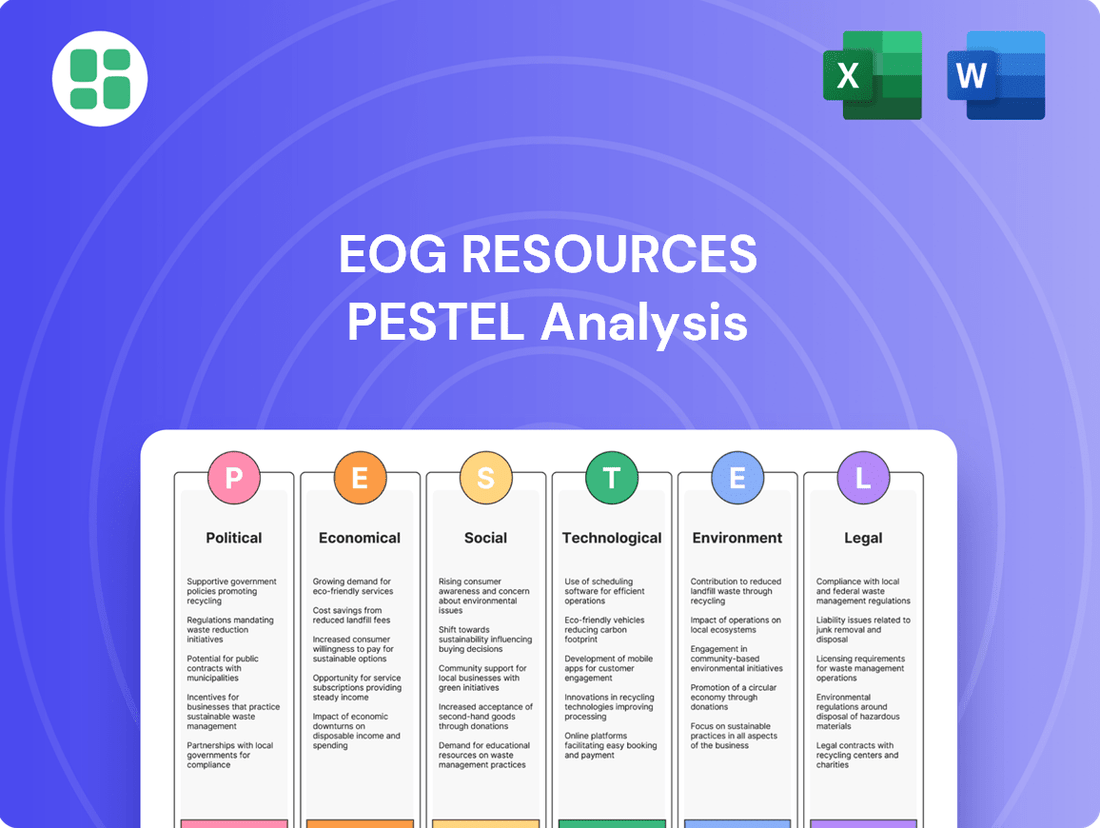

EOG Resources PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EOG Resources Bundle

Navigate the complex external forces shaping EOG Resources's future. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic decisions. Gain a critical understanding of the landscape and identify potential opportunities and challenges. Download the full PESTLE analysis now to unlock actionable intelligence and sharpen your competitive edge.

Political factors

Government policies, especially in the United States, are a major factor for EOG Resources, dictating everything from drilling permits and land access to environmental rules. The upcoming 2024 and 2025 elections could bring significant shifts in energy policy, directly affecting the regulatory landscape for oil and gas companies like EOG.

A change in administration might usher in either more permissive environments for fossil fuel extraction or a stronger push for renewable energy, potentially altering EOG's operational costs and strategic direction.

Global geopolitical stability and evolving trade relations significantly influence EOG Resources' international operations and the broader energy market. Events like the ongoing tensions in Eastern Europe and the Middle East directly impact global oil and gas prices, creating volatility that can affect EOG's revenue streams from its ventures in Trinidad, Bahrain, and the UAE. For instance, the average Brent crude oil price experienced significant fluctuations throughout 2024, driven by these geopolitical concerns, directly impacting the profitability of exploration and production activities.

Changes in tax laws and the potential introduction of new fees, like a methane fee, can significantly impact EOG Resources' bottom line. For instance, the U.S. Tax Cuts and Jobs Act of 2017, which lowered the corporate tax rate, has already affected EOG's cash tax payments, leading to a more favorable tax environment in the short term.

