EnQuest Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnQuest Bundle

EnQuest operates in a dynamic oil and gas sector, where understanding the competitive landscape is crucial for success. Our Porter's Five Forces analysis delves into the key pressures impacting EnQuest, from the bargaining power of suppliers and buyers to the threat of new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore EnQuest’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The oil and gas sector, including companies like EnQuest, often depends on a limited number of specialized suppliers for crucial equipment and services. For instance, the market for advanced seismic survey technology or deep-sea drilling rigs is dominated by a few global engineering firms. This concentration means these suppliers can wield considerable influence over pricing and contract terms.

For EnQuest, the bargaining power of suppliers is amplified when these suppliers offer unique, high-value technologies or services with few viable alternatives. In 2024, the demand for offshore drilling services remained robust, with major rig operators reporting high utilization rates, which can translate to stronger pricing power for those suppliers.

Switching suppliers in the oil and gas industry, particularly for specialized equipment and services like those EnQuest relies on, involves significant hurdles. These include the substantial costs and time associated with technical integration of new systems, the necessity for extensive personnel retraining, and the inherent risk of operational delays during transition periods. These factors collectively create high switching costs for EnQuest.

These elevated switching costs directly bolster the bargaining power of EnQuest's current suppliers. Because changing providers is so complex and expensive, EnQuest is incentivized to maintain relationships with existing suppliers, even when more competitive alternatives might become available. This dependence grants suppliers leverage in price negotiations and contract terms.

Suppliers providing highly specialized or proprietary technology, such as advanced enhanced oil recovery (EOR) solutions or complex decommissioning services for mature assets, hold a significant advantage. EnQuest's operational focus on maturing assets necessitates tailored solutions, granting these niche suppliers considerable leverage in setting prices and contract conditions.

These unique offerings significantly limit EnQuest's capacity to find comparable services from alternative providers. For instance, in 2024, the demand for specialized subsea intervention equipment, critical for maintaining production from aging fields, saw lead times extend due to limited manufacturing capacity, directly impacting supplier pricing power.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while not a frequent occurrence, poses a potential leverage point for service companies. Large oilfield service providers could, in theory, move into exploration and production (E&P) themselves, directly competing with companies like EnQuest. This would require substantial capital investment, but the mere possibility can strengthen their bargaining position during contract negotiations.

For EnQuest, this hypothetical scenario underscores the critical need to cultivate robust relationships with its core service providers. Maintaining strong partnerships can mitigate the risk associated with potential supplier encroachment and ensure more favorable terms for essential services. In 2024, the oil and gas services sector saw significant activity, with major players reporting strong revenues, indicating their financial capacity for such strategic shifts.

- Potential for Competition: Large oilfield service companies possess the financial and operational capabilities to potentially enter the E&P market, creating new competitive pressures.

- Supplier Leverage: The mere threat of forward integration can empower suppliers, giving them greater influence in pricing and contract terms with E&P companies.

- Strategic Importance of Relationships: EnQuest must prioritize strong, collaborative relationships with its key service providers to counter this potential threat and secure reliable service delivery.

Importance of EnQuest to Suppliers

EnQuest, as a significant independent oil and gas producer, particularly in the UK Continental Shelf and Malaysia, can be a crucial customer for specialized suppliers. For instance, in 2023, EnQuest's production averaged approximately 44,000 boepd, indicating a consistent demand for goods and services within its operational areas. This substantial client base can influence supplier relationships.

When EnQuest represents a considerable percentage of a supplier's annual revenue, the supplier’s bargaining power is somewhat diminished. This is because retaining EnQuest’s business becomes a priority, potentially leading suppliers to offer more competitive pricing or favorable contract terms to secure continued engagement. For example, if a key subsea equipment provider derives over 15% of its income from EnQuest contracts, it would be incentivized to maintain a strong working relationship.

- Supplier Dependence: EnQuest’s operational scale in the North Sea, where it is a major player, means certain niche suppliers may rely heavily on its contracts for a significant portion of their income.

- Revenue Contribution: For suppliers of specialized drilling fluids or offshore maintenance services, EnQuest could represent a substantial revenue stream, potentially exceeding 10% of their annual turnover.

- Contractual Leverage: The long-term nature of many oil and gas supply contracts grants EnQuest leverage, as switching suppliers can be costly and time-consuming for both parties.

