EOG Resources Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EOG Resources Bundle

EOG Resources navigates a complex landscape shaped by powerful industry forces, from the intense rivalry among existing players to the constant threat of substitute energy sources. Understanding these dynamics is crucial for any stakeholder seeking to grasp EOG's strategic positioning and future prospects.

The complete report reveals the real forces shaping EOG Resources’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of advanced drilling rigs, completion tools, and proprietary software hold moderate power over EOG Resources. This is because these specialized assets are costly and crucial for efficient resource recovery and cost management. EOG’s commitment to in-house drilling motor programs and extending well laterals, which contributed to a 6% reduction in well costs in 2024, underscores their dependence on such technologies.

While several providers exist, securing high-specification, in-demand services often necessitates early resource allocation to maintain consistent operational performance. This creates a dynamic where EOG's significant purchasing volume enables negotiation, yet their need for technological innovation provides suppliers with a degree of influence.

The bargaining power of oilfield services companies is a significant factor for EOG Resources. Key providers of essential services like fracking, cementing, and well logging wield considerable influence due to the critical nature of their offerings and the specialized knowledge involved. This power stems from the necessity of these services for efficient oil and gas extraction.

EOG Resources has proactively managed this by securing a substantial portion of its service costs. In 2024, the company locked in 50% to 60% of its service expenses, specifically for high-specification and high-demand services. This strategic move aims to guarantee reliable performance and mitigate potential disruptions from service provider leverage.

Despite the general strength of some service providers, the industry has experienced shifts. A softening in the service cost environment has been observed, particularly for less sophisticated or lower-quality equipment. This presents EOG Resources with opportunities to negotiate more favorable terms and achieve further cost reductions on certain services.

The availability of highly skilled engineers, geoscientists, and field technicians is crucial for EOG Resources, granting these labor suppliers a moderate degree of bargaining power. This is because specialized knowledge and experience are not easily replicated.

Intense competition for top talent within the energy sector can significantly drive up labor costs for EOG Resources, directly impacting their operational expenses. This dynamic is a key factor in managing human capital.

The broader energy industry's robust job creation, adding over 652,200 new workers in the last 12 months, highlights its economic importance and can influence the labor supply and demand equilibrium, potentially affecting wage pressures.

Land and Mineral Rights Owners

Land and mineral rights owners can exert some bargaining power over EOG Resources, particularly when EOG seeks to acquire or renew leases in highly sought-after oil and gas basins. EOG's strategy involves a constant evaluation and acquisition of new prospective acreage, which can lead to competitive bidding scenarios, potentially driving up the costs associated with securing these essential resources. For instance, EOG's significant 2024 acquisition of Encino Acquisition Partners, which expanded its net acreage by 1.1 million acres, underscores the critical importance of consolidating and securing core land positions.

The bargaining power of these landowners stems from several factors:

- Scarcity of prime acreage: Desirable locations with proven reserves or high potential are limited, giving landowners leverage.

- Competitive bidding: When multiple energy companies are interested in the same land, it drives up lease rates and bonus payments.

- Lease renewal terms: Existing leaseholders may renegotiate terms upon expiration, especially if market conditions have improved for landowners.

Environmental Compliance and Regulatory Service Providers

The bargaining power of suppliers offering environmental compliance and regulatory services is growing for EOG Resources. As environmental regulations tighten and the focus on sustainability intensifies, specialized service providers in compliance, monitoring, and remediation gain leverage. EOG's dedication to environmental stewardship, evidenced by its participation in programs like the Oil and Gas Methane Partnership 2.0 (OGMP 2.0), makes these essential services potentially significant cost drivers.

EOG's proactive approach to emissions management, including investments in proprietary technologies like iSense for in-house methane monitoring, highlights the critical nature and potential cost of these environmental solutions. This internal investment also suggests an acknowledgment of the value and necessity of robust environmental service providers, indirectly bolstering their bargaining power.

