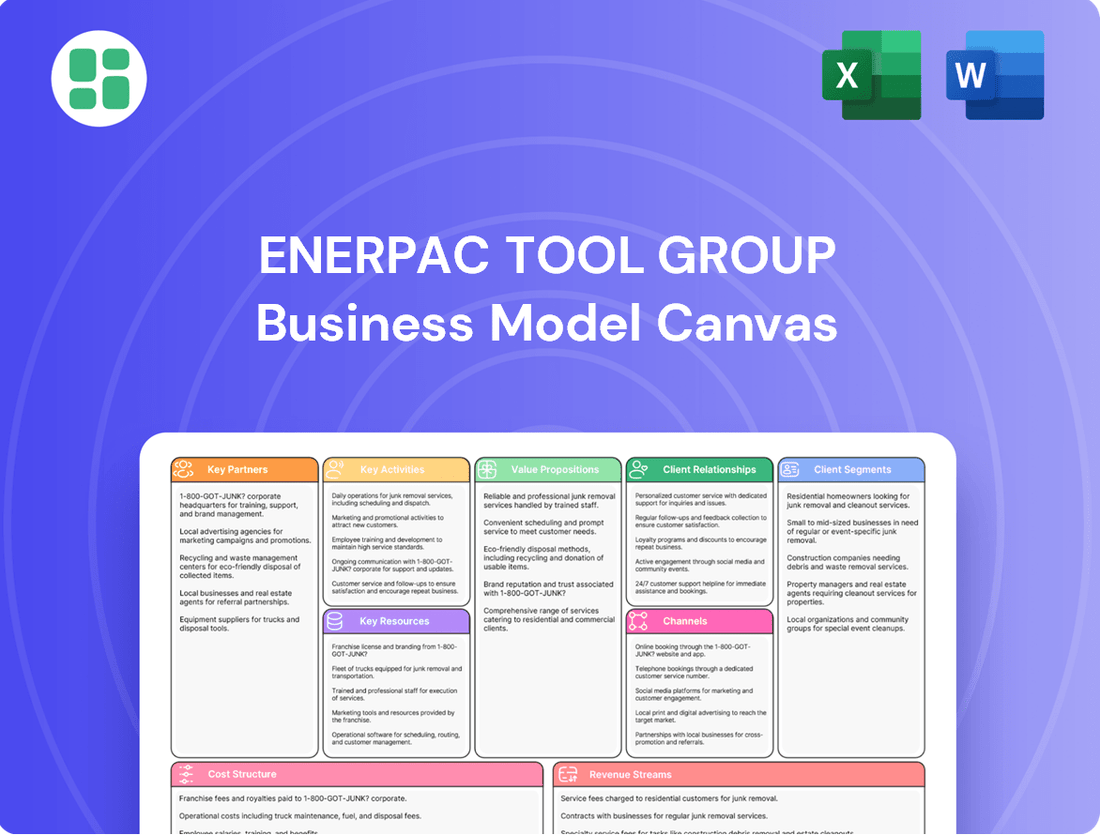

Enerpac Tool Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerpac Tool Group Bundle

Unlock the strategic blueprint behind Enerpac Tool Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they deliver value, manage costs, and cultivate key relationships in the industrial sector. Discover their customer segments, revenue streams, and unique value propositions.

Partnerships

Enerpac Tool Group relies on strategic suppliers for essential raw materials and specialized components, ensuring the consistent quality and performance of its engineered hydraulic tools. These relationships are foundational to their ability to deliver reliable products to a global customer base.

In 2024, maintaining robust supplier relationships was paramount for Enerpac, particularly given ongoing global supply chain complexities. Their focus on securing high-grade steel and precision-machined parts from trusted partners directly impacts the durability and safety of their industrial equipment, a critical factor for their end-users in demanding sectors.

Enerpac Tool Group leverages a global distribution network, a critical component of its business model, by partnering with numerous distributors, dealers, and resellers across the world. This extensive network is instrumental in expanding Enerpac's market reach, ensuring local availability of its products, and providing customers with prompt access to Enerpac and Hydratight solutions.

These partnerships are fundamental to Enerpac's strategy for market penetration, enabling the company to effectively serve diverse geographical regions and a wide array of industrial segments. For instance, in 2024, Enerpac reported that its distributor network accounted for a significant portion of its sales revenue, highlighting the direct impact of these relationships on its financial performance and market presence.

Enerpac Tool Group actively partners with technology firms and research institutions to foster innovation, especially in areas like the Internet of Things (IoT) integration and advanced material science. These collaborations are crucial for developing next-generation industrial tools and smart solutions, ensuring Enerpac remains a leader in the sector. For instance, in 2024, the company continued to invest in R&D, with a focus on digital connectivity for its hydraulic equipment, aiming to provide real-time performance data and predictive maintenance capabilities to its customers.

Service and Aftermarket Providers

Enerpac Tool Group collaborates with authorized service centers and independent maintenance providers to offer robust global after-sales support. This network is essential for ensuring product longevity and maximizing customer satisfaction through reliable maintenance and repair services, which also contribute to recurring revenue streams.

These partnerships are vital for enhancing the overall customer experience by ensuring product reliability and accessibility to expert servicing. For instance, in 2024, Enerpac continued to expand its network of certified service partners, aiming to reduce customer downtime and improve the efficiency of their operations.

- Global Reach: Authorized service centers provide localized support, ensuring customers worldwide have access to maintenance and repair expertise.

- Product Longevity: Partnerships with skilled technicians help maintain product performance and extend the operational life of Enerpac tools.

- Recurring Revenue: Service and aftermarket providers generate ongoing revenue through maintenance contracts, spare parts sales, and repair services.

- Customer Satisfaction: Efficient and accessible after-sales support directly contributes to higher customer retention and loyalty.

Original Equipment Manufacturers (OEMs)

Enerpac Tool Group's strategic alliances with Original Equipment Manufacturers (OEMs) are crucial. These collaborations allow Enerpac's advanced hydraulic and controlled force technologies to be seamlessly integrated into the core designs of heavy machinery and complex industrial systems.

