EnQuest Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnQuest Bundle

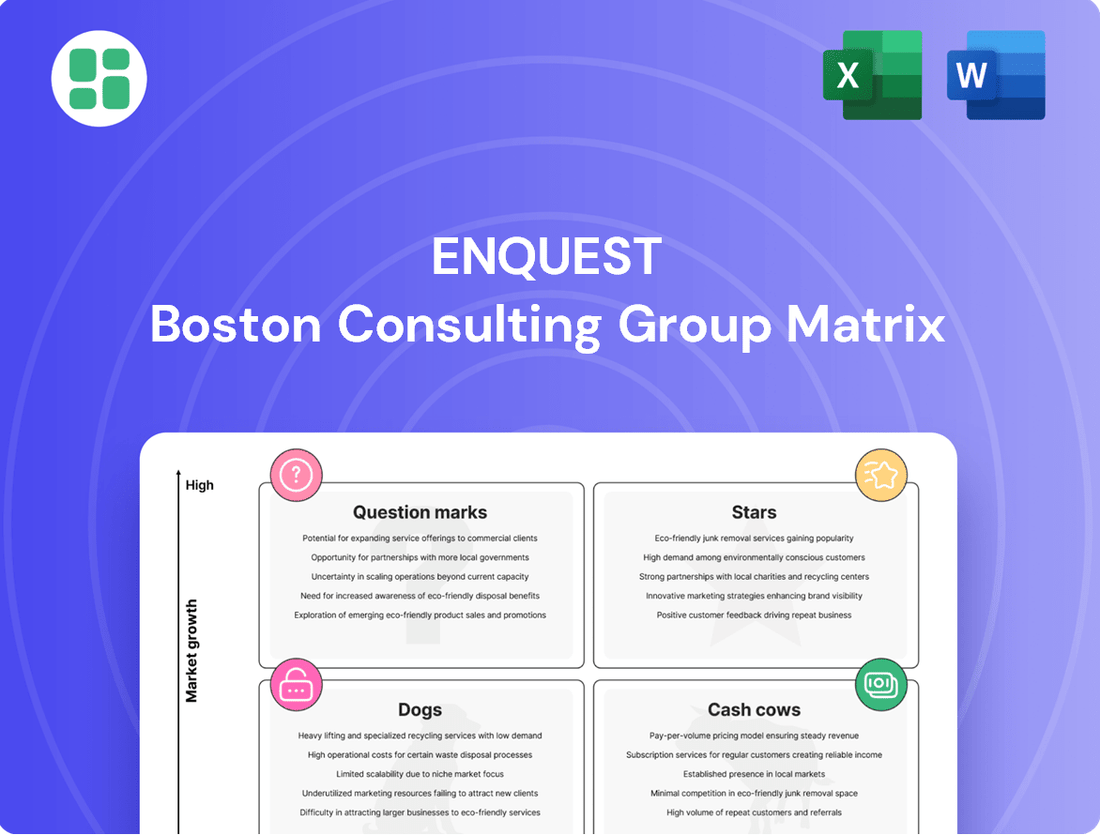

Curious about EnQuest's product portfolio performance? Our BCG Matrix preview highlights their current market standing, revealing potential Stars and Cash Cows.

Don't miss out on the full strategic advantage. Purchase the complete EnQuest BCG Matrix for a detailed quadrant breakdown, actionable insights into their Stars, Cash Cows, Dogs, and Question Marks, and a clear roadmap for optimizing your investments.

Unlock the full potential of your strategic planning with our comprehensive EnQuest BCG Matrix. Gain the clarity needed to make informed decisions and drive profitable growth.

Stars

EnQuest's acquisition of Harbour Energy's Vietnam Block 12W assets, including a 53.125% stake in Chim Sáo and Dua, positions this venture as a significant growth driver. This move diversifies EnQuest's geographic exposure and product mix, a key strategic objective.

The Block 12W acquisition is projected to contribute approximately 5.3 Kboed to EnQuest's pro forma 2025 production. This new asset is considered high-potential, aligning with EnQuest's ambition to expand its operational presence and growth trajectory in the Asia-Pacific region.

EnQuest secured the DEWA Production Sharing Contract (PSC) in Malaysia, a promising new discovery. This block holds an estimated 500 billion standard cubic feet (Bscf) of gas, with a projected production capacity of around 18,000 barrels of oil equivalent per day (Kboed).

Although development is in its nascent stages and expected to materialize in the coming years, the DEWA PSC represents a significant future growth avenue for EnQuest due to its substantial resource potential.

