EOG Resources Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EOG Resources Bundle

Unlock the strategic blueprint behind EOG Resources's success with our comprehensive Business Model Canvas. This detailed analysis dissects their approach to value creation, customer relationships, and revenue streams, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand the core mechanics of a leading energy company.

Dive into EOG Resources's operational genius with the full Business Model Canvas. This professionally crafted document reveals their key partners, core activities, and cost structure, providing invaluable insights for strategic planning and competitive analysis. Download the complete version to gain a competitive edge.

Want to replicate EOG Resources's market leadership? Our complete Business Model Canvas breaks down their customer segments, value propositions, and channels, offering a practical guide to their winning strategy. Get your copy today and elevate your business acumen.

Partnerships

EOG Resources heavily depends on a broad spectrum of specialized service providers and contractors for its upstream operations. These include companies offering drilling, hydraulic fracturing, completion, and well intervention services. For instance, in 2024, EOG continued to leverage these partnerships to optimize its drilling and completion efficiencies, a strategy that has historically contributed to lower per-well costs.

These collaborations are vital for EOG to access cutting-edge technologies and skilled labor, which are essential for maximizing hydrocarbon recovery from its unconventional resource plays. By outsourcing these specialized functions, EOG can maintain flexibility and focus on its core competencies in exploration and production, while ensuring access to best-in-class service capabilities.

EOG Resources maintains crucial partnerships with technology and equipment suppliers to leverage cutting-edge advancements. These collaborations are essential for implementing sophisticated drilling techniques, like extended laterals, and for their proprietary in-house drilling motor programs.

These strategic alliances foster innovation, directly contributing to the reduction of well costs and a significant boost in operational efficiency. For instance, in 2023, EOG reported a 10% reduction in drilling and completion costs per well compared to 2022, a testament to the impact of such supplier relationships.

EOG Resources relies heavily on its partnerships with midstream companies and pipeline operators. These collaborations are critical for moving crude oil, natural gas liquids (NGLs), and natural gas from EOG's production sites to refineries and end-users.

This infrastructure ensures that EOG's valuable resources can reach markets efficiently and reliably. For instance, in 2024, EOG's extensive operations across key basins like the Permian and Eagle Ford necessitate robust midstream support to handle its substantial production volumes.

Joint Venture Partners

EOG Resources actively pursues joint ventures, especially for international exploration initiatives. For instance, collaborations with bp in Trinidad and Bapco Energies in Bahrain are key examples of this strategy, enabling shared risk and access to valuable local knowledge.

These strategic alliances are crucial for EOG's growth, allowing the company to mitigate the inherent risks of exploration and production while benefiting from the specialized expertise of its partners. This approach also facilitates EOG's expansion into new geographical areas, thereby broadening its resource base and global presence.

- International Exploration: Joint ventures are primarily utilized in international exploration projects to share capital expenditure and operational risks.

- Risk Mitigation: Partnerships allow EOG to reduce its financial exposure in high-cost, high-risk exploration ventures.

- Leveraging Local Expertise: Collaborating with local entities provides invaluable insights into regional geology, regulations, and operational environments.

- Expanding Footprint: Joint ventures are instrumental in EOG's strategy to enter and operate in new international markets, enhancing its global diversification.

Acquisition Targets

Strategic acquisitions are a cornerstone of EOG Resources' growth, acting as key partnerships that bolster its operational capabilities and asset base. These aren't just about buying companies; they're about integrating new, high-quality acreage and production streams that are essential for long-term success.

A prime example is the acquisition of Encino Acquisition Partners. This deal, which closed in 2023, significantly expanded EOG's footprint in the Permian Basin. It brought approximately 60,000 net acres, primarily in the Delaware Basin, adding substantial proved developed producing reserves and undeveloped locations. This move directly enhances EOG's resource depth and overall production capacity.

- Acquisition of Encino Acquisition Partners: Added ~60,000 net acres in the Delaware Basin.

- Impact on Reserves: Significantly increased proved developed producing reserves and undeveloped locations.

- Strategic Rationale: Enhanced resource depth, production capacity, and financial metrics through integration.

EOG Resources cultivates key partnerships with specialized service providers, essential for efficient drilling and completion operations. These collaborations, crucial for accessing advanced technology and skilled labor, allow EOG to optimize hydrocarbon recovery and maintain focus on core exploration and production activities.

The company also relies on strategic alliances with technology and equipment suppliers to implement innovative drilling techniques, directly contributing to reduced well costs and improved operational efficiency. Furthermore, robust partnerships with midstream companies and pipeline operators are vital for reliably transporting EOG's produced commodities to market, ensuring efficient delivery from its extensive operations in key basins.

EOG actively engages in joint ventures, particularly for international exploration, to share risks and leverage local expertise, as seen with its collaborations in Trinidad and Bahrain. These ventures are instrumental in mitigating exploration risks and expanding the company's global footprint by entering new markets.

Strategic acquisitions, such as the 2023 purchase of Encino Acquisition Partners, also function as critical partnerships, significantly expanding EOG's acreage and enhancing its production capacity. This acquisition added approximately 60,000 net acres in the Delaware Basin, bolstering proved reserves and future drilling locations.

| Partnership Type | Key Collaborators/Focus | Strategic Benefit | 2024 Relevance/Example |

| Service Providers | Drilling, Fracing, Completion Companies | Operational Efficiency, Cost Reduction, Access to Expertise | Continued optimization of drilling and completion efficiencies. |

| Technology & Equipment Suppliers | Providers of drilling motors, advanced tools | Innovation, Cost Savings, Enhanced Recovery | Implementation of sophisticated drilling techniques. |

| Midstream & Pipeline Operators | Infrastructure companies | Market Access, Reliable Transportation | Supporting substantial production volumes in Permian and Eagle Ford. |

| Joint Ventures | International E&P companies (e.g., bp, Bapco Energies) | Risk Sharing, Local Knowledge, Market Entry | Mitigating exploration risks and expanding into new geographies. |

| Acquisitions | Companies with strategic acreage (e.g., Encino Acquisition Partners) | Asset Base Growth, Reserve Enhancement | Added ~60,000 net acres in Delaware Basin in 2023. |

What is included in the product

This Business Model Canvas provides a comprehensive overview of EOG Resources' strategy, detailing their customer segments, key partnerships, and core activities in the exploration and production of oil and natural gas.

