EnQuest PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnQuest Bundle

Uncover the intricate web of external forces shaping EnQuest's trajectory. Our comprehensive PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company's operations and future growth. Gain a critical understanding of the landscape and identify opportunities and threats. Purchase the full analysis now to equip yourself with actionable intelligence for strategic advantage.

Political factors

EnQuest's operations are heavily influenced by government policies, particularly in its core regions of the UK Continental Shelf (UKCS) and Malaysia. The stability and direction of these policies directly shape the company's operational environment and investment attractiveness.

The UK's Energy Profits Levy (EPL), or windfall tax, has seen significant adjustments, with its extension to March 2030 and an increased rate to 38%. This policy change directly impacts EnQuest's profitability and influences its capital allocation strategies within the UK.

Furthermore, the removal of the investment allowance for new projects in the UKCS presents a substantial hurdle for future capital expenditure. This regulatory shift creates a less favorable climate for developing new ventures, potentially affecting EnQuest's long-term growth prospects in the region.

Geopolitical events significantly shape global energy markets and national policies. For instance, the ongoing conflict in Eastern Europe has underscored the vulnerability of energy supplies, prompting many nations, including the UK, to re-evaluate their energy security strategies.

The UK's commitment to energy security, especially in light of recent global disruptions, may lead to policies favoring domestic production or a faster shift away from fossil fuels. This creates a dynamic environment for companies like EnQuest.

EnQuest's strategic expansion into Southeast Asia, including acquisitions in Vietnam and a strengthened presence in Malaysia, serves to diversify its operational footprint. This geographical spread helps to buffer against localized political risks and ensures a more resilient business model.

Governments, particularly in the UK, are doubling down on their net-zero commitments, significantly impacting the energy sector. This translates into policy decisions that shape licensing rounds and environmental regulations for companies like EnQuest. For instance, the UK's legally binding target to reach net zero by 2050 continues to drive policy, affecting the operational landscape for oil and gas producers.

These mandates can create both challenges and opportunities. While EnQuest's focus on mature fields might seem less directly impacted by new exploration bans, the overall political momentum towards renewables introduces long-term uncertainty for hydrocarbon investments. This necessitates a strategic approach to managing existing assets and exploring potential diversification or transition strategies.

Fiscal Regimes and Taxation

The stability of fiscal regimes significantly impacts long-term investments in the oil and gas industry. The UK's approach to taxation, particularly its energy profits levy (EPL), has seen frequent adjustments, creating an environment of uncertainty that can discourage capital deployment.

EnQuest's financial strategies must actively incorporate these policy shifts. The company's planning for 2025, for instance, needs to factor in projected cash tax obligations stemming directly from the EPL, reflecting the direct financial consequences of these political decisions.

Recent fiscal policy in the UK has introduced volatility:

- Energy Profits Levy (EPL) adjustments: The EPL's rate and duration have been subject to change, impacting profitability forecasts for oil and gas producers.

- Investment deterrents: Unpredictable tax policies can lead to a reassessment of investment viability, potentially delaying or cancelling projects.

- 2025 tax considerations: EnQuest anticipates significant cash tax payments related to the EPL in 2025, underscoring the immediate financial impact of fiscal policy.

International Agreements and Trade Policies

EnQuest's international operations are significantly shaped by global trade agreements and energy policies. For instance, the outcomes of COP28 in late 2023, which saw nations agreeing to transition away from fossil fuels, could influence future investment decisions in oil and gas exploration versus renewables. These broader frameworks can directly impact the financial viability and regulatory landscape for projects in regions where EnQuest operates, like the UK and Malaysia.

Specific trade policies can also create both opportunities and challenges. For example, preferential trade agreements might reduce tariffs on equipment for energy projects, thereby lowering capital expenditure. Conversely, new trade barriers or sanctions imposed on certain countries could disrupt supply chains or limit market access for EnQuest's products.

These international dynamics are crucial for strategic planning. EnQuest must monitor evolving climate commitments and trade regulations to adapt its portfolio. The increasing global focus on energy transition, as evidenced by commitments made at international forums, suggests a potential shift in the attractiveness of traditional oil and gas development versus investments in lower-carbon energy solutions.

- Global Climate Pledges: Over 120 countries at COP28 endorsed the goal of transitioning away from fossil fuels, impacting long-term investment sentiment for oil and gas.

- Trade Agreements Impact: The UK's trade deals post-Brexit, for example, could affect the cost of importing specialized equipment for offshore projects.

- Energy Security Concerns: Geopolitical events in 2024 continue to highlight the importance of energy security, influencing national policies on domestic production and international energy sourcing, which EnQuest navigates.

