Element Solutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Solutions Bundle

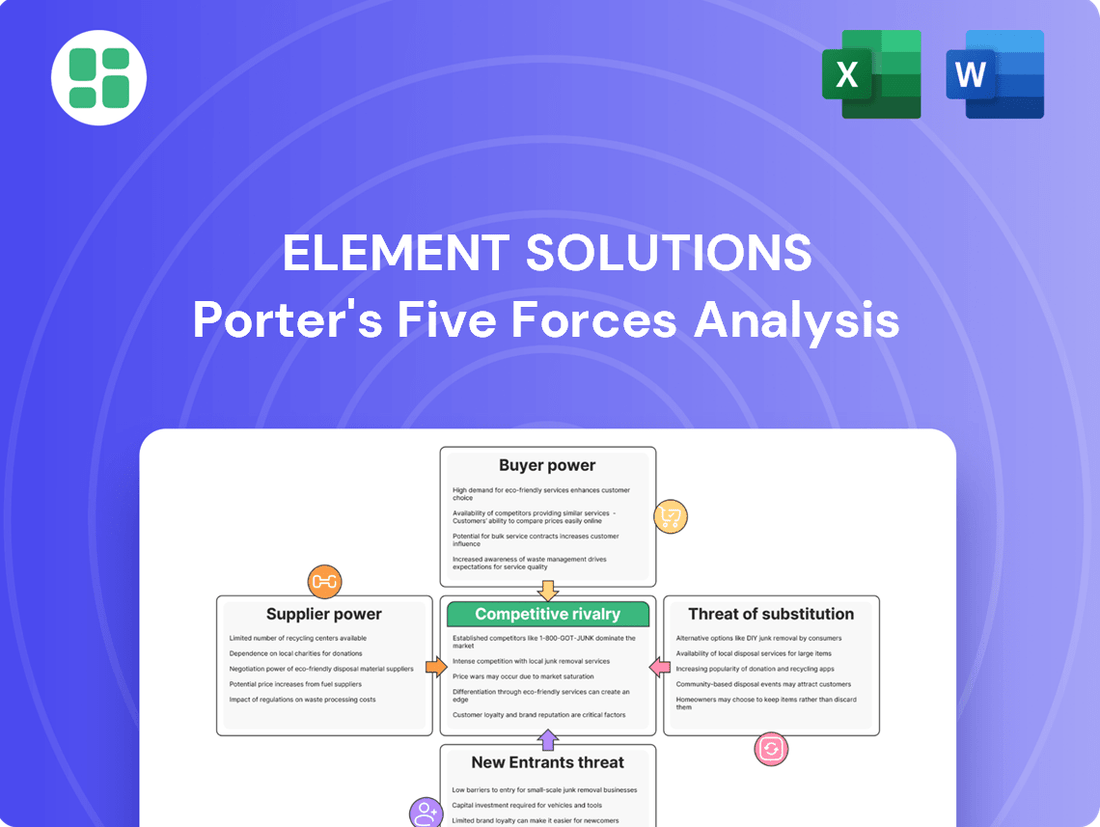

Element Solutions operates within a dynamic market shaped by several key forces. Understanding the bargaining power of buyers and the intensity of rivalry among competitors is crucial for navigating this landscape. Furthermore, the threat of new entrants and the availability of substitutes significantly influence strategic decisions.

The complete report reveals the real forces shaping Element Solutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Element Solutions Inc. sources critical raw materials like specialized chemicals and intermediates, essential for its advanced product lines. When these inputs come from a limited number of highly specialized suppliers, their bargaining power naturally rises. This is especially true for components that are proprietary or challenging to manufacture, as seen in the specialty chemicals sector.

The unique nature of these specialty chemical inputs significantly restricts Element Solutions' alternatives. This scarcity of substitutes grants these suppliers greater leverage in negotiating prices and contract terms. For instance, if a key intermediate chemical is only produced by one or two firms globally, Element Solutions has little recourse but to accept the supplier's terms, impacting its cost structure and profitability.