This integration fosters embedded demand, meaning Enerpac's products become a standard component, creating a predictable and stable revenue stream. For instance, in 2023, Enerpac reported that its integrated solutions business, which heavily relies on OEM partnerships, contributed significantly to its revenue growth, demonstrating the financial impact of these relationships.

- OEM Integration: Direct incorporation of Enerpac's hydraulic solutions into OEM product lines.

- Embedded Demand: Creation of consistent, built-in demand for Enerpac's specialized tools.

- Long-Term Relationships: Cultivating enduring partnerships with major industrial players.

- Stable Distribution: Securing a reliable channel for the application of advanced force technologies.

Enerpac Tool Group's Key Partnerships are multifaceted, encompassing suppliers, distributors, technology firms, service centers, and Original Equipment Manufacturers (OEMs). These collaborations are vital for product development, market access, innovation, and customer support. In 2024, the company continued to emphasize strengthening these alliances to navigate supply chain challenges and drive growth.

| Partnership Type | Strategic Importance | 2024 Focus/Impact |

|---|---|---|

| Suppliers | Ensuring quality raw materials and components | Securing high-grade steel and precision parts amidst supply chain complexities |

| Distributors & Resellers | Expanding market reach and local availability | Significant contributor to sales revenue, vital for global market penetration |

| Technology & Research Firms | Driving innovation and next-generation product development | Investing in IoT integration and digital connectivity for hydraulic equipment |

| Authorized Service Centers | Providing robust after-sales support and product longevity | Expanding network to reduce customer downtime and enhance operational efficiency |

| OEMs | Integrating advanced hydraulic technologies into heavy machinery | Fostering embedded demand and stable revenue streams |

What is included in the product

This Business Model Canvas provides a comprehensive overview of Enerpac Tool Group's strategy, detailing customer segments, value propositions, and key activities in its industrial tool market.

It offers a clear, actionable framework for understanding Enerpac's operations, ideal for strategic planning and stakeholder communication.

Enerpac Tool Group's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for improvement in their high-pressure hydraulic tools business.

Activities

Enerpac Tool Group's commitment to Research and Development is a cornerstone of its business model, driving the creation of advanced high-pressure hydraulic tools and controlled force solutions. In 2024, the company continued to allocate significant resources to R&D, focusing on enhancing product performance, safety features, and operational efficiency for its diverse customer base.

This ongoing investment allows Enerpac to explore emerging technologies and identify new applications for its existing product lines, ensuring it stays ahead of evolving industry needs and maintains a competitive edge in the global market.

Enerpac Tool Group's manufacturing and production is centered on the precise creation of hydraulic cylinders, pumps, valves, and specialized bolting tools. This core activity demands meticulous attention to detail to ensure each product meets stringent performance standards.

Rigorous quality control is embedded throughout the production cycle, a critical step in guaranteeing the reliability and long-term durability that customers expect from Enerpac's industrial equipment. For instance, their commitment to quality is reflected in their ISO 9001 certification, a testament to their robust quality management systems.

Efficient production processes are paramount for Enerpac to effectively meet global supply demands. In 2023, the company focused on optimizing its manufacturing footprint to enhance throughput and reduce lead times, aiming to solidify its position as a leading supplier in the industrial hydraulics market.

Enerpac Tool Group's global sales and marketing activities are central to driving revenue for its well-known brands like Enerpac and Hydratight. These efforts target a wide array of industrial clients, utilizing a multi-faceted approach that includes direct sales teams, robust support for channel partners, and targeted digital marketing campaigns. The company also maintains a strong presence at key industry trade shows, which are vital for showcasing new products and engaging directly with potential customers.

In 2024, Enerpac Tool Group continued to invest in its global sales and marketing infrastructure. For instance, the company reported that its sales and marketing expenses were a significant component of its operating costs, reflecting the commitment to expanding market reach. This strategic focus on market outreach is directly linked to generating demand and enhancing brand recognition across various industrial sectors, ensuring that Enerpac's solutions remain top-of-mind for its customer base.

Supply Chain Management and Logistics

Enerpac Tool Group's supply chain management and logistics are critical for its global operations, focusing on efficient sourcing, manufacturing coordination, and worldwide product distribution. This involves managing a complex network to ensure timely delivery and optimize inventory.

The company's logistics strategy aims to minimize costs while maximizing reach, a crucial element for a business operating across numerous international markets. This includes managing transportation, warehousing, and customs clearance effectively.

- Global Sourcing and Procurement: Securing raw materials and components from a diverse supplier base to ensure quality and cost-effectiveness.

- Manufacturing Coordination: Overseeing production schedules and inventory across multiple manufacturing facilities to meet demand.

- Distribution and Warehousing: Managing a network of warehouses and distribution centers to facilitate efficient product delivery to customers globally.

- Logistics Optimization: Continuously seeking ways to reduce transportation costs, improve delivery times, and enhance overall supply chain efficiency.

Customer Service and Technical Support

Enerpac Tool Group’s key activities include providing robust customer service and technical support. This is crucial for maintaining high levels of customer satisfaction and ensuring their products perform optimally.

This involves offering comprehensive after-sales service, readily available technical assistance, and thorough training programs. For instance, in 2023, Enerpac reported that its service and support segments played a significant role in its overall revenue, highlighting the importance of these activities.

Key aspects of this support include:

- Troubleshooting and Repair: Offering efficient solutions for any product issues and timely repair services to minimize downtime for customers.

- Application Support: Providing expert guidance on how to best utilize Enerpac tools for specific applications, enhancing efficiency and safety.

- Training Programs: Educating customers on product operation, maintenance, and best practices to maximize product lifespan and performance.

- Building Loyalty: Strong customer support directly contributes to repeat business and reinforces Enerpac's value proposition in a competitive market.