Political factors significantly influence EnQuest's operating environment, particularly through UK government fiscal policies and broader energy security concerns. The UK's Energy Profits Levy (EPL), extended to March 2030 with a 38% rate, directly impacts EnQuest's profitability and investment decisions. Furthermore, the removal of the investment allowance for new UKCS projects creates a less favorable climate for expansion.

Global geopolitical events, such as conflicts impacting energy supplies, prompt nations to re-evaluate energy security, potentially favoring domestic production. EnQuest's international diversification, including operations in Malaysia and Vietnam, helps mitigate localized political risks.

The UK's commitment to net-zero targets by 2050 drives policy decisions affecting licensing and environmental regulations for oil and gas producers. While EnQuest's focus on mature fields may be less directly impacted by exploration bans, the overall momentum towards renewables creates long-term uncertainty for hydrocarbon investments.

EnQuest's financial planning for 2025 must account for significant cash tax obligations related to the EPL, highlighting the direct financial consequences of these policy shifts.

| Policy Area | Specifics | Impact on EnQuest | Relevant Period |

|---|---|---|---|

| Fiscal Policy (UK) | Energy Profits Levy (EPL) extended to March 2030 at 38% | Reduced profitability, influences capital allocation | 2024-2030 |

| Investment Policy (UK) | Removal of investment allowance for new UKCS projects | Hinders new venture development, impacts long-term growth | Ongoing |

| Climate Policy (Global/UK) | Net-zero targets (UK by 2050), COP28 transition away from fossil fuels | Long-term uncertainty for hydrocarbon investments, potential shift to renewables | Ongoing |

What is included in the product

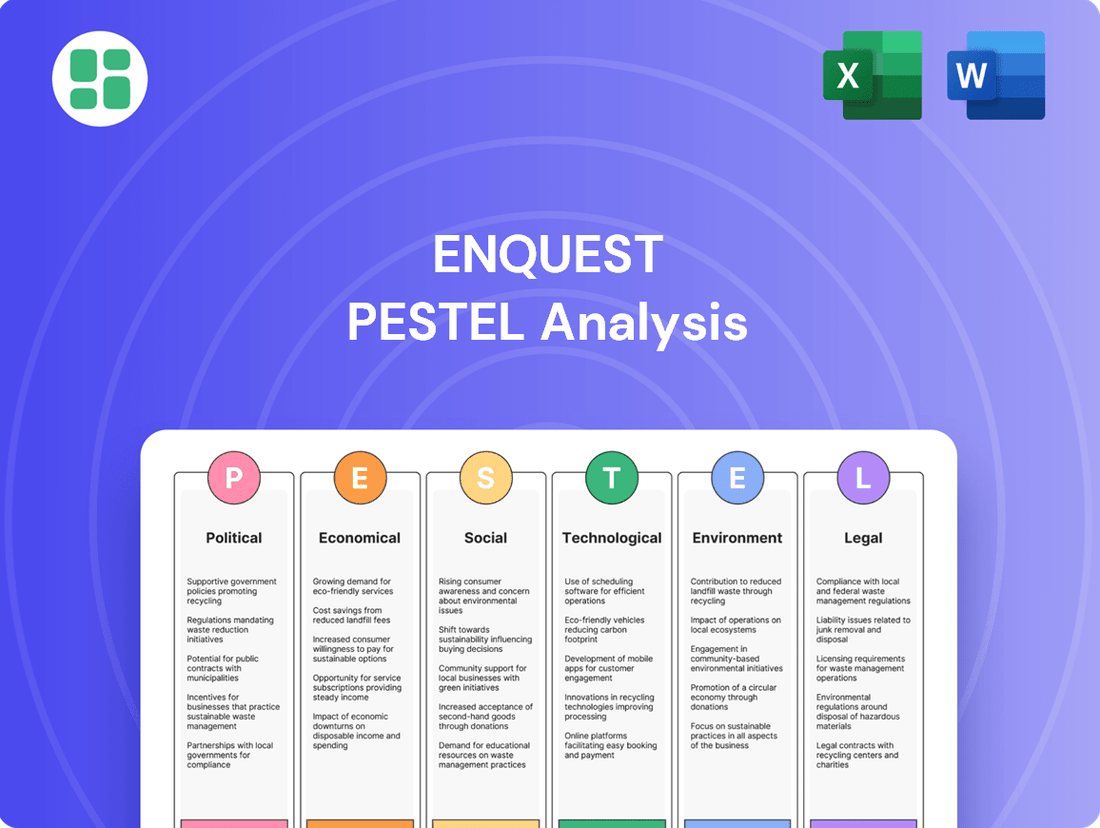

This EnQuest PESTLE Analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within EnQuest's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights for EnQuest's strategic discussions.