- Market Position: EnQuest’s established presence and ongoing development projects, such as those at the Magnus field, ensure a steady demand for its suppliers, reinforcing its position as a key client.

The bargaining power of suppliers for EnQuest is significant due to the industry's reliance on specialized equipment and services, often provided by a concentrated group of firms. In 2024, high demand for offshore drilling services meant rig operators had strong pricing power, directly impacting EnQuest's costs.

High switching costs, stemming from technical integration, retraining, and operational risks, further empower EnQuest's suppliers. Companies offering unique technologies, like advanced EOR solutions or decommissioning services, hold considerable leverage, as demonstrated by extended lead times for specialized subsea equipment in 2024.

While the threat of forward integration by large oilfield service providers is a potential concern, EnQuest's substantial customer base, representing a significant revenue stream for some niche suppliers, can temper this power. For example, EnQuest's 2023 production of approximately 44,000 boepd highlights its importance as a client.

| Factor | Impact on EnQuest | Supporting Data/Observation (2024 Focus) |

|---|---|---|

| Supplier Concentration | High | Limited number of specialized engineering firms dominate advanced seismic and drilling rig markets. |

| Switching Costs | High | Significant expenses and operational risks associated with technical integration and retraining. |

| Uniqueness of Offering | High | Demand for specialized subsea intervention equipment saw extended lead times, increasing supplier pricing power. |

| EnQuest's Customer Size | Moderate | EnQuest's 2023 production (~44,000 boepd) makes it a key client for some niche suppliers, potentially reducing their leverage. |

What is included in the product

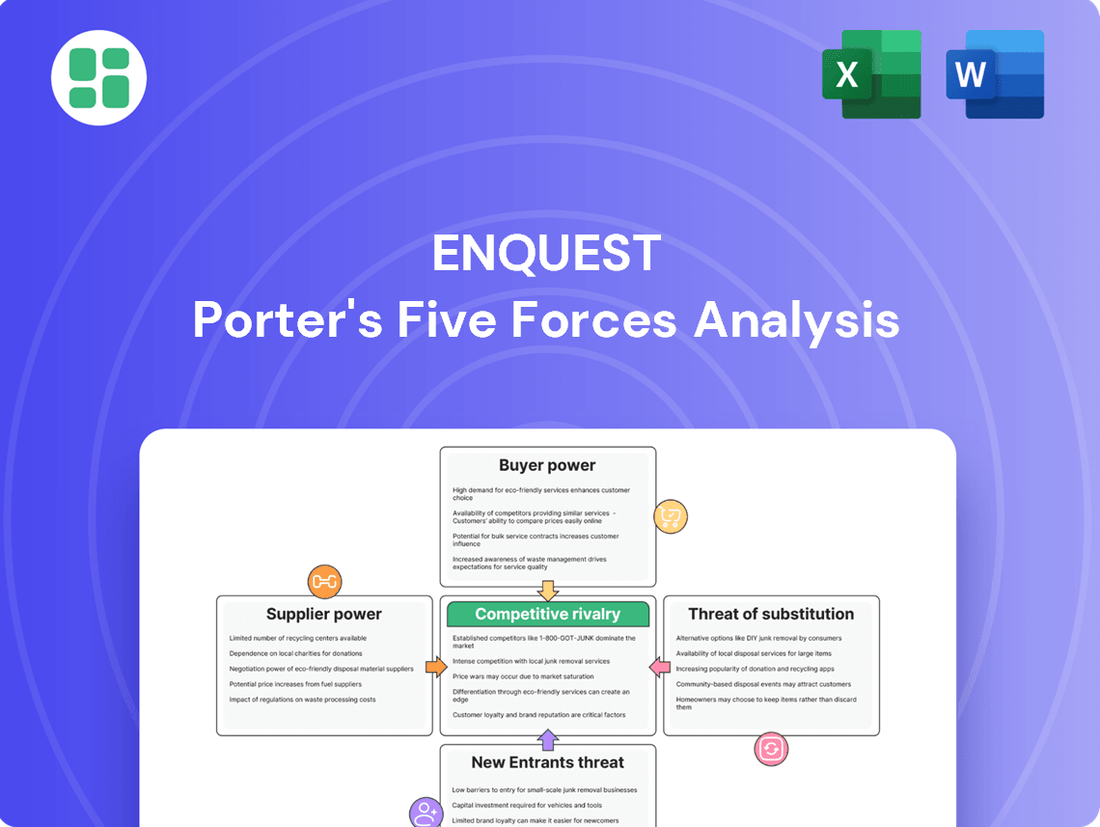

This analysis examines the five competitive forces impacting EnQuest, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position and profitability.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

EnQuest's customers are primarily large oil refineries and trading houses, entities that buy significant volumes of crude oil and natural gas. These major buyers possess substantial purchasing power due to their size and sophistication, which translates into strong leverage during price negotiations.

