EQT AB Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EQT AB Bundle

EQT AB's marketing strategy is a finely tuned engine, with its product offerings meticulously designed to meet the evolving needs of the energy sector. Their pricing reflects a keen understanding of market value and competitive positioning. This comprehensive analysis delves into how EQT AB leverages its place and promotion strategies to solidify its market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for EQT AB. Ideal for business professionals, students, and consultants looking for strategic insights into one of the energy sector's key players.

Product

EQT AB offers a diverse array of investment funds, encompassing private equity, infrastructure, real estate, and venture capital. This extensive product range is designed to meet the varied needs and risk tolerances of institutional investors, providing them with opportunities for diversified investment across different asset classes and global markets.

The firm's commitment to specialization is evident in its fund structuring. Each fund is meticulously crafted to align with distinct investment strategies and target specific sectors, thereby creating focused avenues for capital allocation and growth.

EQT's active ownership is a cornerstone of its product offering, differentiating it from passive investment strategies. This model involves deep engagement to drive transformation and value creation within portfolio companies.

EQT actively deploys its industrial network and sector expertise to implement operational improvements and strategic enhancements. For instance, in 2023, EQT’s portfolio companies collectively achieved an average EBITDA growth of 15%, a testament to this hands-on approach.

EQT's product, its investment strategies, is significantly enhanced by its deep sector-specific expertise. By concentrating on areas like healthcare, technology, and industrials, EQT gains a nuanced understanding of market trends and potential. This focus is crucial for identifying high-potential investments, as seen in their successful technology investments, which represented a significant portion of their portfolio by mid-2024.

This specialized knowledge translates directly into better strategic guidance for their portfolio companies. For instance, in the technology sector, EQT's insights into digital transformation and AI integration have helped companies accelerate growth. This specialized approach contributed to EQT's strong performance in 2024, with several portfolio companies achieving significant market share gains.

Ultimately, EQT's sector-specific expertise allows for more discerning investment decisions and drives superior value creation. Their ability to navigate the complexities of industries like healthcare, where regulatory landscapes are critical, ensures a more robust approach to portfolio management and a higher likelihood of successful exits, bolstering their reputation as a leading private equity firm.

Sustainability and ESG Integration

EQT AB's product offering deeply embeds sustainability and ESG principles, recognizing their critical role in long-term value creation. This commitment is not merely a trend but a core tenet of their investment strategy, influencing every stage of the investment process.

EQT actively integrates ESG considerations from initial due diligence through to portfolio company value creation and eventual exit. This holistic approach ensures that sustainability is a driver of operational improvement and risk mitigation, not an afterthought.

The firm’s dedication to responsible investing resonates with a growing investor base. For instance, in 2023, EQT reported that over 90% of its capital was managed under an ESG-integrated strategy, highlighting the widespread adoption of these principles across its funds.

- ESG Integration Across Investment Lifecycle: EQT's methodology spans due diligence, active ownership, and exit strategies.

- Investor Demand Alignment: Over 90% of EQT's capital was managed under an ESG-integrated strategy in 2023, reflecting market trends.

- Resilience and Future-Proofing: The focus on ESG aims to build businesses that are more robust against evolving environmental and social challenges.

- Value Creation Driver: ESG factors are leveraged to enhance operational performance and unlock new opportunities within portfolio companies.

Tailored Investment Solutions for Private Wealth

EQT AB is strategically broadening its reach by introducing tailored investment solutions specifically for the private wealth sector. This expansion includes offerings like EQT Nexus Infrastructure, designed to attract both individual and institutional investors. This move signifies EQT's commitment to diversifying its client base and providing more accessible avenues into its established investment strategies.

These new solutions grant investors direct exposure to EQT's proprietary direct investment and infrastructure portfolios. This enhanced accessibility is crucial for a wider spectrum of financially-literate decision-makers seeking to diversify their holdings with proven alternative asset managers.

- Product Expansion: Introduction of tailored investment solutions for private wealth.

