EOG Resources Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EOG Resources Bundle

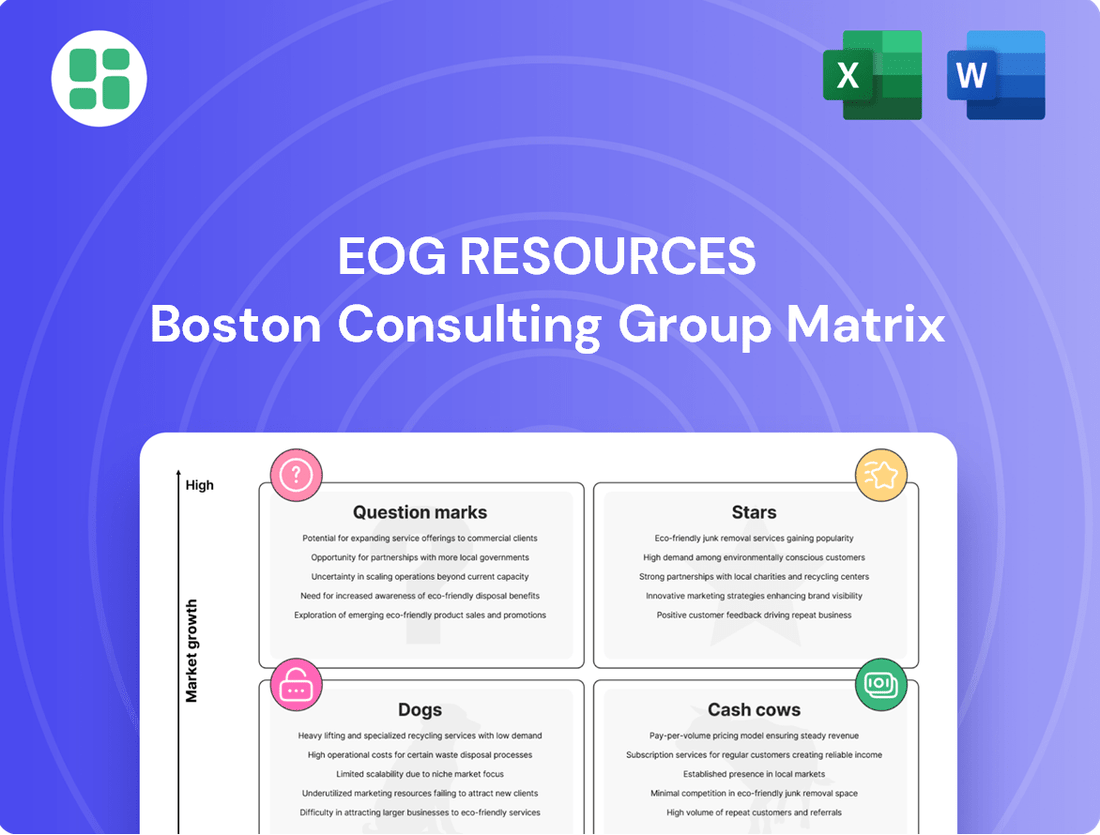

Curious about EOG Resources' strategic positioning? This glimpse into their BCG Matrix reveals how their various business segments perform in terms of market share and growth. Understanding these dynamics is crucial for any investor or competitor looking to navigate the energy landscape.

Don't miss out on the complete picture! Purchase the full EOG Resources BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

EOG Resources' Delaware Basin operations are a cornerstone of its 2025 capital program, maintaining consistent activity. This basin remains a foundational asset, contributing substantially to the company's oil output and cash generation.

While the 2025 well completion forecast for the Delaware Basin sees a modest decrease compared to 2024, it still represents a robust, high-return inventory. EOG's deep understanding of this vast resource potential solidifies its importance to the company's financial performance.

EOG Resources is significantly boosting its focus on the Utica play in its 2025 capital expenditure plans. This strategic move is driven by consistently strong performance metrics and a bullish outlook for sustained growth within this resource-rich area.

The company plans a notable 20% surge in completion activities within the Utica region for 2025. This expansion underscores EOG’s dedication to maximizing the potential of this key asset and capitalizing on its inherent value.

This intensified investment is designed to further enhance operational efficiency and productivity in the Utica. EOG aims to solidify its competitive standing in this rapidly developing, high-potential natural gas market.

