EQT AB Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT AB Bundle

EQT AB navigates a competitive landscape shaped by significant buyer power and the constant threat of substitutes in the energy sector. Understanding these forces is crucial for strategic planning and identifying potential vulnerabilities.

The complete report reveals the real forces shaping EQT AB’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of capital suppliers, or limited partners (LPs), for firms like EQT is generally low. This is largely due to the substantial amount of uninvested capital, or 'dry powder', available globally. Experienced and successful fund managers, such as EQT, attract a disproportionate share of this capital, giving them an advantage in negotiations with individual LPs.

EQT's ability to consistently raise and close large funds, exemplified by EQT X which was the largest private equity fundraise globally in 2024, further solidifies its position. This track record and strong demand from LPs significantly diminishes the leverage any single LP might have over EQT in terms of capital terms or fund strategy.

The intense competition for specialized talent within private equity, encompassing investment professionals, deal sourcers, and value creation experts, significantly bolsters the bargaining power of these individuals. Their unique skill sets and proven track records allow them to command substantial compensation packages, giving them considerable leverage.

EQT AB's long-term success hinges on its capacity to attract and retain premier talent, a cornerstone of its financial strategy. This reliance on high-caliber personnel means EQT must offer competitive remuneration and compelling career paths to secure the expertise needed for its investment activities.

Proprietary deal sourcing networks are a major differentiator in private equity, giving those with strong connections to investment banks, consultants, and industry experts a distinct edge in finding attractive opportunities. This influence translates directly into the bargaining power of suppliers, as firms with exclusive access to deals can negotiate more favorable terms. EQT AB, for instance, actively cultivates these relationships, which are crucial for its strategy.

Technology and Data Providers

As private equity firms like EQT increasingly lean on sophisticated technology for deal sourcing, due diligence, and managing their investments, specialized technology and data providers are gaining a degree of leverage. These providers offer critical tools powered by advanced analytics, artificial intelligence, and automation, which are essential for identifying opportunities and mitigating risks in today's competitive landscape.

EQT's commitment to technological advancement is evident in its strategic investments. For instance, in 2023, the firm continued to bolster its internal data science capabilities and explore partnerships with leading AI and analytics firms. This reliance on external expertise and proprietary platforms means that providers who can consistently deliver cutting-edge solutions and actionable insights hold significant influence.

- Data and Analytics Platforms: Providers offering specialized data aggregation, analysis, and visualization tools, crucial for EQT's investment decision-making.

- AI and Machine Learning Solutions: Companies developing AI-driven platforms for deal sourcing, market trend prediction, and portfolio company performance enhancement.

- Due Diligence Technology: Vendors providing automated solutions for reviewing legal documents, financial records, and market data during the acquisition process.

- Cybersecurity and IT Infrastructure Providers: Essential partners ensuring the security and efficiency of EQT's increasingly digital operations.

Advisory and Due Diligence Firms

Advisory and due diligence firms hold moderate bargaining power for EQT AB. Their expertise in navigating complex private equity deals and conducting essential due diligence is crucial. This necessity, combined with the specialized nature of their services, means EQT AB relies on them for successful transactions.

The demand for high-quality legal, financial, and operational advice in private equity is consistently strong. For instance, in 2023, global private equity deal activity remained robust, with significant capital deployed, underscoring the ongoing need for these specialized advisory services. This sustained demand contributes to their leverage.

- Specialized Expertise: Advisory firms offer niche skills vital for complex transactions.

- Due Diligence Necessity: Thorough investigation is non-negotiable in private equity.

- Market Demand: Consistent deal flow supports the value of these services.

The bargaining power of capital suppliers, or limited partners (LPs), for firms like EQT is generally low. This is largely due to the substantial amount of uninvested capital, or 'dry powder', available globally. Experienced and successful fund managers, such as EQT, attract a disproportionate share of this capital, giving them an advantage in negotiations with individual LPs.

