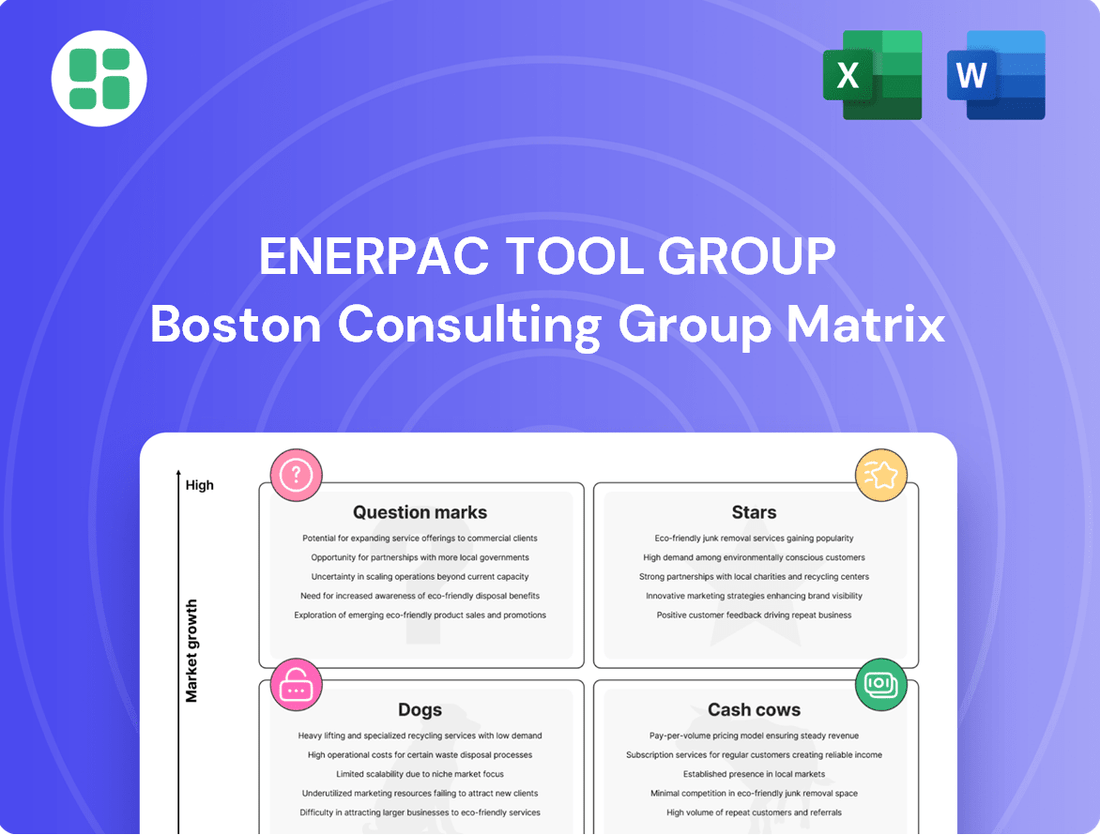

Enerpac Tool Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerpac Tool Group Bundle

Curious about Enerpac Tool Group's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but to truly understand their strategic positioning—identifying Stars, Cash Cows, Dogs, and Question Marks—you need the full picture. Purchase the complete BCG Matrix for a detailed breakdown and actionable insights to drive your investment decisions.

Stars

Enerpac's battery-powered bolting tools, like the BTW-Series Torque Wrench and SC-Series Pumps, are entering a market segment that's really taking off. Think of how much easier it is to work without cords! This cordless industrial tool market is booming, with global sales projected to reach over $20 billion by 2027, showing a clear demand for these types of products.

These tools aren't just cordless; they pack some serious tech. Features like digital motor control and wireless communication give them a real edge over older equipment. This innovation is key, as companies are increasingly looking for ways to boost productivity and safety on job sites, making these advanced tools highly attractive.

Enerpac's recent launch of these products signals a strategic move to dominate this expanding sector. By focusing on cutting-edge technology and user convenience, they're aiming to grab a significant slice of the market, particularly as industries continue to prioritize efficiency and on-site mobility.

Enerpac Tool Group's commitment to digital transformation, exemplified by the integration of Enerpac Connect wireless connectivity into its product lines, positions this segment as a high-growth potential area. This focus on smart solutions, delivering real-time data and improved accuracy, directly addresses the needs of industries prioritizing operational efficiency and data traceability.

These advanced offerings are strategically developed to capture market leadership by incorporating cutting-edge technology and proactively addressing evolving customer demands, signaling a forward-looking approach to the connected solutions market.

