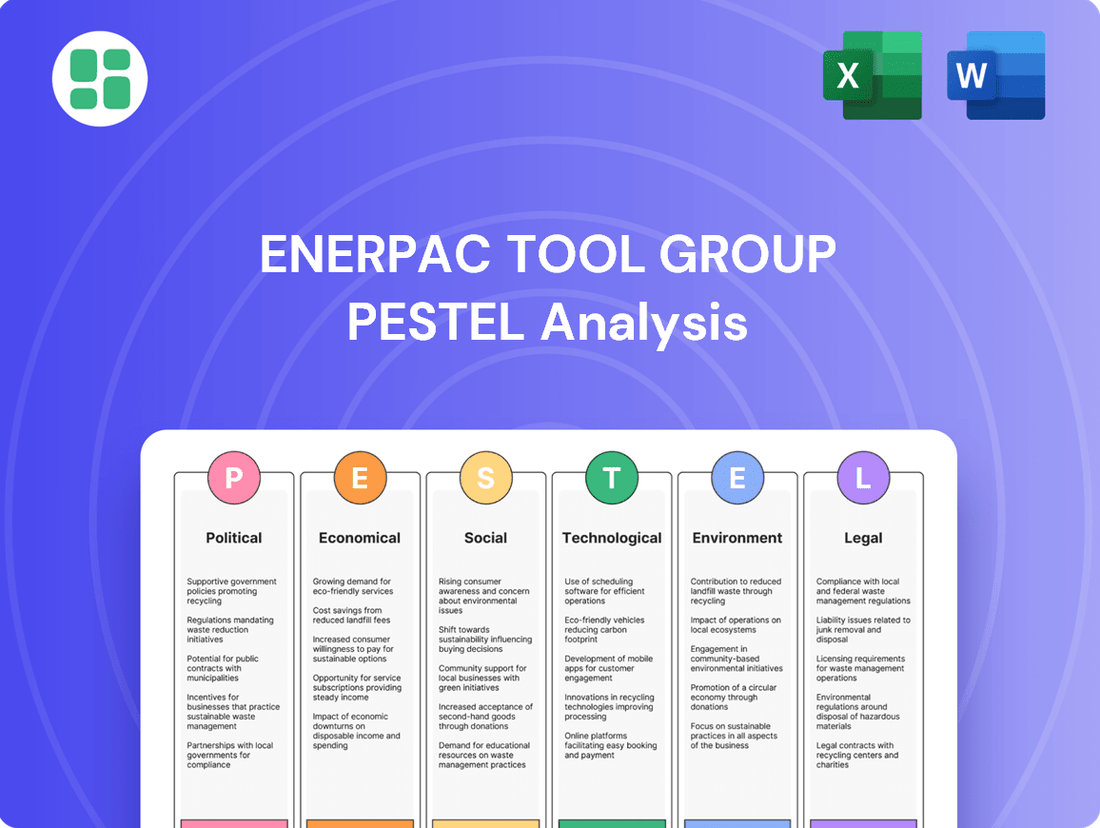

Enerpac Tool Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerpac Tool Group Bundle

Enerpac Tool Group operates within a dynamic global landscape, influenced by evolving political stability, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats.

Gain a competitive edge by exploring the intricate PESTLE factors affecting Enerpac Tool Group's market position. Our comprehensive analysis delves into political, economic, social, technological, legal, and environmental influences, providing actionable intelligence for your business strategy.

Don't get caught off guard by external shifts impacting Enerpac Tool Group. Our expertly crafted PESTLE analysis offers deep insights into the forces shaping the industry, empowering you to make informed decisions and secure your future success. Download the full version now to unlock this vital market intelligence.

Political factors

Government infrastructure spending policies are a significant driver for Enerpac Tool Group. Initiatives like the Infrastructure Investment and Jobs Act in the United States, with its substantial allocations for roads, bridges, and public transit, directly boost demand for Enerpac's specialized hydraulic tools used in heavy construction and maintenance. Globally, similar investments in energy grids and water systems are also expected to fuel the need for robust industrial equipment through 2024 and 2025.

Changes in international trade policies and tariffs directly impact Enerpac's global operations. For example, the potential for increased tariffs on goods imported from China, a topic of discussion in early 2025, could lead to higher costs for raw materials and components, affecting Enerpac's manufacturing expenses.

These trade shifts can also influence the price competitiveness of Enerpac's industrial tools and solutions in various international markets. A fluctuating tariff landscape necessitates agile supply chain management and pricing strategies to mitigate risks and maintain market share.

