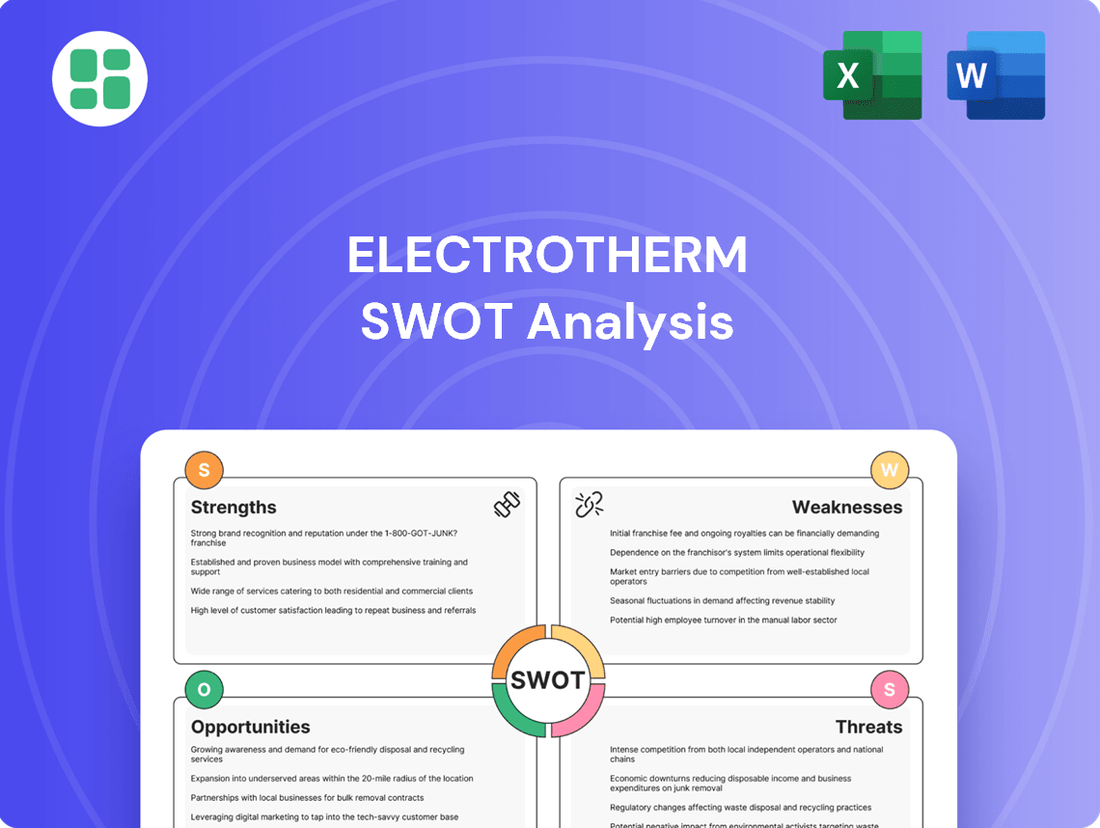

Electrotherm SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Electrotherm Bundle

Electrotherm's strengths lie in its established brand and technological expertise, but it faces opportunities in emerging markets and potential threats from evolving regulations. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Electrotherm's competitive edge and potential pitfalls? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and market strategy.

Strengths

Electrotherm (India) Limited boasts a strategically diversified business portfolio, spanning critical sectors like induction melting furnaces, steel production, ductile iron pipes, and comprehensive engineering and construction services. This multi-segment approach significantly mitigates risks tied to any single market, fostering greater financial stability and creating robust, varied revenue streams.

Further broadening its market footprint, Electrotherm has ventured into the burgeoning electric vehicle (EV) sector, offering both low-speed and high-speed electric two-wheelers. This strategic expansion into e-mobility not only taps into a high-growth industry but also complements its existing industrial offerings, presenting a holistic approach to industrial and sustainable mobility solutions.

Electrotherm boasts a commanding presence in India's steelmaking sector, holding over 65% of the market share for induction melting equipment. This leadership signifies robust brand loyalty and deep-rooted customer trust in a vital industrial segment.

Globally, the company's strength is further underscored by its substantial 3.5 Lacs KW market share in the broader metal melting industry, demonstrating its significant reach and capability on an international scale.

