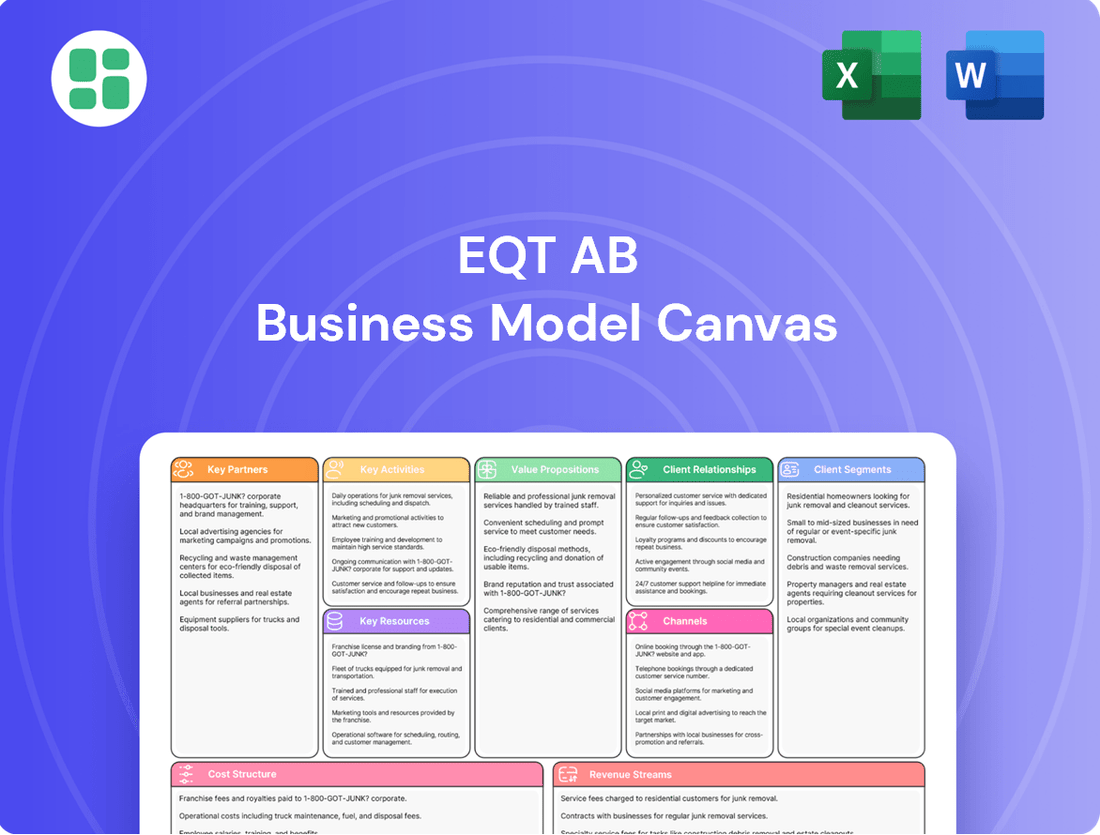

EQT AB Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT AB Bundle

Unlock the core of EQT AB's success with our comprehensive Business Model Canvas. This detailed breakdown illustrates their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their market dominance. Dive into the strategic blueprint that drives their innovation and growth.

Ready to dissect EQT AB's winning strategy? Our full Business Model Canvas provides an in-depth look at their value propositions, cost structure, and channels, giving you the insights to benchmark and strategize. Download now to gain a competitive edge.

Partnerships

EQT AB's business model is deeply intertwined with its key partnerships with institutional investors. These include major players like pension funds, sovereign wealth funds, and university endowments, which are crucial for channeling significant capital into EQT's diverse investment strategies, such as private equity and infrastructure.

The ability to attract and retain these sophisticated investors is paramount for EQT's fundraising success. For instance, the firm's strong track record and client relationships are evident in the impressive average tenure of its top 100 clients, which stands at 15 years, highlighting the long-term commitment and trust these partners place in EQT.

Fund-of-funds also play a vital role, acting as aggregators of capital from smaller institutional investors and providing EQT with access to a broader investor base. This symbiotic relationship ensures a consistent flow of capital, enabling EQT to execute its investment mandates effectively and pursue opportunities across various asset classes.

EQT AB actively cultivates co-investment opportunities with its diverse client base, a strategy that significantly enhances deal capacity and spreads investment risk across a broader base. For instance, in 2024, EQT facilitated co-investments totaling billions of euros across its various funds, demonstrating the scale and importance of these client relationships.

Furthermore, EQT forms strategic alliances with other leading investment firms and influential industry players. This collaborative approach allows EQT to leverage shared resources and specialized expertise, which is crucial for successfully navigating and executing highly complex transactions, particularly in the private equity landscape.

These robust partnerships are becoming increasingly vital for EQT, not only for facilitating larger and more impactful acquisitions but also for deepening client loyalty and solidifying its position as a preferred investment partner in the global market.

EQT AB's active ownership model is significantly bolstered by its extensive network of industrial advisors and sector experts. These seasoned professionals offer invaluable deep industry knowledge and operational insights, directly guiding EQT's portfolio companies toward enhanced performance and strategic growth.

The expertise of these advisors is fundamental to EQT's value creation strategy. For instance, in 2024, EQT continued to emphasize the integration of external specialists to optimize operations and identify nascent market opportunities within its diverse portfolio, which spans sectors like technology, healthcare, and infrastructure.

Management Teams of Portfolio Companies

EQT cultivates deep, collaborative relationships with the management teams of its portfolio companies. This partnership is crucial for unlocking the full potential of each business, focusing on sustainable growth and operational excellence.

