EOG Resources Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EOG Resources Bundle

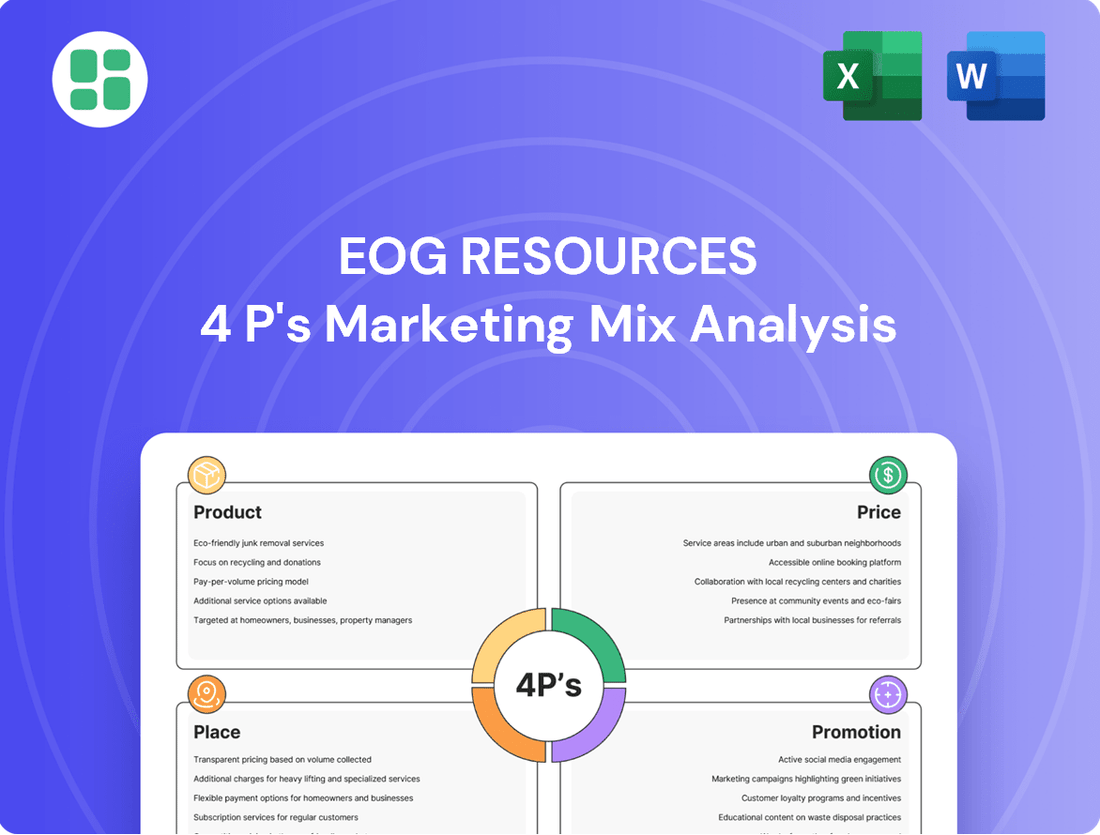

Uncover the strategic brilliance behind EOG Resources' marketing efforts, from their innovative product development to their shrewd pricing strategies. Understand how their distribution channels and promotional campaigns create a powerful market presence.

Dive deeper into the specifics of EOG Resources' 4Ps to gain actionable insights for your own business. This comprehensive analysis, covering Product, Price, Place, and Promotion, is your key to unlocking strategic marketing success.

Go beyond the surface and access a complete, editable 4Ps Marketing Mix Analysis for EOG Resources. Perfect for professionals and students seeking detailed market understanding and strategic planning tools.

Product

EOG Resources' core products are diverse grades of crude oil and natural gas liquids, vital for refineries and petrochemical operations. These are sourced from key basins, leveraging sophisticated extraction methods.

The quality and uniformity of EOG's oil and NGLs are paramount, ensuring they meet stringent downstream industry standards and command optimal market prices. For instance, in the first quarter of 2024, EOG reported an average crude oil equivalent production of 1,062.7 thousand barrels per day, highlighting the scale of their hydrocarbon output.