Furthermore, the presence or absence of energy subsidies directly influences the economic viability of EOG's projects. As political discussions increasingly focus on the energy transition, there's a growing likelihood of fiscal incentives favoring renewable energy sources or imposing disincentives on fossil fuels, which could alter the competitive landscape for companies like EOG.

International Energy Agreements

International energy agreements and climate commitments, like those discussed at global climate conferences such as COP30, significantly influence the long-term demand for fossil fuels. These agreements can steer investment away from traditional energy sources and impact EOG's strategic planning regarding its operational footprint and future exploration activities. For instance, the Paris Agreement, which aims to limit global warming, sets a precedent for national decarbonization targets that indirectly affect the oil and gas sector.

While EOG Resources primarily operates within U.S. basins, its international exploration ventures are directly subject to the specific government approvals and bilateral energy agreements of host countries. These agreements can dictate terms of operation, environmental standards, and revenue sharing, creating a complex regulatory landscape. The global political commitment to decarbonization also shapes the industry's social license to operate, potentially leading to increased scrutiny and operational challenges.

- Global Climate Summits: Discussions at events like COP30 in 2024 and upcoming meetings in 2025 will continue to shape global energy policy and investment trends.

- Decarbonization Targets: National commitments to reduce carbon emissions, often influenced by international agreements, can impact the perceived long-term viability of fossil fuel projects.

- Bilateral Agreements: EOG's international operations necessitate navigating specific energy agreements with host governments, affecting operational approvals and compliance.

Lobbying and Industry Advocacy

The oil and gas sector, with EOG Resources as a key participant, heavily invests in lobbying to shape legislation and regulations. These activities aim to boost domestic production and energy security, while opposing policies seen as hindering industry expansion. For instance, in 2023, the American Petroleum Institute, a prominent industry group, reported spending over $20 million on lobbying efforts.

- Influence on Policy: Lobbying directly impacts the creation and enforcement of environmental, tax, and operational regulations.

- Industry Spending: Major oil and gas companies, including EOG, contribute significantly to industry advocacy groups.

- Economic Impact: Favorable policies can lead to increased investment and operational efficiency for companies like EOG.

Governmental policies in the United States, particularly concerning drilling permits and environmental regulations, directly shape EOG Resources' operations. The outcomes of the 2024 and 2025 elections are anticipated to influence the regulatory landscape, potentially leading to shifts in energy policy that could impact EOG's operational costs and strategic planning.

What is included in the product

This PESTLE analysis of EOG Resources examines the impact of political, economic, social, technological, environmental, and legal factors on its operations and strategy.

It provides a comprehensive overview of the external landscape, highlighting key trends and their implications for the company's future growth and risk management.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of EOG Resources' external environment to inform strategic decisions.

Economic factors

Global oil and natural gas prices are the most significant economic drivers for EOG Resources, directly impacting its profitability and strategic investment choices. For 2025, projections indicate crude oil prices could range from $70 to $80 per barrel, with geopolitical instability posing an upside risk.

Natural gas prices are also anticipated to experience greater fluctuations in 2025, largely influenced by the demand for U.S. liquefied natural gas (LNG) exports. This volatility necessitates careful financial planning and operational flexibility for EOG.

The global economic outlook significantly shapes energy demand, and thus EOG Resources' performance. Strong economic expansion in key markets such as China and India, for example, fuels increased consumption of oil and natural gas. In 2024, projections for global GDP growth, estimated around 3.2% by the IMF, suggest a generally supportive environment for energy demand.

When economies are thriving, industrial activity increases, transportation needs rise, and overall energy consumption goes up. This robust demand directly benefits EOG by potentially boosting their production volumes and leading to higher revenue streams from their oil and natural gas sales. For instance, if these major economies experience growth rates exceeding 5% in 2025, it would likely translate into stronger pricing for EOG's commodities.

Conversely, any slowdown in global economic activity, perhaps due to geopolitical instability or inflationary pressures, can dampen energy demand. A projected global GDP growth rate dipping below 2.5% for 2025, for example, would likely lead to softer commodity prices and could negatively impact EOG's financial results by reducing their realized prices and potentially their sales volumes.

EOG Resources is committed to a disciplined capital expenditure strategy, projecting $6.2 billion to $6.4 billion in spending for 2025. This investment is designed to drive production growth and maximize shareholder value.

While the energy sector is seeing increased investment in supply, the pace of this growth is moderating from its earlier trajectory in the 2020s. EOG's approach involves carefully allocating capital between its established core operational areas and exploring new avenues, such as international market expansion.