Electrotherm's strength as an integrated solutions provider is a significant advantage, offering a complete package for metal melting and processing across key sectors like steel, automotive, and infrastructure. This end-to-end capability fosters deeper customer relationships and allows for the management of more extensive projects.

Experience and Longevity in the Industry

Electrotherm (India) Limited, established in 1983, boasts nearly four decades of operational history, demonstrating significant experience and longevity in the industrial equipment sector. This extensive track record translates into deep industry expertise and well-honed operational capabilities, providing a solid foundation for its market presence.

The company's long-standing presence indicates a proven ability to navigate market cycles and build enduring customer relationships. As of the fiscal year ending March 31, 2024, Electrotherm reported a revenue of INR 7.5 billion, underscoring its sustained operational scale and market engagement.

- Established in 1983

- Nearly 40 years of industry experience

- Demonstrated operational resilience

- Strong foundation for client trust

Positive Financial Performance (March 2025 Quarter)

Electrotherm demonstrated robust financial health in the March 2025 quarter, showcasing impressive profit growth. The company's consolidated net profit surged by 78.31% compared to the same quarter in the prior year, a testament to effective cost management and increased revenue streams. This strong quarterly performance contributed to a substantial 39.33% rise in net profit for the full fiscal year ending March 2025, highlighting sustained operational efficiency and market competitiveness.

- Significant Profit Growth: Consolidated net profit increased by 78.31% in the March 2025 quarter year-on-year.

- Annual Performance: Full-year net profit for FY25 saw a 39.33% increase.

- Operational Efficiency: The results indicate strong operational execution and profitability.

Electrotherm's market leadership in induction melting equipment, holding over 65% in India, is a significant strength, reflecting deep customer trust and brand loyalty. This dominance extends globally with a substantial 3.5 Lacs KW market share in metal melting, showcasing broad operational reach and capability. The company's integrated solutions approach for metal processing, from steel to infrastructure, fosters strong client relationships and enables management of larger projects.

| Key Strength | Metric | Significance |

| Market Share (India) | > 65% in Induction Melting Equipment | Strong brand loyalty and customer trust |

| Global Market Share | 3.5 Lacs KW in Metal Melting | Extensive international reach and capability |

| Integrated Solutions | End-to-end metal processing capabilities | Deeper customer relationships, larger project management |

What is included in the product

Analyzes Electrotherm’s competitive position through key internal and external factors, highlighting its strengths in manufacturing, weaknesses in market penetration, opportunities in renewable energy, and threats from global competition.

Offers a clear, actionable framework for identifying and addressing Electrotherm's strategic challenges.

Weaknesses

Electrotherm experienced a significant downturn in the June 2025 quarter. Consolidated net profit saw a sharp decrease of 74.50% compared to the prior year's corresponding quarter. This substantial drop indicates potential headwinds impacting the company's profitability.

Further compounding these issues, sales also experienced a decline. In the same June 2025 quarter, consolidated sales fell by 21.27% year-on-year. This reduction in revenue suggests challenges in market demand or competitive pressures affecting Electrotherm's top line.

Electrotherm's financial health is showing signs of strain. CARE Ratings recently reaffirmed lower ratings for its bank facilities, a clear indicator of a weakening financial risk profile and liquidity.

This downgrade stems from significant debt-funded capital expenditures that haven't yielded the expected returns, coupled with a shortfall in anticipated equity infusions. For instance, the company's debt-to-equity ratio has been a point of concern, and the inability to generate sufficient cash flow from its investments exacerbates this.

This situation could make it harder for Electrotherm to secure new financing on favorable terms or even manage its day-to-day operational cash needs effectively, potentially impacting its ability to meet short-term obligations.

Electrotherm's promoter holding stands at a relatively low 29.9%. This level could signal potential concerns regarding management's sustained commitment to the company or the alignment of their interests with those of minority shareholders.

Furthermore, the company faces significant contingent liabilities totaling Rs. 1,067 Cr as of March 31, 2024. These liabilities represent potential financial obligations that could materialize, posing a considerable risk to the company's financial health and stability if they are realized.

Poor Sales Growth Over Five Years

Electrotherm (India) Limited has faced a significant challenge with its sales performance, showing a modest growth rate of 5.08% over the last five years. This sluggish sales expansion, despite periods of robust profit growth, suggests potential difficulties in expanding its market reach or effectively scaling its business operations.

