Element Solutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Element Solutions Bundle

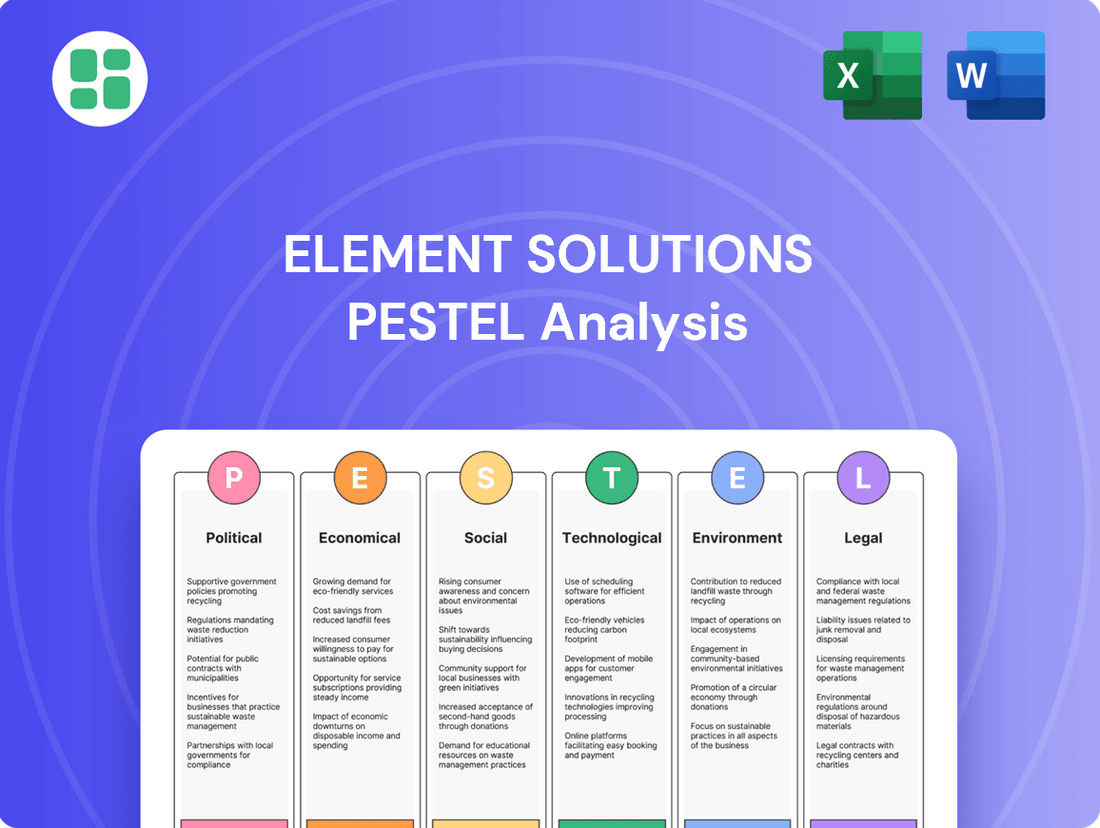

Unlock a strategic advantage by understanding the external forces shaping Element Solutions. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company's trajectory. Equip yourself with actionable intelligence to navigate market complexities and identify opportunities. Download the full PESTLE analysis now and gain the foresight needed to make informed decisions.

Political factors

Global geopolitical tensions and shifting trade policies, including tariffs and import/export restrictions, pose a significant risk to Element Solutions' supply chain and raw material costs. For instance, the ongoing trade disputes between major economies could lead to increased duties on key inputs, impacting the company's profitability. Element Solutions must actively monitor these developments to adapt its sourcing strategies and potentially diversify its supplier base to mitigate disruptions in its international operations.

Government support and industrial policies significantly shape the landscape for companies like Element Solutions. For instance, the US CHIPS and Science Act of 2022, with its substantial funding for domestic semiconductor manufacturing, directly benefits Element Solutions by potentially boosting demand for its specialty chemicals and materials used in electronics production. This policy aims to onshore critical supply chains, creating a more stable operating environment and potentially reducing reliance on overseas suppliers.

Similarly, industrial policies in Europe, such as those under the European Green Deal, which prioritize sustainable manufacturing and advanced materials, could offer opportunities for Element Solutions. By aligning its product development with these green initiatives, the company can tap into new markets and secure government incentives. The growth of the electric vehicle sector, supported by various national and international subsidies, also presents a significant tailwind for Element Solutions, given its role in providing essential materials for battery production and advanced automotive components.

Element Solutions Inc. operates in diverse global markets, making regulatory stability a key concern. For instance, in 2024, the European Union continued its focus on chemical regulations like REACH, impacting product formulations and compliance costs for companies like Element Solutions. Unpredictable shifts in environmental or trade policies in major operating regions could necessitate costly operational adjustments or hinder market access.

Political Stability in Key Markets

Political stability in key markets significantly impacts Element Solutions Inc. Regions with stable political environments, like the United States and parts of Europe, are crucial for the company's electronics and industrial segments. For instance, in 2024, the US electronics manufacturing sector, a key consumer of Element Solutions' products, continued to show resilience despite global economic headwinds, supported by government initiatives aimed at reshoring semiconductor production.

