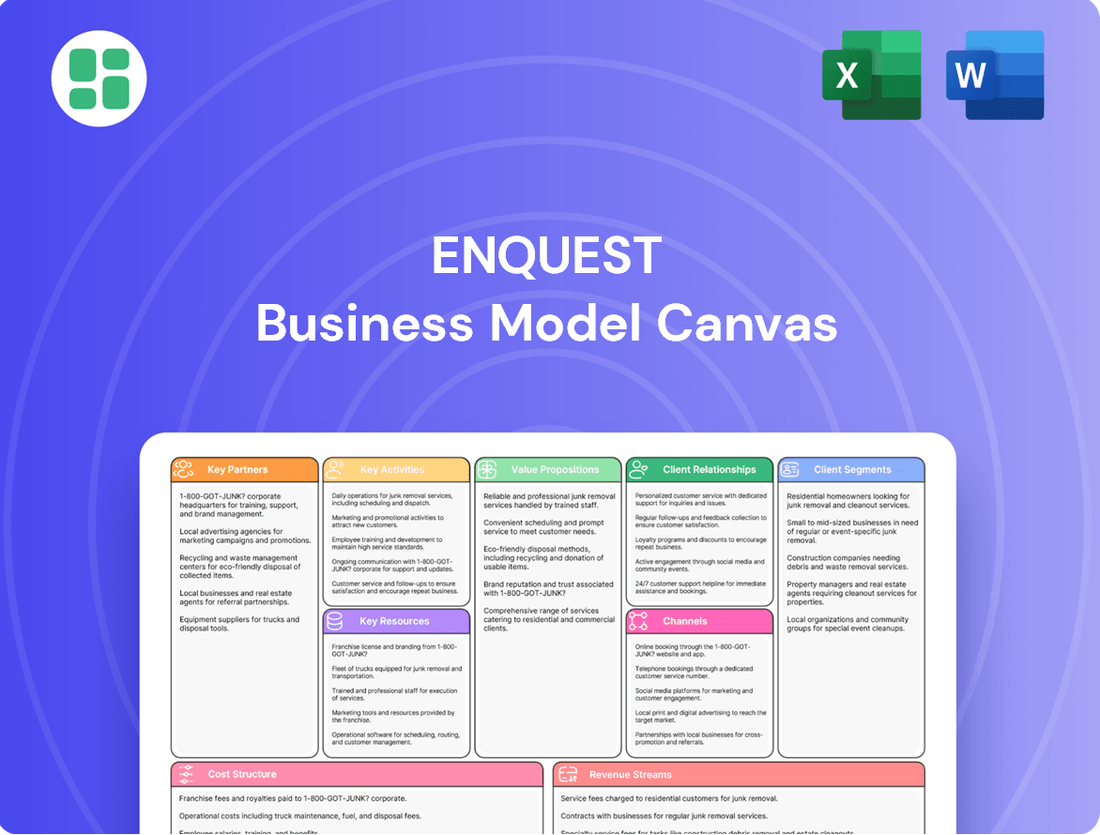

EnQuest Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnQuest Bundle

Unlock the strategic core of EnQuest's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they create, deliver, and capture value within the energy sector. Discover their key partners, revenue streams, and cost structures to inform your own strategic planning.

Ready to dissect EnQuest's success? Our full Business Model Canvas provides an in-depth look at their customer relationships, value propositions, and competitive advantages. This professionally crafted document is your key to understanding their market approach and identifying growth opportunities.

Gain a competitive edge by exploring EnQuest's proven business model. The complete canvas, available for download, offers a clear, actionable framework covering all nine essential building blocks. It's the perfect tool for entrepreneurs and analysts seeking to learn from industry leaders.

Partnerships

EnQuest actively engages in joint ventures, notably with partners in its UK Continental Shelf and Malaysian operations. These collaborations are vital for sharing the significant capital expenditure and operational risks inherent in developing and managing mature oil and gas fields.

For instance, EnQuest's involvement in the Greater Kittiwake Area (GKA) and the Golden Eagle area exemplifies these strategic partnerships. Such alliances enable the pooling of technical expertise, crucial for optimizing production and extending the life of these complex assets.

EnQuest depends on a robust network of specialized service and equipment providers to execute critical operations like drilling, well intervention, and decommissioning. These partnerships are vital for securing access to advanced technologies and experienced personnel essential for safe and efficient offshore work. For instance, in 2024, EnQuest continued to leverage relationships with key rig providers and subsea equipment suppliers to support its North Sea portfolio, ensuring operational continuity and cost-effectiveness.

EnQuest actively engages with regulatory bodies and host governments, particularly in the UK and Malaysia, to secure and maintain essential licenses, permits, and production sharing contracts. This collaboration is fundamental for ensuring ongoing operational stability and adherence to stringent environmental and safety standards.

These crucial partnerships allow EnQuest to navigate complex regulatory landscapes, fostering a compliant and sustainable operating environment. For instance, in 2024, the company continued its dialogue with authorities regarding its North Sea operations, emphasizing its commitment to responsible resource management and environmental stewardship.

Furthermore, EnQuest collaborates with regulators on critical long-term initiatives, including the development of decommissioning plans and the implementation of carbon reduction strategies. This proactive engagement underscores the company's dedication to addressing evolving industry challenges and contributing to a lower-carbon energy future.

Acquisition and Divestment Partners

EnQuest actively engages with other energy companies as acquisition and divestment partners. This strategy involves acquiring mature or complex assets where EnQuest can leverage its specialized expertise. These collaborations are crucial for EnQuest's ongoing growth and the diversification of its asset portfolio.

A prime example of this strategy in action was EnQuest's acquisition of Harbour Energy's Vietnam business. This move not only expanded its geographical reach but also added valuable production assets to its portfolio. Furthermore, EnQuest has been focused on expanding its footprint in Malaysia, a region where it sees significant potential for value creation through strategic acquisitions.

- Strategic Acquisitions: EnQuest targets mature or complex assets that align with its operational capabilities.

- Portfolio Diversification: Partnerships facilitate entry into new regions and acquisition of varied asset types.