- Key Offering: EQT Nexus Infrastructure provides access to EQT's direct investments and infrastructure strategies.

- Client Base Growth: Aims to broaden EQT's client base by catering to individual and institutional investors.

- Enhanced Accessibility: Offers wider access to EQT's investment expertise for a diverse financial audience.

EQT's product strategy centers on specialized, actively managed funds across private equity, infrastructure, and real estate. This approach is bolstered by deep sector expertise, particularly in technology and healthcare, enabling them to identify and cultivate high-growth potential companies. Their active ownership model drives operational improvements, as evidenced by a 15% average EBITDA growth across portfolio companies in 2023.

Furthermore, EQT is expanding its product suite to include offerings for the private wealth sector, such as EQT Nexus Infrastructure, enhancing accessibility to their investment strategies for a broader investor base. This move underscores their commitment to meeting diverse client needs and capturing new market segments.

Sustainability and ESG principles are deeply integrated into EQT's product development and management. In 2023, over 90% of their capital was managed under an ESG-integrated strategy, demonstrating a proactive approach to building resilient, future-proof businesses and aligning with growing investor demand for responsible investing.

| Product Area | Key Strategy | 2023 Highlight | 2024 Focus |

|---|---|---|---|

| Private Equity | Active Ownership, Sector Specialization | 15% Avg. EBITDA Growth in Portfolio Companies | Continued tech and healthcare investment |

| Infrastructure | Direct Investment, ESG Integration | Expansion into private wealth with EQT Nexus | Broadening investor access |

| Real Estate | Value Creation, Sustainability | High ESG integration across funds | Leveraging ESG for operational enhancement |