EQT's ability to consistently raise and close large funds, exemplified by EQT X which was the largest private equity fundraise globally in 2024, further solidifies its position. This track record and strong demand from LPs significantly diminishes the leverage any single LP might have over EQT in terms of capital terms or fund strategy.

The intense competition for specialized talent within private equity, encompassing investment professionals, deal sourcers, and value creation experts, significantly bolsters the bargaining power of these individuals. Their unique skill sets and proven track records allow them to command substantial compensation packages, giving them considerable leverage.

EQT AB's long-term success hinges on its capacity to attract and retain premier talent, a cornerstone of its financial strategy. This reliance on high-caliber personnel means EQT must offer competitive remuneration and compelling career paths to secure the expertise needed for its investment activities.

What is included in the product

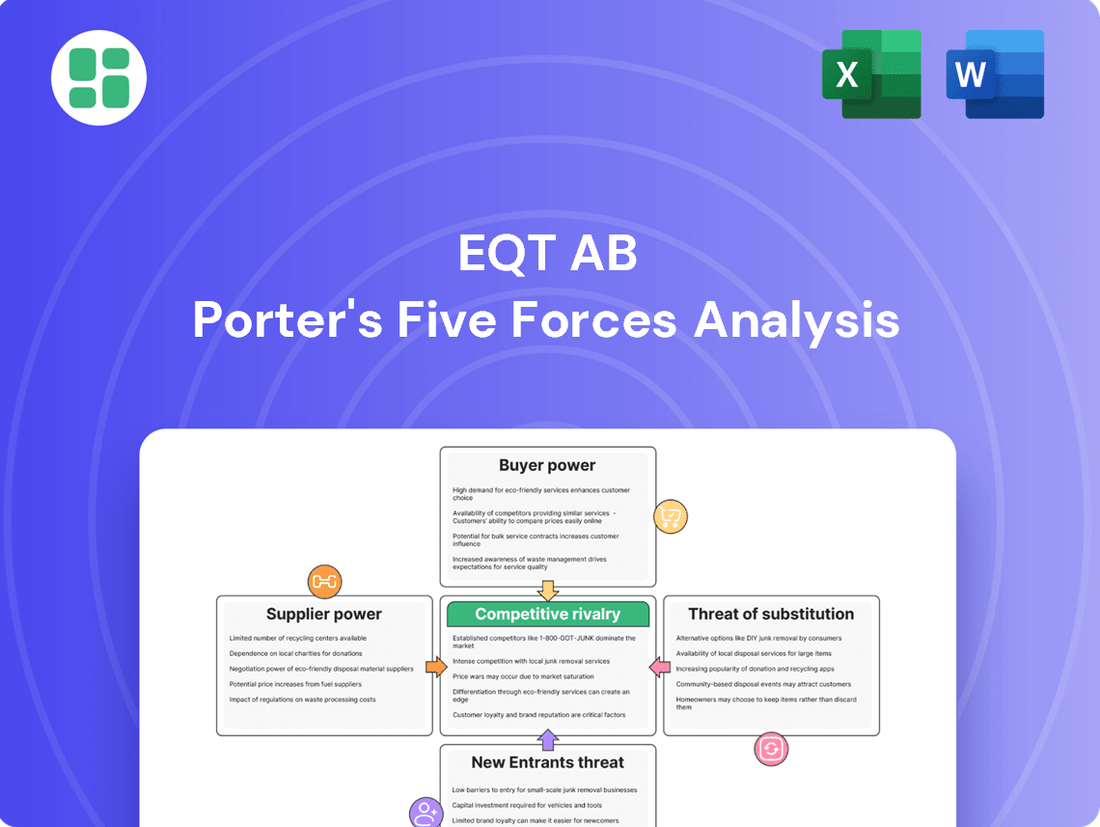

This analysis unpacks the competitive intensity within EQT AB's private equity sector, examining supplier power, buyer bargaining, new entrant threats, substitute investment options, and the rivalry among existing firms.

