Element Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Solutions Bundle

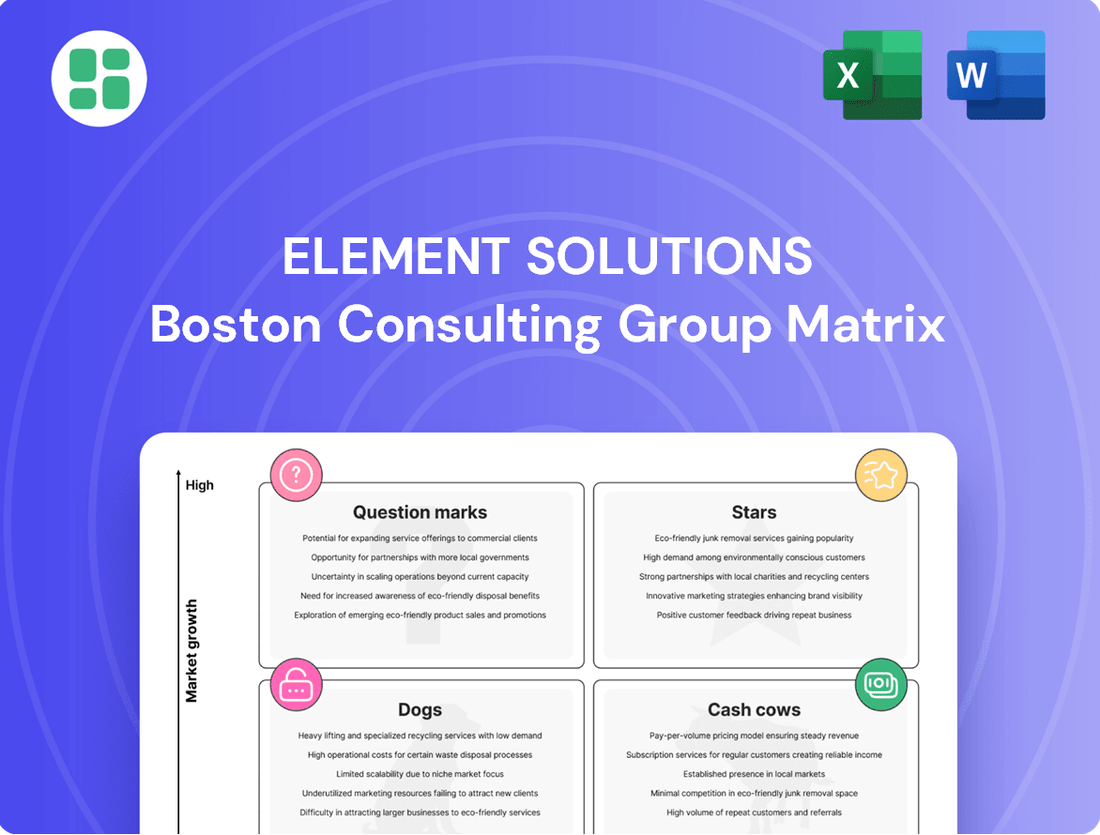

Wondering where Element Solutions' product portfolio truly shines and where it might be lagging? Our BCG Matrix analysis offers a strategic snapshot, categorizing their offerings into Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the critical insights that will shape your investment decisions.

Unlock the full strategic potential of Element Solutions by purchasing the complete BCG Matrix. This comprehensive report provides a detailed breakdown of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future growth strategies.

Stars

Element Solutions' semiconductor materials segment is a strong Star, experiencing robust organic growth. In Q1 2025, this segment saw a notable 17% increase, fueled by the growing demand for wafer-level packaging solutions. This performance highlights the segment's strength in a market that is rapidly advancing.

The segment's success is directly linked to the booming market for advanced semiconductors, particularly those powering high-bandwidth memory (HBM) and cutting-edge nodes essential for AI. Element Solutions is effectively capitalizing on these trends, solidifying its leadership position.