What is included in the product

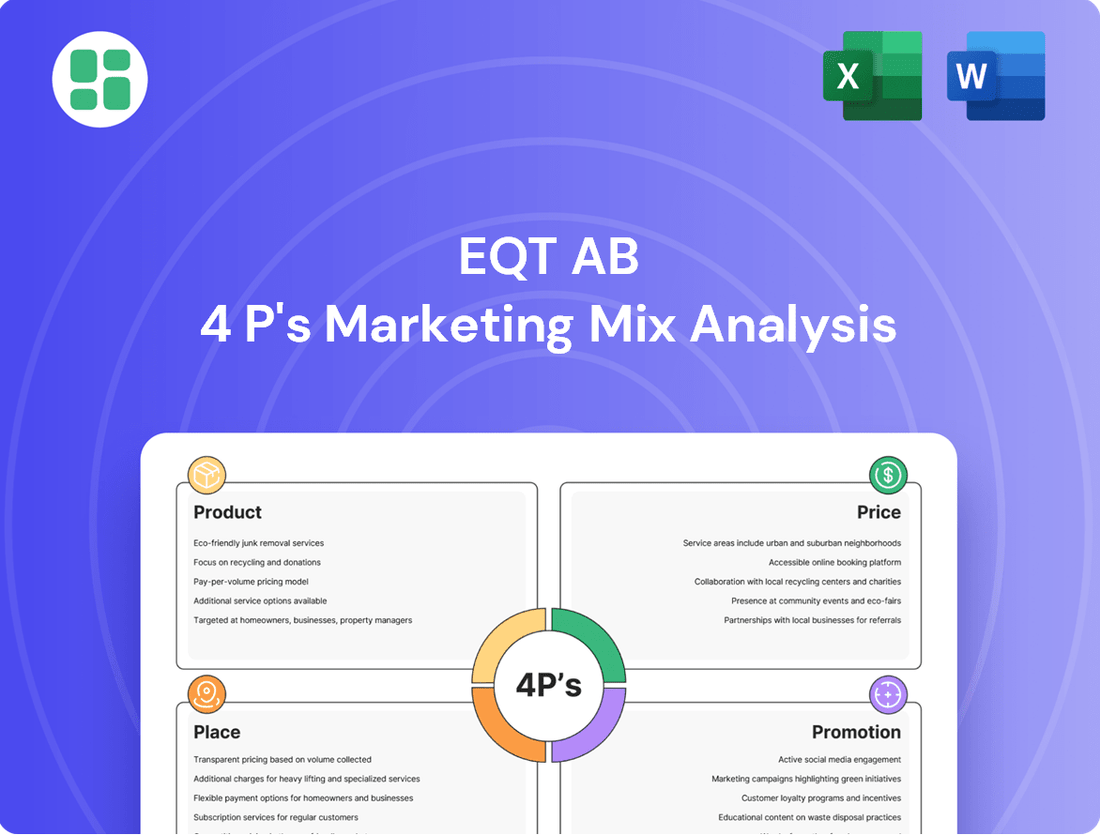

This analysis provides a comprehensive breakdown of EQT AB's marketing mix, detailing their strategies across Product, Price, Place, and Promotion. It offers actionable insights into EQT AB's market positioning and competitive advantages.

This EQT AB 4P's Marketing Mix Analysis acts as a pain point reliever by providing a clear, actionable roadmap to optimize marketing efforts and overcome common strategic challenges.

It simplifies complex marketing decisions into a digestible framework, enabling swift identification and resolution of issues hindering EQT AB's market performance.

Place

EQT AB boasts a substantial global network, with offices strategically positioned in over 25 countries across Europe, North America, and Asia. This expansive reach allows for direct interaction with a diverse base of institutional investors on a worldwide scale.

This widespread physical presence is instrumental in gathering granular local market intelligence, which is vital for both identifying promising investment opportunities and effectively managing existing portfolios. EQT's commitment to having boots on the ground highlights its dedication to being accessible and leveraging localized expertise.

EQT's primary 'place' for engaging its services is through direct channels with institutional investors. This involves dedicated investor relations teams who are the main point of contact for managing relationships, disseminating fund updates, and facilitating capital commitments. This approach ensures a high degree of personalization and cultivates robust, long-term partnerships with its sophisticated clientele.

EQT's distribution strategy is built around meticulously planned fundraising cycles for its diverse fund offerings. For instance, EQT Infrastructure VI achieved a final close in 2023, raising €15 billion, demonstrating the success of these structured processes. The firm also launched EQT XI in early 2024, targeting €20 billion, showcasing ongoing capital raising momentum.

These fundraising efforts involve extensive global roadshows, detailed investor presentations, and rigorous due diligence phases. This controlled environment is where EQT strategically educates and persuades potential investors, including pension funds, sovereign wealth funds, and insurance companies, to commit capital to its investment strategies.

Digital Investor Platforms and Reporting

EQT AB leverages digital investor platforms to provide a secure and efficient channel for reporting and communication. These online portals are essential for investors to monitor fund performance, access critical documents like quarterly reports, and stay updated on EQT's activities. In 2024, EQT reported a significant increase in digital engagement, with over 90% of investor communications being handled through these platforms, streamlining information flow and enhancing transparency.

These digital spaces act as a central hub, offering investors real-time data and insights into their investments. The emphasis is on providing a seamless user experience, allowing for easy navigation and quick access to essential financial information. For instance, EQT's investor portal in early 2025 provided detailed breakdowns of portfolio company performance, including key metrics like revenue growth and EBITDA, which saw a collective year-on-year increase of 15% across its active funds.

- Secure online portals for investor access

- Real-time tracking of fund performance and data

- Efficient dissemination of reports and company updates

- Enhanced transparency and investor engagement

Expanding Private Wealth Distribution Channels

EQT AB is strategically broadening its distribution network for private wealth products. This involves establishing new channels to reach a more diverse investor base beyond traditional institutional clients.

A key initiative includes the launch of U.S. evergreen products, which are being distributed through major global players like private banks and wirehouses. This expansion targets high-net-worth individuals and family offices, tapping into a significant segment of the wealth management market.