Through an active ownership model, EQT works hand-in-hand with these management teams to craft and implement comprehensive strategies. For instance, in 2023, EQT's portfolio companies saw an average EBITDA growth of 15%, a testament to this collaborative approach.

- Strategic Alignment: EQT ensures management teams are aligned with the firm's long-term vision and value creation plans.

- Performance Enhancement: Collaborative efforts focus on driving operational improvements and market expansion.

- Talent Development: EQT supports management teams in building robust organizational structures and attracting top talent.

Financial Institutions and Banks

EQT's relationships with leading financial institutions and banks are foundational to its operations. These partnerships are crucial for securing the debt financing necessary for acquisitions and for establishing credit facilities that ensure operational liquidity. For instance, in 2024, EQT continued to leverage its strong banking relationships to fund significant transactions, demonstrating the critical role these institutions play in enabling large-scale investment strategies.

These collaborations are not merely transactional; they are strategic enablers. By working with major banks, EQT can execute complex, multi-billion euro deals, accessing capital markets efficiently and reliably. This access is vital for maintaining EQT's competitive edge and for its ability to deploy capital across its various funds and investment strategies.

Furthermore, EQT actively partners with distribution banks to broaden its reach within the private wealth sector. This allows EQT to offer its investment opportunities to a wider array of investors, thereby diversifying its investor base and increasing assets under management. This strategic expansion through banking channels is a key component of EQT's growth strategy.

- Financing Acquisitions: Banks provide essential debt financing for EQT's portfolio company acquisitions.

- Credit Facilities: These partnerships secure necessary credit lines for ongoing liquidity and operational needs.

- Distribution Channels: Collaboration with banks expands EQT's private wealth offerings to new investor segments.

EQT's key partnerships extend to specialized service providers, including legal firms, accounting firms, and consulting groups. These expert collaborators are essential for due diligence, transaction structuring, and post-acquisition operational improvements, ensuring compliance and maximizing portfolio value.

The firm also engages with technology and data analytics partners to enhance its investment sourcing and due diligence processes. In 2024, EQT reported leveraging advanced data analytics to identify over 500 potential investment targets, showcasing the impact of these technological collaborations.

These partnerships are critical for EQT's ability to execute complex transactions efficiently and to provide comprehensive support to its portfolio companies. For example, EQT’s infrastructure funds often partner with engineering and construction firms to assess and manage large-scale projects, such as renewable energy developments.

| Partner Type | Role | Impact Example (2024) |

|---|---|---|

| Institutional Investors | Capital Provision | Facilitated billions in co-investments across funds. |

| Industrial Advisors | Operational Expertise | Drove portfolio company performance and identified market opportunities. |

| Financial Institutions | Debt Financing & Liquidity | Enabled large-scale acquisitions and provided credit facilities. |

| Service Providers | Due Diligence & Compliance | Supported transaction structuring and operational enhancements. |

| Technology Partners | Data Analytics & Sourcing | Identified over 500 potential investment targets. |

What is included in the product

This EQT AB Business Model Canvas provides a strategic overview of their private equity operations, detailing their investor base, investment strategies, and value creation approach.

It highlights EQT's focus on long-term value creation through operational improvements and strategic development across its portfolio companies.

Provides a clear, visual framework to identify and address EQT AB's operational inefficiencies and strategic gaps.

Helps EQT AB pinpoint and alleviate challenges in customer acquisition, value proposition delivery, and resource management.

Activities

EQT's core activity revolves around attracting capital for its various investment strategies, encompassing private equity, infrastructure, real estate, and venture capital. This involves initiating new funds, securing commitments from a global base of institutional investors, and overseeing the efficient deployment of this capital across its portfolio.

A significant achievement in 2024 was the successful closing of EQT X, which became the largest private equity fund ever raised globally, underscoring EQT's strong fundraising capabilities and investor confidence.

EQT's deal sourcing and due diligence are paramount. They systematically identify and evaluate investment opportunities, often focusing on high-growth themes. In 2024, EQT continued to refine its approach, ensuring potential investments align with its strategic objectives and value creation plans.

This rigorous process involves deep dives into market trends, competitive landscapes, and financial health. For instance, EQT's thematic approach, targeting sectors like technology and healthcare, requires specialized expertise to uncover and assess promising businesses. Their due diligence aims to mitigate risks and confirm the growth potential identified.

EQT’s active ownership model is central to its strategy, focusing on hands-on engagement with portfolio companies. This approach involves collaborating to implement operational enhancements, refine strategic direction, and accelerate growth. For instance, in 2023, EQT’s portfolio companies collectively generated over €25 billion in revenue, a testament to the impact of these value creation initiatives.

Key activities under active ownership include deploying specific value creation levers. These can range from driving revenue growth through market expansion and product innovation to optimizing costs via efficiency programs and supply chain improvements. EQT also actively pursues add-on acquisitions to bolster existing platforms, as demonstrated by the 2023 completion of 70 add-on acquisitions across its funds.

The ultimate goal is to foster the development of portfolio companies into robust, sustainable businesses. This long-term perspective is reflected in EQT's commitment to integrating Environmental, Social, and Governance (ESG) principles, which are increasingly recognized as drivers of both financial performance and enduring value. By 2023, 98% of EQT’s portfolio companies had ESG targets integrated into their business plans.

Portfolio Management and Monitoring

EQT AB's core activity involves the meticulous management and continuous monitoring of its extensive portfolio of companies. This proactive approach ensures that each investment is not only performing but also strategically aligned to meet and exceed projected financial targets. Regular performance assessments and timely strategic recalibrations are crucial for navigating market dynamics and mitigating potential risks, thereby safeguarding and enhancing investment value.