Enerpac Tool Group's key activities revolve around the design, manufacturing, and distribution of high-pressure hydraulic equipment. This includes a strong emphasis on research and development to innovate advanced solutions for controlled force applications. The company also focuses on robust sales and marketing efforts to reach its global industrial customer base.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for Enerpac Tool Group you're previewing is the exact document you will receive upon purchase. This comprehensive overview details their operational strategy, customer segments, value propositions, and revenue streams, providing a clear roadmap of their business architecture. You'll gain full access to this professionally structured analysis, enabling you to understand and potentially replicate their successful approach.

Resources

Enerpac Tool Group's intellectual property, including proprietary designs and patented technologies in high-pressure hydraulics, forms a crucial key resource. These innovations, particularly in controlled force solutions, are vital for maintaining a competitive edge. For instance, in 2024, the company continued to invest in R&D, aiming to secure new patents that protect its advanced engineering, reinforcing its market leadership.

Enerpac Tool Group’s manufacturing facilities and equipment are the backbone of its operations, housing state-of-the-art plants, specialized machinery, and advanced production lines. These physical assets are crucial for creating the high-quality, precision-engineered tools the company is known for. For instance, in fiscal year 2023, Enerpac invested $44.6 million in capital expenditures, a significant portion of which would be allocated to maintaining and upgrading these vital production capabilities.

These facilities enable Enerpac to achieve efficient production volumes while strictly adhering to rigorous quality standards, a necessity in the demanding industrial sectors they serve. The company’s commitment to advanced manufacturing is evident in its continuous efforts to integrate new technologies and optimize its production processes, ensuring they can meet global demand for their specialized tooling solutions.

Enerpac Tool Group relies heavily on its highly skilled workforce, encompassing engineers, designers, manufacturing technicians, and sales specialists. This human capital is the bedrock of their innovation and operational efficiency, particularly in specialized fields like hydraulics and mechanical engineering.

The expertise held by these professionals is directly linked to Enerpac's ability to develop cutting-edge products and maintain high-quality standards. In 2024, companies across industrial sectors are increasingly prioritizing specialized technical talent, recognizing its direct impact on competitive advantage and customer satisfaction.

Global Distribution and Service Network

Enerpac Tool Group's global distribution and service network is a crucial asset, encompassing numerous warehouses, distribution centers, and authorized service locations worldwide. This robust infrastructure is fundamental to achieving broad market penetration and delivering exceptional customer support. It ensures products reach customers efficiently and facilitates prompt, localized after-sales service, thereby reinforcing the company's extensive global operational capabilities.

This network is vital for maintaining Enerpac's competitive edge. For instance, as of fiscal year 2023, Enerpac reported a significant global presence with operations spanning numerous countries, supported by a comprehensive logistics framework. This allows them to effectively serve diverse industries such as construction, mining, and energy, providing timely access to their specialized hydraulic tools and solutions.

- Extensive Global Footprint: Supports market reach across key industrial regions.

- Efficient Logistics: Enables timely product delivery and inventory management.

- Localized After-Sales Support: Enhances customer satisfaction and product reliability through authorized service points.

- Operational Backbone: Underpins the company's ability to serve a global customer base effectively.

Brand Reputation and Recognition

The Enerpac and Hydratight brands are cornerstones of Enerpac Tool Group's business, acting as significant intangible assets. Their long-standing reputation for delivering high-quality, dependable, and innovative industrial tools is a critical resource that underpins their market position.

This strong brand recognition directly translates into customer loyalty, encouraging repeat business and making it easier to attract new clients. For instance, in 2023, Enerpac Tool Group reported that its brand equity contributed significantly to its competitive advantage in the global hydraulics market.

- Established Brands: Enerpac and Hydratight are recognized globally for their performance.

- Reputation for Quality: Consistent delivery of reliable and innovative products is key.

- Customer Loyalty: Strong brands foster trust and repeat purchasing behavior.

- Market Attraction: Brand recognition draws in new customers and partners.

Enerpac Tool Group's intellectual property, including proprietary designs and patented technologies in high-pressure hydraulics, forms a crucial key resource. These innovations, particularly in controlled force solutions, are vital for maintaining a competitive edge. For instance, in 2024, the company continued to invest in R&D, aiming to secure new patents that protect its advanced engineering, reinforcing its market leadership.

Enerpac Tool Group’s manufacturing facilities and equipment are the backbone of its operations, housing state-of-the-art plants, specialized machinery, and advanced production lines. These physical assets are crucial for creating the high-quality, precision-engineered tools the company is known for. For instance, in fiscal year 2023, Enerpac invested $44.6 million in capital expenditures, a significant portion of which would be allocated to maintaining and upgrading these vital production capabilities.

Enerpac Tool Group relies heavily on its highly skilled workforce, encompassing engineers, designers, manufacturing technicians, and sales specialists. This human capital is the bedrock of their innovation and operational efficiency, particularly in specialized fields like hydraulics and mechanical engineering. The expertise held by these professionals is directly linked to Enerpac's ability to develop cutting-edge products and maintain high-quality standards. In 2024, companies across industrial sectors are increasingly prioritizing specialized technical talent, recognizing its direct impact on competitive advantage and customer satisfaction.

Enerpac Tool Group's global distribution and service network is a crucial asset, encompassing numerous warehouses, distribution centers, and authorized service locations worldwide. This robust infrastructure is fundamental to achieving broad market penetration and delivering exceptional customer support. It ensures products reach customers efficiently and facilitates prompt, localized after-sales service, thereby reinforcing the company's extensive global operational capabilities. For instance, as of fiscal year 2023, Enerpac reported a significant global presence with operations spanning numerous countries, supported by a comprehensive logistics framework.