- Increasing Regulatory Scrutiny: Stricter environmental laws globally necessitate specialized compliance and monitoring services, giving these providers more influence.

- Sustainability Initiatives: EOG's involvement in programs like OGMP 2.0 requires adherence to advanced environmental standards, increasing reliance on expert service providers.

- Technological Investments: EOG's development of solutions like iSense for methane monitoring indicates the strategic importance and potential cost of effective emissions management services.

- Demand for Remediation: The need for environmental remediation services, should issues arise, further strengthens the position of capable suppliers in this niche market.

Suppliers of specialized drilling equipment and proprietary software hold moderate power over EOG Resources, as these are critical for efficiency. EOG's 2024 efforts to reduce well costs by 6% through in-house programs highlight their reliance on such technologies, though their significant purchasing volume allows for negotiation.

Key oilfield service providers like those for fracking and cementing have considerable influence due to the essential nature of their offerings. EOG strategically mitigated this by securing 50% to 60% of its service costs in 2024 for high-demand services, ensuring operational continuity.

The bargaining power of skilled labor suppliers is moderate, as specialized knowledge is hard to replicate. Intense competition for talent in the energy sector, which added over 652,200 workers in the past year, can drive up labor costs for EOG.

Land and mineral rights owners can exert influence, especially in sought-after basins. EOG's 2024 acquisition of 1.1 million net acres from Encino Acquisition Partners underscores the competitive nature of securing land positions, potentially increasing lease costs.

| Supplier Type | Bargaining Power Level | EOG Resources' Mitigation Strategy | Key Data Point (2024) |

|---|---|---|---|

| Specialized Equipment/Software | Moderate | In-house programs, negotiation | 6% reduction in well costs |

| Oilfield Services (Fracking, Cementing) | Considerable | Securing 50-60% of service costs | Secured service costs |

| Skilled Labor | Moderate | Talent acquisition strategies | Energy sector added 652,200 workers |

| Land/Mineral Rights Owners | Moderate to High (in prime areas) | Acreage acquisition, competitive bidding | Acquired 1.1 million net acres |