By strategically targeting and dominating high-value niches within the semiconductor materials sector, Element Solutions is well-positioned for continued expansion. This focused approach allows the company to capture significant market share in a dynamic and expanding industry.

Element Solutions' power electronics solutions, featuring innovations like ArgoMax sintered silver technology, are a significant growth driver, particularly in the booming Asian and European electric vehicle (EV) markets. This segment is crucial for managing heat in advanced EV systems, directly benefiting from the rapid worldwide shift towards electric mobility.

The company is strategically increasing its presence and market share within this high-growth sector. For instance, in 2024, the global EV market saw continued expansion, with projections indicating substantial year-over-year growth in sales, underscoring the demand for Element Solutions' specialized offerings.

Element Solutions is making significant strides in advanced packaging materials, a sector poised for substantial growth. This area is vital for supporting more intricate chip designs and the expanding needs of data center infrastructure.

The company has a clear roadmap, with new advanced packaging products slated for release in late 2025. This demonstrates a sustained commitment and investment in a market that is evolving at a rapid pace.

This strategic focus allows Element Solutions to capitalize on the increasing demand driven by technological advancements. For instance, the semiconductor packaging market is projected to reach $30 billion by 2027, highlighting the significant opportunity.

Circuitry Solutions for Data Centers and AI

Circuitry solutions are a vital component of Element Solutions' portfolio, especially those catering to the burgeoning data center and AI sectors. These specialized components are engineered to handle the immense processing power and data throughput required by modern artificial intelligence applications and the vast storage needs of data centers.

In the first quarter of 2025, this segment demonstrated impressive organic growth, achieving an 8% increase. This robust expansion is directly attributable to the escalating demand for advanced computing capabilities and sophisticated data storage solutions. Element Solutions' products are instrumental in enabling higher functionality and efficiency within these rapidly expanding markets.

- Market Segment: Circuitry Solutions for Data Centers and AI

- Q1 2025 Organic Growth: 8%

- Key Drivers: Increasing demand for high-performance computing and data storage.

- Element Solutions' Role: Enhancing functionality in high-growth AI and data center applications.

High-Performance Computing Consumables

Element Solutions is making significant inroads into the high-growth, high-value segments of the electronics consumables market, particularly those supporting high-performance computing (HPC). This strategic positioning allows them to capitalize on the increasing demand for advanced materials.

Their focus includes specialized chemicals and materials crucial for intricate circuit board fabrication and advanced chip packaging. These consumables are designed to meet critical customer requirements for improved power efficiency and effective thermal management in demanding HPC applications.

This targeted approach in specialized, high-demand niches is a key driver for Element Solutions' robust profit expansion within the rapidly evolving electronics sector.

- Market Penetration: Element Solutions is targeting the fastest-growing segments within electronics consumables.

- HPC Focus: Materials are developed for complex circuit board and chip designs in high-performance computing.

- Customer Needs: Addressing power and thermal management requirements is a key differentiator.

- Growth Strategy: Specialization in high-demand areas fuels strong profit growth.

Element Solutions' semiconductor materials, circuitry solutions, and advanced packaging materials are all strong Stars within the BCG matrix. These segments are characterized by high growth and high market share, indicating significant current and future potential.

The semiconductor materials segment, in particular, saw a 17% organic growth in Q1 2025, driven by the demand for wafer-level packaging. Similarly, circuitry solutions for data centers and AI achieved 8% organic growth in the same period, reflecting the booming need for advanced computing capabilities.

The company's strategic focus on high-value niches within these sectors, coupled with ongoing product development, positions these segments for continued leadership and expansion in the dynamic electronics market.

| BCG Category | Key Segments | Q1 2025 Organic Growth | Market Drivers | Element Solutions' Position |

| Stars | Semiconductor Materials | 17% | Wafer-level packaging, HBM, advanced nodes | Leadership in high-value niches |

| Stars | Circuitry Solutions (Data Centers & AI) | 8% | High-performance computing, data storage | Enhancing functionality in AI/data center applications |

| Stars | Advanced Packaging Materials | N/A (New products late 2025) | Complex chip designs, data center infrastructure | Strategic investment in a rapidly evolving market |

What is included in the product

This BCG Matrix analysis provides a strategic overview of Element Solutions' product portfolio, categorizing each unit.