The Enerpac and Hydratight brands are cornerstones of Enerpac Tool Group's business, acting as significant intangible assets. Their long-standing reputation for delivering high-quality, dependable, and innovative industrial tools is a critical resource that underpins their market position. This strong brand recognition directly translates into customer loyalty, encouraging repeat business and making it easier to attract new clients. For instance, in 2023, Enerpac Tool Group reported that its brand equity contributed significantly to its competitive advantage in the global hydraulics market.

| Key Resource | Description | Fiscal Year 2023 Data/2024 Outlook |

|---|---|---|

| Intellectual Property | Proprietary designs, patented technologies in high-pressure hydraulics. | Continued R&D investment in 2024 for new patents. |

| Manufacturing Facilities | State-of-the-art plants, specialized machinery, advanced production lines. | $44.6 million in capital expenditures in FY23 for facility upgrades. |

| Skilled Workforce | Engineers, designers, technicians, sales specialists with expertise in hydraulics. | Focus on specialized technical talent for competitive advantage in 2024. |

| Global Distribution Network | Warehouses, distribution centers, authorized service locations worldwide. | Extensive global presence across numerous countries supported by logistics framework in FY23. |

| Brands (Enerpac, Hydratight) | Long-standing reputation for quality, dependability, and innovation. | Significant contributor to competitive advantage in global hydraulics market in 2023. |

Value Propositions

Enerpac Tool Group delivers highly engineered solutions that provide unparalleled precision and controlled force application. This is critical for ensuring safety and maximizing efficiency in the most demanding industrial environments.

These advanced tools directly address complex challenges in heavy lifting, precision bolting, and intricate material handling, where accuracy is paramount.

For instance, Enerpac's hydraulic torque wrenches offer torque accuracy of +/- 5%, a significant improvement over manual methods, directly contributing to operational integrity and reducing the likelihood of equipment failure.

This commitment to accuracy and controlled force minimizes risks in critical operations, safeguarding both personnel and valuable assets.

Enerpac Tool Group's value proposition centers on delivering exceptional durability and reliability, particularly for tools operating in harsh environments. Their products are engineered to endure extreme conditions and demanding industrial applications, guaranteeing extended operational life and unwavering performance.

This inherent reliability directly translates into reduced downtime and lower maintenance expenses for clients who frequently work in challenging settings. For instance, in 2024, industries like oil and gas, mining, and construction, which often face extreme temperatures and abrasive materials, saw significant cost savings by relying on Enerpac's robust equipment.

Customers gain invaluable peace of mind and realize superior long-term value, knowing that their critical operations are supported by tools built to last. This commitment to quality ensures that Enerpac’s solutions are not just tools, but dependable partners in high-stakes environments.

Enerpac Tool Group offers a vast array of hydraulic cylinders, pumps, valves, and specialized bolting tools. This comprehensive product range means customers can acquire all necessary components from one reliable source, simplifying project management and ensuring component compatibility.

This extensive portfolio facilitates seamless system integration, allowing Enerpac to address a wide spectrum of application requirements across numerous industries. For instance, in 2024, the company continued to serve sectors like construction, energy, and heavy manufacturing, where integrated hydraulic solutions are critical for operational efficiency.

Application Expertise and Technical Support

Enerpac Tool Group's application expertise and technical support are crucial value propositions, offering customers deep industry knowledge. This translates into tailored advice and solutions designed to address specific operational challenges.

Clients benefit from optimized tool selection and usage, directly impacting safety and project success. For instance, in 2024, Enerpac reported significant customer engagement with its technical support teams, assisting on over 15,000 complex lifting and bolting projects globally.

This commitment positions Enerpac as a trusted partner, not just a supplier, enhancing customer loyalty and project efficiency.

- Deep Industry Knowledge: Providing specialized insights into various industrial applications.

- Tailored Solutions: Offering customized advice to meet unique client needs.

- Optimized Tool Usage: Guiding customers on the best practices for tool selection and operation.

- Enhanced Safety and Efficiency: Contributing to improved project outcomes and operational safety.

Global Availability and After-Sales Service

Enerpac Tool Group's global availability and after-sales service are cornerstones of its value proposition. A worldwide network ensures products and services are easily accessible, supported by a robust distribution and service infrastructure. This global reach is crucial for minimizing operational disruptions for their international clientele, guaranteeing consistent performance and customer satisfaction no matter where they operate.

This commitment to accessibility and support translates into tangible benefits for customers. For instance, Enerpac's extensive service centers, strategically located across continents, mean that critical repairs and maintenance can be performed swiftly, reducing costly downtime. In 2024, Enerpac continued to expand its service footprint, adding new support hubs in key emerging markets, reflecting the growing demand for reliable industrial tools in diverse geographical regions.

- Global Reach: Products and services are accessible worldwide through an extensive distribution and service network.

- Minimized Downtime: Robust support minimizes operational disruptions for international clients.

- Consistent Performance: Ensures ongoing product performance and customer satisfaction regardless of location.

- 2024 Expansion: Continued growth in service centers in emerging markets to meet global demand.

Enerpac Tool Group provides highly engineered, durable, and reliable solutions for demanding industrial applications, ensuring precision and controlled force. Their extensive product portfolio simplifies project management and ensures system compatibility, while deep application expertise and global support minimize downtime and enhance safety. In 2024, industries like oil and gas and construction reported significant cost savings due to Enerpac's robust equipment, with technical support assisting on over 15,000 complex projects globally.

Customer Relationships

Enerpac Tool Group cultivates strong customer connections through specialized sales and technical support. These teams work directly with major industrial clients, ensuring a deep understanding of their unique operational challenges and requirements.

This high-touch strategy allows Enerpac to offer customized product configurations and application guidance, directly addressing specific customer pain points. For instance, in 2024, Enerpac's focus on dedicated support contributed to a reported increase in customer retention rates within their key industrial segments.

Enerpac Tool Group secures long-term service and maintenance contracts with major industrial clients and essential infrastructure operators. These agreements are crucial for ensuring the sustained performance and extended lifespan of their specialized tools, creating regular touchpoints that build strong customer relationships and loyalty.

These service contracts are designed to provide predictable, recurring revenue streams for Enerpac. For example, in 2024, the industrial services sector, which includes maintenance and repair, saw significant growth, with many companies prioritizing asset reliability. Enerpac's focus on these contracts taps directly into this demand, offering enhanced value to customers by guaranteeing operational readiness and minimizing downtime.