Switching suppliers for Element Solutions in the specialty chemicals sector presents significant hurdles. The process demands extensive testing and re-qualification of new materials, which can lead to substantial costs and disruptions in production. For instance, a single material qualification process can take anywhere from six months to over a year, depending on the complexity and regulatory requirements.

These high switching costs effectively bolster the bargaining power of Element Solutions' suppliers. If Element Solutions decides to change its raw material providers, it faces the prospect of considerable expenses and potential delays in its manufacturing operations. The specialized nature of many of their chemical solutions means that inputs are often custom-formulated, making the transition to a new supplier particularly challenging and costly.

Suppliers of critical raw materials could potentially integrate forward into Element Solutions' specialty chemical manufacturing. This threat is more pronounced if the supplier possesses significant intellectual property or production capabilities, allowing them to directly compete in Element Solutions' market. For instance, if a key component is becoming more commoditized, a supplier might see an opportunity to capture more value by producing the final chemical formulation themselves.

Importance of Raw Material to Product Quality

The quality of Element Solutions' advanced materials, crucial for sectors like electronics and semiconductors, is intrinsically linked to the caliber of its raw material suppliers. Suppliers providing exceptional or unique components, particularly for demanding applications, wield considerable influence. For instance, in 2023, Element Solutions reported that its Materials Technologies segment, which heavily relies on specialized inputs, generated approximately $2.4 billion in revenue, highlighting the significance of these raw materials.

Suppliers of proprietary or high-purity chemicals and metals essential for semiconductor fabrication and advanced packaging processes can exert substantial bargaining power. Their ability to control the supply of these critical inputs directly impacts Element Solutions' production capabilities and product performance. A disruption or a decline in the quality of these key materials from such suppliers could significantly compromise the integrity and market reputation of Element Solutions' offerings.

- Criticality of Raw Materials: The performance of Element Solutions' high-performance materials is directly dependent on the quality and consistency of its raw material inputs.

- Supplier Influence: Suppliers of superior or proprietary ingredients, especially for sensitive applications in electronics and semiconductor packaging, possess significant bargaining power.

- Impact of Disruptions: Any interruption in the supply chain or a reduction in the quality of materials from key suppliers could severely affect Element Solutions' product integrity and brand standing.

- Revenue Dependence: In 2023, Element Solutions' Materials Technologies segment, a key consumer of specialized raw materials, contributed significantly to its overall revenue, underscoring the importance of these inputs.

Availability of Substitute Inputs

The bargaining power of suppliers for Element Solutions is significantly influenced by the availability of substitute inputs. If Element Solutions can readily access a broad spectrum of alternative raw materials, or if the necessary inputs are largely commoditized, the suppliers' leverage diminishes. This is because the company has more options and can switch suppliers with less disruption.

However, for many of Element Solutions' advanced and specialized materials, the situation is quite different. The inputs required are often highly specific, meaning that direct substitutes are scarce. This lack of alternatives inherently strengthens the bargaining power of the existing suppliers. Element Solutions faces a challenge when these specialized inputs are critical, as they cannot easily switch to different materials without potentially impacting product performance or incurring considerable research and development expenses to qualify new inputs.

- Limited Substitutes for Key Inputs: Element Solutions often relies on highly specialized chemical compounds and materials that do not have readily available, cost-effective substitutes.

- Supplier Concentration: In certain niche markets, there may be only a few dominant suppliers for critical raw materials, increasing their pricing power.

- Impact on R&D and Product Performance: Switching to alternative inputs, even if available, could necessitate extensive re-qualification processes and potentially alter the performance characteristics of Element Solutions' products, creating a barrier to switching.

- Commoditization vs. Specialization: While some inputs might be commoditized, a significant portion of Element Solutions' value proposition stems from specialized formulations, where supplier dependency is higher.