What is included in the product

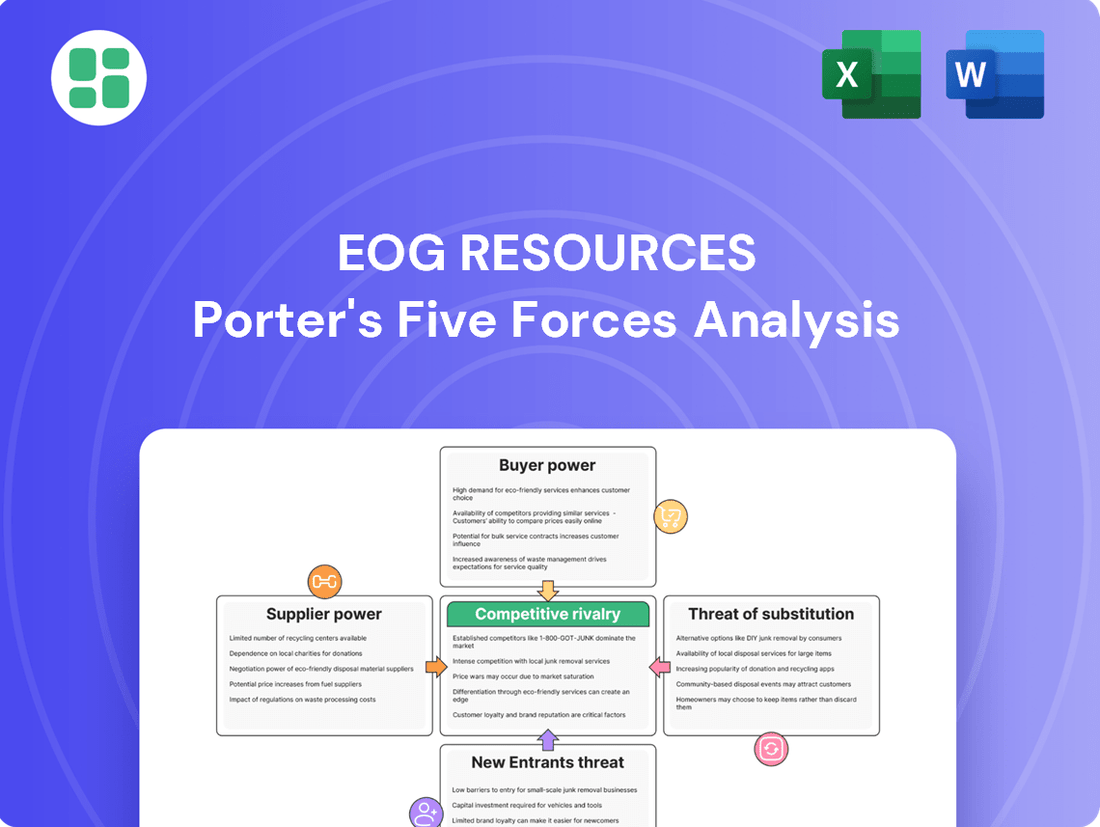

This analysis unpacks the competitive forces impacting EOG Resources, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the oil and gas industry.

Quickly identify and address EOG Resources' competitive landscape with a visual breakdown of Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The commodity nature of crude oil, natural gas, and natural gas liquids (NGLs) means EOG Resources' products are largely undifferentiated. This allows customers to easily switch between suppliers, primarily based on price. In 2024, global oil prices, for instance, experienced significant volatility, with WTI futures trading in a range influenced by supply dynamics and geopolitical events, underscoring the price-sensitive nature of this market.

This inherent lack of differentiation grants buyers substantial bargaining power. EOG Resources, therefore, faces intense competition where price and the reliability of supply are paramount. To counter this, EOG's marketing strategy focuses on achieving premium U.S. price realizations, aiming to maximize profit margins even within this highly competitive, commodity-driven landscape.

EOG Resources primarily serves large-scale customers like refiners, petrochemical firms, and utility companies. These buyers, due to their substantial purchase volumes, wield considerable influence, often negotiating for better pricing and advantageous contract terms. This directly affects EOG's per-unit revenue.

In 2023, EOG Resources reported total revenue of approximately $23.4 billion. The company's strategy of focusing on full-cycle returns and maintaining a lean, low-cost operational framework is crucial for effectively managing the price and term negotiations with these significant volume buyers.

The global crude oil market's interconnectedness and the regional variations in natural gas supply mean customers can source from numerous suppliers. This wide availability significantly boosts their bargaining power, reducing reliance on any single entity like EOG Resources. For instance, in 2024, the average global oil price fluctuated, offering buyers opportunities to negotiate based on prevailing market conditions.

Price Sensitivity and Downstream Margins

Customers in the refining and petrochemical sectors often operate with very thin profit margins. This makes them acutely sensitive to the cost of raw materials, driving a strong demand for lower prices from suppliers like EOG Resources. This pressure directly impacts EOG's ability to maintain healthy profitability.

The bargaining power of these customers is amplified by their cost-consciousness. For instance, if crude oil prices were to stabilize around the projected $75/bbl mark in 2025, refiners would exert significant pressure to secure supplies at the lowest possible cost to protect their own downstream margins.

- Price Sensitivity: Refiners and petrochemical companies have tight margins, making them highly sensitive to the cost of crude oil.

- Demand for Lower Prices: This sensitivity translates into strong customer pressure on producers like EOG Resources to offer lower prices.

- Impact on Profitability: Customer demands for lower prices directly affect EOG's revenue and profit margins.

- Industry Outlook Influence: Projected oil prices for 2025, potentially in the $70-$80/bbl range, will shape customer price expectations and bargaining leverage.