EOG Resources' Dorado Dry Gas Play in South Texas stands out as a premier low-cost natural gas development in North America, showcasing strong economic performance. The company anticipates a substantial 12% increase in its natural gas volumes for 2025, largely attributable to enhanced drilling efficiencies and crucial infrastructure such as the Verde Pipeline, which ensures vital market access.

This strategic play is instrumental in driving EOG's overall natural gas production growth and is well-positioned to deliver consistent, high returns. In 2024, EOG Resources reported that its South Texas operations, including the Dorado play, were a significant contributor to its production, with natural gas accounting for a substantial portion of its output.

Advanced Drilling & Completion Technologies

EOG Resources places a strong emphasis on advanced drilling and completion technologies to drive efficiency and productivity. Innovations like extended laterals and their own drilling motor programs are key to this strategy.

These technological advancements have demonstrably paid off. In 2024, EOG reported a significant 6% reduction in total well costs, directly attributable to improved drilling and completion speeds. This focus on operational excellence allows them to extract more value from their resources.

- Extended Laterals: EOG utilizes longer horizontal wellbores to access more of the reservoir from a single pad.

- In-house Drilling Motor Programs: Developing and managing their own drilling motor capabilities provides greater control over drilling efficiency and cost.

- Productivity Enhancement: These technologies are designed to increase the amount of oil and gas produced from each well.

- Cost Reduction: The primary goal is to lower the overall expense associated with drilling and completing new wells.

Overall Oil & NGL Production Growth

EOG Resources is strategically focused on oil and natural gas liquids (NGLs), which made up a significant 69% of its production in 2024. This focus is well-aligned with current market trends, which show strong demand and favorable pricing for these commodities.

Looking ahead, EOG anticipates continued expansion in its high-value production segments. The company projects a 3% growth in oil volumes and an overall 6% increase in total production volumes for 2025. This demonstrates a clear strategy to grow its core business effectively.

This consistent growth trajectory, when combined with EOG's commitment to operational efficiency, solidifies its position as a frontrunner in the energy industry. The company's ability to scale production while managing costs is a key differentiator.

- 2024 Production Mix: 69% Oil & NGLs

- 2025 Projected Oil Volume Growth: 3%

- 2025 Projected Total Volume Growth: 6%

- Strategic Focus: High-value oil and NGL production

EOG Resources' Dorado Dry Gas Play in South Texas is a prime example of a Star in the BCG Matrix. Its exceptional low-cost natural gas development and anticipated 12% increase in natural gas volumes for 2025 highlight its strong market position and growth potential. The play's contribution to EOG's overall natural gas production, as evidenced by significant output in 2024, solidifies its status as a high-performing asset.

| Asset | BCG Category | Key Performance Indicators |

|---|---|---|

| Dorado Dry Gas Play (South Texas) | Star | Low-cost natural gas development; 12% projected natural gas volume growth in 2025; Significant contributor to 2024 natural gas production. |

What is included in the product

EOG Resources' BCG Matrix analyzes its oil and gas assets, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear EOG Resources BCG Matrix visually clarifies portfolio strengths, easing the pain of resource allocation decisions.

Cash Cows

Mature Permian Basin operations, particularly in the Delaware Basin, are EOG Resources' established cash cows. These highly productive assets consistently generate significant cash flow, underpinning the company's financial stability.

EOG focuses on optimizing efficiency in these mature Permian areas, ensuring a robust production base through disciplined capital deployment. This strategic approach allows them to extract maximum value from these core holdings.

The Eagle Ford Shale represents a mature yet highly productive asset for EOG Resources, functioning as a classic Cash Cow. EOG's operational expertise and stringent cost controls have solidified its leading position in this well-established play. In 2024, EOG continued to prioritize optimization over aggressive expansion, focusing on longer lateral lengths and advanced completion techniques to maintain robust production and strong cash flow from this basin.

EOG Resources showcases its commitment to shareholders through a robust return program, fueled by its strong free cash flow generation. The company consistently channels substantial capital back to investors via dividends and share buybacks, a testament to its financial health.

In 2024 alone, EOG returned an impressive $5.3 billion to shareholders, which accounted for 98% of its free cash flow. This aggressive capital return strategy is further underscored by a 7% increase in its regular dividend for 2025, demonstrating confidence in its ongoing profitability.

This consistent and generous shareholder return program is directly supported by the stable and predictable cash flows generated from EOG's mature, highly profitable assets, solidifying its position as a cash cow.

Low Cash Operating Costs & High ROCE

EOG Resources' dedication to being a low-cost producer is clearly demonstrated by its consistently low cash operating costs and its superior Return on Capital Employed (ROCE) compared to its peers.