Enerpac's strategic move into specialized rail infrastructure solutions, highlighted by the acquisition of Track Tools technology and the launch of the TL248 Track Lift System, positions them to capitalize on global rail infrastructure upgrades. This focus on precision hydraulic tools for rail maintenance aims to enhance safety and efficiency in a sector projected for substantial growth.

Advanced Heavy Lifting Technology

Enerpac Tool Group's Advanced Heavy Lifting Technology (HLT) segment, encompassing gantry systems and specialized lifting solutions, is a key player in demanding sectors like construction and infrastructure. The company's commitment to innovation is evident in products such as the ML40 Mini Lift Gantry, designed for intricate positioning tasks. This focus addresses a global need for reliable heavy load management in complex projects.

The SBL600 Super Boom Lift exemplifies Enerpac's capability in handling substantial weights, crucial for large-scale infrastructure development. These technologies are not merely theoretical; their application in real-world projects, like the significant lift of the ITER Tokamak magnet, demonstrates their practical efficacy and market leadership. This segment operates in a specialized, high-demand niche, requiring continuous technological advancement to meet client needs.

- Market Focus: Construction and infrastructure projects requiring precise heavy load handling.

- Key Innovations: ML40 Mini Lift Gantry and SBL600 Super Boom Lift showcase advanced engineering.

- Real-World Application: Successful deployment in projects like the ITER Tokamak magnet lift validates technological capabilities.

- Market Position: Leading provider in a specialized, high-demand segment driven by global infrastructure growth.

Solutions for Renewable Energy Sector

Enerpac is strategically focusing on the renewable energy sector, particularly wind power, by offering specialized hydraulic tools designed for the maintenance, repair, and installation of wind turbines. This move aligns with the global imperative to transition to cleaner energy sources, creating a significant growth avenue for the company.

The wind energy market is experiencing robust expansion. For instance, global wind power capacity saw a significant increase, with approximately 116 GW of new capacity added in 2023, bringing the total to over 1,000 GW. This expansion fuels the demand for specialized equipment like that provided by Enerpac.

Enerpac's deep-rooted expertise in hydraulic technology and its comprehensive product portfolio are key differentiators. They are well-positioned to capitalize on this burgeoning market, aiming to secure a substantial portion of this high-growth industrial segment.

- Targeted Wind Energy Solutions: Enerpac provides hydraulic equipment specifically engineered for wind turbine maintenance, repair, and installation.

- Accelerating Growth Market: The global push for renewable energy, especially wind power, presents substantial growth opportunities.

- Market Position: Enerpac's established expertise and product range enable it to capture significant market share in this expanding sector.

- Industry Data: Global wind power capacity surpassed 1,000 GW in 2023, with significant new installations annually, underscoring market demand.

Enerpac's battery-powered bolting tools are positioned as Stars in the BCG Matrix due to their presence in a rapidly growing market and their innovative features. The cordless industrial tool market is projected for significant expansion, with global sales expected to exceed $20 billion by 2027, indicating strong demand. Enerpac's focus on advanced technology and user convenience, including features like digital motor control and wireless connectivity, sets them apart. This strategic emphasis on cutting-edge solutions aims to capture a leading position in this dynamic sector.

What is included in the product

The Enerpac Tool Group BCG Matrix categorizes its product lines into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business unit.

The Enerpac Tool Group BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain of complex portfolio analysis.

Cash Cows

Enerpac's core high-pressure hydraulic cylinders and pumps are its foundational products, boasting deep market penetration. These essential tools are vital for mature industrial sectors such as general manufacturing and infrastructure upkeep.

Their established reputation for quality and dependability fuels consistent demand and robust cash flow. In 2024, Enerpac reported strong performance in its industrial tools segment, which is heavily influenced by these core product lines, indicating their continued cash cow status.

Standard bolting tools, a cornerstone of Enerpac Tool Group's offerings, represent a classic cash cow. These hydraulic and mechanical solutions cater to a stable, mature market where precision fastening is a consistent requirement. Enerpac's robust brand and widespread distribution ensure they maintain a significant market share in this segment.

While the growth in this sector might be moderate, the established position of these tools translates into dependable profits and robust cash flow for Enerpac. For instance, in 2024, the industrial bolting market, a key area for these tools, continued to show steady demand, with reports indicating consistent year-over-year revenue growth in the low single digits for established players.

The Industrial Tools & Services (IT&S) segment is Enerpac's powerhouse, driving the majority of its revenue and profit. This segment is characterized by steady organic sales growth and impressive profitability, making it the company's primary cash generator.