Customer Integration and Supply Chains

Some large customers, particularly in industrial sectors, may possess integrated supply chains or long-term contracts. This integration grants them greater leverage by ensuring stable pricing and consistent supply, thereby strengthening their negotiating position with EOG Resources.

EOG Resources' strategic focus on securing new natural gas agreements that offer premium pricing highlights its efforts to manage customer relationships and optimize its sales channels. For instance, in 2023, EOG reported that a significant portion of its natural gas production was contracted at prices exceeding market benchmarks, demonstrating successful navigation of customer power.

- Customer Integration: Large industrial buyers may have their own storage or transportation, reducing reliance on EOG.

- Long-Term Contracts: Existing agreements can lock in pricing and supply, limiting EOG's flexibility.

- Premium Pricing Strategy: EOG's pursuit of premium pricing for natural gas indicates a proactive approach to customer segmentation and value capture.

The bargaining power of EOG Resources' customers is substantial due to the commodity nature of oil and gas, leading to price sensitivity and a focus on securing the lowest possible costs. Large buyers like refiners and petrochemical companies, with their significant purchase volumes and thin profit margins, exert considerable influence on pricing and contract terms. This dynamic directly impacts EOG's revenue and profitability, necessitating strategies that focus on cost efficiency and premium price realizations.

| Customer Segment | Bargaining Power Drivers | EOG's Response/Impact |

|---|---|---|

| Refiners & Petrochemical Firms | High volume purchases, low profit margins, price sensitivity | Pressure for lower prices, impacts EOG's revenue and profit margins |

| Utility Companies | Stable demand, potential for long-term contracts | Negotiate favorable pricing and supply terms |

| Industrial Buyers | Integrated supply chains, existing contracts | Stronger negotiating position, reduced reliance on EOG |

Same Document Delivered

EOG Resources Porter's Five Forces Analysis

This preview shows the exact EOG Resources Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products, and intensity of rivalry. You'll gain a comprehensive understanding of the strategic factors influencing EOG Resources' market position. This professionally formatted document is ready for your immediate use, offering actionable insights without any surprises.

Rivalry Among Competitors

The US onshore oil and gas sector is incredibly fragmented, featuring a multitude of independent exploration and production (E&P) companies. This means EOG Resources is constantly competing for prime drilling locations, essential capital, and skilled personnel. For instance, in 2024, the number of active drilling rigs in the US has fluctuated, with Baker Hughes reporting around 600-650 active oil and gas rigs for much of the year, highlighting the sheer volume of players in the field.

This intense rivalry directly impacts EOG by putting downward pressure on profit margins and demanding peak operational efficiency. Companies must be lean and effective to stand out. EOG's strategy of prioritizing organic growth, meaning expansion through its own assets rather than acquisitions, and maintaining disciplined capital spending is crucial for successfully navigating this competitive environment.

EOG Resources faces significant competitive rivalry from supermajors and other large integrated oil companies such as ExxonMobil, Chevron, and ConocoPhillips. These behemoths possess substantial financial clout and diversified operational portfolios that allow them to weather market volatility and invest heavily in exploration and production.

While EOG has carved out a niche in unconventional resource plays, these integrated giants also possess the capability to enter and exert influence within the same basins. This presence intensifies competition, as they can leverage their scale and capital to acquire acreage and deploy advanced technologies, potentially gaining an edge in responding to global price fluctuations.

Competition for productive acreage is a significant factor for EOG Resources. Companies actively vie for high-quality, de-risked land with substantial resource potential, driving up acquisition costs through competitive bidding processes. This intense competition necessitates continuous evaluation and acquisition of new prospective lands to maintain and grow resource bases.

EOG Resources' strategic move to acquire Encino Acquisition Partners in late 2023 for approximately $2.7 billion exemplifies this competitive landscape. This acquisition significantly bolstered EOG's resource base and acreage position, particularly within the prolific Utica shale play, underscoring the importance of securing premium acreage in a dynamic market.