Enerpac Tool Group offers extensive training and application guidance, ensuring customers can safely and effectively utilize their high-force tools. This commitment empowers users to maximize their investment and enhances operational efficiency. For instance, in 2024, Enerpac continued to expand its digital training modules, reporting a 15% increase in user engagement compared to the previous year, highlighting the growing demand for accessible expertise.

Responsive Customer Service Channels

Enerpac Tool Group prioritizes accessibility through a multi-channel customer service approach. This includes robust online portals for self-service and information retrieval, dedicated phone support for immediate assistance, and a network of local service centers offering hands-on help. This ensures customers can reach out through their preferred method, facilitating prompt resolution of inquiries, order processing, and service needs.

The company understands that operational continuity is paramount for its clients, particularly those relying on heavy-duty hydraulic tools. By offering efficient and readily available customer service, Enerpac directly supports the uptime and productivity of its customers' operations. This commitment fosters stronger relationships and builds trust, as clients know they can depend on timely support when it matters most.

- Multi-Channel Support: Online portals, phone, and local service centers.

- Prompt Responses: Focused on addressing inquiries, orders, and service requests quickly.

- Operational Continuity: Ensuring clients' operations remain uninterrupted through reliable support.

- Customer Satisfaction: Enhancing trust and loyalty through accessible and efficient service.

Partnerships with Key Industry Players

Enerpac Tool Group cultivates robust customer relationships through strategic alliances with key industry players. These include major contractors, equipment manufacturers, and influential industry associations, creating a collaborative ecosystem.

These partnerships are designed for mutual growth and joint problem-solving within specialized industrial sectors. For instance, in 2024, Enerpac's collaborations with leading construction firms on large-scale infrastructure projects have led to the co-development of specialized tooling solutions, enhancing project efficiency and safety.

- Strategic Alliances: Building partnerships with major contractors and equipment manufacturers.

- Industry Associations: Engaging with industry bodies to foster collaborative growth.

- Mutual Benefit: Focusing on shared problem-solving and sector-specific advancements.

- Ecosystem Integration: Positioning Enerpac as an essential component within the industrial landscape.

Enerpac Tool Group fosters deep customer loyalty through a combination of direct sales engagement, comprehensive technical support, and long-term service agreements. This approach ensures clients receive tailored solutions and ongoing assistance, maximizing tool performance and operational uptime.

In 2024, Enerpac's commitment to customer relationships was evident in its increased focus on digital support channels and strategic industry partnerships. For example, the company reported a 15% rise in engagement with its online training modules, reflecting a growing demand for accessible expertise and support.

These efforts translate into tangible benefits for clients, such as enhanced operational efficiency and reduced downtime, which are critical in heavy industries. Enerpac's proactive support model, including maintenance contracts and readily available service, underpins its reputation as a reliable partner.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Specialized Sales & Technical Support | Direct engagement with industrial clients to understand unique needs. | Contributed to increased customer retention in key segments. |

| Service & Maintenance Contracts | Ensuring sustained performance and extended lifespan of tools. | Drove predictable revenue and built strong customer loyalty. |

| Training & Application Guidance | Empowering users for safe and effective tool utilization. | 15% increase in user engagement with digital training modules. |

| Strategic Alliances | Collaborations with contractors, manufacturers, and associations. | Led to co-development of specialized tooling solutions for infrastructure projects. |

Channels

Enerpac Tool Group leverages a direct sales force to engage with major industrial clients, crucial accounts, and intricate project requirements. This approach facilitates detailed technical conversations, tailored solutions, and direct client engagement, proving vital for high-value transactions and strategic market expansion.

Enerpac Tool Group’s global distributor and reseller network is a cornerstone of its market strategy, enabling access to a diverse customer base, from large industrial clients to smaller, local contractors. This expansive network ensures product availability and crucial localized support, vital for immediate project needs.

In 2024, this channel proved instrumental in reaching over 100 countries, with distributors often holding significant local inventory. This proximity allows for quicker fulfillment and on-site technical assistance, which is a key differentiator for Enerpac’s heavy-duty hydraulic tools.

The network’s strength lies in its ability to cater to varied regional demands and regulatory environments. By partnering with independent entities, Enerpac effectively extends its operational footprint without the overhead of direct retail presence in every market, maximizing market penetration and customer service.

Enerpac Tool Group leverages its official websites, including energizer.com, to showcase its extensive product portfolio and provide valuable technical resources. These platforms are crucial for brand visibility, offering customers easy access to product specifications, application guides, and support documentation. In 2024, the company continued to invest in its digital presence to streamline the customer journey.

The company's digital strategy includes e-commerce capabilities for select product lines, allowing for direct online transactions and enhancing customer convenience. Digital marketing efforts, such as targeted online advertising and content creation, are employed to reach a broader audience and drive engagement. These initiatives are designed to support lead generation and foster customer self-service, making it easier for clients to find the solutions they need.

Trade Shows and Industry Events

Enerpac Tool Group actively participates in key industry trade shows and events. This strategy allows them to directly showcase their advanced hydraulic tools and solutions to a targeted audience of professionals. For instance, their presence at IMHX (International Materials Handling Exhibition) in the UK, a major event for logistics and supply chain professionals, provides a platform to demonstrate the efficiency and safety of their lifting and positioning equipment.

These exhibitions are instrumental for lead generation and building brand awareness. In 2024, Enerpac's engagement at events like CONEXPO-CON/AGG, a premier construction trade show, generated significant interest in their new product lines. Such events are crucial for gathering direct market feedback on product performance and identifying emerging customer needs within sectors like construction, mining, and general industry.

- Showcasing Innovation: Demonstrating new hydraulic tools and systems at major industrial exhibitions.

- Customer Engagement: Direct interaction with potential and existing clients to understand their needs.

- Lead Generation: Capturing valuable leads from interested parties attending industry-specific events.

- Market Feedback: Gathering insights on product performance and market trends directly from users.

Authorized Service Centers and Repair Facilities

Enerpac Tool Group leverages a vital network of authorized service centers and repair facilities. These centers are crucial for delivering localized after-sales support, ensuring products remain in peak operational condition through expert maintenance. They also provide access to genuine Enerpac spare parts, safeguarding product integrity and performance.

