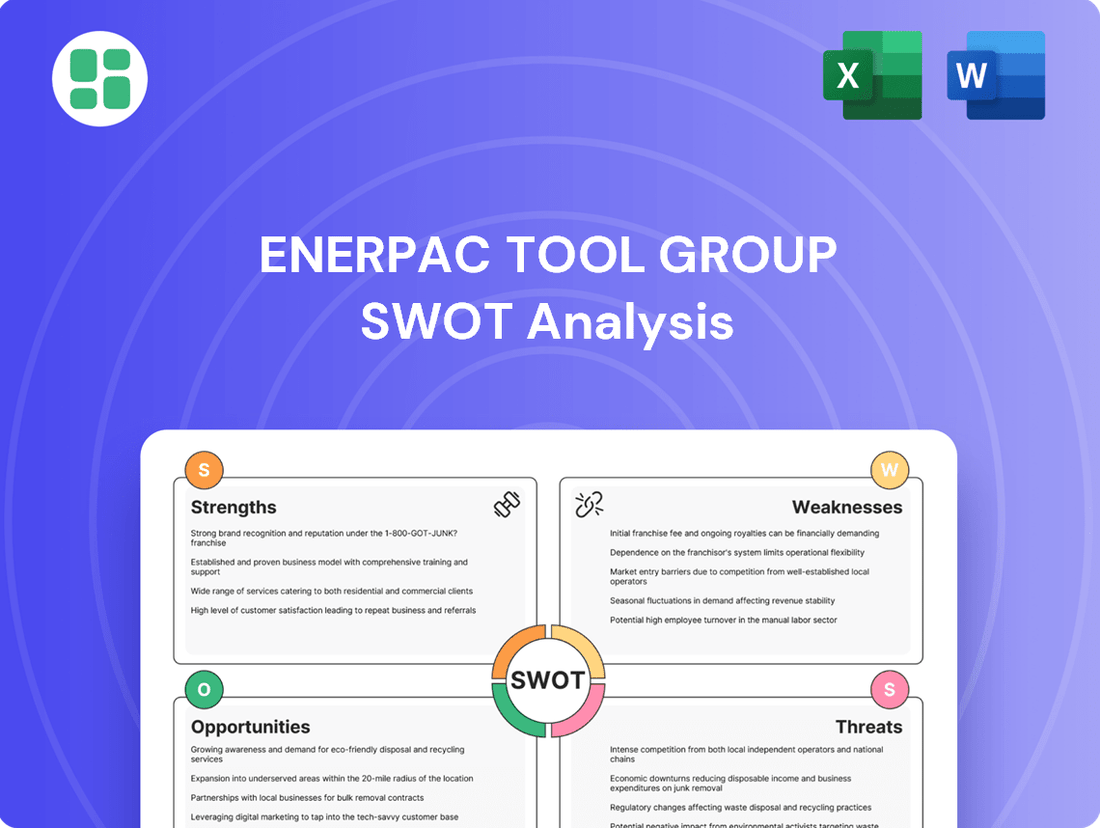

Enerpac Tool Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerpac Tool Group Bundle

Enerpac Tool Group's strengths lie in its robust product portfolio and established brand recognition within the industrial sector. However, understanding its vulnerabilities, such as supply chain disruptions and competitive pressures, is crucial for strategic planning. The full SWOT analysis provides a deep dive into these elements, offering actionable insights to navigate the market effectively.

Want the full story behind Enerpac Tool Group’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Enerpac Tool Group stands as a global leader in high-pressure hydraulic tools and controlled force solutions, a position built on decades of innovation and reliable performance. Their products are trusted for precise heavy load positioning in critical industries worldwide, a testament to their unwavering commitment to quality and safety.

The Enerpac brand is synonymous with durability and reliability, a reputation that resonates across over 100 countries where their solutions are deployed. This strong global recognition and established market presence provide a substantial competitive moat, allowing them to command premium pricing and foster deep customer loyalty.

Enerpac Tool Group showcased impressive financial health in fiscal year 2024, achieving a 2.2% organic growth. This performance was bolstered by exceeding its 25% adjusted EBITDA margin target a full year ahead of schedule.