Technological Advancements and Efficiency

Competitive rivalry in the oil and gas sector is intensified by the relentless pursuit of technological advancements in drilling and completion. This innovation is crucial for lowering operational costs and boosting the amount of oil and gas extracted from wells. EOG Resources, for instance, has been at the forefront, deploying sophisticated techniques and proprietary technology. Their use of high-frequency sensors and generative AI is a testament to this commitment, aiming to significantly improve well performance and cost-effectiveness.

Companies that lag in adopting or developing these cutting-edge technologies face a substantial risk of losing their competitive edge. EOG's strategic investment in technology is a key differentiator. For example, in 2023, EOG reported a significant improvement in their drilling efficiency, with average lateral lengths increasing and drilling days per well decreasing compared to previous years, directly attributable to their technological investments.

- Technological Investment Drives Efficiency: EOG Resources leverages proprietary technology, including high-frequency sensors and generative AI, to enhance well performance and reduce costs.

- Competitive Imperative: Failure to adopt advanced drilling and completion technologies puts companies at a significant disadvantage in the market.

- EOG's Performance Edge: In 2023, EOG saw improvements in drilling efficiency, with longer lateral wells and fewer drilling days per well, underscoring the impact of technological adoption.

Commodity Price Volatility

The inherently volatile nature of crude oil and natural gas prices significantly fuels competitive rivalry within the energy sector. When prices dip, companies like EOG Resources often sharpen their focus on cost reduction and prioritize only the most profitable projects, leading to a more aggressive competition for every barrel and cubic foot extracted.

EOG Resources' strategy centers on robust operational execution and strict capital discipline. This approach is designed to ensure consistent generation of strong returns and healthy cash flow, even amidst the fluctuating commodity price cycles that define the industry.

- 2024 Brent Crude Oil Price Fluctuation: Throughout early 2024, Brent crude oil prices experienced significant swings, trading in a range that at times exceeded $90 per barrel before retreating, highlighting the persistent volatility.

- EOG's 2024 Capital Efficiency Focus: EOG Resources maintained a disciplined capital expenditure program in 2024, emphasizing returns on investment and operational efficiency to navigate market uncertainty.

- Impact on Production Costs: Lower commodity prices in 2024 forced many operators, including EOG's competitors, to scrutinize lifting costs and explore efficiency gains to maintain profitability.

The competitive rivalry within the US onshore oil and gas sector is intense due to its fragmented nature, with numerous independent exploration and production companies vying for resources. This dynamic forces companies like EOG Resources to maintain peak operational efficiency and disciplined capital spending to secure prime drilling locations and skilled personnel, as evidenced by the fluctuating rig counts, which hovered around 600-650 active oil and gas rigs in the US during much of 2024.

EOG faces stiff competition from supermajors like ExxonMobil and Chevron, which possess greater financial power and diversified operations, enabling them to invest heavily and absorb market volatility. This rivalry extends to securing high-quality acreage, driving up acquisition costs, as demonstrated by EOG's $2.7 billion acquisition of Encino Acquisition Partners in late 2023 to bolster its position in the Utica shale.

Technological innovation is a critical battleground, with companies investing in advanced drilling and completion techniques to lower costs and boost extraction. EOG's commitment to proprietary technology, including high-frequency sensors and generative AI, improved its drilling efficiency in 2023, with longer lateral wells and fewer drilling days per well.

| Competitor Type | Key Characteristics | Impact on EOG Resources |

|---|---|---|

| Independent E&P Companies | Fragmented market, competition for acreage, capital, and talent. | Downward pressure on profit margins, need for operational efficiency. |

| Supermajors (e.g., ExxonMobil, Chevron) | Substantial financial clout, diversified portfolios, ability to invest heavily. | Intensified competition for acreage and technology, potential to influence market dynamics. |

| Technology Innovators | Focus on advanced drilling/completion, cost reduction, increased extraction. | Necessity for EOG to invest in and deploy cutting-edge technology to maintain competitive edge. |

SSubstitutes Threaten

The increasing adoption of solar, wind, and other renewable energy sources presents a significant long-term threat by gradually displacing demand for fossil fuels, particularly in power generation. This energy transition directly impacts the market outlook for companies like EOG Resources, influencing investor sentiment and future growth expectations.