The Kraken Enhanced Oil Recovery (EOR) project is a significant strategic move for EnQuest, with a final investment decision anticipated within the next year. This initiative is designed to recover an additional 30 to 60 million barrels of oil from the existing Kraken field.

Successful implementation of this EOR project could substantially increase Kraken's output and prolong its operational viability, potentially shifting it from a mature asset to a key growth driver for EnQuest.

New UK North Sea Acquisitions

EnQuest is actively seeking new acquisitions in the UK North Sea, a move that positions these potential assets as future stars within its BCG Matrix. The company intends to utilize its specialized operating skills and favorable tax situation to enhance the value of these acquisitions.

The strategy is centered on growth through significant purchases, showing EnQuest is on the lookout for promising assets that could become key revenue generators. This focus reinforces their commitment to expanding their presence in their primary operational area.

- Strategic Focus: EnQuest's pursuit of new UK North Sea assets underscores a commitment to growth via acquisition.

- Differentiated Capabilities: The company aims to leverage its unique operating strengths and tax advantages.

- Future Stars: These acquisitions are intended to become high-potential, growth-driving assets for EnQuest.

- Portfolio Expansion: The strategy emphasizes building a stronger portfolio within its core UK North Sea region.

Potential New Country Entry in South East Asia

EnQuest is actively assessing a new country entry in Southeast Asia, building on its existing operations in Vietnam and an expanded presence in Malaysia. This strategic move targets emerging markets with substantial growth potential, aligning with EnQuest's objective to diversify its international footprint and leverage its operational capabilities.

While these new ventures begin with a nascent market share, they represent a calculated investment in future growth opportunities. Southeast Asia's economic dynamism, with projected GDP growth rates around 4-5% in key markets for 2024, offers a fertile ground for expansion.

- Strategic Expansion: EnQuest's exploration of a new Southeast Asian market underscores a deliberate strategy to tap into high-growth regions.

- Diversification Benefits: Entering a new country reduces reliance on existing markets and spreads operational risk.

- Future Growth Potential: Despite initial low market share, new entries are positioned to capture significant future market share as they mature.

- Market Opportunity: Southeast Asia continues to be a region of significant economic activity, with many countries showing robust GDP growth forecasts for 2024.

EnQuest's pursuit of new UK North Sea assets, coupled with its recent acquisition of Harbour Energy's Vietnam Block 12W and the promising DEWA PSC in Malaysia, positions these ventures as potential Stars in its BCG Matrix. These assets are characterized by high growth potential and a strong market position or the clear intent to establish one. The Kraken EOR project also aims to transform a mature asset into a growth engine, further bolstering EnQuest's Star portfolio.

| Asset/Venture | Current Status/Potential | Projected Impact/Growth | BCG Category |

| Vietnam Block 12W | Acquired assets, operational integration underway | Adds ~5.3 Kboed to 2025 pro forma production | Star |

| DEWA PSC (Malaysia) | New discovery, development in nascent stages | Estimated 500 Bscf gas, potential ~18 Kboed production | Star |

| Kraken EOR | Final investment decision expected within a year | Potential to recover 30-60 million additional barrels | Potential Star |

| New UK North Sea Acquisitions | Actively seeking opportunities | Leveraging specialized skills and tax advantages for growth | Potential Star |

| New Southeast Asia Entry | Assessing new country entry | Targeting emerging markets with substantial growth potential | Potential Star |

What is included in the product

The EnQuest BCG Matrix analyzes a company's product portfolio by plotting market share against market growth.

It provides strategic guidance on investing in Stars and Question Marks, milking Cash Cows, and divesting Dogs.

The EnQuest BCG Matrix provides a clear, one-page overview, instantly clarifying your portfolio's position and alleviating the pain of strategic uncertainty.

Cash Cows

The Kraken field is a prime example of a cash cow for EnQuest, consistently delivering strong operational results. In 2024, it achieved an impressive 96% production efficiency, underscoring its reliability. This field recently surpassed a significant milestone, having produced 70 million barrels of oil.

Its robust uptime and efficiency make Kraken a dependable generator of cash flow, even as the basin it operates in matures. This stable performance is crucial for EnQuest's overall production and financial health, cementing Kraken's status as a vital cash-generating asset.

Magnus Field stands as a cornerstone of EnQuest's operations, firmly positioned as a Cash Cow within the company's portfolio. In 2024, it consistently delivered strong performance, with average production reaching 14,173 barrels of oil equivalent per day (Boepd). This robust output was supported by an impressive production efficiency of 83%, underscoring the asset's maturity and reliability.

