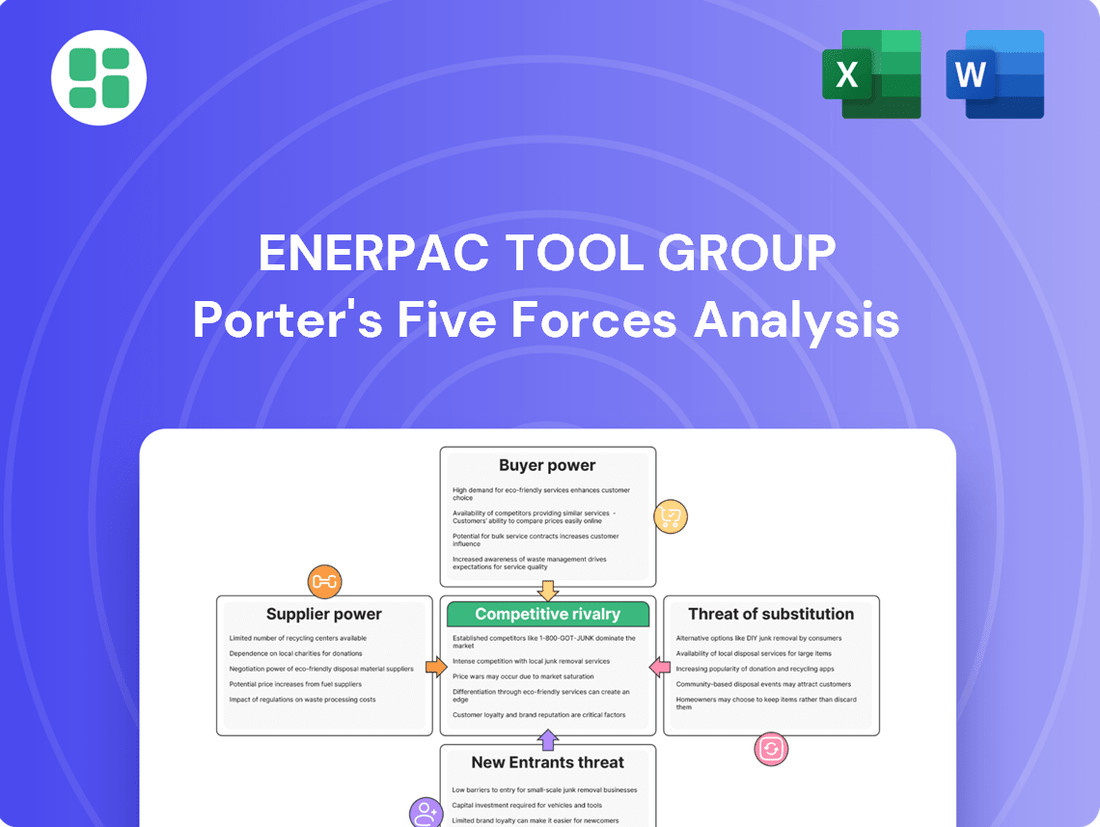

Enerpac Tool Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerpac Tool Group Bundle

Enerpac Tool Group navigates a competitive landscape shaped by moderate buyer power and the persistent threat of substitutes, particularly in specialized industrial applications. Understanding the intensity of rivalry and the influence of suppliers is crucial for strategic positioning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Enerpac Tool Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Enerpac Tool Group's reliance on specialized, highly engineered components for its core products, such as high-pressure hydraulic tools, means that suppliers of these critical parts hold significant sway. The limited number of firms capable of producing these sophisticated components directly translates to increased supplier bargaining power.

This concentration among specialized suppliers can exert upward pressure on Enerpac's input costs. For instance, if a key supplier of advanced hydraulic valves experiences production constraints or decides to increase prices, Enerpac may have few viable alternatives, impacting its profitability. In 2023, the industrial machinery sector, which Enerpac operates within, saw input cost inflation averaging around 4.5%, highlighting the general sensitivity to supplier pricing.

The cost and complexity for Enerpac Tool Group to switch suppliers for its highly specialized hydraulic components can be substantial. This involves significant investment in re-engineering existing products to accommodate new parts, re-tooling manufacturing lines, and undertaking rigorous re-certification processes for any new supplier's components to meet quality and safety standards.

