EnQuest SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnQuest Bundle

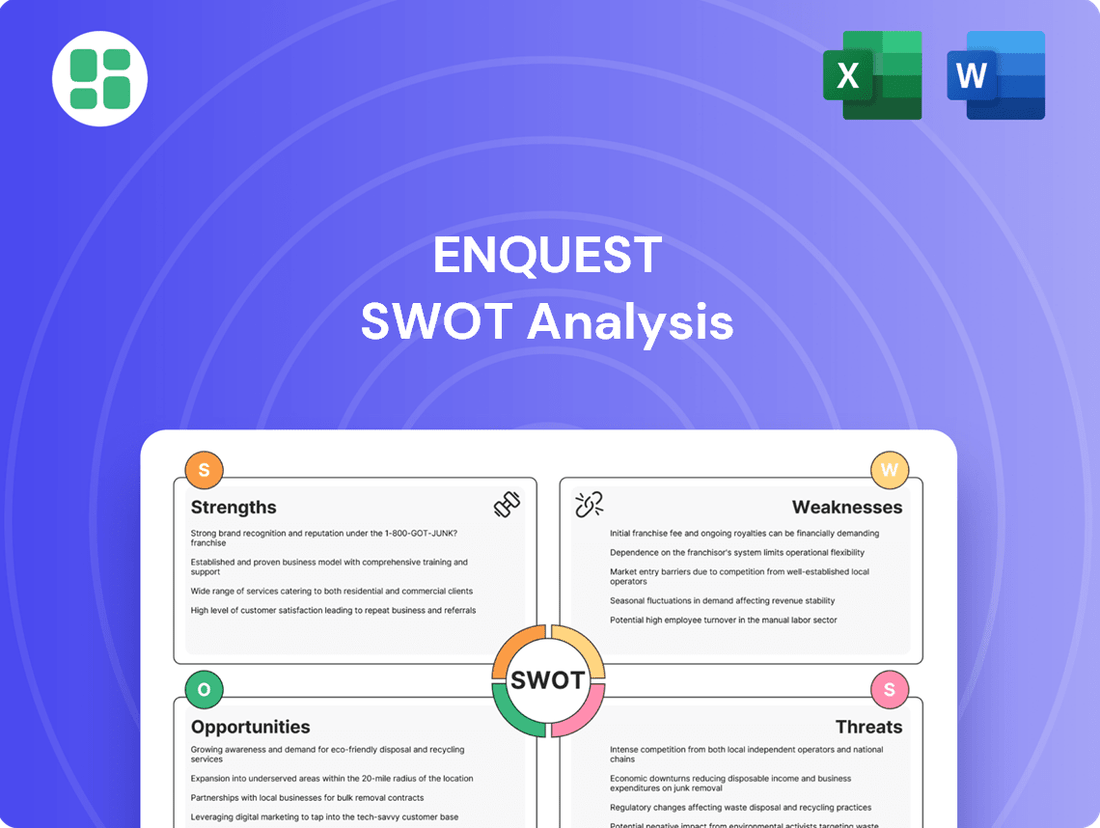

Our EnQuest SWOT analysis reveals key strengths like their experienced team and established production assets, alongside significant opportunities in new project development. However, potential weaknesses such as high debt levels and the inherent volatility of oil prices present considerable threats that demand careful navigation.

Want the full story behind EnQuest’s market position and future prospects? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

EnQuest's core strength lies in its specialized focus on mature oil and gas assets. This niche allows them to excel at extracting maximum value from fields that larger, more diversified companies might overlook or divest. Their strategic approach centers on efficient operation and development of these late-life assets.

The company's Chief Executive has emphasized EnQuest's position as a top-quartile operator, particularly skilled in managing assets throughout their entire lifecycle, including the transition phase. This deep operational expertise is a significant differentiator in the industry.

EnQuest demonstrates exceptional operational efficiency, consistently achieving high production uptime across its diverse assets. In 2024, the company reported approximately 90% group operated production uptime, a figure that places it among the best performers in the UK North Sea sector.