Geopolitical stability in key markets is a critical consideration for Enerpac Tool Group. Instability in regions where Enerpac operates or sources materials, such as the Middle East or Eastern Europe, can significantly disrupt supply chains and impact market demand. For example, ongoing conflicts in 2024 have already led to increased shipping costs and material price volatility for many industrial manufacturers.

Enerpac's extensive global footprint, with operations in over 100 countries, makes it particularly susceptible to the ripple effects of regional conflicts, political unrest, and economic sanctions. These events can create operational challenges, from securing necessary components to ensuring the safety of personnel and assets. The company's reliance on a diverse international supplier base means that disruptions in one region can have cascading effects across its entire business.

Industrial policy and manufacturing incentives

Government initiatives like the CHIPS and Science Act of 2022, which allocates $52.7 billion for semiconductor manufacturing and research, directly aim to bolster domestic industrial capacity. These policies, designed to encourage onshoring and technological advancement, present a significant tailwind for companies like Enerpac, which manufacture critical industrial equipment. By incentivizing advanced manufacturing, governments are creating a more favorable environment for capital investment in production facilities and skilled labor development.

Enerpac, with its focus on highly engineered hydraulic tools and systems, is well-positioned to capitalize on a renewed emphasis on domestic manufacturing. Policies promoting clean technology production, for instance, could drive demand for specialized equipment used in renewable energy infrastructure development. Such government support can reduce operational costs through tax credits or subsidies, thereby enhancing Enerpac's competitive edge in the global market.

- CHIPS Act Funding: $52.7 billion allocated to boost U.S. semiconductor manufacturing and R&D.

- Clean Energy Incentives: Policies like the Inflation Reduction Act offer tax credits for renewable energy production, potentially increasing demand for industrial equipment.

- Reshoring Trends: Government efforts to bring manufacturing back onshore create opportunities for domestic suppliers of industrial machinery.

Regulatory environment for heavy industry

The regulatory environment for heavy industry significantly impacts Enerpac Tool Group. Compliance with evolving environmental standards, such as emissions controls and waste management, directly affects manufacturing operations and can necessitate investments in new technologies. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to emphasize stricter oversight on industrial emissions, potentially increasing compliance burdens for manufacturers like Enerpac.

Changes in operational standards and permitting processes can also influence Enerpac's product development cycles and market access. For example, new safety regulations for lifting equipment, which Enerpac specializes in, could require product redesigns to meet updated performance criteria. The European Union’s ongoing review of industrial safety directives in 2025 is a key area to monitor for potential impacts on product design and certification.

- Permitting: Streamlined or more complex permitting processes for manufacturing facilities can affect expansion plans and operational flexibility.

- Environmental Compliance: Adherence to air, water, and waste regulations, with potential fines for non-compliance, adds to operational costs.

- Product Standards: Evolving safety and performance standards for heavy industrial tools can drive innovation but also require significant R&D investment.

- Trade Regulations: Tariffs and trade agreements can influence the cost of raw materials and the competitiveness of Enerpac's products in global markets.

Government infrastructure spending remains a key driver, with significant global investment anticipated through 2024-2025 in areas like energy grids and water systems, directly benefiting demand for Enerpac's heavy construction tools. However, evolving trade policies, such as potential tariffs in early 2025, could increase raw material costs and affect product pricing competitiveness. Geopolitical instability in operating regions also poses risks, leading to supply chain disruptions and price volatility, as seen with 2024 conflicts impacting shipping costs.

| Factor | Impact on Enerpac | Data/Trend (2024-2025) |

|---|---|---|

| Infrastructure Spending | Increased demand for construction tools | Global investments in energy/water systems expected to fuel demand. |

| Trade Policies/Tariffs | Higher raw material costs, pricing challenges | Potential for increased tariffs on goods from China impacting manufacturing expenses. |

| Geopolitical Stability | Supply chain disruptions, market demand impact | Conflicts in 2024 led to increased shipping costs and material price volatility. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Enerpac Tool Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges within Enerpac's operating landscape.

A PESTLE analysis for Enerpac Tool Group serves as a pain point reliever by offering a structured framework to proactively identify and address external threats and opportunities, enabling more informed strategic decisions and mitigating potential market disruptions.

Economic factors

Global economic growth significantly shapes demand for industrial equipment. A robust global economy typically fuels expansion in construction, manufacturing, and energy, all key markets for Enerpac's solutions. For instance, the IMF projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicating a generally expanding, albeit cautious, economic environment.