Conversely, political instability in emerging markets or regions experiencing geopolitical tensions can disrupt supply chains and dampen demand for specialty chemicals. For example, if significant policy shifts occur in East Asian countries that are major hubs for electronics manufacturing, it could directly affect Element Solutions' sales volumes and operational costs. The company's reliance on global distribution channels means that unrest or trade policy changes in any of these critical areas pose a tangible risk to its revenue streams.

- US Electronics Manufacturing Growth: The US semiconductor industry, a vital market for Element Solutions, saw projected growth in manufacturing capacity in 2024 due to legislative support like the CHIPS Act.

- Geopolitical Risk Assessment: Element Solutions likely monitors political risk indices for key manufacturing regions, such as Taiwan and South Korea, where any escalation of regional tensions could impact production and demand.

- Trade Policy Impact: Changes in international trade agreements or the imposition of tariffs, particularly between major economic blocs, could influence the cost and availability of raw materials and finished goods for Element Solutions.

International Relations and Alliances

Element Solutions Inc. operates within a global landscape where international relations and alliances significantly shape its operational environment. Strong alliances can facilitate smoother cross-border collaborations and technology transfer agreements, potentially lowering barriers to market entry. For instance, the company's presence in regions with robust trade agreements, such as those within the European Union or North America, likely benefits from reduced tariffs and streamlined regulatory processes.

Shifts in global power dynamics can directly impact Element Solutions' strategic partnerships and market expansion. A strengthening of trade blocs or the formation of new economic alliances could open up new avenues for growth, while geopolitical tensions or the dissolution of existing alliances might introduce complexities and risks. As of early 2024, the ongoing re-evaluation of global supply chains and trade relationships, influenced by geopolitical events, presents both challenges and opportunities for companies like Element Solutions that rely on international trade and collaboration.

- Element Solutions benefits from established trade agreements, such as the USMCA, facilitating North American operations.

- Geopolitical shifts in Asia, a key market for specialty chemicals, could impact Element's supply chain stability and market access.

- The company's participation in global industry forums and consortia underscores the importance of international cooperation for innovation and market development.

- Changes in international relations can affect the cost and availability of raw materials sourced from various global suppliers.

Government policies, particularly those focused on industrial development and sustainability, significantly influence Element Solutions' operational landscape and market opportunities. For instance, the US CHIPS and Science Act of 2022, aimed at boosting domestic semiconductor manufacturing, directly benefits Element Solutions by potentially increasing demand for its specialty chemicals used in electronics. Similarly, Europe's Green Deal initiatives, promoting sustainable manufacturing, create avenues for Element Solutions to align its product development with market trends and secure potential incentives.

Regulatory environments, such as the EU's REACH chemical regulations, continue to shape product formulations and compliance costs for Element Solutions in 2024. Political stability in key markets remains crucial; for example, the resilience of the US electronics sector in 2024, supported by reshoring initiatives, is vital for Element Solutions. Conversely, geopolitical tensions or policy shifts in major electronics manufacturing hubs in East Asia could disrupt Element Solutions' sales and operational costs.

International relations and trade agreements are paramount for Element Solutions' global operations. Favorable trade agreements, like the USMCA, streamline operations in North America. However, geopolitical shifts in Asia, a critical market, pose risks to supply chain stability and market access for the company. Element Solutions' engagement in global industry forums highlights the importance of international cooperation for innovation and market growth, with changes in international relations impacting raw material costs and availability.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Element Solutions, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making, helping to identify potential threats and opportunities within Element Solutions' operating landscape.

The Element Solutions PESTLE Analysis provides a clear, summarized version of external factors, offering easy referencing during meetings and presentations to alleviate the pain point of information overload.

Economic factors

Global economic growth is projected to moderate in 2024 and 2025, with the IMF forecasting 3.2% growth for 2024 and a similar rate for 2025. However, recession risks remain, particularly in developed economies, which could dampen demand for Element Solutions' specialty chemicals used in sectors like automotive and electronics.

An economic slowdown would likely lead to reduced industrial production and lower consumer spending, directly impacting Element Solutions' revenue streams. For instance, a significant contraction in automotive sales, a key market, would translate to decreased demand for their advanced materials and coatings.

Element Solutions, a key player in specialty chemicals, faces significant headwinds from fluctuating raw material costs. For instance, the price of key inputs like bromine, a critical component in many of their products, saw considerable volatility throughout 2024, influenced by global demand shifts and geopolitical factors. This volatility directly impacts their cost of goods sold.

Broader inflationary pressures within the supply chain are also a major concern. Rising energy prices, transportation costs, and labor expenses in 2024 and projected into 2025 squeeze Element Solutions' operating margins. For example, global shipping costs, which had spiked significantly in previous years, remained elevated in early 2025, adding to the overall cost burden.

These escalating input costs necessitate careful pricing strategies. Element Solutions must balance the need to pass on these higher expenses to customers to protect profitability against the risk of losing market share. Their ability to manage these cost pressures will be a crucial determinant of their financial performance in the near term.

Currency exchange rate fluctuations significantly impact Element Solutions Inc.'s global financial performance. For instance, a stronger U.S. dollar can make its products more expensive for international customers, potentially reducing sales volume and revenue earned in foreign currencies. Conversely, a weaker dollar could boost international sales but also increase the cost of imported raw materials or components.

