Element Solutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Solutions Bundle

Element Solutions leverages its strong market position and diversified product portfolio, but faces potential headwinds from evolving regulations and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Element Solutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Element Solutions Inc. boasts a diverse and high-performance product portfolio, crucial for everyday items across numerous sectors. This breadth, especially in specialized fields like printed circuit boards and semiconductor packaging, significantly reduces dependence on any single product, bolstering its market standing.

The company's strategic emphasis on developing enabling technologies that improve both functionality and aesthetics offers a distinct competitive advantage and a strong value proposition to its clientele.

Element Solutions' Electronics segment is a powerhouse, consistently delivering strong results. We saw high single-digit organic growth for several quarters in a row, hitting 9% in the second quarter of 2025. This segment is crucial, making up about 64% of total sales in 2024.

This impressive performance is driven by key growth areas. Demand is particularly high for solutions used in advanced wafer-level packaging, power electronics, and circuitry. The expansion in leading-edge semiconductor nodes, the rise of high-performance computing, and the booming electric vehicle market are all fueling this segment's success.

Element Solutions boasts a significant global footprint, with operations strategically positioned to serve diverse markets. This expansive reach allows for localized sourcing, manufacturing, and technical support, bringing resources closer to their customer base.

This dual approach of global presence and localized operations is a key strength. It helps Element Solutions navigate the complexities of international trade, including volatile dynamics and potential tariff changes, ensuring a more resilient and responsive supply chain.

For instance, in 2023, Element Solutions reported that its Global Transaction Services segment, which includes its electronics and industrial chemicals, saw strong performance across various regions, underscoring the benefit of its widespread operational network.

Solid Financial Health and Cash Flow Generation

Element Solutions Inc. has showcased impressive financial strength, achieving record results in 2024 with substantial growth in net income and adjusted EBITDA. This performance underscores the company's operational efficiency and market position.

The company consistently generates robust cash flows from both operating activities and free cash flow. For instance, in the first quarter of 2024, Element Solutions reported operating cash flow of $197 million and free cash flow of $155 million, highlighting its ability to convert profits into readily available cash.

- Record Financials: 2024 saw Element Solutions achieve record net income and adjusted EBITDA.

- Strong Cash Flow: Consistent generation of operating and free cash flow indicates financial discipline.

- Capital Efficiency: Robust cash flow supports strategic investments and shareholder returns.

- Financial Flexibility: The company's solid financial health allows for debt management and strategic capital allocation.

Commitment to Innovation and R&D

Element Solutions demonstrates a strong commitment to innovation, consistently investing in high-value technologies and research and development. This focus fuels the creation of leading-edge solutions for demanding applications. For instance, the company is actively expanding its global R&D footprint, with new research centers and labs being established in key electronics manufacturing hubs such as India, Thailand, and Vietnam. This strategic placement aims to bolster support for the burgeoning electronics sector.

This dedication to R&D directly translates into the development of differentiated products that anticipate and meet evolving customer requirements. A prime example is their work on solutions for power and thermal management, critical for the increasingly complex designs found in modern semiconductor technology. In 2023, Element Solutions reported approximately $1.1 billion in sales for its Electronics segment, underscoring the market demand for its innovative offerings.

The company’s investment in innovation is not just about creating new products; it’s about staying ahead of technological curves and providing essential materials that enable advancements across industries. This forward-thinking approach is crucial for maintaining a competitive edge in the fast-paced materials science sector.

Element Solutions' diverse product portfolio, particularly its strength in specialized electronics materials, provides a strong foundation. The company's consistent investment in research and development fuels innovation, creating differentiated products that meet evolving market demands.

The Electronics segment, representing a significant portion of sales (around 64% in 2024), continues to show robust growth, driven by demand in advanced semiconductor packaging and electric vehicles. This segment achieved 9% organic growth in Q2 2025.

Element Solutions' global operational footprint, combined with localized support, enhances supply chain resilience and customer responsiveness. This strategic positioning allows them to effectively navigate international market complexities.

Financially, the company demonstrated exceptional performance in 2024, achieving record net income and adjusted EBITDA. Strong cash flow generation, with $155 million in free cash flow reported in Q1 2024, underpins its financial flexibility and ability to invest in growth.