Inflationary Pressures and Operating Costs

Inflationary pressures have a direct impact on EOG Resources' operating costs, affecting everything from the price of drilling equipment and materials to the wages paid to its workforce. For instance, the Producer Price Index (PPI) for inputs to crude petroleum and natural gas production saw significant increases throughout 2023 and into early 2024, reflecting higher costs for services and commodities.

EOG Resources has proactively implemented cost-mitigation strategies and focused on enhancing operational efficiencies to counteract these rising expenses. The company's commitment to maintaining a low-cost production profile remains a cornerstone of its profitability strategy, particularly in navigating the inherent volatility of commodity prices.

- Rising Input Costs: Increased prices for materials, services, and labor directly inflate EOG's exploration and production expenses.

- Efficiency Initiatives: EOG's focus on technological advancements and streamlined operations aims to absorb inflationary impacts.

- Cost Leadership: A low-cost production base is essential for EOG to remain competitive and profitable, especially when oil and gas prices fluctuate.

Shareholder Returns and Free Cash Flow

EOG Resources demonstrates a strong commitment to shareholder returns, consistently prioritizing free cash flow generation. This financial discipline translates directly into capital being returned to investors.

In 2024, EOG Resources achieved a significant milestone by generating $5.4 billion in free cash flow. The company then returned a substantial $5.3 billion of this to shareholders, highlighting its dedication to rewarding its investors.

Looking ahead to 2025, EOG Resources anticipates generating $4.3 billion in free cash flow. This continued focus on robust cash flow generation underscores the company's financial health and its strategic approach to capital allocation.

- 2024 Free Cash Flow: $5.4 billion

- 2024 Shareholder Returns: $5.3 billion

- 2025 Projected Free Cash Flow: $4.3 billion

Economic factors significantly influence EOG Resources' performance, with global oil and natural gas prices being paramount. Projections for 2025 suggest crude oil prices could hover between $70 and $80 per barrel, with geopolitical events acting as a potential upward catalyst.

Natural gas prices are expected to be more volatile in 2025, driven by U.S. LNG export demand. This volatility necessitates robust financial planning and operational adaptability for EOG.

The overall health of the global economy directly impacts energy consumption and, consequently, EOG's results. For instance, IMF projections of around 3.2% global GDP growth in 2024 indicate a generally supportive demand environment for energy.

Inflationary pressures continue to affect EOG's operational costs, from materials to labor. The Producer Price Index for inputs to crude petroleum and natural gas production saw notable increases through early 2024, highlighting these rising expenses.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on EOG Resources |

|---|---|---|---|

| Crude Oil Price | $70-$80 range (Q4 2024) | $70-$80 range | Directly impacts revenue and profitability. |

| Natural Gas Price | Volatile, influenced by LNG exports | Volatile, influenced by LNG exports | Affects revenue and operational planning. |

| Global GDP Growth | ~3.2% (IMF) | Slight slowdown expected, below 2.5% possible | Dampened demand if growth falters, increased demand with strong growth. |

| Inflation (PPI for Energy Inputs) | Significant increases in 2023-early 2024 | Continued pressure expected | Increases operating costs, requiring efficiency measures. |

What You See Is What You Get

EOG Resources PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive EOG Resources PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the external landscape shaping EOG Resources' operations and strategic decisions.

Sociological factors

Public awareness of climate change is soaring, with a significant majority of adults in the US expressing concern about its impacts. This heightened awareness directly affects companies like EOG Resources, as public sentiment can impact their social license to operate, especially concerning fossil fuel extraction. Environmental activist groups are increasingly vocal, pushing for reduced emissions and a faster shift towards renewable energy sources. For instance, by the end of 2023, renewable energy capacity additions globally were projected to increase by nearly 50% compared to 2022, highlighting the growing momentum for cleaner alternatives.

EOG Resources is actively responding to these societal pressures by detailing its sustainability initiatives and maintaining transparent reporting. The company's commitment to reducing its environmental footprint is a key aspect of its strategy to maintain public trust and stakeholder support. In its 2023 sustainability report, EOG highlighted a reduction in its Scope 1 and Scope 2 greenhouse gas intensity by 20% since 2019, demonstrating tangible progress in addressing environmental concerns.

EOG Resources actively pursues corporate social responsibility, focusing on community engagement and responsible land stewardship in its operational regions. This commitment is exemplified by conservation leases with state land offices, aimed at preserving biodiversity and archaeological resources. For instance, in 2024, EOG reported engaging in numerous community outreach programs across its key operating states, fostering goodwill and ensuring local support for its activities.