Natural gas represents another cornerstone of EOG Resources' portfolio, serving as a critical fuel for electricity generation, industrial operations, and home heating. EOG prioritizes efficient extraction methods to bolster the energy supply chain. In 2024, the company's natural gas production, encompassing both dry and associated gas, is designed to meet varied market needs.

EOG Resources' advanced hydrocarbon exploration and production expertise is a critical component of its marketing mix, functioning as a core offering to investors. This technical capability, demonstrated through innovations like horizontal drilling and hydraulic fracturing, allows EOG to unlock reserves previously considered uneconomical.

In 2024, EOG continued to leverage this expertise, focusing on high-return plays. For instance, their Permian Basin operations, a key area for their advanced techniques, are expected to contribute significantly to production growth. The company's commitment to technological advancement ensures efficient resource recovery and robust reserve replacement, a testament to their operational prowess.

Integrated Value Chain Optimization

EOG Resources' integrated value chain optimization significantly bolsters its product offering by controlling critical midstream infrastructure. This internal capability ensures the efficient gathering and processing of hydrocarbons, directly impacting product quality and delivery reliability. While not a standalone service, this integration enhances the marketability of EOG's oil and natural gas.

This control over the journey from wellhead to market streamlines operations and reduces costs. For instance, EOG's investments in gathering systems and processing facilities in key plays like the Delaware Basin and Eagle Ford Shale contribute to its operational efficiency. In 2024, EOG reported capital expenditures of approximately $7.1 billion, a portion of which is allocated to enhancing these midstream assets, underscoring their strategic importance.

- Enhanced Product Quality: Integrated processing minimizes contamination and degradation of hydrocarbons.

- Reliable Delivery: Control over midstream ensures consistent supply to market.

- Cost Efficiencies: Reduced transportation and processing costs are passed on through competitive product pricing.

- Market Access: Direct access to pipelines and processing facilities improves market reach and flexibility.

Sustainable Energy ion Practices

EOG Resources' product is increasingly defined by its commitment to sustainable energy production, a crucial element in meeting today's environmental, social, and governance (ESG) demands. This focus translates into tangible actions like reducing operational emissions and minimizing their overall environmental footprint. For instance, by the end of 2023, EOG reported a 42% reduction in Scope 1 and Scope 2 greenhouse gas (GHG) emissions intensity compared to a 2018 baseline, demonstrating a clear commitment to cleaner operations.

Responsible water management is another cornerstone of their sustainable product offering. EOG prioritizes water recycling and reuse in its hydraulic fracturing operations, aiming to lessen reliance on freshwater sources. In 2023, they achieved a 93% water recycling rate across their operations, significantly reducing their water usage impact.

This dedication to sustainability is not merely an operational choice but a core component of the product's value proposition for investors and stakeholders. It signals long-term viability and a forward-thinking approach to energy production, aligning with the growing market preference for environmentally conscious investments.

The perceived value of EOG's product is directly enhanced by these sustainable practices, which contribute to a stronger brand reputation and appeal to a broader investor base concerned with ESG criteria. This strategic alignment positions EOG favorably in a market that increasingly rewards environmental stewardship.

EOG Resources' product encompasses a range of high-quality crude oil and natural gas liquids, crucial for downstream industries. Their expertise in advanced extraction techniques, like horizontal drilling and hydraulic fracturing, allows them to efficiently access and produce these vital resources. This technical capability is a key differentiator, enabling them to unlock reserves and maintain robust production levels.

The company's commitment to sustainability further enhances its product offering. EOG prioritizes reducing operational emissions and responsible water management, evidenced by a 42% reduction in Scope 1 and 2 GHG emissions intensity by the end of 2023 (vs. 2018 baseline) and a 93% water recycling rate in 2023. These practices align with growing ESG demands, bolstering brand reputation and investor appeal.

| Product Segment | Key Characteristics | 2024 Production Focus | Sustainability Metric |

|---|---|---|---|

| Crude Oil & NGLs | Diverse grades, high quality, uniform | Permian Basin growth, high-return plays | Reduced GHG emissions intensity |

| Natural Gas | Vital fuel for power, industry, heating | Meeting varied market needs efficiently | Responsible water management |

| Extraction Expertise | Horizontal drilling, hydraulic fracturing | Unlocking previously uneconomical reserves | Water recycling in operations |

What is included in the product

This analysis provides a comprehensive examination of EOG Resources' marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning.