What is included in the product

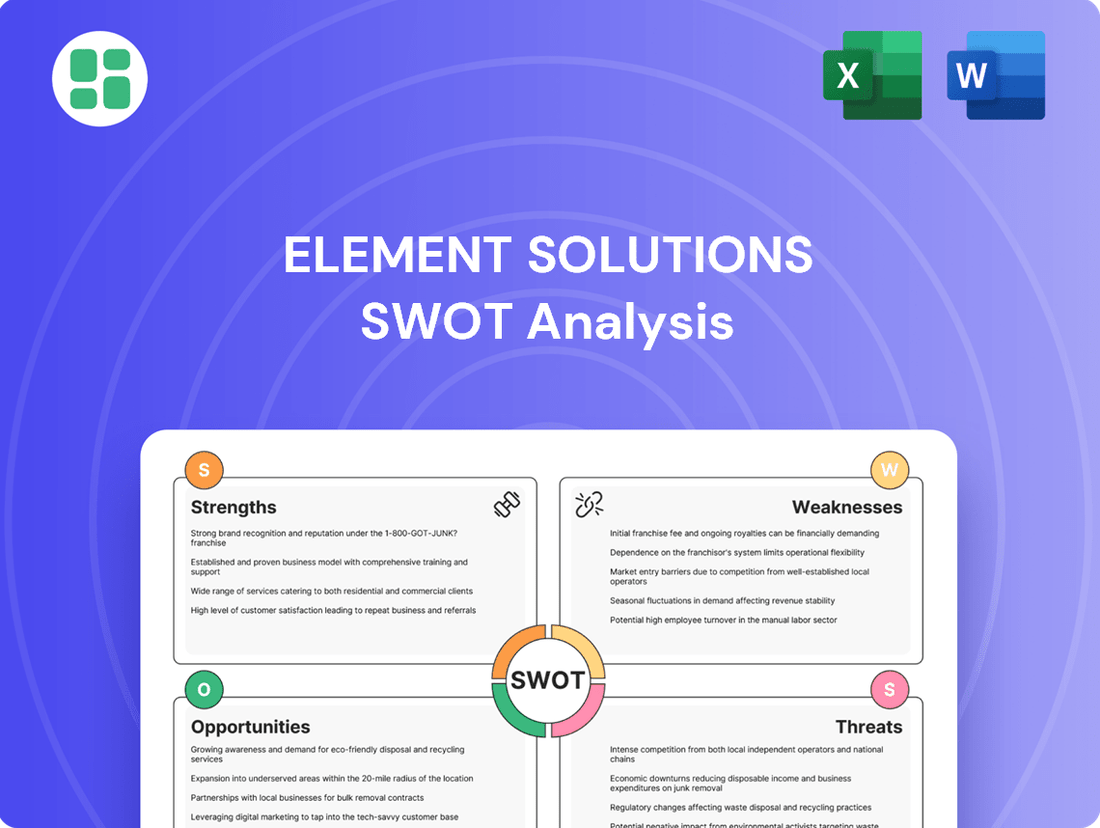

Offers a full breakdown of Element Solutions’s strategic business environment by examining its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a structured framework to identify and address critical business challenges, transforming potential weaknesses into actionable strategies.

Weaknesses

Element Solutions' significant reliance on its Electronics segment, a key revenue driver, exposes it to the inherent cyclicality of consumer electronics and semiconductor markets. Even with a focus on high-growth areas, a general market slowdown or a dip in consumer spending, such as a weaker smartphone market, could negatively affect the company's financial results.

Element Solutions' profitability is sensitive to raw material costs. For instance, their adjusted EBITDA margin saw a dip in Q2 2025, partly due to higher pass-through metal prices. This highlights the challenge for specialty chemical firms like Element Solutions in absorbing or passing on these cost increases without impacting their margins.

The Industrial & Specialty segment has faced headwinds, exhibiting slower organic net sales growth. Macroeconomic softness, especially in European and American markets, has notably impacted this sector.

Further compounding these challenges, the segment experienced declines in both net sales and adjusted EBITDA. These decreases were partly influenced by strategic divestitures and a generally tough industrial economic climate, suggesting a less dynamic performance compared to other divisions like electronics.

Dependence on Niche Market Penetration for Growth

Element Solutions' focus on high-growth, high-value niches within the electronics sector, while a strategic advantage, also creates a significant dependency. This reliance means that if these specific niche markets experience slowdowns, saturation, or are disrupted by emerging technologies, Element Solutions' growth could be significantly hampered. For instance, the semiconductor industry, a key area for advanced electronic materials, saw a projected global revenue of $624 billion in 2024, according to Statista, but shifts in demand or technological obsolescence within specific segments could impact Element Solutions.

This dependence necessitates a continuous effort to identify and penetrate new, emerging niches. Without this proactive market development, the company risks its current growth drivers becoming less potent. The challenge lies in anticipating technological shifts and consumer trends to ensure a pipeline of future growth opportunities, especially as the pace of innovation in electronics accelerates.