The availability of a skilled workforce is critical for EOG Resources, especially given the aging demographic in the oil and gas sector. The U.S. Bureau of Labor Statistics projected that by 2030, a significant portion of experienced oil and gas workers could be nearing retirement age, potentially creating a talent gap. EOG's decentralized operational model and emphasis on a collaborative culture are strategic moves to attract and retain top talent in this competitive environment.

To combat potential labor shortages and ensure operational excellence, EOG Resources prioritizes significant investment in employee safety and continuous development. In 2023, the company reported a Total Recordable Incident Rate (TRIR) that was well below the industry average, underscoring their commitment to a safe work environment. These investments are not only vital for maintaining a competitive edge but also for fostering the expertise needed to navigate the complexities of the energy industry.

Energy Transition and Societal Expectations

Societal pressure for an energy transition significantly shapes the long-term demand for fossil fuels. EOG Resources recognizes this shift but emphasizes the continued importance of oil and natural gas in the global energy landscape. The company’s approach centers on providing dependable, cost-effective energy while proactively managing climate-related risks.

EOG's strategy aims to balance current energy needs with future sustainability goals. This includes investments in technologies that reduce emissions and improve operational efficiency.

- Energy Transition Impact: Growing public and governmental demand for cleaner energy sources creates uncertainty for traditional oil and gas producers.

- EOG's Stance: EOG Resources believes oil and natural gas will remain crucial components of the energy mix for decades, citing their role in affordability and reliability.

- Strategic Response: The company is focusing on producing lower-cost, lower-emission intensity oil and natural gas, aligning with market expectations for environmental responsibility.

- 2024/2025 Outlook: Analysts project continued demand for natural gas in 2024 and 2025, particularly for power generation, as the transition unfolds.

Health, Safety, and Quality of Life

Societal expectations for stringent health and safety standards in industrial operations are increasingly critical, directly influencing public perception and regulatory scrutiny of companies like EOG Resources. EOG's stated commitment to safe operations and environmental stewardship is therefore not just a compliance matter but a fundamental aspect of its corporate mission and social license to operate.

The potential for severe reputational damage and significant public backlash following operational incidents underscores the necessity of robust safety protocols and transparent reporting. In 2023, the energy sector, as a whole, continued to face intense public focus on safety metrics, with organizations like the National Safety Council highlighting ongoing efforts to reduce workplace injuries. While specific EOG incident data for 2024 is still emerging, the industry trend indicates a zero-tolerance approach from stakeholders regarding preventable accidents.

- Societal Demand: Growing public emphasis on worker well-being and minimal environmental impact.

- Reputational Risk: Safety lapses can lead to immediate and lasting damage to brand image.

- Operational Imperative: Maintaining high safety standards is crucial for continued operational access and community relations.

- Regulatory Environment: Evolving safety regulations necessitate continuous investment in advanced safety technologies and training.

Societal attitudes towards the energy industry are evolving, with a strong push for sustainability and reduced environmental impact. This sentiment directly influences EOG Resources' operational strategies and public perception. For instance, by early 2024, surveys indicated that over 70% of US adults believed companies should prioritize environmental protection even if it affects profits, a significant shift from previous years.

EOG Resources is actively addressing these societal expectations by focusing on producing lower-emission intensity oil and natural gas. The company's commitment to transparency in its sustainability reporting, including detailed metrics on emissions and community engagement, is crucial for maintaining its social license to operate. In its 2023 reporting, EOG highlighted its continued efforts to reduce methane intensity, a key concern for environmental groups.

The demand for skilled labor in the energy sector remains a key sociological consideration, particularly with an aging workforce. EOG's focus on attracting and retaining talent through competitive compensation and a strong safety culture is vital. By mid-2024, the industry continued to face challenges in recruiting younger workers, making employee development and retention a strategic priority for companies like EOG.