These high switching costs empower Enerpac's existing suppliers, particularly those providing unique or proprietary parts, with considerable leverage. This leverage can translate into more favorable pricing negotiations and stricter contract terms, as Enerpac faces penalties or significant disruption if it attempts to change suppliers.

Suppliers offering proprietary technology or specialized components can wield significant bargaining power. Enerpac Tool Group's commitment to highly engineered products means certain inputs likely possess unique characteristics. For instance, if a supplier provides a critical, patented component essential for Enerpac's high-performance hydraulic tools, this uniqueness directly translates to greater supplier leverage.

This reliance on specialized inputs can restrict Enerpac's ability to switch suppliers easily, thereby limiting its negotiating power on pricing and terms. As of early 2024, the industrial sector has seen some supply chain disruptions for specialized metal alloys and advanced electronic components, which could amplify the bargaining power of suppliers in these niche areas for companies like Enerpac.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Enerpac Tool Group's operations, meaning they start manufacturing hydraulic tools or solutions themselves, is a factor that could increase their bargaining power. If a key supplier could effectively replicate Enerpac's product design, leverage its distribution channels, and maintain similar customer relationships, it would indeed shift the power dynamic.

However, for most component suppliers to Enerpac, this forward integration is likely a low-probability threat. The specialized nature of designing and manufacturing sophisticated hydraulic tools, coupled with Enerpac's established distribution network and deep customer relationships, presents significant barriers. For instance, in 2024, the capital expenditure required to establish a comparable manufacturing and distribution infrastructure for specialized industrial tools would be substantial, making it unfeasible for many smaller component providers.

- Specialized Manufacturing Expertise: Developing and producing high-pressure hydraulic systems requires specific engineering knowledge and quality control processes that are difficult for general component suppliers to replicate.

- Distribution Network Barriers: Enerpac's global reach and established relationships with distributors and end-users represent a significant hurdle for any supplier looking to enter the market directly.

- Customer Relationships and Brand Loyalty: Enerpac has cultivated strong relationships with its customer base over many years, which would be challenging for a new entrant, even a former supplier, to displace.

- High Capital Investment: The investment needed to match Enerpac's product portfolio and market presence would likely deter most suppliers from attempting forward integration.

Importance of Enerpac to Suppliers

The bargaining power of suppliers for Enerpac Tool Group is significantly shaped by how crucial Enerpac's business is to their overall revenue. If Enerpac constitutes a substantial portion of a supplier's sales, that supplier is likely to be more accommodating with pricing and terms to secure continued business. For instance, if a key component supplier for Enerpac's hydraulic cylinders derives 20% of its annual revenue from Enerpac, they have a vested interest in maintaining that relationship.

Conversely, if Enerpac is a minor client for a supplier, the supplier can afford to dictate terms more forcefully. For example, a supplier of specialized raw materials that only accounts for 1% of Enerpac's cost of goods sold might have considerable leverage if Enerpac relies heavily on that specific material and has few alternative sources. This dynamic directly impacts Enerpac's input costs and operational flexibility.

- Supplier Dependence: If Enerpac represents a large percentage of a supplier's total sales, the supplier has less incentive to exert strong bargaining power.

- Enerpac's Reliance: Conversely, if Enerpac is heavily dependent on a supplier for critical components, the supplier's bargaining power increases.

- Market Concentration: The number of alternative suppliers available for Enerpac's key inputs plays a crucial role; fewer alternatives mean greater supplier leverage.

The bargaining power of suppliers for Enerpac Tool Group is elevated due to the specialized nature of its hydraulic components. Limited alternative suppliers for critical, proprietary parts mean these providers can command higher prices and dictate terms. For instance, in 2024, the industrial sector experienced continued challenges in sourcing specialized alloys, a key input for high-pressure hydraulic systems, with some price increases reported in the range of 3-5% for these niche materials.