It highlights EOG's value proposition of efficient resource extraction and cost leadership, supported by their robust infrastructure and technological innovation, all while considering market risks and opportunities.

EOG Resources' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operational strategy, simplifying complex upstream oil and gas processes for better understanding and decision-making.

Activities

EOG Resources' primary focus is on discovering and developing oil and natural gas reserves by pinpointing and assessing promising drilling sites. This involves extensive geological and geophysical studies to identify new resource areas and grow their existing land holdings.

In 2024, EOG continued to emphasize its exploration efforts, particularly in key U.S. shale plays. The company's strategy centers on finding reserves that can be developed at a low cost, ensuring profitability even in fluctuating market conditions.

EOG Resources' core activity involves the meticulous execution of drilling and completion operations across its diverse shale plays. This includes extensive work in prolific areas like the Delaware Basin and Eagle Ford. In 2024, EOG continued to refine its approach to these operations, focusing on efficiency and maximizing the extraction of oil and natural gas resources.

The company leverages cutting-edge technology to enhance well performance and resource recovery. This commitment to innovation is crucial for maintaining competitive advantage in the dynamic energy market. For instance, advancements in hydraulic fracturing techniques and horizontal drilling continue to be central to their operational strategy, aiming for higher production rates and improved economic outcomes.

EOG Resources' core activity involves the meticulous management and optimization of oil and gas production from its extensive well portfolio. This ongoing process focuses on maximizing output from existing assets, ensuring efficient extraction of crude oil, natural gas liquids, and natural gas.

Maintaining the integrity and performance of its operational infrastructure is paramount. This includes regular upkeep of pipelines, processing facilities, and other essential equipment to prevent downtime and ensure smooth operations. For instance, in 2023, EOG reported total production of 1,077 MBOE/d (thousand barrels of oil equivalent per day), highlighting the scale of their operational footprint.

Continuous monitoring of well performance is crucial for identifying opportunities for improvement. EOG actively implements advanced technologies and strategies, such as artificial lift automation, to enhance recovery rates and operational efficiency. This proactive approach helps to sustain production levels and manage costs effectively, contributing to their overall profitability.

Marketing and Sales of Hydrocarbons

EOG Resources actively markets and sells its crude oil, natural gas liquids, and natural gas to a diverse customer base. Their strategy focuses on achieving superior price realizations compared to peers, thereby enhancing profitability across their entire production portfolio.

The company's marketing efforts are designed to capture maximum value for its products. For instance, in the first quarter of 2024, EOG reported average realized prices that often outpaced benchmark indices, reflecting the effectiveness of their marketing and sales approach.

- Peer-leading price realizations: EOG consistently aims to achieve higher prices for its hydrocarbons than its competitors.

- Margin maximization: This focus on pricing directly contributes to maximizing profit margins on the oil and gas produced.

- Diverse customer base: Sales are made to a variety of end-users, ensuring broad market reach.

- Q1 2024 performance: EOG's realized prices in early 2024 demonstrated strong performance relative to market benchmarks.

Capital Allocation and Financial Management

EOG Resources' key activities center on disciplined capital allocation and robust financial management. This involves meticulously managing capital expenditures for exploration and development projects, ensuring each dollar spent is aimed at maximizing the rate of return on investment.

The company prioritizes generating substantial free cash flow, which then fuels its strategy of returning capital directly to shareholders. This return of capital is primarily executed through consistent dividend payments and opportunistic share repurchases.

- Disciplined Capital Allocation: EOG Resources maintains a rigorous approach to allocating capital, focusing on high-return opportunities in exploration and development.

- Maximizing Return on Investment: The core financial objective is to achieve the highest possible rate of return on all invested capital.

- Free Cash Flow Generation: A key output of their operational and financial strategy is the consistent generation of free cash flow.

- Shareholder Returns: EOG actively returns capital to shareholders through dividends and share buybacks, demonstrating a commitment to shareholder value.

EOG Resources' key activities revolve around the efficient exploration, development, and production of oil and natural gas. This includes identifying and securing promising drilling sites, executing drilling and completion operations with advanced technology, and optimizing production from existing wells. The company also focuses on marketing its products to achieve superior price realizations and maintains disciplined capital allocation to maximize shareholder returns.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Exploration & Development | Identifying and securing new oil and gas reserves. | Continued emphasis on U.S. shale plays like Delaware Basin and Eagle Ford. |

| Drilling & Completion | Executing well operations to extract resources. | Refining efficiency and maximizing resource extraction. |

| Production Optimization | Maximizing output from existing wells. | Utilizing advanced technologies like artificial lift automation. |

| Marketing & Sales | Selling crude oil, NGLs, and natural gas. | Aiming for peer-leading price realizations; Q1 2024 saw strong realized prices. |

| Financial Management | Disciplined capital allocation and shareholder returns. | Prioritizing free cash flow generation and returning capital via dividends and buybacks. |