This strong performance is further underscored by specific asset achievements, with the Kraken Floating Production Storage and Offloading (FPSO) unit reaching an impressive 95.5% uptime. Similarly, the PM8/Seligi project in Malaysia recorded a notable 94% uptime, highlighting EnQuest's ability to maintain reliable operations even in challenging environments.

EnQuest has achieved remarkable financial de-leveraging, slashing its net debt by over $1.6 billion from its highest point. This strategic reduction brought net debt down to $385.8 million by the close of 2024, and continued to improve to $321.0 million by mid-2024.

This robust financial health is further bolstered by substantial liquidity, standing at approximately $550 million in transaction-ready funds as of February 2025. Such a strong balance sheet and readily available cash provide a secure platform for future expansion and the potential for rewarding shareholders.

Diversified Geographic Footprint and Commodity Mix

EnQuest's strategic expansion beyond its traditional UK Continental Shelf base is a significant strength. Recent acquisitions in South East Asia, such as the Block 12W acquisition in Vietnam and an increased presence in Malaysia, highlight this diversification. This geographic spread helps mitigate risks associated with reliance on a single region.

This international push also diversifies EnQuest's commodity exposure. By broadening its portfolio, the company reduces its dependence on a purely oil-centric business model, which is crucial in a fluctuating energy market. For instance, as of early 2024, EnQuest reported that its production mix was becoming more balanced, with a notable increase in gas production from its international assets contributing to overall revenue stability.

The benefits of this diversified footprint are clear:

- Reduced Regional Risk: Lessens exposure to regulatory or operational challenges specific to the UKCS.

- Commodity Hedging: A more balanced oil and gas production profile can offer better price stability.

- Growth Opportunities: Access to new markets and resources in high-potential regions like South East Asia.

Advantaged UK Tax Position

EnQuest benefits from a substantial UK tax asset, a significant advantage that can be leveraged through strategic financial maneuvers. This asset directly contributes to reducing the company's cash tax outflows, a benefit amplified by initiatives like the Magnus Flare Gas Recovery project, which qualifies for valuable decarbonisation allowances. For instance, in 2024, EnQuest's ability to utilize these tax assets is projected to significantly reduce its effective tax rate.

This fiscal advantage provides crucial flexibility for capital allocation. It enables EnQuest to more effectively fund growth opportunities and enhance shareholder returns, particularly as it navigates the energy transition and invests in projects with clear decarbonisation benefits. The company's strategic use of these tax assets is a key element in its financial planning for the 2024-2025 period.

- Significant UK Tax Asset: EnQuest holds a substantial tax asset in the UK.

- Cash Tax Minimization: This asset helps lower cash tax payments, especially with qualifying projects.

- Decarbonisation Allowances: Projects like Magnus Flare Gas Recovery enhance fiscal efficiency.

- Capital Deployment Support: The tax position facilitates investment in growth and shareholder value.

EnQuest's expertise in managing mature oil and gas assets is a key strength, enabling them to maximize value from late-life fields. This focus, combined with a top-quartile operational capability, allows for efficient asset lifecycle management, including the transition phase.

The company consistently demonstrates high operational efficiency, with group operated production uptime reaching approximately 90% in 2024. Specific assets, like the Kraken FPSO at 95.5% uptime and the PM8/Seligi project at 94% uptime, highlight this reliability.

EnQuest has made significant strides in financial de-leveraging, reducing net debt by over $1.6 billion from its peak to $321.0 million by mid-2024. This is supported by substantial liquidity, with approximately $550 million in transaction-ready funds as of February 2025.

Geographic diversification into South East Asia, including recent acquisitions in Vietnam and an increased Malaysian presence, mitigates regional risks and balances commodity exposure, with gas production from international assets improving revenue stability.

A substantial UK tax asset provides a distinct advantage, reducing cash tax outflows, particularly with decarbonisation initiatives like the Magnus Flare Gas Recovery project. This fiscal benefit supports capital allocation for growth and shareholder returns through 2024-2025.

| Metric | 2024 (Approx.) | Mid-2024 | Feb 2025 (Approx.) |

|---|---|---|---|

| Group Operated Production Uptime | 90% | ||

| Kraken FPSO Uptime | 95.5% | ||

| PM8/Seligi Uptime | 94% | ||

| Net Debt | $321.0 million | ||

| Liquidity | $550 million |

What is included in the product

Maps out EnQuest’s market strengths, operational gaps, and risks, offering a comprehensive view of its strategic landscape.