The global energy market often features a limited number of major purchasers relative to the number of producers. This imbalance inherently concentrates bargaining power in the hands of these few large customers, enabling them to drive harder bargains and potentially influence EnQuest's pricing and contract terms.

The volume of oil and gas EnQuest sells significantly influences customer bargaining power. As a commodity producer, EnQuest faces buyers who can leverage their purchase size for better terms. Large purchasers, in particular, can negotiate lower prices or preferential delivery schedules.

Given EnQuest's projected production of approximately 40,000 to 45,000 barrels of oil equivalent per day (boepd) for both 2024 and 2025, it operates within a global market where substantial buyers hold considerable sway. These major entities, by consolidating their purchasing power, can exert pressure on suppliers like EnQuest.

For major buyers of crude oil and gas, switching suppliers generally involves low costs. This is because crude oil is largely an undifferentiated commodity, meaning buyers can easily source from various producers globally based on price and availability.

While logistics and specific crude grades can introduce minor complexities, these typically do not represent significant barriers. For instance, in 2024, the global oil market saw ample supply from diverse regions, allowing major refiners and energy companies to readily shift between suppliers to secure the most favorable terms.

This low switching cost empowers buyers, giving them significant leverage to negotiate lower prices from producers like EnQuest. They can often play suppliers against each other, further intensifying competitive pressure.

Backward Integration by Customers

Refineries and integrated energy companies, key customers for EnQuest, often possess their own upstream exploration and production capabilities. This vertical integration allows them to generate their own oil and gas, lessening their reliance on independent producers like EnQuest. Consequently, these customers gain significant leverage, as they can increase their internal output rather than purchasing from external suppliers when market conditions are unfavorable.

This backward integration by customers directly enhances their bargaining power. For instance, major oil companies with substantial refining operations also control significant exploration and production assets. In 2023, for example, many integrated oil majors continued to invest in their upstream segments, aiming to secure a stable supply of crude oil for their downstream operations, thereby reducing their need to procure from third parties.

- Reduced Dependence: Integrated customers can meet a larger portion of their crude oil needs internally, diminishing their reliance on independent producers.

- Price Sensitivity: The ability to self-supply makes these customers more sensitive to pricing from external suppliers like EnQuest.

- Strategic Advantage: Backward integration provides customers with greater control over their supply chain and costs, a strategic advantage that translates into stronger negotiation power.

Price Sensitivity of Customers

Customers in the commodity market, especially those in oil and gas like EnQuest's clients, exhibit significant price sensitivity. Their own profit margins are often directly linked to the cost of the raw materials they purchase, making them keen on securing the lowest possible prices from producers.

For instance, in 2024, the volatility in global oil prices directly influenced the purchasing power of downstream companies. A drop in Brent crude, which averaged around $80-$85 per barrel for much of the year, would empower these customers to demand lower prices from suppliers like EnQuest. This sensitivity is amplified by the transparent nature of commodity markets, where pricing is readily available, allowing customers to easily compare offers and negotiate aggressively.

- Price Sensitivity Drivers: Customer profitability is often a direct function of raw material costs.

- Market Transparency: Global commodity pricing allows for easy comparison and negotiation.

- Impact of Price Fluctuations: Changes in oil and gas prices directly affect customer willingness to pay higher prices to producers like EnQuest.

EnQuest's customers, primarily large refineries and trading houses, wield considerable bargaining power due to their substantial purchase volumes and market sophistication. The global energy landscape, with its concentrated buyer base, allows these major entities to negotiate favorable terms, impacting EnQuest's pricing and contract conditions.

The low cost for customers to switch suppliers, given crude oil's commodity nature, further amplifies their leverage. In 2024, ample global supply facilitated easy supplier shifts, enabling buyers to secure better deals and intensify competitive pressures on producers like EnQuest.