- Growth Engine: Mergers and acquisitions are a primary driver for EnQuest's expansion and market position.

New Energy and Decarbonisation Collaborators

EnQuest, through its subsidiary Veri Energy, is actively forging partnerships in the new energy and decarbonisation sector. These collaborations are crucial for advancing projects in carbon capture and storage (CCS) and renewable energy development.

These strategic alliances are designed to leverage EnQuest's existing infrastructure, such as the Sullom Voe Terminal, for future decarbonisation efforts. This approach aims to unlock new, diversified revenue streams for the company.

- Veri Energy's Role: EnQuest's subsidiary, Veri Energy, is the primary vehicle for these new energy partnerships.

- Focus Areas: Key areas of collaboration include carbon capture and storage (CCS) and renewable energy projects.

- Infrastructure Leverage: Partnerships are vital for utilizing existing assets like the Sullom Voe Terminal for decarbonisation.

- Revenue Diversification: These ventures are intended to create new and varied income sources for EnQuest.

EnQuest's key partnerships extend to joint ventures, particularly in its UK Continental Shelf and Malaysian operations, essential for sharing capital expenditure and operational risks in mature fields. These alliances, such as those in the Greater Kittiwake Area, pool technical expertise to optimize production.

The company also relies on specialized service providers for critical operations like drilling and well intervention. In 2024, EnQuest continued to work with key rig and subsea equipment suppliers to ensure efficient North Sea operations. Moreover, EnQuest actively collaborates with other energy companies for acquisitions and divestments, a strategy that has seen it expand its footprint in Malaysia and acquire assets like Harbour Energy's Vietnam business.

Furthermore, EnQuest, through its subsidiary Veri Energy, is building partnerships in new energy sectors like carbon capture and storage (CCS) and renewables. These collaborations aim to leverage existing infrastructure, such as the Sullom Voe Terminal, to create diversified revenue streams and contribute to decarbonisation efforts.

| Partnership Type | Key Focus Areas | Examples/2024 Activity | Strategic Importance |

|---|---|---|---|

| Joint Ventures | UKCS & Malaysia operations, mature field development | Greater Kittiwake Area, Golden Eagle | Risk sharing, technical expertise pooling |

| Service Providers | Drilling, well intervention, subsea equipment | Rig providers, subsea suppliers (ongoing in 2024) | Access to technology, operational efficiency |

| Acquisition/Divestment Partners | Asset acquisition, portfolio diversification | Harbour Energy's Vietnam business, Malaysia expansion | Growth, market position enhancement |

| New Energy/Decarbonisation | CCS, renewable energy development | Veri Energy's initiatives, Sullom Voe Terminal leverage | Revenue diversification, future energy transition |

What is included in the product

A detailed EnQuest Business Model Canvas outlining its focus on mature offshore oil and gas fields, emphasizing cost-efficient production and value creation through strategic partnerships and asset optimization.

Enables rapid identification of customer pains and how the business model addresses them, streamlining the process of developing targeted solutions.

Provides a clear framework to pinpoint and alleviate customer frustrations by visualizing the value proposition and its connection to specific problems.

Activities

EnQuest's primary focus is the efficient extraction and development of oil and gas reserves. This involves managing daily production from its operated and non-operated fields, predominantly located in the UK North Sea and Malaysia.

The company actively works to optimize output from its existing wells and bring new wells into production, aiming for high operational efficiency across its entire asset base. For example, in 2024, EnQuest reported average gross production of approximately 43,000 boepd (barrels of oil equivalent per day).

A core activity for EnQuest involves strategically acquiring oil and gas assets, particularly those that are maturing or present operational complexities. This is followed by efficiently integrating these new assets into their existing operational framework. This process is crucial for unlocking additional value from these fields.

The acquisition process itself demands rigorous due diligence, skillful negotiation, and a smooth transition of operations to ensure the acquired assets contribute positively to EnQuest's overall portfolio. This careful integration is key to maximizing the return on investment from these strategic purchases.

Recent examples of this key activity include EnQuest's acquisition of assets in Vietnam. Furthermore, they have expanded their interests in Malaysia, demonstrating a continued focus on strategic growth through asset acquisition and integration.

EnQuest prioritizes maximizing output from its current fields by employing strategies like infill drilling and well interventions. This focus on operational efficiency aims to extend the productive life of their assets and boost hydrocarbon recovery rates. The company consistently achieves high production uptime, demonstrating effective asset management.

In 2023, EnQuest reported an average net production of 39,000 boepd, with their UK North Sea operations demonstrating significant resilience and efficiency. Their commitment to operational excellence is a core element of their business model, directly contributing to sustained revenue streams.

Decommissioning and Late-Life Asset Management

EnQuest’s expertise in decommissioning and late-life asset management is crucial for its portfolio of mature North Sea fields. This involves meticulous planning and execution of activities such as well plug and abandonment (P&A) campaigns and the safe removal of offshore platforms. The company prioritizes cost-effectiveness and safety throughout these complex operations.

As a recognized leader in the North Sea decommissioning sector, EnQuest actively manages the entire lifecycle of its assets. This includes developing and implementing strategies for the eventual shutdown and removal of facilities, ensuring environmental compliance and minimizing disruption. The company leverages its experience to optimize these processes, often securing favorable contracts and efficient execution methods.

- Cost-Effective Decommissioning: EnQuest aims to deliver decommissioning projects within budget, a critical factor given the significant costs associated with these activities. For instance, in their 2023 financial reporting, EnQuest highlighted progress on P&A campaigns, contributing to their overall asset stewardship strategy.

- Safety Excellence: Maintaining a strong safety record is paramount in all decommissioning operations. The company’s commitment to safety is reflected in its operational procedures and performance metrics, ensuring the well-being of personnel and the protection of the environment.

- Leading North Sea Operator: EnQuest's established track record and operational experience position it as a key player in the North Sea decommissioning market, capable of handling complex projects for both its own assets and potentially for third parties.

Debt Management and Capital Allocation

EnQuest actively manages its balance sheet, prioritizing debt reduction and optimizing its financial architecture. This involves strategic engagement with its reserve-based lending facility and its various bond structures to ensure financial flexibility and stability. For instance, as of early 2024, EnQuest continued its focus on deleveraging, aiming to strengthen its financial position.