Despite facing some operational challenges, EnQuest has actively pursued well optimization initiatives and has strategic plans for future drilling to sustain Magnus's significant contribution. The field benefits from well-established infrastructure, which is crucial for its consistent output and cost-effective operations. This consistent performance directly translates into substantial and reliable cash flow generation for EnQuest, reinforcing its Cash Cow status.

EnQuest's PM8/Seligi asset in Malaysia is a prime example of a Cash Cow within the company's portfolio. Its operational performance in 2024 was robust, with Malaysian production reaching an average of 8,149 barrels of oil equivalent per day (Boepd), marking a significant 10% increase compared to 2023. This strong output was supported by an impressive 94% production uptime, highlighting its reliability.

The asset's status as a Cash Cow is further solidified by its future development plans and agreements. The sanctioning of a four-well drilling campaign slated for 2025, coupled with an enhanced gas agreement, indicates continued investment and a commitment to maximizing its value. These initiatives are expected to sustain its role as a stable, high-market-share contributor, generating consistent and dependable cash flow for EnQuest.

Golden Eagle Field (Non-operated)

Golden Eagle Field, a non-operated asset where EnQuest holds an interest, is a strong performer. In 2024, it maintained an impressive production efficiency of around 95%. This consistent operational success directly translates into reliable cash flow for EnQuest, even without direct operational management.

EnQuest's net production from Golden Eagle averaged 3,328 Boepd in 2024. This steady output, coupled with the asset's high efficiency, solidifies its position as a cash cow, providing a stable revenue stream with limited capital expenditure requirements from EnQuest's side.

- Asset: Golden Eagle Field (Non-operated)

- 2024 Production Efficiency: Approximately 95%

- 2024 Net Production: 3,328 Boepd

- Contribution: Consistent cash flow with minimal direct operational investment by EnQuest

Sullom Voe Terminal (SVT)

The Sullom Voe Terminal (SVT) is a cornerstone of EnQuest's operations, functioning as a vital cash cow within its portfolio. In 2024, SVT demonstrated exceptional operational resilience, achieving a perfect 100% export service availability. This reliability is crucial, as SVT, while not a direct production asset, is the essential midstream infrastructure that guarantees the smooth off-take of crude oil from EnQuest's UK North Sea fields.

This consistent export capability directly translates into stable revenue generation for EnQuest. By ensuring that produced oil can be efficiently transported and sold, SVT acts as a dependable cash flow enabler. Its role is foundational to the financial health of the company's North Sea segment.

- Operational Excellence: SVT achieved 100% export service availability in 2024, highlighting its reliability.

- Midstream Criticality: It supports EnQuest's UK North Sea production by facilitating crude oil off-take.

- Revenue Generation: SVT's infrastructure is key to consistent revenue streams for the company.

- Cash Flow Stability: As a stable cash flow enabler, SVT underpins EnQuest's financial performance.

Cash Cows represent mature, stable assets within a company's portfolio that generate consistent, predictable cash flow with minimal need for further investment. For EnQuest, these are the bedrock of its financial stability, allowing for reinvestment into growth areas or distribution to shareholders.

Assets like Kraken, Magnus, and PM8/Seligi exemplify this category, consistently contributing to EnQuest's revenue. The Sullom Voe Terminal, while infrastructure, also functions as a cash cow by ensuring the efficient sale of produced oil.

These established operations, characterized by high production efficiency and uptime, provide a reliable financial foundation. Their mature nature means they require less capital expenditure, making them dependable sources of profit.

| Asset | 2024 Production Efficiency | 2024 Net Production (Boepd) | Cash Flow Contribution |

|---|---|---|---|

| Kraken Field | 96% | N/A (Gross production data available) | Strong, reliable cash flow |

| Magnus Field | 83% | 14,173 | Substantial and reliable cash flow |

| PM8/Seligi | 94% | 8,149 | Stable, high-market-share contributor |

| Golden Eagle Field | ~95% | 3,328 | Stable revenue stream |

| Sullom Voe Terminal | 100% Export Availability | N/A (Infrastructure) | Dependable cash flow enabler |

What You See Is What You Get

EnQuest BCG Matrix

The EnQuest BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content—just the comprehensive, professionally formatted strategic analysis ready for your immediate use.

Dogs

Heather and Thistle fields are categorized as Dogs within EnQuest's BCG Matrix. These assets are currently in the decommissioning phase, with substantial well plug and abandonment (P&A) programs underway. For instance, EnQuest's 2023 annual report highlighted ongoing P&A activities across its portfolio, reflecting the mature nature of these fields.

While these decommissioning efforts are essential for responsible closure, they represent capital expenditure focused on cessation rather than revenue generation. This signifies that Heather and Thistle are at the tail end of their economic viability, a common characteristic of Dog assets in a portfolio.

