Element Solutions Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Solutions Bundle

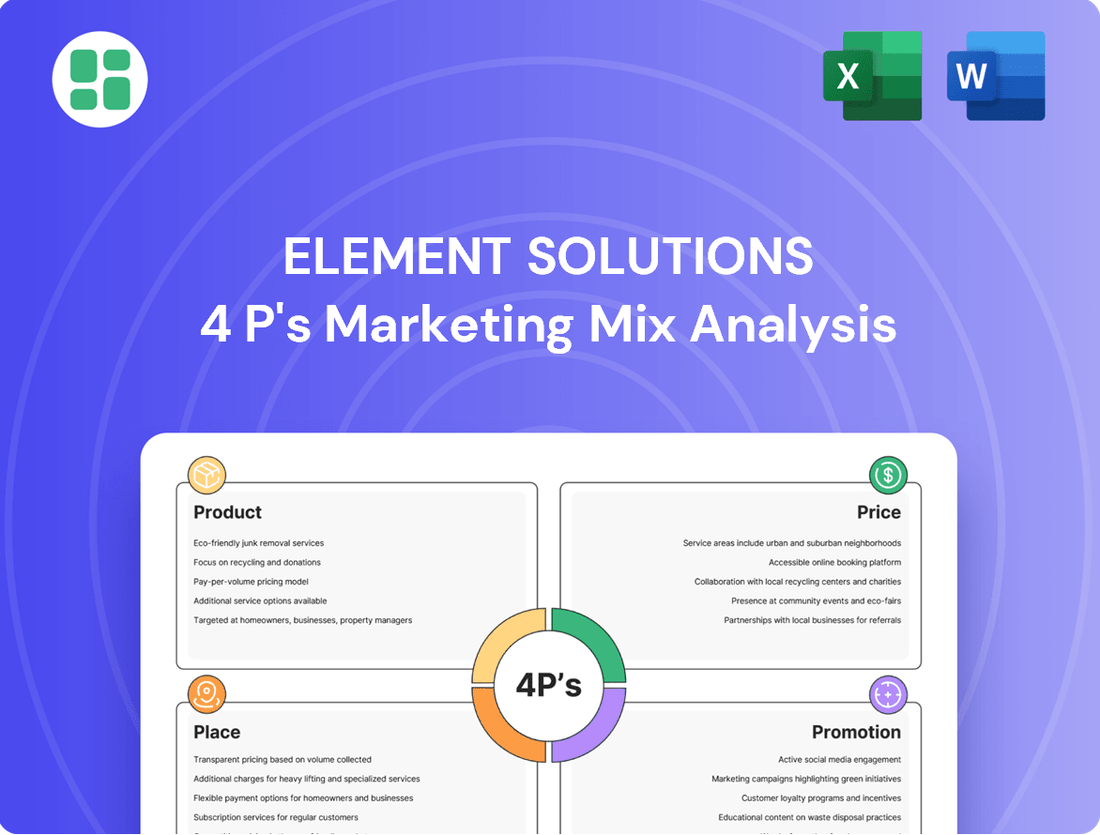

Element Solutions leverages a robust marketing mix, strategically aligning its product portfolio, pricing structures, distribution channels, and promotional activities to capture market share. Understand how these core elements create a powerful synergy for competitive advantage.

Dive deeper into the specifics of Element Solutions' product innovation, its competitive pricing strategies, its expansive place in the market, and its targeted promotion efforts. This comprehensive analysis is your key to unlocking their success.

Gain instant access to a professionally crafted, editable 4Ps Marketing Mix analysis for Element Solutions, perfect for business professionals, students, and consultants seeking strategic insights. Save valuable time and elevate your understanding of their market dominance.

Product

Element Solutions' high-performance specialty chemicals are the core of their product strategy, focusing on advanced formulations that improve performance and aesthetics in industrial applications. These aren't everyday consumer products; instead, they are essential ingredients for sectors like electronics, automotive, and industrial manufacturing. For instance, in 2023, the company reported that its Electronics segment, heavily reliant on these specialty chemicals, saw significant growth, contributing substantially to its overall revenue of $2.4 billion.