Disciplined capital allocation is central to EnQuest's strategy, directing funds towards projects that promise value creation. This also ensures the smooth continuation of its operational activities and considers opportunities for returning capital to shareholders. The company's approach balances investment in growth with maintaining a robust operational base.

- Balance Sheet Management: EnQuest's key financial activity involves actively managing its debt levels and optimizing its overall financial structure, including its reserve-based lending and bond issuances.

- Capital Allocation: The company employs a disciplined approach to allocating capital, focusing on funding value-accretive growth projects, supporting ongoing operations, and exploring potential capital returns to shareholders.

EnQuest's core activities revolve around the efficient production of oil and gas, strategic asset acquisition and integration, and expert management of late-life assets and decommissioning. These operations are underpinned by robust financial management and disciplined capital allocation to ensure long-term value creation.

The company focuses on maximizing output from its existing fields through initiatives like infill drilling and well interventions. For example, in 2024, EnQuest reported average gross production of approximately 43,000 boepd. They also strategically acquire and integrate new assets, such as their recent expansion of interests in Malaysia, to enhance their portfolio.

A critical aspect of EnQuest's business is its proficiency in decommissioning mature assets, particularly in the North Sea. This includes meticulous planning and execution of well plug and abandonment campaigns and platform removals, prioritizing safety and cost-effectiveness. EnQuest also actively manages its balance sheet, focusing on debt reduction and optimizing its financial structure, as evidenced by its continued deleveraging efforts in early 2024.

| Key Activity | Description | 2023/2024 Data Points |

|---|---|---|

| Production & Operations | Efficient extraction and development of oil and gas reserves. | 2024 average gross production: ~43,000 boepd. |

| Asset Acquisition & Integration | Strategic acquisition of oil and gas assets and their integration into existing operations. | Expansion of interests in Malaysia; acquisition of assets in Vietnam. |

| Decommissioning & Late-Life Asset Management | Managing the lifecycle of mature fields, including P&A and platform removal. | Progress on P&A campaigns reported in 2023. |

| Financial Management & Capital Allocation | Balance sheet management, debt reduction, and disciplined investment in growth projects. | Continued focus on deleveraging in early 2024. |

Full Version Awaits

Business Model Canvas

The EnQuest Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

EnQuest's core tangible assets are its proved and probable (2P) oil and gas reserves, complemented by contingent (2C) resources. These reserves are strategically situated in the UK Continental Shelf and Malaysia, forming the bedrock of the company's production and revenue streams.

As of the end of 2023, EnQuest reported 2P reserves of 171 million barrels of oil equivalent (MMboe). The company's strategy has actively focused on expanding this reserve base through targeted acquisitions, notably the acquisition of the remaining 50% interest in the Golden Eagle area in 2023, which significantly bolstered its reserves and production capacity.

EnQuest's production infrastructure is its backbone, featuring key assets like the Kraken FPSO, offshore platforms, and extensive pipelines. These facilities are crucial for the efficient extraction and transportation of oil and gas to market, underpinning the company's operational capabilities.

The Sullom Voe Terminal (SVT) is another vital component, acting as a central hub for processing and exporting hydrocarbons. In 2024, EnQuest continued to leverage SVT's capacity, handling significant volumes of production from its North Sea assets, demonstrating its ongoing importance to the UK's energy infrastructure.

Beyond traditional oil and gas, EnQuest is strategically positioning SVT for future growth, exploring its potential as a hub for new energy projects. This forward-looking approach highlights the adaptability of their infrastructure to evolving energy landscapes.

EnQuest's strength lies in its highly skilled workforce, boasting specialized technical expertise crucial for managing complex, mature oil and gas assets. This includes deep knowledge in late-life asset management and the intricacies of decommissioning, areas where operational know-how is a significant differentiator.

This human capital is a key resource, enabling EnQuest to extract maximum value from challenging fields. For instance, as of early 2024, EnQuest's operational efficiency in its mature UK North Sea assets, a testament to its workforce's expertise, contributed to a significant portion of its production output.

Financial Capital and Liquidity

EnQuest's access to financial capital is a cornerstone of its business model, enabling it to fund day-to-day operations, significant capital expenditures, and strategic acquisitions. This includes not only its cash reserves but also crucial credit facilities, such as its Reserve Based Lending (RBL) facility, which is directly tied to its proven oil and gas reserves.

The company's ability to raise funds through avenues like bond issuances is also a key resource, providing flexibility in its financial management and growth plans. A robust balance sheet and a healthy liquidity position are therefore not just desirable but essential for executing EnQuest's growth strategy and navigating the often volatile energy market.

As of the first half of 2024, EnQuest reported a strong liquidity position, with cash and cash equivalents amounting to approximately $380 million. This financial strength allows the company to manage its debt obligations effectively and pursue opportunities for expansion and development.

- Access to Capital: EnQuest relies on cash, credit facilities like its Reserve Based Lending (RBL), and bond issuances to fund operations and growth.

- Balance Sheet Strength: A solid balance sheet and ample liquidity are critical for EnQuest's strategic objectives and market resilience.

- First Half 2024 Liquidity: The company maintained approximately $380 million in cash and cash equivalents, underscoring its financial stability.

- Strategic Funding: Financial capital is the enabler for EnQuest's capital expenditures, acquisitions, and overall business development.

UK Tax Asset

EnQuest's UK tax asset is a crucial element in its business model, offering a significant strategic advantage within the UK's petroleum revenue tax (PRT) and corporation tax framework. This asset represents carried-forward tax losses and capital allowances that can offset future tax liabilities, effectively reducing the company's overall tax burden. For instance, as of the end of 2023, EnQuest reported substantial tax assets that can be utilized against future taxable profits generated from its UK operations. This is particularly valuable given the fluctuating oil and gas prices and the inherent risks in the sector.