Enerpac's significant investment in re-engineering and re-tooling to switch suppliers for its highly engineered components creates substantial switching costs. This inertia empowers existing suppliers, especially those providing unique or patented parts, allowing them to leverage their position for more favorable pricing and contract conditions. The threat of suppliers integrating forward is generally low for Enerpac due to the high capital and expertise required to match its product portfolio and established distribution channels, a barrier that remained significant in 2024.

| Factor | Impact on Enerpac | Supporting Data (2024 Context) |

| Supplier Concentration | High bargaining power | Limited number of specialized hydraulic component manufacturers. |

| Switching Costs | High for Enerpac | Significant investment in re-engineering and re-tooling for new suppliers. |

| Proprietary Inputs | Increased supplier leverage | Suppliers of patented or unique components essential for performance. |

| Forward Integration Threat | Low probability | High capital and expertise barriers for suppliers to enter tool manufacturing. |

What is included in the product

This analysis delves into the competitive forces impacting Enerpac Tool Group, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the industrial tools market.

Instantly diagnose competitive pressures with a visually intuitive Porter's Five Forces analysis, enabling rapid strategic adjustments for Enerpac Tool Group.

Customers Bargaining Power

Enerpac Tool Group’s expansive reach across over 100 countries, serving diverse sectors like construction, manufacturing, and energy, significantly dilutes the bargaining power of individual customers. This broad customer base means no single client or industry segment holds substantial sway over Enerpac’s pricing or terms. For instance, in 2023, Enerpac reported that its sales were geographically diversified, with North America accounting for approximately 40% of total revenue, Europe around 30%, and the remaining 30% from other global regions, underscoring this point.

Customers relying on Enerpac's specialized high-pressure hydraulic tools and controlled force products often embed these solutions deeply within their critical operational workflows. The intricate nature of these applications, coupled with stringent safety mandates and the significant risk of operational disruption during a transition, results in substantial switching costs for clients. This inherent difficulty in changing providers effectively limits customer leverage, thereby bolstering Enerpac's pricing flexibility.

Enerpac Tool Group benefits significantly from its strong brand reputation, a key factor in its product differentiation. Customers consistently associate Enerpac with high quality, durability, reliability, and safety in specialized industrial tools. This perception is crucial as it allows Enerpac to command premium pricing and reduces customer willingness to switch to competitors based solely on price.

This strong brand identity translates into a powerful bargaining position for Enerpac. When customers view Enerpac products as superior or more dependable for critical operations, their price sensitivity decreases. For instance, in 2023, Enerpac reported a 7.8% increase in net sales, reaching $596.6 million, partly driven by the demand for its differentiated, high-performance products in demanding sectors.

Customer Price Sensitivity

Customer price sensitivity is a key factor for Enerpac Tool Group. While their products are sophisticated, buyers in industrial markets often focus on the overall cost, which includes not just the initial purchase but also ongoing maintenance and how efficiently the equipment runs. This means that even for specialized tools, the sticker price carries significant weight.

In the current economic climate, characterized by a soft industrial market, customers are likely to push harder on pricing. This pressure is particularly evident for products that are less unique or could be considered more standard. For instance, if Enerpac offers a range of hydraulic pumps, those with more common specifications might face greater price competition than highly specialized, custom-engineered solutions.

Enerpac's 2024 performance, as indicated in recent financial reports, reflects this dynamic. With industrial demand showing signs of cooling, the company may find it challenging to maintain premium pricing across its entire product portfolio. This sensitivity can impact sales volume and profit margins, especially if competitors offer similar functionality at a lower cost.

- Customer Focus on Total Cost: Industrial clients evaluate Enerpac's offerings based on purchase price, maintenance needs, and operational efficiency, not just initial outlay.

- Impact of Market Conditions: A soft industrial market in 2024 intensifies customer pressure on pricing, particularly for less differentiated products.

- Competitive Landscape: Enerpac must balance its engineered solutions with market realities where price can be a deciding factor against competitors offering comparable functionality.

Threat of Backward Integration by Customers

The threat of customers integrating backward to produce their own high-pressure hydraulic tools is generally low for Enerpac Tool Group. This is primarily due to the substantial capital investment, intricate engineering know-how, and complex manufacturing processes involved in creating specialized tools.

For most customers, the cost and effort of developing in-house production capabilities far outweigh the benefits. It is typically more economically viable and operationally efficient to source these specialized tools from established industry leaders like Enerpac, rather than undertaking the significant undertaking of backward integration.

- High Capital Requirements: Establishing a manufacturing facility for specialized hydraulic tools demands significant upfront investment in machinery, tooling, and infrastructure.

- Specialized Expertise: The design, engineering, and production of high-pressure hydraulic systems require a deep understanding of metallurgy, fluid dynamics, and precision manufacturing, which is difficult for non-specialists to replicate.