- Niche Market Saturation Risk: Growth is tied to the sustained expansion of specific, high-value segments within electronics.

- Technological Disruption Vulnerability: New technologies could emerge that render Element Solutions' current offerings less relevant or obsolete.

- Need for Continuous Adaptation: The company must constantly evolve its product portfolio and market focus to counter potential slowdowns in existing niches.

- Dependence on External Market Dynamics: Growth is heavily influenced by factors outside of Element Solutions' direct control within these specialized markets.

Geopolitical and Trade Policy Volatility

Element Solutions, like many global manufacturers, faces headwinds from fluctuating geopolitical landscapes and trade policies. The ongoing shifts in international trade dynamics, including the potential for new tariffs or trade restrictions, create uncertainty. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, impacting various industries, and similar measures could reappear or escalate in 2024 and 2025, affecting input costs and market access for Element Solutions' products.

While Element Solutions benefits from its geographically diverse manufacturing footprint, which can buffer against localized trade disruptions, significant global trade volatility still presents a risk. Increased tariffs could directly impact the cost of raw materials or finished goods, potentially squeezing profit margins or necessitating price adjustments that affect demand. Furthermore, trade uncertainties can disrupt the company's established supply chains, leading to delays and increased logistical expenses, complicating its operational efficiency.

The company's exposure to global markets means that sudden changes in trade agreements or the imposition of protectionist policies in key regions could negatively affect its revenue streams. For example, if a major market implements new import duties on specialty chemicals, Element Solutions might see a reduction in sales volume or be forced to absorb higher costs, impacting its overall financial performance in the 2024-2025 period.

- Trade Policy Uncertainty: Continued unpredictability in global trade agreements and tariff structures poses a risk to Element Solutions' cost management and market access.

- Supply Chain Vulnerability: Geopolitical tensions can disrupt established supply chains, potentially increasing lead times and operational costs for the company.

- Impact on Input Costs: Escalating tariffs on raw materials or intermediate goods could directly increase Element Solutions' cost of goods sold, affecting profitability.

- Market Access Restrictions: New trade barriers in key operating regions could limit Element Solutions' ability to serve its customer base effectively, impacting revenue growth.

Element Solutions' reliance on specific high-growth electronics niches, while beneficial, also creates a significant dependency. Should these specialized markets face slowdowns, saturation, or technological disruption, the company's growth trajectory could be severely impacted. For instance, the semiconductor industry, a key market for advanced electronic materials, is projected to reach $624 billion in global revenue for 2024, but shifts in demand or technological obsolescence within specific segments pose a risk.

Preview the Actual Deliverable

Element Solutions SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The surge in demand for high-performance computing and AI infrastructure is a major tailwind for Element Solutions. The company's advanced materials are crucial for the intricate packaging and semiconductor solutions powering these technologies, positioning it to benefit from robust organic growth in its Electronics segment. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to reach over $200 billion by 2030, highlighting the immense scale of this opportunity.

Element Solutions is strategically increasing its presence in the electric vehicle (EV) sector by offering specialized power electronics components. Their ArgoMax sintered silver technology, for instance, plays a vital role in managing heat effectively within EVs, a crucial factor for performance and longevity.

With the global EV market projected to reach over $800 billion by 2025, this expansion presents a significant avenue for Element Solutions. The company has a strong opportunity to acquire new clients and expand its share in this rapidly growing, high-margin market segment.

Element Solutions possesses a robust financial position, enabling it to actively pursue strategic acquisitions. This strength allows the company to target opportunities that can enhance its existing capabilities and expand its market presence. For instance, in 2023, the company reported a strong cash flow from operations, providing ample resources for such strategic moves.

The recent divestiture of MacDermid Graphics Solutions in 2023 for $1.9 billion is a prime example of their portfolio optimization strategy. This move sharpens their focus on more dynamic, high-growth segments within their business, such as specialty chemicals for electronics and industrial applications.

This strategic pruning not only streamlines operations but also significantly bolsters Element Solutions' balance sheet flexibility. This enhanced financial agility is crucial for capitalizing on future acquisition opportunities and investing in innovation within their core, higher-growth markets.

Leveraging Sustainability Trends for Product Development

The increasing global demand for eco-friendly chemical solutions presents a significant opportunity for Element Solutions to pioneer new product lines and refine existing processes. By focusing on sustainability, the company can tap into a growing market segment that values environmental responsibility. For instance, Element Solutions reported a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions in their 2023 sustainability report, demonstrating progress in this area.