Despite a generally softer industrial market in fiscal year 2024, Enerpac demonstrated resilience. The company managed to outpace the broader industrial sector's performance, suggesting effective strategies in navigating economic headwinds. This ability to outperform indicates strong demand for their specialized tools even when the overall economic climate presents challenges.

Inflationary pressures are a significant concern for manufacturers like Enerpac Tool Group, directly impacting their bottom line. In 2025, many manufacturers, including those in industrial equipment sectors, are bracing for continued increases in raw material and other input costs. This means the cost to produce their tools and equipment will likely rise, potentially leading to higher prices for customers.

Rising interest rates add another layer of complexity. Higher borrowing costs can deter customers, particularly in sectors reliant on large capital investments. For instance, the construction industry, a key market for Enerpac's hydraulic tools, has seen non-residential construction projects slow down as interest rates climb. This slowdown can directly translate to reduced demand for Enerpac's products and services.

Currency exchange rate fluctuations present a significant economic factor for Enerpac Tool Group, a global entity. As Enerpac converts earnings from various foreign markets back to its primary reporting currency, shifts in exchange rates can directly influence its reported revenue and overall profitability. This dynamic means that even strong operational performance in local currencies can be eroded or amplified by currency movements.

The impact of these fluctuations is not merely theoretical. For instance, Enerpac's fiscal 2024 guidance explicitly acknowledged a $5 million headwind attributed to updated foreign exchange rate assumptions. This figure highlights the tangible financial consequences of currency volatility, underscoring the need for robust currency risk management strategies.

Commodity prices (e.g., steel, oil)

Commodity prices, particularly for steel, are a significant economic factor for Enerpac Tool Group. As steel is a primary raw material for hydraulic tools and equipment, its price directly impacts Enerpac's manufacturing costs and, consequently, its gross margins. For instance, in early 2024, steel prices saw some volatility, with benchmarks like hot-rolled coil trading around $750-$850 per ton, a slight increase from late 2023 levels, presenting a challenge for cost management.

Furthermore, fluctuations in oil and gas prices have a notable effect on Enerpac's key end markets. Higher energy prices can lead to increased capital expenditure in the oil and gas sector, driving demand for Enerpac's specialized tools. Conversely, a significant downturn in oil prices, as observed in periods of global economic slowdown, can dampen investment and reduce demand for industrial equipment.

- Steel Price Impact: Rising steel costs in 2024, with hot-rolled coil prices hovering in the $750-$850 range, directly pressure Enerpac's production expenses and profitability.

- Oil Market Influence: The energy sector's investment cycles, influenced by oil prices, directly correlate with demand for Enerpac's hydraulic solutions in oil exploration and production.

- Energy Sector Investment: Periods of elevated oil prices, such as those seen in late 2023 and early 2024, often stimulate increased capital spending by energy companies, benefiting Enerpac's sales pipeline.

Construction and manufacturing sector health

The health of the construction and manufacturing sectors is a critical driver for Enerpac Tool Group, as these industries represent its core customer base. While some segments of non-residential construction might experience a slowdown, the manufacturing sector is showing robust growth. This is particularly evident in burgeoning areas like electric vehicle (EV) production and the semiconductor industry, which are projected to see increased spending through 2024 and into 2025.

This trend is supported by recent data. For instance, the U.S. Census Bureau reported a 1.5% increase in manufacturing industrial production in April 2024 compared to the previous month. Furthermore, projections for semiconductor capital expenditures in 2024 are expected to reach approximately $200 billion globally, a significant uptick driven by demand for advanced chips. Similarly, the automotive sector, with a strong focus on EV manufacturing, is anticipated to continue its investment in new production facilities and equipment, directly benefiting companies like Enerpac.

- Manufacturing Industrial Production: Increased by 1.5% in April 2024 (U.S. Census Bureau).

- Global Semiconductor CapEx: Projected to reach around $200 billion in 2024.

- EV Production Growth: Continued investment in new facilities and equipment is expected.

- Infrastructure Maintenance: Ongoing needs for repair and upgrades in existing infrastructure provide a stable demand base.

Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports demand for industrial equipment, though Enerpac has shown resilience despite a softer industrial market. Inflationary pressures are a concern, with rising raw material costs impacting production. Higher interest rates can slow capital investments in key sectors like construction, and currency fluctuations, which caused a $5 million headwind in Enerpac's fiscal 2024 guidance, also affect profitability.

| Economic Factor | Impact on Enerpac | Data Point/Trend |

|---|---|---|

| Global Growth | Drives demand for industrial equipment. | IMF projects 3.2% global growth for 2024. |

| Inflation | Increases raw material and input costs. | Manufacturers bracing for continued cost increases in 2025. |

| Interest Rates | Can slow capital investments in key markets. | Non-residential construction projects slowing due to rising rates. |

| Currency Exchange Rates | Affects reported revenue and profitability. | $5 million headwind in FY24 guidance due to FX assumptions. |

Full Version Awaits

Enerpac Tool Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Enerpac Tool Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights and strategic planning tools.