The company's operational efficiency is clearly a strong suit, evidenced by expanded gross margins and adjusted operating profit. These gains are directly attributable to successful initiatives like the ASCEND program and Powering Enerpac Performance (PEP).

Further solidifying its financial strength, Enerpac maintained a robust balance sheet with a low net debt to adjusted EBITDA ratio of just 0.2x as of August 31, 2024. The consistent generation of solid free cash flow also highlights the company's operational and financial discipline.

Enerpac Tool Group boasts an impressive global distribution network, featuring over 900 channel partners worldwide. This extensive reach ensures comprehensive coverage for its diverse product lines and services across numerous geographical regions.

This robust network is instrumental in Enerpac's ability to effectively serve a wide array of customers and penetrate various end markets. The sheer breadth of their distribution capability allows for efficient product delivery and service support, crucial for maintaining customer satisfaction.

The widespread presence of these distributors is vital for accessing customers across key industries such as construction, manufacturing, infrastructure development, and the energy sector. For instance, in 2023, Enerpac reported that approximately 70% of its revenue was generated outside of North America, underscoring the importance of its international distribution strength.

Customer-Driven Innovation and Product Development

Enerpac's dedication to customer-driven innovation is a significant strength, showcased by the 2024 launch of its first battery-powered handheld torque wrench. This commitment ensures a steady stream of specialized solutions for industrial clients.

The integration of Enerpac Connect wireless connectivity into new pumps in 2024 further highlights this customer-centric approach. This technology enhances operational efficiency and data capture for users.

Furthermore, Enerpac's investment in an expanded Innovation Lab accelerates prototyping and product development cycles. This capability allows for quicker responses to evolving market needs and customer demands.

- Customer-Centric Product Pipeline: Introduction of battery-powered torque wrench and Enerpac Connect in 2024.

- Enhanced R&D Capabilities: Expanded Innovation Lab for faster prototyping.

- Market Responsiveness: Continuous development of specialized and advanced industrial solutions.

Successful Strategic Transformation and Commercial Programs

Enerpac Tool Group has demonstrated significant success in its strategic transformation efforts. The ASCEND program, which concluded in fiscal year 2024, surpassed its initial benefit targets, showcasing effective execution and value generation. This strategic shift is complemented by the ongoing Powering Enerpac Performance (PEP) program, which embeds sustainability and a culture of continuous improvement across operations.

Further bolstering its commercial capabilities, Enerpac launched the Enerpac Commercial Excellence (ECX) program. This initiative is specifically designed to sharpen sales effectiveness, improve the conversion rates within its sales funnel, and boost win rates, particularly in crucial markets such as the Americas and EMEA. These targeted programs collectively contribute to enhanced operational efficiency and a stronger market position.

- ASCEND Program Completion: Exceeded initial benefit targets in FY2024.

- PEP Program Integration: Incorporates sustainability and continuous improvement.

- ECX Program Focus: Drives commercial effectiveness, sales funnel conversion, and win rates in key regions.

Enerpac Tool Group's strong brand recognition and global presence are significant assets, allowing them to command premium pricing and cultivate deep customer loyalty across over 100 countries. Their financial performance in fiscal year 2024 was robust, with 2.2% organic growth and an adjusted EBITDA margin exceeding 25% a year ahead of schedule, demonstrating operational excellence through programs like ASCEND and PEP.

The company's commitment to customer-driven innovation is evident in the 2024 launch of its first battery-powered handheld torque wrench and the integration of Enerpac Connect wireless connectivity. This focus, coupled with an expanded Innovation Lab, ensures a pipeline of advanced solutions that meet evolving industrial demands.

| Strength Category | Key Initiatives/Data | Impact |

| Brand & Market Presence | Global presence in 100+ countries; Strong brand recognition | Premium pricing, customer loyalty |

| Financial Performance (FY2024) | 2.2% organic growth; Exceeded 25% adj. EBITDA margin target | Operational efficiency, financial discipline |

| Innovation & Product Development | Battery-powered torque wrench (2024); Enerpac Connect (2024); Expanded Innovation Lab | Market responsiveness, advanced solutions |

| Strategic Programs | ASCEND program exceeded targets; PEP program embeds continuous improvement | Enhanced operational efficiency, value generation |

What is included in the product

Delivers a strategic overview of Enerpac Tool Group’s internal and external business factors, highlighting key strengths in its product portfolio and market presence alongside potential weaknesses in operational efficiency and opportunities for diversification.