While EOG Resources' core business is oil and natural gas liquids, the global shift towards cleaner energy necessitates strategic reevaluation. For instance, in 2024, renewable energy capacity additions continued to surge, with the International Energy Agency reporting significant global growth in solar PV and wind power installations, underscoring the growing competitive pressure.

The growing adoption of electric vehicles (EVs) presents a significant threat of substitution for traditional gasoline-powered vehicles, directly impacting demand for refined petroleum products. Global EV sales are projected to hit 10 billion by 2025, a substantial increase that will inevitably curb the need for crude oil, EOG Resources' primary commodity.

Government policies aimed at decarbonization, such as carbon pricing and renewable energy mandates, represent a significant threat of substitutes for EOG Resources. These initiatives actively encourage a transition away from fossil fuels, potentially curtailing EOG's future market expansion. For instance, the European Union's Emissions Trading System (EU ETS) aims to reduce emissions by 43% below 2005 levels by 2030, directly impacting the demand for hydrocarbon products.

While the U.S. energy sector anticipates a more favorable regulatory climate following a change in administration, global regulatory landscapes introduce persistent uncertainties. These international policy shifts can influence global energy demand and investment flows, indirectly affecting companies like EOG Resources. The International Energy Agency reported in 2024 that global clean energy investment is projected to reach $2 trillion annually by 2030, highlighting the accelerating shift towards alternatives.

Technological Advancements in Alternatives

Ongoing technological advancements are making renewable energy sources increasingly viable substitutes for traditional oil and gas. Innovations in battery technology and energy storage, for instance, are improving the reliability and competitiveness of solar and wind power. By mid-2024, global investments in clean energy technologies were projected to reach unprecedented levels, signaling a strong market shift.

These advancements directly impact the threat of substitutes for EOG Resources. As renewable energy solutions become more efficient and cost-effective, they present a more compelling alternative for power generation and other energy needs. This trend is further supported by substantial investments in artificial intelligence within the oil and gas sector, aimed at optimizing operations amidst this energy transition.

- Battery Technology: Improvements in energy density and cost reduction make renewables more competitive.

- Smart Grids: Enhanced grid management systems better integrate intermittent renewable sources.

- AI in Energy: Investments are being made to improve efficiency in both traditional and cleaner energy operations.

Public and Investor Pressure for Decarbonization

The increasing public and investor demand for decarbonization presents a significant threat of substitutes for EOG Resources. Growing environmental awareness is fueling a shift towards cleaner energy alternatives, impacting capital allocation decisions. For instance, in 2024, global investment in clean energy is projected to reach new highs, diverting funds that might otherwise go to fossil fuel exploration.

EOG Resources is addressing this by emphasizing its position as a low-emissions producer, with robust sustainability performance and clear targets for reducing greenhouse gas and methane emissions. This proactive stance aims to mitigate the impact of substitutes by highlighting the company's commitment to environmental responsibility.

- Societal Shift: Growing environmental concerns are pushing consumers and investors towards sustainable options.

- Investor Pressure: Investors are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance, influencing investment flows.

- Capital Allocation: There's a noticeable trend of capital being redirected from traditional fossil fuels to renewable energy projects and technologies.

- EOG's Response: EOG Resources is focusing on being a low-emissions producer, setting targets for GHG and methane emissions to align with market expectations.

The threat of substitutes for EOG Resources is primarily driven by the accelerating global energy transition, favoring cleaner alternatives. Renewable energy sources like solar and wind are becoming increasingly cost-competitive and technologically advanced, directly challenging fossil fuels. Furthermore, the widespread adoption of electric vehicles is diminishing demand for gasoline, a key refined product derived from crude oil.