Element Solutions faces considerable supplier bargaining power due to the specialized nature of its raw materials, particularly in sectors like semiconductors. When few suppliers can produce high-purity chemicals or proprietary intermediates, their leverage increases significantly. This is underscored by the fact that in 2023, Element Solutions' Materials Technologies segment, heavily reliant on these specialized inputs, generated approximately $2.4 billion in revenue, highlighting the critical importance and potential supplier influence over these revenue streams.

The difficulty in finding substitutes for these advanced materials, coupled with high switching costs that can extend over a year for material re-qualification, further empowers suppliers. This situation can force Element Solutions to accept less favorable pricing or terms, directly impacting its cost structure and profitability. For instance, a single material qualification process can take anywhere from six months to over a year, depending on the complexity and regulatory requirements.

Suppliers of unique or high-purity components essential for Element Solutions' advanced product lines, such as those used in electronics and semiconductors, wield substantial influence. Their ability to control the supply of these critical inputs directly affects Element Solutions' production capabilities and product performance, making any disruption or quality reduction a significant risk.

| Factor | Description | Impact on Element Solutions |

|---|---|---|

| Criticality of Inputs | High-purity chemicals and proprietary intermediates are essential for Element Solutions' advanced materials. | Increases supplier leverage due to dependence on specific, high-quality inputs. |

| Supplier Concentration | Limited number of specialized manufacturers for certain niche chemicals. | Concentrated suppliers have more power to dictate terms and prices. |

| Switching Costs | Extensive re-qualification processes for new materials can take 6-12+ months. | High switching costs lock Element Solutions into existing supplier relationships, reducing flexibility. |

| Revenue Dependence (2023) | Materials Technologies segment revenue was ~$2.4 billion. | Highlights the significant financial reliance on suppliers for this key segment. |

What is included in the product

This analysis meticulously examines the five competitive forces impacting Element Solutions, providing strategic insights into industry structure, profitability, and competitive advantage.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces dashboard, enabling rapid strategic adjustments.

Customers Bargaining Power

Element Solutions' customers, particularly those in high-volume sectors like semiconductor fabrication and automotive manufacturing, can wield considerable bargaining power. In 2023, the electronics segment, a key market for Element Solutions, saw continued demand for advanced materials, but also intense price competition among suppliers. This dynamic means large buyers can leverage their purchasing volume to negotiate favorable pricing and terms.

Element Solutions' customers face varying switching costs. For highly specialized applications, such as those in semiconductor packaging, changing suppliers often necessitates extensive re-qualification, which can lead to significant production disruptions and increased costs. This complexity inherently limits the bargaining power of these customers.

In contrast, for more standardized product lines, the effort and expense involved in switching suppliers are considerably lower. This can empower customers in those segments to exert greater leverage, potentially demanding more favorable pricing or terms.

Element Solutions significantly reduces customer bargaining power by focusing on product differentiation and uniqueness. Their specialty chemicals are not mere commodities; they are high-performance materials that are critical to the functionality and appearance of customers' end products, such as advanced electronics and specialized coatings.

For instance, in the realm of printed circuit boards, the precise chemical formulations provided by Element Solutions are essential for performance and reliability, making them difficult to substitute. This deep integration into customer value chains means customers are less likely to switch suppliers due to the high switching costs and the risk to their own product quality.

The company's commitment to innovation ensures that its offerings remain at the cutting edge, further solidifying its unique market position. This differentiation strategy directly translates into Element Solutions' ability to command premium pricing, as customers recognize the superior value and performance their products deliver, thereby diminishing the customers' leverage.

Customer Price Sensitivity

Customer price sensitivity for Element Solutions is a key factor. It hinges on how critical their products are to a customer's final product cost and the competitive intensity within the customer's own industry. For instance, in sectors with tight margins and intense competition, like consumer electronics, customers are likely to push harder for lower prices from Element Solutions.

Conversely, when Element Solutions' products are indispensable for performance in mission-critical applications, such as in aerospace or advanced medical devices, customers tend to be less sensitive to price. This is because the added value and reliability of Element Solutions' offerings outweigh minor cost considerations. For example, in 2024, the semiconductor industry, a significant customer base for specialty chemicals, faced fluctuating demand, potentially increasing price sensitivity in certain segments.