Sociological factors

Enerpac Tool Group's reliance on a skilled workforce, especially in engineering and advanced manufacturing, is a significant factor. The U.S. Bureau of Labor Statistics projected a 4% employment growth for mechanical engineers between 2022 and 2032, indicating a competitive landscape for specialized talent. Shortages in these critical areas can directly affect Enerpac's ability to innovate, produce high-quality tools, and deliver essential technical services to its global customer base.

The increasing focus on industrial safety, particularly in demanding sectors like construction and manufacturing, directly benefits Enerpac. As industries prioritize worker well-being and operational integrity, the need for reliable, high-precision tools for heavy lifting and controlled force applications escalates. This trend is underscored by a general rise in safety regulations and a proactive approach to risk mitigation across many developed economies.

Enerpac's core mission to equip customers with tools that enable them to perform challenging tasks safely resonates strongly with this evolving safety culture. For instance, in 2024, reports indicated a significant reduction in workplace accidents in sectors heavily reliant on heavy machinery when advanced safety protocols and equipment were implemented. This heightened awareness fuels demand for Enerpac's engineered solutions designed to prevent accidents and ensure predictable outcomes in high-risk environments.

Societal and customer expectations are increasingly pushing for products and operational methods that prioritize environmental responsibility. This growing demand directly influences how companies like Enerpac design their products and manage their manufacturing processes.

Enerpac is actively addressing this trend by focusing on reducing its environmental footprint and developing solutions that are more eco-friendly. For instance, the company's commitment to sustainability is reflected in initiatives aimed at improving energy efficiency in its operations and exploring the use of recycled materials in its product lines.

Urbanization and infrastructure development

Global urbanization remains a powerful catalyst for infrastructure development, directly benefiting companies like Enerpac Tool Group. As more people flock to cities, the demand for new construction – from roads and bridges to power grids and water systems – escalates. This ongoing trend ensures a consistent need for the heavy-duty tools and solutions Enerpac provides, supporting its core business segments in construction and infrastructure maintenance.

The United Nations projects that by 2050, 68% of the world's population will live in urban areas. This demographic shift translates into substantial investment in urban infrastructure. For instance, the global construction market was valued at approximately $10.7 trillion in 2023 and is expected to grow significantly in the coming years, driven by these urbanization efforts. Enerpac's specialized hydraulic tools are crucial for many of these large-scale projects, from lifting heavy components to precise assembly and demolition.

- Sustained Demand: Urbanization fuels the need for new infrastructure, creating a long-term demand driver for Enerpac's products.

- Market Growth: The global construction market's projected growth, fueled by urban development, directly benefits Enerpac's revenue streams.

- Project Scale: The increasing complexity and scale of urban infrastructure projects require robust and reliable tools, aligning with Enerpac's product offerings.

Customer preferences for advanced solutions

Customers today are really looking for tools and systems that are not just powerful, but also smart and connected. They want solutions that make their jobs easier, faster, and safer, often preferring integrated systems over standalone tools. This shift is driven by a desire for greater operational efficiency and improved outcomes.

Enerpac is actively addressing this trend by focusing on innovation that meets these advanced needs. For instance, their development of battery-powered hydraulic tools, like the BT-Series, offers greater portability and ease of use compared to traditional corded or engine-driven options. This directly caters to the demand for more user-friendly and efficient equipment.

Furthermore, Enerpac's exploration and integration of Internet of Things (IoT) technology into their products is a key response to customer preferences for data-driven insights and remote monitoring. This allows for better asset management, predictive maintenance, and optimized performance, aligning with the move towards smarter industrial solutions. In 2023, Enerpac reported a significant portion of its new product development pipeline focused on connected and battery-powered technologies, reflecting this market direction.

- Demand for Smart Tools: Customers increasingly value tools with integrated sensors and connectivity for real-time data and remote management.

- Efficiency and Precision: Advanced solutions are sought for their ability to boost operational efficiency and enhance the precision of tasks.

- Safety Focus: Modern preferences lean towards equipment that inherently improves workplace safety, such as battery-powered tools reducing trip hazards.