Public demand for reliable and affordable energy continues, even as the transition to renewables accelerates. EOG Resources positions itself as a provider of essential energy resources while investing in technologies that minimize its environmental footprint. Analysts in early 2025 are projecting a continued, albeit moderating, demand for natural gas in power generation, underscoring the ongoing role of fossil fuels in the near to medium term.

| Sociological Factor | EOG Resources' Response/Consideration | 2024/2025 Data/Trend |

| Environmental Awareness & Activism | Focus on reduced emissions intensity, transparent reporting, community engagement. | High public concern for climate change; activist pressure for faster transition. Global renewable energy capacity additions projected to rise significantly in 2024. |

| Workforce Demographics & Talent Acquisition | Emphasis on safety, employee development, and collaborative culture to attract and retain talent. | Aging workforce in oil and gas sector; potential talent shortages projected by 2030. |

| Energy Transition & Demand | Producing lower-cost, lower-emission intensity oil and gas; balancing current needs with sustainability. | Continued demand for natural gas in power generation; societal pressure for cleaner energy sources. |

| Health & Safety Expectations | Prioritizing robust safety protocols and transparent reporting; aiming for industry-leading safety metrics. | Zero-tolerance approach from stakeholders regarding preventable accidents; industry focus on reducing workplace injuries. EOG's 2023 TRIR was well below industry average. |

Technological factors

EOG Resources' operational success is deeply intertwined with its adoption of advanced drilling and completion technologies. Innovations like horizontal drilling, hydraulic fracturing, and extended laterals are fundamental to their strategy for maximizing oil and natural gas recovery from reservoirs. These techniques allow EOG to access resources previously considered uneconomical.

The company's investment in its proprietary drilling motor program, coupled with ongoing advancements in completion design, directly translates to enhanced well productivity and reduced per-unit costs. For instance, EOG has consistently reported improved production profiles from wells utilizing their latest completion technologies, contributing to their competitive cost structure in the industry.

These technological leaps are not merely incremental improvements; they are core enablers of EOG's operational efficiency and profitability. By pushing the boundaries of what's possible in extraction, EOG Resources solidifies its position as a leader in efficient resource development, a critical factor in navigating the volatile energy market of 2024 and beyond.

EOG Resources is heavily leveraging data analytics and automation, integrating real-time data streams and artificial intelligence to significantly optimize its operations. This technological push is directly impacting completion efficiency, supply chain management, and the precision of drilling site selection, crucial for maximizing resource extraction.

The company's proprietary technology and commitment to data-driven decisions are key to its strategy as a low-cost producer. For instance, in 2024, EOG reported substantial improvements in well productivity through advanced analytics, contributing to a reduction in per-barrel lifting costs, which stood at $9.50 per barrel of oil equivalent in Q1 2024, down from $10.20 in Q1 2023.

Furthermore, the implementation of AI-driven predictive maintenance is actively reducing operational downtime and associated repair expenses. This proactive approach ensures equipment reliability and minimizes costly interruptions, a critical factor in maintaining consistent production output and profitability in the volatile energy market.

EOG Resources is actively investing in technologies to reduce its environmental footprint, notably with its proprietary iSense® methane monitoring solution and efforts to minimize flaring.

The company has successfully achieved zero routine flaring, surpassing its initial 2025 target, showcasing a commitment to operational efficiency and environmental stewardship.

These technological advancements are vital for EOG to meet evolving emissions regulations and solidify its position as an environmentally responsible leader in the energy sector, especially as global focus on carbon reduction intensifies through 2024 and into 2025.

Exploration and Seismic Imaging Innovations

EOG Resources leverages its industry-leading exploration expertise and advanced seismic imaging techniques to pinpoint new resource opportunities and enhance recovery from existing fields. This technological edge is crucial for identifying high-return prospects and ensuring consistent free cash flow generation. For instance, EOG's investment in proprietary seismic technology has been instrumental in its success in unconventional plays, allowing for more precise well placement and improved production efficiency.

The company’s ongoing commitment to innovation in seismic imaging directly translates into a competitive advantage by unlocking additional well locations. This technological capability is a key differentiator in the highly competitive oil and gas sector. EOG’s focus on technology-driven exploration is expected to continue providing long-term visibility for strong financial performance.

- Seismic Imaging Advancement: EOG's proprietary seismic technology allows for detailed subsurface mapping, identifying previously uneconomical reserves.

- Resource Optimization: Innovations in data processing and interpretation improve recovery rates from existing wells, boosting overall output.

- Competitive Advantage: The ability to consistently identify and access new well locations through technology provides a sustained edge over competitors.

- Future Growth Driver: Continued investment in exploration technology underpins EOG's strategy for long-term growth and robust free cash flow generation.

Digital Transformation and Cybersecurity

The oil and gas industry, including EOG Resources, is undergoing a significant digital transformation. This means more operations, from remote well monitoring to sophisticated data analytics and corporate back-office functions, are becoming digitized. For instance, by the end of 2023, many upstream operators reported increased reliance on cloud-based platforms for data management and operational efficiency, a trend expected to accelerate through 2025.