Economic factors

EnQuest's financial performance is intrinsically linked to the ebb and flow of global oil and gas prices. While Brent crude experienced a period of relative stability in 2024, averaging around $83 per barrel, projections for 2025 from key bodies like OPEC and the International Energy Agency (IEA) point towards a more subdued demand growth, potentially capping price increases.

These price volatilities directly affect the economic feasibility of EnQuest's operations, especially given its strategy of maximizing value from existing, mature fields. For instance, a sustained downturn in oil prices below the operational cost threshold for these assets could significantly erode profitability and hinder investment in their continued production.

Developing and maintaining oil and gas assets, particularly mature ones like those in EnQuest's portfolio, demands significant capital expenditure. For instance, in 2023, EnQuest reported capital expenditure of $377 million, demonstrating the ongoing investment needed to sustain operations and pursue growth opportunities.

EnQuest's access to financing is directly tied to broader economic trends, including global interest rates and investor attitudes toward the fossil fuel sector. The company's strategic focus on reducing debt and maintaining a strong liquidity position, evidenced by its cash and cash equivalents of $558 million as of December 31, 2023, is crucial for funding its strategic initiatives, such as acquisitions and capital projects.

EnQuest faces significant operational cost pressures driven by persistent inflation. Supply chain disruptions and rising energy prices in 2024 continue to impact expenditures, potentially affecting profitability, especially for their established fields. Effective cost management remains crucial for extending the economic viability of existing assets.

Currency Exchange Rate Fluctuations

EnQuest, as an international energy company, faces significant exposure to currency exchange rate fluctuations. Reporting its financial results in US Dollars while operating extensively in the United Kingdom and Malaysia means that movements in the British Pound (GBP) and Malaysian Ringgit (MYR) against the USD directly impact its reported revenues, operational costs, and the valuation of its assets and liabilities. For instance, if the GBP weakens against the USD, EnQuest's UK-based revenues and assets will translate into fewer US Dollars, potentially reducing its reported financial performance.

The volatility of these currency pairs is a critical consideration for EnQuest's financial planning. For example, in late 2023 and early 2024, the GBP experienced fluctuations against the USD, influenced by factors such as UK inflation rates and monetary policy decisions by the Bank of England. Similarly, the MYR's performance is tied to Malaysia's economic growth, commodity prices, and regional market sentiment. These shifts necessitate robust hedging strategies or meticulous financial management to mitigate potential negative impacts on profitability and balance sheet strength.

To manage this risk, EnQuest likely employs various financial instruments and strategies. These could include forward contracts, options, or currency swaps to lock in exchange rates for future transactions. Effective management of these currency exposures is vital for providing a stable and predictable financial outlook to investors and stakeholders, ensuring that operational success is not unduly overshadowed by foreign exchange market volatility.

- GBP/USD Volatility: In early 2024, the GBP/USD exchange rate traded within a range, reflecting ongoing economic adjustments in the UK.

- MYR/USD Dynamics: The Malaysian Ringgit's performance in 2023 and early 2024 was influenced by global energy prices and domestic economic indicators.

- Impact on Financials: A 5% adverse movement in GBP or MYR could materially affect EnQuest's reported earnings per share and asset values.

- Hedging Importance: Proactive currency hedging can protect EnQuest's profit margins from unexpected currency depreciations.

Economic Growth and Energy Demand

Global economic growth is a primary driver for energy demand. Nations experiencing robust economic expansion typically see a corresponding increase in their consumption of oil and gas, directly impacting market prices and the opportunities available to companies like EnQuest. For instance, projections for 2025 suggest a moderating global economic growth rate, which could lead to a more subdued demand for hydrocarbons.

EnQuest needs to closely track these macroeconomic shifts. A slowdown in economic activity can translate to lower energy prices and reduced investment appetite, forcing the company to adjust its production levels and capital expenditure plans accordingly. Staying attuned to these trends is crucial for maintaining operational flexibility and strategic alignment.

- Global GDP Growth Forecasts: The International Monetary Fund (IMF) projected global GDP growth to be around 3.2% in 2024 and a similar pace in 2025, indicating a potentially stable but not explosive demand environment for energy.

- Energy Intensity of Economies: As economies develop, their energy intensity (energy consumed per unit of GDP) can change. Shifts towards service-based economies or increased energy efficiency can decouple growth from energy demand.

- Impact on Oil Prices: Historical data shows a strong correlation between global economic growth and oil prices. For example, periods of strong global growth in the mid-2010s supported higher oil prices, while the COVID-19 pandemic-induced recession in 2020 saw prices plummet.