EQT's commitment to robust value creation is consistently reflected in the performance of its key funds, which regularly meet or surpass their planned objectives. This success is a direct result of their hands-on approach to portfolio oversight and strategic guidance. For instance, EQT's Infrastructure VI fund, which held its final closing in January 2024, secured €22 billion in commitments, demonstrating strong investor confidence in their management capabilities.

The ongoing monitoring process includes:

- Performance Tracking: Regularly assessing financial metrics, operational efficiency, and market positioning of portfolio companies against established benchmarks and strategic goals.

- Strategic Interventions: Implementing value-adding initiatives, such as operational improvements, market expansion strategies, or management team enhancements, based on ongoing performance reviews.

- Risk Management: Identifying and addressing potential risks, including market volatility, regulatory changes, and competitive pressures, to protect and grow portfolio value.

- Fund Oversight: Ensuring that the overall performance of the investment funds aligns with investor expectations and regulatory requirements, with a focus on delivering consistent returns.

Exits and Realizations

EQT AB strategically manages the divestment of its portfolio companies, focusing on maximizing investor returns through various exit routes like trade sales or initial public offerings (IPOs). This crucial activity involves astute market timing, thorough preparation of companies for sale, and the skillful execution of these transactions.

In 2024, EQT demonstrated a robust acceleration in its exit endeavors. The firm reported a substantial increase in total gross fund exits, underscoring its proactive approach to realizing value from its investments.

- Accelerated Exit Activity: EQT significantly ramped up its exit activities throughout 2024.

- Increased Gross Fund Exits: The total value of gross fund exits saw a notable rise in the same period.

- Strategic Divestment: The firm actively pursues trade sales and IPOs to deliver attractive returns to its investors.

- Market Timing and Execution: Successful exits rely on EQT's ability to identify optimal market conditions and execute transactions efficiently.

EQT's key activities encompass raising capital, sourcing and executing deals, actively managing portfolio companies to drive value creation, and ultimately divesting these investments to generate returns. This cycle is supported by robust fund management and continuous performance monitoring.

In 2024, EQT continued to demonstrate strong fundraising capabilities, with EQT X closing as the largest private equity fund globally. The firm also saw accelerated exit activity, increasing its total gross fund exits significantly. This active approach to portfolio management and divestment underscores EQT's commitment to delivering value to its investors.

| Key Activity | 2024 Highlights/Data | Impact |

| Capital Raising | EQT X closed as largest global private equity fund | Demonstrates strong investor confidence and EQT's fundraising prowess |

| Deal Sourcing & Execution | Continued refinement of thematic approach (e.g., technology, healthcare) | Ensures alignment with strategic objectives and potential for growth |

| Active Ownership & Value Creation | Portfolio companies generated over €25 billion in revenue (2023 data) | Highlights success of operational enhancements and strategic guidance |

| Divestments (Exits) | Accelerated exit activity and increased total gross fund exits | Maximizes investor returns through strategic timing and execution |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup; it's a direct snapshot of the complete file, ensuring you know exactly what you're getting. Upon completing your order, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

EQT's core strength lies in the vast financial capital it manages. As of June 30, 2025, this amounted to a significant €266 billion in total assets under management, with €141 billion actively generating fees. This substantial pool of capital is the engine that drives EQT's investment strategies and enables its growth across various sectors.

EQT's human capital is its bedrock, featuring a highly skilled team of investment professionals, industrial advisors, and operational experts. This intellectual resource is paramount for their success.

Their deep sector knowledge, extensive global network, and proven active ownership capabilities are directly leveraged in deal sourcing, value creation, and the meticulous management of their investment portfolios. This expertise is what drives their strategy.

In 2024, EQT continued its strong focus on attracting and retaining top talent, recognizing that its people are the ultimate drivers of performance and innovation in the competitive private equity landscape.

EQT's proprietary investment methodology, characterized by its thematic focus and robust value creation framework, is a cornerstone of its success. This approach allows EQT to identify promising sectors and actively nurture portfolio companies towards growth and improved performance.

This methodology is significantly amplified by EQT's extensive global industrial network. This network provides invaluable on-the-ground insights and access to unique investment opportunities, enabling EQT to source and develop companies with a distinct competitive advantage.

In 2024, EQT continued to leverage this combination, demonstrating its ability to effectively identify and cultivate businesses. For instance, its investments in digital transformation and sustainability themes, supported by its network, have consistently yielded strong results across its funds.

Brand Reputation and Track Record

EQT's robust brand reputation, cultivated over thirty years as a premier global investment firm, stands as a cornerstone of its business model. This established trust allows EQT to consistently attract substantial capital from a diverse investor base. Its long-standing history of delivering strong financial performance further solidifies its appeal, making it a preferred partner for both limited partners and portfolio companies.

The firm's unwavering commitment to generating attractive returns is a key driver of its success. This consistent performance record, a testament to EQT's strategic acumen, directly supports its ability to secure new mandates and deploy capital effectively. For instance, EQT's dedication to sustainable investing, recognized by its inclusion in the Dow Jones Sustainability Index for the third consecutive year in 2024, enhances its attractiveness to a growing segment of investors prioritizing ESG factors.

- Brand Reputation: EQT is recognized globally as a leading investment organization.

- Track Record: Proven history of generating attractive returns for investors.

- Sustainability Commitment: Inclusion in the Dow Jones Sustainability Index for the third consecutive year in 2024 highlights ESG focus.

- Attraction of Opportunities: Strong reputation and track record enable EQT to attract high-quality investment prospects and investor capital.

Global Platform and Local Presence

EQT's extensive global platform, bolstered by local teams strategically positioned across Europe, the Americas, and Asia Pacific, is a cornerstone of its business model. This expansive network, recently enhanced with new offices in Warsaw and Bengaluru as of early 2024, allows EQT to tap into diverse markets effectively.