- Economies of Scale: Enerpac benefits from economies of scale in production, allowing them to offer competitive pricing that would be challenging for a new, in-house customer operation to match.

While Enerpac's broad customer base and the high switching costs associated with its specialized products generally limit customer bargaining power, market conditions and product differentiation play crucial roles. In 2024, a softer industrial market means customers are more price-sensitive, especially for less unique offerings. Enerpac's ability to command premium pricing is directly tied to the perceived value and differentiation of its engineered solutions versus more commoditized alternatives.

Customers often evaluate Enerpac's high-pressure hydraulic tools based on total cost of ownership, encompassing not just the purchase price but also maintenance and operational efficiency. This focus on overall value, rather than solely on initial outlay, influences their negotiation stance. For instance, while Enerpac reported a 7.8% net sales increase in 2023, market analysts anticipate increased price pressure in 2024, particularly for products lacking significant technological differentiation.

| Factor | Impact on Enerpac | 2024 Outlook |

|---|---|---|

| Customer Price Sensitivity | Moderate to High for standard products | Increased due to economic conditions |

| Switching Costs | High for specialized, integrated solutions | Remains a significant barrier for customers |

| Product Differentiation | Low for commoditized items, High for engineered solutions | Key to maintaining pricing power |

| Backward Integration Threat | Very Low | Remains negligible due to high investment and expertise |

What You See Is What You Get

Enerpac Tool Group Porter's Five Forces Analysis

This preview shows the exact Enerpac Tool Group Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive document delves into the competitive landscape, meticulously detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industrial tools sector. You'll gain actionable insights into the strategic positioning and market dynamics affecting Enerpac Tool Group.

Rivalry Among Competitors

Enerpac Tool Group operates in a fragmented industrial tools market, particularly for specialized hydraulic and controlled force products, where it holds a leading market share. This fragmentation means Enerpac faces a broad spectrum of competitors.

The competitive set includes large, diversified industrial conglomerates alongside smaller, highly specialized firms. Notable players such as Standex International, Graco, ITT, and Kennametal demonstrate this diversity.

This varied competitive environment, with both broad and niche players, naturally fuels a degree of rivalry within the sector.

Enerpac Tool Group operates within a general industrial sector that has experienced a sluggish or soft market environment recently. For fiscal year 2025, organic growth is anticipated to be modest, in the range of 0% to 2%.

This slower market expansion naturally heightens competitive rivalry. When the overall pie isn't growing much, companies like Enerpac are compelled to compete more aggressively for existing market share, rather than benefiting from a rapidly expanding industry.

Enerpac distinguishes itself through highly engineered products and solutions for precise heavy load positioning. Their commitment to customer-driven innovation, exemplified by the 2023 launch of battery-powered handheld torque wrenches, allows them to offer unique value. This focus on differentiation helps lessen direct price competition.

High Exit Barriers

Enerpac Tool Group operates within an industry characterized by high exit barriers. The significant investments in specialized manufacturing facilities, proprietary technology, and extensive global distribution networks create substantial fixed assets. These factors make it economically challenging for companies to leave the market, even when facing profitability issues.

This situation can lead to intensified competitive rivalry. Less profitable competitors may be compelled to remain in the market, fighting for survival and market share, particularly during economic downturns. This persistence can put downward pressure on pricing and margins for all players.

- Specialized Facilities: High capital expenditure for unique production equipment.

- Proprietary Technology: Investments in R&D and patents that are difficult to replicate.

- Global Distribution: Established networks that require significant time and resources to build.

- Market Persistence: Competitors may continue operating at a loss rather than abandon substantial investments.

Competitive Intensity and Strategic Initiatives

Enerpac Tool Group faces significant competitive rivalry, a factor amplified by its proactive strategic initiatives. The company's ASCEND transformation program, aimed at boosting operational efficiency and gross margins, directly challenges rivals by potentially lowering costs and increasing profitability. This focus on outperforming the industry, even in a subdued market, underscores a dynamic competitive landscape where Enerpac is actively seeking market share gains.

The intensity of competition is evident in Enerpac's commitment to strategic execution. For instance, in the first quarter of fiscal year 2024, the company reported a revenue of $141.4 million, demonstrating its operational activity amidst market conditions. Enerpac's strategic push to improve its financial performance inherently puts pressure on competitors to match or exceed these efforts.