EnQuest's financial health is heavily influenced by global economic growth, which directly impacts energy demand and prices. For 2024, global GDP growth is anticipated around 3.2%, with similar projections for 2025, suggesting a stable but not booming demand for oil and gas. This moderate growth environment means EnQuest must remain agile in managing production and capital expenditures to align with market realities.

The company's profitability hinges on oil and gas prices, which are sensitive to economic cycles. While Brent crude averaged approximately $83 per barrel in 2024, forecasts for 2025 indicate subdued demand growth, potentially limiting price increases. This price volatility directly impacts the economic viability of EnQuest's mature fields, necessitating efficient cost management to maintain profitability.

Operational costs are also a significant factor, with inflation and supply chain disruptions in 2024 continuing to pressure expenditures. EnQuest's capital expenditure in 2023 was $377 million, highlighting the ongoing investment required to sustain operations. Access to financing is further influenced by interest rates and investor sentiment towards the energy sector.

Currency fluctuations, particularly between GBP/USD and MYR/USD, present another economic challenge. A 5% adverse currency movement could materially affect EnQuest's reported earnings. For instance, the GBP/USD traded within a range in early 2024, reflecting UK economic adjustments, while the MYR's performance in 2023-2024 was tied to global energy prices and domestic indicators.

What You See Is What You Get

EnQuest PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive EnQuest PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a thorough overview to inform strategic decision-making.

Sociological factors

Public and societal attitudes toward fossil fuels are undergoing a significant shift, largely propelled by growing concerns about climate change. This evolving sentiment directly impacts how stakeholders engage with companies like EnQuest, influencing investment decisions and intensifying political pressure for a more rapid transition to cleaner energy sources.

As an oil and gas producer, EnQuest faces heightened scrutiny concerning its environmental footprint and its position within a global economy striving for decarbonization. This increased public and governmental attention directly affects its social license to operate, potentially impacting regulatory approvals and operational continuity.

For instance, in 2023, global public opinion surveys indicated a growing majority favoring renewable energy investments over fossil fuels, with a significant portion of respondents expressing concern about the environmental impact of oil and gas extraction. This trend suggests a challenging landscape for companies like EnQuest, requiring proactive strategies to maintain public trust and a favorable operating environment.

The ongoing energy transition significantly reshapes the workforce within the oil and gas sector, with pronounced effects felt in areas like the UK North Sea. As fossil fuel production gradually decreases, there's a tangible risk of job displacement, prompting urgent discussions and planning for a 'just transition' to support affected workers through retraining and other assistance measures.

For companies like EnQuest, navigating these shifts necessitates proactive workforce management. This includes identifying and addressing potential skills gaps that arise from evolving industry demands and implementing strategies to ensure the retention of crucial talent amidst a dynamic and changing energy landscape.

Operating in the offshore oil and gas sector means confronting substantial health and safety challenges. Public and regulatory bodies demand exceptionally high safety benchmarks, and EnQuest's dedication to achieving top-tier operational and safety performance is paramount. This commitment is vital for safeguarding its reputation and preventing expensive accidents and regulatory sanctions.

Community Engagement and Local Impact

EnQuest's operations, particularly in areas like the North Sea, can significantly affect local communities. For instance, their activities near Shetland, a key hub for their operations, necessitate careful management of their social license to operate. This involves actively addressing concerns about potential environmental impacts from both ongoing production and future decommissioning projects, such as the Magnus field decommissioning which will require extensive local support and engagement.

Maintaining strong community relationships is crucial for EnQuest's long-term success. This includes demonstrating tangible benefits to local economies, such as job creation and local supply chain utilization. For example, during the Magnus decommissioning, EnQuest aims to leverage local expertise and services, contributing to the economic vitality of the Shetland region. Proactive engagement helps mitigate potential opposition and fosters a supportive environment for their projects.

- Local Economic Contribution: EnQuest's commitment to using local suppliers and services in areas like Shetland helps bolster regional economies, creating jobs and supporting businesses.

- Environmental Stewardship: Addressing community concerns about environmental impacts, especially during decommissioning phases, is vital for maintaining trust and operational continuity.

- Stakeholder Relations: Effective dialogue with local communities and authorities ensures that EnQuest's operations are aligned with societal expectations and local needs.

- Decommissioning Impact: Projects like the Magnus field decommissioning highlight the need for robust community engagement to manage the social and economic transitions associated with asset life cycles.

Consumer Behavior and Energy Consumption Patterns

Societal shifts towards sustainability are increasingly influencing energy consumption. While EnQuest operates upstream, a growing consumer preference for lower-carbon alternatives, such as electric vehicles and renewable energy sources, could gradually dampen long-term demand for oil and gas. This evolving consumer behavior necessitates strategic adaptation for companies like EnQuest.