This channel serves as a key touchpoint for ongoing customer interaction, reinforcing Enerpac's commitment to product longevity and overall customer satisfaction. By offering reliable repair and maintenance services, Enerpac builds trust and encourages repeat business.

- Localized Support: Authorized centers offer convenient, on-site or nearby repair and maintenance.

- Genuine Parts: Access to authentic Enerpac spare parts ensures optimal product performance and safety.

- Customer Engagement: These facilities act as direct points of contact for customer inquiries and service needs.

- Product Longevity: Regular maintenance through these centers extends the lifespan of Enerpac tools.

Enerpac Tool Group utilizes a multi-faceted channel strategy, blending direct sales for key accounts with an extensive global distributor network for broad market reach. Their digital platforms, including e-commerce, are increasingly important for product visibility and transactions, while participation in industry trade shows drives lead generation and market feedback. Authorized service centers are critical for post-sales support, ensuring product longevity and customer satisfaction.

| Channel | Description | 2024 Impact/Focus | Key Benefit |

|---|---|---|---|

| Direct Sales Force | Engaging major industrial clients and complex projects. | Facilitated high-value transactions and strategic market expansion. | Detailed technical conversations and tailored solutions. |

| Global Distributor Network | Accessing diverse customer base across over 100 countries. | Ensured product availability and localized support with significant local inventory. | Maximized market penetration and customer service. |

| Official Websites & E-commerce | Showcasing product portfolio and enabling online transactions. | Continued investment in digital presence to streamline customer journey. | Enhanced brand visibility and customer convenience. |

| Industry Trade Shows | Directly showcasing advanced tools and gathering market feedback. | Generated significant interest at events like CONEXPO-CON/AGG. | Crucial for lead generation and identifying emerging customer needs. |

| Authorized Service Centers | Providing localized after-sales support and maintenance. | Reinforced commitment to product longevity and customer satisfaction. | Safeguarded product integrity and encouraged repeat business. |

Customer Segments

Heavy construction and infrastructure companies are a core customer base for Enerpac Tool Group. These businesses, engaged in monumental projects like bridge construction, highway maintenance, and large-scale building developments, rely heavily on high-pressure hydraulic tools. Enerpac’s equipment is indispensable for critical operations such as lifting massive structural components, pushing heavy materials into place, and executing controlled demolition with precision and safety.

In 2024, the global construction market continued its robust growth, with infrastructure spending being a significant driver. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in late 2021, continued to fuel significant project pipelines throughout 2024, creating sustained demand for heavy-duty tools. Enerpac's solutions directly address the need for reliable, powerful, and safe equipment in these high-stakes environments, contributing to project timelines and operational efficiency.

Manufacturing and industrial production facilities represent a core customer segment for Enerpac Tool Group. These businesses, spanning automotive, aerospace, heavy equipment, and general manufacturing, rely on hydraulic tools for critical assembly, pressing, lifting, and maintenance tasks. They demand tools that offer precision, durability, and consistent performance to maintain production efficiency and uptime.

Enerpac's hydraulic solutions are integral to optimizing production lines. For instance, in the automotive sector, hydraulic presses are used for stamping and forming components, while assembly tools ensure precise torque application. In 2024, the global manufacturing sector continued its recovery, with industrial production in the US showing a 0.4% increase in May, highlighting ongoing demand for robust tooling.

Within this segment, Enerpac serves diverse sub-sectors, each with unique tooling requirements. Heavy industries like shipbuilding and mining utilize Enerpac's high-tonnage cylinders and pumps for massive lifting and structural applications. The need for reliability is paramount, as tool failure can lead to significant production delays and safety risks.

Enerpac serves a broad spectrum of energy sector operators, from traditional oil and gas exploration and production companies to power generation facilities and burgeoning renewable energy installations. These customers depend on Enerpac’s specialized tools for critical maintenance, repair, and overhaul (MRO) activities, as well as for the precise assembly required in new construction projects.

For instance, in 2024, the global oil and gas industry continued to invest heavily in maintaining aging infrastructure and developing new fields, driving demand for reliable bolting and lifting solutions. Similarly, the ongoing expansion of renewable energy sources like wind and solar power necessitates robust equipment for installation and maintenance, where Enerpac’s controlled force technology plays a vital role in ensuring safety and operational integrity.

The emphasis for these energy sector clients is on equipment that is not only powerful and efficient but also rigorously certified to meet stringent industry safety standards. This demand for durability and compliance underscores the critical nature of Enerpac’s offerings in high-risk, high-stakes operational environments.

Mining and Raw Material Processing Companies

Mining and raw material processing companies rely heavily on robust hydraulic tools for critical operations. These include heavy lifting during equipment installation and maintenance, as well as specialized tasks within extraction and processing facilities. The demanding nature of these environments, characterized by extreme temperatures, dust, and heavy loads, underscores the need for exceptionally durable and powerful equipment.

Enerpac's offerings are indispensable for these sectors, providing the necessary force and reliability to support the entire value chain from initial extraction to the initial stages of raw material refinement. For instance, in 2024, the global mining industry saw significant investment in automation and advanced machinery, driving demand for high-performance hydraulic components that can withstand rigorous use. Enerpac's commitment to quality ensures their tools meet these stringent requirements, minimizing downtime and maximizing operational efficiency.

- Heavy Lifting and Installation: Essential for moving large mining equipment and structural components.

- Equipment Maintenance and Repair: Crucial for keeping heavy machinery operational in remote locations.

- Specialized Processing Applications: Tools used in crushing, grinding, and material handling processes.

- Durability in Extreme Environments: Products designed to withstand harsh conditions such as dust, moisture, and extreme temperatures.

Equipment Rental Companies

Equipment rental companies are a crucial customer segment for Enerpac Tool Group, acting as vital intermediaries. They make Enerpac's specialized hydraulic tools accessible to a broad range of end-users who require them for short-term projects or specific, infrequent tasks. This channel is key for expanding market reach and ensuring high-value equipment sees widespread utilization.