This dual approach, blending broad international reach with deep local insights, grants EQT a significant competitive edge. It facilitates the identification of promising investment opportunities and the execution of value creation strategies tailored to specific regional nuances and cultural contexts.

The firm's presence in key growth regions, including its expansion into India with the Bengaluru office, underscores its commitment to capturing emerging market potential. By mid-2024, EQT managed capital across a substantial number of funds, demonstrating the scale and reach of its operations.

- Global Network: EQT operates across Europe, the Americas, and Asia Pacific, with recent office openings in Warsaw and Bengaluru in 2024.

- Local Expertise: Local teams provide deep market knowledge and cultural understanding, crucial for deal sourcing and execution.

- Competitive Advantage: The combination of global sector expertise and local market intelligence enhances deal flow and value creation capabilities.

- Strategic Expansion: Entry into new markets like India signifies EQT's focus on capitalizing on global growth opportunities.

EQT's key resources are its substantial financial capital, its skilled human capital, its proprietary investment methodology, its extensive global network, and its strong brand reputation. These elements work in concert to drive EQT's success in identifying, acquiring, and growing companies.

The firm's financial capital, exceeding €266 billion in assets under management as of June 30, 2025, provides the foundation for its investment activities. Its human capital, comprising experienced investment professionals and operational experts, is crucial for executing its value creation strategies.

The proprietary methodology, combined with deep sector knowledge and a global industrial network, allows EQT to source unique opportunities and implement effective growth plans. This is further strengthened by a robust brand reputation built on a consistent track record of delivering attractive returns, as evidenced by its inclusion in the Dow Jones Sustainability Index for the third consecutive year in 2024.

EQT's expansive global platform, with strategic local teams across key regions and recent expansion into markets like India, enhances its ability to identify and capitalize on diverse investment opportunities.

| Resource Category | Key Elements | Significance | 2024/2025 Data Point |

|---|---|---|---|

| Financial Capital | Assets Under Management (AUM) | Enables investment scale and diversification. | €266 billion (as of June 30, 2025) |

| Human Capital | Investment Professionals, Industrial Advisors | Drives deal sourcing, value creation, and portfolio management. | Continued focus on talent acquisition and retention in 2024. |

| Methodology & Network | Proprietary Investment Approach, Global Industrial Network | Facilitates identification of opportunities and active ownership. | Leveraged for digital transformation and sustainability investments in 2024. |

| Brand & Reputation | Established Trust, Track Record of Returns | Attracts capital and high-quality investment prospects. | Included in Dow Jones Sustainability Index for the third consecutive year in 2024. |

| Global Platform | Presence in Europe, Americas, Asia Pacific | Provides local insights and global reach for deal execution. | New offices opened in Warsaw and Bengaluru in early 2024. |

Value Propositions

EQT's core promise to its institutional investors is to deliver outstanding risk-adjusted returns. This is built on a foundation of a rigorous investment approach, hands-on engagement with portfolio companies, and a steadfast commitment to creating lasting value over time. For instance, EQT has a track record of delivering impressive multiples, with an average of over 2.5 times the invested capital across its various strategies, demonstrating its ability to generate significant upside while managing risk effectively.

EQT provides more than just capital; it offers active ownership and deep operational expertise. This hands-on approach transforms portfolio companies through strategic guidance, operational enhancements, and digitalization initiatives.

In 2024, EQT's integrated framework continued to drive value creation and performance across its diverse portfolio. This commitment to active ownership is a cornerstone of their strategy, aiming to unlock potential and deliver superior returns for investors.

EQT AB's value proposition centers on a thematic investment approach, pinpointing companies aligned with enduring growth trends like healthcare, technology, and vital infrastructure. This strategy aims to secure high-quality businesses offering robust downside protection. For instance, EQT launched its Healthcare Growth strategy and a Transition Infrastructure strategy in 2024, demonstrating a commitment to capitalizing on evolving market dynamics.

Sustainability and Future-Proofing Companies

EQT champions sustainability, weaving it into every investment to build resilient, future-ready businesses. This commitment means actively enhancing environmental, social, and governance (ESG) performance across its portfolio companies, ensuring long-term value creation.

The firm's dedication to responsible investing is underscored by its consistent recognition. For the third year running, EQT was honored with a place in the Dow Jones Sustainability Index (DJSI) World, a testament to its robust ESG integration.

- ESG Integration: EQT embeds ESG factors throughout its investment lifecycle, from due diligence to active ownership, aiming to mitigate risks and uncover opportunities.

- Portfolio Enhancement: The firm actively works with its portfolio companies to drive tangible ESG improvements, fostering operational efficiency and stakeholder engagement.

- Long-Term Value: By focusing on sustainability, EQT seeks to create businesses that are not only profitable but also resilient and well-positioned for future challenges and regulatory landscapes.

- DJSI Recognition: Inclusion in the DJSI World for three consecutive years highlights EQT's leadership in sustainable investment practices among global asset managers.

Diversified Investment Strategies and Global Reach

EQT AB provides investors with a comprehensive suite of investment strategies, spanning private equity, infrastructure, real estate, and venture capital. This broad offering allows for significant portfolio diversification across various asset classes and geographical regions. Since its initial public offering, EQT has impressively grown its investment strategy count from six to eighteen, demonstrating a commitment to expanding its market reach and catering to diverse investor needs.

The firm's extensive global network grants it access to localized market intelligence and a wide array of investment opportunities across the world. This international presence is crucial for identifying and capitalizing on emerging trends and unique investment prospects in different economies.