Provides a clear, actionable framework to identify and address EnQuest's strategic challenges.

Weaknesses

EnQuest's reliance on mature fields, while leveraging their established infrastructure, presents a significant weakness due to inherent natural production declines. For instance, in its 2023 fiscal year, the company reported a production decline in some of its older UK North Sea assets, necessitating ongoing capital allocation towards infill drilling and well workovers to counteract this trend. This constant need for investment to sustain output, even with efficiency gains, remains a persistent challenge in offsetting the natural depletion of these mature reserves.

EnQuest, as an independent oil and gas producer, faces significant vulnerability to the unpredictable swings in global commodity prices. This inherent exposure directly impacts its revenue streams and overall profitability, making it a key weakness.

While EnQuest employs hedging strategies to mitigate some of this risk, prolonged periods of depressed oil and gas prices, such as those experienced in recent years, can severely strain its cash flow. This strain can then limit the company's ability to fund essential investments and operational activities, hindering future growth prospects.

Operating mature fields, particularly in the North Sea, presents EnQuest with significant future decommissioning liabilities. These costs stem from the necessary well plug and abandonment activities and the eventual removal of offshore facilities.

In 2024, EnQuest reported decommissioning expenditures amounting to $60.5 million. This figure underscores the substantial and ongoing financial commitment the company faces to responsibly manage the end-of-life cycle for its assets.

UK Fiscal and Regulatory Uncertainty

EnQuest has highlighted significant weaknesses stemming from the UK's fiscal and regulatory environment. The continued application of the Energy Profits Levy (EPL), often referred to as a windfall tax, alongside broader fiscal uncertainty in the UK North Sea, is a major concern. EnQuest has stated this situation causes irreversible damage and erodes the region's global competitiveness, which could deter crucial investment.

This uncertainty directly impacts EnQuest's operational and strategic planning. The company's own reports from 2024 indicate that such fiscal instability makes it challenging to commit to long-term projects, essential for maximizing the recovery of North Sea oil and gas reserves. This can lead to suboptimal resource utilization and reduced economic returns for the UK.

- Energy Profits Levy (EPL): The EPL, introduced in 2022 and subsequently increased, significantly impacts the profitability of North Sea oil and gas operations.

- Fiscal Uncertainty: Frequent changes or the threat of changes to tax regimes create an unpredictable investment climate.

- Competitiveness: The UK North Sea faces competition from other global energy basins with more stable fiscal frameworks.

- Investment Deterrence: Uncertainty discourages new capital expenditure, potentially leading to premature field closures and stranded assets.

Capital Intensive Operations

EnQuest's operations are inherently capital intensive. Maintaining and enhancing production from its existing, mature fields demands significant ongoing investment. For instance, the company projected capital expenditure of around $190 million for 2025, highlighting this substantial financial commitment.

This continuous need for capital expenditure can put a strain on EnQuest's free cash flow. Consequently, these high operational costs may limit the company's flexibility to pursue other strategic growth opportunities or shareholder returns.

- High Capital Expenditure: EnQuest faces substantial costs to maintain and improve production from its mature fields.

- 2025 Capital Forecast: The company anticipated investing approximately $190 million in capital projects for 2025.

- Cash Flow Constraints: The significant capital needs can restrict the generation of free cash flow.

- Limited Strategic Flexibility: High investment requirements may hinder the pursuit of alternative strategic initiatives.

EnQuest's reliance on mature assets means that production naturally declines, requiring continuous investment to maintain output. For example, the company's 2023 fiscal year saw production dips in older UK North Sea fields, necessitating ongoing capital for infill drilling and well workovers. This constant effort to offset depletion, even with efficiency improvements, remains a core challenge.

The company is highly susceptible to volatile oil and gas prices, which directly impact revenue and profitability. While hedging provides some buffer, sustained low prices, as seen in recent years, can severely strain cash flow, limiting investment and growth. For instance, EnQuest reported adjusted EBITDA of $469 million for the fiscal year 2023, a figure directly tied to prevailing market conditions.