- High Price Sensitivity: In competitive markets like consumer electronics, customers may demand price concessions.

- Low Price Sensitivity: For mission-critical applications where performance is paramount, customers are less focused on price.

- Industry Dynamics: The competitive landscape of Element Solutions' customers directly impacts their ability to absorb price increases.

- Product Importance: The proportion of Element Solutions' product cost to the customer's total cost of goods sold is a major driver of price sensitivity.

Threat of Backward Integration by Customers

Large customers, especially those with strong R&D and chemical know-how, might explore producing their own specialty chemicals. This strategy, known as backward integration, allows them to gain more control over their supply chain and potentially reduce costs.

For Element Solutions, this threat is typically subdued due to the intricate nature and proprietary development of its specialty chemical formulations. These products often demand considerable investment in research and development, alongside highly specialized manufacturing capabilities, making in-house production by customers challenging.

However, for Element Solutions' less specialized products, the risk of customers opting for in-house production rises. This possibility directly enhances the bargaining power of these customers, as they possess a credible alternative to purchasing from Element Solutions.

- Threat of Backward Integration: Customers with significant R&D and chemical expertise may consider producing their own specialty chemicals.

- Low Threat for Complex Formulations: Element Solutions' highly complex and proprietary formulations, requiring extensive R&D and specialized manufacturing, generally mitigate this threat.

- Increased Threat for Less Differentiated Products: For less specialized offerings, the potential for customers to produce in-house grows, boosting their bargaining power.

Element Solutions' customers, particularly large buyers in high-volume sectors like semiconductor fabrication and automotive manufacturing, can exert significant bargaining power. For instance, in 2023, the electronics sector, a key market for Element Solutions, experienced intense price competition among suppliers, enabling large buyers to negotiate better terms and pricing due to their substantial purchasing volumes.

Switching costs for customers vary; high switching costs in specialized applications like semiconductor packaging, due to extensive re-qualification, limit customer bargaining power. Conversely, lower switching costs for more standardized products empower customers to demand favorable pricing.

Element Solutions mitigates customer bargaining power through product differentiation, offering high-performance specialty chemicals critical to end-product functionality, such as in printed circuit boards. This integration into customer value chains, coupled with innovation, allows for premium pricing and reduces customer leverage.

Customer price sensitivity is influenced by the criticality of Element Solutions' products and the competitive intensity within the customer's industry. For example, in 2024, fluctuating demand in the semiconductor industry increased price sensitivity in certain segments, while mission-critical applications in aerospace or medical devices show lower price sensitivity due to the indispensable value provided.

| Customer Segment | Switching Costs | Price Sensitivity | Bargaining Power Influence |

|---|---|---|---|

| Semiconductor Fabrication | High (for specialized chemicals) | Moderate to High (depending on market conditions) | Moderate to High |

| Automotive Manufacturing | Moderate (for coatings and treatments) | Moderate | Moderate |

| Consumer Electronics | Low (for more commoditized chemicals) | High | High |

| Aerospace/Medical Devices | High (for critical performance materials) | Low | Low |

Preview Before You Purchase

Element Solutions Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis for Element Solutions provides a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes, offering actionable insights for strategic planning.

Rivalry Among Competitors

The specialty chemicals market is seeing a healthy expansion, with projections indicating a compound annual growth rate (CAGR) of 4.4% by 2025 and reaching 5.7% by 2029. This growth is particularly robust in areas like electronics chemicals, fueled by the demand for AI and 5G technologies.

This upward trend in demand can actually ease competitive pressures. When the pie is getting bigger, companies can grow their revenues by capturing new demand rather than by aggressively stealing market share from rivals. This generally leads to less intense rivalry.

However, it's not a universal cooling of competition. Regional economic differences and the potential for overcapacity in specific chemical segments can still create pockets of fierce rivalry. Companies must navigate these nuances to manage competitive intensity effectively.