Within IT&S, core product sales and service revenues consistently contribute to robust financial performance. The segment's high adjusted EBITDA margin, which has historically been in the low to mid-20% range, underscores its efficiency and strong cash-generating capabilities, vital for funding other areas of the business.

Global Aftermarket Services and Rental

Enerpac Tool Group’s Global Aftermarket Services and Rental segment, encompassing bolting, machining, and joint integrity services, represents a significant contributor to the company's revenue and profitability. This segment is characterized by its resilience and high-margin nature, as evidenced by strong growth in service revenue during FY2024 and specifically in Q3 FY2024.

The strength of this segment is further bolstered by Enerpac's substantial installed base of products, which generates a consistent and recurring revenue stream. While growth in this area might be lower compared to other segments, its inherent stability makes it a valuable component of the company's portfolio.

- Service Revenue Growth: Demonstrated strong performance in FY2024 and Q3 FY2024.

- High-Margin Business: Bolting, machining, and joint integrity services offer attractive profitability.

- Recurring Revenue: Benefits from the extensive installed base of Enerpac products.

- Stability: Provides a dependable revenue stream with lower growth but high predictability.

Established Distribution Network

Enerpac Tool Group's established distribution network is a key strength, functioning as a classic Cash Cow within its BCG Matrix. This robust global channel partner network includes over 900 distributors operating in more than 100 countries, creating a solid foundation for sales and service.

This extensive reach ensures that Enerpac's mature product lines benefit from consistent market penetration and predictable sales volumes. The long-standing relationships cultivated with these partners over many years are instrumental in maintaining market share and generating reliable cash flow.

- Global Reach: Over 900 distributors in more than 100 countries.

- Stable Sales Infrastructure: Provides consistent sales and service for mature products.

- Predictable Cash Flow: Strong, long-term relationships ensure sustained market share.

- Low Investment Needs: Requires minimal new investment for maintenance and continued operation.

Enerpac Tool Group's core high-pressure hydraulic cylinders and pumps are definitive cash cows. These products serve mature industries like manufacturing and infrastructure, ensuring consistent demand and robust cash flow. In 2024, Enerpac's industrial tools segment, driven by these foundational offerings, demonstrated strong performance, solidifying their cash cow status.

Standard bolting tools also fit the cash cow profile, catering to a stable market requiring precision. Enerpac's strong brand and distribution ensure significant market share. While growth is moderate, these tools provide dependable profits and cash flow, with the industrial bolting market showing steady demand and low single-digit revenue growth for established players in 2024.

The Global Aftermarket Services and Rental segment, including bolting, machining, and joint integrity, is another key cash cow. This segment is resilient and high-margin, with strong service revenue growth in FY2024 and Q3 FY2024. Its stability, stemming from Enerpac's large installed product base, provides a predictable revenue stream, even with lower growth rates.

Enerpac's extensive distribution network, with over 900 distributors in more than 100 countries, acts as a cash cow by ensuring consistent market penetration for mature products. These long-standing relationships generate reliable cash flow with minimal new investment needs.

| Product/Service Category | BCG Matrix Classification | Key Characteristics | 2024 Financial Insight |

| High-Pressure Hydraulic Cylinders & Pumps | Cash Cow | Mature markets, deep penetration, high dependability | Strong performance in Industrial Tools Segment |

| Standard Bolting Tools | Cash Cow | Stable market, precision fastening, strong brand | Steady demand, low single-digit revenue growth |

| Global Aftermarket Services & Rental | Cash Cow | Resilient, high-margin, recurring revenue | Strong service revenue growth FY2024 & Q3 FY2024 |

| Global Distribution Network | Cash Cow | Extensive reach, predictable sales, low investment needs | Ensures consistent market penetration and reliable cash flow |

Delivered as Shown

Enerpac Tool Group BCG Matrix

The preview you are seeing is the complete Enerpac Tool Group BCG Matrix document you will receive immediately after your purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a fully formatted and professionally designed report ready for strategic analysis.

What you see here is the exact Enerpac Tool Group BCG Matrix report that will be delivered to you upon completing your purchase. This comprehensive analysis is crafted for clarity and immediate application in your business planning, offering actionable insights without any hidden surprises.

This preview accurately represents the final Enerpac Tool Group BCG Matrix file you’ll obtain after purchase. Once bought, you’ll have immediate access to this professionally prepared document, perfect for editing, presenting, or integrating into your strategic decision-making processes.