Delivered as Displayed

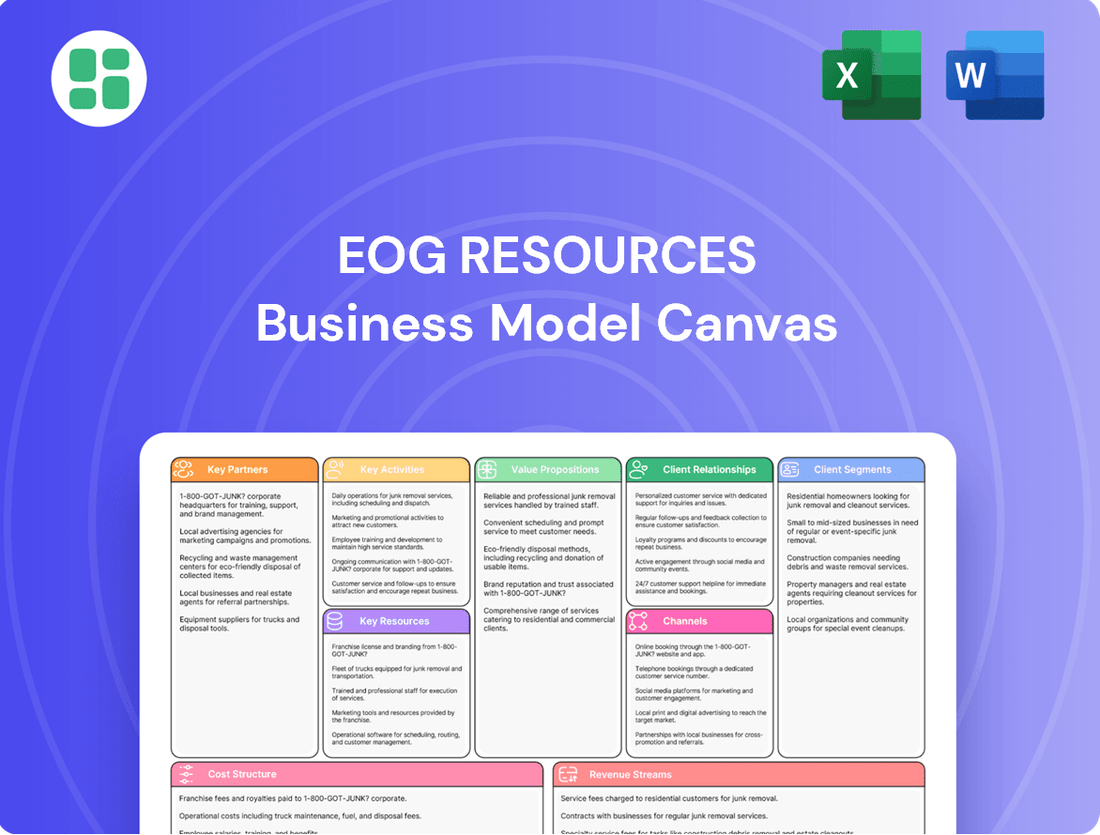

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details EOG Resources' strategic approach to business, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You are seeing a direct snapshot of the final, ready-to-use deliverable, ensuring no surprises and full transparency.

Resources

EOG Resources' core strength lies in its vast holdings of proved and undeveloped oil and natural gas reserves. These reserves are spread across prime locations, including the Permian Basin's Delaware formation, the Eagle Ford, Utica, Dorado, and Powder River Basin.

As of year-end 2023, EOG reported total proved reserves of 4,407 million barrels of oil equivalent (MMboe). The company's net acreage position stood at approximately 12.2 million acres, with a significant portion dedicated to its key growth plays.

This extensive acreage and reserve base are the bedrock upon which EOG builds its production strategy and drives future growth. The company consistently invests in developing these assets to maximize their value.

EOG Resources' advanced drilling and completion technologies, developed in-house, represent a core asset. These proprietary innovations, such as extended lateral drilling techniques and specialized drilling motors, are fundamental to their operational success.

These advanced capabilities directly translate into superior well performance and cost efficiencies. For instance, in 2023, EOG reported that their enhanced completion designs, a direct result of these technologies, contributed to a significant uplift in production compared to industry averages.

The ability to recover more resources from each well, at a lower cost per barrel, is a direct consequence of this technological prowess. This focus on innovation allows EOG to maintain a competitive edge and maximize the economic viability of their asset base.

EOG Resources leverages its highly skilled workforce and deep operational expertise, particularly in unconventional resource development, as a cornerstone of its business model. This human capital is critical for identifying and extracting value from complex geological formations, a key differentiator in the energy sector.

The company's decentralized organizational structure actively promotes innovation and facilitates the rapid transfer of knowledge across its operational teams. This approach empowers field personnel, fostering a culture of continuous improvement and enabling efficient execution of drilling and completion strategies, which directly contributes to their competitive edge.

In 2024, EOG Resources continued to emphasize its operational efficiency, reporting a production increase that outpaced industry averages. This success is directly attributable to the expertise of its teams in optimizing well performance and managing costs, showcasing the tangible impact of their human capital and operational know-how.

Strategic Infrastructure and Logistics

EOG Resources' strategic infrastructure, including extensive gathering and processing facilities, is a critical asset. This network ensures the efficient movement of oil and natural gas from wellheads to market, directly supporting their marketing and sales efforts. In 2024, EOG continued to invest in optimizing its midstream assets to enhance operational efficiency and reduce transportation costs.

Ownership and control over these vital logistics networks provide a significant competitive advantage. It allows EOG to manage the entire value chain, from extraction to delivery, with greater predictability and cost-effectiveness. This integration is fundamental to their ability to capitalize on market opportunities.

- Owned and operated midstream infrastructure: Facilitates seamless product flow and cost control.

- Extensive transportation networks: Connects production basins to key demand centers, enhancing market access.

- Processing capabilities: Ensures products meet market specifications and maximizes recovery.

Strong Financial Position and Access to Capital

EOG Resources boasts a formidable financial standing, underpinned by a healthy balance sheet featuring significant cash reserves and minimal debt. This financial strength is crucial for its business model, enabling it to self-fund extensive capital expenditure programs without relying heavily on external financing.

This robust financial position grants EOG the flexibility to navigate market fluctuations and seize growth opportunities. For instance, as of the first quarter of 2024, EOG reported approximately $6.6 billion in cash and cash equivalents, alongside a manageable debt-to-equity ratio that remained well below industry averages.