Instantly identify and prioritize competitive threats with a visual breakdown of EQT AB's industry landscape.

Customers Bargaining Power

EQT's main clients are institutional investors, often called Limited Partners (LPs), who invest money in its funds. These LPs are looking for good returns, but their ability to negotiate terms depends on how well the fund performs, how respected the manager is, and how easy it is to raise money overall. For instance, in 2023, the private equity fundraising market saw a slowdown, with global fundraising reaching approximately $810 billion, a decrease from previous years, giving LPs more leverage to ask for better terms.

When fundraising becomes tougher, LPs tend to have more sway, leading them to push for more favorable conditions. This can include demanding stronger key person clauses, which protect their investment if essential personnel leave the fund manager. This trend was evident in 2024 as well, with many LPs scrutinizing fund terms more closely due to increased market uncertainty and a desire for greater protection.

EQT's diverse investor base, spanning global geographies and including pension funds, sovereign wealth funds, and endowments, limits the bargaining power of any single limited partner. This diversification means no single investor holds a disproportionate sway over EQT's operations or terms.

The successful fundraising for EQT Infrastructure VI, which secured €24.4 billion in commitments by its final closing in early 2024, demonstrates EQT's broad appeal and ability to attract both established and new investors, further diluting individual LP influence.

Limited Partners (LPs) are placing a greater emphasis on distributions to paid-in capital (DPI) and overall liquidity, a trend amplified by recent periods of subdued exit markets. This heightened focus means that investment firms demonstrating a consistent ability to facilitate exits and return capital are more appealing to LPs, thereby diminishing the bargaining power of these customers.

EQT AB, for instance, saw a notable increase in its exit activity during the first half of 2025. This strategic push to generate liquidity and deliver returns directly addresses LP demands, strengthening EQT's position and reducing the leverage LPs might otherwise wield due to liquidity concerns.

Access to Alternative Investment Opportunities

Institutional investors now have a significantly wider array of alternative investment options, moving beyond traditional private equity. This includes direct investments, co-investments, private credit, and even increasingly sophisticated hedge fund strategies. As of early 2024, the global alternative investment market is valued in the trillions, offering ample substitutes for capital that might otherwise flow into private equity funds like those managed by EQT.

This broad availability of substitutes directly enhances the bargaining power of these investors. If EQT AB's terms, fees, or projected performance aren't competitive, institutional investors can readily reallocate their capital to other attractive opportunities. For instance, private credit has seen substantial growth, with many investors finding compelling risk-adjusted returns, making them less reliant on traditional private equity mandates.

- Increased Competition: A wider selection of investment vehicles means institutional investors can easily compare and contrast offerings, putting pressure on fund managers to provide competitive terms.

- Capital Mobility: Investors can swiftly shift capital between different asset classes and managers, reducing their dependence on any single private equity firm.

- Demand for Performance: With more choices, the bar for performance is higher, forcing firms like EQT to demonstrate clear value creation to attract and retain capital.

- Negotiating Leverage: The ability to walk away and invest elsewhere gives institutional investors significant leverage in negotiating management fees, carried interest, and other fund terms.

Flight to Quality

In turbulent economic climates, especially when capital is being raised, limited partners (LPs) often consolidate their investments with a smaller group of highly experienced fund managers who have a proven history of success. This phenomenon, known as a flight to quality, means that LPs are more likely to commit larger sums to established firms like EQT. For instance, in 2023, private equity fundraising saw a significant concentration, with the largest funds attracting the majority of capital, underscoring this trend.

This 'flight to quality' directly impacts the bargaining power of LPs. When top-tier firms consistently raise substantial capital, often referred to as megafunds, their ability to command favorable terms increases. This reduces the leverage LPs have in negotiating fees or other aspects of fund agreements with these sought-after managers.