Element Solutions faces a crowded marketplace. Major players like DuPont and BASF, with their broad chemical portfolios, directly compete, while specialized firms such as Atotech focus on specific market segments. This mix of large conglomerates and niche specialists means competitive strategies can range from broad market penetration to highly targeted innovation.

Competitive rivalry in specialty chemicals, including for Element Solutions, is significantly shaped by product differentiation and the relentless pursuit of innovation. Element Solutions itself focuses on delivering high-performance materials and groundbreaking solutions to its clientele.

Companies that excel at consistently launching novel, superior products or developing bespoke solutions tailored to unique customer requirements can carve out a distinct competitive advantage. This strategic focus allows them to steer the competitive landscape away from a pure price war and towards a battleground of value and enhanced performance.

For instance, in 2023, Element Solutions reported that its Innovation pipeline contributed to a substantial portion of its sales growth, demonstrating the tangible impact of R&D investment. This emphasis on unique product offerings allows them to command premium pricing and foster customer loyalty, thereby intensifying rivalry among peers who struggle to match such capabilities.

Exit Barriers

High exit barriers significantly influence competitive rivalry within the specialty chemicals industry, including companies like Element Solutions. These barriers, such as specialized, non-divisible assets and substantial investments in research and development and manufacturing infrastructure, make it difficult and costly for firms to leave the market. This often forces companies to remain operational even when facing low profitability, thereby intensifying competition as they fight for market share.

The capital-intensive nature of specialty chemical production, coupled with the necessity for ongoing innovation to maintain a competitive edge, creates a challenging environment for exiting. For instance, the development and scaling of advanced chemical formulations require long-term commitments to R&D and specialized production lines. This can lead to a situation where companies are reluctant to divest or shut down operations due to the potential for substantial asset write-downs.

- Specialized Assets: Element Solutions, like others in its sector, likely possesses manufacturing facilities and equipment tailored to specific chemical processes, which have limited alternative uses.

- R&D Investment: Continuous investment in developing new and improved chemical products is crucial, representing a significant sunk cost that discourages exit.

- Long-Term Contracts: Companies may be bound by long-term supply agreements with customers, making it impractical to cease operations abruptly.

- Industry Dynamics: The specialty chemicals market, valued at over $600 billion globally in 2024, demands sustained investment, making exit a complex financial decision.

Cost Structure and Capacity Utilization

The specialty chemicals sector, including players like Element Solutions, is inherently capital-intensive. This means significant upfront investment in plants and equipment. Companies in this industry constantly aim for high capacity utilization to spread these substantial fixed costs over more units, leading to lower per-unit production expenses and improved economies of scale.

The global chemical industry experienced a notable overcapacity situation in 2024. This surplus production capacity often forces companies to adopt aggressive pricing tactics to ensure their production lines remain active and profitable. Such strategies directly escalate competitive rivalry, as firms compete fiercely on price to capture market share and cover their operational overheads, inevitably squeezing profit margins across the board.

- Capital Intensity: Specialty chemicals require substantial investment in manufacturing facilities.

- Economies of Scale: High capacity utilization is crucial for reducing per-unit costs.

- 2024 Overcapacity: A global surplus in chemical production capacity was observed.

- Pricing Pressure: Overcapacity leads to price competition to fill production lines.

Competitive rivalry within the specialty chemicals sector, where Element Solutions operates, is intense due to a mix of large, diversified players and nimble, specialized firms. Innovation and product differentiation are key battlegrounds, allowing companies to command premium pricing and foster loyalty, as evidenced by Element Solutions' reliance on its innovation pipeline for sales growth in 2023.

High exit barriers, stemming from specialized assets and significant R&D investments, compel companies to remain in the market, intensifying competition even during periods of low profitability. The capital-intensive nature of the industry, coupled with a 2024 global overcapacity in chemical production, further fuels aggressive pricing strategies as firms strive to maintain high capacity utilization and cover fixed costs.