The ability to leverage this tax asset enhances the economic viability of EnQuest's existing assets and new project developments in the UK North Sea. It acts as a direct enhancement to project economics by reducing the post-tax cash flow hurdle rate, making marginal projects more attractive. This strategic advantage is vital for EnQuest as it seeks to optimize its portfolio and invest in mature fields, where tax considerations play a significant role in capital allocation decisions.

- UK Tax Asset Value: EnQuest's tax asset provides a substantial benefit, allowing for the offsetting of future taxable profits. While specific figures fluctuate, these assets are a key component of their financial planning.

- Strategic Advantage: The tax asset enhances the economics of UK North Sea projects, making them more competitive and attractive for investment and development.

- Cash Flow Enhancement: By reducing future tax payments, the asset directly contributes to improved operating cash flow and free cash flow generation for the company.

- Acquisition and Development Support: The tax asset can be utilized to improve the financial attractiveness of potential acquisitions or new development opportunities within the UK.

EnQuest's key resources are multifaceted, encompassing its significant oil and gas reserves, robust production infrastructure, a highly skilled workforce, and access to substantial financial capital. The company also benefits from a valuable UK tax asset, which enhances project economics.

These resources collectively enable EnQuest to operate efficiently, pursue growth opportunities, and maintain financial stability in the competitive energy sector.

The company's strategic management of these assets is crucial for maximizing shareholder value and achieving its long-term objectives.

| Resource Category | Key Components | Significance | 2023/2024 Data Points |

|---|---|---|---|

| Hydrocarbon Reserves | Proved and Probable (2P) reserves, Contingent (2C) resources | Foundation of production and revenue | 171 MMboe (2P reserves end-2023) |

| Production Infrastructure | Kraken FPSO, offshore platforms, pipelines, Sullom Voe Terminal (SVT) | Enables extraction, processing, and export | SVT handled significant production volumes in 2024 |

| Human Capital | Skilled workforce with technical expertise | Drives operational efficiency, late-life asset management | High operational efficiency in mature UK North Sea assets (early 2024) |

| Financial Capital | Cash reserves, RBL facility, bond issuances | Funds operations, capex, acquisitions | ~$380 million cash and cash equivalents (H1 2024) |

| UK Tax Asset | Carried-forward tax losses and capital allowances | Reduces future tax liabilities, improves project economics | Substantial tax assets utilized against future profits (end-2023) |

Value Propositions

EnQuest excels at breathing new life into mature oil and gas fields, a core strength that translates directly into significant value for stakeholders. By focusing on operational efficiency and employing advanced techniques like infill drilling, the company extracts more from these existing assets than many competitors. For instance, in 2023, EnQuest reported a significant uplift in production from its mature assets through these very strategies, demonstrating a tangible return on its expertise.

EnQuest offers leading decommissioning expertise, a critical service as North Sea fields mature. Their differentiated approach focuses on safety, efficiency, and cost-effectiveness, minimizing environmental impact and partner liabilities.

This specialized capability is becoming increasingly vital. For instance, in 2024, the UK government continued to emphasize the need for responsible decommissioning, with significant financial provisions allocated for these activities across the sector.

EnQuest delivers dependable oil and gas, boasting high production uptime. In 2024, the company continued to focus on operational excellence, ensuring a steady flow of hydrocarbons to meet market needs.

This reliable output is crucial for energy security, providing essential resources that power economies and industries. EnQuest's commitment to consistent production underpins its value proposition in the energy sector.

Strategic Partner for Energy Transition

EnQuest is positioning itself as a key collaborator for companies navigating the energy transition. They offer a way to responsibly manage existing oil and gas assets while simultaneously developing new, lower-carbon energy solutions.

Leveraging its substantial infrastructure, such as the Sullom Voe Terminal, EnQuest is actively pursuing projects like carbon capture and storage (CCS). This strategic approach provides a clear route for decarbonization and builds a foundation for diverse future energy ventures.

In 2024, EnQuest continued to advance its decarbonization strategy, with significant progress reported on its CCS initiatives. The company is actively engaged in discussions with multiple industrial partners seeking to utilize its infrastructure for emissions reduction projects.

- Infrastructure Leverage: Utilizing existing assets like the Sullom Voe Terminal for new energy projects.

- Decarbonization Pathway: Enabling industrial partners to reduce their carbon footprint through CCS.

- Future Energy Diversification: Creating opportunities for new, sustainable energy solutions.

- Strategic Partnerships: Acting as a trusted partner for responsible energy asset management during the transition.

Value Creation Through Disciplined Growth

EnQuest creates shareholder value by pursuing a disciplined growth strategy, primarily through mergers and acquisitions. The company prioritizes deals that are accretive, meaning they are expected to increase earnings per share, and that effectively utilize its existing operational strengths and tax assets. This focused approach ensures that growth initiatives are financially sound and contribute positively to the company's bottom line.

The company’s strategic expansion efforts are concentrated in key regions like South East Asia and the UK North Sea. These areas offer significant opportunities for EnQuest to leverage its expertise and expand its operational footprint. By targeting these markets, EnQuest aims to increase its overall cash flow generation, which is crucial for reinvestment and returning value to its investors.

- Disciplined M&A: EnQuest focuses on accretive acquisitions that enhance operating capabilities and tax assets.

- Geographic Focus: Growth is strategically directed towards South East Asia and the UK North Sea.

- Cash Flow Enhancement: Expansion aims to increase cash flow generation to support shareholder returns.

- Shareholder Returns: The ultimate goal of this disciplined growth strategy is to improve shareholder value.

EnQuest's value proposition centers on its ability to maximize value from mature oil and gas assets, a skill demonstrated by their consistent production and operational efficiency. They also offer crucial decommissioning services, ensuring responsible asset retirement and addressing industry needs for environmental stewardship. Furthermore, EnQuest is actively building a future in lower-carbon energy, leveraging its existing infrastructure for projects like carbon capture and storage.

| Value Proposition | Key Activities | Financial Data (Illustrative) |

|---|---|---|

| Mature Asset Optimization | Infill drilling, enhanced oil recovery | 2023 Production Uplift: Significant increase from mature fields |

| Decommissioning Expertise | Safe, efficient, cost-effective asset retirement | 2024 UK Decommissioning Allocation: Government emphasis on financial provisions |

| Energy Transition Facilitation | CCS infrastructure development, low-carbon solutions | 2024 CCS Progress: Advancements reported, multiple partner discussions |

Customer Relationships

EnQuest primarily engages in direct commercial contracts with a select group of crude oil and gas purchasers, known as offtakers. These relationships are the bedrock of their sales strategy, ensuring a consistent outlet for their production.