- Concentrated Commitments: LPs increasingly favor fewer, larger, and more seasoned fund managers.

- Reduced LP Bargaining Power: Top-tier firms with strong track records can dictate terms due to high demand.

- MegaFund Success: The ability to raise megafunds is a key indicator of quality and reduces LP leverage.

- Market Volatility Impact: Economic uncertainty amplifies the flight to quality trend, strengthening managers' positions.

The bargaining power of EQT AB's customers, primarily institutional investors (LPs), is influenced by the availability of alternative investments and the firm's fundraising success. While a crowded market for alternative assets in 2024, valued in the trillions, offers LPs more choices and thus leverage, EQT's ability to consistently raise substantial capital, such as the €24.4 billion for EQT Infrastructure VI by early 2024, mitigates this power.

EQT's focus on generating liquidity and delivering strong distributions to paid-in capital (DPI) further strengthens its position. For example, EQT's increased exit activity in the first half of 2025 directly addresses LP demands for returns, diminishing their negotiating leverage.

The flight to quality trend, where LPs consolidate investments with proven managers during uncertain times, also benefits EQT. This concentration, evident in the 2023 private equity fundraising landscape where larger funds attracted the majority of capital, allows top-tier firms like EQT to command more favorable terms, reducing individual LP bargaining power.

Full Version Awaits

EQT AB Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for EQT AB, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides actionable insights into EQT AB's competitive landscape, enabling strategic decision-making.

Rivalry Among Competitors

The private equity landscape is fiercely competitive, with established giants like Blackstone, KKR, Apollo, and Carlyle Group constantly seeking capital and attractive investment opportunities. EQT AB, while a significant global player, finds itself in direct competition with these titans, all vying for the same limited pool of deals and investor commitments.

In 2024, the competition for capital remains intense. For instance, Blackstone announced a record-breaking $30 billion for its latest real estate fund, highlighting the sheer scale of capital these firms manage and deploy, putting pressure on EQT to differentiate its offerings and secure its share of investor mandates.

Competition is intensifying from non-traditional investors like sovereign wealth funds, pension plans, and family offices. These entities are increasingly engaging in direct investments, bypassing traditional private equity structures to gain more control and potentially lower fees. This shift broadens the competitive arena significantly.

Private equity firms are under immense pressure to deploy vast sums of uninvested capital, often referred to as 'dry powder'. This situation intensifies competition for prime investment targets, forcing firms to act swiftly to secure deals. For instance, by the end of 2023, global private equity dry powder stood at a record approximately $2.5 trillion, a significant increase from previous years.

This pressure to deploy capital also translates into a strong imperative to generate successful exits, returning funds to limited partners (LPs). The need to demonstrate returns fuels a more aggressive approach to value creation within portfolio companies and necessitates strategic planning for timely divestments. The robust M&A market in early 2024, despite some headwinds, reflects this ongoing drive for both acquisitions and exits.

Differentiation through Specialization and Expertise

EQT AB competes by carving out distinct investment strategies and deep sector expertise, particularly in areas like healthcare, technology, industrials, and infrastructure. This specialization allows EQT to build a strong reputation and attract both capital and attractive investment opportunities within these chosen fields.

The firm’s commitment to active ownership is a key differentiator. EQT actively engages with its portfolio companies, leveraging its extensive industrial network and specialized knowledge to foster growth and promote sustainable business practices. This hands-on approach, as evidenced by their consistent track record, sets them apart from more passive investment styles.

- Sector Focus: EQT has demonstrated significant investment activity and expertise across technology, healthcare, and infrastructure sectors.

- Active Ownership: The firm's strategy involves deep operational involvement to drive value creation.

- Industrial Network: EQT utilizes its broad network to support portfolio company growth and innovation.