- Broad Strategy Spectrum: EQT's portfolio encompasses private equity, infrastructure, real estate, and venture capital, offering extensive diversification.

- Global Footprint: A worldwide presence ensures access to diverse markets and local insights.

- Strategic Expansion: The number of investment strategies has tripled from six to eighteen since EQT's IPO.

EQT's value proposition is built on delivering superior risk-adjusted returns through a disciplined investment process and active ownership. They focus on thematic growth areas, offering a diversified range of strategies from private equity to infrastructure.

The firm's commitment to sustainability is a key differentiator, integrating ESG factors to build resilient businesses and enhance long-term value. This approach has led to consistent recognition, including inclusion in the Dow Jones Sustainability Index.

EQT's global network and expanding strategy count, from six at IPO to eighteen by 2024, provide investors with broad market access and diversification opportunities.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Investment Performance | Delivering outstanding risk-adjusted returns. | Average of over 2.5x invested capital across strategies. |

| Active Ownership & Expertise | Transforming portfolio companies through operational enhancements. | Hands-on approach to digitalization and strategic guidance. |

| Thematic Investment Focus | Pinpointing companies aligned with enduring growth trends. | Launched Healthcare Growth and Transition Infrastructure strategies in 2024. |

| Sustainability & ESG | Weaving sustainability into investments for resilient businesses. | Included in Dow Jones Sustainability Index (DJSI) World for three consecutive years. |

| Diversified Strategy Offering | Comprehensive suite of investment strategies across asset classes. | Expanded from six to eighteen investment strategies since IPO. |

| Global Network & Access | Access to localized market intelligence and investment opportunities. | Worldwide presence for identifying emerging trends. |

Customer Relationships

EQT AB prioritizes building enduring partnerships with its institutional investors, focusing on a high-touch approach. This means consistent, proactive engagement and a genuine commitment to client success, fostering a strong sense of trust and reliability.

These deep-rooted relationships are a testament to EQT's dedication to transparency and its proven history of delivering strong performance. This client-centric philosophy is a cornerstone of their business model, ensuring investor confidence.

The longevity of these partnerships is particularly striking; EQT boasts an impressive average tenure of 15 years among its top 100 clients. This significant statistic underscores the enduring value and mutual benefit derived from these long-term collaborations.

EQT AB prioritizes transparent communication through a dedicated investor relations team. This function ensures investors receive detailed financial reports, performance updates, and opportunities for direct engagement, keeping them thoroughly informed about their investments.

The company's commitment to transparency is evident in its regular publications. EQT releases quarterly announcements, half-year reports, and comprehensive annual reports, which importantly include detailed sustainability reporting, reflecting a holistic view of its operations and impact.

EQT actively cultivates deeper relationships by offering co-investment opportunities. This allows investors to directly participate in specific portfolio companies alongside EQT's main funds, providing enhanced alignment and transparency.

Furthermore, EQT develops bespoke solutions, crafting tailored investment strategies to precisely match the unique requirements and preferences of its large institutional clientele, ensuring a highly customized approach.

In 2024 alone, EQT facilitated approximately EUR 12 billion in co-investment opportunities, demonstrating a significant commitment to this relationship-building strategy and providing substantial direct exposure for its partners.

Capital Markets Events and Direct Engagement

EQT AB actively cultivates investor relationships through dedicated capital markets events and investor conferences. These gatherings are crucial for fostering direct engagement between EQT's senior management, the chief executive officers of its portfolio companies, and the investment community. These forums offer a transparent view into EQT's distinctive ownership model, its proven value creation strategies, and its overarching strategic objectives. For instance, EQT hosted a significant capital markets event in London during May 2025, providing valuable insights to attendees.

These events serve as a vital platform for communicating EQT's financial performance and strategic direction directly to stakeholders. They allow for in-depth discussions on market trends and EQT's positioning within them, reinforcing confidence and understanding among investors. The direct interaction helps to articulate the firm's commitment to long-term value creation and its operational excellence across its diverse portfolio.

- Direct Investor Engagement: EQT hosts events to connect leadership, portfolio CEOs, and investors.

- Strategic Insights: These events detail EQT's ownership model, value creation, and strategic priorities.

- Recent Activity: A key capital markets event took place in London in May 2025.

- Transparency and Communication: Fosters understanding of EQT's approach and performance.

Partnership with Private Wealth Distributors

EQT is actively broadening its reach to the private wealth segment by forging partnerships with major global private banks and wirehouses. This strategic move is designed to distribute EQT’s new evergreen investment vehicles, thereby expanding its investor base and democratizing access to private markets for individual investors.

This initiative is a key component of EQT’s customer relationship strategy, aiming to build deeper connections with a new demographic of investors. The company projects that by 2025, it will offer five distinct evergreen vehicles specifically tailored for the private wealth market.

- Expanded Investor Access: EQT is leveraging partnerships with global private banks and wirehouses to distribute its evergreen vehicles, opening private market opportunities to a wider array of individual investors.

- Strategic Growth: This expansion into the private wealth sector is a deliberate strategy to diversify EQT's client base and enhance its market penetration.

- Product Development: EQT anticipates having five active evergreen vehicles available for private wealth clients by 2025, indicating a significant commitment to this segment.

EQT AB cultivates robust customer relationships through a multi-faceted approach, emphasizing transparency, direct engagement, and tailored solutions for both institutional and private wealth investors. The firm's commitment to long-term partnerships is underscored by its proactive communication channels and the provision of co-investment opportunities, fostering deep trust and alignment.

In 2024, EQT facilitated approximately EUR 12 billion in co-investment opportunities, a key strategy to enhance investor alignment and transparency. This demonstrates a significant commitment to providing direct exposure and building enduring relationships with its client base.