In 2023, Element Solutions reported that approximately 35% of its net sales were generated outside of North America, highlighting the substantial exposure to currency volatility. A hypothetical 5% strengthening of the U.S. dollar against a basket of major currencies could reduce reported international earnings by tens of millions of dollars in a given year, impacting profit margins directly.

Interest Rates and Access to Capital

Prevailing interest rates significantly influence Element Solutions Inc.'s cost of capital. Higher rates directly translate to increased borrowing expenses, potentially impacting the company's ability to finance research and development or pursue expansion projects. For instance, if Element Solutions needs to issue new debt in a high-interest rate environment, the cost of servicing that debt rises, affecting profitability and cash flow.

Changes in monetary policy by central banks, such as the U.S. Federal Reserve or the European Central Bank, are critical. These policies dictate the baseline interest rates, influencing the overall cost and availability of capital. In early 2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25%-5.50%, a level that has been consistent for some time, reflecting an effort to curb inflation but also presenting a higher hurdle for new debt financing compared to periods of lower rates. This environment requires careful financial management to ensure access to affordable capital for growth.

- Impact on Borrowing Costs: Higher interest rates increase the expense of any debt Element Solutions Inc. takes on, affecting its net income.

- Investment Decisions: Elevated borrowing costs can make R&D and expansion projects less attractive, potentially slowing down innovation and growth.

- Access to Capital: Monetary policy shifts can tighten or loosen the availability of credit, directly impacting Element Solutions' capacity to fund strategic initiatives.

- Financial Health: A sustained period of high interest rates can strain Element Solutions' balance sheet and overall financial stability.

End-Market Demand and Industry Cycles

Element Solutions Inc. is heavily influenced by the cyclical nature of its key end-markets, particularly electronics and industrial applications. Demand for semiconductors and consumer electronics directly impacts the company's performance, as these sectors often experience rapid growth followed by periods of contraction.

The electronics sector, a significant driver for Element Solutions, saw robust growth in 2021 and 2022, fueled by increased demand for semiconductors and digital devices. However, projections for 2024 and 2025 indicate a more moderate growth trajectory for the semiconductor industry, with some segments facing inventory adjustments. For instance, global semiconductor revenue was projected to grow by 16.8% in 2024 according to Gartner, a slowdown from the 2023 figures.

Industrial applications, another core market, are sensitive to broader economic conditions and capital expenditure cycles. When industrial output increases and businesses invest in new equipment, demand for Element Solutions' specialized materials rises. Conversely, economic slowdowns or recessions can lead to reduced industrial activity and, consequently, lower sales for the company.

- Semiconductor Market Growth: Global semiconductor revenue is expected to reach approximately $689 billion in 2024, a notable increase but reflecting a normalization after prior boom years.

- Consumer Electronics Demand: While consumer electronics demand remained strong through much of 2023, analysts anticipate a more subdued growth rate in 2024 due to inflation and shifting consumer spending priorities.

- Industrial Production Trends: Industrial production growth rates, a key indicator for Element Solutions' industrial segment, are projected to be modest in developed economies through 2024, influenced by global supply chain adjustments and geopolitical factors.

- Impact on Element Solutions: Fluctuations in these end-markets directly correlate with Element Solutions' sales volumes and profitability, necessitating agile strategic planning to navigate industry cycles.

Global economic growth is projected to moderate in 2024 and 2025, with the IMF forecasting 3.2% growth for 2024 and a similar rate for 2025. However, recession risks remain, particularly in developed economies, which could dampen demand for Element Solutions' specialty chemicals used in sectors like automotive and electronics.

An economic slowdown would likely lead to reduced industrial production and lower consumer spending, directly impacting Element Solutions' revenue streams. For instance, a significant contraction in automotive sales, a key market, would translate to decreased demand for their advanced materials and coatings.

Element Solutions, a key player in specialty chemicals, faces significant headwinds from fluctuating raw material costs. For instance, the price of key inputs like bromine, a critical component in many of their products, saw considerable volatility throughout 2024, influenced by global demand shifts and geopolitical factors. This volatility directly impacts their cost of goods sold.

Broader inflationary pressures within the supply chain are also a major concern. Rising energy prices, transportation costs, and labor expenses in 2024 and projected into 2025 squeeze Element Solutions' operating margins. For example, global shipping costs, which had spiked significantly in previous years, remained elevated in early 2025, adding to the overall cost burden.

These escalating input costs necessitate careful pricing strategies. Element Solutions must balance the need to pass on these higher expenses to customers to protect profitability against the risk of losing market share. Their ability to manage these cost pressures will be a crucial determinant of their financial performance in the near term.

Currency exchange rate fluctuations significantly impact Element Solutions Inc.'s global financial performance. For instance, a stronger U.S. dollar can make its products more expensive for international customers, potentially reducing sales volume and revenue earned in foreign currencies. Conversely, a weaker dollar could boost international sales but also increase the cost of imported raw materials or components.

In 2023, Element Solutions reported that approximately 35% of its net sales were generated outside of North America, highlighting the substantial exposure to currency volatility. A hypothetical 5% strengthening of the U.S. dollar against a basket of major currencies could reduce reported international earnings by tens of millions of dollars in a given year, impacting profit margins directly.