Customers' backward integration into upstream production also significantly bolsters their bargaining power. By meeting more of their needs internally, these integrated companies reduce their reliance on external suppliers, making them more price-sensitive and strategically positioned to negotiate from a stronger footing.

| Customer Characteristic | Impact on Bargaining Power | Supporting Data/Context (2024) |

|---|---|---|

| Purchase Volume | High | Large refineries and trading houses buy significant volumes of crude oil and natural gas. |

| Market Sophistication | High | Customers are experienced negotiators in the global energy market. |

| Switching Costs | Low | Crude oil is a commodity, allowing easy sourcing from multiple producers. |

| Backward Integration | High | Integrated customers can self-supply, reducing reliance on external producers. |

| Price Sensitivity | High | Customer profitability is linked to raw material costs; market transparency facilitates aggressive negotiation. |

Preview the Actual Deliverable

EnQuest Porter's Five Forces Analysis

This preview showcases the complete EnQuest Porter's Five Forces analysis, offering a detailed examination of competitive forces within the oil and gas sector. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises. You'll gain instant access to this valuable resource, ready for your strategic planning and decision-making needs.

Rivalry Among Competitors

The oil and gas sector, especially in established areas like the UK Continental Shelf (UKCS) and parts of Southeast Asia, is populated by a significant number of independent and major oil and gas firms. EnQuest faces a broad spectrum of competitors, from large integrated energy giants to other independent exploration and production companies, each bringing different cost bases, asset mixes, and strategic aims to the market, intensifying the competitive landscape.

The UK Continental Shelf (UKCS) is a mature basin, meaning its production is declining, and a substantial amount of decommissioning work is underway. This situation inherently creates a low-growth or even shrinking market, which naturally heightens competition among the companies operating there. In 2023, UKCS oil and gas production continued its long-term decline, with decommissioning expenditure expected to remain significant in the coming years.

Crude oil and natural gas are fundamentally undifferentiated commodities, meaning EnQuest's production is largely interchangeable with that of its competitors. This inherent lack of product differentiation compels companies in the sector to compete intensely on price and operational efficiency, fueling significant rivalry.

EnQuest's strategic emphasis on achieving operational excellence, particularly within its late-life asset portfolio, is designed to carve out a competitive edge. By focusing on cost control and maximizing efficiency, the company aims to mitigate the pressures of commodity price volatility and intense competition.

For instance, in 2024, the Brent crude oil price averaged around $83 per barrel, highlighting the global benchmark for oil. This price point directly influences the profitability and competitive positioning of producers like EnQuest, where cost management is paramount.

Exit Barriers

High exit barriers significantly influence competitive rivalry in the oil and gas sector, as demonstrated by EnQuest. The substantial capital tied up in specialized infrastructure, such as offshore platforms and extensive pipeline networks, makes it incredibly costly and complex to divest or cease operations. For instance, decommissioning a North Sea platform can cost hundreds of millions of pounds, a significant factor deterring companies from exiting even when facing challenging market conditions.

These considerable costs associated with exiting the market mean that companies like EnQuest are often compelled to continue operating and competing intensely, even when profitability is strained. This persistence in the face of adversity fuels a more aggressive competitive landscape, as firms fight to maintain market share and recover their investments. Long-term contractual obligations for supply and processing further lock companies into the industry, reinforcing this dynamic.

- High Decommissioning Costs: In 2023, the estimated cost for decommissioning North Sea oil and gas infrastructure was projected to reach over £50 billion, highlighting the significant financial burden of exiting.

- Capital Intensity: The oil and gas industry requires massive upfront capital expenditure, with projects often running into billions of dollars, making it difficult to recoup investments if operations are terminated early.

- Contractual Commitments: Companies often have long-term supply agreements and joint venture obligations that create financial penalties or operational complexities if they attempt to exit prematurely.

- Specialized Assets: The highly specialized nature of oil and gas assets means they have limited alternative uses, drastically reducing their resale value and increasing exit costs.

Fixed Costs and Capacity

The oil and gas industry, including companies like EnQuest, is characterized by significant upfront investments in exploration, drilling, and infrastructure. These high fixed costs necessitate a continuous drive for high production volumes to achieve economies of scale and cover expenses. For instance, in 2024, major oil producers continued to invest billions in new projects, underscoring the capital-intensive nature of the sector.