It delves into EOG Resources' actual brand practices and competitive context, delivering a professionally written deep dive ideal for understanding their marketing approach.

Provides a clear, actionable framework for EOG Resources to address market challenges and refine their strategic approach.

Simplifies complex marketing strategies into manageable components, easing the burden of comprehensive planning for EOG Resources.

Place

EOG Resources primarily distributes its crude oil, NGLs, and natural gas through direct sales to industrial customers like refineries and petrochemical plants. This direct approach cuts out middlemen, enabling more customized supply deals and stronger customer relationships. For instance, EOG's 2024 production targets are designed to meet the consistent demand from these core buyers, ensuring stable revenue.

EOG Resources boasts an extensive pipeline and gathering system, a crucial component of its marketing mix. This integrated infrastructure efficiently moves oil and natural gas from its well sites across major U.S. basins, such as the Permian and Eagle Ford, to key market hubs. For instance, in 2023, EOG continued to invest in and expand its midstream assets, recognizing their vital role in cost-effective product delivery.

EOG Resources leverages strategically located storage facilities for crude oil and natural gas liquids (NGLs), providing crucial flexibility to navigate market volatility and optimize sales timing. This infrastructure allows EOG to hold inventory when prices are low and release it when favorable market conditions arise.

Furthermore, EOG's access to or ownership of natural gas processing plants is vital for separating valuable NGLs from raw natural gas. In 2024, EOG continued to invest in enhancing its midstream infrastructure, including processing capabilities, to ensure its natural gas meets stringent pipeline quality specifications and maximizes NGL recovery.

Proximity to Major U.S. Production Basins

EOG Resources strategically positions its operations within premier U.S. shale plays, including the Permian Basin, Eagle Ford Shale, and Bakken Shale. This concentration in high-output regions provides a distinct advantage by placing EOG close to substantial market demand and established transportation networks.

This proximity directly translates into lower logistical expenses and improved access to buyers. For instance, in 2024, EOG's focus on these core basins allowed it to capitalize on robust regional demand for its oil and natural gas.

- Permian Basin: A cornerstone of EOG's portfolio, offering significant production volumes and extensive midstream infrastructure.

- Eagle Ford Shale: Provides access to Gulf Coast markets and petrochemical demand centers.

- Bakken Shale: Leverages existing rail and pipeline infrastructure for efficient market delivery.

The company's commitment to developing in these economically favorable and accessible areas underscores its disciplined approach to capital allocation, optimizing the 'place' element of its marketing mix for maximum efficiency and profitability.

Commodity Trading and Marketing Desks

EOG Resources leverages specialized commodity trading and marketing desks to expertly manage the sale and delivery of its diverse energy products. These desks are instrumental in executing forward sales contracts and employing sophisticated hedging strategies to lock in favorable pricing and mitigate market volatility. For instance, in the first quarter of 2024, EOG reported that its marketing and midstream segment generated $2.6 billion in revenue, underscoring the significant financial impact of these operations.

These teams are adept at navigating the intricate logistics of moving oil, natural gas, and natural gas liquids across various market hubs. Their primary function is to ensure the efficient and timely placement of EOG's production, capitalizing on regional price differentials and demand surges. This proactive approach allows EOG to optimize its realized prices, a critical factor in maintaining profitability in the dynamic energy sector.

- Optimized Pricing: Utilizes forward sales and hedging to secure better prices for produced commodities.

- Logistical Efficiency: Manages the movement of products to market, ensuring timely delivery.

- Market Navigation: Expertise in understanding and capitalizing on volatile energy market conditions.

- Revenue Generation: Contributes significantly to overall company revenue through effective sales and marketing.