Prevailing interest rates significantly influence Element Solutions Inc.'s cost of capital. Higher rates directly translate to increased borrowing expenses, potentially impacting the company's ability to finance research and development or pursue expansion projects. For instance, if Element Solutions needs to issue new debt in a high-interest rate environment, the cost of servicing that debt rises, affecting profitability and cash flow.

Changes in monetary policy by central banks, such as the U.S. Federal Reserve or the European Central Bank, are critical. These policies dictate the baseline interest rates, influencing the overall cost and availability of capital. In early 2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25%-5.50%, a level that has been consistent for some time, reflecting an effort to curb inflation but also presenting a higher hurdle for new debt financing compared to periods of lower rates. This environment requires careful financial management to ensure access to affordable capital for growth.

- Impact on Borrowing Costs: Higher interest rates increase the expense of any debt Element Solutions Inc. takes on, affecting its net income.

- Investment Decisions: Elevated borrowing costs can make R&D and expansion projects less attractive, potentially slowing down innovation and growth.

- Access to Capital: Monetary policy shifts can tighten or loosen the availability of credit, directly impacting Element Solutions' capacity to fund strategic initiatives.

- Financial Health: A sustained period of high interest rates can strain Element Solutions' balance sheet and overall financial stability.

Element Solutions Inc. is heavily influenced by the cyclical nature of its key end-markets, particularly electronics and industrial applications. Demand for semiconductors and consumer electronics directly impacts the company's performance, as these sectors often experience rapid growth followed by periods of contraction.

The electronics sector, a significant driver for Element Solutions, saw robust growth in 2021 and 2022, fueled by increased demand for semiconductors and digital devices. However, projections for 2024 and 2025 indicate a more moderate growth trajectory for the semiconductor industry, with some segments facing inventory adjustments. For instance, global semiconductor revenue was projected to grow by 16.8% in 2024 according to Gartner, a slowdown from the 2023 figures.

Industrial applications, another core market, are sensitive to broader economic conditions and capital expenditure cycles. When industrial output increases and businesses invest in new equipment, demand for Element Solutions' specialized materials rises. Conversely, economic slowdowns or recessions can lead to reduced industrial activity and, consequently, lower sales for the company.

- Semiconductor Market Growth: Global semiconductor revenue is expected to reach approximately $689 billion in 2024, a notable increase but reflecting a normalization after prior boom years.

- Consumer Electronics Demand: While consumer electronics demand remained strong through much of 2023, analysts anticipate a more subdued growth rate in 2024 due to inflation and shifting consumer spending priorities.

- Industrial Production Trends: Industrial production growth rates, a key indicator for Element Solutions' industrial segment, are projected to be modest in developed economies through 2024, influenced by global supply chain adjustments and geopolitical factors.

- Impact on Element Solutions: Fluctuations in these end-markets directly correlate with Element Solutions' sales volumes and profitability, necessitating agile strategic planning to navigate industry cycles.

Element Solutions' financial performance is closely tied to global economic trends, with moderate growth projected for 2024-2025, though recession risks persist. Inflationary pressures and volatile raw material costs, such as bromine, directly impact operating margins and necessitate strategic pricing. Fluctuations in currency exchange rates and prevailing interest rates also pose significant challenges, affecting international sales and the cost of capital.

| Economic Factor | 2024/2025 Projection/Data | Impact on Element Solutions |

| Global GDP Growth | IMF: 3.2% (2024 & 2025) | Moderated demand for specialty chemicals; recession risks impact key end-markets. |

| Raw Material Costs | Volatile (e.g., Bromine prices) | Increased cost of goods sold, pressure on operating margins. |

| Inflation | Persistent (energy, transport, labor) | Squeezes operating margins; necessitates careful pricing strategies. |

| Currency Exchange Rates | Fluctuating (e.g., USD strength) | Impacts international sales revenue and cost of imported materials. |

| Interest Rates | Elevated (e.g., Fed Funds Rate 5.25%-5.50%) | Increases borrowing costs, affects R&D/expansion financing, access to capital. |

Full Version Awaits

Element Solutions PESTLE Analysis

The Element Solutions PESTLE analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Element Solutions.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive strategic overview.

Sociological factors

Consumer demand for electronics with enhanced performance and longer lifespans directly impacts Element Solutions' product development. For instance, the growing preference for lighter, more durable smartphones and laptops necessitates specialty chemicals that offer superior conductivity and heat dissipation. This trend is reflected in the global consumer electronics market, which was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating sustained demand for advanced materials.

Global workforce demographics are shifting, with an aging population in many developed nations and a growing youth population in emerging economies. This creates both challenges and opportunities for talent availability in specialized fields like chemistry and engineering, critical for Element Solutions' innovation in areas like advanced materials and electronic chemicals.

The availability of skilled labor in chemistry, engineering, and manufacturing remains a key concern. For instance, the U.S. Bureau of Labor Statistics projected a 4% job growth for chemical engineers between 2022 and 2032, indicating continued demand. Element Solutions must navigate this landscape by focusing on robust talent acquisition, competitive retention strategies, and continuous training programs to maintain its innovative edge and operational efficiency.