It offers insights into which business units to invest in, hold, or divest based on market growth and share.

Clear visualization of Element Solutions' portfolio, simplifying strategic decisions.

Cash Cows

Element Solutions' Established Industrial Finishes are classic Cash Cows. Their strong market position translates into stable, high-profit margins, a hallmark of this category. Despite broader segment challenges, these mature product lines reliably generate consistent cash flow, needing minimal new investment for promotion or market placement due to their established brand recognition.

Within Element Solutions' Industrial & Specialty segment, mature surface treatment technologies represent classic cash cows. These established offerings operate in a low-growth market but consistently generate significant and stable cash flow for the company, likely due to their dominant market share and entrenched competitive advantages.

These mature technologies are crucial for funding growth initiatives and research and development in other, more dynamic parts of Element Solutions' portfolio. For instance, the company's focus on advanced plating solutions, a likely area for these cash cows, saw continued investment, with Element Solutions reporting robust performance in its Industrial & Specialty segment throughout 2024, underscoring the reliable contribution of these mature businesses.

Element Solutions' legacy printed circuit board (PCB) chemicals represent a classic cash cow within their portfolio. While the semiconductor and advanced packaging sectors grab headlines for their rapid expansion, these established PCB chemical offerings are the bedrock, consistently generating substantial cash flow. Their essential role in the vast, ongoing electronics manufacturing landscape ensures a steady demand, even without explosive growth.

These mature product lines likely command significant market share due to their long-standing presence and reliability in traditional PCB fabrication. In 2023, the global PCB market was valued at approximately $75 billion, with conventional PCBs forming a substantial portion of this. The predictable revenue from these chemicals provides a crucial financial cushion, enabling Element Solutions to invest in higher-growth areas and weather market fluctuations.

Select General Industrial Applications

Within Element Solutions' Industrial & Specialty segment, specific general industrial applications stand out as potential cash cows. These are areas where the company holds a leading market position, allowing it to generate substantial profits even amidst broader economic headwinds.

Despite a challenging industrial macro environment, particularly in regions like Europe, Element Solutions has demonstrated a strong ability to extract value from these dominant applications. This is achieved through focused commercial strategies and ongoing productivity improvements, underscoring their robust cash-generating capacity.

These established general industrial applications serve as foundational revenue streams for the company, contributing significantly to its overall financial stability and profitability. Their consistent performance provides a reliable base from which Element Solutions can invest in other areas of its business.

- Dominant Market Share: Element Solutions commands a leading position in select general industrial applications within its Industrial & Specialty segment.

- Profitability Drivers: Commercial execution and productivity initiatives are key to driving profits in these areas, even with regional industrial slowdowns.

- Foundational Revenue: These applications provide stable and significant revenue streams, acting as core contributors to the company's financial performance.

- Resilience: The ability to generate profits despite a challenging industrial macro backdrop highlights the resilience and strong cash-generating potential of these business lines.

Offshore Energy Solutions

Element Solutions offers specialized chemical solutions to the offshore energy sector. This market is generally mature and stable, indicating a strong position for companies with established market share, like Element Solutions.

The company's consistent involvement in offshore energy suggests a reliable source of cash flow, characteristic of a Cash Cow in the BCG matrix. These operations likely generate significant earnings without demanding heavy reinvestment for growth.

- Market Maturity: The offshore energy sector is a well-established market.

- Stable Cash Flow: Element Solutions' presence indicates a consistent generation of funds.

- High Market Share: A long-term presence suggests a dominant position.

- Low Reinvestment Needs: Mature markets typically require less capital for expansion.

Element Solutions' legacy printed circuit board (PCB) chemicals represent a classic cash cow. While newer technologies emerge, these established offerings consistently generate substantial cash flow due to their essential role in ongoing electronics manufacturing. The predictable revenue from these chemicals, which likely command significant market share, provides a crucial financial cushion for the company.