In 2024, EOG Resources achieved an impressive ROCE of 25%. This strong performance is underpinned by a portfolio designed to generate a 10% ROCE even when West Texas Intermediate (WTI) crude oil prices are below $45 per barrel.

These financial indicators underscore the inherent efficiency and profitability of EOG's existing production assets, solidifying its position as a dependable source of cash flow.

- Low Cash Operating Costs: EOG Resources consistently manages its operational expenses to remain among the lowest in the industry.

- High ROCE: The company reported a 25% ROCE in 2024, reflecting efficient capital deployment.

- Resilient Portfolio: EOG's assets are structured to yield a 10% ROCE at WTI prices under $45.

- Reliable Cash Generation: The efficiency and profitability of its established production base make EOG a strong cash generator.

Strategic Infrastructure Investments

EOG Resources' strategic infrastructure investments, like the Verde Pipeline, are designed to bolster its cash cow assets. This focus on optimizing existing production and lowering operational expenses directly enhances the profitability of its established fields.

The Verde Pipeline, specifically built to support the Dorado gas field, exemplifies this strategy. By securing crucial market access and cutting down on third-party fees, EOG ensures that its existing production is more efficient and cost-effective.

- Verde Pipeline Completion: Enhanced EOG's ability to optimize existing production.

- Dorado Gas Field Support: Provided critical market access and minimized third-party fees.

- Cost Reduction: Lowered operational costs through improved efficiency and reliable delivery.

EOG Resources' mature Permian Basin operations, particularly in the Delaware Basin, and its Eagle Ford Shale assets are its primary cash cows. These areas are characterized by high productivity and consistent cash flow generation, which are crucial for the company's financial health.

The company actively optimizes efficiency in these established plays, employing advanced techniques to maintain robust production and strong cash flow. This focus on operational excellence ensures these assets remain highly profitable.

EOG's commitment to shareholder returns is directly linked to this cash flow. In 2024, the company returned $5.3 billion to shareholders, representing 98% of its free cash flow, and increased its regular dividend by 7% for 2025.

The company's low cash operating costs and a 25% ROCE in 2024, with a portfolio designed to achieve 10% ROCE at WTI prices below $45, highlight the inherent profitability and dependability of these cash cow assets.

| Asset Area | BCG Matrix Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Permian Basin (Delaware Basin) | Cash Cow | Mature, highly productive, consistent cash flow | Strong free cash flow generation |

| Eagle Ford Shale | Cash Cow | Mature, high productivity, operational expertise, cost control | Optimized for robust production and cash flow |

| Shareholder Returns | Cash Cow Benefit | Directly funded by cash cow cash flow | $5.3 billion returned in 2024 (98% of free cash flow) |

| Financial Efficiency | Cash Cow Support | Low operating costs, high ROCE | 25% ROCE in 2024 |

What You’re Viewing Is Included

EOG Resources BCG Matrix

The EOG Resources BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises—just a professionally designed and analysis-ready report ready for your strategic planning. You are seeing the actual, complete BCG Matrix report that will be yours to download and utilize for immediate business insights and decision-making. This preview accurately represents the final product, ensuring you receive a comprehensive and actionable tool for evaluating EOG Resources' business portfolio.

Dogs

EOG Resources historically divested non-core natural gas assets to focus capital on higher-return oil plays. While recent specific divestitures of "dog" assets aren't explicitly detailed for 2024-2025, the ongoing strategy implies continued evaluation of legacy fields with declining production or lower profitability.

Within EOG Resources' diverse asset base, older wells situated in mature, declining oil and gas plays represent a category that requires careful management. These wells, while having served their purpose, naturally experience lower production volumes and often come with proportionally higher operating expenses as extraction becomes more challenging.

These assets might be characterized by marginal profitability, potentially consuming more capital than they generate in returns. EOG's commitment to capital efficiency means these wells are under constant scrutiny, with decisions leaning towards minimal further investment or eventual decommissioning if they no longer meet economic thresholds.

For instance, while EOG reported a significant increase in its oil and natural gas production in 2024, the company's strategy inherently involves optimizing its portfolio by divesting or reducing investment in less productive legacy assets to focus capital on higher-return opportunities.

EOG Resources, despite its strong exploration track record, encounters ventures that don't pan out. These unsuccessful exploration projects, categorized as Dogs in the BCG Matrix, represent investments that failed to uncover economically viable hydrocarbon reserves.