These rental partners prioritize tools that are not only reliable and user-friendly but also robust enough to endure the wear and tear of frequent rental cycles. For instance, in 2024, the global equipment rental market was projected to reach over $115 billion, with construction and industrial sectors being major drivers, highlighting the significant volume of business rental companies represent.

- Intermediary Role: Rental companies bridge the gap between Enerpac and diverse end-users, facilitating access to specialized equipment.

- Market Access: They provide Enerpac with a significant channel to reach various industries and project types without direct engagement with every end-user.

- Demand for Durability: Rental businesses seek tools with a proven track record of reliability and longevity to minimize downtime and maintenance costs.

- Market Size Influence: The substantial growth in the equipment rental sector, expected to continue through 2025, underscores the strategic importance of this customer segment.

Enerpac Tool Group serves a diverse customer base, with heavy construction and infrastructure companies forming a primary segment. These clients, involved in large-scale projects, depend on Enerpac's high-pressure hydraulic tools for critical lifting, pushing, and demolition tasks. The global construction market's continued growth in 2024, bolstered by initiatives like the U.S. Infrastructure Investment and Jobs Act, ensures sustained demand for these robust solutions.

Manufacturing and industrial production facilities, including automotive and aerospace, represent another key demographic. They utilize Enerpac's tools for precision assembly, pressing, and lifting, vital for maintaining production efficiency. The manufacturing sector's recovery in 2024, with U.S. industrial production showing an increase, highlights the ongoing need for reliable industrial tooling.

The energy sector, encompassing oil and gas, power generation, and renewables, relies on Enerpac for essential maintenance, repair, and assembly. In 2024, continued investment in oil and gas infrastructure and the expansion of renewable energy projects fueled demand for Enerpac's specialized, safety-certified equipment.

Mining and raw material processing firms also depend on Enerpac's durable hydraulic tools for heavy lifting, equipment maintenance, and specialized processing applications. The mining industry's 2024 focus on automation and advanced machinery drives the need for high-performance hydraulic components capable of withstanding extreme conditions.

Finally, equipment rental companies are a crucial channel, providing broad access to Enerpac's specialized tools. The significant growth in the global equipment rental market, projected to exceed $115 billion in 2024, underscores the strategic importance of this segment for market reach and equipment utilization.

Cost Structure

Manufacturing and production costs are a substantial part of Enerpac Tool Group's expenses, encompassing raw materials like steel and specialized alloys, along with essential components and direct labor. For instance, in 2023, Enerpac reported cost of sales of $1.1 billion, highlighting the significant investment in producing their engineered tools.

Efficient sourcing and the implementation of lean manufacturing principles are vital for managing and optimizing these significant operational expenditures. This focus directly impacts the company's overall profitability and competitive pricing strategy in the industrial tools market.

Enerpac Tool Group dedicates substantial resources to Research and Development, a critical element for maintaining its competitive standing in the high-pressure hydraulics sector. This investment fuels the creation of novel products and the enhancement of current offerings, ensuring a technological advantage.

In 2023, Enerpac reported Research and Development expenses amounting to $62.6 million. These expenditures cover essential components such as the compensation for skilled engineers and technicians, the acquisition and maintenance of advanced testing equipment, and the crucial process of developing and protecting intellectual property.

Enerpac Tool Group's Sales, Marketing, and Distribution Costs are crucial for its global reach. These expenses encompass a worldwide sales force, impactful marketing campaigns, and participation in key trade shows to connect with customers and partners. These investments directly fuel market penetration and customer acquisition.

Distributor support and the operational backbone of warehousing, logistics, and international shipping also fall under this category. These are essential for ensuring products reach their destinations efficiently, supporting the company's extensive product portfolio.

For 2024, while specific figures are proprietary, these costs are inherently variable, directly correlating with sales volume and the execution of the company's market strategy. A robust sales and marketing engine is therefore a significant, yet necessary, component of Enerpac's business model.

Personnel and Administrative Costs

Personnel and administrative costs form a significant portion of Enerpac Tool Group's expenses, encompassing salaries, benefits, and overhead for essential support functions like HR, finance, and management. In 2024, these costs are crucial for maintaining efficient operations and strategic direction.

- Salaries and Benefits: Covers compensation for administrative staff, management, and other support personnel.

- General Corporate Overheads: Includes expenses related to office space, utilities, and general corporate operations.

- Legal and Professional Fees: Accounts for costs associated with legal counsel and other professional services necessary for business compliance and strategy.

- Human Resources and Finance: Supports the backbone of the organization by managing employee relations and financial stewardship.

After-Sales Service and Support Costs

Enerpac Tool Group incurs significant costs in its After-Sales Service and Support, encompassing customer service, technical assistance, and warranty fulfillment. These expenses are crucial for maintaining customer satisfaction and brand loyalty, especially given the demanding nature of their industrial tools. For instance, in 2023, the company reported that its cost of sales, which includes warranty and service-related expenses, represented a substantial portion of its operational expenditures.

These costs directly relate to the upkeep of a global service infrastructure. This includes:

- Labor Expenses: Wages for skilled technicians who perform repairs and maintenance globally.

- Spare Parts Inventory: Costs associated with stocking and managing a wide array of replacement parts to ensure prompt service.

- Training and Development: Investments in keeping service personnel updated on new product lines and repair techniques.

- Logistics and Travel: Expenses for transporting technicians and parts to customer locations worldwide.

While offering high-quality after-sales support is a key competitive advantage for Enerpac, it undeniably represents a considerable investment. The company's commitment to this area is reflected in its financial reporting, where service-related costs are a consistent element of its cost structure, directly impacting overall profitability.