In 2023, the global PCB market was valued at approximately $75 billion, with conventional PCBs forming a substantial portion of this. This demonstrates the enduring demand for the products that Element Solutions' cash cow PCB chemicals serve.

These mature product lines are vital for funding Element Solutions' growth initiatives in more dynamic sectors. The consistent, reliable earnings from these established businesses are a cornerstone of the company's financial strategy, enabling investment in innovation and expansion.

| Business Segment | Product Example | BCG Classification | Key Characteristics | 2024 Relevance |

|---|---|---|---|---|

| Industrial & Specialty | Mature Surface Treatment Technologies | Cash Cow | Low growth, high market share, stable cash flow | Continued strong performance in the segment, underscoring reliable contribution. |

| Electronics | Legacy PCB Chemicals | Cash Cow | Essential for established manufacturing, predictable revenue | Supports investment in advanced packaging and semiconductor sectors. |

| Industrial & Specialty | General Industrial Applications | Cash Cow | Dominant market position, resilience against headwinds | Drives profits through commercial execution and productivity, providing foundational revenue. |

What You’re Viewing Is Included

Element Solutions BCG Matrix

The BCG Matrix analysis you are previewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no sample data, and no missing sections – just the comprehensive strategic tool ready for your immediate application. You're seeing the actual, professionally compiled report that will be yours to download and utilize for your business planning and decision-making processes. This preview assures you of the quality and completeness of the final product, offering a clear and actionable understanding of your product portfolio's strategic positioning. Rest assured, the file you see is the file you get, providing instant value for your strategic initiatives.

Dogs

MacDermid Graphics Solutions, the flexographic printing plate business, was categorized as a Dog in the BCG Matrix. Its low growth and low market share meant it wasn't a significant contributor to the company's overall performance.

This strategic assessment led to its divestiture. In early 2025, Element Solutions completed the sale of MacDermid Graphics Solutions for approximately $325 million. This move aimed to streamline the company's portfolio and concentrate resources on more promising areas.

Certain legacy industrial product lines within Element Solutions are likely positioned as Dogs in the BCG Matrix. These are offerings that struggle in mature, low-growth industrial markets, often facing stiff competition that erodes their market share. For instance, a specific line of older chemical processing equipment might have seen its market shrink due to technological advancements and the rise of more efficient alternatives.

These products typically exhibit a low market share within their respective low-growth industrial sectors. Consider a particular type of industrial lubricant that has been around for decades; its market growth is stagnant, and newer, specialized lubricants have captured a larger portion of sales, leaving this legacy product with a diminished presence. This situation can be particularly true for products that haven't undergone significant innovation or adaptation to evolving industry standards.

The primary concern with these Dog products is their tendency to consume valuable capital and management resources without yielding substantial returns or future growth potential. For example, a company might still be producing a line of basic industrial coatings that, while profitable on a per-unit basis, require significant operational overhead and marketing efforts for minimal market expansion. In 2024, the industrial sector saw an average market growth rate of around 2-3%, making products in sub-2% growth segments with declining market share prime candidates for the Dog quadrant.

Element Solutions might classify certain niche industrial applications with low market share as Dogs within its BCG Matrix. These are segments where the company hasn't established a strong foothold, often due to intense local competition or the high cost of market entry. For instance, a specialized chemical additive for a very specific manufacturing process, where only a handful of companies globally use it, could fit this description.

In these Dog segments, the growth rate of the market itself is likely low, meaning there's limited opportunity for significant expansion. Element Solutions might find that the investment required to increase market share in these areas is simply not justified by the potential returns. Consider a situation where Element Solutions has a product for a dying industry, like a specific type of lubricant for older, less common machinery.

These products typically operate at the break-even point or contribute very little to overall profitability. Element Solutions' focus in such areas would likely be on managing costs and potentially phasing out these offerings if they become a drain on resources. For example, if a particular cleaning solvent for a niche electronics assembly line has seen demand plummet due to new manufacturing techniques, it would likely be categorized as a Dog.