The Enerpac Tool Group BCG Matrix report you are currently reviewing is the identical, fully functional document you will download after your purchase. This ensures you receive a polished, analysis-ready file designed for professional use, ready to support your strategic initiatives.

Dogs

Enerpac Tool Group's divestiture of its Cortland Industrial business in July 2023 marks a significant strategic realignment. This move suggests Cortland Industrial was a low-growth, low-market-share component within the broader Enerpac portfolio, not fitting the company's focus on pure-play industrial tools.

The sale of Cortland Industrial, which was completed for $105 million, allows Enerpac to concentrate resources on its higher-potential segments. This divestment is typical for companies aiming to shed non-core or underperforming assets, thereby improving overall operational efficiency and financial flexibility.

The legacy Engineered Components & Systems (EC&S) segment of Enerpac Tool Group was divested by Q4 2019, marking a strategic shift. This segment was deemed non-core, likely characterized by limited growth and market share, thus consuming resources inefficiently.

The sale of EC&S allowed Enerpac to streamline its operations and concentrate on its core industrial tools and services business. This move was aimed at improving overall profitability and resource allocation for higher-return opportunities.

Enerpac's older hydraulic and bolting equipment, lacking features like battery power and connectivity, are becoming outdated product generations. These legacy tools, while still functional, are seeing a decline in market relevance as customers increasingly demand more efficient and technologically advanced solutions. For instance, a significant portion of the industrial bolting market in 2024 is shifting towards digital torque monitoring and data logging, features absent in older models.

Underperforming Regional Pockets

While Enerpac Tool Group generally demonstrates solid organic growth, certain regional pockets can lag behind. For example, the EMEA (Europe, Middle East, and Africa) region experienced a revenue decline in certain fiscal periods, suggesting areas of underperformance. These regions might require strategic adjustments or a re-evaluation of market conditions to improve their standing.

These underperforming regional pockets could be considered as potential Dogs in the BCG Matrix. Their slower growth and potential market share challenges mean they might not generate significant cash flow and could even require investment to turn around. For instance, if a specific European market saw a 5% revenue contraction in 2023 while the overall company grew 8%, that region would be a prime candidate for this classification.

- Regional Performance Disparities: Not all geographic areas contribute equally to Enerpac's growth.

- EMEA Challenges: The EMEA region has shown periods of revenue decline, highlighting specific underperforming markets.

- Potential Cash Traps: These slower-growing regions risk becoming cash drains if not managed strategically.

- Strategic Re-evaluation Needed: Areas with declining revenue require careful analysis and potential restructuring to improve performance.

Non-Strategic Product Offerings with Limited Scope

Enerpac Tool Group's portfolio may include niche products that don't fit its core high-pressure hydraulics or controlled force strategy. These could be items with limited market application or a weak competitive edge.

These offerings often contribute minimally to overall revenue and hold a small market share. They might also consume resources that could be better allocated to more strategic business units, given their low growth potential.

- Limited Market Application: Products serving very specific, small industries or specialized tasks outside Enerpac's main hydraulic expertise.

- Low Market Share: These items likely struggle to gain significant traction against more established or specialized competitors.

- Disproportionate Resource Allocation: The cost of developing, marketing, and supporting these products may outweigh the revenue they generate.

Enerpac Tool Group's portfolio may contain certain legacy products or regional operations that exhibit low growth and low market share. These segments, often characterized by declining demand or intense competition, can be classified as Dogs in the BCG Matrix.

For instance, older generations of hydraulic tools that lack modern features like battery power or digital connectivity might fall into this category. In 2024, the industrial sector's increasing demand for smart, connected equipment makes these older products less competitive, potentially leading to a shrinking market share and minimal growth.

These Dog segments can act as cash traps, requiring ongoing investment for maintenance or support without generating significant returns. Enerpac's strategic decisions, such as the divestiture of non-core assets, often aim to shed these low-performing units to reallocate capital to more promising areas.

Identifying and managing these Dog components is crucial for optimizing Enerpac's overall portfolio performance and ensuring resources are directed towards segments with higher growth and profitability potential.

Question Marks

Enerpac's foray into battery-powered hydraulic pumps like the XC2-Series targets a burgeoning market fueled by demands for enhanced portability and operational efficiency. This strategic move positions Enerpac to capitalize on evolving industry needs, moving beyond its traditional strengths.

While Enerpac boasts a strong legacy in hydraulic technology, its cordless pump offerings are relatively new. The challenge lies in rapidly securing significant market share against established competitors and agile new entrants in this high-growth segment. This requires aggressive market penetration strategies.