This increasing reliance on digital systems makes robust cybersecurity paramount. Protecting these interconnected systems from cyber threats is not just about safeguarding sensitive company data, but also about ensuring the operational integrity of EOG's assets. A breach could lead to significant disruptions, impacting production and financial performance.

EOG Resources must therefore maintain continuous investment in its cybersecurity infrastructure to counter evolving threats. The global cybersecurity market for the energy sector is projected to grow substantially, with estimates suggesting it could reach over $20 billion by 2025, reflecting the critical need for enhanced defenses against sophisticated attacks.

- Digitalization of Operations: EOG's operations are increasingly reliant on digital technologies for efficiency and data-driven decision-making.

- Cybersecurity Imperative: Protecting IT and OT (Operational Technology) systems is crucial for maintaining operational continuity and data security.

- Evolving Threat Landscape: Continuous investment in advanced cybersecurity measures is necessary to mitigate the growing sophistication of cyber threats.

- Industry Investment Trends: The energy sector's cybersecurity spending is expected to rise significantly, indicating the industry-wide recognition of this challenge.

Technological advancements in drilling and completion continue to be a cornerstone of EOG Resources' strategy, driving efficiency and cost reduction. Innovations like advanced hydraulic fracturing techniques and horizontal drilling allow for greater resource recovery, making previously uneconomical reserves viable. EOG's investment in proprietary technologies, such as their drilling motor program, directly enhances well productivity and lowers per-unit extraction costs, a critical advantage in the competitive 2024-2025 market.

The company is also heavily integrating data analytics and AI to optimize operations, from site selection to supply chain management. This data-driven approach directly impacts completion efficiency and resource extraction precision. For instance, EOG reported a reduction in lifting costs to $9.50 per barrel of oil equivalent in Q1 2024, partly due to these technological improvements, down from $10.20 in Q1 2023.

Furthermore, EOG's commitment to technological solutions for environmental stewardship is evident. Their proprietary iSense® methane monitoring system and efforts to minimize flaring have led to achieving zero routine flaring, ahead of their initial 2025 target. These technological strides are essential for meeting evolving emissions regulations and reinforcing their position as an environmentally responsible operator.

EOG Resources leverages cutting-edge seismic imaging to identify new exploration opportunities and improve recovery from existing fields, securing a competitive edge. This focus on technology-driven exploration is expected to fuel long-term growth and robust free cash flow generation through 2025. The increasing digitalization of operations across the energy sector also necessitates significant investment in cybersecurity to protect critical infrastructure.

| Technology Area | EOG's Application | Impact/Benefit | 2024/2025 Relevance |

|---|---|---|---|

| Drilling & Completion | Horizontal drilling, hydraulic fracturing, proprietary drilling motors | Increased resource recovery, reduced per-unit costs, enhanced well productivity | Core to competitive cost structure and operational efficiency |

| Data Analytics & AI | Optimizing operations, predictive maintenance, site selection | Improved completion efficiency, reduced downtime, precise resource extraction | Driving efficiency and cost reduction in a dynamic market |

| Environmental Tech | iSense® methane monitoring, flaring reduction | Zero routine flaring achieved, reduced environmental footprint | Meeting regulatory demands and enhancing corporate responsibility |

| Exploration & Imaging | Advanced seismic imaging, data interpretation | Identification of new reserves, improved recovery rates, competitive advantage | Underpinning long-term growth and free cash flow |

| Digitalization & Cybersecurity | Cloud platforms, IT/OT system protection | Operational efficiency, data security, mitigating cyber threats | Essential for safeguarding operations amidst increasing digital reliance |

Legal factors

EOG Resources navigates a dense web of environmental laws governing air emissions, water consumption, and waste management. Adherence to these mandates, particularly those addressing climate change, is paramount for avoiding fines and securing operational licenses.

The company's 2024 strategy emphasizes adapting to stricter emissions standards, a critical factor given the increasing global focus on carbon reduction. For instance, the U.S. Environmental Protection Agency's proposed rules for oil and gas facilities in 2024 aim to curb methane emissions, a key area of focus for EOG.

Legal shifts concerning hydraulic fracturing techniques and the disposal of produced water present ongoing challenges and opportunities. EOG's ability to innovate and comply with evolving state and federal regulations, such as those impacting water recycling, directly influences its operational efficiency and cost structure.