Societal expectations for robust corporate social responsibility (CSR) are intensifying, pushing companies like Element Solutions Inc. to prioritize ethical sourcing, fair labor, and active community involvement. Consumers and stakeholders increasingly demand transparency and positive social impact, influencing purchasing decisions and brand loyalty.

Element Solutions' dedication to CSR can significantly bolster its brand image, making it more attractive to a growing segment of socially conscious investors and customers. For instance, in 2023, companies with strong ESG (Environmental, Social, and Governance) performance saw an average of 1.5% higher returns than their peers, highlighting the financial benefits of responsible practices.

Health and Safety Awareness

Public and industrial awareness regarding health and safety in chemical handling and manufacturing is significantly increasing. Element Solutions Inc.'s commitment to rigorous safety protocols, such as those outlined in their Responsible Care initiatives, directly addresses these concerns. By maintaining high operational safety standards, the company can foster trust with stakeholders and reduce the potential for negative publicity stemming from incidents. For instance, in 2023, the chemical industry globally saw continued focus on process safety management, with regulatory bodies like OSHA issuing updated guidance to prevent workplace accidents.

Element Solutions' proactive approach to transparency in communicating its safety performance and product stewardship is crucial. This open dialogue helps to build confidence among customers, employees, and the communities where they operate. Adherence to international standards like ISO 45001 for occupational health and safety management systems further solidifies their dedication. The company's investment in safety training and advanced monitoring technologies in 2024 is expected to further enhance their safety record, aligning with a global trend of prioritizing worker well-being.

- Growing Public Scrutiny: Increased media coverage and public discourse on chemical safety incidents globally.

- Regulatory Compliance: Stringent regulations like REACH in Europe and TSCA in the US demand robust safety data and handling procedures.

- Employee Expectations: A heightened expectation from the workforce for safe working environments, impacting recruitment and retention.

- Supply Chain Demands: Customers increasingly require suppliers to demonstrate strong health and safety credentials as part of their own risk management.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This trend directly fuels demand for Element Solutions' industrial finishes and advanced materials, essential for constructing and maintaining the infrastructure supporting these growing cities. Emerging markets, in particular, are experiencing significant investment in new roads, bridges, and public transportation systems, creating substantial opportunities.

The construction sector is a primary beneficiary, requiring specialized coatings and materials for durability and aesthetics. Similarly, the automotive industry's shift towards electric vehicles and advanced manufacturing processes relies on high-performance plating and finishing solutions. The electronics sector's constant innovation also drives demand for precision materials used in everything from semiconductors to consumer devices.

- Infrastructure Growth: Global infrastructure spending is projected to reach $15 trillion by 2040, with a significant portion allocated to emerging economies.

- Urban Population Shift: The United Nations estimates that by 2030, 30% of the global population will live in cities of 1 million or more people.

- Automotive Demand: The electric vehicle market is expected to grow at a CAGR of over 18% through 2030, increasing the need for specialized automotive finishes.

- Electronics Market Expansion: The global semiconductor market alone was valued at over $600 billion in 2024, underscoring the demand for advanced materials in this sector.

Societal expectations for corporate social responsibility (CSR) are growing, pushing companies like Element Solutions to prioritize ethical practices and community engagement. Consumers and investors increasingly favor businesses demonstrating transparency and positive social impact, influencing purchasing decisions and brand loyalty. In 2023, companies with strong ESG performance showed higher returns, highlighting the financial advantages of responsible operations.

There's a rising public and industrial awareness regarding health and safety in chemical handling. Element Solutions' commitment to rigorous safety protocols, such as their Responsible Care initiatives, directly addresses these concerns. By maintaining high safety standards, the company builds trust and reduces the risk of negative publicity. The chemical industry globally continued to focus on process safety management in 2023, with regulatory bodies issuing updated guidance.

The increasing demand for electronics with better performance and longer lifespans directly impacts Element Solutions' product development. The preference for lighter, more durable smartphones and laptops requires specialty chemicals offering superior conductivity and heat dissipation. The global consumer electronics market, valued at approximately $1.1 trillion in 2023, shows sustained demand for advanced materials.

Global workforce demographics are shifting, presenting both challenges and opportunities for talent in specialized fields like chemistry and engineering. Element Solutions must focus on talent acquisition, retention, and training to maintain its innovative edge. The U.S. Bureau of Labor Statistics projected a 4% job growth for chemical engineers between 2022 and 2032, indicating continued demand for skilled professionals.

Technological factors

Element Solutions Inc. demonstrates a strong commitment to innovation through its consistent investment in research and development. This focus on R&D is crucial for developing advanced chemistry and application technologies, enabling the company to create high-performance materials and solutions that meet evolving customer demands and maintain a competitive edge in the market.

In 2023, Element Solutions reported R&D expenses of $151.7 million, representing approximately 2.8% of their net sales. This ongoing investment fuels their ability to innovate across their diverse product portfolio, from advanced semiconductor materials to specialized chemicals for various industrial applications, ensuring they remain at the forefront of technological advancements.

Breakthroughs in materials science, including nanotechnology and advanced composites, are poised to significantly reshape Element Solutions' product offerings. These innovations open doors for developing next-generation electronic chemicals and performance materials with enhanced properties, potentially leading to new market segments and increased demand for specialized solutions.