Element Solutions can further capitalize on these trends by actively promoting its environmental stewardship and community engagement efforts. Highlighting achievements in areas like waste reduction and cleaner production can bolster brand image and attract customers who prioritize sustainable supply chains. This strategic positioning can lead to increased market share, especially as corporate procurement policies increasingly favor environmentally conscious suppliers.

Key opportunities include:

- Developing biodegradable or recyclable chemical formulations

- Investing in R&D for lower-emission manufacturing processes

- Partnering with organizations focused on circular economy initiatives

- Marketing sustainability credentials to attract environmentally conscious clients

Market Recovery and Cyclical Upswing in Industrial Segments

A significant opportunity lies in the potential recovery of industrial markets, especially in Europe and the Americas. As economic conditions improve, Element Solutions can capitalize on this cyclical upswing, particularly within its Industrial & Specialty segment. This recovery could translate into increased demand for its products, leveraging existing customer relationships and a strong market presence.

For instance, the Purchasing Managers' Index (PMI) for the manufacturing sector in the Eurozone showed signs of stabilization in early 2024, hinting at a potential bottoming out of the downturn. Similarly, industrial production in the United States has demonstrated resilience, with some sub-sectors experiencing growth. Element Solutions is well-positioned to benefit from these trends, as its specialty chemicals and materials are integral to various industrial processes.

- Cyclical Upswing: Anticipated recovery in global industrial activity, particularly in key regions like Europe and the Americas, offers a tailwind.

- Leveraging Existing Strengths: Element Solutions can deploy its established product portfolio and strong customer ties within the Industrial & Specialty segment to capture renewed demand.

- Economic Indicators: Positive shifts in manufacturing PMIs and industrial production figures in major economies signal a potential rebound, directly benefiting companies like Element Solutions.

Element Solutions is well-positioned to capitalize on the burgeoning demand for advanced materials in high-performance computing and AI. The company's specialized products are essential for semiconductor packaging, a critical component in these rapidly expanding tech sectors. The global AI chip market's projected growth, from around $20 billion in 2023 to over $200 billion by 2030, underscores this significant opportunity.

The company's strategic focus on the electric vehicle (EV) market presents another substantial growth avenue. Element Solutions' innovative solutions, such as ArgoMax sintered silver technology for thermal management, are vital for EV performance and durability. With the EV market anticipated to exceed $800 billion by 2025, this segment offers considerable potential for market share expansion and increased profitability.

Element Solutions' robust financial health, evidenced by strong 2023 cash flow from operations, empowers strategic acquisitions and investments in innovation. The 2023 divestiture of MacDermid Graphics Solutions for $1.9 billion exemplifies their commitment to optimizing their portfolio for higher-growth markets, enhancing financial flexibility for future strategic moves.

The company's commitment to sustainability offers a distinct advantage, with opportunities to develop eco-friendly chemical formulations and lower-emission manufacturing processes. Element Solutions' reported 10% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 highlights their progress and positions them to attract environmentally conscious clients.

A potential recovery in industrial markets, particularly in Europe and the Americas, presents a significant opportunity for Element Solutions. Positive economic indicators, such as stabilizing manufacturing PMIs in the Eurozone in early 2024, suggest a rebound that will drive demand for their specialty chemicals and materials.

| Opportunity Area | Key Driver | Market Projection/Data Point | Element Solutions' Role |

|---|---|---|---|

| High-Performance Computing & AI | Demand for advanced semiconductor materials | AI Chip Market: ~$20B (2023) to >$200B (2030) | Crucial for intricate packaging and semiconductor solutions |

| Electric Vehicles (EVs) | Growth in EV adoption and thermal management needs | EV Market: Projected to exceed $800B by 2025 | Specialized power electronics components (e.g., ArgoMax) |

| Portfolio Optimization & Financial Strength | Strategic divestitures and strong cash flow | MacDermid Graphics Solutions divestiture: $1.9B (2023) | Enhanced financial flexibility for acquisitions and R&D |

| Sustainability & Green Chemistry | Increasing demand for eco-friendly solutions | 10% reduction in Scope 1 & 2 GHG emissions (2023) | Pioneering biodegradable/recyclable formulations, cleaner processes |

| Industrial Market Recovery | Economic upswing in key regions | Eurozone Manufacturing PMI stabilization (early 2024) | Leveraging existing products and customer ties in Industrial & Specialty segment |

Threats

The specialty chemicals sector is inherently competitive, with established companies and emerging players constantly seeking to capture market share. Element Solutions faces the challenge of differentiating its offerings in this dynamic landscape, particularly in lucrative, high-value market segments where competition is most intense.