EOG Resources must rigorously follow federal, state, and local health and safety regulations to protect its workforce. These rules encompass everything from daily operational safety standards to comprehensive emergency preparedness. For instance, OSHA's Process Safety Management standard requires detailed hazard analyses and safety procedures for facilities handling highly hazardous chemicals, directly impacting EOG's operations.

Failure to comply with these mandates, such as those enforced by the Occupational Safety and Health Administration (OSHA) or the Environmental Protection Agency (EPA), can result in substantial penalties. In 2023, OSHA reported over $350 million in penalties for workplace safety violations across various industries, a figure that underscores the financial risks of non-compliance for companies like EOG.

EOG Resources' operations are intrinsically tied to securing and upholding land use permits and leases, critical for exploration and production. Federal and state land access regulations, alongside local zoning ordinances, directly influence EOG's capacity to unlock new reserves, impacting project timelines and feasibility.

Tax Legislation and Fiscal Policies

Tax legislation and fiscal policies are critical considerations for EOG Resources. Corporate income taxes, severance taxes levied by states where EOG operates, and the potential introduction of carbon taxes significantly impact the company's profitability and investment decisions. For instance, changes in U.S. tax law, such as those enacted in recent years, have already shaped EOG's financial projections for 2025, influencing its effective tax rate and net income. The company actively manages its tax liabilities by strategically navigating these legal frameworks to optimize its tax position and maintain full compliance.

Key aspects of tax legislation affecting EOG Resources include:

- Corporate Income Tax Rates: Fluctuations in federal and state corporate income tax rates directly alter EOG's bottom line.

- Severance Taxes: These production-based taxes, varying by state, represent a significant operational cost for EOG.

- Potential Carbon Taxes: EOG must monitor and strategize for the potential financial implications of future carbon pricing mechanisms.

- Tax Credits and Incentives: The company also leverages available tax credits and incentives, particularly those related to energy production and innovation, to mitigate tax burdens.

Corporate Governance and Shareholder Rights

EOG Resources operates under stringent corporate governance regulations that safeguard shareholder rights. These mandates include the requirement for annual shareholder meetings, adherence to proxy solicitation rules, and provisions for voting on executive compensation. For instance, in 2023, EOG Resources held its annual shareholder meeting where key proposals, including the election of directors and advisory votes on executive compensation, were presented to shareholders for their consideration.

The company's corporate governance framework is designed to ensure full compliance with the listing requirements of the New York Stock Exchange (NYSE) and the regulations set forth by the U.S. Securities and Exchange Commission (SEC). This commitment to regulatory adherence is fundamental to building and maintaining investor trust. EOG Resources' proxy statement for its 2024 annual meeting detailed its board structure and compensation practices, reflecting its dedication to transparency and compliance with SEC filings.

Maintaining robust corporate governance practices is paramount for EOG Resources, directly impacting investor confidence and ensuring ongoing regulatory compliance. Strong governance signals financial health and ethical operations, which is crucial for attracting and retaining capital. A review of EOG's 2024 proxy statement shows a board of directors with a majority of independent members, a common indicator of strong governance.

Key aspects of EOG Resources' corporate governance include:

- Annual Shareholder Meetings: Providing a platform for shareholders to engage with management and vote on critical corporate matters.

- Proxy Solicitation: Ensuring transparent communication and facilitation of shareholder voting on proposals.

- Executive Compensation Votes: Allowing shareholders to voice their opinions on the remuneration of top executives.

- Board Independence: Maintaining a board structure with a significant majority of independent directors to ensure objective oversight.

EOG Resources faces evolving legal landscapes concerning environmental protection, worker safety, and land use. Compliance with regulations from agencies like the EPA and OSHA is critical, with significant penalties for violations. For example, in 2023, workplace safety violations across industries resulted in over $350 million in penalties, highlighting the financial risks.

Tax laws and fiscal policies directly influence EOG's profitability and investment strategies. Changes in corporate income taxes, severance taxes, and the potential for carbon taxes require careful management. EOG’s 2025 financial projections are already shaped by these tax considerations, impacting its effective tax rate.

Corporate governance regulations, including NYSE listing requirements and SEC mandates, are essential for maintaining investor trust. EOG's 2024 proxy statement, for instance, detailed its board structure and compensation practices, emphasizing transparency and compliance. A board with a majority of independent directors, as seen in EOG's 2024 filings, is a key indicator of strong governance.