Such ventures are essentially sunk costs, meaning the capital invested is unlikely to generate future returns. For instance, if a specific exploration block in the Permian Basin in 2024 yielded disappointing results, it would be classified here. In 2023, EOG reported exploration expenses of $1.2 billion, a portion of which would have been allocated to projects that ultimately proved unsuccessful.

These failed ventures are typically written off from EOG's books and no longer receive substantial capital allocation, allowing the company to redirect resources to more promising opportunities.

Marginal Acreage with Limited Upside

Marginal acreage for EOG Resources represents landholdings that don't offer the same high-return potential as their prime locations. These might be smaller parcels or areas with less favorable geological characteristics, meaning they have a limited capacity for future growth and a small footprint within EOG's broader operations. Their strategic value is minimal unless there's a substantial rise in oil and gas prices.

EOG's operational philosophy clearly favors developing assets with proven, high-return drilling inventory. This focus means that resources are channeled towards areas with the greatest potential for profitability, rather than spreading them thinly across less promising acreage. For instance, in 2024, EOG continued to emphasize its premium locations in basins like the Delaware and Eagle Ford, where it can achieve superior well economics.

- Focus on Premium Locations: EOG Resources prioritizes investment in acreage with high-return drilling opportunities, such as those in the Delaware Basin.

- Limited Scalability: Marginal acreage often lacks the scale to significantly impact EOG's overall production or financial performance.

- Price Sensitivity: The economic viability of these marginal assets is highly dependent on favorable commodity price environments.

- Strategic Value: Unless commodity prices surge, these areas offer minimal strategic advantage compared to EOG's core, high-performing assets.

Inefficient or Outdated Field Operations

Even with EOG Resources' strong focus on cutting-edge technology, some field operations might still rely on older, less efficient methods or equipment. These could be areas where upgrades haven't been fully implemented yet.

These less efficient operations can lead to higher costs and reduced output compared to EOG's more advanced sites. Think of it like using older tools that take longer and cost more to run. In 2023, EOG reported that its operating expenses per barrel of oil equivalent (BOE) were around $9.50, but any segment lagging significantly behind this average would be a concern.

- Higher Operating Costs: Legacy equipment often consumes more energy and requires more frequent maintenance, driving up per-unit production costs.

- Lower Productivity: Outdated technology can limit extraction rates and overall output efficiency, impacting revenue generation.

- Resource Drain: Inefficient segments can divert capital and attention away from more profitable, technologically advanced operations.

- Ongoing Optimization: EOG is committed to continuously identifying and upgrading these areas to maintain a competitive edge and improve overall operational performance.

EOG Resources' "Dogs" category encompasses assets with low market share and low growth potential, often characterized by declining production or marginal profitability. These include older wells in mature fields, unsuccessful exploration projects, and less productive acreage. The company's strategy involves actively managing or divesting these underperforming assets to reallocate capital towards more promising, higher-return opportunities, ensuring efficient portfolio management.

Question Marks

EOG Resources is channeling increased capital into international exploration, with Bahrain and Trinidad slated for significant drilling activity in 2025. These regions are recognized for their high-growth potential, though they are still in the nascent stages of development and haven't yet secured significant market presence or stable production levels.

A notable oil discovery in Trinidad during 2024 underscores the promise these areas hold for future growth, potentially elevating them to Star status within EOG's portfolio. However, realizing this potential necessitates substantial ongoing investment to fully delineate and develop these reserves.

EOG Resources' $275 million acquisition of 30,000 net acres in the Eagle Ford shale in late 2023 exemplifies a strategic move that could be classified as a Question Mark within a BCG Matrix framework. This acquisition, while in a familiar operational area, is designed to fill gaps in their existing leasehold and extend the reach of current well pads, suggesting a focus on optimizing existing infrastructure and unlocking further production efficiencies.

The rationale behind this bolt-on acquisition points to its potential for significant future growth, but also highlights the inherent uncertainties. EOG is investing capital to integrate these new acres, a process that requires careful execution and ongoing development to prove its success. The ultimate contribution of this acreage to EOG's overall market share and production profile remains to be seen, making it a classic Question Mark needing further investment and evaluation.

EOG Resources actively seeks out and invests in new domestic plays that show promise for substantial resource potential. These emerging areas are in the early stages of development, meaning their full commercial viability is still being determined, which involves significant upfront investment and operational focus to de-risk and scale up production.