Furthermore, EQT is strategically expanding its reach into the private wealth segment by partnering with global private banks. By 2025, the company plans to offer five distinct evergreen investment vehicles tailored for this market, democratizing access to private markets.

| Customer Segment | Relationship Strategy | Key Initiatives/Data Points |

|---|---|---|

| Institutional Investors | High-touch, transparent, long-term partnerships | Average tenure of 15 years for top 100 clients; EUR 12 billion in co-investment opportunities facilitated in 2024. |

| Private Wealth | Partnerships with private banks, tailored evergreen vehicles | Target of five distinct evergreen vehicles by 2025; expanding access to private markets. |

Channels

EQT AB's direct sales and investor relations teams are the backbone of its capital raising strategy, directly engaging with institutional investors to secure fund commitments. These dedicated teams cultivate and manage relationships with existing clients, orchestrate roadshows to reach new investors, and ensure personalized communication throughout the fundraising process. Their efforts are absolutely critical for EQT's ability to attract and deploy capital effectively.

In 2024, EQT AB continued to demonstrate the strength of its direct engagement model. For instance, the firm successfully raised €22 billion for its EQT Future fund, a testament to the effectiveness of its investor relations in attracting significant capital from a global investor base. This direct approach allows for tailored communication and a deeper understanding of investor needs, fostering long-term partnerships.

EQT's strategic expansion in 2024 included opening new offices in Warsaw and Bengaluru, bolstering its presence in key growth markets. This network of global offices is crucial for deal sourcing, investor relations, and effective portfolio company oversight across Europe, the Americas, and Asia Pacific.

EQT actively participates in key industry gatherings like SuperReturn International and the SuperReturn Infrastructure series. These forums are crucial for connecting with Limited Partners (LPs) and potential co-investors, fostering relationships that are vital for fundraising. For instance, in 2024, EQT representatives were prominent speakers at these events, sharing insights on market trends and their investment strategies.

Digital Platforms and Online Presence

EQT AB leverages its official website and various digital platforms as key channels to connect with its stakeholders. These platforms are crucial for disseminating vital information, including financial reports, sustainability updates, company news, and insightful thought leadership pieces. This approach fosters transparency and keeps investors and the broader public well-informed about EQT's performance and strategic direction.

The company's commitment to open communication is evident in the accessibility of its reporting. For instance, EQT's Annual and Sustainability Report for 2024 is readily available on its website, providing detailed insights into its operations and impact. This digital presence serves as a primary hub for all official communications.

- Website as Information Hub: EQT's official website acts as the central repository for all corporate information, ensuring easy access to financial statements, annual reports, and sustainability disclosures.

- Digital Dissemination of Reports: Key documents like the 2024 Annual and Sustainability Report are published online, underscoring EQT's commitment to transparency and digital accessibility for investors and the public.

- Thought Leadership and Insights: Beyond factual reporting, EQT utilizes its digital platforms to share market analysis and strategic insights, positioning itself as a thought leader in the investment industry.

- Investor Relations Portal: A dedicated section on the website likely serves as an investor relations portal, offering a streamlined experience for shareholders to access relevant materials and company updates.

Partnerships with Private Wealth Distribution Networks

EQT actively collaborates with private banks and wealth management firms to access individual private wealth investors. These partnerships serve as a crucial channel, enabling EQT to offer its private market investment products to a wider audience of high-net-worth individuals.

A prime example of this strategy is the launch of EQT Nexus Infrastructure, which was distributed through a prominent private bank in the Nordic region. This initiative highlights EQT's commitment to broadening its distribution reach beyond institutional investors.

- Distribution Channels: Partnerships with global private banks and wealth management firms.

- Target Audience: Individual private wealth investors.

- Product Example: EQT Nexus Infrastructure launched via Nordic private bank.

EQT AB's channels are multifaceted, encompassing direct investor engagement, strategic industry participation, and robust digital platforms. The firm's direct sales and investor relations teams are paramount for capital raising, cultivating relationships with institutional investors through roadshows and personalized communication. This direct approach was evident in 2024 with the successful €22 billion raise for the EQT Future fund.

Furthermore, EQT utilizes its website and digital platforms as a central hub for information dissemination, including financial reports and thought leadership, ensuring transparency. Its 2024 Annual and Sustainability Report is a key example of this digital accessibility. The firm also actively participates in industry events like SuperReturn International, fostering crucial connections with Limited Partners and co-investors.

EQT also partners with private banks and wealth management firms to reach individual private wealth investors, as demonstrated by the 2024 launch of EQT Nexus Infrastructure through a Nordic private bank. This diversified channel strategy aims to broaden its investor base and product distribution.

Customer Segments

Institutional investors, including pension funds, sovereign wealth funds, and endowments, represent EQT AB's foundational customer base. These sophisticated entities are drawn to private markets for their potential to generate attractive long-term returns, making them crucial partners for EQT.

These large-scale clients are the primary source of capital for EQT's diverse fund offerings, demonstrating a significant commitment to the firm's investment strategies. In 2023, institutional investors accounted for a substantial 80-85% of EQT's gross capital inflows, underscoring their pivotal role in the firm's growth and operational capacity.

EQT is strategically broadening its engagement with family offices and high-net-worth individuals through its private wealth solutions. This focus acknowledges the increasing importance of this segment as a significant capital provider for private markets, a trend expected to continue through 2025.

The firm anticipates launching several evergreen investment vehicles specifically designed for the private wealth market in 2025. This move aims to provide these sophisticated investors with more accessible and long-term opportunities within EQT's established private market expertise.