These dealings are fundamentally transactional, centering on securing stable supply agreements and clear pricing mechanisms. This approach aligns with the typical wholesale dynamics of the oil and gas industry, where volumes and market-driven prices are key.

In 2024, EnQuest's strategy of direct offtake contracts proved resilient. For instance, their Kraken field, a significant contributor, continued to supply major international energy companies under established agreements, contributing to their robust revenue streams.

EnQuest's customer relationships extend significantly to its joint venture partners, fostering a collaborative environment crucial for operational planning and investment decisions. These alliances are built on mutual trust and shared objectives, underpinning the effective development and production of assets.

These strategic partnerships are long-term commitments, requiring open communication and a clear division of responsibilities and risks. For instance, in the Magnus field, EnQuest operates as the sole partner, but historically, joint ventures have been a cornerstone of its strategy, allowing for shared capital expenditure and expertise.

EnQuest prioritizes robust engagement with host governments and regulatory bodies to ensure the continuity of its operations. This involves actively participating in dialogues concerning licensing renewals and production sharing agreements, which are fundamental to the company's license to operate.

These relationships are inherently compliance-focused, necessitating adherence to all stipulated regulations. For instance, in 2024, EnQuest continued its proactive engagement with the UK's North Sea Transition Authority (NSTA) regarding its existing licenses and potential new opportunities, ensuring alignment with evolving energy policies.

Beyond compliance, EnQuest also engages in strategic discussions with these authorities. These conversations aim to shape and understand the future energy landscape, including policy frameworks that impact offshore oil and gas production and the transition to lower-carbon energy sources.

Investor Relations and Communication

EnQuest actively cultivates relationships with its varied investor base, encompassing both institutional and individual shareholders. This engagement is primarily achieved through consistent financial reporting, investor presentations, and the annual general meetings.

Maintaining investor confidence hinges on EnQuest's commitment to transparency and direct communication concerning its operational performance, strategic direction, and capital allocation decisions. For instance, in their 2024 interim report, EnQuest highlighted their proactive approach to stakeholder engagement, noting increased participation in investor calls.

- Regular Financial Updates: EnQuest provides quarterly and annual financial reports, ensuring shareholders are consistently informed about the company's financial health and operational progress.

- Investor Presentations and Webcasts: The company hosts regular presentations and webcasts to discuss financial results, strategic initiatives, and market outlook, offering direct access to management.

- Annual General Meetings (AGMs): AGMs serve as a crucial forum for shareholders to engage with the board, ask questions, and vote on key company matters, reinforcing accountability.

- Proactive Communication on Strategy: EnQuest emphasizes clear communication regarding its long-term strategy, including exploration plans, production targets, and capital expenditure, to align investor expectations.

Supply Chain and Vendor Management

EnQuest cultivates robust relationships with its key suppliers and contractors, primarily through meticulously crafted contractual agreements. These agreements are designed to ensure optimal performance, drive cost efficiencies, and uphold stringent safety standards across all operations. This focus is critical for the consistent and effective procurement of essential services, equipment, and cutting-edge technology that underpin EnQuest's upstream oil and gas activities. For instance, EnQuest's 2023 annual report highlighted significant investments in long-term supply agreements to secure critical components for its North Sea projects, aiming to mitigate supply chain volatility.

These vital partnerships are the bedrock for the timely and efficient execution of EnQuest's operational plans. By fostering strong supplier relationships, EnQuest can better manage risks associated with the supply chain, ensuring that the necessary resources are available when and where they are needed. In 2024, EnQuest continued to emphasize collaborative efforts with its major service providers, such as Baker Hughes and Schlumberger, to jointly develop innovative solutions and improve operational uptime, a key performance indicator for the company.

- Contractual Frameworks: EnQuest relies on detailed contracts that specify performance metrics, cost controls, and safety protocols with its suppliers and contractors.

- Operational Continuity: These relationships are fundamental to guaranteeing the uninterrupted flow of services, equipment, and technology essential for EnQuest's exploration and production activities.

- Strategic Partnerships: EnQuest actively engages with key vendors to foster innovation and enhance efficiency, as demonstrated by its 2024 collaborations aimed at optimizing production processes.

- Risk Mitigation: Strong vendor management helps EnQuest to proactively address potential disruptions in the supply chain, ensuring project timelines and cost targets are met.

EnQuest's customer relationships are primarily direct and transactional with crude oil and gas purchasers, ensuring stable sales channels. These agreements focus on securing supply and clear pricing, typical for wholesale energy markets.

The company also maintains crucial long-term partnerships with joint venture participants, fostering collaboration for operational planning and shared investment. These alliances are built on trust and mutual objectives.

Furthermore, EnQuest actively engages with host governments and regulatory bodies to ensure operational continuity and compliance. This includes dialogue on licensing and production sharing agreements, vital for their license to operate.

Investor relations are managed through consistent financial reporting and direct communication, aiming to maintain confidence in the company's performance and strategy.

EnQuest also cultivates strong relationships with suppliers and contractors through detailed contractual agreements, ensuring performance, cost efficiency, and safety. These partnerships are vital for operational execution and risk mitigation.

| Relationship Type | Nature of Interaction | Key Focus | 2024 Relevance |

|---|---|---|---|

| Crude Oil & Gas Purchasers (Offtakers) | Direct Commercial Contracts | Stable Supply Agreements, Pricing Mechanisms | Continued supply from Kraken field to international energy companies. |

| Joint Venture Partners | Collaborative Alliances | Operational Planning, Investment Decisions, Shared Risk | Essential for asset development and production, historically a cornerstone. |

| Host Governments & Regulatory Bodies | Compliance & Strategic Dialogue | Licensing Renewals, Production Sharing Agreements, Policy Alignment | Proactive engagement with NSTA on licenses and evolving energy policies. |

| Investors (Shareholders) | Financial Reporting & Communication | Transparency, Operational Performance, Strategic Direction | Increased participation in investor calls noted in 2024 interim reports. |

| Suppliers & Contractors | Contractual Agreements | Performance, Cost Efficiency, Safety Standards, Innovation | Collaborations with major service providers like Baker Hughes and Schlumberger to improve operational uptime. |

Channels

EnQuest's primary revenue stream flows from the direct sale of crude oil and natural gas. These sales are made directly to entities like refiners, traders, and major industrial consumers who require these raw materials.