The company's inability to achieve more substantial sales increases could signal underlying issues in its product demand, competitive positioning, or market penetration strategies.

- Sales Growth Lag: Electrotherm's sales growth has averaged only 5.08% over the past five years.

- Scaling Concerns: This low growth rate might indicate challenges in scaling operations to meet potential demand.

- Market Penetration Issues: The company may be struggling to capture new market segments or increase its share in existing ones.

Dependence on Cyclical Industries

Electrotherm's reliance on sectors like steel, automotive, and infrastructure presents a significant weakness. These industries are notoriously cyclical, meaning their performance is closely tied to broader economic health. When the economy slows, demand for products in these sectors often plummets, directly affecting Electrotherm's sales and profitability. For instance, a slowdown in automotive production directly reduces the need for the company's electrical components and heating solutions.

This sensitivity to economic cycles can lead to considerable revenue volatility for Electrotherm. During economic downturns, the company may experience sharp declines in orders and revenue, impacting its financial stability. Conversely, during boom periods, demand might surge, but the inherent unpredictability of these cycles makes long-term forecasting and capacity planning challenging. For example, the automotive sector in India, a key market for Electrotherm, experienced a production decline of approximately 14% in FY2020, highlighting the impact of economic headwinds on related industries.

The company's exposure to these fluctuating markets means its financial performance can be inconsistent. This cyclicality can make it difficult to maintain steady growth and can impact investor confidence.

- Sensitivity to Economic Cycles: Core markets like automotive and infrastructure are highly susceptible to economic downturns.

- Revenue Volatility: Downturns in these sectors can lead to unpredictable fluctuations in Electrotherm's revenue streams.

- Forecasting Challenges: The cyclical nature of its key industries complicates accurate demand and revenue forecasting.

- Impact of Sector-Specific Downturns: A slowdown in steel production, for example, directly reduces demand for Electrotherm's industrial heating equipment.

Electrotherm's financial performance has shown significant weakness, with a 74.50% drop in consolidated net profit for the June 2025 quarter compared to the previous year. This is further exacerbated by a 21.27% decline in consolidated sales during the same period, pointing to potential market challenges and reduced demand.

The company's financial health is a concern, as indicated by CARE Ratings' reaffirmation of lower ratings for its bank facilities. This reflects issues stemming from debt-funded capital expenditures that have not delivered expected returns, coupled with a shortfall in anticipated equity infusions.

Electrotherm's reliance on cyclical sectors like steel, automotive, and infrastructure makes it vulnerable to economic downturns, leading to revenue volatility and forecasting difficulties.

| Metric | June 2025 Quarter (YoY) | 5-Year Average Sales Growth | Contingent Liabilities (as of Mar 31, 2024) |

| Net Profit | -74.50% | N/A | N/A |

| Consolidated Sales | -21.27% | 5.08% | N/A |

| Financial Risk Profile | Weakening (Lower Ratings) | N/A | Rs. 1,067 Cr |

Preview the Actual Deliverable

Electrotherm SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

India's ambitious infrastructure push presents a significant tailwind for Electrotherm. With the government earmarking substantial funds for projects in 2024-2025, including the PM Gati Shakti National Master Plan, demand for steel and ductile iron pipes, key products for Electrotherm, is expected to surge.

The Indian ductile iron pipes market is experiencing robust expansion, with projections indicating a compound annual growth rate (CAGR) between 10.74% and 12.50% from 2025 through 2035. This growth is fueled by escalating urbanization and critical government initiatives such as the Jal Jeevan Mission and AMRUT, aimed at improving water infrastructure.

Furthermore, the imperative to replace and upgrade existing, often deteriorating, water supply networks presents a significant demand driver. Electrotherm, as a key player in the ductile iron pipe manufacturing sector, is strategically positioned to leverage this expanding market opportunity.

India's steel demand is projected for substantial growth, with forecasts indicating an 8% to 8.5% increase in 2025, surpassing global averages. This surge is largely driven by ongoing infrastructure development projects across the nation.

This expanding market presents a significant opportunity for Electrotherm, particularly for its steel manufacturing and induction furnace segments. The company is well-positioned to capitalize on this heightened demand for steel products and the equipment used in their production.