The company's ability to access capital readily is a key resource, allowing it to invest in exploration and production, acquire promising assets, and consistently return value to its shareholders through dividends and share repurchases. This financial discipline is a cornerstone of its operational strategy.

- Strong Balance Sheet: EOG consistently maintains a low debt-to-capitalization ratio, demonstrating financial prudence.

- Ample Liquidity: Significant cash on hand provides immediate resources for investments and operational needs.

- Access to Credit Markets: A solid credit rating ensures favorable terms for any necessary borrowing.

- Shareholder Returns: Financial strength supports consistent dividend payments and share buyback programs.

EOG Resources' key resources are its extensive and high-quality oil and natural gas reserves, proprietary drilling and completion technologies, a highly skilled workforce with deep operational expertise, and strategic midstream infrastructure. These assets are complemented by a strong financial position, characterized by ample liquidity and a conservative balance sheet.

| Resource Category | Description | Key Data Point (as of latest available, aiming for 2024 where possible) |

|---|---|---|

| Reserves & Acreage | Vast holdings in prime unconventional basins. | Proved reserves of 4,407 MMboe (YE 2023); ~12.2 million net acres. |

| Technology & Innovation | Proprietary drilling and completion techniques. | Contributes to superior well performance and cost efficiencies. |

| Human Capital | Skilled workforce and operational expertise. | Drives operational efficiency and innovation in resource extraction. |

| Infrastructure | Owned and operated midstream assets. | Ensures efficient product movement and cost control. |

| Financial Strength | Strong balance sheet with significant liquidity. | Approx. $6.6 billion in cash and cash equivalents (Q1 2024). |

Value Propositions

EOG Resources delivers dependable energy by supplying crude oil, natural gas liquids, and natural gas to meet worldwide needs. This reliability is a cornerstone of their value proposition, ensuring customers have access to essential resources when they need them.

A key aspect of EOG's strategy is its commitment to being a low-cost producer. This focus allows them to offer competitive pricing, which is crucial for maintaining profitability even when commodity prices fluctuate. For instance, EOG consistently aims for industry-leading low finding and development costs.

EOG Resources is dedicated to generating superior shareholder returns by prioritizing strong financial performance and consistent free cash flow. In 2024, the company continued its commitment to returning capital to shareholders through a combination of a growing regular dividend and strategic share repurchases, aiming to enhance long-term value.

EOG Resources leverages cutting-edge drilling and completion techniques to extract the most value from its oil and gas reserves, ensuring optimal resource recovery across its vast operational areas. This focus on technological advancement and operational efficiency directly translates into higher productivity per well.

In 2024, EOG's commitment to efficiency resulted in a significant decrease in finding and development costs, reaching approximately $8.00 per barrel of oil equivalent (BOE) for its North American operations. This competitive cost structure enhances profitability and strengthens its market position.

Strategic Portfolio Management and Growth

EOG Resources delivers strategic portfolio management by prioritizing high-return drilling inventory across key basins like the Permian and Eagle Ford. This disciplined approach ensures long-term production visibility and fuels sustained growth.

The company's value proposition includes strategically acquiring accretive assets that enhance its existing footprint and cash flow generation. In 2024, EOG continued to emphasize capital discipline, aiming for efficient deployment to maximize shareholder returns.

- Disciplined Portfolio Selection: Focus on high-return, low-cost inventory across multiple premium basins.

- Accretive Asset Acquisitions: Strategic M&A to enhance scale and cash flow.

- Long-Term Production Visibility: Maintaining a robust inventory of future drilling locations.

- Capital Efficiency: Maximizing returns on invested capital through operational excellence.

Responsible Operations and Environmental Performance

EOG Resources is dedicated to robust environmental stewardship and ensuring safe operational practices, striving to be a leader in low-emissions production within the energy sector. This focus is crucial for building trust with stakeholders and securing a long-term social license to operate, directly addressing growing investor and consumer demand for sustainable business models.

Their commitment translates into tangible value by mitigating environmental risks and enhancing brand reputation. For instance, EOG consistently reports on its greenhouse gas (GHG) intensity, with their 2023 Scope 1 and 2 GHG intensity for oil and gas operations being 8.44 kg CO2e/MBOE, a figure they aim to further reduce.

- Environmental Stewardship: EOG actively manages its environmental footprint, focusing on reducing emissions and conserving resources.

- Safety Culture: A paramount commitment to the safety of employees, contractors, and the communities in which they operate.

- Low-Emissions Production: Pursuing operational efficiencies and technological advancements to achieve industry-leading low-emission intensity.

- Social License to Operate: Maintaining positive relationships with stakeholders through responsible and transparent operations.

EOG Resources offers a compelling value proposition centered on delivering essential energy reliably and affordably. Their strategy emphasizes operational efficiency, leading to low production costs, which allows them to provide competitive pricing. This focus on cost leadership is a significant draw for customers and investors alike, especially in a volatile energy market.

The company is committed to generating superior shareholder returns through strong financial performance and consistent free cash flow generation. EOG prioritizes capital discipline, aiming to maximize returns on invested capital while also returning capital to shareholders via dividends and buybacks. For example, in 2024, EOG continued its practice of returning capital, underscoring its dedication to shareholder value.

EOG Resources distinguishes itself through advanced technological application in its drilling and completion techniques, ensuring maximum resource recovery and operational productivity. This commitment to innovation, coupled with strategic portfolio management focusing on high-return assets, provides long-term production visibility and sustained growth potential.