This pressure to maintain high output, even when market demand is not growing, directly fuels intense price competition among industry players. When companies must produce at high levels to cover their fixed costs, they are more likely to engage in price wars to secure market share and revenue, especially if capacity utilization is a key performance indicator.

- High Capital Expenditure: Exploration and production (E&P) companies often face capital expenditures in the tens or hundreds of millions of dollars per project.

- Capacity Utilization: Maintaining high capacity utilization is crucial for profitability due to the fixed nature of infrastructure costs.

- Price Sensitivity: The need to cover fixed costs makes companies more sensitive to price fluctuations, leading to aggressive competitive behavior.

Competitive rivalry in the oil and gas sector, particularly for companies like EnQuest operating in mature basins, is fierce due to the commodity nature of oil and gas, high exit barriers, and the need for high production volumes to cover substantial fixed costs. The UK Continental Shelf, a key area for EnQuest, exemplifies this with its declining production and ongoing decommissioning activities, intensifying competition among the numerous independent and major players present.

| Competitor Characteristic | Impact on Rivalry | Example Data/Fact (as of 2024/2023) |

|---|---|---|

| Number of Competitors | High rivalry due to many players | UKCS hosts numerous independent and major oil & gas firms. |

| Product Differentiation | Intense price competition | Crude oil and natural gas are undifferentiated commodities. |

| Exit Barriers | Companies persist, increasing rivalry | Decommissioning a North Sea platform can cost hundreds of millions of pounds (estimated £50bn+ for North Sea in 2023). |

| Fixed Costs & Scale | Pressure for high output fuels price wars | Brent crude averaged ~$83/barrel in 2024; E&P projects often cost billions. |

SSubstitutes Threaten

The most significant threat to EnQuest's business comes from alternative energy sources, particularly renewables like solar, wind, and hydropower. These technologies are rapidly improving and becoming more cost-competitive.

Advancements in battery storage and the widespread adoption of electric vehicles further bolster the appeal of these alternatives, directly impacting the demand for traditional fossil fuels that EnQuest produces.

Global initiatives to address climate change are driving substantial investment into renewables. For instance, in 2024, global renewable energy capacity additions were projected to reach record levels, signaling a clear shift in energy consumption patterns.

The competitiveness of substitutes for EnQuest's oil and gas products hinges on their price relative to traditional energy sources, as well as their performance and dependability. While oil and gas have historically been cost-effective and reliable, the decreasing costs of renewable energy technologies and advancements in energy efficiency are making alternatives more attractive, particularly in sectors like power generation and transportation.

The threat of substitutes for EnQuest, particularly in the oil and gas sector, is influenced by significant switching costs for many industrial and transport users. Transitioning from fossil fuels to alternative energy sources often requires substantial investments in new infrastructure and technology, making immediate shifts less likely for established operations. For instance, upgrading a fleet of heavy-duty vehicles to electric or hydrogen power involves considerable capital expenditure.

However, this threat becomes more pronounced in scenarios with lower switching costs, such as new project developments or sectors where alternative technologies are becoming more competitive and readily adoptable. For example, when building a new power plant, the decision to opt for renewables over natural gas can be driven by long-term operational cost savings and evolving regulatory landscapes, even if initial setup costs are comparable.

The impact of substitutes varies considerably across EnQuest's diverse end-use applications. While sectors like aviation may face higher barriers to immediate substitution due to the specialized nature of jet fuel, other areas, like residential heating or certain industrial processes, might see a quicker adoption of alternatives if cost-effectiveness and availability improve. In 2024, the global investment in renewable energy sources continued to grow, with projections indicating further expansion, underscoring the dynamic nature of this competitive force.

Buyer Propensity to Substitute

Growing environmental awareness and stricter government regulations are significantly pushing buyers towards cleaner energy alternatives, thereby increasing the threat of substitutes for traditional oil and gas producers like EnQuest. Policies such as carbon pricing mechanisms and ambitious emissions reduction targets are making these alternatives more economically viable and attractive. For instance, the UK's North Sea Transition Deal aims to support the industry's shift towards lower-carbon operations, while Malaysia's own energy transition initiatives are actively promoting renewable energy sources.

