy transition sector, a domain characterized by high growth potential but also significant investment needs and unproven market dominance.

The fund's strategic objective is to capitalize on the global shift towards sustainable energy solutions. However, as it actively builds its portfolio and seeks to establish a strong market presence, it necessitates substantial ongoing investment to support its growth and demonstrate its capacity for generating competitive returns. This stage is critical for proving its long-term viability and market leadership.

EQT AB is actively exploring new evergreen vehicles, particularly US-domiciled products, to tap into the burgeoning private wealth market. These offerings, like the planned EQT Nexus Infrastructure for private wealth, represent a strategic move into a high-growth segment.

While these initiatives are in their early stages, they aim to capture significant inflows and scale distribution networks. The private wealth market is a substantial opportunity, with global private wealth projected to reach $103 trillion by 2025, according to Statista.

EQT Healthcare Growth Strategy (Early Stages)

EQT's dedicated Healthcare Growth strategy, while operating within the high-growth healthcare sector, is currently classified as a Question Mark within the BCG matrix. This is due to its nascent stage in fundraising and portfolio development. As of early 2024, EQT AB has been actively raising capital for this focused strategy, aiming to replicate its success in other sectors by targeting innovative healthcare companies.

The strategy's placement as a Question Mark reflects its potential for significant future growth, mirroring the overall strong performance of healthcare investments which are generally considered Stars for EQT. However, the specific sub-strategy needs time to build a robust track record and demonstrate consistent returns. The firm's commitment to this area is evident in its ongoing efforts to deploy capital into promising healthcare businesses, seeking to capitalize on favorable market trends like an aging global population and advancements in medical technology.

- Sector Focus: Targeting high-growth segments within healthcare, including digital health, medtech, and specialized services.

- Fundraising Stage: Actively raising capital for its dedicated Healthcare Growth fund, indicating early-stage deployment.

- Market Potential: Leverages the strong underlying growth drivers of the global healthcare industry.

- Strategic Importance: Represents EQT's deliberate expansion into a sector identified for future value creation.

Early-Stage Venture Capital Investments

EQT Ventures, a significant player in the venture capital landscape, actively deploys capital into early-stage companies. Despite raising substantial funds, such as its $1.3 billion venture fund, these investments are inherently high-risk, high-reward opportunities. Individual early-stage portfolio companies typically begin with a low market share, demanding considerable investment to foster growth and achieve scalability. Successful ventures in this category have the potential to transition into future market leaders or 'Stars' within the BCG framework.

In 2024, EQT Ventures continued its strategy of identifying and backing disruptive technologies and innovative business models at their inception. The firm's commitment to the early-stage segment underscores its belief in the transformative power of nascent companies. For example, in the first half of 2024, EQT Ventures participated in several funding rounds for Series A and B startups across sectors like deep tech and sustainable solutions, reflecting a focus on long-term value creation.

- High Risk, High Reward: Early-stage ventures are characterized by significant uncertainty and the potential for substantial returns if they achieve market traction.

- Capital Intensive: Nurturing these companies from seed to growth stages requires substantial capital injections for product development, market penetration, and operational scaling.

- Low Initial Market Share: By definition, early-stage companies are new entrants with limited existing market share, presenting an opportunity for rapid expansion.

- Future Star Potential: Successful early-stage investments can evolve into market-leading 'Stars,' generating significant future revenue and valuation growth.

EQT AB's new venture capital initiatives, such as its expansion into the US private wealth market with vehicles like EQT Nexus Infrastructure, are positioned as Question Marks. These efforts target a high-growth segment, aiming to capture significant inflows and scale distribution networks, but are in early stages of development and require substantial investment to build market share.

The firm's dedicated Healthcare Growth strategy also falls into the Question Mark category. While the healthcare sector generally presents strong growth opportunities for EQT, this specific sub-strategy is in its nascent fundraising and portfolio development phase. It needs time to build a robust track record and demonstrate consistent returns, despite leveraging favorable market trends.

EQT Ventures' investments in early-stage companies represent classic Question Marks. These ventures operate in high-risk, high-reward environments with low initial market share, demanding significant capital to foster growth and achieve scalability. Successful ventures have the potential to evolve into market-leading Stars.

EQT XI, the firm's latest flagship private equity fund, is a Question Mark due to its recent launch and the need for substantial capital investment to establish its market presence and prove its strategy within the high-growth private equity market.

BCG Matrix Data Sources

Our EQT AB BCG Matrix leverages comprehensive data from EQT's annual reports, public financial disclosures, and industry-specific market research to accurately assess portfolio performance and strategic positioning.