SSubstitutes Threaten

The threat of substitutes for Element Solutions is significant, particularly from alternative materials and emerging technologies that can replicate or surpass the performance of its specialty chemicals. For example, in the electronics sector, breakthroughs in material science or novel manufacturing techniques might reduce reliance on specific chemical formulations. Element Solutions’ 2023 revenue was $2.6 billion, highlighting the scale of its operations and the potential impact of substitute threats.

The threat of substitutes for Element Solutions' products hinges significantly on the price-performance trade-off offered by alternatives. If a substitute material provides similar functionality at a substantially lower cost, or even enhanced performance at a comparable price point, it presents a considerable challenge. For instance, in the semiconductor industry where Element Solutions operates, the development of new, more cost-effective etching chemicals or plating solutions directly impacts customer willingness to switch.

Element Solutions' strategy to command premium pricing is directly challenged when substitutes offer a compelling value proposition. For example, if a competitor introduces a new chemical process that achieves comparable or better results in semiconductor fabrication with a 15% cost reduction, customers will likely evaluate the switch. This means Element Solutions must continuously innovate to ensure its products deliver demonstrable superior performance or unique value that justifies their price, making it difficult for substitutes to gain significant traction.

Customer propensity to substitute is a key driver in assessing the threat of substitutes. Factors like how easily a new chemical can be integrated, the perceived risk involved in making a switch, and how crucial the chemical is to the end product all play a significant role. For instance, in demanding sectors like semiconductor manufacturing, companies are often reluctant to change from established chemical suppliers. This is because the consequences of product failure or the extensive process of re-qualifying new materials can be extremely costly and time-consuming. In 2024, the semiconductor industry continued to emphasize reliability, with many leading firms investing heavily in supply chain stability rather than exploring alternative chemical formulations unless absolutely necessary.

Rate of Technological Advancement

The rapid pace of technological advancement poses a significant threat of substitutes for Element Solutions. Innovations in fields like advanced materials, nanotechnology, and AI-driven material discovery can quickly create new alternatives that may outperform or be more cost-effective than current offerings. For instance, the semiconductor industry, a crucial market for Element Solutions, is seeing substantial progress in chip design and packaging. This evolution might introduce novel material demands or make existing materials redundant.

Consider the impact of new semiconductor fabrication techniques. For example, advancements in extreme ultraviolet (EUV) lithography, which became more widespread in the early 2020s, necessitate new photoresist materials and etching chemistries. Element Solutions, as a supplier of specialty chemicals and materials, must continuously innovate to meet these evolving requirements. Failure to adapt could see competitors offering superior or more compatible solutions, thereby increasing the threat of substitution.

- Technological Disruption: Emerging technologies can create entirely new product categories or significantly alter existing ones, potentially bypassing the need for Element Solutions' current product portfolio.

- Semiconductor Innovation: The semiconductor sector's rapid development in areas like advanced packaging and heterogeneous integration requires specialized materials. If Element Solutions cannot supply these, alternative suppliers or material types could gain traction.

- AI in Materials Science: Artificial intelligence is accelerating the discovery and development of new materials, potentially identifying substitutes for Element Solutions' products faster than traditional R&D methods.

In-house Development by Customers

Customers with substantial R&D resources might develop their own chemical solutions, particularly if Element Solutions' products aren't highly differentiated or if they perceive a cost advantage in-house. This threat is amplified for less complex chemical needs where the barrier to entry for development is lower.

For instance, a large industrial manufacturer might invest in developing proprietary cleaning agents or process chemicals if Element Solutions' standard offerings do not meet specific performance or cost targets. This vertical integration strategy allows them to gain more control over their supply chain and potentially reduce overall operational expenses.

In 2024, the trend of customers seeking greater supply chain control and cost efficiencies continued. Companies that previously relied on external chemical suppliers began exploring in-house development for non-core, yet critical, chemical inputs. This is driven by a desire to insulate operations from supply disruptions and to capture value further up the chain.

- Customer R&D Investment: Large customers may allocate significant capital to internal research and development to replicate or improve upon existing chemical solutions.