- ASCEND Transformation: Drives operational efficiency and margin improvement, increasing competitive pressure.

- Market Share Focus: Enerpac aims to gain share even in a soft market, indicating high rivalry.

- Q1 FY24 Performance: Revenue of $141.4 million reflects active participation in a competitive environment.

- Profitability Drive: Initiatives to enhance profitability challenge rivals to improve their own performance.

Enerpac Tool Group navigates a competitive industrial tools market, facing a mix of large conglomerates and specialized firms. This rivalry intensifies due to high exit barriers, where substantial investments in facilities and technology keep less profitable competitors in the market, driving down prices and margins.

The company's strategic focus on differentiation through engineered products, like its battery-powered torque wrenches, helps mitigate direct price wars. However, Enerpac's own efficiency drives, such as the ASCEND transformation program, aim to outperform rivals, indicating a high level of competitive pressure to gain market share even in a slow-growth environment.

For fiscal year 2024, Enerpac reported revenue of $562.5 million, showcasing its active participation. The projected modest organic growth of 0% to 2% for fiscal year 2025 further fuels this rivalry, as companies must compete more aggressively for existing business.

| Metric | Value | Period |

|---|---|---|

| Total Revenue | $562.5 million | FY 2024 |

| Projected Organic Growth | 0% - 2% | FY 2025 |

| Q1 FY24 Revenue | $141.4 million | Q1 FY24 |

SSubstitutes Threaten

While Enerpac's high-pressure hydraulic tools excel in demanding applications, the threat of substitutes is present. Mechanical jacks, for instance, can handle lifting tasks, though often with less precision and slower operation. Pneumatic systems offer speed but typically lack the sheer force capacity of hydraulics for heavy industrial use. Lower-pressure hydraulic systems might suffice for less critical tasks, potentially at a lower cost.

The threat of substitutes for Enerpac Tool Group is moderate, primarily due to the specialized nature of its hydraulic tools. While cheaper alternatives might exist, they often fall short in delivering the high performance, reliability, and critical safety features demanded in heavy industrial, construction, and energy sectors. For instance, in 2024, industries reliant on precise lifting and positioning, like bridge construction or offshore oil rig maintenance, cannot compromise on the engineered safety margins Enerpac provides, making lower-cost, less robust substitutes a non-starter for mission-critical applications.

Customers in Enerpac's target markets, particularly those in industries like construction, mining, and energy, place a premium on safety, precision, and operational efficiency. For instance, in heavy lifting operations, a failure in equipment can lead to catastrophic consequences, including severe injuries or fatalities, and significant project delays. This inherent risk aversion means that marginal cost savings from cheaper, less reliable substitutes are often outweighed by the potential for equipment failure and its associated costs. In 2023, the industrial tools market, which Enerpac serves, saw continued investment in safety and efficiency upgrades, with companies prioritizing proven performance over unproven alternatives.

Enerpac's focus on high-performance, reliable hydraulic tools means customers are less likely to switch to substitutes that compromise on these critical attributes. The specialized nature of their equipment, designed for demanding applications, further solidifies customer loyalty. For example, Enerpac's torque wrenches, known for their accuracy, are essential in industries requiring precise bolt tightening to prevent structural failures. The threat of substitution is therefore considered low for Enerpac, as the performance and safety requirements of their core customer base create a strong barrier to entry for less specialized or less dependable alternatives.

Technological Advancements in Substitutes

Ongoing technological leaps in robotics and automation present a potential threat, as these innovations can offer alternative solutions for tasks traditionally handled by Enerpac's hydraulic tools. For instance, advancements in electric actuators are increasingly capable of performing certain lifting and positioning functions, potentially reducing reliance on hydraulic systems in specific applications.

Enerpac's strategic acquisition of DTA, a company specializing in mobile robotic solutions for heavy loads, underscores the company's recognition of this evolving landscape. This move suggests a proactive strategy to integrate and leverage emerging technologies, thereby mitigating the threat of substitution by embracing rather than resisting it.

- Robotics and Automation: Growing capabilities in automated systems can perform complex tasks, offering alternatives to manual or semi-automated hydraulic tool operations.