Environmental stewardship and safety are integral to EOG's operations, aiming for low-emissions production and maintaining a strong social license to operate. This responsible approach addresses growing demands for sustainable energy solutions and mitigates operational risks, enhancing their reputation among stakeholders.

| Value Proposition Element | Key Differentiator | 2024 Impact/Focus |

|---|---|---|

| Reliable Energy Delivery | Consistent supply of crude oil, NGLs, and natural gas. | Meeting global energy demands with dependable access to resources. |

| Low-Cost Production | Industry-leading finding and development costs. | Targeting costs around $8.00 per BOE in North America for enhanced profitability. |

| Superior Shareholder Returns | Strong financial performance and free cash flow generation. | Continued commitment to dividends and share repurchases to enhance long-term value. |

| Technological Innovation | Advanced drilling and completion techniques. | Maximizing resource recovery and well productivity through operational excellence. |

| Environmental Stewardship | Focus on low-emissions production and safety. | Reducing GHG intensity (e.g., 8.44 kg CO2e/MBOE in 2023) and maintaining a strong safety culture. |

Customer Relationships

EOG Resources cultivates direct customer relationships by engaging in negotiated sales agreements and securing long-term contracts for its crude oil, natural gas liquids, and natural gas. This strategy provides a predictable revenue stream and helps stabilize pricing for their energy products.

For instance, in 2024, EOG's commitment to these direct sales and contracts underpins its ability to manage market volatility, ensuring consistent demand and favorable price realizations for its substantial production volumes.

EOG Resources prioritizes a strong relationship with its investors, recognizing them as a key customer segment. This is actively managed through consistent and transparent financial reporting, regular earnings calls, and detailed investor presentations.

The company's strategy centers on clearly communicating its financial performance, including key metrics like production growth and cost management. For instance, in the first quarter of 2024, EOG reported strong operational results, highlighting its ability to generate free cash flow.

Furthermore, EOG emphasizes its capital return strategy, which often includes dividends and share repurchases, to bolster investor confidence. The company aims to articulate its long-term value proposition, focusing on sustainable growth and efficient resource development to assure shareholders of future returns.

EOG Resources actively cultivates industry partnerships, engaging in joint ventures with other exploration and production companies. These collaborations allow for risk sharing and access to specialized expertise, particularly in complex or capital-intensive projects. For example, in 2024, EOG continued to leverage these relationships to optimize its operational footprint and enhance resource development.

Regulatory and Community Engagement

EOG Resources actively engages with regulatory bodies to ensure compliance with all environmental and operational standards. This proactive approach is crucial for maintaining their license to operate and fostering trust.

The company also prioritizes building strong relationships with local communities where its operations are located. This includes transparent communication about projects and potential impacts, as well as investing in community development initiatives.

- Regulatory Compliance: EOG adheres to stringent federal, state, and local regulations governing oil and gas exploration and production.

- Community Investment: In 2023, EOG reported significant community investments, including support for local education, infrastructure, and environmental stewardship programs, demonstrating a commitment to social responsibility in its operating areas.

- Stakeholder Communication: Maintaining open dialogue with community leaders and residents helps address concerns and build collaborative relationships, ensuring smoother operations and long-term social license.

Strategic Acquisition Integration

When EOG Resources acquires companies, such as the significant acquisition of Encino Acquisition Partners in 2024, it actively cultivates new customer relationships. These relationships extend to the acquired entity's prior management team, its workforce, and holders of existing contracts. This proactive approach is crucial for fostering trust and ensuring the seamless integration of new assets and operational capabilities.

The integration process following the Encino Acquisition Partners deal, valued at approximately $2.7 billion, involved establishing clear communication channels and defining new roles. EOG's strategy prioritizes retaining key personnel and leveraging existing contractual agreements to maintain operational continuity and unlock synergies.

- New Stakeholder Engagement: EOG establishes direct relationships with former Encino management and employees, fostering a collaborative environment post-acquisition.

- Contractual Continuity: Existing contracts inherited from Encino are managed to ensure uninterrupted service and value for all parties involved.

- Operational Synergy: The integration aims to combine operational expertise and resources to enhance efficiency and production from the acquired assets.

- Value Realization: Building these relationships is key to realizing the full strategic and financial benefits of acquisitions like Encino.

EOG Resources builds strong customer relationships through direct, negotiated sales and long-term contracts for its energy products, ensuring stable revenue and pricing. They also prioritize investor relations via transparent reporting and clear communication of financial performance, as demonstrated by their strong free cash flow generation in early 2024. Furthermore, EOG actively fosters industry partnerships and engages with regulatory bodies and local communities to maintain operational continuity and social license.

| Customer Segment | Relationship Strategy | Key Activities/Metrics (2024 Data where available) |

|---|---|---|

| Direct Buyers (Crude Oil, NGLs, Natural Gas) | Negotiated Sales, Long-Term Contracts | Securing predictable revenue streams, stabilizing pricing. |

| Investors | Transparent Financial Reporting, Earnings Calls, Investor Presentations | Communicating financial performance, generating free cash flow (e.g., Q1 2024 strong results), capital return strategy (dividends, share repurchases). |

| Industry Partners | Joint Ventures | Risk sharing, access to specialized expertise, optimizing operational footprint. |

| Regulatory Bodies | Proactive Compliance Engagement | Maintaining license to operate, fostering trust. |

| Local Communities | Transparent Communication, Community Investment | Addressing concerns, building collaborative relationships, social responsibility. |

| Acquired Company Stakeholders (e.g., Encino Acquisition Partners) | New Stakeholder Engagement, Contractual Continuity | Fostering collaboration, ensuring uninterrupted service, realizing acquisition value. |

Channels

EOG Resources heavily relies on direct sales agreements to move its crude oil, natural gas liquids, and natural gas. These agreements are typically made with major customers like refiners, petrochemical plants, utility companies, and large industrial consumers.

This direct channel allows EOG to negotiate specific contract terms and pricing, offering flexibility and potentially better margins compared to selling through intermediaries. For instance, in 2024, EOG reported that a significant portion of its production was sold under various contractual arrangements, reflecting the importance of these direct relationships.