EOG Resources' "Place" strategy centers on its integrated infrastructure and strategic basin positioning. The company's extensive pipeline network and storage facilities are key to efficiently delivering crude oil, NGLs, and natural gas to market hubs. This infrastructure, coupled with operations in prime U.S. shale plays like the Permian and Eagle Ford, minimizes logistical costs and maximizes market access.

EOG's marketing and midstream segment is a critical revenue driver, demonstrating the effectiveness of its placement strategy. In the first quarter of 2024, this segment generated $2.6 billion in revenue. The company's ability to manage product flow and capitalize on regional demand through its logistical assets directly contributes to optimizing its realized prices and overall profitability.

| Metric | 2023 (Approx.) | Q1 2024 |

|---|---|---|

| Marketing & Midstream Revenue | $9.5 billion | $2.6 billion |

| Key Basins | Permian, Eagle Ford, Bakken | Permian, Eagle Ford, Bakken |

What You See Is What You Get

EOG Resources 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished EOG Resources 4P's Marketing Mix analysis you’ll own. You can confidently purchase knowing you're getting the exact, comprehensive document you see here. It's ready for immediate application to your strategic planning.

Promotion

EOG Resources actively engages financial markets by showcasing its value through comprehensive investor relations. This includes detailed quarterly earnings calls, thorough annual reports, and insightful investor presentations, all designed to communicate transparently with shareholders and potential investors.

The company's communications focus on presenting clear financial and operational performance data. For instance, in the first quarter of 2024, EOG Resources reported a net income of $1.5 billion, demonstrating a strong financial footing and consistent profitability.

By highlighting strategic execution and financial discipline, EOG Resources aims to foster investor confidence and attract capital. This commitment to clear reporting underpins its strategy to maintain strong relationships within the investment community.

EOG Resources actively participates in major industry conferences, showcasing their operational successes and forward-thinking strategies. For instance, at the 2024 EnerCom Denver conference, EOG's leadership highlighted advancements in their low-cost, high-return drilling techniques, particularly in the Delaware Basin. This presence reinforces their standing as an innovator in the exploration and production (E&P) space.

These engagements are vital for thought leadership, allowing EOG to share insights on market trends and technological adoption. By presenting at events like the SPE Annual Technical Conference and Exhibition, EOG cultivates relationships with peers and potential collaborators, which is crucial for staying ahead in the dynamic energy landscape.

The company's consistent participation in these forums, often featuring presentations on their robust free cash flow generation, as seen in their Q1 2025 earnings reports, helps maintain strong industry visibility. This thought leadership directly supports their brand and influences perceptions within the independent E&P sector.

EOG Resources emphasizes its dedication to environmental, social, and governance (ESG) principles through comprehensive reporting and proactive initiatives. This promotional strategy specifically targets investors and stakeholders who prioritize sustainability and ethical operations, showcasing EOG's commitment to responsible business practices.

In 2023, EOG Resources reported a reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity by 10% compared to 2022, demonstrating tangible progress in environmental stewardship. This focus on ESG performance is crucial for attracting socially conscious capital and bolstering the company's reputation in an increasingly ESG-focused market.

Public Relations and Media Engagement

EOG Resources actively manages its corporate image through public relations and media engagement, aiming to communicate its operational strategies and community involvement effectively. This proactive approach ensures that key messages reach stakeholders, including local communities and the general public, fostering transparency and understanding.

The company utilizes various channels for media engagement, such as issuing press releases to announce significant operational updates or financial performance, and responding promptly to media inquiries. These efforts are crucial in shaping public perception and addressing any potential concerns, thereby building trust and maintaining a positive corporate reputation.

In 2023, EOG Resources reported capital expenditures of approximately $6.5 billion, with a significant portion allocated to exploration and development activities. Its commitment to community outreach programs further reinforces its dedication to being a responsible corporate citizen, a key aspect of its public relations strategy.

- Corporate Image Management: EOG Resources prioritizes its public image through strategic communication and community engagement initiatives.

- Media Relations: The company actively issues press releases and responds to media inquiries to ensure accurate and timely information dissemination.