Significant decommissioning liabilities represent a substantial future cost for EnQuest, particularly from its North Sea operations. These costs include plugging wells and removing offshore infrastructure. In 2024, the company allocated $60.5 million towards decommissioning, highlighting the ongoing financial burden.

The UK's fiscal and regulatory environment, specifically the Energy Profits Levy (EPL), creates considerable uncertainty. This, coupled with broader fiscal instability in the North Sea, deters investment and impacts EnQuest's ability to plan long-term projects, potentially leading to suboptimal resource utilization.

EnQuest's operations are inherently capital intensive, with substantial ongoing investment needed to maintain production from mature fields. The company forecast capital expenditure of approximately $190 million for 2025. This high level of investment can constrain free cash flow and limit strategic flexibility.

| Weakness | Description | Relevant Data/Impact |

| Production Decline in Mature Fields | Natural depletion of older assets requires continuous investment to sustain output. | 2023 fiscal year saw production declines in some UK North Sea assets. |

| Commodity Price Volatility | High exposure to fluctuating oil and gas prices impacts revenue and profitability. | 2023 Adjusted EBITDA was $469 million, reflecting market price sensitivity. |

| Decommissioning Liabilities | Significant future costs associated with end-of-life asset management. | 2024 decommissioning expenditures were $60.5 million. |

| UK Fiscal and Regulatory Uncertainty | The Energy Profits Levy (EPL) and general instability deter investment and long-term planning. | EPL impacts profitability; fiscal uncertainty hinders commitment to long-term projects. |

| High Capital Expenditure Requirements | Maintaining mature fields demands substantial ongoing investment, potentially limiting cash flow and strategic options. | Projected 2025 capital expenditure was around $190 million. |

What You See Is What You Get

EnQuest SWOT Analysis

The preview you see is the actual EnQuest SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of EnQuest's internal strengths and weaknesses, as well as external opportunities and threats.

You’re viewing a live preview of the actual SWOT analysis file for EnQuest. The complete, in-depth version becomes available immediately after purchase, offering actionable insights.

Opportunities

Major oil companies are increasingly divesting mature, non-core assets as they focus on the energy transition. This creates a prime opportunity for EnQuest to acquire these assets, particularly in the UK, where it possesses significant expertise in managing late-life operations. EnQuest's stated strategy includes actively pursuing transformational UK deals, capitalizing on this market shift.

EnQuest's strategic focus on late-life asset management positions it well to benefit from these divestments. The company is also exploring new country entries, specifically in South East Asia, which could further diversify its portfolio and leverage its operational capabilities. This dual approach to acquisition, both domestically and internationally, underscores a proactive strategy to grow through strategic M&A.

EnQuest is actively pursuing growth in South East Asia, recently completing the acquisition of Harbour Energy's Vietnam business. This strategic move, alongside ongoing expansion in Malaysia, offers significant opportunities for diversifying both its geographic footprint and commodity exposure. The company is actively screening further prospects in this dynamic region.

EnQuest is actively pursuing enhanced oil recovery (EOR) projects, with Kraken being a prime example. This initiative alone has the potential to add between 30 and 60 million barrels of oil to their recoverable reserves, showcasing a substantial avenue for organic growth.

The company's commitment to adopting cutting-edge technologies is crucial for maximizing the value of its existing assets. By integrating new EOR techniques, EnQuest can significantly improve recovery rates and extend the operational lifespan of its fields, thereby bolstering long-term production and profitability.

Leveraging Infrastructure for Energy Transition

EnQuest's strategic focus on providing creative solutions for the energy transition, coupled with its role as a partner for managing existing energy assets responsibly, presents a significant opportunity. The company's established expertise in infrastructure and decommissioning can be a valuable asset in developing new energy projects.

This expertise can be directly leveraged for emerging sectors like carbon capture and storage (CCS) or offshore wind development, as demonstrated by its subsidiary, Veri Energy. For instance, the UK government has committed to investing £20 billion in the energy sector by 2030, with a significant portion earmarked for green technologies and infrastructure, creating a fertile ground for companies like EnQuest to pivot.