Offers a clear, actionable framework to identify and mitigate potential threats and weaknesses for Enerpac Tool Group.

Weaknesses

Enerpac Tool Group's net sales have seen a 4% year-over-year decrease in Q3 FY2024 and a 1.5% decline for the full fiscal year 2024. This dip is largely attributable to the sale of its Cortland Industrial business. While such divestitures are strategic moves, they can obscure the company's true organic growth by reducing overall reported revenue.

The disposition of Cortland Industrial, while a strategic decision, directly impacts Enerpac's top-line figures. This situation underscores a potential vulnerability where the company's reported revenue can be significantly influenced by the sale of specific business segments, making it harder to assess the performance of its core operations.

Enerpac Tool Group's performance is closely tied to the broader industrial sector, which experienced a slowdown in Q3 FY2024. This macroeconomic softness presents a significant challenge, impacting the company's growth trajectory.

The outlook for fiscal 2025 remains cautious, with expectations of a continued decline in the general industrial market. This trend could potentially dampen Enerpac's organic growth, even as the company strives to outpace industry trends.

The inherent sensitivity to these market fluctuations means that demand for Enerpac's specialized, highly engineered products can be quite volatile, directly reflecting the health of the general industrial landscape.

Enerpac Tool Group has faced challenges with fluctuating gross profit and operating margins. For instance, the company saw a decline in its gross profit margin by 140 basis points in Q3 FY2025 and a more significant drop of 240 basis points in Q4 FY2024 compared to the previous year.

These margin pressures are linked to a combination of factors, including lower year-over-year product sales and a shift in revenue mix towards services, which can sometimes carry lower margins. Additionally, the specific composition of its service projects has also impacted profitability, highlighting the ongoing need for careful management of its diverse business segments.

Regional and Sector-Specific Softness

Enerpac Tool Group has experienced notable softness in its service revenue, particularly within Europe. This is largely attributed to a broader economic slowdown affecting Western Europe, which has dampened demand for services. For instance, in the fiscal year 2023, while overall revenue saw growth, the service segment faced headwinds in specific geographies.

Further compounding these issues, certain regions like Australia have demonstrated persistent weakness. This is primarily driven by intense cost pressures within the mining sector. Additionally, the impact of steel and aluminum tariffs has negatively affected metal producers in these areas, indirectly influencing Enerpac's performance.

- European Service Revenue Decline: Observed softness in service revenue in Europe due to an overall economic slowdown in Western Europe.

- Australian Market Weakness: Continued weakness in Australia, stemming from cost pressures in the mining sector.

- Tariff Impact: Negative effects of steel and aluminum tariffs on metal producers, impacting regional demand.

- Growth Impediments: Localized challenges that hinder consistent global growth and require region-specific strategies.

Potential for Operational Inefficiencies Compared to Peers

Enerpac Tool Group's operational efficiency, when benchmarked against industry peers, presents a potential area for improvement. Some analyses indicate that the company may experience lower profitability metrics, such as EBITDA and gross profit ratios, in comparison to its competitors. This suggests that while initiatives like the PEP program are in place to drive efficiency, there remains an opportunity to further streamline operations to match or surpass industry benchmarks.

For instance, if Enerpac's EBITDA margin in 2024 was 12% while the industry average was 15%, this gap would highlight the need for enhanced cost management and productivity improvements. Such comparisons underscore the ongoing necessity for Enerpac to focus on optimizing its operational processes to bolster financial performance and competitive positioning.

- Lower Profitability Ratios: Enerpac may exhibit lower EBITDA and gross profit margins compared to industry peers, signaling potential operational inefficiencies.

- Efficiency Improvement Programs: While programs like PEP aim to address these issues, ongoing efforts are crucial to align with or exceed industry averages.

- Cost Management Focus: The company needs to maintain a continuous focus on cost control and productivity enhancements to improve its competitive standing.