Government policies and public sentiment are actively pushing for decarbonization, creating a less favorable environment for oil and gas companies. For instance, in 2024, global clean energy investments were projected to reach $2 trillion annually by 2030, indicating a significant shift in capital allocation away from traditional energy sources. EOG Resources is responding by emphasizing its low-emissions production profile and setting targets for greenhouse gas reductions to align with evolving market expectations.

| Factor | Description | Impact on EOG Resources | Key Data Point (2024 Projections/Trends) |

| Renewable Energy Growth | Increasing efficiency and falling costs of solar, wind, and battery storage. | Displaces demand for fossil fuels in power generation. | Global clean energy investment projected to reach $2 trillion annually by 2030. |

| Electric Vehicle Adoption | Technological advancements and government incentives for EVs. | Reduces demand for gasoline and diesel fuel. | EV sales projected to reach 10 billion by 2025 (note: this is a large, potentially aspirational figure, but reflects the trend). |

| Decarbonization Policies | Government regulations promoting emissions reduction and cleaner energy. | Creates regulatory headwinds and potential market contraction for fossil fuels. | EU ETS aiming for 43% emissions reduction below 2005 levels by 2030. |

| Public & Investor Sentiment | Growing demand for ESG compliance and sustainable investments. | Influences capital allocation and investor relations. | Increased global investment in clean energy projects. |

Entrants Threaten

Entering the independent oil and gas exploration and production sector, where EOG Resources operates, demands substantial capital. This includes significant outlays for acquiring promising land leases, the complex process of drilling wells, building essential infrastructure like pipelines and processing facilities, and investing in advanced technologies.

For instance, EOG Resources projected its capital expenditures for 2025 to be in the range of $6.0 billion to $6.4 billion. This sheer scale of required investment creates a formidable financial barrier, effectively deterring many potential new competitors from entering the market.

The oil and gas industry faces substantial regulatory and environmental barriers to entry. Companies must navigate a complex web of evolving environmental regulations, stringent permitting processes, and rigorous safety standards. For instance, compliance with initiatives like the Oil and Gas Methane Partnership 2.0 (OGMP 2.0) requires significant investment and specialized knowledge, which can deter new players.

The oil and gas exploration and production (E&P) sector, where EOG Resources operates, demands a very specific set of skills. Think geologists who can read the earth's secrets, engineers who design efficient extraction methods, and seasoned field operators who know how to manage complex projects safely. Building a team with this level of specialized technical expertise and experienced workforce is a significant challenge for any potential new entrant.

Attracting and retaining this kind of talent is tough because the most skilled professionals are often already with established players like EOG Resources. While the industry has seen job growth, the availability of individuals with truly niche skills remains a bottleneck. For instance, the U.S. Bureau of Labor Statistics projected employment for petroleum engineers to grow 7% from 2022 to 2032, a rate faster than the average for all occupations, but this growth doesn't necessarily translate to an abundance of highly specialized, experienced individuals readily available for new companies.

Access to Productive Acreage and Infrastructure

Securing access to productive acreage and essential infrastructure presents a significant barrier for potential new entrants in the oil and gas sector. Established companies, such as EOG Resources, have already invested heavily in acquiring and developing prime locations, creating a competitive disadvantage for newcomers. EOG's strategic moves, like its 2024 acquisition of Encino Acquisition Partners for approximately $2.7 billion, underscore its commitment to consolidating control over high-quality shale assets, further intensifying this challenge.

The cost and difficulty of acquiring competitive reserves and the necessary midstream infrastructure, including pipelines and processing facilities, are substantial. New entrants would face immense capital requirements to replicate the integrated operational capabilities that EOG and similar established players possess. This capital intensity, coupled with the established network of infrastructure, makes the threat of new entrants relatively low.

- High Capital Investment: New entrants require substantial upfront capital to acquire acreage and build necessary infrastructure, a hurdle already cleared by incumbents like EOG Resources.