Element Solutions is increasingly integrating automation and AI into its production, aiming to boost efficiency and cut operational expenses. For instance, in 2024, the company highlighted its ongoing investments in advanced manufacturing to improve output consistency and reduce waste in its specialty chemical processes.

These technological advancements are crucial for Element Solutions to meet evolving customer demands for higher-purity chemicals and more intricate formulations. By leveraging robotics and AI-driven process optimization, the company can achieve greater precision, which is vital in sectors like electronics and semiconductors where even minor variations can impact performance.

The adoption of Industry 4.0 principles allows Element Solutions to enhance product quality and develop more sophisticated chemical solutions. This technological edge is particularly important as customers in high-tech industries require materials that can withstand increasingly demanding operating conditions, a capability directly supported by advanced manufacturing techniques.

Digital Transformation and Data Analytics

Element Solutions Inc. is increasingly leveraging digital transformation and data analytics to sharpen its competitive edge. By integrating advanced analytics across its operations, the company aims to unlock significant efficiencies. For instance, in 2024, many industrial chemical companies reported substantial cost savings through optimized supply chains driven by real-time data. Element Solutions is likely pursuing similar strategies, using predictive analytics for inventory management and demand forecasting to reduce waste and improve service levels.

The application of big data extends to enhancing customer engagement and ensuring operational reliability. Through sophisticated data analysis, Element Solutions can gain deeper insights into customer needs and market trends, allowing for more tailored product development and service offerings. Furthermore, predictive maintenance, powered by sensor data and machine learning, is crucial for minimizing downtime in manufacturing processes. This proactive approach helps maintain asset integrity and ensures consistent production output, a critical factor in the specialty chemicals sector.

- Supply Chain Optimization: Utilizing real-time data for predictive inventory management and logistics, potentially reducing carrying costs by 5-10% as seen in industry benchmarks.

- Customer Relationship Management: Employing data analytics to personalize customer interactions and identify cross-selling opportunities, aiming for a 3-5% increase in customer retention.

- Predictive Maintenance: Implementing AI-driven systems to forecast equipment failures, reducing unplanned downtime by an estimated 15-20% and associated repair costs.

- Operational Efficiency: Analyzing production data to identify bottlenecks and areas for process improvement, targeting a 2-4% boost in overall manufacturing output.

Intellectual Property Protection and Innovation Cycles

Intellectual property (IP) protection is crucial for Element Solutions Inc. (ESI) to safeguard its unique chemical formulations and advanced manufacturing processes, which are the bedrock of its competitive edge. The company actively manages its extensive IP portfolio, including patents and trade secrets, to maintain its market position in the fast-paced specialty chemicals sector.

Innovation cycles in the specialty chemicals industry are accelerating, requiring ESI to continually invest in research and development. By strategically protecting its intellectual assets, ESI ensures that its technological advancements translate into sustained market leadership and profitability.

Element Solutions is heavily investing in advanced manufacturing and automation, aiming to enhance production efficiency and product consistency. This focus on Industry 4.0 principles is vital for meeting the stringent quality requirements in sectors like electronics, where precision is paramount.

The company is also leveraging digital transformation and data analytics to optimize its operations, from supply chain management to customer engagement. By harnessing big data, Element Solutions seeks to improve forecasting, reduce waste, and gain deeper market insights.

These technological investments are crucial for maintaining a competitive edge, enabling the development of next-generation materials and solutions. The company's commitment to R&D, evidenced by its 2023 R&D expenses of $151.7 million, underpins its ability to innovate and adapt to evolving market demands.

Intellectual property protection remains a cornerstone of Element Solutions' strategy, safeguarding its proprietary chemical formulations and manufacturing processes in a rapidly advancing technological landscape.

Legal factors

Element Solutions Inc. navigates a complex web of global chemical regulations, including REACH in Europe and TSCA in the United States, which significantly influence product development, manufacturing processes, and market access. Ensuring compliance with these evolving standards, such as the Globally Harmonized System (GHS) for classification and labeling, demands substantial investment in testing, documentation, and specialized personnel. For instance, the cost of REACH registration alone can run into millions of euros for a single substance, impacting the company's operational budget and strategic planning for new product introductions.

Element Solutions Inc. operates within a complex web of product safety and liability laws across its global markets, particularly concerning its specialty chemicals. These regulations dictate stringent standards for chemical composition, handling, and disposal, directly impacting product development and market access. Failure to comply can lead to significant penalties and reputational damage.

The company faces potential legal challenges stemming from product performance, environmental impact, and health effects. For instance, regulations like REACH in Europe and TSCA in the United States impose rigorous testing and registration requirements for chemicals. Element Solutions mitigates these risks through comprehensive internal testing protocols, adherence to international safety standards, and transparent product labeling, aiming to preemptively address any potential safety concerns.

Element Solutions Inc. relies heavily on intellectual property, including patents and trade secrets, to safeguard its innovative chemical solutions. These legal protections are crucial for maintaining a competitive edge in the specialty chemicals market. In 2023, the company reported significant investment in research and development, a portion of which directly supports the acquisition and maintenance of patents.

The company actively employs legal strategies to defend its intellectual property against potential infringement. This includes monitoring the market for unauthorized use of its patented technologies and pursuing legal action when necessary. Element Solutions also focuses on securing new patents globally to expand its IP portfolio and protect its innovations in key operating regions, contributing to its robust market position.