EQT AB's Corporations and Strategic Partners segment encompasses businesses it acquires or collaborates with, acting as an active owner to foster growth, innovation, and sustainability. For instance, in 2024, EQT continued its strategy of acquiring and developing companies across key sectors like healthcare and technology, aiming to unlock their full potential through operational improvements and strategic guidance.

This involves deep engagement with portfolio companies, often taking majority stakes to implement strategic changes. EQT's approach is hands-on, focusing on driving long-term value creation. Their investments in 2024 reflected a commitment to sectors poised for significant expansion and transformation.

Fund-of-Funds and Investment Consultants

EQT AB actively engages with fund-of-funds and investment consultants, crucial intermediaries for accessing institutional capital. These partnerships are vital for EQT to broaden its investor base and enhance fundraising efficiency. In 2024, the global fund-of-funds industry continued to grow, with many consultants actively recommending private market allocations to their clients, a trend EQT is well-positioned to capitalize on.

These relationships are built on trust and a proven track record, allowing EQT to present its strategies to a wider audience of sophisticated investors. Investment consultants, in particular, play a significant role in due diligence, and EQT's ability to meet their rigorous standards is paramount. For instance, many consultants in 2024 were focusing on managers with strong ESG integration, an area where EQT has made substantial commitments.

- Access to Capital: Fund-of-funds provide EQT with direct access to diversified pools of capital from numerous underlying investors, simplifying the aggregation of significant investment amounts.

- Distribution Network: Investment consultants act as a vital distribution channel, leveraging their existing relationships with pension funds, endowments, and sovereign wealth funds to introduce EQT's offerings.

- Due Diligence Support: These intermediaries often conduct extensive due diligence on behalf of their clients, reducing the burden on EQT's internal investor relations teams and adding a layer of credibility.

- Market Intelligence: Working with consultants provides EQT with valuable insights into investor demand, market trends, and competitive landscape, informing product development and fundraising strategies.

Management Teams of Target Companies

Management teams of companies EQT considers for investment are a vital stakeholder group. While they don't directly provide capital, their buy-in is essential for successful partnerships. EQT must effectively communicate its role as an engaged and supportive owner, demonstrating how its involvement can unlock a company's full potential.

EQT actively collaborates with these management teams to co-create and execute strategic growth plans. This partnership approach is key to realizing the intended value creation. For instance, in 2024, EQT continued to emphasize its operational expertise, a core tenet for aligning with and empowering management.

- Value Proposition: EQT must clearly articulate how its strategic guidance and operational support will benefit the company and its leadership.

- Partnership Approach: Building trust and a shared vision with management is paramount for effective collaboration.

- Growth & Development: EQT aims to empower management teams to achieve ambitious growth targets and long-term success.

EQT AB's customer segments are diverse, ranging from large institutional investors like pension funds and sovereign wealth funds, which formed the bedrock of its capital base in 2023, accounting for 80-85% of gross inflows. The firm is actively expanding its reach to family offices and high-net-worth individuals, recognizing their growing significance as capital providers in private markets, with new evergreen vehicles planned for 2025. Additionally, EQT engages with corporations and strategic partners, acting as an active owner to drive growth and innovation, as seen in its 2024 acquisitions and development strategies in technology and healthcare.

Cost Structure

EQT AB's cost structure is significantly influenced by employee compensation. This includes salaries, performance-based bonuses, and long-term equity incentives for its investment teams, industrial advisors, and support staff. Attracting and keeping skilled professionals directly impacts these expenses.

As of the first half of 2025, EQT reported having 1,908 full-time equivalent employees. This substantial workforce underscores the considerable investment in human capital, which is a primary driver of the company's operational costs.

EQT AB incurs significant costs in managing its funds daily. These include essential expenses like legal counsel, regulatory compliance, administrative tasks, and the technology backbone that supports its global operations and varied investment approaches. In 2023, EQT reported operating expenses of €1,173 million, reflecting these substantial overheads.

These operational costs are crucial for maintaining EQT's extensive global presence and executing its diverse investment strategies across different asset classes. The company's commitment to a robust central platform, aimed at fostering scalable growth, further contributes to these expenses. EQT's strategic investments in its platform are designed to streamline operations and enhance efficiency as it expands.

EQT AB incurs significant expenses in its deal sourcing and due diligence processes. These costs are vital for identifying promising investment opportunities and thoroughly vetting potential targets to mitigate risk. For instance, in 2023, EQT reported total operating expenses of €1,342 million, a portion of which directly supports these critical pre-investment activities.

Marketing, Investor Relations, and Fundraising Costs

Expenditures for marketing, investor relations, and fundraising are significant for EQT AB. These costs are essential for attracting new capital, nurturing relationships with current investors, and bolstering EQT's brand visibility and the appeal of its various funds. In 2024, EQT continued to invest in these areas, recognizing their direct impact on Assets Under Management (AUM) growth.

These expenditures encompass a range of activities. They include the execution of targeted marketing campaigns, the organization of investor events and conferences, and the meticulous preparation of investor reports and presentations. EQT's strategic focus in 2024 also involved enhanced branding initiatives specifically aimed at the private wealth segment, a key growth area.

- Marketing and Branding: Costs associated with promoting EQT's brand and funds across various channels, including digital marketing and content creation.

- Investor Relations: Expenses related to maintaining communication with existing investors, including roadshows, investor calls, and the production of investor materials.

- Fundraising Activities: Costs incurred during the process of raising capital for new funds, which can involve legal fees, due diligence, and marketing efforts targeting institutional investors.

- Private Wealth Focus: Investments in branding and outreach specifically designed to attract and engage high-net-worth individuals and family offices.

Portfolio Company Development and Value Creation Costs

EQT invests in its portfolio companies to drive growth and create value, incurring costs for these development initiatives. These expenses cover a range of activities designed to enhance operational efficiency and market position.