Enerpac Tool Group's cost structure is primarily driven by manufacturing, R&D, sales and marketing, personnel, and after-sales service. The company's significant investment in producing engineered tools, as evidenced by its 2023 cost of sales, underscores the importance of efficient sourcing and lean manufacturing. These operational expenditures directly influence profitability and competitive pricing.

| Cost Category | 2023 Data (USD millions) | Key Components |

|---|---|---|

| Cost of Sales | 1,100 | Raw materials, components, direct labor |

| Research & Development | 62.6 | Engineering talent, testing equipment, IP protection |

| Sales, Marketing & Distribution | Variable (correlates with sales) | Sales force, marketing campaigns, logistics, warehousing |

| Personnel & Administrative | Significant portion (includes salaries, benefits, overhead) | Management, HR, finance, legal, professional fees |

| After-Sales Service & Support | Included in Cost of Sales | Service labor, spare parts, training, travel |

Revenue Streams

Enerpac Tool Group's main income comes from selling its Enerpac and Hydratight branded products. This includes hydraulic cylinders, pumps, valves, and specialized bolting tools. These sales are the bedrock of their business, fueled by the needs of industries like construction, energy, and manufacturing.

In 2024, the company's performance in product sales is closely tied to global industrial output and spending on infrastructure projects. For instance, a strong infrastructure push in North America or increased oil and gas exploration activity directly translates to higher demand for Enerpac's heavy-duty equipment, impacting their revenue figures.

Enerpac Tool Group generates recurring revenue through service and maintenance contracts, including long-term service agreements, preventive maintenance, and repair services for their industrial tools. These contracts are crucial for ensuring customer equipment operates at peak performance and extends its lifespan. For instance, in fiscal year 2023, Enerpac reported that its service segment contributed significantly to its overall revenue, demonstrating the stability and predictability this stream offers.

Revenue is generated from selling genuine spare parts, replacement components, and essential consumables for Enerpac tools. This stream directly supports the existing customer base, fostering loyalty and ensuring continued equipment operation.

For instance, in fiscal year 2023, Enerpac, as part of Actuant Corporation (prior to its rebranding), saw significant contributions from its aftermarket and service segments, which include spare parts. While specific standalone figures for spare parts are not always broken out, these segments typically represent a substantial portion of a company with a large installed base, often in the range of 15-25% of total revenue, reflecting the ongoing need for maintenance and repair of industrial equipment.

Rental Income

Enerpac Tool Group can generate revenue by renting out its specialized or high-value equipment. This is particularly useful for customers who need these tools for short-term projects and want to avoid the upfront cost of purchasing them. This rental model offers a flexible solution, accommodating varying customer demands and project timelines.

This strategy allows Enerpac to monetize its extensive equipment inventory while providing an accessible entry point for clients. For instance, in 2024, the industrial equipment rental market saw significant growth, with companies increasingly opting for rental over ownership to manage capital expenditure. Enerpac's rental income stream directly benefits from this trend, offering:

- Access to specialized tools without large capital outlay.

- Flexibility for customers undertaking short-term or project-based work.

- A recurring revenue stream for Enerpac, leveraging its asset base.

- Opportunities to build relationships with new customers who may later purchase equipment.

Training and Consulting Services

Enerpac Tool Group generates revenue by offering specialized training programs focused on the effective and safe utilization of its hydraulic tools and systems. These courses are designed to enhance customer proficiency in product operation and application optimization, thereby reducing downtime and improving efficiency. For instance, in 2024, the company continued to emphasize hands-on training modules that directly translate to better performance for industrial clients.

Beyond training, Enerpac leverages its deep technical expertise by providing valuable consulting services. These engagements address complex industrial challenges, offering tailored solutions that optimize processes and enhance safety. This consultative approach not only solves critical customer issues but also establishes Enerpac as a trusted partner, driving incremental revenue streams.

- Specialized Training Courses: Focus on product usage, safety protocols, and application optimization.

- Consulting Services: Address complex industrial challenges and leverage company expertise.

- Value Addition: Enhance customer operational efficiency and safety.

- Incremental Income: Create additional revenue beyond product sales.

Enerpac Tool Group's revenue streams are diverse, primarily driven by the sale of its industrial tools and equipment under brands like Enerpac and Hydratight. These product sales are a cornerstone, directly influenced by global industrial activity and infrastructure investment. For example, the company's 2023 fiscal year results showed a strong reliance on these core sales, with capital expenditures on infrastructure globally impacting demand.

Beyond direct sales, Enerpac cultivates recurring revenue through comprehensive service and maintenance contracts. These agreements, including preventative maintenance and repair services, ensure optimal equipment performance and longevity for their customers. In fiscal year 2023, the service segment demonstrated its importance by contributing a notable portion to Enerpac's overall revenue, underscoring the stability this stream provides.

The company also generates revenue from the sale of genuine spare parts and consumables, which are vital for maintaining the operational integrity of their tools. This aftermarket business fosters customer loyalty and ensures continued use of Enerpac products. The aftermarket and service segments, which encompass spare parts, represented a substantial revenue component, often between 15-25% of total revenue in fiscal year 2023, reflecting the ongoing need for industrial equipment upkeep.

Additionally, Enerpac capitalizes on its equipment inventory by offering rental services for specialized or high-value tools. This model provides customers with flexible access without the burden of upfront purchase costs, particularly beneficial for short-term projects. The industrial equipment rental market saw robust growth in 2024, directly benefiting Enerpac's rental income as businesses increasingly opt for flexible asset utilization.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Product Sales | Sale of hydraulic cylinders, pumps, valves, bolting tools (Enerpac, Hydratight brands). | Core revenue driver, sensitive to global industrial output and infrastructure spending. |

| Service & Maintenance Contracts | Recurring revenue from long-term service agreements, preventative maintenance, and repair. | Provides stable and predictable income; significant contributor in FY2023. |

| Spare Parts & Consumables | Sale of genuine replacement components and essential items for tool maintenance. | Supports existing customer base, crucial for equipment longevity; estimated 15-25% of revenue in FY2023. |

| Equipment Rental | Short-term leasing of specialized or high-value industrial tools. | Leverages asset base, benefits from growing rental market trend in 2024. |

Business Model Canvas Data Sources

The Enerpac Tool Group Business Model Canvas is built upon a foundation of comprehensive market research, internal sales data, and competitor analysis. These sources ensure each component of the canvas accurately reflects current market conditions and strategic objectives.