EOG Resources heavily utilizes extensive pipeline networks and other transportation infrastructure to get its hydrocarbons to market. This is a critical part of their business model, ensuring products reach customers efficiently.

To manage this, EOG partners with midstream companies. These partnerships are key for timely delivery of oil and natural gas from where it's produced to where it's needed, like refineries and consumers.

In 2024, EOG's commitment to efficient transportation was evident in its capital expenditures, with a significant portion allocated to infrastructure development and access. For instance, the company continued to invest in expanding its takeaway capacity in key producing regions like the Delaware Basin.

EOG Resources leverages its corporate website and a dedicated investor relations portal as primary digital channels to communicate with its investor base. These platforms are crucial for disseminating essential financial information, including quarterly earnings reports, SEC filings, and investor presentations.

Furthermore, EOG utilizes established financial news platforms and wire services to ensure broad accessibility of its disclosures. In 2024, the company continued to provide webcast replays of earnings calls, enhancing transparency and allowing stakeholders to review discussions on performance and strategy at their convenience.

Industry Conferences and Presentations

EOG Resources leverages industry conferences and presentations as crucial channels to disseminate its strategic vision and performance metrics. These events provide a direct platform for EOG executives to engage with a critical audience of financial professionals, analysts, and potential investors, fostering transparency and building confidence in the company's direction.

These engagements are vital for communicating EOG's operational successes and financial health. For instance, at the 2024 EnerCom Denver conference, EOG's leadership highlighted their disciplined approach to capital allocation and their focus on generating free cash flow, a key message for the investment community.

The company's participation in these forums allows for the articulation of key strategic updates, such as their ongoing commitment to low-cost production and technological innovation. This direct communication is essential for shaping market perception and attracting capital.

- Strategic Communication: EOG executives regularly address energy investment conferences and industry events.

- Audience Engagement: These platforms are used to connect with financial professionals, analysts, and potential investors.

- Information Dissemination: Key messages include strategic updates, financial performance, and operational achievements.

- Market Perception: Participation helps shape how the company is viewed by the financial community.

Public Relations and News Releases

EOG Resources leverages official news releases and public relations through channels like PR Newswire to communicate critical company updates. These announcements cover vital information such as financial performance, capital allocation strategies, and significant corporate developments, ensuring a wide reach among investors, media, and the general public.

In 2024, EOG Resources continued to utilize these channels to inform stakeholders about its operational achievements and financial health. For instance, their Q1 2024 earnings release, disseminated via PR Newswire, highlighted strong production volumes and efficient cost management, reinforcing investor confidence.

- Dissemination of Key Information: Official news releases are the primary vehicle for sharing earnings reports, capital expenditure plans, and strategic initiatives.

- Stakeholder Engagement: Public relations efforts aim to build and maintain positive relationships with investors, analysts, and the media.

- Market Perception Management: Timely and transparent communication helps shape market perception and manage expectations regarding company performance and future outlook.

- Broad Audience Reach: Platforms like PR Newswire ensure that important announcements reach a diverse and extensive network of financial news outlets and interested parties.

EOG Resources' primary channels for reaching its customers are direct sales agreements and extensive pipeline networks. These channels ensure efficient delivery and allow for negotiated pricing with major buyers like refiners and industrial consumers.

The company also actively engages with the financial community through its corporate website, investor relations portal, and participation in industry conferences. These platforms are vital for disseminating financial data and strategic updates, as demonstrated by their presence at events like the 2024 EnerCom Denver conference.

Official news releases and wire services, such as PR Newswire, serve as critical conduits for communicating company performance and strategic initiatives to a broad audience of investors and the media. For example, their Q1 2024 earnings release highlighted strong production and cost management.

| Channel Type | Key Activities | 2024 Focus/Data Point | Audience |

|---|---|---|---|

| Direct Sales Agreements | Negotiating terms with refiners, petrochemical plants, utilities | Significant portion of production sold under contracts | Major Industrial Consumers |

| Pipeline Networks/Midstream Partnerships | Efficient transportation of hydrocarbons to market | Capital expenditures for infrastructure expansion (e.g., Delaware Basin takeaway capacity) | Refineries, Consumers |

| Digital Platforms (Website, Investor Portal) | Disseminating financial reports, SEC filings, investor presentations | Webcast replays of earnings calls available | Investors, Analysts |

| Industry Conferences & Presentations | Communicating strategic vision, performance metrics, capital allocation | Leadership highlighted disciplined capital allocation and free cash flow focus at EnerCom Denver | Financial Professionals, Analysts, Potential Investors |

| News Releases & PR Wire Services | Sharing earnings reports, capital plans, corporate developments | Q1 2024 release noted strong production and cost efficiency | Investors, Media, General Public |

Customer Segments

Refineries and petroleum processors represent a core customer segment for EOG Resources, purchasing significant volumes of crude oil and natural gas liquids (NGLs). These companies transform EOG's raw output into essential refined products such as gasoline, jet fuel, and various petrochemical feedstocks. In 2023, EOG's total crude oil and condensate production averaged approximately 940,000 barrels per day, much of which directly serves these downstream industrial customers.

EOG Resources supplies natural gas directly to natural gas utilities, which then distribute it to homes and businesses. Additionally, power generators rely on EOG's natural gas to fuel electricity production. This segment is a core customer base for EOG's output.

The Dorado play is a key asset for serving these customers, boasting a low break-even price that makes it highly competitive. In 2024, EOG continued to focus on optimizing production from plays like Dorado to meet the steady demand from utilities and power generators.

Industrial end-users, encompassing sectors like manufacturing, chemical production, and agriculture, are key purchasers of EOG Resources' natural gas and natural gas liquids (NGLs). These companies rely on these hydrocarbons as essential feedstocks for their processes or as fuel to power their operations. In 2024, the industrial sector's demand for natural gas remained robust, driven by its cost-effectiveness and lower emissions profile compared to other fossil fuels, making it a preferred energy source for many heavy industries.