Element Solutions' tailored industry solutions are meticulously crafted to address the specific needs of diverse sectors. Their product portfolio is strategically segmented into Electronics and Industrial & Specialty, catering to critical markets like consumer electronics, power electronics, semiconductor fabrication, automotive systems, and industrial surface finishing.

These solutions are not off-the-shelf products; rather, they are the result of multi-step technological processes designed to directly enhance customer manufacturing capabilities. This deep integration means Element Solutions provides specialty chemicals vital for printed circuit boards, semiconductor packaging, and a range of advanced materials, underpinning innovation across these industries.

For instance, in the semiconductor sector, Element Solutions' advanced materials and chemicals are crucial for the intricate processes involved in chip fabrication and packaging. In 2024, the global semiconductor market was projected to reach over $600 billion, highlighting the immense demand for the specialized inputs Element Solutions provides.

Element Solutions Inc. places a strong emphasis on innovation and R&D, channeling significant resources into developing advanced materials that enable cutting-edge technologies. This strategic focus is evident in their commitment to high-growth sectors such as data centers and AI, where their specialized products are crucial.

In 2023, Element Solutions reported R&D expenses of $220.1 million, reflecting a dedicated investment in future growth and technological leadership. This investment fuels their ability to stay ahead in rapidly evolving markets.

The company's sustained investment in R&D, coupled with a highly skilled workforce, underpins its strong innovation track record. This expertise allows them to consistently deliver solutions that meet the demanding requirements of emerging technologies.

Critical Functionality Enhancement

Element Solutions' critical functionality enhancement goes beyond simply supplying raw materials. Their innovative solutions are integral to the performance and quality of their customers' finished products. For instance, in 2024, their advanced plating technologies were crucial for automotive manufacturers seeking to improve corrosion resistance, a key factor in vehicle longevity.

These specialized materials empower clients to achieve superior functionality, enhanced durability, and desirable aesthetic properties in their manufactured goods. This focus on problem-solving and fulfilling specific industrial needs forms the core of their value proposition. In the semiconductor industry, their high-purity chemicals, used in wafer fabrication, directly contribute to the increased speed and reduced power consumption of next-generation microchips.

- Superior Performance: Enabling customers to meet demanding performance specifications in their end-products.

- Enhanced Durability: Providing materials that significantly extend the lifespan and resilience of manufactured goods.

- Aesthetic Improvement: Offering solutions that elevate the visual appeal and marketability of finished products.

- Problem Solving: Addressing complex industrial challenges through tailored material science and chemical expertise.

Portfolio Optimization

Element Solutions actively refines its product portfolio, strategically divesting non-core assets and investing in high-growth areas. This approach ensures the company remains focused on segments offering superior profitability and strategic alignment. For example, the planned sale of MacDermid Graphics Solutions in early 2025 is a key initiative to elevate the overall portfolio's growth trajectory, enhance margins, and boost cash return on investment.

This portfolio optimization strategy is crucial for maintaining a competitive edge and maximizing shareholder value. By concentrating resources on core competencies and attractive market opportunities, Element Solutions aims to drive sustainable financial performance.

- Strategic Divestitures: Sale of MacDermid Graphics Solutions in early 2025.

- Focus on Growth Markets: Prioritizing segments with higher growth potential.

- Margin Enhancement: Improving profitability through portfolio adjustments.

- Cash Flow Optimization: Increasing cash return on investment.

Element Solutions' product strategy centers on high-performance specialty chemicals and advanced materials tailored for demanding industrial applications. Their offerings enhance critical functionalities like durability, performance, and aesthetics in sectors such as electronics and automotive. This focus is backed by significant R&D investment, with $220.1 million allocated in 2023 to drive innovation in high-growth areas.

The company strategically manages its product portfolio, exemplified by the planned divestiture of MacDermid Graphics Solutions in early 2025. This move aims to sharpen focus on core, high-margin segments and improve overall growth trajectory and cash return on investment.