- Stakeholder Trust: Effective media engagement and transparency in operations are vital for building and maintaining trust with stakeholders and the public.

- Community Outreach: Involvement in community programs demonstrates EOG's commitment to social responsibility and local development, underpinning its PR efforts.

Digital Presence and Corporate Website

EOG Resources leverages its digital presence, particularly its corporate website, as a critical promotional tool. This platform acts as a comprehensive information hub, offering investors, media, and potential employees easy access to vital data.

The website provides up-to-date financial reports, operational performance metrics, and detailed sustainability initiatives. For instance, as of their Q1 2024 earnings report, EOG Resources highlighted their commitment to transparency through readily available investor relations materials online, detailing production volumes and financial results.

This robust online infrastructure ensures broad accessibility and reinforces EOG's brand identity in the digital landscape. Key information points available include:

- Financial Data: Quarterly and annual reports, SEC filings, and investor presentations.

- Operational Updates: Information on production, exploration activities, and asset performance.

- Sustainability Reports: Details on environmental, social, and governance (ESG) efforts and performance metrics.

- Career Opportunities: Job listings and information for prospective employees.

EOG Resources employs a multi-faceted promotional strategy, emphasizing investor relations through detailed financial reporting and participation in industry events. The company actively communicates its operational successes and strategic vision, aiming to build investor confidence and thought leadership.

Their commitment to ESG principles is a key promotional element, attracting socially conscious capital and enhancing corporate reputation. EOG's digital presence, particularly its website, serves as a vital hub for comprehensive data access, reinforcing brand identity.

For instance, EOG Resources reported a net income of $1.5 billion in Q1 2024 and highlighted their low-cost drilling techniques at the 2024 EnerCom Denver conference. Their 2023 ESG report noted a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity.

| Promotional Element | Key Activities | Data/Examples (2023-2024) |

|---|---|---|

| Investor Relations | Earnings calls, annual reports, investor presentations | Q1 2024 Net Income: $1.5 billion |

| Industry Engagement | Conference participation, thought leadership | 2024 EnerCom Denver: Highlighted Delaware Basin techniques |

| ESG Communication | Sustainability reporting, proactive initiatives | 2023: 10% reduction in GHG emissions intensity |

| Digital Presence | Corporate website, online data hub | Q1 2024: Transparent online investor relations materials |

Price

EOG Resources' product pricing is intrinsically tied to global commodity market indices. For crude oil, this often means benchmarks like West Texas Intermediate (WTI), while natural gas prices typically track the Henry Hub index. These benchmarks are the primary drivers, reflecting the constant interplay of worldwide supply and demand.

These market-driven prices are volatile, reacting swiftly to geopolitical shifts and broader economic trends. For instance, WTI crude oil prices saw significant fluctuations throughout 2024, influenced by OPEC+ production decisions and ongoing global energy demand. EOG's realized prices are therefore directly correlated, often adjusted for specific product quality and delivery location.

EOG Resources actively uses hedging to navigate the unpredictable nature of oil and gas prices, employing instruments like futures contracts and options. This strategy is crucial for managing price volatility and ensuring a more stable revenue stream for the company.

By locking in prices for a portion of their future output, EOG Resources effectively reduces the risk of sharp price drops, offering a layer of financial security. For instance, in Q1 2024, EOG reported that approximately 60% of its projected crude oil production was hedged at an average price of $75 per barrel, providing a solid floor for revenue.

This proactive approach to risk management not only shields the company from significant downturns but also aids in more reliable capital expenditure planning, ensuring that investment decisions are made with a clearer understanding of future financial performance.

EOG Resources' pricing strategy is deeply rooted in its relentless pursuit of cost-efficiency across its entire operational spectrum. By consistently optimizing drilling and completion techniques, the company has managed to lower its break-even costs, a critical factor in its pricing flexibility. For instance, in the first quarter of 2024, EOG reported a company-wide oil equivalent production cost of approximately $9.00 per barrel, a testament to their operational discipline.