This customer segment constitutes a substantial portion of the overall demand for EOG's products. The continued growth in industrial output, particularly in areas like petrochemicals and advanced manufacturing, directly translates to increased consumption of natural gas and NGLs. EOG's ability to reliably supply these critical inputs is vital for the operational continuity and expansion of these diverse industrial businesses.

Institutional and Individual Investors

Institutional investors, such as mutual funds and pension funds, alongside individual shareholders, represent a crucial customer segment for EOG Resources. Their primary interest lies in the company's financial performance, including stock appreciation and dividend payouts. For instance, as of the first quarter of 2024, EOG Resources reported a net income of $1.0 billion, or $1.73 per diluted share, demonstrating its ability to generate returns for these stakeholders.

These investors closely monitor EOG's operational efficiency and its strategic approach to resource development, as these factors directly influence the company's valuation. The company's commitment to returning capital to shareholders is a key driver for this segment. In 2023, EOG returned approximately $3.5 billion to shareholders through dividends and share repurchases, a figure that directly appeals to investor expectations for financial rewards.

- Capital Providers: Institutional and individual investors supply the necessary capital for EOG's exploration and production activities.

- Valuation Influence: Their investment decisions significantly impact EOG's market capitalization and overall valuation.

- Return Expectations: This segment prioritizes financial returns, including dividends and stock price growth, driven by operational success.

- Shareholder Value Focus: EOG's strategy to enhance shareholder value through efficient operations and capital allocation directly addresses the interests of this customer base.

Commodity Traders and Marketers

EOG Resources engages with commodity trading firms and marketers, who act as crucial intermediaries in getting its oil and natural gas products to a wider market. These partners are essential for EOG to efficiently move its production and achieve favorable pricing.

These trading entities provide vital market access and liquidity, allowing EOG to manage its sales volumes effectively. For instance, in 2024, EOG reported that its marketing and midstream segment played a significant role in optimizing the delivery and sale of its produced commodities.

- Market Access: Commodity traders facilitate entry into diverse markets, reaching consumers EOG might not directly access.

- Liquidity Provision: They ensure a consistent demand for EOG's products, smoothing out sales and price volatility.

- Price Optimization: By understanding market dynamics, traders help EOG realize better prices for its extracted resources.

- Logistical Support: Many trading firms also offer logistical solutions, easing the burden of transportation and storage for EOG.

EOG Resources serves a diverse customer base, including refineries and petroleum processors who are major purchasers of crude oil and natural gas liquids. Additionally, natural gas utilities and power generators form a core segment, relying on EOG for fuel to meet residential, commercial, and industrial energy needs.

Industrial end-users, such as chemical manufacturers and agricultural businesses, also represent a significant customer group, utilizing EOG's products as feedstocks and energy sources. Finally, capital providers, including institutional and individual investors, are key stakeholders whose investment decisions are driven by EOG's financial performance and shareholder return strategies.

| Customer Segment | Primary Need | EOG's Role | 2023/2024 Data Point |

|---|---|---|---|

| Refineries & Processors | Crude Oil & NGLs | Supplier of raw hydrocarbons | Avg. 940,000 bbl/day crude oil production (2023) |

| Utilities & Power Generators | Natural Gas | Fuel supplier for electricity and distribution | Continued focus on optimizing production for steady demand (2024) |

| Industrial End-Users | Natural Gas & NGLs | Feedstock and energy source provider | Robust industrial demand for natural gas (2024) |

| Capital Providers (Investors) | Financial Returns | Provider of investment opportunity and shareholder value | $1.0 billion net income Q1 2024; $3.5 billion returned to shareholders (2023) |

Cost Structure

Capital expenditures are EOG Resources' most substantial cost. These investments fuel exploration, drilling new wells, building necessary facilities, and acquiring valuable oil and gas leases. For 2025, EOG plans to spend between $5.8 billion and $6.4 billion on these crucial capital projects.

Lease Operating Expenses (LOE) are the direct costs tied to keeping producing wells up and running. This includes everyday expenses like paying the crew, powering the equipment, fixing things, and buying necessary materials.

EOG Resources places a strong emphasis on managing these operating costs effectively. Their strategy aims to maintain their standing as a low-cost producer in the industry, which is crucial for profitability, especially when commodity prices fluctuate.

For instance, in the first quarter of 2024, EOG Resources reported total LOE of approximately $759 million, a slight increase from the $730 million reported in the same period of 2023, reflecting their ongoing efforts to optimize these essential operational expenditures.

EOG Resources faces significant expenses related to gathering, processing, and transporting its oil and gas products from where they are extracted to where they are sold. These operational necessities are fundamental to their business. For 2024, EOG consolidated these into a single reporting category to simplify and improve the transparency of their cost structure.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for EOG Resources encompass a range of corporate overhead, employee compensation and benefits, and professional services like legal and accounting. These costs are fundamental to the company's operational infrastructure and strategic direction. EOG Resources consistently strives for operational efficiency within its G&A functions to bolster its competitive low-cost producer advantage.

In 2024, EOG Resources reported G&A expenses that reflect their commitment to lean operations. For example, their G&A as a percentage of revenue is a key metric they monitor to ensure cost-effectiveness. This focus on efficiency helps maintain their position as a low-cost operator in the energy sector.

- Corporate Overhead: Includes costs associated with maintaining headquarters, IT infrastructure, and corporate support functions.

- Employee-Related Expenses: Covers salaries, benefits, and training for administrative and management staff.

- Professional Fees: Encompasses payments for external legal counsel, accounting audits, and consulting services.

- Efficiency Focus: EOG Resources actively manages these costs to contribute to their overall low-cost structure and profitability.

Drilling and Completion Costs (Well Costs)

EOG Resources focuses heavily on reducing drilling and completion costs, often referred to as well costs. These are the specific expenses incurred for each individual well drilled and made operational. By implementing strategies like extending lateral lengths and leveraging in-house technology, EOG has made significant strides in cost efficiency.