- Expanded Reach: EQT is moving beyond institutional investors to engage directly with high-net-worth individuals and family offices.

- U.S. Market Focus: The introduction of U.S. evergreen products signifies a targeted effort to penetrate the American private wealth sector.

- Global Distribution: Partnerships with global private banks and wirehouses are crucial for accessing a broad international client base.

EQT AB's 'Place' strategy encompasses both its physical global footprint and its digital investor platforms. The firm's extensive network of over 25 offices worldwide facilitates direct engagement with institutional investors and provides crucial local market insights. This physical presence is complemented by secure online portals, which are vital for transparent reporting, real-time performance tracking, and efficient communication, as evidenced by over 90% of investor communications occurring digitally in 2024.

Furthermore, EQT is actively expanding its distribution channels for private wealth products, targeting high-net-worth individuals and family offices through partnerships with global private banks and wirehouses, particularly with its U.S. evergreen product offerings. This dual approach ensures broad accessibility and tailored engagement for its diverse investor base.

| Channel | Target Audience | Key Initiatives/Data |

|---|---|---|

| Global Offices | Institutional Investors | 25+ countries; direct engagement; local market intelligence |

| Digital Investor Platforms | All Investors | Secure reporting; real-time data; 90%+ digital communications (2024) |

| Private Wealth Distribution | High-Net-Worth Individuals, Family Offices | U.S. evergreen products; partnerships with private banks/wirehouses |

Preview the Actual Deliverable

EQT AB 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of EQT AB's 4P's marketing mix is fully complete and ready for your immediate use.

Promotion

EQT's promotional strategy hinges on exceptional investor relations, featuring transparent and frequent reporting. This includes detailed updates on fund performance, portfolio company progress, and strategic moves, fostering trust with its institutional investors. For instance, EQT's 2023 Annual Report highlighted a 12% increase in Assets Under Management (AUM) to €242 billion, underscoring the impact of their consistent communication.

Key elements of this approach involve comprehensive annual reports, timely quarterly updates, and engaging investor calls. These channels are crucial for reinforcing EQT's credibility and providing their sophisticated investor base with the in-depth information they require for informed decisions.

EQT AB actively cultivates its reputation as an industry thought leader. This is achieved through a consistent stream of publications, in-depth white papers, and active engagement in key industry forums. For instance, EQT's commitment to sharing expertise is evident in its regular publications that delve into evolving market dynamics and innovative investment strategies.

By disseminating valuable insights on crucial topics like sustainability and emerging market trends, EQT strategically positions itself as a knowledgeable and forward-thinking entity within the alternative investments sector. This approach directly contributes to enhancing brand reputation and attracting a wider pool of potential investors seeking expert guidance.

EQT AB's marketing mix heavily features showcasing portfolio company successes, a potent promotional tool. Highlighting growth and transformation stories, including significant exits and value creation, provides concrete evidence of EQT's capabilities. For instance, the successful sale of portfolio company IFS in 2023, which saw substantial revenue growth under EQT's ownership, serves as a prime example of this strategy.

Case studies, testimonials, and public announcements of successful exits or operational improvements act as tangible proof of EQT's value creation. This approach effectively communicates demonstrable returns and operational excellence to potential investors, reinforcing EQT's reputation in the market.

Strategic Media Engagement and Public Relations

EQT AB actively manages its public image through strategic media engagement and public relations. This involves disseminating news releases concerning significant events like acquisitions and executive leadership transitions, ensuring timely and accurate communication to stakeholders.

The firm's approach includes proactive outreach for announcements and providing expert commentary on market trends, thereby shaping the narrative around its operations and performance. This consistent engagement aims to foster a positive brand perception and enhance visibility within the financial sector. For instance, EQT's public relations efforts in 2024 have focused on highlighting its continued investment in sustainable energy solutions and its expansion into new geographic markets, as evidenced by their Q1 2024 earnings call where media coverage emphasized these strategic priorities.