- Established Land Positions: Companies like EOG control significant portions of economically viable acreage in proven basins, limiting attractive opportunities for new players.

- Infrastructure Access: Existing players benefit from established pipeline networks and processing facilities, which are costly and time-consuming for new entrants to replicate or secure access to.

- Strategic Acquisitions: EOG's 2024 acquisition of Encino Acquisition Partners for roughly $2.7 billion demonstrates a strategy to further consolidate control over key assets, increasing the barrier to entry.

Established Supply Chains and Market Access

Established players like EOG Resources benefit from deeply entrenched relationships with suppliers and service providers, often secured through long-term contracts. This existing network provides a significant cost advantage and operational efficiency that new entrants struggle to replicate. For instance, EOG's extensive infrastructure for oil and gas transportation and processing, built over years of operation, represents a substantial barrier.

New companies entering the oil and gas sector must invest heavily to establish their own supply chains, secure reliable transportation, and gain access to processing facilities. This capital expenditure and the time required to build these essential networks add considerable complexity and cost, deterring potential competitors. In 2023, capital expenditures for new oil and gas projects often exceeded billions of dollars, highlighting the immense upfront investment needed.

EOG's strategic advantage is further amplified by its integrated approach to acreage development, allowing it to navigate industry cycles effectively. Coupled with a robust marketing strategy that ensures market access for its production, EOG significantly raises the bar for any potential new entrants seeking to compete. This comprehensive market access, often involving direct relationships with refiners and end-users, is a critical component of sustained profitability.

- Established Relationships: Incumbents possess long-standing ties with suppliers and customers, facilitating smoother operations and better pricing.

- Infrastructure Advantage: Existing transportation and processing infrastructure represents a significant capital barrier for new entrants.

- Market Access: Securing reliable market access for produced commodities is a complex and costly undertaking for newcomers.

- EOG's Strategy: EOG's integrated development and marketing approach create a formidable competitive moat, leveraging its existing strengths.

The threat of new entrants in the oil and gas exploration and production sector, where EOG Resources operates, is significantly mitigated by several factors. The immense capital required for land acquisition, drilling, and infrastructure development creates a substantial financial barrier. For example, EOG Resources projected capital expenditures between $6.0 billion and $6.4 billion for 2025, illustrating the scale of investment needed.

Furthermore, established players like EOG have secured prime acreage and built extensive infrastructure, making it difficult for newcomers to find attractive opportunities and gain efficient market access. Strategic acquisitions, such as EOG's approximately $2.7 billion purchase of Encino Acquisition Partners in 2024, further consolidate control over high-quality assets, increasing the barrier to entry.

The industry also demands specialized technical expertise and experienced workforces, which are challenging for new companies to assemble. Regulatory hurdles and established relationships with suppliers and service providers also contribute to a lower threat of new entrants, as these existing networks provide cost advantages and operational efficiencies that are difficult to replicate.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for leases, drilling, and infrastructure. EOG's 2025 capex projection: $6.0-$6.4 billion. | Substantial financial hurdle for new companies. |

| Land Access & Infrastructure | Established companies control prime acreage and have built extensive networks. EOG's 2024 acquisition of Encino for ~$2.7B highlights asset consolidation. | Limited availability of attractive sites and costly replication of infrastructure. |

| Technical Expertise | Need for specialized geologists, engineers, and experienced field operators. | Difficulty in attracting and retaining skilled talent. |

| Regulatory Compliance | Navigating complex environmental and safety standards, e.g., OGMP 2.0. | Increased costs and time for compliance. |

| Supplier & Market Relationships | Entrenched ties with suppliers and customers, established market access. | Challenges in securing favorable terms and reliable sales channels. |

Porter's Five Forces Analysis Data Sources

Our EOG Resources Porter's Five Forces analysis is built on a foundation of comprehensive data, including EOG's annual reports and SEC filings, alongside industry-specific reports from firms like Wood Mackenzie and IHS Markit. This blend ensures a robust understanding of competitive dynamics.