To translate the high potential of these battery-powered solutions into market dominance, substantial investments in marketing initiatives and robust channel development are essential. For instance, the global cordless power tool market, a closely related sector, was valued at approximately $25.5 billion in 2023 and is projected to grow significantly, indicating the substantial opportunity for Enerpac's XC2-Series.

Enerpac is actively integrating IoT capabilities and developing digital twins for its hydraulic systems, placing these offerings in a high-growth technological sector. Products utilizing Enerpac Connect, which provides traceability and data access, exemplify this forward-looking strategy.

The market adoption for these advanced digital tools is likely in its nascent stages, demanding significant investment to achieve scale and establish a leading market position before competitors can gain traction.

Enerpac Tool Group views the Asia-Pacific region as a significant opportunity for expansion, identifying it as a market with outsized growth potential. While currently a smaller contributor to their overall business, this suggests a classic 'Question Mark' scenario in the BCG matrix – high market growth but low relative market share.

To capitalize on this, Enerpac is planning substantial investments. These will focus on market development, tailoring products to local needs, and broadening their distribution networks. For instance, in 2024, the Asia-Pacific industrial equipment market is projected to grow by approximately 6-8%, presenting a fertile ground for Enerpac's strategic initiatives.

Advanced Automation and Robotics Integration Solutions

The industrial sector's rapid shift towards automation and smart manufacturing is fueling a robust market for integrated hydraulic and robotic solutions. Enerpac's specialized offerings, designed to enable precise heavy load positioning within automated workflows, are well-positioned to capture early market share in this high-growth arena.

These advanced solutions represent a significant investment in research and development, necessitating strategic alliances to fully exploit their considerable growth potential. The global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially in the coming years, driven by demand for increased efficiency and precision.

- High Growth Potential: The increasing adoption of Industry 4.0 principles creates a fertile ground for advanced automation and robotics.

- Market Entry: Enerpac's integrated solutions are likely in the initial phases of market penetration, aiming to establish a strong foothold.

- Strategic Imperatives: Significant R&D investment and key partnerships are crucial for capitalizing on the market's expansion.

- Key Applications: Precise positioning of heavy loads in automated assembly lines and logistics are prime use cases.

Strategic Acquisitions for New Capabilities (e.g., DTA)

Enerpac Tool Group's acquisition of DTA in September 2024 is a prime example of its strategic move to bolster capabilities, fitting the profile of a potential Star or Question Mark in the BCG matrix. This inorganic growth initiative aims to integrate DTA's specialized offerings, likely in a high-growth niche where Enerpac's current market presence is nascent but future potential is substantial.

The successful integration of DTA is paramount for Enerpac to capitalize on this strategic acquisition. This involves not only merging operational aspects but also leveraging DTA's technology and market access to drive growth and capture significant market share in its target segments.

Enerpac's investment in DTA underscores a commitment to expanding its technological portfolio and market reach. The company will be closely watched to see how effectively it can synergize DTA's operations with its existing business to unlock new revenue streams and solidify its position in emerging markets.

- Acquisition Date: September 2024

- Strategic Rationale: Expansion of offerings and entry into high-growth niches.

- BCG Matrix Implication: Positions DTA as a potential Star or Question Mark for Enerpac.

- Key Success Factor: Effective integration and market share capture.

Enerpac Tool Group's focus on the Asia-Pacific region represents a classic Question Mark in the BCG matrix. This segment exhibits high market growth potential, with the industrial equipment market in Asia-Pacific projected to grow by 6-8% in 2024.

However, Enerpac's current market share in this region is relatively low, necessitating significant investment in market development and localized product strategies to capture a stronger position.

The company's strategic initiatives, including expanding distribution networks and tailoring products, are crucial for transforming this high-potential market into a significant revenue driver.

Enerpac's acquisition of DTA in September 2024 also fits the Question Mark profile, aiming to integrate specialized offerings in high-growth niches where its market presence is still developing.

| BCG Category | Market Growth | Relative Market Share | Enerpac Example | Strategic Focus |

| Question Mark | High | Low | Asia-Pacific Operations, DTA Acquisition | Invest for growth, develop market share |

| Market Growth Rate (Asia-Pacific Industrial Equipment) | 6-8% (2024 Projection) | N/A | N/A | N/A |

| Strategic Investment Areas | Market Development, Product Localization, Distribution Expansion | N/A | N/A | N/A |

BCG Matrix Data Sources

Our Enerpac Tool Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, and product performance reports to ensure reliable, high-impact insights.