Labor Laws and Employment Regulations

Element Solutions Inc. operates globally, necessitating adherence to a complex web of labor laws and employment regulations across its manufacturing and office locations. These regulations, covering everything from minimum wage and working hours to unionization rights and termination procedures, directly influence operational costs and human resource strategies. For instance, differing statutory severance pay requirements in countries like Germany compared to the United States can significantly impact workforce restructuring expenses.

Compliance with worker safety standards, such as those mandated by OSHA in the US or similar bodies in Europe and Asia, is paramount. These standards dictate workplace design, equipment usage, and training protocols, all of which add to operational expenditures but are crucial for mitigating risks and maintaining a positive corporate reputation. A strong safety record, often reflected in lower workers' compensation claims, can also indirectly reduce insurance premiums.

The company's human resource management must navigate varying statutory requirements for benefits, leave policies, and anti-discrimination laws, which differ substantially by jurisdiction. For example, parental leave entitlements in Nordic countries are far more extensive than in many other regions, impacting payroll and staffing flexibility. These legal frameworks shape how Element Solutions attracts, retains, and manages its workforce, directly affecting its ability to operate efficiently and cost-effectively.

- Global Labor Law Variance: Element Solutions must comply with diverse labor laws, impacting hiring, compensation, and termination practices across its international operations.

- Worker Safety Costs: Adherence to stringent safety regulations, like those from OSHA, incurs costs for equipment, training, and compliance audits, but is vital for risk mitigation.

- HR Management Complexity: Differing statutory benefits, leave policies, and anti-discrimination laws require tailored HR strategies for each operating country.

- Reputational Impact: Strong compliance with labor and safety laws enhances corporate reputation, while violations can lead to significant financial penalties and brand damage.

Anti-Trust and Competition Laws

Anti-trust and competition laws are highly relevant to Element Solutions Inc. in the specialty chemicals sector, especially when considering mergers, acquisitions, or any actions that could lead to market dominance. These regulations ensure a level playing field, preventing monopolistic practices that could stifle innovation and harm consumers. For instance, significant consolidation within the specialty chemicals market, where Element Solutions operates, often attracts scrutiny from regulatory bodies like the Federal Trade Commission (FTC) in the US or the European Commission.

These laws directly influence Element Solutions' strategic decisions regarding expansion and market conduct. Any acquisition or partnership must be carefully evaluated to ensure it doesn't violate thresholds for market share or create undue competitive advantage. In 2024, the specialty chemicals industry saw continued M&A activity, with regulators closely monitoring deals that could impact pricing or product availability. Element Solutions' approach to growth must therefore be compliant, balancing ambitious targets with adherence to competition frameworks.

Element Solutions must navigate these legal landscapes to pursue its growth objectives. For example, if Element Solutions were to consider acquiring a competitor in a key market segment, such a move would likely undergo rigorous review. The company's ability to expand its product lines or geographic reach through M&A hinges on demonstrating that such actions do not substantially lessen competition. The regulatory environment in 2025 is expected to maintain a strong focus on market concentration across various industrial sectors, including chemicals.

- Regulatory Scrutiny: Mergers and acquisitions in the specialty chemicals sector are subject to review by antitrust authorities globally to prevent anti-competitive outcomes.

- Market Share Limits: Laws often impose limits on market share to prevent monopolies and ensure fair competition, impacting Element Solutions' growth strategies.

- Impact on Pricing: Competition laws aim to protect consumers from potential price gouging that can arise from reduced competition.

- Innovation Incentives: By fostering competition, these laws encourage companies like Element Solutions to continuously innovate and improve their offerings.

Element Solutions Inc. must navigate a complex global regulatory environment, particularly concerning environmental protection and chemical substance management. Laws like the Clean Air Act and Clean Water Act in the US, and similar directives in the EU, dictate emissions standards and waste disposal practices, directly impacting manufacturing costs and operational permits. For instance, the company's adherence to stringent wastewater discharge limits in 2024 required significant investment in advanced treatment technologies.

The company's product portfolio is subject to evolving regulations regarding chemical safety and environmental impact. For example, the ongoing review of certain per- and polyfluoroalkyl substances (PFAS) by regulatory bodies in 2024 and projected into 2025 could necessitate reformulation or phase-out of specific products, impacting revenue streams and R&D priorities. Element Solutions actively monitors these developments to ensure proactive adaptation and compliance.

Element Solutions faces potential liabilities related to historical environmental contamination at former manufacturing sites. Remediation efforts and compliance with Superfund laws in the US, or equivalent legislation elsewhere, represent ongoing financial commitments. The company's 2023 annual report detailed provisions for environmental remediation, underscoring the long-term financial implications of past operations and the importance of stringent environmental stewardship moving forward.

Environmental factors

Element Solutions Inc. demonstrates a growing commitment to sustainability, actively integrating green chemistry principles into its operations. This focus translates into tangible efforts to minimize its environmental footprint, such as optimizing processes to reduce waste and energy consumption. For instance, in 2023, the company reported a 5% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2022 baseline, a direct result of these initiatives.