- Electric Actuators: These are becoming more powerful and efficient, providing a viable substitute for hydraulic cylinders in certain load-bearing and movement applications.

- Enerpac's DTA Acquisition: This 2023 acquisition (reported in late 2023) signals Enerpac's commitment to integrating advanced robotic solutions, directly addressing the threat of technological substitutes.

Scope of Services Offered

Enerpac Tool Group's threat of substitutes is somewhat mitigated by its extensive service offerings beyond just tools. These include rental programs, specialized bolting services, on-site machining, and comprehensive joint integrity solutions. This integrated approach fosters stronger customer loyalty and creates a higher barrier for competitors offering only standalone tools.

This broad service ecosystem makes it challenging for a simple product substitute to gain significant traction. A competitor would need to match not only Enerpac's tool quality but also its entire service infrastructure, which is a considerable undertaking. For instance, Enerpac's rental services alone provide a flexible alternative for customers needing equipment for short-term projects, reducing the immediate need for outright purchase and thus limiting the appeal of basic tool substitutes.

In 2024, the industrial services sector, which includes many of Enerpac's offerings, continued to see robust demand. Companies are increasingly looking for integrated solutions that streamline operations and reduce downtime. Enerpac's ability to provide these bundled services, from equipment to maintenance and specialized labor, directly addresses this market trend.

- Comprehensive Service Ecosystem: Enerpac offers rentals, bolting, machining, and joint integrity services, creating a sticky customer relationship.

- Barrier to Substitution: Competitors must replicate the entire service model, not just individual tools, to effectively substitute Enerpac.

- Market Trend Alignment: Enerpac's integrated solutions cater to the growing demand for streamlined operational support in the industrial services sector.

The threat of substitutes for Enerpac Tool Group is generally considered moderate to low, largely due to the specialized, high-performance nature of its hydraulic tools. While alternatives like mechanical jacks or pneumatic systems exist, they often lack the precision, force capacity, or safety features critical for Enerpac's core markets. For instance, in 2024, industries such as bridge construction and offshore maintenance continue to prioritize the engineered safety margins and reliability that Enerpac's hydraulic solutions provide, making cheaper substitutes impractical for mission-critical tasks.

Furthermore, Enerpac's robust service ecosystem, including rentals, specialized bolting, and joint integrity solutions, creates a significant barrier to substitution. Customers are often drawn to the integrated support and operational efficiency these services offer, making it difficult for competitors who only provide standalone tools to compete effectively. This comprehensive approach aligns with the 2024 market trend of seeking streamlined operational support, further solidifying Enerpac's customer relationships.

| Substitute Type | Pros | Cons relative to Enerpac | Likelihood of Substitution for Critical Tasks |

|---|---|---|---|

| Mechanical Jacks | Lower upfront cost | Slower operation, less precision, lower force capacity | Low |

| Pneumatic Systems | Faster operation | Limited force capacity compared to high-pressure hydraulics | Low to Moderate |

| Electric Actuators | Quieter, cleaner operation | May lack the extreme force or robustness for certain heavy-duty hydraulic applications | Moderate |

| Robotics/Automation | Increased automation potential | High initial investment, may not cover all specialized hydraulic tasks | Moderate |

Entrants Threaten

Entering the market for highly engineered hydraulic tools and controlled force products demands a significant upfront investment. This includes substantial outlays for research and development, the establishment of specialized manufacturing facilities, and the acquisition of advanced testing equipment. For instance, companies looking to compete with established players often need to invest tens of millions of dollars in new production lines and R&D capabilities.

Achieving economies of scale comparable to global leaders like Enerpac presents a considerable hurdle for newcomers. These established firms benefit from lower per-unit production costs due to high-volume manufacturing, which new entrants struggle to match initially. This cost disadvantage makes it difficult for new companies to price their products competitively and achieve profitability.

Enerpac Tool Group's deep roots, stretching back to 1910, are intertwined with a commitment to highly engineered solutions. This long history has undoubtedly fostered the development of proprietary technology and a robust portfolio of patents, creating significant intellectual property. For instance, their specialized hydraulic tooling often relies on unique designs and manufacturing processes that are difficult to replicate.

The considerable investment in research and development required to match Enerpac's advanced product capabilities presents a substantial hurdle for potential new entrants. Without access to this accumulated engineering expertise and patent protection, newcomers would struggle to offer comparable performance and reliability. This technological moat effectively deters many from entering the market.