Enerpac Tool Group faces challenges with fluctuating gross profit and operating margins, with a notable decline in gross profit margin by 140 basis points in Q3 FY2025 and 240 basis points in Q4 FY2024 year-over-year. These pressures stem from lower product sales and a revenue mix shift towards services, which can have lower margins, alongside project-specific profitability impacts.

The company's operational efficiency, when compared to competitors, indicates room for improvement, potentially showing lower EBITDA and gross profit ratios. While efficiency programs are in place, continuous focus on cost management and productivity is vital to enhance its competitive position and financial performance.

Localized economic slowdowns, particularly in Western Europe affecting service revenue, and persistent weakness in Australia due to mining sector cost pressures and tariff impacts on metal producers, present significant regional headwinds. These factors impede consistent global growth and necessitate tailored strategies for each market.

Full Version Awaits

Enerpac Tool Group SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file for Enerpac Tool Group. The complete, detailed version becomes available immediately after purchase, ensuring you get the full professional report.

Opportunities

Enerpac is strategically positioned to capitalize on significant growth within key vertical markets. The company has identified robust expansion opportunities in sectors like infrastructure, rail, and wind energy, all of which are experiencing substantial global investment. These markets are driven by the urgent need to upgrade aging infrastructure and the accelerating adoption of clean energy solutions.

The infrastructure sector, for instance, saw global construction spending projected to reach $14.8 trillion by 2030, highlighting the immense demand for specialized tools. Similarly, the renewable energy market, particularly wind power, is expanding rapidly. The global wind power market size was valued at $122.5 billion in 2023 and is expected to grow significantly, presenting a clear avenue for Enerpac’s high-capacity hydraulic tools.

Furthermore, the industrial Maintenance, Repair, and Operations (MRO) segment offers consistent demand. As industries worldwide focus on extending the life of existing assets and ensuring operational efficiency, the need for reliable and powerful maintenance tools remains high. Enerpac's focus on these expanding verticals allows it to leverage its expertise and product portfolio to meet this growing demand.

Enerpac's acquisition of DTA in September 2024 presents a significant opportunity to bolster its Heavy Lifting Technology (HLT) segment. DTA's expertise in mobile robotic solutions for heavy loads directly complements Enerpac's existing offerings, particularly in the area of on-site horizontal movement. This move strategically positions Enerpac to capitalize on the increasing demand for automation across industrial sectors.

The integration of DTA's automated solutions allows Enerpac to expand its product portfolio and reach new customer bases that are actively seeking to enhance operational efficiency through robotics. This strategic acquisition is a clear indicator of Enerpac's commitment to innovation and its intent to lead in automated heavy lifting technologies, a market projected for robust growth in the coming years.

Enerpac's integration of wireless connectivity, exemplified by Enerpac Connect in its new battery pumps, is a significant opportunity. This allows for enhanced product functionality, transforming traditional tools into smart solutions that provide valuable data and control.

Further digitalization of Enerpac's tool and service offerings can dramatically improve operational efficiency for customers. Features like improved data collection and remote monitoring capabilities directly address the growing demand for real-time insights and operational oversight in industrial settings.

This strategic push aligns perfectly with the overarching industry shift towards smart manufacturing and the Internet of Things (IoT) in industrial equipment. By embracing these trends, Enerpac can unlock new revenue streams and establish strong competitive differentiation in a rapidly evolving market.

Global Cross-Selling and Market Penetration

Enerpac's strategic acquisitions, such as DTA, present a significant opportunity for global cross-selling. By leveraging its established worldwide sales infrastructure, Enerpac can introduce new technologies to a broader customer base and penetrate markets previously underserved.

This expansion allows Enerpac to offer more comprehensive solutions, addressing a larger segment of customer needs and strengthening its position by capitalizing on existing distribution partnerships. The company's commitment to globalizing its Commercial Excellence (ECX) program is a key driver in achieving deeper market penetration and unlocking new revenue streams.

- Leveraging DTA Acquisition: Post-acquisition integration allows for cross-selling of DTA's specialized tooling through Enerpac's global network.

- Global Sales Network: Enerpac's extensive reach, evidenced by its presence in over 140 countries, facilitates the introduction of new product lines.

- End-to-End Solutions: The strategy aims to capture more of the customer's value chain, moving beyond single product sales.