- Integrated Systems: A growing preference exists for comprehensive solutions that work together seamlessly, rather than disparate components.

The increasing emphasis on worker safety and well-being across industries directly benefits Enerpac Tool Group. As companies prioritize reducing workplace accidents, the demand for reliable, high-precision tools for heavy lifting and controlled force applications rises. This trend is supported by stricter safety regulations and a proactive approach to risk mitigation, which drives the need for Enerpac's engineered solutions.

Societal expectations are also shifting towards greater environmental responsibility, influencing product design and manufacturing processes. Enerpac is responding by focusing on reducing its environmental footprint and developing more eco-friendly solutions, such as improving energy efficiency in operations and exploring recycled materials. This aligns with a growing consumer and regulatory push for sustainable industrial practices.

Global urbanization continues to be a significant driver for infrastructure development, a core market for Enerpac. The projected increase in urban populations worldwide means sustained demand for new construction and maintenance of essential services. The global construction market's growth, fueled by these urban development efforts, directly benefits Enerpac's revenue streams by requiring its specialized tools for large-scale projects.

Customers are increasingly seeking smart, connected tools that enhance efficiency and safety. Enerpac's development of battery-powered hydraulic tools and the integration of IoT technology cater to this demand for user-friendly, data-driven solutions. This focus on innovation ensures Enerpac remains competitive by meeting the evolving preferences for advanced, integrated industrial equipment.

Technological factors

Ongoing innovations in hydraulic systems are significantly shaping the landscape for companies like Enerpac. We're seeing a push towards improved energy efficiency, which is crucial for reducing operational costs and environmental impact. Electro-hydraulic integration is another key area, blending the power of hydraulics with the precision of electronic controls. This allows for smarter, more responsive tools and machinery.

New materials are also playing a vital role, leading to lighter, stronger, and more durable hydraulic components. This directly impacts Enerpac's product development, enabling them to offer more advanced and reliable solutions. The company's competitive edge hinges on its ability to integrate these advancements into its product lines.

Looking ahead to 2025, the future of hydraulics is clearly a fusion of robust traditional strength with modern intelligence. This means not just raw power, but also sophisticated control and connectivity. For Enerpac, this translates to opportunities in developing next-generation tools that are not only powerful but also data-driven and highly adaptable to various industrial needs.

The integration of intelligent sensors and IoT connectivity into industrial tools is a significant technological driver. This allows for real-time monitoring of tool performance and condition, paving the way for predictive maintenance. For instance, Enerpac has incorporated wireless connectivity into its latest pump models, enabling better data collection and remote diagnostics.

Leveraging IoT for asset management offers substantial benefits. Companies can track tool location, usage patterns, and maintenance schedules more effectively. This data-driven approach, supported by predictive analytics, helps optimize operational efficiency and reduce downtime, a key consideration for industries relying on heavy-duty equipment.

The increasing adoption of industrial automation and robotics is reshaping manufacturing, directly influencing the demand for tools like those Enerpac offers and driving the need for more automated solutions. This trend is a significant technological factor for Enerpac.

The global industrial automation market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 9.5% from 2024 to 2033. This expansion is largely fueled by the widespread integration of advanced control systems and robotics in production processes worldwide.

Development of new materials

Innovations in materials science are significantly impacting the hydraulics sector. The development of stronger, lighter, and more durable composites and alloys directly translates to enhanced performance and extended lifespan for products like those offered by Enerpac Tool Group. These advancements are not just theoretical; they are driving tangible improvements in how hydraulic equipment functions.

By 2025, advanced materials and lightweighting are recognized as critical trends within the hydraulics industry. This focus on material innovation helps reduce the overall weight of hydraulic systems, which in turn leads to lower energy consumption and improved operational efficiency. For instance, the adoption of high-strength aluminum alloys in hydraulic cylinders can yield weight savings of up to 30% compared to traditional steel, boosting fuel efficiency in mobile hydraulic applications.

- Enhanced Product Performance: New materials allow for hydraulic components that can withstand higher pressures and operate more efficiently.

- Increased Durability: Composites and advanced alloys offer superior resistance to wear and corrosion, extending the service life of Enerpac's tools.

- Lightweighting Benefits: Material advancements contribute to lighter equipment, improving portability and reducing energy demands in operation.

- Cost-Effectiveness: While initial investment in advanced materials can be higher, their longevity and efficiency often lead to lower total cost of ownership.

Research and development investment trends

Investment in research and development (R&D) is a crucial driver for innovation and market positioning in the industrial tools sector. Companies prioritizing R&D are better equipped to develop next-generation products and maintain a competitive edge.