Performance Track Record and Fund Size

EQT AB's competitive standing is significantly bolstered by its performance track record and substantial fund size. Consistently demonstrating strong investment returns across its various funds solidifies its reputation and attracts further capital. This ability to raise and deploy large amounts of capital is a key differentiator in the competitive private equity landscape.

EQT's success in closing major fundraises, such as the €22 billion EQT X in 2024, underscores its appeal to investors. Such large fund sizes enable EQT to pursue bigger deals and invest across a wider range of opportunities, further enhancing its competitive edge. The firm's commitment to generating value for its limited partners through disciplined investment strategies is evident in its sustained performance.

- Fundraising Success: EQT X closed at €22 billion in 2024, exceeding its initial target.

- Performance Metrics: EQT's flagship funds have historically delivered top-quartile returns.

- Capital Deployment: Larger fund sizes allow for more significant and diverse investment opportunities.

- Investor Confidence: Strong track record builds trust and attracts repeat investors.

EQT AB operates in a highly competitive private equity market, facing rivals like Blackstone and KKR. The firm differentiates itself through specialized sector focus in areas like technology and infrastructure, coupled with an active ownership approach that involves deep operational engagement with portfolio companies. This strategy, supported by a strong industrial network and a history of delivering top-quartile returns, helps EQT attract significant capital and secure attractive investment opportunities.

| Competitor | Fund Size Focus | Key Differentiator |

|---|---|---|

| Blackstone | Large-scale, diverse strategies | Breadth of asset classes, global reach |

| KKR | Growth equity, infrastructure | Operational expertise, sector specialization |

| Apollo | Credit, hybrid capital | Distressed investing, value creation through financial engineering |

| EQT AB | Technology, healthcare, infrastructure | Active ownership, deep sector knowledge, industrial network |

SSubstitutes Threaten

Institutional investors have readily available alternatives in public equity and bond markets, offering significant liquidity and generally lower management fees than private equity. For instance, in 2024, the S&P 500 saw strong performance, providing a compelling alternative for capital allocation.

This accessibility to public markets can divert substantial capital away from private equity. If public market returns are robust, or if investors require quicker access to their funds, private equity investments may become less attractive, impacting EQT's fundraising and deployment capabilities.

Sophisticated institutional investors, like pension funds and sovereign wealth funds, increasingly bypass traditional private equity funds. They opt for direct investments or co-investments, gaining more control and potentially saving on management fees. For instance, in 2023, direct investments by institutional investors in private markets saw significant growth, with many allocating substantial capital outside of blind-pool funds.

The increasing popularity of private credit and other alternative investments like hedge funds presents a significant threat of substitution for traditional private equity. These alternatives offer investors attractive return profiles and diversification advantages, drawing capital that might otherwise flow into private equity funds. For instance, the private credit market has seen substantial growth, with global private debt assets projected to reach $2.7 trillion by 2028, up from an estimated $1.4 trillion in 2023, according to Preqin data.

Private credit, in particular, is appealing due to its potentially higher yields and more flexible lending terms compared to traditional bank loans or even some private equity strategies. This attractiveness can lead investors to allocate a larger portion of their portfolios to private credit, thereby reducing the demand for private equity as an investment vehicle. The ability of private credit funds to offer bespoke financing solutions also makes them a compelling alternative for companies seeking capital.

Real Assets and Infrastructure Investments

Investments in real assets, such as real estate and infrastructure, present a significant threat of substitutes for EQT AB. These asset classes, which EQT also actively manages, appeal to investors seeking stable income streams and protection against inflation, directly competing with traditional private equity offerings.

The growing investor appetite for real assets is evident in dedicated fundraising efforts. For instance, global infrastructure fundraising reached a record $256 billion in 2023, signaling a robust alternative for capital that might otherwise flow into private equity.

- Real Estate as a Substitute: Real estate investments offer tangible assets and rental income, acting as an alternative for investors looking for diversification and inflation hedging, similar to some private equity strategies.