For instance, by the end of 2023, global electric vehicle sales surpassed 13 million units, a significant increase from previous years, signaling a clear consumer shift. This trend directly impacts the projected demand for traditional fuels, influencing EnQuest's long-term investment and production strategies to align with a changing energy landscape.

- Growing EV Adoption: Global EV sales are projected to reach 16.7 million units in 2024, up from 13.6 million in 2023, indicating a sustained consumer move away from internal combustion engines.

- Energy Efficiency Focus: Increased consumer and industrial demand for energy efficiency measures, driven by cost savings and environmental concerns, can also reduce overall fossil fuel consumption.

- Renewable Energy Investment: Significant global investment in renewable energy infrastructure, expected to exceed $2 trillion in 2024, further underscores the shift in energy preferences away from fossil fuels.

Societal attitudes are increasingly prioritizing sustainability, impacting the demand for fossil fuels and influencing investment in renewable energy. This shift necessitates that EnQuest adapt its strategies to align with evolving consumer preferences and a global move towards decarbonization.

The workforce in the oil and gas sector is also affected by the energy transition, with potential job displacement and a need for reskilling initiatives to support workers. EnQuest must proactively manage its talent pool and address skills gaps to navigate these changes effectively.

Community relations are vital for EnQuest's social license to operate, especially concerning environmental impacts and local economic contributions. Proactive engagement and addressing concerns, such as those related to the Magnus field decommissioning, are crucial for maintaining trust and operational continuity.

| Societal Factor | Impact on EnQuest | Supporting Data (2023-2025) |

|---|---|---|

| Climate Change Concerns | Increased pressure for decarbonization, impacting investment and operations. | Global surveys in 2023 showed a majority favoring renewables; EV sales hit 13.6 million in 2023, projected to reach 16.7 million in 2024. |

| Workforce Transition | Risk of job displacement in traditional sectors, need for reskilling. | Ongoing discussions in UK North Sea for a 'just transition' to support affected workers. |

| Community Expectations | Demand for local economic benefits and environmental stewardship, particularly during decommissioning. | EnQuest's Magnus field decommissioning project emphasizes local engagement and services in Shetland. |

| Consumer Energy Preferences | Shift towards lower-carbon alternatives potentially reducing long-term oil and gas demand. | Renewable energy investment expected to exceed $2 trillion globally in 2024. |

Technological factors

EnQuest's strategic emphasis on extracting maximum value from its mature oil fields makes advanced Enhanced Oil Recovery (EOR) techniques a cornerstone of its technological approach. Innovations in EOR, like sophisticated thermal or chemical injection methods, are vital for extending the productive life and boosting recovery factors from existing reservoirs.

These technologies are particularly crucial for EnQuest in unlocking additional reserves from challenging or aging geological formations, thereby enhancing the economic viability of its asset portfolio. For instance, in 2024, the company continued to explore and implement various EOR strategies across its North Sea assets, aiming to improve production efficiency and extend field life.

The oil and gas sector is rapidly embracing digitalization, with AI and IoT becoming key drivers of change. Companies like EnQuest are leveraging these technologies to streamline operations, aiming for greater efficiency and cost reduction. For instance, predictive analytics can anticipate equipment failures, minimizing downtime and associated expenses.

Automation is also playing a crucial role, enhancing safety and optimizing production across various assets. EnQuest's focus on digital twins and remote monitoring is particularly beneficial for managing its mature offshore fields. This allows for real-time performance tracking and proactive adjustments, crucial for maximizing output from these established resources.

As environmental regulations tighten, Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming crucial for oil and gas firms like EnQuest. The push for energy transition makes CCUS a key area for reducing emissions and potentially repurposing existing infrastructure for carbon storage.

EnQuest could find new revenue streams by adopting CCUS, particularly with growing government incentives for decarbonization projects. For instance, the UK government's CCUS cluster plan aims to support projects, potentially offering substantial financial backing for companies investing in this technology.

Decommissioning Technologies

As EnQuest's asset base matures, decommissioning technologies are becoming increasingly crucial. Innovations in this area directly impact operational costs and environmental stewardship. For instance, advancements in subsea robotics and modular removal techniques are streamlining the process, making it more efficient. These technologies are vital for EnQuest to meet stringent regulatory demands and maintain its reputation as a responsible operator.

The drive for cost reduction in decommissioning is significant. By 2025, the UK offshore oil and gas industry is projected to spend billions on decommissioning, with estimates varying but consistently in the tens of billions over the coming decades. Companies like EnQuest are actively exploring and adopting new methods to manage these expenses. For example, the development of in-situ recycling technologies for platforms and pipelines offers a promising avenue to reduce transportation and disposal costs.

- Robotic advancements: Enhanced underwater vehicles reduce the need for human intervention in hazardous environments, lowering risk and cost.