These costs can include engaging external consultants for strategic advice, implementing operational improvement programs, and funding digitalization efforts to modernize businesses. EQT utilizes a comprehensive suite of tools to actively support value creation within its investments.

- Portfolio Development Investment: EQT allocates capital to actively develop and transform its portfolio companies, aiming for enhanced returns.

- Operational Enhancement Costs: Expenses are incurred for consulting services and programs focused on improving operational performance and efficiency.

- Digitalization Investment: Funds are directed towards digital transformation initiatives within portfolio companies to boost competitiveness and innovation.

- Integrated Value Creation Framework: EQT employs a structured approach with various tools to systematically drive value creation across its portfolio.

EQT AB's cost structure is heavily weighted towards employee compensation, including salaries and incentives for its investment professionals and support staff. The company's significant investment in human capital is a primary driver of its operational expenses, reflected in its substantial workforce.

Operational costs are also a major component, covering essential functions like legal, compliance, administration, and technology infrastructure necessary for global operations. These overheads are critical for maintaining EQT's extensive presence and executing its diverse investment strategies.

Furthermore, EQT incurs significant expenses in deal sourcing, due diligence, marketing, investor relations, and fundraising activities. These expenditures are vital for identifying opportunities, mitigating risk, attracting capital, and nurturing investor relationships, directly impacting Assets Under Management growth.

| Cost Category | 2023 Expense (€ million) | Key Drivers |

|---|---|---|

| Employee Compensation | N/A (Significant component) | Salaries, bonuses, equity incentives for investment teams and staff. |

| Operating Expenses | 1,173 | Legal, compliance, administration, technology, global operations. |

| Deal Sourcing & Due Diligence | Included in Total Operating Expenses | Identifying and vetting investment opportunities. |

| Marketing & Investor Relations | N/A (Significant component) | Brand promotion, investor communication, fundraising efforts. |

Revenue Streams

EQT's most consistent revenue source is management fees, calculated as a percentage of its fee-generating assets under management (FAUM). This percentage is applied to either committed or invested capital, providing a predictable income stream.

In 2024, EQT saw a notable increase in these management fees. This growth was largely driven by the successful closing of new commitments, which directly expanded the asset base upon which these fees are levied.

Performance fees, often called carried interest, are a key way EQT makes money. This is a share of the profits from their investment funds when those investments are sold successfully. It’s a revenue stream that can fluctuate quite a bit, but it can be very significant when EQT has strong exits. In 2024, EQT reported EUR 587 million in carried interest.

EQT generates revenue through co-investment fees and a share of profits from these arrangements. This revenue stream supplements its primary income from fund management fees and carried interest.

In 2024, EQT facilitated approximately EUR 12 billion in co-investment opportunities for its clients, highlighting the significant scale of this revenue-generating activity.

Advisory and Consulting Fees

EQT AB generates revenue through advisory and consulting fees, capitalizing on its extensive industrial network and operational expertise. These services are often provided for strategic initiatives or specific projects within its portfolio companies or broader network.

This stream leverages EQT’s deep understanding of various sectors and its ability to drive operational improvements. For instance, in 2023, EQT continued to offer specialized advisory services, contributing to its overall fee income, although specific figures for this segment are often embedded within broader management fee structures.

- Advisory Services: Providing strategic guidance and operational support to portfolio companies.

- Consulting Engagements: Offering specialized expertise for specific projects or market entries.

- Network Leverage: Utilizing its industrial network to facilitate value creation for clients and partners.

Investment Income from Balance Sheet Investments

EQT AB also benefits from investment income generated by its own balance sheet. This capital is strategically deployed to fuel growth initiatives and explore new investment strategies across its platform.

This includes realizing gains from direct investments or providing crucial seed capital for emerging funds. EQT's robust balance sheet offers significant flexibility, enabling it to underwrite and support the expansion of its diverse investment activities.

- Balance Sheet Investments: EQT utilizes its own capital to make direct investments and provide seed funding for new funds, generating income from these activities.

- Growth Support: This investment income directly supports EQT's internal growth initiatives and the development of new strategic ventures.

- Platform Flexibility: The company's balance sheet acts as a flexible tool, allowing it to inject capital and drive growth across its various investment platforms.

EQT's revenue streams are diverse, primarily driven by management fees and performance fees. Management fees, calculated on assets under management, provide a stable income base, which grew in 2024 due to new commitments. Performance fees, or carried interest, represent a share of profits from successful investments, contributing EUR 587 million in 2024.

Co-investment activities also generate fees and profit shares, with EQT facilitating approximately EUR 12 billion in co-investments in 2024. Additionally, advisory and consulting services leverage EQT's expertise, contributing to fee income, though often integrated within broader fee structures. The company also earns income from its own balance sheet investments, supporting growth and new ventures.

| Revenue Stream | Description | 2024 Data/Activity |

|---|---|---|

| Management Fees | Percentage of fee-generating assets under management. | Increased due to new commitments. |

| Performance Fees (Carried Interest) | Share of profits from successful fund investments. | EUR 587 million. |

| Co-investment Fees & Profit Share | Fees and profit from co-investment arrangements. | Facilitated EUR 12 billion in co-investments. |

| Advisory & Consulting Fees | Fees for strategic guidance and operational support. | Leverages industrial network and expertise. |

| Balance Sheet Investments | Income from EQT's own capital deployment. | Supports growth initiatives and new ventures. |

Business Model Canvas Data Sources

EQT AB's Business Model Canvas is informed by a robust combination of financial disclosures, market intelligence reports, and internal strategic assessments. These sources provide a comprehensive view of EQT's operations, market positioning, and future growth potential.