This channel involves EnQuest negotiating and securing contracts for the delivery of its produced hydrocarbons. These deliveries originate from EnQuest's own production sites and storage terminals, ensuring a streamlined supply chain.

In 2024, EnQuest reported average daily production of approximately 35,000 boepd (barrels of oil equivalent per day). The majority of this output is sold through these direct off-take agreements, highlighting the significance of this channel.

EnQuest leverages its owned and operated pipeline infrastructure and terminals, including the significant Sullom Voe Terminal, as crucial channels. These assets are vital for transporting, processing, and ultimately exporting the company's oil and gas production, ensuring products reach the market efficiently.

The Sullom Voe Terminal, a cornerstone of EnQuest's operations, processed approximately 220,000 barrels of oil equivalent per day in 2023. This facility's capacity and strategic location are instrumental in EnQuest's ability to reliably deliver its hydrocarbons to global customers.

EnQuest leverages its official annual reports, interim results, and investor presentations to communicate financial performance, strategic direction, and operational updates. These crucial documents are readily accessible on the company's corporate website and via prominent financial news platforms, ensuring transparency with stakeholders.

For 2024, EnQuest's investor communications would highlight key financial metrics. For instance, their performance in the first half of 2024, as reported in their interim results, would detail revenue figures, operational costs, and any significant capital expenditures. These reports are vital for investors to assess the company's health and future prospects.

Industry Conferences and Forums

EnQuest actively participates in key industry conferences and forums, such as SPE Offshore Europe and the Society of Petroleum Engineers (SPE) International Conference on Oilfield Chemistry. These events are crucial for showcasing their expertise in areas like mature field development and carbon storage, fostering new business relationships, and identifying potential strategic alliances. For instance, in 2023, EnQuest highlighted its progress in carbon capture, utilization, and storage (CCUS) projects at various industry gatherings, underscoring its commitment to the energy transition.

These forums allow EnQuest to directly engage with potential partners, clients, and technology providers, facilitating business development and crucial networking. By presenting their technical capabilities and project successes, they can attract investment and collaboration opportunities. This direct interaction is vital for staying competitive and informed about the latest market demands and technological innovations shaping the oil and gas sector.

EnQuest's presence at these events also serves as a platform to demonstrate their strategic vision and operational excellence. For example, their participation in forums discussing the future of North Sea oil and gas production reinforces their position as a key player in maximizing the value of existing assets while exploring new avenues like renewable energy integration. The company's focus on innovation and sustainability is often a central theme in their conference presentations.

- Showcasing Capabilities: EnQuest uses conferences to highlight its expertise in mature field redevelopment and low-carbon solutions.

- Business Development: Events facilitate direct engagement with potential partners, clients, and investors to drive new opportunities.

- Industry Insight: Participation keeps EnQuest informed about emerging technologies, regulatory changes, and market trends.

- Networking: Forums provide essential opportunities to build and strengthen relationships within the energy sector.

Corporate Website and Media Releases

EnQuest's corporate website serves as the primary digital storefront, offering a comprehensive repository for official company news, financial reports, and operational highlights. It's the go-to source for investors seeking detailed information, including annual reports and sustainability initiatives. For instance, as of their 2024 reporting, the website would prominently feature their latest production figures and strategic outlook.

Disseminating crucial updates through media releases to financial news services and specialized industry publications ensures broad market awareness. These releases are vital for communicating significant developments, such as successful drilling campaigns or strategic partnerships, to a wide array of stakeholders. In 2024, EnQuest's proactive communication strategy through these channels would have been key to maintaining investor confidence amidst fluctuating energy markets.

- Centralized Information Hub: EnQuest's corporate website consolidates all official communications, investor relations data, and operational updates in one accessible location.

- Broad Reach via Media: Strategic distribution of press releases to financial news outlets and industry journals extends EnQuest's message to a global audience of investors and analysts.

- Transparency and Engagement: These channels facilitate transparency, allowing stakeholders to stay informed about EnQuest's performance, strategy, and commitment to responsible operations throughout 2024.

EnQuest's channels primarily involve direct sales of crude oil and natural gas to refiners and traders. They also utilize their own infrastructure, like the Sullom Voe Terminal, for transportation and export. Investor relations are managed through official reports and industry conferences, ensuring transparency and engagement.

| Channel Type | Description | Key Activities/Assets | 2024 Relevance |

|---|---|---|---|

| Direct Sales | Selling hydrocarbons directly to buyers. | Negotiating contracts, delivering oil and gas. | Majority of 35,000 boepd production sold this way. |

| Infrastructure Utilization | Leveraging owned assets for logistics. | Sullom Voe Terminal for processing and export. | Crucial for efficient delivery to global customers. |

| Investor Communications | Disseminating company performance and strategy. | Annual reports, interim results, investor presentations, corporate website. | Key for stakeholder assessment of health and prospects. |

| Industry Engagement | Participating in conferences and forums. | Showcasing expertise, networking, business development. | Highlighting CCUS progress and North Sea strategy. |

Customer Segments

International oil and gas traders and refiners represent EnQuest's core customer base, actively seeking consistent and high-quality hydrocarbon supplies. These entities are crucial for EnQuest as they purchase the crude oil and natural gas produced, facilitating its journey through the value chain to become refined products or feedstock for industrial processes.

These are large, global commercial organizations that navigate the complexities of international energy markets. Their operations demand a reliable and predictable source of raw materials to maintain their refining capacity and meet downstream demand, making EnQuest a key supplier in their procurement strategies.