Enerpac Tool Group demonstrates a strong commitment to R&D, evidenced by its focus on customer-driven innovation and internal improvement initiatives. Programs like 'Powering Enerpac Performance' (PEP) underscore this dedication, aiming to enhance product offerings and operational efficiency through ongoing development.

Looking at broader industry trends, global R&D spending in industrial automation and technology is projected to see continued growth. For instance, the industrial automation market alone was valued at approximately $175 billion in 2023 and is expected to expand significantly in the coming years, with a substantial portion allocated to R&D for smarter, more connected solutions.

- R&D drives innovation: Investment in R&D is key to developing advanced industrial tools and maintaining market leadership.

- Enerpac's commitment: Enerpac emphasizes customer-driven innovation and continuous improvement through programs like PEP.

- Industry growth: The industrial automation sector, a key market for Enerpac, saw R&D investment fueling its growth from an estimated $175 billion market in 2023.

Technological advancements are continuously reshaping the industrial tools sector, directly impacting Enerpac Tool Group. The integration of electro-hydraulics and smart sensors into equipment enhances precision and enables real-time monitoring, crucial for predictive maintenance. For example, Enerpac's wireless connectivity in pumps facilitates better data collection and remote diagnostics.

Innovations in materials science are also critical, leading to lighter, stronger components. By 2025, advanced materials are expected to reduce hydraulic system weight by up to 30%, improving energy efficiency. This focus on lightweighting and durability directly enhances product performance and extends service life.

The industrial automation market, a key area for Enerpac, is projected for substantial growth, with R&D spending driving this expansion. Global R&D investment in industrial automation is expected to fuel the market's growth from an estimated $175 billion in 2023.

| Technological Factor | Impact on Enerpac | Key Trend/Data (2024/2025) |

|---|---|---|

| Electro-Hydraulics & IoT | Enhanced precision, remote diagnostics, predictive maintenance | Wireless connectivity in pumps (Enerpac) |

| Advanced Materials | Lighter, stronger, more durable components, improved efficiency | Up to 30% weight savings in hydraulic cylinders by 2025 |

| Industrial Automation | Increased demand for automated solutions, market growth driver | Industrial automation market valued at $175 billion in 2023, significant R&D investment |

Legal factors

Enerpac Tool Group operates under strict product liability laws, meaning they can be held responsible for damages caused by defective products. This is particularly critical for their industrial tools and heavy lifting equipment, where failures can lead to severe injuries or property damage. For instance, in 2024, the US saw an increase in product liability claims, highlighting the ongoing need for robust safety protocols.

Evolving safety standards globally and regionally demand continuous adaptation. Enerpac must invest in rigorous testing and quality control to ensure its products not only meet but surpass these benchmarks. Failure to do so could result in costly lawsuits and damage to their reputation, impacting their market position.

Enerpac Tool Group must adhere to stringent health and safety regulations, including those set by OSHA, to ensure safe manufacturing processes and product usage by its clientele. For instance, in 2023, OSHA reported that manufacturing industries experienced a recordable incident rate of 2.9 per 100 full-time workers, underscoring the importance of robust safety protocols.

Evolving health and safety legislation can directly influence Enerpac's operational expenditures and necessitate modifications to product development and engineering. Failure to comply can result in significant fines, impacting profitability; OSHA penalties can range from thousands to hundreds of thousands of dollars for serious or willful violations.

Environmental protection laws are becoming stricter, impacting how Enerpac Tool Group operates. Regulations concerning hazardous chemicals, like those under REACH in Europe, and emissions standards are tightening globally. For instance, in 2024, the EU continued its focus on restricting substances of very high concern, potentially affecting materials used in hydraulic tools.

Compliance with these evolving environmental mandates, including waste management and recycling protocols, is crucial for Enerpac to avoid fines and maintain its operational license. Companies that fail to adapt, such as those not meeting new emissions targets set for 2025 in various manufacturing hubs, risk significant financial penalties and reputational damage.

Intellectual property rights and patents

Enerpac's reliance on intellectual property, particularly patents for its specialized hydraulic tools, is a cornerstone of its competitive edge. The company's ability to secure and defend these patents directly impacts its market exclusivity and the profitability of its innovative product lines. As of early 2024, the global patent landscape continues to evolve, with increased scrutiny on patent validity and enforcement, a factor Enerpac must navigate diligently.