Environmental factors

EOG Resources is actively addressing climate change by targeting reductions in its greenhouse gas (GHG) intensity and methane emissions. The company has demonstrated success in meeting and surpassing its 2025 goals, notably achieving zero routine flaring ahead of its planned schedule.

These achievements underscore EOG's commitment to operating as a low-emissions producer while ensuring a consistent supply of energy. For instance, as of its 2023 reporting, EOG achieved a 58% reduction in its Scope 1 and 2 GHG intensity compared to a 2018 baseline.

The oil and gas sector, including EOG Resources, faces scrutiny over its substantial water consumption, especially for hydraulic fracturing. In 2023, EOG reported utilizing approximately 12.5 million barrels of water in its operations, with a significant portion dedicated to completion activities. This intensive water usage directly impacts environmental considerations and local water availability.

EOG Resources is actively implementing strategies to mitigate its water footprint. The company's 2023 sustainability report highlighted that over 60% of the water used in its North American operations was recycled or reused, a key component of their conservation efforts. These initiatives aim to reduce reliance on freshwater sources and minimize the environmental impact of their operations.

Addressing water scarcity and potential contamination remains paramount for EOG's long-term viability and community engagement. By prioritizing responsible water management, including advanced treatment technologies and closed-loop systems, EOG seeks to ensure sustainable operations and maintain positive relationships with the communities where it operates, particularly in water-stressed regions.

EOG Resources actively engages in biodiversity and land stewardship, implementing conservation leases to safeguard natural habitats and archaeological sites within its operational zones. This commitment is underscored by their use of advanced technologies like drones for monitoring endangered species, reflecting a proactive approach to environmental responsibility.

Waste Management and Pollution Prevention

EOG Resources prioritizes robust waste management and pollution prevention, crucial for its environmental stewardship. This includes the safe disposal of drilling fluids and produced water, with a focus on minimizing ecological impact. In 2023, the company reported significant progress in reducing its environmental footprint, though specific figures for waste reduction were not publicly detailed.

The company employs stringent measures to prevent spills and leaks, ensuring adherence to evolving environmental regulations. EOG's commitment to continuous improvement in waste handling is evident in its ongoing investment in advanced treatment technologies and operational best practices.

- Waste Disposal: Safe and compliant disposal of drilling fluids, produced water, and other operational wastes.

- Spill Prevention: Implementing measures to prevent leaks and spills, safeguarding the environment.

- Regulatory Compliance: Adhering to all applicable environmental laws and regulations.

- Continuous Improvement: Ongoing focus on enhancing waste handling processes and technologies.

Energy Transition and Resource Mix

EOG Resources acknowledges the global shift toward cleaner energy sources but maintains that oil and natural gas will remain crucial components of the energy landscape for the foreseeable future. The company's operational strategy focuses on providing essential energy while simultaneously investing in technologies aimed at reducing emissions throughout its activities.

This energy transition also highlights opportunities for natural gas, particularly as a transitional fuel. The growing global demand for Liquefied Natural Gas (LNG) further underscores this point, positioning natural gas as a key player in meeting evolving energy needs.

- EOG's 2023 production highlights: EOG reported average daily net equivalent production of approximately 1,037 MBOE/d in 2023.

- Focus on emissions reduction: The company has set targets to reduce its Scope 1 and Scope 2 greenhouse gas emissions intensity.

- LNG market growth: Global LNG demand is projected to increase significantly in the coming years, driven by energy security concerns and environmental policies.

EOG Resources is actively managing its environmental impact, particularly concerning greenhouse gas emissions and water usage. The company has made significant strides in reducing its GHG intensity, achieving a 58% reduction in Scope 1 and 2 intensity by 2023 compared to a 2018 baseline. Furthermore, EOG prioritizes water conservation, with over 60% of water used in its North American operations being recycled or reused in 2023.

EOG's commitment extends to land stewardship and responsible waste management. They employ conservation leases and advanced monitoring technologies for biodiversity, alongside stringent measures for spill prevention and compliant waste disposal. This proactive approach aims to minimize ecological disruption and adhere to environmental regulations.

| Environmental Metric | 2023 Data | 2025 Target (if applicable) |

|---|---|---|

| Scope 1 & 2 GHG Intensity Reduction (vs. 2018) | 58% | Not specified |

| Water Reuse/Recycling (North America) | >60% | Not specified |

| Routine Flaring Status | Zero Achieved | Achieved ahead of schedule |

PESTLE Analysis Data Sources

Our PESTLE Analysis for EOG Resources is built on a robust foundation of data from official government agencies, reputable industry associations, and leading financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the energy sector.