For context, in 2024, global oil refining capacity stood at approximately 102 million barrels per day, highlighting the immense scale of operations for these international traders and refiners. EnQuest's ability to provide consistent production volumes directly supports these significant market players.

Joint venture partners are crucial for EnQuest, representing companies that co-own and actively participate in EnQuest's oil and gas assets. These collaborations involve sharing in production, operational costs, and the inherent risks associated with exploration and development.

These partners leverage EnQuest's proven operational expertise and efficient asset management capabilities. This is particularly valuable for the development and operation of mature and often complex fields, where specialized knowledge is key to maximizing recovery and profitability.

For example, in 2024, EnQuest continued to manage its interests in various fields through joint venture agreements, demonstrating the ongoing importance of these partnerships in its operational structure and risk diversification strategy.

EnQuest's energy infrastructure, including its extensive pipeline network and the Sullom Voe Terminal, serves as a critical asset for third-party companies. These companies leverage EnQuest's established logistics and midstream capabilities for processing, storing, and transporting their own hydrocarbon products.

This segment of customers relies on EnQuest to efficiently manage their oil and gas flows, reducing their need for independent infrastructure investment. For instance, in 2024, EnQuest continued to facilitate third-party throughput at Sullom Voe, demonstrating the terminal's ongoing importance as a central hub for North Sea operations.

Shareholders and Investors

Shareholders and investors represent a crucial segment for EnQuest, encompassing a wide range including large institutional bodies like pension funds and asset managers, as well as individual retail investors. These stakeholders are primarily motivated by the prospect of financial returns, seeking both capital appreciation through share price growth and income generation via dividends. Their investment decisions are heavily influenced by EnQuest's financial health, strategic direction, and commitment to environmental, social, and governance (ESG) principles.

For these investors, EnQuest's performance in 2024 is a key focus. The company's ability to manage its debt, optimize production costs, and navigate the volatile energy markets directly impacts their investment thesis. Understanding EnQuest's reserve replacement ratio and its success in developing new projects are also critical factors they consider when evaluating the company's long-term value proposition.

- Financial Returns: Investors look for consistent profitability and dividend payouts.

- Capital Appreciation: Growth in EnQuest's share price is a primary objective.

- Strategic Growth: Interest in the company's plans for expansion and asset development.

- Sustainability Efforts: Growing importance of ESG factors in investment decisions.

Governments and Regulatory Authorities

Governments, particularly those in the UK and Malaysia where EnQuest operates, are crucial stakeholders. While not paying customers for EnQuest's core services, they are significant beneficiaries through substantial tax revenues and royalties derived from oil and gas production. For instance, in 2023, EnQuest contributed significantly to the Exchequer in the UK, reflecting the importance of the sector to national finances.

These governmental bodies also act as 'customers' in a regulatory capacity, demanding strict adherence to environmental, safety, and local content requirements. EnQuest's commitment to these standards is paramount for maintaining its operating licenses and social license to operate. The company actively engages with regulatory authorities to ensure compliance and contribute positively to local economies through its supply chain and employment practices.

- Revenue Generation: Governments benefit from taxes and royalties on EnQuest's production, contributing to national budgets.

- Regulatory Oversight: Authorities ensure EnQuest operates safely, environmentally responsibly, and meets local content obligations.

- Economic Contribution: Governments value EnQuest's role in job creation and local supply chain development.

- Policy Alignment: EnQuest's operations are aligned with national energy policies and objectives.

EnQuest's customer segments are diverse, ranging from major international oil and gas traders and refiners who rely on consistent hydrocarbon supply, to joint venture partners who collaborate on asset development and operations. Additionally, third-party companies utilize EnQuest's infrastructure for processing and transport, while shareholders and investors seek financial returns and growth. Governments, though not direct customers, are key stakeholders benefiting from tax revenues and ensuring regulatory compliance.

| Customer Segment | Needs/Expectations | 2024 Relevance/Data Point |

| International Traders & Refiners | Consistent, high-quality hydrocarbon supply | Global refining capacity ~102 million bpd in 2024, highlighting demand for feedstock. |

| Joint Venture Partners | Shared expertise, risk diversification, asset development | EnQuest continued managing interests via JVs in 2024, crucial for complex field operations. |

| Third-Party Infrastructure Users | Efficient processing, storage, and transport of hydrocarbons | EnQuest facilitated third-party throughput at Sullom Voe in 2024, underscoring its logistical hub role. |

| Shareholders & Investors | Financial returns, capital appreciation, ESG performance | Investor focus in 2024 on EnQuest's debt management, cost optimization, and strategic growth. |

| Governments (UK, Malaysia) | Tax revenues, royalties, regulatory compliance (safety, environment) | EnQuest's operations in 2024 continued to contribute significantly to national budgets via taxes and royalties. |

Cost Structure

Operating Expenditure (OpEx) represents the ongoing costs critical for EnQuest's daily oil and gas field operations. This encompasses essential expenses like employee salaries, routine maintenance, energy consumption for operations, and various consumable supplies needed to keep production running smoothly.

EnQuest places a strong emphasis on efficiently managing these operating expenditures. For 2025, the company has provided guidance indicating that its OpEx is expected to be around $450 million, reflecting a commitment to cost control and operational effectiveness.

Capital Expenditure (CapEx) represents EnQuest's significant investments in its operational future. These funds are allocated to crucial areas like new project development, infill drilling to maximize existing reserves, production enhancement initiatives, and essential infrastructure upgrades. The primary goal is to sustain or boost production levels and prolong the productive life of their valuable assets.

For 2025, EnQuest has projected its capital expenditure to be around $190 million. This substantial investment is strategically directed towards projects that are characterized by their low cost and rapid return on investment, ensuring efficient deployment of capital.

Decommissioning costs represent a significant and ongoing expense for EnQuest, particularly given its focus on mature North Sea assets. These costs encompass the essential but complex tasks of plugging and abandoning wells and dismantling offshore infrastructure.