This shift directly impacts the long-term demand for EnQuest's core products. As buyers, including industrial consumers and even governments, prioritize sustainability and compliance, they are increasingly exploring and adopting options like solar, wind, and hydrogen power. This trend is not just a future concern; it's actively shaping market dynamics now.

- Increased Buyer Preference for Renewables: Global investment in renewable energy sources reached approximately $500 billion in 2023, signaling a strong buyer propensity to shift away from fossil fuels.

- Regulatory Push for Decarbonization: Many nations, including those where EnQuest operates, have set net-zero targets, often by 2050, which necessitates a reduction in fossil fuel consumption and a corresponding increase in demand for substitutes.

- Technological Advancements in Alternatives: Innovations in battery storage and renewable energy efficiency are making substitutes more competitive on cost and reliability, further eroding the market share of conventional energy sources.

Innovation and Technological Advancements in Substitutes

The threat of substitutes for EnQuest, primarily an oil and gas producer, is significantly amplified by ongoing innovation in alternative energy sources. For instance, advancements in solar photovoltaic (PV) efficiency have seen costs drop dramatically; by the end of 2023, the global average cost of electricity from utility-scale solar PV had fallen by 89% since 2010, making it increasingly competitive with fossil fuels. This trend directly challenges the demand for oil and gas.

Furthermore, the rapid development of energy storage solutions, such as improved battery technologies, is addressing the intermittency issues historically associated with renewables like wind and solar. By mid-2024, battery energy storage system (BESS) deployment is projected to reach over 150 GW globally, a substantial increase that enables a more reliable and consistent supply of clean energy, further eroding the market share of traditional energy sources.

The increasing sophistication and adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies also present a form of substitution. While CCUS aims to mitigate emissions from fossil fuels, its growing viability and government support, evidenced by significant investment in CCUS projects worldwide, could prolong the life of cleaner fossil fuel use but also represents a shift in how energy is produced and consumed, potentially impacting the long-term demand for EnQuest’s core products.

- Renewable Energy Cost Reduction: Global solar PV costs decreased by 89% from 2010 to 2023.

- Energy Storage Growth: Global BESS deployment projected to exceed 150 GW by mid-2024.

- CCUS Investment: Growing global investment in CCUS projects signals a shift in energy infrastructure.

The threat of substitutes for EnQuest is substantial, driven by the increasing competitiveness and adoption of renewable energy sources. These alternatives are not only becoming more cost-effective but are also supported by global decarbonization efforts and technological advancements. While switching costs can be a barrier, new projects and evolving regulations are accelerating the shift towards cleaner energy, directly impacting long-term demand for oil and gas.

| Substitute Type | Key Driver | Impact on EnQuest | Supporting Data (2023/2024 Projections) |

|---|---|---|---|

| Renewable Energy (Solar, Wind) | Cost reduction, efficiency gains, government incentives | Directly reduces demand for fossil fuels | Solar PV costs down 89% (2010-2023); Global renewable capacity additions at record levels in 2024 |

| Energy Storage Solutions (Batteries) | Addressing intermittency of renewables | Enhances the viability and reliability of renewable substitutes | BESS deployment projected to exceed 150 GW globally by mid-2024 |

| Carbon Capture, Utilization, and Storage (CCUS) | Mitigating fossil fuel emissions, government support | Potentially prolongs cleaner fossil fuel use but represents a shift in energy consumption | Significant global investment in CCUS projects |

Entrants Threaten

The oil and gas sector demands enormous upfront investment for exploration, drilling, and infrastructure, creating a substantial barrier for newcomers. This capital intensity means only well-funded entities can realistically enter the market.

For instance, EnQuest itself reported capital expenditures of approximately $250 million in 2024, underscoring the significant financial commitment required to operate in this industry and deterring potential new competitors.

The oil and gas industry, particularly in established regions like the UK Continental Shelf (UKCS) and Malaysia, faces substantial regulatory and licensing hurdles. These include rigorous environmental standards, demanding safety protocols, and complex operational requirements that new entrants must navigate.

Securing the necessary licenses and permits is a lengthy and intricate undertaking, requiring strict adherence to evolving government policies. For instance, the UK's Energy Profits Levy, introduced in 2022 and extended, adds another layer of financial complexity, significantly raising the barrier to entry for potential new operators.