- Infrastructure Expertise: EnQuest's proven track record in managing complex offshore infrastructure can be repurposed for CCS pipelines or offshore wind farm foundations.

- Decommissioning Synergies: Experience in safely decommissioning old assets can translate into efficient project management for new energy installations.

- Veri Energy's Role: The subsidiary's focus on renewable energy projects provides a direct avenue for EnQuest to participate in the growing wind sector.

- Market Growth: The global CCS market is projected to reach over $10 billion by 2027, and offshore wind capacity is expected to grow substantially in the coming years, offering significant market potential.

Cost Optimization and Efficiency Gains

EnQuest has a significant opportunity to enhance its financial performance through ongoing cost optimization and efficiency improvements. This focus is particularly crucial in managing operations effectively, especially when commodity prices are volatile. By diligently seeking out and implementing cost-saving measures, the company can bolster its profit margins and strengthen its overall financial resilience.

A prime example of this strategy in action is the renegotiated lease rate for the Kraken Floating Production, Storage, and Offloading (FPSO) unit. This adjustment, effective from April 2025, is projected to deliver substantial savings, directly contributing to improved operational economics.

- Reduced Operating Expenses: Lowering the Kraken FPSO lease rate from April 2025 is a tangible step towards decreasing overall operating costs.

- Enhanced Profitability: Successfully optimizing the cost base directly translates into improved margins per barrel of oil equivalent.

- Financial Resilience: A leaner cost structure better positions EnQuest to navigate periods of lower oil and gas prices, ensuring greater financial stability.

- Competitive Advantage: Demonstrating a commitment to efficiency can provide a competitive edge in the industry, attracting investment and partnerships.

EnQuest is well-positioned to acquire mature, non-core assets from larger companies focusing on the energy transition, particularly in the UK where it has strong operational expertise. The company's expansion into South East Asia, including the recent acquisition in Vietnam and ongoing efforts in Malaysia, offers significant diversification opportunities. Furthermore, EnQuest’s focus on enhanced oil recovery projects, such as at Kraken, promises substantial organic growth by increasing recoverable reserves.

| Opportunity Area | Specific Initiative/Example | Potential Impact |

|---|---|---|

| Asset Acquisitions | Acquiring mature, non-core assets from majors | Portfolio growth, leveraging expertise in late-life operations |

| Geographic Diversification | Expansion in South East Asia (Vietnam, Malaysia) | Reduced geographic concentration, new revenue streams |

| Organic Growth | Enhanced Oil Recovery (EOR) at Kraken | Increased recoverable reserves (30-60 million barrels), extended field life |

| Energy Transition | Leveraging infrastructure and decommissioning expertise for CCS/offshore wind | Participation in growing green energy markets, new business lines via Veri Energy |

| Cost Optimization | Renegotiated Kraken FPSO lease rate (effective April 2025) | Reduced operating expenses, enhanced profitability and financial resilience |

Threats

A sustained downturn in oil and gas prices presents a substantial risk for EnQuest. For instance, if Brent crude averages $60 per barrel in 2024, a significant drop from 2023 highs, it directly squeezes EnQuest's revenue streams and operating margins. This environment can also make marginal fields uneconomical, hindering the company's ability to fund new projects and potentially impacting its debt servicing capabilities.

The UK's Energy Profits Levy (EPL), often referred to as the "windfall tax," remains a significant concern for EnQuest. This levy, which was extended in the 2024 Spring Budget, continues to impact profitability and investment decisions within the North Sea oil and gas sector. The ongoing uncertainty surrounding energy taxation policies creates a challenging operating environment.

Further shifts in government policy or the introduction of more stringent environmental regulations could escalate operating expenses for EnQuest. Such changes might also diminish the sector's appeal to investors, potentially hindering future capital allocation and project development. These factors contribute to the overall regulatory and fiscal risks faced by the company.

EnQuest faces escalating decommissioning costs, a significant threat to its financial stability. While the company budgets for these expenses, unforeseen complexities or shifts in regulatory requirements for its mature North Sea assets could trigger substantial cost overruns. This is particularly concerning given EnQuest's ongoing well plug and abandonment program, which represents a considerable financial liability.