- Modularization: Breaking down large structures into smaller, manageable sections for easier and safer removal.

- In-situ recycling: Developing methods to process materials directly on the seabed or at the surface, minimizing logistical burdens.

- Environmental impact reduction: Technologies aimed at minimizing seabed disturbance and preventing the release of contaminants are paramount for regulatory approval and public perception.

Exploration and Drilling Innovations

EnQuest's strategy hinges on maximizing value from existing assets, making advancements in exploration and drilling technology particularly relevant. Innovations like extended reach drilling (ERD) and multilateral wells are key. ERD allows access to reserves further from existing infrastructure, potentially unlocking new pockets of hydrocarbons within EnQuest's mature fields. For instance, in 2024, the company continued to leverage efficient drilling techniques in its North Sea operations, aiming to optimize production from its key assets like Kraken and Magnus. These technologies not only improve access but also enhance drilling efficiency, reducing operational costs and the environmental impact per barrel produced.

The economic viability of developing remaining reserves is significantly boosted by these technological leaps. By enabling more precise targeting and maximizing hydrocarbon recovery from each wellbore, these methods can make previously uneconomical resources profitable. This is crucial for companies like EnQuest that operate in mature basins where incremental recovery is vital for sustained production. In 2025, the industry is seeing continued investment in digital drilling solutions and AI-driven optimization, which further refine these processes, leading to faster well construction and improved reservoir understanding.

- Extended Reach Drilling (ERD): ERD techniques allow wells to be drilled horizontally for many kilometers, accessing reserves far from the surface location. This is particularly beneficial for offshore platforms with limited well slots.

- Multilateral Wells: These wells have multiple branches emanating from a single main bore, significantly increasing the drainage area and reservoir contact. This can lead to higher initial production rates and improved overall recovery.

- Efficiency Gains: Advanced drilling fluids, directional control systems, and real-time data analytics contribute to faster drilling times and reduced non-productive time (NPT).

- Cost Reduction: By minimizing the number of wells required and optimizing drilling operations, these technologies directly lower the cost per barrel of oil equivalent (BOE).

Technological advancements are critical for EnQuest's strategy of maximizing value from mature fields. Innovations in Enhanced Oil Recovery (EOR) are vital for boosting recovery factors, with the company actively implementing these in the North Sea in 2024 to extend field life and improve efficiency.

Digitalization, including AI and IoT, is streamlining operations for greater efficiency and cost reduction, with predictive analytics anticipating equipment failures. Automation, particularly through digital twins and remote monitoring, enhances safety and optimizes production from offshore assets.

Carbon Capture, Utilization, and Storage (CCUS) is becoming essential for emissions reduction, with potential new revenue streams and government incentives, such as the UK's CCUS cluster plan, supporting investment in decarbonization projects.

Decommissioning technologies are crucial for cost management and environmental responsibility, with advancements in subsea robotics and modular removal techniques improving efficiency. The UK offshore sector faces billions in decommissioning costs by 2025, driving the adoption of methods like in-situ recycling to reduce expenses.

Legal factors

EnQuest's operations in the UK and Malaysia are heavily governed by licensing and permitting rules. For instance, the UK's approach to new oil and gas exploration, exemplified by the 'Climate Compatibility Checkpoint' introduced in 2023, directly influences the company's ability to secure future exploration licenses and continue developing existing assets.

These regulations are not static; evolving environmental and safety standards can necessitate costly upgrades or operational adjustments. In 2024, the UK government continued to emphasize a balanced approach to energy security and climate targets, meaning any shifts in policy could significantly affect EnQuest's project pipeline and operational costs.

EnQuest operates under stringent environmental laws, particularly concerning offshore activities. These include rules for emissions, waste disposal, and preventing pollution in marine environments. Failure to comply can result in substantial fines and operational disruptions.

A key legal development is the UK Supreme Court's stance on Scope 3 emissions. This means environmental impact assessments for new projects must now account for indirect emissions, increasing the complexity and legal risk associated with developing new oil and gas fields.

Taxation laws, particularly the UK's Energy Profits Levy (EPL), significantly impact EnQuest's profitability. For instance, the EPL, introduced in 2022, imposed a 25% supplementary tax on oil and gas profits, adding to the existing 40% corporation tax. This dual burden directly affects EnQuest's bottom line.

The EPL's history shows considerable volatility; its rate was initially set to expire at the end of 2025 but was later extended to March 2028, and its rate was increased to 35% from January 2023. These frequent legislative adjustments create an uncertain financial landscape for EnQuest, requiring constant strategic adaptation to manage its tax liabilities effectively.