These ventures, while carrying higher inherent risks due to their unproven nature, also offer the potential for very high rewards as they mature. For instance, in 2024, EOG's exploration and appraisal activities in emerging plays are targeting areas with projected breakeven oil prices below $50 per barrel, indicating strong potential profitability if successful.

Carbon Capture & Storage (CCS) Initiatives

EOG Resources' involvement in a Carbon Capture & Storage (CCS) pilot project, launched in 2022, positions them in a developing sector with significant future growth potential within the energy transition landscape. This initiative, while not directly linked to their core hydrocarbon operations, is in its early phases for EOG, necessitating substantial research, development, and capital investment to achieve scalability and commercial viability.

The CCS initiative for EOG Resources can be viewed as a potential 'Question Mark' in the BCG Matrix. This is due to its current low market share in the CCS sector, coupled with high expected future growth prospects as the industry matures and regulatory frameworks evolve. For instance, the global CCS market is projected to grow significantly, with some estimates suggesting it could reach hundreds of billions of dollars by 2030, driven by climate change mitigation efforts and government incentives.

- Nascent Stage: EOG's CCS project is in its initial development phase, requiring substantial R&D.

- High Growth Potential: The broader CCS market is anticipated to expand considerably in the coming years.

- Investment Required: Significant capital and technological advancements are needed for commercial viability.

- Strategic Diversification: This represents a move into a new, albeit early-stage, area of the energy sector.

Potential Future Diversification or New Energy Technologies

EOG Resources, in line with its strategic framework, constantly scans the horizon for emerging opportunities. Any significant diversification into new energy technologies, such as large-scale geothermal projects or advanced biofuel production, would likely be classified as a question mark in the BCG matrix. These ventures, while holding substantial long-term growth potential, demand considerable upfront investment and a lengthy period to achieve market penetration and demonstrate profitability.

For instance, the global hydrogen market is projected to reach $250 billion by 2030, presenting a potential growth avenue. However, developing the infrastructure and scaling production for green hydrogen, a key area for diversification, involves significant capital expenditure and technological maturation. EOG's approach would involve careful analysis of these nascent markets, similar to how they evaluated unconventional oil and gas plays in their early stages.

- High Capital Requirements: New energy technologies often necessitate substantial initial investments in research, development, and infrastructure.

- Market Uncertainty: The profitability and market acceptance of novel energy solutions can be uncertain, leading to higher risk.

- Technological Maturation: Many future energy technologies are still in developmental phases, requiring time and further innovation to become commercially viable.

- Long-Term Growth Potential: Despite the risks, these diversified areas offer the promise of significant future growth and market leadership.

EOG Resources' strategic acquisitions and exploration into new energy sectors, like their Eagle Ford acreage expansion and CCS pilot, represent classic Question Marks in the BCG Matrix. These ventures require significant investment and have uncertain futures regarding market share and profitability, but also offer high growth potential.

The company's approach to these areas involves careful evaluation and capital allocation to de-risk and scale operations, mirroring their past success in developing unconventional plays. Success in these Question Mark segments could lead to future Stars for EOG.

The inherent uncertainty means that while substantial returns are possible, the outcome is not guaranteed, necessitating ongoing monitoring and strategic adjustments.

For example, EOG's 2024 exploration in emerging domestic plays targets breakeven oil prices below $50 per barrel, highlighting the high-risk, high-reward nature of these Question Marks.

| EOG Resources: Question Mark Examples (BCG Matrix) | Current Market Share | Market Growth Rate | Investment Required | Potential Outcome |

|---|---|---|---|---|

| Eagle Ford Acreage Expansion (Late 2023) | Low (relative to total EOG portfolio) | Moderate to High (shale play maturity) | High (integration, development) | Potential Star or Cash Cow |

| International Exploration (Bahrain, Trinidad - 2025 focus) | Very Low (nascent stage) | High (emerging markets) | High (exploration, appraisal) | Potential Star |

| Carbon Capture & Storage (CCS) Pilot | Very Low (emerging industry) | Very High (industry growth projections) | High (R&D, scaling) | Potential Star or Dog (depending on market adoption) |

| New Energy Technologies (e.g., Hydrogen) | Negligible (early exploration) | Very High (market growth projections) | Very High (infrastructure, tech dev) | Potential Star |

BCG Matrix Data Sources

Our EOG Resources BCG Matrix is informed by comprehensive data, including company financial reports, industry growth rates, and market share analysis to provide strategic insights.