New entrants in the oil and gas sector, like EnQuest, encounter significant hurdles in securing access to vital distribution channels and infrastructure. Established companies often control critical assets such as pipeline networks, processing facilities, and export terminals. For instance, in the North Sea, the existing infrastructure is largely operated by major oil companies, making it difficult for newcomers to connect their production to the market.

The sheer cost and time involved in constructing new infrastructure present a formidable barrier. Building a new offshore platform, laying pipelines, or developing a new export terminal can easily run into billions of dollars and take several years. This capital-intensive nature of infrastructure development effectively deters many potential entrants.

EnQuest, however, is well-positioned due to its existing operational infrastructure. In the UK North Sea, the company utilizes a network of shared pipelines and processing facilities, reducing the need for new build capital expenditure. Similarly, in Malaysia, EnQuest benefits from access to established production and export infrastructure, which significantly lowers its entry barriers and operational costs compared to a hypothetical new entrant.

Economies of Scale and Experience Curve

Established players like EnQuest enjoy significant advantages due to economies of scale and the experience curve. This means they can produce goods or services at a lower cost per unit than smaller, newer companies. For instance, in 2023, EnQuest's operational efficiency contributed to a significant portion of its production costs, allowing it to remain competitive.

New entrants would find it challenging to match EnQuest's cost structure without substantial upfront investment and time to build comparable operational scale and expertise. This is particularly true in the North Sea, where EnQuest operates, as managing mature and complex assets requires specialized knowledge and infrastructure that is difficult and expensive to replicate quickly.

- Economies of Scale: EnQuest leverages its size for bulk purchasing of materials and services, reducing per-unit costs.

- Experience Curve: Years of operating in the North Sea have honed EnQuest's technical skills and operational processes, lowering the cost of production.

- Barriers to Entry: The high capital expenditure required to establish similar-scale operations and acquire the necessary expertise acts as a significant deterrent for potential new entrants.

- Cost Disadvantage for Newcomers: New companies would face higher initial operating costs, making it difficult to compete on price with established, scaled operators like EnQuest.

Brand Loyalty and Reputation

Even though oil and gas are largely seen as commodities, a company's reputation for doing things well, especially concerning safety and dependable delivery, can be a significant factor in attracting partnerships and investment. This is where brand loyalty and reputation come into play as a barrier to new companies entering the market.

EnQuest has cultivated a strong reputation for its operational excellence, particularly in managing late-life assets. In 2024, the company reported a production efficiency of around 90%, demonstrating its capability to maintain high output levels. This proven track record makes it challenging for newcomers who lack a similar history of reliable performance to gain trust and secure the necessary backing.

- Reputation for Operational Excellence: EnQuest's consistent high production efficiency, around 90% in 2024, builds trust.

- Safety and Reliability: A strong safety record and dependable delivery are crucial for attracting partnerships and investment.

- Barrier to Entry: New entrants struggle to establish the credibility needed to compete with established reputations.

- Late-Life Asset Management: EnQuest's specialization in this area further solidifies its expertise and market position.

The threat of new entrants in the oil and gas sector, as it pertains to EnQuest, is generally low. The industry's inherent capital intensity, demanding significant upfront investment for exploration and infrastructure, acts as a substantial deterrent. For instance, EnQuest's 2024 capital expenditures were around $250 million, highlighting the financial commitment required. Furthermore, stringent regulatory frameworks, complex licensing procedures, and the need for specialized expertise in areas like late-life asset management create high barriers for newcomers. EnQuest's established infrastructure access and operational scale, evidenced by its ~90% production efficiency in 2024, further solidify its competitive position against potential new market participants.

| Factor | Impact on New Entrants | EnQuest's Position |

| Capital Intensity | Very High Barrier | Established financial capacity |

| Regulatory Hurdles | High Barrier | Experienced in navigating complex regulations |

| Infrastructure Access | High Barrier | Utilizes existing networks, reducing new build costs |

| Economies of Scale & Experience | Significant Cost Disadvantage for Newcomers | Leverages bulk purchasing and honed operational expertise |

| Reputation & Track Record | Challenging to Replicate | Proven operational excellence and reliability |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data from company annual reports, industry-specific market research, and publicly available financial filings. This ensures a comprehensive understanding of competitive intensity and strategic positioning.