Element Solutions' products are crucial enablers for their customers' manufacturing processes, directly contributing to the quality and competitiveness of end products. For instance, their advanced plating technologies are vital for automotive manufacturers seeking improved corrosion resistance, a key factor in vehicle longevity, especially as the automotive industry increasingly adopts advanced materials and electrification.

| Product Focus | Key Applications | 2023 R&D Investment | Strategic Portfolio Action |

|---|---|---|---|

| High-performance specialty chemicals | Electronics, Automotive, Industrial Manufacturing | $220.1 million | Divestiture of MacDermid Graphics Solutions (early 2025) |

| Advanced materials for semiconductor fabrication | Chip packaging, wafer fabrication | Focus on high-growth sectors (data centers, AI) | |

| Plating technologies for enhanced durability | Automotive components, industrial surface finishing | Margin enhancement and cash flow optimization |

What is included in the product

This analysis provides a comprehensive examination of Element Solutions' marketing strategies, detailing their Product offerings, Pricing tactics, Place distribution channels, and Promotion efforts to understand their market positioning.

Streamlines the complex process of marketing strategy by offering a clear, actionable framework for Element Solutions' 4Ps, alleviating the pain of strategic ambiguity.

Place

Element Solutions Inc. boasts a robust global manufacturing and distribution network, a cornerstone of its Place strategy. This expansive infrastructure, with facilities strategically positioned across continents, ensures efficient delivery of its specialized materials and solutions to a worldwide clientele.

In 2024, Element Solutions continued to leverage its global footprint, with operations in over 50 countries. This extensive reach allows for localized service and support, a critical factor in the high-tech industries it serves. The company's commitment to maintaining regional manufacturing and sourcing capabilities helps to streamline logistics and reduce lead times, a significant advantage in a dynamic global market.

Element Solutions leverages a direct sales force and specialized technical support, a crucial element in their distribution strategy. This hands-on approach is vital for their B2B chemical solutions, ensuring customers receive expert guidance directly on their production lines. In 2024, the company continued to invest in its technical sales teams, recognizing that close customer interaction fosters loyalty and drives adoption of their advanced materials.

Element Solutions strategically positions its operations and technical support near major industrial and electronics manufacturing centers. This geographical advantage, particularly evident in regions like Taiwan and South Korea which are global leaders in semiconductor production, allows for streamlined logistics and quicker product delivery. For instance, in 2024, the Asia-Pacific region continued to dominate global semiconductor manufacturing capacity, with Taiwan alone accounting for a significant portion of advanced chip production, underscoring the importance of Element Solutions' localized presence.

Integrated Supply Chain Management

Element Solutions leverages integrated supply chain management as a core component of its 'Place' strategy, ensuring high-value specialty chemicals reach customers efficiently. This focus on robust logistics and optimized inventory levels is critical for their market position.

The company prioritizes a nimble supply chain, designed to react swiftly to shifting market demands and evolving trade landscapes. This adaptability is key to maintaining product availability and mitigating potential disruptions for their global customer base, a strategy that also aids in managing raw material costs effectively.

- Supply Chain Efficiency: Element Solutions aims for streamlined logistics and inventory control for specialty chemicals.

- Adaptability: Their supply chain is built to respond to market changes and trade dynamics.

- Customer Availability: Minimizing disruptions ensures consistent product access for clients.

- Cost Management: An efficient supply chain supports better control over raw material expenses.

Digital and Web Presence for Accessibility

Element Solutions Inc. (ESI) understands that a robust digital and web presence is crucial for accessibility in today's global market. Their corporate website serves as a central hub, offering comprehensive information about their worldwide operations, product portfolio, and investor relations. This digital infrastructure is vital for their B2B strategy, providing essential resources and clear contact points for both prospective and current clients.

The company's digital footprint enhances accessibility by making critical data readily available. For instance, their investor relations section provides timely updates and financial reports, fostering transparency. In 2024, ESI reported a significant increase in website traffic, indicating strong engagement from stakeholders seeking information on their specialty chemicals and materials.