These efforts directly translate to improved profitability, as lower well costs mean a higher return on investment for each successful well. For instance, EOG reported in their 2024 investor presentations that they continued to see reductions in their pad drilling times and overall well costs, contributing to their strong operational performance.

- Efficiency Gains: EOG's commitment to operational efficiency in drilling and completion processes has been a key driver in lowering well costs.

- Extended Laterals: By drilling longer horizontal sections, EOG maximizes the amount of reservoir contacted by a single well, improving economics and reducing per-foot drilling costs.

- In-house Technology: Investment in and development of proprietary technology allows EOG to optimize drilling operations and reduce reliance on external service providers, further controlling costs.

EOG Resources' cost structure is heavily influenced by capital expenditures, which are investments in exploration, drilling, and infrastructure. Lease Operating Expenses (LOE) represent the ongoing costs of maintaining production, with a strategic focus on remaining a low-cost producer. Gathering, processing, and transportation costs are also essential operational necessities. Finally, General and Administrative (G&A) expenses cover corporate overhead and employee-related costs, with a continuous drive for efficiency.

Revenue Streams

EOG Resources primarily generates revenue through the sale of crude oil. This segment is the backbone of their earnings, reflecting the company's strategic focus on developing oil reserves in prolific basins.

In 2023, crude oil and condensate sales constituted a significant majority of EOG's revenue, underscoring its importance. For instance, the company reported substantial volumes of oil production, directly translating into robust sales figures.

EOG Resources generates substantial revenue from selling natural gas liquids (NGLs) like ethane, propane, and butane, which are extracted from their natural gas production. These liquids are valuable commodities, and their sales provide a crucial diversification to EOG's income, complementing its primary focus on crude oil.

In 2024, NGLs played a vital role in EOG's financial performance. For instance, in the first quarter of 2024, EOG reported that its NGLs production averaged 1,038 MBoe/d, contributing a significant portion to their overall hydrocarbon output and revenue streams, demonstrating their importance beyond just natural gas sales.

EOG Resources generates significant income through the marketing and sale of natural gas. This segment is bolstered by increasing output from gas-centric plays, such as Dorado and Utica, which effectively broadens the company's revenue streams.

Hedge Gains/Losses

EOG Resources utilizes commodity derivative contracts, or hedges, to manage the inherent volatility of oil and natural gas prices. While not a primary operational revenue source, these hedging activities can lead to realized gains or losses, thereby impacting the company's overall reported revenue. For instance, in the first quarter of 2024, EOG reported gains on commodity derivative instruments, contributing positively to their financial results.

These hedging strategies are crucial for providing a degree of price certainty in a fluctuating market. By entering into futures contracts and options, EOG aims to lock in prices for a portion of its future production. This practice helps stabilize cash flows and protects against significant downturns in commodity prices, though it also limits potential upside if prices surge unexpectedly.

- Hedge Gains/Losses: EOG's financial performance is influenced by gains or losses realized from its commodity derivative contracts.

- Price Risk Management: Hedging is a key strategy to mitigate the financial impact of volatile oil and gas prices.

- Q1 2024 Impact: EOG reported positive gains from commodity derivative instruments in the first quarter of 2024, underscoring the financial relevance of these activities.

Other Operating Revenues

EOG Resources' Other Operating Revenues encompass a range of smaller income streams that supplement its core oil and gas production activities. These can include reimbursements from joint venture partners for specific operational costs, fees for providing services to third parties, or other miscellaneous income generated incidentally from their extensive operations.

While these revenues are not the primary drivers of EOG's financial performance, they contribute to the overall profitability. For instance, in 2023, EOG Resources reported total revenues of approximately $24.7 billion, with the bulk stemming from crude oil, natural gas, and natural gas liquids sales. The specific breakdown of 'Other Operating Revenues' within this total is typically less significant, often representing a single-digit percentage of overall income.

- Reimbursements: Income received from partners for shared operational expenses on joint projects.

- Service Fees: Charges for utilizing EOG's infrastructure or expertise by other entities.

- Miscellaneous Income: Various smaller revenue sources not directly tied to core production.

- Contribution to Total Revenue: Typically represents a minor portion of EOG's overall financial performance, which is dominated by commodity sales.

EOG's revenue is predominantly driven by the sale of crude oil and condensate, a testament to its significant production capabilities in key shale plays. This segment consistently forms the largest portion of its income, reflecting strategic investments in oil-rich reserves.

Natural gas sales also represent a substantial revenue stream for EOG, supported by growing production from its gas-focused assets, which diversifies its earnings base. Additionally, the company benefits from the sale of natural gas liquids (NGLs), such as ethane and propane, extracted from its natural gas production, adding another layer of income.

EOG also engages in commodity derivative contracts to manage price volatility; these hedging activities can result in realized gains or losses that impact overall revenue. For instance, in Q1 2024, EOG reported gains on these instruments, highlighting their financial relevance.

| Revenue Stream | Primary Focus | 2023 Significance (Approx.) | Q1 2024 Data Point |

|---|---|---|---|

| Crude Oil & Condensate Sales | Core Production | Majority of Total Revenue | Significant Production Volumes |

| Natural Gas Sales | Growing Asset Base | Substantial Revenue Contributor | Increasing Output from Gas Plays |

| Natural Gas Liquids (NGLs) Sales | Value-Added Extraction | Important Diversification | 1,038 MBoe/d Average Production (Q1 2024) |

| Commodity Derivative Contracts (Hedges) | Price Risk Management | Impacts Realized Gains/Losses | Reported Gains in Q1 2024 |

Business Model Canvas Data Sources

The EOG Resources Business Model Canvas is informed by extensive public financial disclosures, industry-specific market analysis, and internal operational data. These sources provide a comprehensive view of the company's strategic positioning and market engagement.