Products in Declining Industrial Sub-segments

Products in declining industrial sub-segments, such as legacy chemicals used in older manufacturing processes, would be categorized as Dogs within Element Solutions' BCG Matrix. These offerings are characterized by low market growth, often due to technological obsolescence or shifting consumer preferences.

Element Solutions might hold a low market share in these areas if they haven't prioritized investment or innovation. For instance, if a specific chemical compound used in a now-discontinued electronic manufacturing technique is still part of their portfolio, it would likely fall into this category.

These Dog products are typically prime candidates for divestiture, allowing Element Solutions to reallocate resources to more promising growth areas. Alternatively, a harvesting strategy could be employed, where the company aims to extract any remaining value with minimal further investment.

- Secular Decline: Products tied to industries experiencing a long-term, fundamental downturn, such as certain types of industrial coatings for older vehicle models.

- Technological Disruption: Offerings replaced by newer, more efficient technologies, like specific types of adhesives that have been superseded by advanced bonding agents.

- Low Market Growth & Share: These segments exhibit minimal expansion, and Element Solutions' presence might be shrinking without active strategic intervention.

Non-core Businesses Lacking Strategic Fit

Element Solutions, beyond its divestiture of the graphics business, might still hold non-core segments that don't fit its strategic direction in high-performance electronics and advanced materials. These could be units with a low market share, contributing little to the company's growth trajectory.

Such businesses often exhibit characteristics of Question Marks or Dogs in the BCG matrix, requiring careful evaluation. For instance, if a segment operates in a mature or declining market with limited competitive advantage, it would likely fall into the Dog category.

- Low Market Share: These segments typically possess a small share of their respective markets, limiting their ability to generate significant revenue or profit.

- Minimal Growth Contribution: Their contribution to overall company growth is often negligible, as they operate in slow-growing or stagnant industries.

- Strategic Misalignment: These businesses may not align with Element Solutions' core competencies or future strategic objectives, making them candidates for divestiture or restructuring.

- Potential for Divestment: Element Solutions actively seeks to optimize its portfolio by shedding assets that do not contribute to its strategic focus, potentially including these non-core businesses.

Dogs in Element Solutions' portfolio represent business units or product lines with low market share in low-growth markets. These are often legacy products or those in mature industries with limited expansion potential. For example, certain legacy industrial chemical lines might fall into this category if their markets are not growing and Element Solutions holds a small percentage of sales.

In 2024, many industrial sectors experienced growth rates around 2-3%. Products within these or slower segments, especially those with declining market share, are prime candidates for the Dog quadrant. Element Solutions' strategy often involves divesting these underperforming assets to reallocate capital to higher-growth areas.

These Dog segments typically consume resources without generating substantial returns, potentially operating at break-even or contributing minimally to profitability. Element Solutions' approach focuses on cost management and strategic divestment to streamline its portfolio and enhance overall performance.

Element Solutions' divestiture of MacDermid Graphics Solutions in early 2025 for approximately $325 million exemplifies the strategic handling of Dog assets. This action allowed the company to concentrate resources on its core strengths in high-performance electronics and advanced materials.

Question Marks

Element Solutions is poised to introduce two innovative advanced packaging products in late 2025, marking them as question marks in the BCG matrix. These offerings are entering a market experiencing robust expansion, fueled by the escalating needs of AI and data centers, a trend projected to see the global advanced packaging market reach $70 billion by 2028, up from an estimated $40 billion in 2023.

Currently, these products hold minimal market share, reflecting their early stage of commercialization. The company will need to significantly invest in sales, marketing, and product development to drive adoption and transition them into stars within this dynamic, high-growth sector.

Early-stage R&D initiatives like active copper represent Element Solutions' ventures into potentially high-growth future markets. These areas, while promising, are characterized by substantial investment requirements and currently low market penetration, placing them in the 'Question Marks' category of the BCG matrix.