For instance, in its 2023 annual report, EnQuest highlighted its decommissioning provisions, indicating a substantial commitment to future asset retirement. The company's strategy involves managing these costs through efficient execution and planning, but the inherent uncertainties in offshore decommissioning, especially in older fields, mean that budget adherence is not guaranteed. Any significant increase in these costs could directly impact profitability and cash flow.

Competition for Growth Opportunities

EnQuest, while focused on the UK Continental Shelf, encounters significant competition from other independent oil and gas companies vying for the same growth opportunities. This rivalry can inflate acquisition costs, making it harder for EnQuest to secure assets at attractive valuations. For instance, in 2024, the market for mature North Sea assets saw increased bidding activity, potentially impacting EnQuest's ability to expand its portfolio efficiently.

The drive for consolidation and portfolio optimization among peers means EnQuest must be agile in identifying and pursuing acquisition targets. This competitive landscape can lead to:

- Increased acquisition premiums: As more players target similar assets, purchase prices are likely to rise.

- Limited availability of prime assets: The most strategically valuable or cost-effective opportunities may be quickly snapped up by competitors.

- Pressure on deal structuring: EnQuest might face pressure to offer more favorable terms to secure acquisitions, potentially impacting future profitability.

This competitive pressure for growth directly impacts EnQuest's strategic flexibility and its capacity to enhance its asset base and production levels in the coming years.

Negative Investor Sentiment towards Hydrocarbons

A significant headwind for EnQuest is the intensifying negative investor sentiment surrounding hydrocarbons. This is driven by a growing global emphasis on Environmental, Social, and Governance (ESG) criteria and the accelerating energy transition. Consequently, securing capital for traditional oil and gas projects, even those with strong operational performance, is becoming increasingly difficult.

This shift in investor preference directly impacts EnQuest's ability to attract new investment and obtain financing. For instance, many institutional investors are actively divesting from fossil fuel assets or imposing stricter criteria for new investments, favoring companies demonstrably committed to renewable energy or carbon capture technologies.

The implications are stark:

- Reduced Access to Capital: Difficulty in raising funds for exploration and production activities.

- Higher Cost of Capital: Lenders and investors may demand higher returns to compensate for perceived ESG risks.

- Valuation Pressure: Market valuations for hydrocarbon-focused companies may be depressed compared to those in the renewable sector.

Volatile commodity prices remain a primary threat; if Brent crude averages $60/barrel in 2024, EnQuest's revenue and margins will be squeezed, potentially hindering debt servicing. The UK's extended Energy Profits Levy (EPL) continues to impact profitability and investment decisions, creating fiscal uncertainty. Intensifying investor focus on ESG criteria and the energy transition makes securing capital for hydrocarbon projects increasingly challenging, leading to reduced access to capital and higher borrowing costs.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Data/Context |

|---|---|---|---|

| Market Volatility | Oil and Gas Price Fluctuations | Reduced revenue, squeezed margins, impact on debt servicing. | Brent crude averaged around $80-$85/barrel in late 2023, but forecasts for 2024 suggest potential moderation, with some analysts predicting averages closer to $70-$80. |

| Fiscal & Regulatory | UK Energy Profits Levy (EPL) | Reduced profitability, impact on investment decisions, fiscal uncertainty. | The EPL was extended in the 2024 Spring Budget, maintaining a 75% tax rate on profits above a certain threshold. |

| Investor Sentiment | ESG Focus & Energy Transition | Difficulty securing capital, higher cost of capital, valuation pressure. | Many institutional investors are increasing their allocation to renewables and divesting from fossil fuels, a trend expected to continue through 2025. |

| Operational | Decommissioning Costs | Potential cost overruns, impact on profitability and cash flow. | EnQuest's decommissioning provisions were substantial in its 2023 report, with ongoing well plug and abandonment programs representing significant future liabilities. |

SWOT Analysis Data Sources

This EnQuest SWOT analysis is built upon a comprehensive review of publicly available financial reports, industry-specific market intelligence, and expert commentary from reputable energy sector analysts. These sources provide a robust foundation for understanding EnQuest's operational landscape and strategic positioning.