Navigating these evolving tax regulations is crucial for EnQuest to maintain compliance and avoid potential penalties. The company's ability to forecast and manage its tax obligations under such dynamic legal frameworks is a key factor in its financial stability and operational planning.

Health and Safety Legislation

EnQuest operates under stringent health and safety legislation, particularly critical for its offshore activities. These regulations are designed to safeguard personnel and prevent catastrophic incidents. For instance, the UK's Health and Safety Executive (HSE) enforces comprehensive offshore petroleum safety directives, which EnQuest must meticulously follow.

Compliance is not merely a legal obligation but a fundamental operational necessity. Non-compliance can result in substantial fines, temporary or permanent cessation of operations, and significant damage to EnQuest's reputation. In 2023, the energy sector globally saw continued focus on safety performance, with regulatory bodies increasing scrutiny on operational integrity.

- Rigorous Health and Safety Laws: Offshore operations are subject to extensive regulations like the Offshore Installations (Safety Case) Regulations 2005 in the UK.

- Paramount Importance of Compliance: EnQuest's adherence to directives, including those concerning emergency response and pollution prevention, is crucial.

- Consequences of Non-Adherence: Penalties can include significant financial penalties, operational halts, and severe reputational harm, impacting investor confidence and market standing.

- Industry Focus on Safety: The broader energy industry, including companies like EnQuest, faces ongoing pressure from regulators and stakeholders to maintain and improve safety records, especially following incidents in other regions.

Corporate Governance and Reporting Requirements

As a publicly traded entity, EnQuest faces stringent corporate governance and reporting obligations. These include regular financial disclosures, the publication of annual reports, and an increasing emphasis on Environmental, Social, and Governance (ESG) reporting. For instance, in its 2023 annual report, EnQuest detailed its commitment to transparency and stakeholder accountability.

The regulatory landscape in the UK is evolving, with a notable shift towards adopting International Sustainability Standards Board (ISSB) standards for sustainability reporting. This move is significant, as these standards are slated to become mandatory for many companies for fiscal periods commencing after January 1, 2026. This will necessitate enhanced data collection and reporting on sustainability metrics for companies like EnQuest.

- Mandatory ISSB Adoption: UK companies will be required to adhere to ISSB standards for periods starting after January 1, 2026.

- Enhanced ESG Reporting: EnQuest, like its peers, must bolster its ESG reporting capabilities to meet these new global benchmarks.

- Increased Transparency: The new standards aim to provide investors with more consistent and comparable sustainability information.

EnQuest's operational framework is shaped by evolving UK and Malaysian energy policies, including the 2023 UK Climate Compatibility Checkpoint, which impacts future exploration licensing. Furthermore, the company must adapt to increasingly stringent environmental regulations concerning offshore emissions and waste management, with non-compliance leading to significant financial and operational penalties.

The UK's Energy Profits Levy (EPL) directly impacts EnQuest's profitability, with its rate increasing to 35% from January 2023 and its extension to March 2028. This fiscal uncertainty, coupled with the legal requirement to account for Scope 3 emissions in environmental impact assessments, heightens the complexity of EnQuest's strategic planning and financial forecasting.

Health and safety legislation, such as the UK's Offshore Installations (Safety Case) Regulations 2005, is paramount for EnQuest's offshore activities, with non-adherence risking severe penalties and reputational damage. The company is also preparing for mandatory adoption of International Sustainability Standards Board (ISSB) standards for sustainability reporting from fiscal periods commencing after January 1, 2026, necessitating enhanced ESG data collection and transparency.

Environmental factors

The global push to combat climate change places intense environmental scrutiny on oil and gas firms like EnQuest. The company is under pressure to lower its greenhouse gas output, covering Scope 1, 2, and 3 emissions, and to meet national and international climate goals.

EnQuest has already achieved substantial reductions in its UK emissions, outpacing the objectives set by the North Sea Transition Deal. For instance, by the end of 2023, EnQuest reported a 47% reduction in Scope 1 and 2 emissions intensity compared to a 2018 baseline, surpassing the 2030 target of 10% reduction set by the deal.

EnQuest's offshore operations, particularly in the UK Continental Shelf and Malaysia, inherently carry risks to marine ecosystems. These risks include the potential for oil spills, the discharge of operational waste, and the direct impact on marine life and habitats.

The company must navigate a complex web of environmental regulations designed to safeguard biodiversity and prevent pollution. For instance, in the UK, the Offshore Environmental

Adherence to these regulations is crucial for EnQuest's social license to operate and its long-term sustainability. For example, the EU's Habitats Directive and Birds Directive, which have influenced UK policy, impose obligations to protect specific species and habitats, requiring careful environmental impact assessments and mitigation strategies for any proposed offshore activities.