Legal frameworks governing patents and trademarks significantly shape Enerpac's innovation pipeline and its capacity to bring new, highly engineered solutions to market. Robust patent protection allows Enerpac to recoup its substantial R&D investments and maintain a pricing advantage. For instance, the United States Patent and Trademark Office (USPTO) reported a 3% increase in utility patent applications filed in 2023, highlighting a dynamic environment where securing and maintaining IP is paramount.

- Patent Portfolio Strength: Enerpac's ability to protect its unique hydraulic technologies through patents is critical for market differentiation.

- Innovation Incentives: The legal system's effectiveness in granting and enforcing patents directly influences Enerpac's investment in new product development.

- Global IP Landscape: Navigating varying patent laws across different jurisdictions is essential for Enerpac's international operations and market access.

International trade agreements and compliance

Enerpac Tool Group's global operations necessitate strict adherence to international trade agreements and customs regulations. For instance, in 2024, the World Trade Organization reported that global trade in goods saw a modest increase, but navigating varied tariff structures and import/export controls across different regions remains a critical compliance challenge for companies like Enerpac. Failure to comply can result in substantial penalties, impacting profitability and market access.

Compliance with sanctions regimes, such as those imposed by the United States and the European Union, is also paramount. In 2025, continued geopolitical tensions are expected to maintain a complex web of sanctions affecting various countries and entities. Enerpac must diligently screen its customers and transactions to avoid engaging with sanctioned parties, which could lead to severe legal repercussions and operational disruptions.

- Trade Agreement Navigation: Enerpac must stay abreast of agreements like the USMCA and EU trade pacts to optimize its supply chain and market entry strategies.

- Customs Duty Optimization: Understanding and leveraging preferential trade agreements can reduce costs associated with importing and exporting components and finished goods.

- Sanctions Screening: Robust due diligence processes are essential to prevent transactions with entities or individuals subject to international sanctions, mitigating legal and financial risks.

- Regulatory Changes: Proactive monitoring of evolving trade policies and customs procedures globally is crucial for maintaining uninterrupted global sales and distribution.

Enerpac Tool Group's product liability exposure is significant, with potential for substantial damages in cases of equipment failure. For example, in 2024, product liability claims continued to be a concern across manufacturing sectors, emphasizing the need for rigorous quality control and safety standards. Adherence to evolving global safety regulations is paramount to avoid costly litigation and reputational damage.

| Legal Factor | Impact on Enerpac | 2024/2025 Relevance |

|---|---|---|

| Product Liability | Responsibility for defective products, especially in heavy-duty equipment. | Increased claims in 2024 highlight ongoing risk; robust safety protocols are critical. |

| Health & Safety Regulations | Compliance with standards like OSHA for safe manufacturing and product use. | Manufacturing incident rates (2.9 per 100 workers in 2023) show the importance of safety; non-compliance can incur fines up to hundreds of thousands of dollars. |

| Environmental Laws | Adherence to regulations on hazardous chemicals and emissions (e.g., REACH). | Stricter EU rules in 2024 on substances of very high concern may affect material choices; failure to meet 2025 emissions targets risks penalties. |

| Intellectual Property | Protection of patents for specialized hydraulic tools to maintain market exclusivity. | USPTO saw a 3% rise in patent applications in 2023, indicating a dynamic IP landscape requiring diligent navigation. |

| International Trade & Sanctions | Compliance with trade agreements, customs, and sanctions regimes. | Global trade saw modest growth in 2024, but navigating varied tariffs and sanctions (expected to remain complex in 2025) is crucial to avoid penalties. |

Environmental factors

Global efforts to combat climate change are intensifying, with governments worldwide implementing more stringent regulations on greenhouse gas (GHG) emissions and mandating detailed reporting. These evolving environmental policies directly influence Enerpac Tool Group's operational costs and energy usage, pushing for greater efficiency and potentially higher compliance expenses.

In response to these pressures, Enerpac took a significant step in 2024 by completing its inaugural comprehensive Greenhouse Gas (GHG) Inventory. This initiative was crucial for establishing a baseline understanding of the company's carbon footprint, a foundational element for developing targeted reduction strategies and ensuring future regulatory compliance.

Enerpac Tool Group, like many industrial manufacturers, faces challenges related to resource scarcity and the sourcing of raw materials. The availability and fluctuating costs of key metals such as steel and aluminum, crucial for their hydraulic tools, are directly impacted by global supply and demand dynamics and geopolitical events. For instance, in early 2024, steel prices saw volatility driven by production issues in major exporting nations, potentially affecting Enerpac's cost of goods sold.