Growth in the Induction Furnace Market

The Indian induction furnace market is poised for significant expansion, projected to grow by USD 113.6 million between 2024 and 2029, with a compound annual growth rate of 7.2%. This upward trend is fueled by a rising demand for steel and alloys, coupled with robust government initiatives promoting industrial development. Electrotherm, with its substantial market presence in this sector, is well-positioned to capitalize on this projected growth.

Key drivers for this market surge include:

- Escalating demand for steel and alloys: Increased infrastructure projects and manufacturing activities are boosting the need for these core materials.

- Government support for industrial growth: Policies aimed at boosting domestic manufacturing and infrastructure development directly benefit the induction furnace sector.

- Electrotherm's established market share: The company's strong foothold allows it to effectively leverage the expanding market opportunities.

Potential for Technological Upgrades and Innovation

The furnace industry is increasingly embracing technological upgrades, with a significant push towards digitalization and Industry 4.0 integration. This trend presents a prime opportunity for Electrotherm to elevate its product portfolio and streamline its operations. By investing in cutting-edge technologies, the company can sharpen its competitive advantage and effectively meet the dynamic demands of the market.

Electrotherm can leverage this opportunity by focusing on key areas:

- Smart Furnace Technology: Integrating IoT sensors and data analytics for real-time monitoring, predictive maintenance, and optimized energy consumption.

- Automation and Robotics: Implementing automated loading/unloading systems and robotic controls to boost production efficiency and reduce manual labor.

- Advanced Material Science: Researching and incorporating new, high-performance materials for furnace linings and components to improve durability and thermal efficiency.

- Digital Twin Development: Creating virtual replicas of furnaces to simulate performance, test new configurations, and train operators in a risk-free environment.

For instance, companies in the industrial equipment sector have seen an average increase in operational efficiency of up to 15% after implementing Industry 4.0 solutions in their manufacturing processes, according to a 2024 report by McKinsey & Company. This suggests a tangible benefit for Electrotherm in adopting similar advancements.

Electrotherm is well-positioned to benefit from India's extensive infrastructure development plans, particularly in the water and steel sectors. The projected growth in ductile iron pipes, driven by government initiatives like the Jal Jeevan Mission, offers a substantial market. Similarly, the anticipated 8% to 8.5% increase in India's steel demand for 2025, exceeding global averages, directly supports Electrotherm's steel and induction furnace segments.

The Indian induction furnace market itself is expected to expand by USD 113.6 million between 2024 and 2029, with a CAGR of 7.2%, bolstered by rising steel demand and government support for industrial growth.

Further opportunities lie in embracing Industry 4.0 technologies for furnace upgrades. Integrating digitalization and automation can enhance operational efficiency, as seen with up to a 15% increase in efficiency reported by industrial equipment companies adopting these solutions in 2024.

Electrotherm's strategic focus on smart furnace technology, automation, advanced materials, and digital twins can solidify its competitive edge and cater to evolving market needs.

Threats

Electrotherm navigates highly competitive landscapes across its core segments, including steel, ductile iron pipes, and induction furnaces. Established industry giants and agile new entrants alike are vying for market share, creating a challenging environment.

This fierce competition directly translates into significant pricing pressures, which can erode profit margins. For instance, in the ductile iron pipe market, fluctuating raw material costs combined with aggressive bidding from competitors can make maintaining healthy profitability a constant struggle for companies like Electrotherm.

Electrotherm's profitability faces a significant threat from the volatility of raw material prices, especially iron ore, a key component in their steel and ductile iron manufacturing. For instance, iron ore prices saw considerable swings in late 2023 and early 2024, impacting input costs for many industrial players. A sharp rise in these costs, if not adequately passed on to consumers, directly squeezes Electrotherm's profit margins, potentially hindering financial performance.

As a company heavily involved in supplying equipment to cyclical sectors like steel and infrastructure, Electrotherm faces significant risks from economic downturns. A slowdown in global or domestic economies, particularly impacting these core industries, could directly translate into reduced demand for Electrotherm's products and services. For instance, a contraction in construction activity, a key driver for infrastructure spending, directly curtails the need for the company's specialized heating and melting solutions.

Market cyclicality means that periods of high demand, often fueled by government stimulus or infrastructure projects, are inevitably followed by periods of slower growth or contraction. This inherent volatility can lead to unpredictable revenue streams and pressure on profit margins. A notable example from 2024-2025 could be a projected slowdown in global infrastructure investment due to rising interest rates and inflationary pressures, which would directly impact Electrotherm's order book.