As an operator of maturing offshore oil and gas assets, EnQuest faces substantial decommissioning liabilities. These obligations, estimated to be in the billions of pounds for the UK Continental Shelf alone, involve the safe removal or repurposing of aging infrastructure like platforms and pipelines, alongside the responsible management of associated waste materials, including hazardous substances.

The environmental impact of these activities is a significant concern. EnQuest's approach to decommissioning must minimize disruption to marine ecosystems and prevent pollution. For instance, the choice between removing or leaving infrastructure in situ has different ecological consequences, and the disposal of materials, especially those containing asbestos or heavy metals, requires stringent protocols. The company's 2023 annual report highlighted ongoing efforts in planning and executing decommissioning projects, emphasizing adherence to strict environmental regulations.

Effective waste management and environmentally sound decommissioning practices are therefore paramount for EnQuest, not just for regulatory compliance but also for maintaining its corporate reputation. The industry is increasingly scrutinized for its environmental stewardship, and EnQuest's commitment to best practices in this area directly influences stakeholder trust and its social license to operate. The company continues to invest in technologies and processes aimed at reducing the environmental footprint of its decommissioning activities, aligning with evolving industry standards and government mandates.

Resource Depletion and Energy Transition

EnQuest faces a significant challenge from resource depletion in mature regions like the UK Continental Shelf (UKCS). While the company excels at maximizing production from existing fields, the inherent decline of these reserves necessitates a long-term strategy for sustainability. For instance, the UKCS, a core operating area for EnQuest, has seen production decline from its peak, requiring continuous investment in enhanced oil recovery and exploration to offset natural depletion.

The global energy transition further complicates this outlook. As nations commit to reducing carbon emissions and increasing renewable energy sources, the demand for traditional oil and gas is expected to shift. EnQuest's future success hinges on its adaptability to this evolving energy landscape, potentially through diversification into lower-carbon energy solutions or by focusing on the most efficient and lowest-emission production methods for its current assets.

- Resource Depletion: Mature basins like the UKCS, where EnQuest operates extensively, are characterized by declining production rates, requiring advanced techniques to maintain output.

- Energy Transition Impact: Global efforts to decarbonize are reducing long-term demand projections for fossil fuels, posing a strategic risk to oil and gas producers.

- Adaptation Strategy: EnQuest's ability to pivot towards new energy technologies or optimize existing operations for greater efficiency and lower emissions will be crucial for its long-term viability.

- Market Dynamics: By 2024, the International Energy Agency (IEA) projected continued, albeit slower, growth in oil demand, but underscored the accelerating rise of renewables, highlighting the dual pressures EnQuest faces.

Water Management and Pollution Prevention

Effective water management is a critical environmental consideration for EnQuest, particularly concerning the treatment and discharge of produced water generated from its oil and gas operations. This process is heavily regulated to prevent marine pollution, a significant concern in the offshore environments where EnQuest operates.

In 2023, the oil and gas industry globally continued to face scrutiny over its water management practices. For instance, the North Sea, a key operational area for EnQuest, has stringent regulations regarding the quality of discharged produced water. Companies are mandated to meet specific standards for oil-in-water content and other contaminants.

To address these requirements, EnQuest, like its peers, must make substantial investments in advanced technologies and operational practices. These investments aim to:

- Minimize overall water usage through recycling and efficient operational design.

- Enhance produced water treatment processes to ensure compliance with increasingly strict discharge limits, aiming for lower parts per million (ppm) of oil content.

- Implement robust monitoring systems to track water quality and operational impacts, ensuring transparency and accountability.

EnQuest operates under significant environmental pressures, including climate change mitigation and stringent pollution control regulations across its UK and Malaysian operations. The company has made strides in reducing its emissions intensity, achieving a 47% reduction in Scope 1 and 2 emissions intensity by the end of 2023 against a 2018 baseline, exceeding the North Sea Transition Deal's 2030 target of 10%.

However, offshore activities carry inherent risks to marine ecosystems, such as potential oil spills and waste discharge, necessitating strict adherence to regulations like the UK's Offshore Environmental Regulations 2002 and Malaysia's Environmental Quality Act 1974.

The company also faces substantial decommissioning liabilities for its mature assets, with environmental considerations paramount in safely removing or repurposing infrastructure and managing waste, as highlighted in its 2023 annual report.

Furthermore, EnQuest must navigate the energy transition, as global decarbonization efforts impact long-term fossil fuel demand projections, while also managing water usage and produced water treatment to meet strict discharge standards, aiming for lower parts per million of oil content.

PESTLE Analysis Data Sources

Our EnQuest PESTLE Analysis is meticulously constructed using data from reputable sources including government energy departments, international financial institutions, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the energy sector.