Supply and Demand Fundamentals

The market price for EOG Resources' products, primarily crude oil and natural gas, is dictated by the dynamic balance of global and regional supply and demand. For instance, in early 2024, the market grappled with tight supply due to ongoing geopolitical tensions and production cuts, which supported higher prices. Conversely, signs of slowing global economic growth in late 2023 and early 2024 exerted downward pressure.

Key influences on these fundamentals include decisions by major producers like OPEC+, which in 2024 continued to manage supply to stabilize prices, and broader economic trends. For example, a robust global economic expansion in 2024 would typically increase demand for energy, while a slowdown would dampen it.

EOG Resources actively monitors these critical supply and demand indicators to shape its operational and sales strategies. By understanding factors such as fluctuating inventory levels and the impact of weather on consumption, EOG aims to optimize its production and capture favorable pricing. In 2024, EOG's focus remained on efficient production and cost management to navigate these volatile market conditions.

Key supply and demand factors impacting EOG Resources in 2024 included:

- OPEC+ Production Policies: Continued voluntary production cuts by OPEC+ members aimed to support oil prices, impacting the overall supply available to the market.

- Global Economic Growth: Projections for global GDP growth in 2024 influenced energy demand forecasts, with stronger growth generally leading to higher demand.

- Inventories: Strategic petroleum reserves and commercial crude oil and natural gas inventories, both domestically and globally, played a crucial role in price discovery.

- Geopolitical Events: Ongoing conflicts and political instability in key energy-producing regions created supply chain risks and price volatility throughout 2024.

Long-Term Contracts and Sales Agreements

While EOG Resources primarily operates within the dynamic spot market, it strategically utilizes long-term contracts and sales agreements to secure more stable revenue streams. These agreements, often focused on natural gas and natural gas liquids (NGLs), offer a degree of price predictability and mitigate the impact of short-term market fluctuations. By locking in prices for specific production volumes, EOG can ensure consistent offtake and establish a foundational level of income. For instance, in early 2024, EOG reported that a significant portion of its natural gas production was hedged through various contracts, providing a buffer against price volatility.

- Secures predictable revenue: Long-term agreements provide a baseline income, reducing reliance on volatile spot market prices.

- Mitigates price risk: Contracts can lock in favorable pricing, protecting against potential downturns in commodity prices.

- Ensures consistent offtake: These agreements guarantee buyers for a portion of production, aiding operational planning.

- Supports capital allocation: Predictable cash flows from contracts can support investment decisions and financial stability.

EOG Resources' pricing is fundamentally tied to global benchmarks like West Texas Intermediate (WTI) for oil and Henry Hub for natural gas, reflecting market dynamics. In 2024, WTI prices experienced significant swings, influenced by OPEC+ decisions and global demand, with EOG's realized prices closely mirroring these trends. The company also leverages hedging, with approximately 60% of its projected Q1 2024 crude oil output hedged at an average of $75 per barrel, providing revenue stability.

EOG's cost efficiency, with Q1 2024 production costs around $9.00 per barrel of oil equivalent, enhances its pricing flexibility. Long-term contracts for natural gas and NGLs further secure predictable revenue streams, mitigating the impact of volatile spot market prices and ensuring consistent offtake. This dual approach of market responsiveness and risk mitigation underpins EOG's pricing strategy.

| Metric | 2024 (Q1) Data | Impact on Pricing |

|---|---|---|

| WTI Crude Oil Price (Average) | ~$80/barrel | Directly influences EOG's oil revenue. |

| Henry Hub Natural Gas Price (Average) | ~$2.00/MMBtu | Sets the baseline for EOG's gas sales. |

| Hedged Crude Oil Production | ~60% | Provides price floor at ~$75/barrel, ensuring revenue stability. |

| Production Cost (Oil Equivalent) | ~$9.00/barrel | Lowers break-even costs, improving pricing competitiveness. |

4P's Marketing Mix Analysis Data Sources

Our EOG Resources 4P's Marketing Mix Analysis is built upon a foundation of verified, up-to-date information, including company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, industry reports, and competitive benchmarks to ensure accuracy.