- Proactive Media Outreach: EQT issues press releases for key developments, such as the acquisition of a renewable energy portfolio in early 2024, which was widely covered by financial news outlets.

- Expert Commentary: The company's leadership regularly provides insights on energy market dynamics, contributing to their reputation as industry thought leaders.

- Reputation Management: Through transparent communication, EQT aims to maintain a strong and positive brand image among investors and the broader financial community.

- Key Message Dissemination: Public relations efforts ensure that messages about EQT's strategic direction, such as its commitment to ESG principles, reach a wide audience.

Targeted Industry Events and Capital Markets Days

EQT AB actively engages in targeted industry events and capital markets days as a core component of its promotional strategy. Participation in major global investment conferences and summits allows EQT to directly connect with potential investors, showcase its strategic vision, and solidify its standing in the market. For instance, EQT was a prominent participant at the SuperReturn International conference in February 2024, a key event for private equity professionals.

These events are crucial for reinforcing EQT's market presence and fostering relationships. By presenting their active ownership model and value creation strategies at these forums, they gain visibility and credibility. EQT also strategically hosts its own capital markets days, offering a more focused environment to deep dive into their operational successes and future plans with the investment community, often highlighting portfolio company performance metrics.

- Global Conference Presence: EQT's participation in events like SuperReturn International in February 2024 provides direct access to a concentrated pool of investors.

- Investor Networking: These platforms are vital for EQT to network with potential limited partners (LPs) and present its investment thesis.

- Strategic Communication: EQT utilizes these opportunities to articulate its active ownership model and demonstrate value creation across its portfolio.

- Capital Markets Days: Hosting dedicated events allows EQT to offer in-depth insights into its financial performance and strategic direction.

EQT AB's promotional efforts are deeply rooted in showcasing tangible results and fostering thought leadership. By highlighting successful portfolio company transformations, such as the notable growth of IFS under their stewardship, EQT provides concrete evidence of its value creation capabilities. This focus on demonstrable success, coupled with proactive media engagement and participation in key industry events like SuperReturn International in February 2024, reinforces their market position and attracts investors.

Price

EQT's pricing heavily relies on management fees, a percentage of assets under management (AUM) for each fund. This fee structure, common in private equity, covers essential operational expenses like deal sourcing and portfolio oversight.

For instance, EQT's flagship EQT X fund, which closed in 2023 with €22 billion in commitments, likely follows a typical management fee structure of 1.5% to 2% on committed capital during the investment period, as seen in similar large-cap buyout funds.

Performance fees, or carried interest, are a cornerstone of EQT's 'price' strategy, representing a significant portion of its earnings. This fee structure allows EQT to capture a share of the profits from its funds, typically 20%, after investors receive a predetermined minimum return, known as the hurdle rate.

This model directly links EQT's compensation to the successful performance of its investments, creating a powerful incentive for generating superior returns for its clients. For instance, EQT's strong fundraising and investment track record in recent years, including significant capital raised for its flagship EQT X fund, underscores the potential for substantial carried interest generation.

EQT AB's fund pricing is highly tailored, reflecting variations across asset classes like private equity and infrastructure. For instance, EQT Infrastructure VI, launched in 2021, had a target size of €15 billion, with management fees typically structured as a percentage of committed capital.

Each fund's specific fee structure, including management fees, carried interest, and other costs, is meticulously outlined in its offering memorandum. This commitment to detail ensures potential investors have a clear understanding of the financial terms associated with their investment in EQT's diverse strategies.

Alignment with Investor Returns

EQT's pricing strategy is fundamentally built around ensuring its success is directly tied to the success of its investors. This means EQT's fees and profit-sharing structures are designed to reward the firm only when it delivers strong, long-term returns for the capital it manages.

The cornerstone of this alignment is EQT's carried interest model. This mechanism means EQT earns a significant portion of its profits, typically 20% of the profits above a certain hurdle rate, only after investors have received their initial capital back plus a preferred return. This creates a powerful incentive for EQT to maximize investor gains, fostering a true partnership rather than a simple client-provider relationship.