- Vertical Integration: Companies are increasingly considering bringing chemical production in-house to reduce reliance on third-party suppliers, especially for less specialized chemicals.

- Cost and Performance Benchmarking: Customers will benchmark Element Solutions' offerings against potential in-house development costs and performance metrics.

- Impact on Differentiation: The threat is heightened if Element Solutions' proprietary technologies are not sufficiently unique or if customers can achieve comparable results through internal efforts.

The threat of substitutes for Element Solutions remains a dynamic challenge, particularly as technological advancements offer new avenues for material replacement. In 2024, the semiconductor industry, a key market for Element Solutions, continued its rapid evolution. For instance, the increasing adoption of advanced packaging techniques, which integrate multiple chips into a single package, creates demand for novel materials and processes that could potentially displace existing chemical solutions if Element Solutions does not adapt quickly.

The cost-effectiveness and performance of substitutes are critical considerations for Element Solutions' customers. If alternative materials can deliver comparable or superior results at a lower price point, the incentive to switch increases significantly. This is particularly relevant in high-volume manufacturing sectors where even small cost savings per unit can translate into substantial overall savings. For example, in 2024, discussions around the total cost of ownership for chemical processes in electronics manufacturing intensified, pushing suppliers to demonstrate clear value beyond just product performance.

Customer willingness to adopt substitutes is influenced by factors such as switching costs and the perceived risk associated with new materials. In highly regulated or performance-critical industries, the inertia to change can be substantial due to the extensive testing and qualification required. However, as new technologies mature and demonstrate reliability, this barrier can diminish. The semiconductor industry, for example, saw a growing openness in 2024 to qualified alternative materials, especially when they offered significant performance gains or cost reductions without compromising yield.

The threat of substitutes for Element Solutions is influenced by several factors, including the availability of viable alternatives, their price-performance ratio, and customer switching costs. In 2024, the semiconductor industry, a major market for Element Solutions, continued to see innovation in materials science. For instance, the development of new, more environmentally friendly or efficient etching chemicals could present a substitute threat if they offer comparable performance at a competitive price.

| Factor | Impact on Element Solutions | 2024 Trend Example |

|---|---|---|

| Technological Advancement | Emerging materials or processes can replace existing chemical functions. | New semiconductor fabrication techniques requiring different chemistries. |

| Price-Performance Ratio | Substitutes offering better value proposition can lure customers. | Customers evaluating total cost of ownership for chemical inputs. |

| Switching Costs | High qualification costs can deter customers from switching. | Increased customer appetite for qualified alternatives offering clear benefits. |

| Customer R&D | In-house development of chemical solutions by large customers. | Focus on supply chain control and cost efficiency driving internal exploration. |

Entrants Threaten

The specialty chemicals sector, where Element Solutions operates, is inherently capital-intensive. Companies need substantial upfront investment for cutting-edge research and development, sophisticated manufacturing plants, and the protection of intellectual property. For instance, building a new, state-of-the-art chemical production facility can easily run into hundreds of millions of dollars.

This significant financial hurdle acts as a powerful deterrent for potential new players. Without access to vast amounts of capital, it becomes exceedingly difficult, if not impossible, for newcomers to establish a foothold and compete effectively against established giants like Element Solutions. The sheer scale of investment required effectively shields existing companies.

The high research and development intensity in specialty chemicals, especially for sectors like electronics, presents a significant barrier to new entrants. Developing sophisticated materials for semiconductor packaging, for instance, demands substantial and ongoing investment in R&D to create innovative and high-performance products.

New companies must commit significant capital to R&D to even begin competing with established firms like Element Solutions, which possess extensive intellectual property and advanced technological capabilities. For example, in 2023, the global semiconductor market, a key area for specialty chemicals, saw significant R&D spending, with major players investing billions to stay ahead in innovation, making it difficult for newcomers to match this level of technological advancement.