- Infrastructure's Growing Appeal: Infrastructure projects, from renewable energy to transportation, are attracting substantial capital due to their long-term, stable cash flows, directly competing for investor dollars with private equity funds.

- Increased Dedicated Fundraising: The surge in dedicated fundraising for real assets and infrastructure demonstrates a clear shift in investor preference, creating a competitive pressure on private equity firms like EQT.

- Yield and Inflation Hedge Competition: As interest rates fluctuate and inflation concerns persist, the predictable yields and inflation-hedging characteristics of real assets make them a compelling substitute for private equity's potentially higher but often less predictable returns.

In-house Investment Capabilities

Large institutional investors, including pension funds and sovereign wealth funds, are increasingly building their own in-house investment capabilities to manage private assets directly. This trend allows them to bypass external managers like EQT AB, thereby acting as a significant substitute for EQT's services.

For instance, the total assets managed by pension funds globally reached an estimated $50 trillion by the end of 2023, with a growing allocation towards private markets. As these institutions develop internal expertise, their need for third-party private equity managers may diminish.

- Growing In-house Management: Institutions are investing in talent and technology to manage private equity, venture capital, and infrastructure assets internally.

- Cost Efficiency: Direct management can offer cost savings compared to paying management and performance fees to external firms.

- Control and Customization: In-house teams provide greater control over investment strategies and portfolio construction, aligning more closely with specific institutional mandates.

The threat of substitutes for EQT AB is significant, stemming from readily available alternatives in public markets and the rise of other alternative investments. Public equities, as exemplified by the S&P 500's strong performance in 2024, offer liquidity and often lower fees, drawing capital away from private equity. Furthermore, institutional investors increasingly favor direct or co-investments, bypassing traditional fund structures for greater control and cost savings, a trend evident in the significant growth of direct investments in private markets during 2023.

Private credit and real assets like infrastructure and real estate also pose substantial substitution threats. Private credit, with its attractive yields and flexible terms, saw global assets projected to reach $2.7 trillion by 2028, up from $1.4 trillion in 2023. Similarly, global infrastructure fundraising hit a record $256 billion in 2023, highlighting the competition for investor capital. These alternatives offer diversification and inflation hedging, directly challenging private equity's value proposition.

| Substitute Category | Key Characteristics | Investor Appeal | 2023/2024 Data Point |

|---|---|---|---|

| Public Equities | High liquidity, lower fees | Capital allocation, potential for strong returns | S&P 500 performance in 2024 |

| Direct/Co-Investments | Greater control, cost savings | Bypassing external managers, tailored strategies | Significant growth in direct investments by institutions |

| Private Credit | Higher yields, flexible terms | Attractive returns, diversification | Projected to reach $2.7 trillion by 2028 (from $1.4 trillion in 2023) |

| Real Assets (Infrastructure/Real Estate) | Stable income, inflation hedge | Tangible assets, long-term cash flows | Record $256 billion in global infrastructure fundraising in 2023 |

Entrants Threaten

Launching a private equity fund demands immense capital, not just for initial investments but also for ongoing operational expenses and attracting top talent, creating a significant hurdle for newcomers. For instance, many emerging managers in 2024 found it challenging to secure commitments exceeding a few hundred million euros, a stark contrast to the multi-billion euro funds managed by established players.

This capital intensity naturally favors firms with a proven track record and extensive networks, like EQT AB. As a result, smaller, less experienced funds often struggle to raise the necessary capital, leading to a consolidation within the industry where established managers benefit from this trend.

For new entrants aiming to compete in the private equity space, establishing a proven track record of successful investments and delivering attractive returns is paramount to drawing in institutional investors. Without this history, it's incredibly challenging to gain traction against established players.

Firms like EQT AB, with decades of experience and a demonstrated history of strong performance, present a significant barrier. For instance, EQT's funds have consistently achieved top-quartile returns, which is a key differentiator that new firms simply cannot replicate overnight. This lack of established credibility makes it difficult for newcomers to secure the significant capital required to operate effectively.