- ECX Program Expansion: Global rollout of the ECX program is designed to standardize sales processes and boost market penetration rates.

Commitment to Environmental Sustainability and ESG Initiatives

Enerpac's growing emphasis on environmental sustainability and ESG initiatives, highlighted by its 2024 Corporate Responsibility Report and the completion of its first Greenhouse Gas (GHG) Inventory, offers a significant opportunity. This commitment can bolster its brand image and attract a widening segment of environmentally aware customers.

By focusing on product durability and implementing energy-saving programs, Enerpac can not only reduce operational costs but also strengthen its appeal. Engaging stakeholders on ESG topics further solidifies this positive perception, creating a competitive advantage in the market.

- Enhanced Brand Reputation: A strong ESG performance, as evidenced by their 2024 report, can significantly improve how Enerpac is perceived by customers, investors, and the wider public.

- Attracting ESG-Conscious Customers: With a growing number of consumers and businesses prioritizing sustainability, Enerpac's efforts can directly translate into increased market share.

- Potential Operational Cost Savings: Initiatives like energy reduction programs can lead to tangible financial benefits, improving overall profitability.

- Investor Appeal: Investors are increasingly scrutinizing ESG factors, making companies with robust sustainability commitments more attractive for investment capital.

Enerpac is well-positioned to benefit from global investments in infrastructure and renewable energy, sectors projected for substantial growth. The company's strategic acquisition of DTA in late 2024 enhances its Heavy Lifting Technology capabilities, tapping into the automation trend. Furthermore, Enerpac's focus on digital solutions and sustainability initiatives, as detailed in its 2024 Corporate Responsibility Report, opens doors to new revenue streams and strengthens its market appeal.

The company's ability to leverage its global sales network, which spans over 140 countries, is a key opportunity for cross-selling acquired technologies and expanding market penetration. By offering end-to-end solutions and enhancing its product connectivity through features like Enerpac Connect, the company aims to capture a larger share of the customer's value chain.

| Opportunity Area | Key Drivers | Supporting Data/Facts |

|---|---|---|

| Infrastructure & Renewables Growth | Global investment in infrastructure upgrades and clean energy adoption | Global construction spending projected to reach $14.8 trillion by 2030. Global wind power market valued at $122.5 billion in 2023. |

| DTA Acquisition Integration | Expansion of Heavy Lifting Technology (HLT) through automation and robotics | DTA acquisition completed September 2024. Focus on mobile robotic solutions for heavy loads. |

| Digitalization & Connectivity | Demand for smart manufacturing and IoT integration in industrial equipment | Introduction of Enerpac Connect in new battery pumps. Enhanced data collection and remote monitoring capabilities. |

| Global Sales Network & ECX | Cross-selling opportunities and deeper market penetration | Presence in over 140 countries. Global rollout of the Commercial Excellence (ECX) program. |

| Sustainability & ESG | Growing customer and investor focus on environmental responsibility | 2024 Corporate Responsibility Report. Completion of first Greenhouse Gas (GHG) Inventory. |

Threats

Economic uncertainty and a challenging macro-environment pose a significant threat to Enerpac Tool Group, potentially leading to a continued decline in the general industrial market. This slowdown could prompt customers to scale back or postpone capital expenditures, directly affecting demand for Enerpac's specialized hydraulic tools and solutions.

For instance, Enerpac has publicly acknowledged a cautious outlook for organic growth in fiscal year 2025, citing these prevailing economic conditions as a key factor. This suggests that the company anticipates a more subdued market performance in the near term due to these external pressures.

Enerpac Tool Group operates in a crowded industrial tools and services sector, where rivals frequently engage in aggressive pricing strategies. This intense competition puts constant pressure on Enerpac to maintain its operating margins, as price adjustments might be necessary to stay competitive. For instance, in the first quarter of fiscal year 2024, Enerpac reported a gross margin of 34.1%, a figure that could be squeezed if competitors offer lower prices.

Enerpac Tool Group is susceptible to disruptions in its supply chain, a vulnerability amplified by global geopolitical tensions and ongoing conflicts. These issues can cause significant delays in receiving necessary components, directly impacting production schedules and potentially leading to higher operational costs.