EnQuest is actively managing these fields as part of its late-life asset strategy. The objective is to ensure an efficient and cost-effective cessation of production, aligning with the company's broader portfolio management approach.

EnQuest's overall production saw a dip in 2024 compared to the previous year, a trend partly attributed to the natural aging of its fields. Assets that are experiencing faster-than-expected production declines, especially when combined with rising operational expenses that aren't counterbalanced by new capital injections or efficiency improvements, can be categorized as 'dogs' within the BCG framework.

These assets consume valuable resources and capital without generating commensurate returns, potentially hindering the company's overall financial health. For instance, if a specific mature field's output drops by 15% year-over-year in 2024 and its operating costs per barrel increase by 10%, it would signal a weakening position, especially if no remedial actions are planned.

EnQuest might consider divesting smaller, non-core assets that don't align with its core strategy. These assets typically have a low market share and limited growth prospects, making them less attractive for further investment. For instance, if EnQuest were to focus solely on its North Sea mature fields and UK onshore operations, any smaller, unrelated international assets with minimal contribution would fall into this category.

Underperforming Exploration Acreage

Underperforming exploration acreage represents assets that have not met expectations, often due to poor geological results or unfavorable market conditions. This category includes areas where initial exploration efforts have yielded disappointing outcomes, making future commercial production unlikely. These holdings tie up valuable capital and resources without contributing to the company's revenue or market position.

For instance, in 2024, EnQuest's strategic review of its portfolio highlighted certain exploration licenses that were deemed non-core due to low prospectivity or high development costs. While specific acreage figures are proprietary, the company's focus has shifted towards optimizing existing production and acquiring more promising opportunities. This aligns with the BCG matrix principle of divesting or minimizing investment in low-growth, low-share assets.

- Low Prospectivity: Exploration areas with a low probability of discovering commercially viable hydrocarbon reserves.

- Capital Tie-up: Acreage that consumes financial resources without generating returns or contributing to future production.

- Strategic Divestment: Companies often look to exit or farm out such underperforming assets to focus on more promising ventures.

Assets Affected by Prolonged Third-Party Outages

Assets heavily dependent on third-party infrastructure, like offshore platforms or shared processing facilities, can become dogs in the EnQuest BCG Matrix. A prime example is the Ninian Central Platform outage in late 2024, which directly affected Magnus production. This incident underscores the significant risk posed by reliance on external, potentially vulnerable systems.

When these critical third-party assets experience prolonged outages, the impact on dependent production assets can be severe. Unpredictable and uncontrollable production stoppages lead to substantial cash flow disruptions. For instance, if a key pipeline or processing hub fails for an extended period, the associated upstream assets might be forced offline, generating no revenue during that time.

- Reliance on Third-Party Infrastructure: Assets are classified as dogs if their operational continuity is significantly jeopardized by the reliability of external providers, such as shared processing facilities or transportation networks.

- Impact of Outages: Prolonged disruptions to these third-party services, like the Ninian Central Platform incident in late 2024 impacting Magnus production, directly translate into lost revenue and reduced asset performance.

- Cash Flow Volatility: The uncontrollable nature of external failures introduces significant volatility into cash flows, making it difficult to forecast and manage financial performance for the affected assets.

Assets categorized as Dogs in EnQuest's BCG Matrix, like the Heather and Thistle fields, are mature and in the decommissioning phase, requiring significant capital for plug and abandonment (P&A) activities. These fields represent low market share and low growth potential, consuming resources without generating substantial returns, a common trait of 'dog' assets.

EnQuest's 2024 performance, showing a dip in overall production, partly reflects the natural aging of its portfolio. Fields experiencing rapid production declines and rising operational costs without new investment are prime candidates for the 'dog' classification, as seen with mature assets requiring cessation of production.

Underperforming exploration acreage and assets reliant on third-party infrastructure, which can suffer from outages like the Ninian Central Platform incident affecting Magnus production in late 2024, also fall into the 'dog' category. These situations highlight low prospectivity and significant operational risks that hinder revenue generation.

EnQuest's strategic focus in 2024 has been on optimizing existing production and divesting non-core, low-prospectivity exploration licenses. This approach aligns with managing 'dog' assets by minimizing investment and seeking to exit or farm out underperforming ventures.

Question Marks

The Bressay gas import project, a crucial subsea tie-back to the Kraken FPSO, is on track for a Final Investment Decision (FID) in 2025. This initiative is designed to significantly cut Kraken's emissions and operational expenses by replacing diesel fuel.