The increasing global emphasis on sustainability is also reshaping raw material sourcing. Companies like Enerpac are under pressure to adopt more responsible procurement practices, which can involve higher upfront costs for ethically sourced or recycled materials. By 2025, it's anticipated that regulatory frameworks and consumer demand will further incentivize the integration of sustainable sourcing into supply chain strategies, potentially influencing Enerpac's operational efficiency and market perception.

Growing environmental awareness is pushing companies like Enerpac to adopt robust waste management and recycling programs. This means looking at how materials are used from the start of production all the way through to when a product is no longer in use.

Enerpac is committed to developing systems that actively manage waste, aiming to minimize its environmental footprint. This aligns with broader industry trends, where companies are increasingly scrutinized for their sustainability practices and waste reduction efforts.

For instance, many industrial manufacturers in 2024 are setting ambitious targets for waste diversion, with some aiming for over 90% of non-hazardous waste to be recycled or reused. Enerpac's focus on responsible waste management positions it to meet these evolving regulatory and stakeholder expectations.

Energy efficiency requirements for products

Growing customer pressure for reduced operational expenses and a smaller environmental footprint is driving significant demand for energy-efficient industrial tools and hydraulic systems. This trend is particularly pronounced in sectors where energy consumption represents a substantial portion of operating costs.

Enerpac is actively responding to this demand by prioritizing investments in technologies that demonstrably lower energy usage. For instance, their development and promotion of variable displacement pumps, which adjust hydraulic flow based on actual demand rather than operating at a constant high rate, directly addresses this need. Furthermore, the company is exploring and implementing eco-friendly hydraulic fluids as part of its commitment to sustainability and efficiency.

- Rising Demand: Industrial clients are increasingly seeking tools that cut energy bills and minimize their carbon emissions.

- Enerpac's Response: The company is focusing R&D on variable displacement pumps and environmentally friendly hydraulic fluids.

- Market Impact: These advancements position Enerpac to meet evolving regulatory standards and customer preferences for greener solutions.

Customer and investor pressure for ESG performance

Customers and investors are placing significant emphasis on Environmental, Social, and Governance (ESG) performance, directly influencing corporate strategy. This trend is evident as stakeholders increasingly demand transparency and accountability regarding a company's impact beyond financial returns. Enerpac Tool Group, recognizing this shift, has actively engaged in reporting its ESG initiatives.

Enerpac has published corporate responsibility reports that outline its strategic commitments and management approach to ESG matters. These reports serve as a key communication tool, detailing the company's efforts in areas such as environmental stewardship, social responsibility, and corporate governance. For instance, in its 2023 Corporate Responsibility Report, Enerpac highlighted progress in reducing its greenhouse gas emissions intensity by 15% compared to a 2020 baseline, demonstrating tangible action on environmental factors.

The pressure for improved ESG performance is translating into concrete investment decisions. A significant portion of institutional investors now integrate ESG factors into their investment screening and portfolio construction. For example, by the end of 2024, it's projected that over $30 trillion in assets under management globally will be influenced by ESG considerations, underscoring the financial imperative for companies like Enerpac to demonstrate strong ESG credentials.

- Stakeholder Scrutiny: Customers and investors are intensifying their focus on ESG performance, impacting corporate reputation and access to capital.

- Transparency Efforts: Enerpac addresses this pressure through its published corporate responsibility reports, detailing its ESG strategy and management.

- Environmental Commitment: Enerpac reported a 15% reduction in greenhouse gas emissions intensity by 2023, showcasing progress in environmental responsibility.

- Investment Influence: ESG factors are increasingly integrated into investment decisions, with over $30 trillion in global assets expected to be ESG-influenced by the end of 2024.

Enerpac Tool Group is navigating a landscape increasingly shaped by environmental regulations and a global push for sustainability. The company's 2024 inaugural Greenhouse Gas (GHG) Inventory was a critical step in understanding its carbon footprint, essential for future compliance and strategic reduction efforts.

Resource scarcity, particularly for metals like steel and aluminum, presents a direct challenge, with prices in early 2024 showing volatility due to production issues in key exporting nations. Enerpac is also responding to growing customer demand for energy-efficient tools and eco-friendly hydraulic fluids, investing in technologies like variable displacement pumps to meet these needs.

The company's commitment to ESG performance is highlighted by its corporate responsibility reports, which detail progress such as a 15% reduction in greenhouse gas emissions intensity by 2023. This focus is crucial as over $30 trillion in global assets are projected to be ESG-influenced by the end of 2024, impacting investment decisions and corporate strategy.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Enerpac Tool Group is informed by a robust dataset encompassing official government publications, reputable market research firms, and leading economic indicators. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.