The development of eco-friendly solutions is a key pillar of Element Solutions' sustainability strategy. These innovations not only cater to increasing market demand for greener products but also contribute to resource efficiency by enabling customers to use less material or energy. The company’s recent launch of a new line of low-VOC (volatile organic compound) coatings in early 2024 is expected to reduce VOC emissions by an estimated 15% for its users.

Element Solutions Inc. navigates a complex web of environmental regulations governing waste management and pollution control within the chemical sector. These include stringent standards for hazardous waste disposal, wastewater discharge limits, and air emission controls, all of which are subject to ongoing updates and enforcement by agencies like the EPA. The company's commitment to sustainability necessitates robust systems for minimizing its ecological footprint.

In 2023, Element Solutions reported significant investments in environmental initiatives, including upgrades to wastewater treatment facilities at several key sites to meet or exceed regulatory requirements. The company actively pursues waste reduction strategies, aiming to divert materials from landfills and explore recycling or reuse opportunities. For instance, their efforts in managing spent acids and other chemical byproducts are crucial for compliance and responsible operations.

Element Solutions Inc. faces increasing scrutiny and regulation regarding climate change. Global and regional policies, such as the European Union's Carbon Border Adjustment Mechanism (CBAM) and various national emissions reduction targets, directly impact the cost of operations and supply chains. For instance, the EU aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels, which could affect the cost of imported materials or the competitiveness of products sold in these markets.

The company is actively managing its carbon footprint through various initiatives. Element Solutions reported a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity in 2023 compared to its 2019 baseline. This includes investments in energy efficiency, process optimization, and exploring renewable energy sources for its manufacturing facilities globally.

Resource Scarcity and Raw Material Sourcing

Resource scarcity, especially for critical raw materials like rare earth elements and certain metals vital for specialty chemicals, presents significant environmental challenges. The extraction and processing of these materials often have a substantial ecological footprint, contributing to habitat destruction and pollution. Element Solutions Inc. is actively addressing these concerns by focusing on sustainable sourcing practices and enhancing supply chain resilience. This includes exploring opportunities for developing and utilizing alternative or recycled materials to mitigate reliance on newly extracted resources.

The company's commitment to sustainability in raw material sourcing is crucial for long-term viability. For instance, the increasing demand for materials used in advanced electronics and renewable energy technologies, which rely on specialty chemicals, puts pressure on global reserves. Element Solutions is investing in research and development to identify and implement more environmentally friendly sourcing methods and to boost the circularity of its material inputs.

- Focus on sustainable sourcing of critical raw materials for specialty chemicals.

- Enhancing supply chain resilience to mitigate risks associated with resource availability.

- Investing in R&D for alternative and recycled materials to reduce environmental impact.

- Addressing the ecological footprint of raw material extraction and processing.

Circular Economy Principles

The chemical industry, including Element Solutions Inc., is increasingly embracing circular economy principles to minimize waste and maximize resource utilization. This involves a shift towards product lifecycle management that prioritizes material reuse and recycling, aiming to keep resources in use for as long as possible.

Designing products for longevity and efficient end-of-life recovery presents significant opportunities for Element Solutions. By focusing on these aspects, the company can not only improve its environmental footprint but also unlock new revenue streams through innovative material recovery and reprocessing services.

- Focus on product longevity: Element Solutions is exploring advanced material science to create chemicals and solutions that have a longer effective lifespan in their intended applications.

- Material reuse and recovery: Initiatives are underway to develop closed-loop systems for key chemical feedstocks and byproducts, reducing reliance on virgin materials.

- End-of-life solutions: The company is investing in technologies for chemical recycling and the safe recovery of valuable components from end-of-life products, such as batteries and electronics.

- Business opportunity creation: By integrating circularity, Element Solutions aims to offer customers more sustainable product options and services, potentially capturing market share in the growing green economy. For instance, in 2024, the demand for recycled plastics in the chemical sector saw a notable increase, indicating a market readiness for such solutions.

Element Solutions Inc. is actively integrating green chemistry and sustainability into its operations, evidenced by a 5% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022. The company is also developing eco-friendly products, such as low-VOC coatings launched in early 2024, projected to cut user VOC emissions by 15%.

Navigating stringent environmental regulations for waste and pollution control, Element Solutions invested in wastewater treatment upgrades in 2023 to meet compliance. They are also focusing on waste reduction, aiming to divert materials from landfills and enhance the circularity of their material inputs by exploring alternative and recycled materials.

| Environmental Initiative | 2023 Performance/Target | Impact |

|---|---|---|

| GHG Emissions Reduction (Scope 1 & 2) | 5% reduction vs. 2022 baseline | Reduced operational carbon footprint |

| Low-VOC Coatings Launch | Early 2024 | Estimated 15% reduction in user VOC emissions |

| Wastewater Treatment Upgrades | Completed at key sites | Ensured regulatory compliance and reduced water pollution |

| Circular Economy Focus | Ongoing R&D for recycled materials | Mitigates reliance on virgin resources and reduces extraction impact |

PESTLE Analysis Data Sources

Our PESTLE analysis for Element Solutions is meticulously constructed using data from leading financial institutions like the IMF and World Bank, alongside reports from industry-specific market research firms and government regulatory bodies. This comprehensive approach ensures that each factor, from economic shifts to technological advancements, is grounded in current, verifiable information.