EnQuest is actively managing these expenditures, with a strategic emphasis on efficiency. For 2025, the company has allocated approximately $60 million specifically for decommissioning activities, reflecting a commitment to responsible asset lifecycle management.

Debt Service Costs

EnQuest's cost structure includes significant debt service expenses. These are primarily interest payments on its outstanding bonds and its reserve-based lending (RBL) facilities, which are crucial for funding its operations and development projects.

The company has actively pursued de-leveraging strategies to manage these costs. For instance, in 2024, EnQuest continued its efforts to optimize its debt profile, aiming to reduce the overall burden of interest payments and enhance its financial flexibility. This focus on debt reduction is key to improving its long-term financial health and operational resilience.

- Debt Service Costs: Primarily interest on bonds and reserve-based lending.

- De-leveraging Focus: EnQuest prioritizes reducing its debt burden.

- Financial Flexibility: Optimization of debt structure aims to improve this.

- 2024 Efforts: Continued focus on managing interest expenses.

Taxes and Levies

EnQuest navigates a complex tax landscape, with significant obligations stemming from operations, particularly in the UK. The UK Energy Profits Levy, often referred to as the 'windfall tax', directly impacts profitability. For instance, in 2023, EnQuest reported a substantial tax charge, reflecting the prevailing rates and its operational footprint.

Effectively managing these tax liabilities and strategically utilizing its UK tax asset is paramount to EnQuest's financial health. This involves careful planning to optimize tax positions and ensure compliance across all operating regions. The company's ability to leverage tax losses and credits can significantly influence its net cash flow and investment capacity.

- UK Energy Profits Levy: This levy imposes additional taxation on the profits of oil and gas companies operating in the UK, directly impacting EnQuest's cost structure.

- Tax Asset Utilization: EnQuest manages its tax assets, such as carried forward losses, to offset future taxable profits, thereby reducing its overall tax burden.

- Operational Jurisdictions: Taxes and levies vary by country, requiring EnQuest to understand and comply with diverse regulatory frameworks in the UK, Malaysia, and other operating areas.

- Cash Flow Impact: Tax payments and the strategic use of tax reliefs are critical drivers of EnQuest's operating cash flow, influencing its ability to fund projects and distribute returns.

EnQuest's cost structure is dominated by operating expenditures, capital investments, decommissioning obligations, debt servicing, and taxes. Managing these efficiently is key to profitability and sustainability.

The company's 2025 projections highlight significant spending in these areas, with OpEx around $450 million, CapEx near $190 million, and decommissioning costs estimated at $60 million. These figures underscore the capital-intensive nature of the oil and gas industry.

Furthermore, EnQuest actively manages its debt profile to reduce interest expenses and strategically navigates the UK tax regime, including the Energy Profits Levy, to optimize its financial performance.

| Cost Category | 2025 Projection (USD Million) | Key Components |

|---|---|---|

| Operating Expenditure (OpEx) | ~450 | Salaries, maintenance, energy, consumables |

| Capital Expenditure (CapEx) | ~190 | New projects, infill drilling, infrastructure upgrades |

| Decommissioning Costs | ~60 | Well plugging, infrastructure dismantling |

| Debt Service | Variable | Interest on bonds and RBL facilities |

| Taxes | Variable | UK Energy Profits Levy, corporate taxes |

Revenue Streams

Crude oil sales represent EnQuest's core revenue engine, stemming from the extraction and sale of oil produced in the UK North Sea and Malaysia. This income is intrinsically tied to global crude oil market prices and the company's operational output. For instance, in 2023, EnQuest reported average Brent crude oil prices of approximately $82 per barrel, significantly impacting their top-line performance.

Natural gas sales represent a significant revenue stream for EnQuest, stemming from both associated gas produced alongside crude oil and from dedicated gas production agreements. This dual source offers a degree of commodity diversification within their hydrocarbon sales portfolio.

EnQuest can earn money by letting other companies use its infrastructure, like the Sullom Voe Terminal and its pipelines. This means they get paid for processing, storing, or moving products for third parties. It's a smart way to make more money from assets they already own, beyond just their own oil and gas.

Gas Handling and Delivery Fees

EnQuest generates revenue through gas handling and delivery fees in certain contracts, such as the Seligi 1a gas production. This model ensures a predictable, fee-based income stream, independent of fluctuating commodity prices.

This fee-based approach offers a layer of financial stability. For example, in their 2024 reporting, EnQuest highlighted the consistent revenue generated from these service agreements, underpinning their operational cash flow.

- Fee-Based Income: Revenue is earned for the service of handling and delivering gas, not for the sale of the gas itself.

- Contractual Stability: Agreements like the Seligi 1a production provide a reliable revenue source.

- Reduced Commodity Risk: This revenue stream insulates EnQuest from direct exposure to volatile gas market prices.

Potential New Energy Service Revenues

EnQuest, through its Veri Energy subsidiary, is actively pursuing new revenue streams by focusing on decarbonization initiatives. These future opportunities are designed to diversify the company's income beyond its traditional oil and gas operations.

The company is exploring services related to carbon capture and storage (CCS), a growing sector driven by global climate targets. Additionally, EnQuest is looking into renewable energy projects, aiming to capitalize on the transition to cleaner energy sources.

- Carbon Capture and Storage (CCS) Services: EnQuest is developing capabilities to offer CCS solutions, potentially generating recurring revenue from capturing and storing industrial CO2 emissions.

- Renewable Energy Projects: The company is evaluating opportunities in renewable energy generation, which could include solar, wind, or other clean energy technologies, creating new income streams.

- Decarbonisation Consulting and Technology: Veri Energy may also offer consulting services or license technologies related to decarbonization, further broadening its revenue base.

EnQuest diversifies its revenue through infrastructure access, charging third parties for services like processing and storage at facilities such as the Sullom Voe Terminal. This strategy leverages existing assets to generate additional income beyond its own production. For instance, in 2023, the company continued to secure third-party processing agreements, contributing to its overall financial performance.

Business Model Canvas Data Sources

The EnQuest Business Model Canvas is built using extensive market research, competitor analysis, and internal operational data. These sources provide a comprehensive view of customer needs, industry trends, and our strategic capabilities.