This investor-centric approach is a significant draw for sophisticated institutional investors, such as pension funds and sovereign wealth funds, who are increasingly scrutinizing how fund managers align their interests with those of their limited partners. EQT's demonstrated ability to generate attractive returns, coupled with this transparent alignment, positions it favorably in attracting and retaining substantial capital commitments.

- Carried Interest: EQT earns carried interest, typically 20%, on profits above a hurdle rate, ensuring shared upside with investors.

- Long-Term Focus: The pricing model encourages a long-term investment horizon, aligning with investor objectives for sustained growth.

- Investor Attraction: This direct alignment is a key differentiator, attracting institutional capital seeking performance-driven partnerships.

- 2024/2025 Performance Alignment: EQT's ongoing strategy continues to emphasize this alignment, with performance metrics in 2024 and projections for 2025 reflecting this commitment to shared returns.

Competitive Landscape and Market Standards

EQT AB's pricing strategy is deeply influenced by the competitive dynamics within the alternative asset management sector. The firm actively monitors prevailing market standards for management and performance fees across comparable fund types, such as private equity and infrastructure. For instance, typical management fees in private equity often range from 1.5% to 2% of committed capital, with performance fees, or carried interest, commonly set at 20% above a hurdle rate. EQT must calibrate its own fee structure to remain attractive to sophisticated institutional investors, including pension funds and sovereign wealth funds, who are highly sensitive to fee levels relative to expected returns.

Maintaining a competitive edge necessitates a careful balance. EQT aims to deliver superior risk-adjusted returns, justifying its fee structure by demonstrating value creation. However, excessively high fees could deter potential investors, especially when other asset managers offer similar strategies at lower price points. In 2024, the industry saw continued pressure on fees, with some larger, established managers even exploring tiered fee structures to cater to different investor segments and fund sizes. EQT's approach thus involves a continuous assessment of its fee proposition against the backdrop of market expectations and its own operational costs and profit objectives.

The firm's fee structure is designed to align its interests with those of its investors. This often includes:

- Management Fees: Typically charged as a percentage of committed capital or net asset value, covering the firm's operational expenses and providing a baseline revenue stream.

- Performance Fees (Carried Interest): A share of the profits generated by the funds, usually realized upon successful exits of portfolio companies, incentivizing EQT to maximize returns.

- Hurdle Rate: A minimum rate of return that must be achieved before EQT can earn performance fees, ensuring investors receive a base return first.

- Catch-up Provisions: Mechanisms that allow EQT to receive a larger share of profits once the hurdle rate is surpassed, reflecting the firm's success in generating alpha.

EQT's pricing strategy is anchored in management fees, typically 1.5% to 2% of committed capital for funds like EQT X, and performance fees, or carried interest, commonly 20% of profits above a hurdle rate.

This model directly links EQT's compensation to investor success, a key differentiator attracting sophisticated institutional capital. The firm continuously calibrates its fees against market standards, balancing competitiveness with value creation.

For instance, EQT Infrastructure VI, aiming for €15 billion in 2021, exemplifies the tailored fee structures across asset classes. This investor-centric approach, emphasizing shared upside, remains central to EQT's strategy through 2024 and into 2025.

| Fee Component | Typical Structure | Purpose |

| Management Fees | 1.5%-2% of Committed Capital/AUM | Covers operational expenses, baseline revenue |

| Performance Fees (Carried Interest) | 20% of profits above hurdle rate | Incentivizes profit maximization, shared upside |

| Hurdle Rate | Minimum investor return threshold | Ensures investors achieve base return first |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis for EQT AB is built upon a foundation of verified data, including official company filings, investor relations materials, and detailed industry reports. We meticulously examine their product portfolio, pricing strategies, distribution channels, and promotional activities to provide a comprehensive overview.