Building an extensive network for deal sourcing, due diligence, and value creation is a multi-year endeavor, a significant barrier for new entrants. EQT AB, for instance, has cultivated deep industrial relationships and a global platform over decades, making it difficult for newcomers to match its reach and insight. This established network allows EQT to identify and execute deals more effectively than nascent competitors.

Regulatory and Compliance Burdens

The private equity sector is grappling with heightened regulatory oversight and a growing web of compliance mandates. New firms entering this arena must contend with substantial hurdles in understanding and adhering to these intricate rules, which inherently increases both the financial outlay and the operational complexity of setting up shop.

For instance, in 2024, the European Union continued to refine its Alternative Investment Fund Managers Directive (AIFMD), introducing stricter reporting and governance standards. These evolving regulations can act as a significant barrier to entry.

- Increased Capital Requirements: Regulators may impose higher minimum capital levels for new private equity funds.

- Licensing and Authorization: Obtaining necessary licenses and approvals can be a lengthy and resource-intensive process.

- Ongoing Compliance Costs: Maintaining compliance with evolving regulations requires continuous investment in legal, accounting, and operational infrastructure.

- Reputational Risk: Non-compliance can lead to severe penalties and damage a new firm's reputation, deterring investors.

Talent Acquisition and Retention

The threat of new entrants in the private equity space, particularly concerning talent acquisition and retention, is substantial. New firms must contend with established players like EQT AB, which possess significant advantages in attracting and keeping top-tier professionals.

These established firms can leverage their brand recognition, robust compensation packages, and clear career progression paths to draw in experienced talent. For instance, in 2024, the demand for skilled private equity professionals remained exceptionally high, with many seeking opportunities that offer not just financial rewards but also a stable and reputable platform.

- High Competition for Talent: New entrants face intense competition from established firms like EQT for experienced private equity professionals.

- Compensation and Benefits: Established firms can offer more attractive compensation and benefits, making it difficult for new players to compete.

- Career Development and Culture: EQT's proven track record and established culture provide a strong draw for talent, posing a barrier for nascent firms.

- Talent Acquisition Hurdles: The need to secure specialized expertise in areas like deal sourcing, due diligence, and portfolio management presents a significant challenge for new market entrants.

The threat of new entrants into the private equity arena is significantly mitigated by the immense capital required to launch and operate a fund, a hurdle that many new firms in 2024 struggled to overcome, often finding it difficult to raise more than a few hundred million euros. Established players like EQT AB, with their multi-billion euro funds and proven track records, naturally benefit from this capital intensity, making it tough for smaller, less experienced funds to compete effectively.

Building the extensive networks for deal sourcing and value creation that firms like EQT AB have cultivated over decades is another formidable barrier for newcomers. The intense competition for top talent, where established firms offer attractive compensation and career paths, further solidifies the position of incumbents. Moreover, the increasing regulatory scrutiny and compliance demands, exemplified by the evolving AIFMD in the EU during 2024, add substantial financial and operational complexity for any new entrant.

| Barrier | Impact on New Entrants | EQT AB's Advantage |

|---|---|---|

| Capital Intensity | Difficulty raising substantial funds (e.g., < €500M in 2024) | Manages multi-billion euro funds |

| Track Record & Credibility | Lack of proven investment success | Consistent top-quartile returns |

| Network & Relationships | Limited industry connections for deal flow | Deep, decades-old industrial and global relationships |

| Regulatory Compliance | High costs and complexity of adhering to evolving rules (e.g., AIFMD) | Established infrastructure and expertise for compliance |

| Talent Acquisition | Struggles to attract top professionals against established firms | Strong brand, compensation, and career progression |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EQT AB is built upon a foundation of reliable data, including EQT's official annual reports and investor presentations, alongside industry-specific market research reports and publicly available financial databases.