- Website as a Global Information Hub: ESI's corporate website offers detailed insights into its diverse product lines and global operational footprint, ensuring easy access for a worldwide audience.

- Investor Relations Accessibility: The dedicated investor relations portal provides real-time financial data, annual reports, and SEC filings, empowering financial stakeholders.

- B2B Engagement Support: Digital platforms facilitate lead generation and customer support, streamlining interactions for business clients seeking solutions.

- Digital Reach in 2024: ESI observed a notable surge in online inquiries and website visits throughout 2024, highlighting the effectiveness of their digital presence in reaching and informing key business partners.

Element Solutions' 'Place' strategy emphasizes a global, yet localized, distribution network, ensuring their specialty chemicals and materials are accessible where and when customers need them. This involves strategically located manufacturing sites and distribution centers, supported by a direct sales force and technical experts. Their 2024 operations spanned over 50 countries, with a particular focus on proximity to key manufacturing hubs like those in the Asia-Pacific region, which continued to lead in semiconductor production.

| Aspect | 2024 Focus | Impact |

|---|---|---|

| Global Footprint | Operations in 50+ countries | Efficient worldwide delivery and localized support |

| Sales & Support | Direct sales force and technical teams | Expert guidance and fostering customer loyalty |

| Geographic Proximity | Near major industrial centers (e.g., Taiwan, South Korea) | Streamlined logistics and reduced lead times |

| Digital Presence | Enhanced corporate website and investor relations portal | Increased stakeholder engagement and B2B lead generation |

Same Document Delivered

Element Solutions 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Element Solutions 4P's Marketing Mix Analysis covers all key aspects of their strategy. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use.

Promotion

Element Solutions Inc. leverages industry-specific trade shows and technical conferences as a key promotional tool. These events, focusing on electronics, industrial finishes, and advanced materials, allow them to directly engage with potential customers and industry leaders.

Participation in these forums is vital for unveiling new products and showcasing technical expertise. For instance, in 2023, Element Solutions highlighted innovations at events like CES for electronics and IMTS for industrial manufacturing, crucial sectors for their business.

Element Solutions leverages technical publications and thought leadership to showcase the performance advantages and novel uses of its specialty chemicals. This strategy positions them as experts in advanced material science, crucial for building trust in technical B2B sectors.

By distributing white papers and case studies, Element Solutions educates potential clients on the tangible value their solutions offer. For instance, their commitment to innovation was highlighted in a recent industry report detailing advancements in semiconductor manufacturing chemicals, a sector projected for significant growth in 2024-2025.

Element Solutions leverages its direct sales force as a crucial promotional tool, fostering deep customer relationships through expert technical service. This personalized engagement allows for detailed problem-solving, showcasing how their specialty chemicals offer precise solutions. In 2023, Element Solutions reported that over 70% of their sales were driven by direct customer interactions, highlighting the effectiveness of this relationship-centric approach in the specialty chemicals market.

Digital Marketing and Investor Communications

Element Solutions leverages digital marketing and investor communications to disseminate vital company information. Their official website and financial news outlets are primary channels for sharing strategic initiatives, financial performance, and sustainability progress with investors and business partners.

Key communication tools include press releases, earnings calls, and investor presentations. These platforms are crucial for showcasing the company's performance and strategic vision, thereby bolstering its corporate reputation and investor confidence. For instance, in Q1 2024, Element Solutions reported net sales of $701.1 million, a slight increase from the previous year, demonstrating consistent operational performance that is communicated through these channels.

- Website: Primary hub for investor relations, financial reports, and sustainability data.

- Press Releases: Timely announcements of financial results, strategic partnerships, and operational updates.

- Earnings Calls: Direct engagement with analysts and investors to discuss financial performance and outlook.

- Investor Presentations: Detailed overviews of strategy, market position, and financial projections.

Sustainability Reporting and Corporate Responsibility

Element Solutions Inc. showcases its dedication to sustainability and corporate responsibility through its annual sustainability reports. These reports detail progress in areas like reducing greenhouse gas emissions, with the company aiming for a 25% reduction in Scope 1 and 2 emissions by 2030 compared to a 2019 baseline. This focus not only bolsters brand reputation but also resonates with a growing segment of consumers and investors prioritizing environmental and social impact.