Global economic uncertainties and a generally slower economic backdrop, particularly impacting industrial markets and consumer electronics, present a significant threat to Element Solutions' demand. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, indicating a challenging environment.

This reduced spending power within key industrial and consumer segments directly translates to lower sales volumes across Element Solutions' diverse product applications. A slowdown in sectors like automotive or semiconductors, both significant end-markets for specialty chemicals, could lead to potential revenue stagnation or even a decline for the company.

The electronics and semiconductor sectors are evolving at an extraordinary pace. This rapid advancement poses a significant threat of technological obsolescence for Element Solutions' current offerings if newer materials or manufacturing methods emerge. For instance, the constant push for smaller, faster, and more energy-efficient chips necessitates continuous adaptation.

Element Solutions faces the critical challenge of maintaining a high tempo of innovation and research and development. Failure to do so risks disruption from competitors introducing breakthrough technologies or alternative solutions that render existing products less competitive. The company's ability to anticipate and integrate these shifts is paramount to its sustained relevance.

Supply Chain Disruptions and Geopolitical Risks

Element Solutions faces significant threats from ongoing global trade dynamics and geopolitical instability. Conflicts like the war in Ukraine and the Israel-Hamas conflict can disrupt critical supply routes and increase transportation expenses. For instance, in 2024, shipping costs on major trade lanes have seen volatility, impacting companies reliant on international logistics.

These geopolitical risks directly translate into potential supply chain disruptions for Element Solutions. This can manifest as shortages of essential raw materials or components, directly affecting production schedules and the company's ability to meet customer demand. The threat of new tariffs or trade barriers also looms, potentially increasing the cost of imported goods and impacting the company's cost structure.

- Supply Chain Vulnerability: Geopolitical events can lead to unexpected delays and increased costs in sourcing raw materials and finished goods.

- Increased Logistics Costs: Disruptions often force the use of more expensive shipping methods or alternative, less efficient routes.

- Raw Material Shortages: Conflicts can impact the availability of key chemicals or metals essential for Element Solutions' products.

- Trade Policy Uncertainty: Shifting trade agreements and tariffs can create unpredictable cost increases and market access challenges.

Strict Environmental Regulations and Compliance Costs

Element Solutions, like many in the chemical sector, faces significant headwinds from increasingly strict environmental regulations worldwide. These regulations, covering everything from chemical usage and waste management to emissions, translate directly into higher compliance costs for the company. For instance, new mandates on greenhouse gas emissions or water discharge could require substantial capital outlays for upgraded equipment and processes.

The evolving regulatory landscape presents a constant challenge, potentially restricting operational flexibility and introducing new liabilities. Companies must remain agile, investing in cleaner technologies and more sustainable practices to meet these demands. Failure to comply can result in hefty fines, reputational damage, and operational shutdowns, all of which can negatively impact profitability. In 2024, the chemical industry saw increased scrutiny on PFAS (per- and polyfluoroalkyl substances) compounds, with potential for stricter controls and remediation costs.

- Increased Compliance Costs: Global environmental regulations necessitate ongoing investment in pollution control technologies and monitoring systems.

- Operational Restrictions: Stricter rules on emissions and waste disposal can limit production volumes or require costly process modifications.

- Potential Liabilities: Non-compliance can lead to significant fines, legal challenges, and the need for expensive environmental remediation efforts.

- Investment in New Technologies: Adapting to evolving regulations, such as those concerning chemical safety and sustainability, may require substantial capital for R&D and implementation of greener alternatives.

Element Solutions operates in a highly competitive specialty chemicals market, facing pressure from both established players and new entrants, particularly in high-margin segments. The company must continually innovate to maintain its edge against rapid technological advancements in sectors like electronics, where obsolescence is a constant threat.

Global economic slowdowns, as projected by the IMF with a 2.9% global growth forecast for 2024, directly impact demand in key end-markets like automotive and semiconductors, potentially leading to revenue stagnation. Geopolitical instability and trade disputes further exacerbate these challenges by disrupting supply chains, increasing logistics costs, and creating uncertainty around tariffs, as seen with volatile shipping costs in 2024.

Increasingly stringent environmental regulations worldwide, such as those concerning PFAS compounds in 2024, pose a significant threat. These regulations can lead to higher compliance costs, operational restrictions, potential liabilities from non-compliance, and necessitate substantial investment in new, greener technologies.

SWOT Analysis Data Sources

This Element Solutions SWOT analysis is built upon a foundation of reliable data, drawing from Element's official financial reports, comprehensive market intelligence, and expert industry analysis to provide a robust strategic overview.