While the project promises substantial environmental and cost benefits, its ultimate contribution to EnQuest's market share and overall success remains a key consideration in its strategic positioning.

The Kraken field, a significant asset for EnQuest, is positioned as a cash cow. However, the planned infill drilling program, now scheduled for 2026 after a shift from 2025, signifies a substantial capital expenditure aimed at mitigating natural production decline and exploring opportunities for output enhancement.

The success of this 2026 drilling campaign is critical. It will directly influence whether Kraken can sustain and potentially grow its production levels, thereby reinforcing its cash cow status. Conversely, if the program encounters challenges or fails to deliver the anticipated production boosts, it could transform into a high-cost, uncertain venture for EnQuest.

EnQuest is set to drill four new infill wells in Malaysia in 2025, alongside ongoing compressor upgrades. This strategic move is designed to boost operational efficiency and reliability within its Malaysian assets.

These investments are crucial for maintaining production levels. However, in a market with limited growth, their ability to substantially expand EnQuest's market share is uncertain. The success of these initiatives will be a key indicator for future capital allocation decisions.

Veri Energy Renewable Ventures (Onshore Wind/CCS)

Veri Energy Renewable Ventures, EnQuest's subsidiary, represents a strategic move into the rapidly expanding energy transition sector, specifically focusing on onshore wind and Carbon Capture and Storage (CCS). These ventures are positioned as potential Stars or Question Marks within EnQuest's BCG Matrix, given their high-growth market potential but currently nascent market share for the company.

The company is targeting a Final Investment Decision (FID) for its onshore wind projects in late 2025. Concurrently, Veri Energy aims to achieve a carbon injection capacity of 2-3 million tonnes per year by 2030, underscoring a significant commitment to decarbonization technologies. This dual focus highlights EnQuest's ambition to diversify its energy portfolio and tap into future-proof markets.

- Market Position: Veri Energy's ventures are in nascent stages, indicating a low current market share for EnQuest in these high-growth areas.

- Investment Needs: Significant capital expenditure will be necessary to develop these onshore wind and CCS projects to maturity and scale.

- Growth Potential: The energy transition market offers substantial long-term growth prospects, aligning with global decarbonization trends.

- Strategic Importance: These initiatives are crucial for EnQuest's future strategy, aiming to balance its traditional oil and gas business with new, sustainable energy sources.

Ninian Bypass Project

The Ninian Bypass project, a subsea development designed to reroute oil from the Magnus field, is poised for a Final Investment Decision (FID) in 2025. This initiative is crucial for establishing a sustained export route for Magnus oil, particularly as the Ninian Central Platform faces a planned cessation of production in 2027.

The successful implementation of the Ninian Bypass is paramount for the continued operational life of the Magnus field. Given the dependence on this new infrastructure for long-term viability, the project represents a significant, albeit uncertain, investment for EnQuest.

- Project Status: Targeting FID in 2025.

- Strategic Importance: Secures long-term export for Magnus oil.

- Critical Dependency: Essential for Magnus field viability post-Ninian Central Platform COP (2027).

- Investment Profile: High-stakes, uncertain investment due to its critical nature and future dependence.

EnQuest's ventures in the energy transition, particularly through Veri Energy, are positioned as Question Marks in the BCG matrix. These represent high-growth potential markets where EnQuest currently holds a low market share.

Significant investment is required for these nascent projects, such as onshore wind and Carbon Capture and Storage (CCS), to achieve scale and maturity. The success of these ventures is crucial for EnQuest's long-term diversification strategy, balancing traditional oil and gas with sustainable energy.

The company is targeting FID for onshore wind in late 2025 and aims for 2-3 million tonnes per year carbon injection capacity by 2030, highlighting a commitment to future-proof markets despite current low market penetration.

The Ninian Bypass project, critical for Magnus field's export post-2027, also fits the Question Mark profile. It's a high-stakes investment with uncertain returns, dependent on successful implementation for long-term asset viability.

| BCG Category | EnQuest Asset/Venture | Market Growth | Market Share | Strategic Consideration |

|---|---|---|---|---|

| Question Mark | Veri Energy (Onshore Wind, CCS) | High | Low | Requires significant investment for growth; crucial for future diversification and decarbonization strategy. Targeting FID for onshore wind in late 2025. |

| Question Mark | Ninian Bypass Project | Moderate (Infrastructure dependent) | Low (New development) | Critical for Magnus field's long-term viability; FID targeted for 2025. Success is uncertain but essential for continued production. |

BCG Matrix Data Sources

Our EnQuest BCG Matrix is built on robust data, integrating financial disclosures, market research reports, and operational performance metrics to provide a comprehensive strategic overview.