The company's commitment extends to tangible community contributions, further solidifying its image as a responsible corporate citizen. By transparently communicating these efforts, Element Solutions Inc. demonstrates that its value proposition extends beyond product efficacy to encompass ethical business practices.

- Greenhouse Gas Emission Reduction: Targeting a 25% decrease in Scope 1 and 2 emissions by 2030 from a 2019 baseline.

- Community Engagement: Actively contributing to local communities where it operates.

- Stakeholder Appeal: Attracting environmentally and socially conscious customers and investors.

- Brand Differentiation: Highlighting responsible practices as a key differentiator.

Element Solutions utilizes a multi-faceted promotional strategy, blending industry events, technical publications, and direct sales engagement to highlight its specialty chemical solutions. This approach aims to educate customers on product performance and foster strong, solution-oriented relationships.

Digital channels and investor communications are key for disseminating corporate performance and strategic direction, reinforcing brand reputation and investor confidence. For instance, Q1 2024 net sales reached $701.1 million, showcasing consistent operational strength communicated through these channels.

The company actively promotes its commitment to sustainability, evidenced by its goal to reduce Scope 1 and 2 greenhouse gas emissions by 25% by 2030 from a 2019 baseline. This focus on environmental and social responsibility enhances its appeal to conscious consumers and investors.

| Promotional Channel | Key Activities | 2024/2025 Focus/Data |

|---|---|---|

| Industry Events & Conferences | Product launches, technical showcases, customer engagement | Highlighting innovations in electronics and industrial finishes sectors; participation in key trade shows like CES and IMTS. |

| Technical Publications & Thought Leadership | White papers, case studies, expert articles | Showcasing advancements in semiconductor manufacturing chemicals, a sector with projected growth in 2024-2025. |

| Direct Sales Force | Technical service, customer relationship building | Over 70% of sales driven by direct interactions in 2023; focus on personalized problem-solving. |

| Digital & Investor Communications | Website, press releases, earnings calls, investor presentations | Communicating Q1 2024 net sales of $701.1 million; detailing strategic initiatives and sustainability progress. |

| Sustainability Reporting | Annual reports, community engagement | Targeting 25% GHG emission reduction (Scope 1 & 2) by 2030 vs. 2019 baseline; emphasizing ethical practices. |

Price

Element Solutions Inc. leverages a value-based pricing strategy, aligning costs with the substantial benefits its specialty chemicals offer. This approach acknowledges the critical role their products play in enhancing customer end-product performance and aesthetics, moving beyond simple cost-plus models.

The pricing reflects the significant value addition, distinguishing Element Solutions from competitors in the commodity chemical space. For instance, in 2024, the company's focus on high-value applications in sectors like electronics and automotive, where performance is paramount, allows for premium pricing that captures a share of the enhanced profitability their solutions enable for clients.

Element Solutions navigates a competitive market by employing pricing strategies that reflect its technological leadership in specialized chemicals. The company seeks to balance aggressive market share acquisition with robust profit margins, a delicate act in segments where innovation commands a premium. For instance, in the semiconductor materials sector, where Element Solutions is a key player, pricing often reflects the high R&D investment and the critical performance enhancements its products offer to chip manufacturers.

Element Solutions leverages long-term contracts and strategic partnerships as a core pricing strategy, reflecting its B2B focus and the critical nature of its products in customer manufacturing. These agreements often incorporate volume discounts and tiered pricing structures, aligning costs with customer usage and commitment. For instance, in the semiconductor industry, where Element Solutions is a key supplier, such multi-year deals are common, ensuring predictable revenue and embedding the company deeply within client operations.

Cost Structure and R&D Investment Influence

Element Solutions' pricing strategy reflects substantial investments in research and development, intricate manufacturing, and specialized technical support for their advanced materials. This ensures they can deliver high-performance solutions to demanding industries.