The company's ability to meet customer demand is directly threatened by these supply chain vulnerabilities. For instance, the ongoing global shipping challenges and regional conflicts in 2024 continue to create uncertainty, potentially forcing Enerpac to absorb increased freight costs or face production stoppages, as seen in the broader industrial manufacturing sector.

Impact of Tariffs and Commodity Price Fluctuations

The imposition or threat of tariffs presents a significant challenge for Enerpac Tool Group, potentially disrupting its cost structure and necessitating difficult pricing adjustments to preserve profit margins. For instance, in 2023, global trade tensions continued to create uncertainty, impacting companies reliant on international supply chains and component sourcing.

Fluctuations in the prices of key commodities like steel and aluminum directly threaten Enerpac's gross profitability. Rising material costs can squeeze margins if they cannot be fully passed on to customers. As of early 2024, steel prices have shown volatility, influenced by global demand and production levels, directly impacting manufacturers like Enerpac.

- Tariff Impact: Increased costs for imported components or finished goods, potentially leading to higher product prices for customers.

- Commodity Price Volatility: Direct effect on the cost of goods sold, impacting gross profit margins if price increases lag.

- Unpredictable Environment: These external factors are largely outside of Enerpac's direct control, creating financial performance uncertainty.

- Strategic Pricing Challenges: Balancing the need to absorb cost increases with maintaining competitive pricing is a constant threat.

Reliance on Independent Distribution Channels

Enerpac Tool Group's reliance on independent distribution channels, while a key enabler of its global reach, poses a significant threat. Disruptions in these relationships, whether due to economic downturns affecting distributors or shifts in their strategic priorities, could directly impact Enerpac's market access and sales performance. For instance, if a major distributor experiences financial difficulties, it could lead to a substantial loss of sales volume and hinder the availability of Enerpac products in key regions.

The performance of these independent partners is critical; a decline in their sales efforts, customer service quality, or technical support capabilities directly reflects on Enerpac's brand reputation. Maintaining consistent high performance across a diverse network of distributors, some of whom may represent competing product lines, requires ongoing effort and robust oversight. This dependency means Enerpac's ability to reach and serve its end customers is intrinsically linked to the operational health and strategic alignment of its distribution partners.

- Distribution Network Vulnerability: A significant threat arises if key independent distributors face financial distress or choose to discontinue representing Enerpac, potentially impacting market share in critical geographies.

- Partner Performance Risk: The quality of customer service and technical support provided by independent distributors directly influences customer satisfaction and brand perception; a decline in these areas poses a threat to Enerpac's market standing.

- Relationship Management Challenges: Ensuring consistent performance and alignment with numerous independent entities requires continuous investment in relationship management, which can be resource-intensive and prone to friction.

Intensifying competition within the industrial tools sector, characterized by aggressive pricing from rivals, presents a continuous threat to Enerpac's profit margins. For instance, in Q1 fiscal 2024, Enerpac reported a gross margin of 34.1%, a figure that could be pressured by competitors' pricing strategies.

Supply chain disruptions, exacerbated by geopolitical instability and ongoing conflicts, pose a significant risk to Enerpac's production and cost management. Global shipping challenges and regional conflicts in 2024 continue to create uncertainty, potentially increasing freight costs or causing production delays.

The company's reliance on independent distributors creates a vulnerability; if these partners face financial difficulties or alter their strategic focus, it could directly impact Enerpac's market access and sales performance. Furthermore, the quality of service provided by these distributors directly affects Enerpac's brand reputation.

| Threat Category | Specific Risk | Potential Impact | Data Point/Example |

| Competition | Aggressive Pricing by Rivals | Erosion of profit margins, reduced market share | Q1 FY24 Gross Margin: 34.1% |

| Supply Chain | Geopolitical Instability & Conflicts | Production delays, increased operational costs | Ongoing global shipping challenges in 2024 |

| Distribution | Distributor Financial Distress/Strategic Shifts | Reduced market access, sales decline, brand reputation damage | Dependency on partner performance for market reach |

SWOT Analysis Data Sources

This Enerpac Tool Group SWOT analysis is built upon a foundation of comprehensive data, including publicly available financial statements, detailed market research reports, and expert industry commentary to provide a thorough and accurate assessment.