The company is dedicating significant resources to develop these emerging capabilities, acknowledging the high cash consumption associated with early-stage research and market establishment. For instance, the global market for advanced materials, which includes innovations like active copper, is projected to grow substantially, with some estimates suggesting a CAGR of over 7% in the coming years, underscoring the strategic importance of these investments.

Success in these 'Question Marks' hinges on Element Solutions' ability to effectively commercialize these technologies and capture significant market share. The company's R&D spending in 2024 reflects this commitment, with a notable portion allocated to exploring and scaling these nascent technologies, aiming to transform them into future market leaders.

Element Solutions is strategically expanding its laboratory infrastructure into Thailand and Vietnam. This move directly targets the burgeoning electronics manufacturing sectors in these high-growth Asian markets. By establishing new labs, the company is positioning itself to capitalize on the increasing demand for advanced materials and solutions in this region.

While these markets present substantial growth opportunities, Element Solutions' initial market share in these specific new ventures is likely to be nascent. This places these expansion efforts squarely in the "Question Marks" category of the BCG matrix, requiring significant investment to foster growth and capture market share effectively. For instance, Vietnam's electronics manufacturing sector is projected to grow by approximately 10-15% annually in the coming years.

Highly Specialized, Nascent Material Technologies

Element Solutions is actively investing in new internal capabilities for emerging material technologies. These are specialized, nascent technologies targeting high-growth markets, but they currently have a small market share.

Significant upfront investment in research and development, alongside market development, is crucial to establish their viability and achieve scalability. Without successful market traction, these ventures risk becoming Dogs in the BCG matrix.

- Nascent Market Position: These technologies are in early-stage markets with low current market share.

- High Growth Potential: They are positioned in markets expected to experience significant future growth.

- Substantial R&D Investment: Significant capital is required for research and development to prove technological feasibility.

- Risk of Stagnation: Failure to achieve market acceptance could relegate them to the Dogs category.

Strategic Investments in AI/5G Infrastructure Materials

Element Solutions is strategically positioning itself in the burgeoning AI and 5G sectors, recognizing their significant growth potential. Investments in new material solutions tailored for these advanced infrastructures, where ESI is actively expanding its footprint, would be classified as Question Marks in the BCG Matrix. These ventures require substantial capital for research, development, and market penetration, with the ultimate aim of securing a substantial future market share.

- AI/5G Infrastructure Materials: ESI's focus on materials for AI and 5G represents a strategic pivot into high-growth technology markets.

- Cash Consumption for Growth: Development and market entry for these specialized materials are capital-intensive, demanding significant cash outlays.

- Future Market Share Potential: The objective is to establish a strong market presence and capture substantial future revenue streams in these evolving industries.

- BCG Matrix Classification: Such initiatives, characterized by high market growth and low current market share, are categorized as Question Marks.

Element Solutions' ventures into new advanced packaging products and emerging material technologies are classic examples of Question Marks in the BCG matrix. These initiatives are characterized by high market growth potential, driven by sectors like AI and data centers, but currently hold minimal market share, necessitating substantial investment to achieve commercial success and transition into Stars.

The company's strategic expansion into Southeast Asia, establishing laboratories in Thailand and Vietnam, also falls into this category. While these regions offer significant growth opportunities in electronics manufacturing, Element Solutions' initial market penetration is nascent, requiring considerable investment to build market share.

These Question Mark investments, such as those in active copper and materials for AI/5G infrastructure, are capital-intensive, demanding significant R&D and market development funding. Without successful market traction, these promising ventures risk becoming Dogs, highlighting the critical need for effective commercialization strategies.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| New Advanced Packaging Products (Late 2025) | High (AI, Data Centers) | Low | High (Sales, Marketing, R&D) | Question Mark |

| Emerging Material Technologies (e.g., Active Copper) | High (Advanced Materials) | Low | High (R&D, Scalability) | Question Mark |

| Southeast Asia Lab Expansion (Thailand, Vietnam) | High (Electronics Manufacturing) | Low | High (Market Development) | Question Mark |

| AI/5G Infrastructure Materials | Very High | Low | Very High (R&D, Market Penetration) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.