The company's capacity to enhance margins through product mix optimization and supply chain efficiencies directly impacts their pricing flexibility and overall profitability. This allows for competitive yet value-driven pricing.

- R&D Investment: Element Solutions consistently invests in innovation, a key driver of their premium pricing.

- Manufacturing Complexity: The specialized nature of their production processes adds to the cost base, reflected in pricing.

- Supply Chain Efficiency: Improvements in logistics and sourcing contribute to margin expansion, influencing pricing power.

- Margin Expansion: The company's focus on driving profitability through strategic product mix and operational improvements supports their pricing structure.

Global Economic Factors and Currency Fluctuations

Element Solutions' pricing strategy is significantly shaped by global economic conditions, raw material costs, and fluctuating currency exchange rates. For instance, in early 2024, persistent inflation in key markets and supply chain disruptions continued to put upward pressure on the cost of essential raw materials like lithium and specialty chemicals, directly impacting production expenses.

The company actively monitors these external forces to make agile pricing adjustments across its diverse geographical segments. This proactive approach helps to safeguard profit margins and ensure competitive positioning, even amidst economic volatility. For example, a strengthening US dollar in late 2023 and early 2024 could have made Element Solutions' products more expensive in countries with weaker currencies, necessitating localized pricing recalibrations.

Key factors influencing Element Solutions' pricing decisions include:

- Global Economic Outlook: Forecasts for global GDP growth and inflation rates for 2024 and 2025 are critical in anticipating demand and cost pressures.

- Raw Material Price Volatility: Fluctuations in the prices of key inputs, such as the average price of lithium carbonate, which saw significant swings in 2023, directly influence cost of goods sold.

- Currency Exchange Rates: The company’s exposure to various currencies means that movements in exchange rates, such as the EUR/USD or USD/CNY, can impact reported revenues and profitability from international operations.

- Competitive Landscape: Pricing must also consider the strategies of competitors within specific product categories and geographic regions.

Element Solutions' pricing is intrinsically linked to the value its advanced chemical solutions deliver, particularly in high-performance sectors. For 2024, the company's strategy focuses on capturing a portion of the enhanced profitability its products enable for clients in electronics and automotive, reflecting a premium based on demonstrable performance gains.

This value-based approach is evident in markets like semiconductor materials, where Element Solutions' pricing reflects substantial R&D investment and the critical performance enhancements provided to chip manufacturers. For instance, in 2024, the semiconductor industry's demand for specialized materials with precise performance characteristics allows for pricing that acknowledges these significant technological contributions.

Element Solutions also utilizes long-term contracts with tiered pricing structures, especially in its B2B relationships. These agreements, common in sectors like advanced coatings where product integration is key, ensure predictable revenue and customer commitment, with pricing often adjusted based on volume and duration of partnership.

The company’s pricing is also influenced by external economic factors. For example, persistent inflation in 2024 continued to exert upward pressure on raw material costs, necessitating agile pricing adjustments to maintain margins. Fluctuations in currency exchange rates, such as the EUR/USD, also require careful consideration for international pricing strategies.

| Pricing Factor | 2024 Impact/Consideration | 2025 Outlook |

|---|---|---|

| Value-Based Pricing | Capturing enhanced client profitability in electronics and automotive. | Continued focus on performance-driven pricing in specialized applications. |

| R&D and Technology | Premium pricing in semiconductor materials reflecting innovation investment. | Pricing to reflect ongoing advancements in material science. |

| Contractual Agreements | Tiered pricing and volume discounts in B2B long-term contracts. | Strategic partnerships to continue embedding value through pricing. |

| Economic Conditions | Managing raw material cost inflation and currency fluctuations. | Adaptability to global economic shifts and currency volatility. |

4P's Marketing Mix Analysis Data Sources

Our Element Solutions 4P's Marketing Mix Analysis is meticulously constructed using a blend of internal company data, market research reports, and competitive intelligence. We integrate information from Element Solutions' official financial disclosures, investor relations materials, and product development updates, alongside industry-specific benchmarks and consumer behavior studies.