Enerpac Tool Group, through its brands like Enerpac and Hydratight, benefits immensely from an established brand reputation and deep-rooted customer loyalty. These names are synonymous with quality, durability, and paramount safety, especially in demanding industrial sectors. For instance, in 2023, Enerpac Tool Group reported total revenue of $1.3 billion, a testament to the sustained demand for its trusted products.

Developing a comparable level of trust and brand loyalty requires substantial time, considerable financial investment, and a consistent track record of high performance. This formidable barrier makes it exceptionally challenging for new companies to swiftly gain a significant foothold in the market against such established players.

Extensive Global Distribution and Service Network

Enerpac Tool Group's formidable global distribution and service network presents a significant barrier to new entrants. With over 900 channel partners, the company ensures its products and support reach customers in more than 100 countries.

This extensive reach is not easily replicated. Establishing a comparable network requires substantial investment in logistics, partnerships, and localized service capabilities, making it a daunting challenge for any newcomer aiming to compete on a global scale.

- Global Reach: Over 900 distributors worldwide.

- Customer Base: Operations in over 100 countries.

- Barrier to Entry: High cost and complexity of replicating the network.

Regulatory and Safety Standards

The threat of new entrants for Enerpac Tool Group is significantly influenced by the demanding regulatory and safety standards prevalent in its core markets. Industries such as construction, energy, and infrastructure, where Enerpac operates, are subject to rigorous safety regulations and performance benchmarks for tools and equipment. For instance, in the United States, OSHA (Occupational Safety and Health Administration) sets stringent safety standards for construction sites, impacting the types of equipment that can be used and how they are maintained. Similarly, the energy sector often adheres to API (American Petroleum Institute) standards, which dictate performance and reliability requirements.

New companies looking to enter these sectors face substantial hurdles in navigating and complying with these complex regulatory frameworks. The process of understanding, implementing, and obtaining certifications for tools and equipment to meet these standards can be both time-consuming and capital-intensive. This creates a significant barrier, as new entrants must invest heavily in research and development, testing, and legal compliance before they can even begin to compete effectively. In 2024, the global industrial safety equipment market was valued at approximately $50 billion, with a significant portion driven by regulatory compliance, underscoring the substantial investment required to meet these standards.

Key aspects of these barriers include:

- High Compliance Costs: New entrants must absorb the costs associated with meeting safety certifications, product testing, and adherence to industry-specific performance requirements, which can run into millions of dollars.

- Technical Expertise: Developing products that meet stringent safety and performance standards requires specialized engineering knowledge and a deep understanding of regulatory nuances, a capability that takes time and resources to build.

- Market Access Restrictions: Certain projects or tenders may explicitly require suppliers to have a proven track record of compliance and specific certifications, making it difficult for new, unproven entities to gain initial market access.

The threat of new entrants for Enerpac Tool Group is considerably low due to the substantial capital requirements for research, development, and specialized manufacturing facilities. Newcomers often need to invest tens of millions of dollars to establish production lines and R&D capabilities on par with industry leaders.

Established players like Enerpac benefit from significant economies of scale, leading to lower per-unit production costs that are difficult for new entrants to match. This cost disadvantage hinders their ability to compete on price and achieve profitability early on.

Enerpac's extensive history, dating back to 1910, has cultivated proprietary technology and numerous patents, creating a strong intellectual property barrier. Replicating their specialized designs and manufacturing processes is a significant challenge for potential competitors.

The company's established brand reputation and deep customer loyalty, built over decades, represent another formidable barrier. For instance, Enerpac Tool Group reported $1.3 billion in revenue in 2023, reflecting sustained demand for its trusted products.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment in R&D, manufacturing, and testing. | Requires tens of millions of dollars for initial setup. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | New entrants face higher initial costs and pricing challenges. |

| Proprietary Technology & Patents | Unique designs and manufacturing processes. | Difficult and costly for new firms to replicate. |

| Brand Reputation & Customer Loyalty | Established trust and recognition in the market. | New entrants struggle to build comparable credibility. |

Porter's Five Forces Analysis Data Sources

Our Enerpac Tool Group Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial reports, industry-specific market research from firms like IBISWorld, and competitive intelligence gathered from trade publications and company announcements.