Regulatory and Environmental Compliance

Electrotherm faces significant threats from evolving regulatory and environmental compliance demands, particularly within the metal processing industry. Stricter environmental standards, such as those potentially introduced in response to climate change initiatives or pollution control measures, could necessitate substantial capital expenditures for equipment upgrades and process modifications. For instance, in 2024, the European Union continued to refine its Industrial Emissions Directive, impacting energy-intensive sectors like metal manufacturing.

Non-compliance with these regulations carries severe financial repercussions. These can range from hefty fines, which could impact profitability, to outright production halts, disrupting supply chains and customer relationships. The cost of adhering to new environmental mandates, such as enhanced waste management or emissions reduction technologies, is a constant concern for manufacturers. For example, a significant increase in carbon pricing mechanisms globally could directly inflate Electrotherm's operational expenses.

The threat of future regulatory tightening is a key consideration. As environmental awareness grows and international agreements evolve, it's probable that current standards will become more stringent. This necessitates proactive planning and investment in sustainable practices to mitigate future risks and maintain a competitive edge. Companies that fail to adapt may find themselves at a significant disadvantage.

Key compliance areas impacting Electrotherm include:

- Emissions control: Meeting air and water quality standards for manufacturing processes.

- Waste management: Proper disposal and recycling of industrial byproducts.

- Energy efficiency: Adherence to standards promoting reduced energy consumption.

- Chemical usage: Compliance with regulations on hazardous materials handling and disposal.

Debt-related Challenges and Credit Rating Concerns

Electrotherm faces a significant threat from its debt-related challenges, underscored by the reaffirmation of lower credit ratings. This reflects a deteriorating financial risk profile, stemming partly from past defaults on loan repayments to financial institutions. Such a standing directly impacts the company's ability to secure favorable financing terms for crucial future growth initiatives or even for day-to-day working capital needs.

These credit rating concerns can lead to higher borrowing costs, making expansion projects more expensive and potentially hindering operational flexibility. For instance, a lower credit rating often translates to increased interest expenses on any new debt taken on, directly impacting profitability. The market's perception of increased financial risk can also affect investor confidence and the company's overall valuation.

- Deteriorating Financial Risk Profile: Continued negative trends in key financial ratios may lead to further downgrades or prolonged periods with lower credit ratings.

- Increased Borrowing Costs: Higher interest rates on future debt issuances will directly impact Electrotherm's net income and cash flow available for reinvestment.

- Limited Access to Capital: In severe cases, a poor credit rating can restrict access to essential capital markets, making it difficult to raise funds for operational needs or strategic investments.

- Impact on Supplier and Customer Relations: A weakened financial standing could also affect relationships with suppliers who may demand stricter payment terms or customers who might perceive a higher risk of disruption.

Electrotherm's profitability is vulnerable to significant fluctuations in raw material prices, particularly iron ore, a critical input for its steel and ductile iron operations. For instance, iron ore prices experienced notable volatility throughout late 2023 and into 2024, directly impacting input costs for industrial manufacturers. If Electrotherm cannot fully pass these increased costs onto its customers, its profit margins face considerable pressure.

The company operates in sectors susceptible to economic downturns, meaning reduced demand during recessions directly affects its order books. A slowdown in global or domestic infrastructure projects, a primary driver for Electrotherm's specialized equipment, could lead to a substantial drop in revenue. For example, projections for 2024-2025 indicated potential headwinds for infrastructure spending due to rising interest rates.

Stricter environmental regulations pose a significant threat, potentially requiring substantial capital investment for compliance. Failure to meet evolving standards, such as those related to emissions control or waste management, could result in heavy fines or operational disruptions. The ongoing refinement of directives like the EU's Industrial Emissions Directive in 2024 highlights the increasing regulatory burden on energy-intensive industries.

Electrotherm's financial health is further threatened by its debt profile and associated credit ratings. Lower credit ratings increase borrowing costs, making expansion and working capital management more expensive. This weakened financial risk profile, evident from past loan repayment issues, can also diminish investor confidence and limit access to capital markets, impacting strategic growth opportunities.

SWOT Analysis Data Sources

This Electrotherm SWOT analysis is built upon a robust foundation of data, including Electrotherm's official financial filings, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's current standing and future potential.