The chemical industry, including players like Element Solutions, faces substantial regulatory hurdles. For instance, in 2024, the European Chemicals Agency (ECHA) continued its rigorous enforcement of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), demanding extensive data and safety assessments from manufacturers. These compliance costs, often running into millions of dollars for new substance registrations, coupled with the need for specialized environmental, health, and safety (EHS) expertise, create a significant barrier to entry.

Access to Distribution Channels and Customer Relationships

Established players like Element Solutions have meticulously built extensive global distribution networks over years, forging deep, trust-based relationships with major clients across various sectors. For instance, Element Solutions' significant presence in the electronics and automotive industries, sectors that demand highly specialized chemicals, means new entrants must overcome substantial hurdles to gain traction.

Newcomers would find it exceptionally difficult to replicate Element Solutions' established credibility and secure access to these vital distribution channels and customer bases. This is a significant barrier to entry, as market penetration hinges on reliable supply chains and existing client loyalty.

- Established Distribution Networks: Element Solutions leverages a robust global supply chain, critical for delivering specialized chemicals efficiently.

- Customer Loyalty and Relationships: Long-standing partnerships with key clients in industries like automotive and electronics provide a stable revenue base.

- Barriers to Entry: New entrants face considerable challenges in building comparable trust and securing access to these established channels.

Economies of Scale and Experience Curve

Existing players in the specialty chemicals sector, like Element Solutions, benefit significantly from economies of scale. Large-scale production, bulk raw material purchasing, and shared R&D expenses allow them to achieve lower per-unit costs compared to potential newcomers.

Furthermore, the experience curve plays a crucial role. Companies that have been operating for years have refined their processes, leading to greater efficiency and reduced waste. For instance, in 2024, major specialty chemical manufacturers reported production efficiencies that are difficult for new entrants to replicate quickly, often citing years of accumulated operational knowledge as a key differentiator.

- Economies of Scale: Lower production costs through larger output.

- Procurement Power: Better pricing on raw materials due to bulk buying.

- R&D Efficiencies: Spreading innovation costs over a larger revenue base.

- Experience Curve: Accumulated knowledge leading to optimized processes and reduced costs over time.

The threat of new entrants in the specialty chemicals sector, where Element Solutions operates, is generally low due to significant capital requirements for R&D and manufacturing, often in the hundreds of millions of dollars. Regulatory compliance, such as REACH in Europe, adds further substantial costs and expertise demands, creating a high barrier to entry. Established players benefit from economies of scale and an experience curve, making it difficult for newcomers to match their cost efficiencies and optimized processes, as seen in 2024 production efficiencies reported by major manufacturers.

| Barrier Type | Description | Example Impact (Element Solutions) | 2024 Data/Trend |

|---|---|---|---|

| Capital Intensity | High upfront investment for R&D, manufacturing, and IP protection. | Building a new chemical plant can cost hundreds of millions. | Continued high investment in advanced manufacturing technologies. |

| R&D Intensity | Need for substantial, ongoing investment in innovation. | Developing advanced materials for semiconductors requires billions in R&D. | Global semiconductor R&D spending exceeded $100 billion in 2023, a trend continuing in 2024. |

| Regulatory Hurdles | Strict compliance with environmental, health, and safety regulations. | REACH compliance can cost millions for new substance registrations. | ECHA's rigorous enforcement of chemical regulations in 2024. |

| Distribution Networks & Customer Loyalty | Established global supply chains and strong client relationships. | Deep ties in automotive and electronics sectors create market access challenges for newcomers. | Sustained demand for specialized chemicals in growth sectors. |

| Economies of Scale & Experience Curve | Lower per-unit costs from large-scale production and refined processes. | Years of operational knowledge lead to greater efficiency and reduced waste. | Specialty chemical manufacturers reporting significant operational efficiencies in 2024. |

Porter's Five Forces Analysis Data Sources

Our Element Solutions Porter's Five Forces analysis is built upon a foundation of robust data, including financial reports from Element Solutions and its competitors, industry-specific market research, and analysis from reputable financial institutions.