Electrotherm Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Electrotherm Bundle

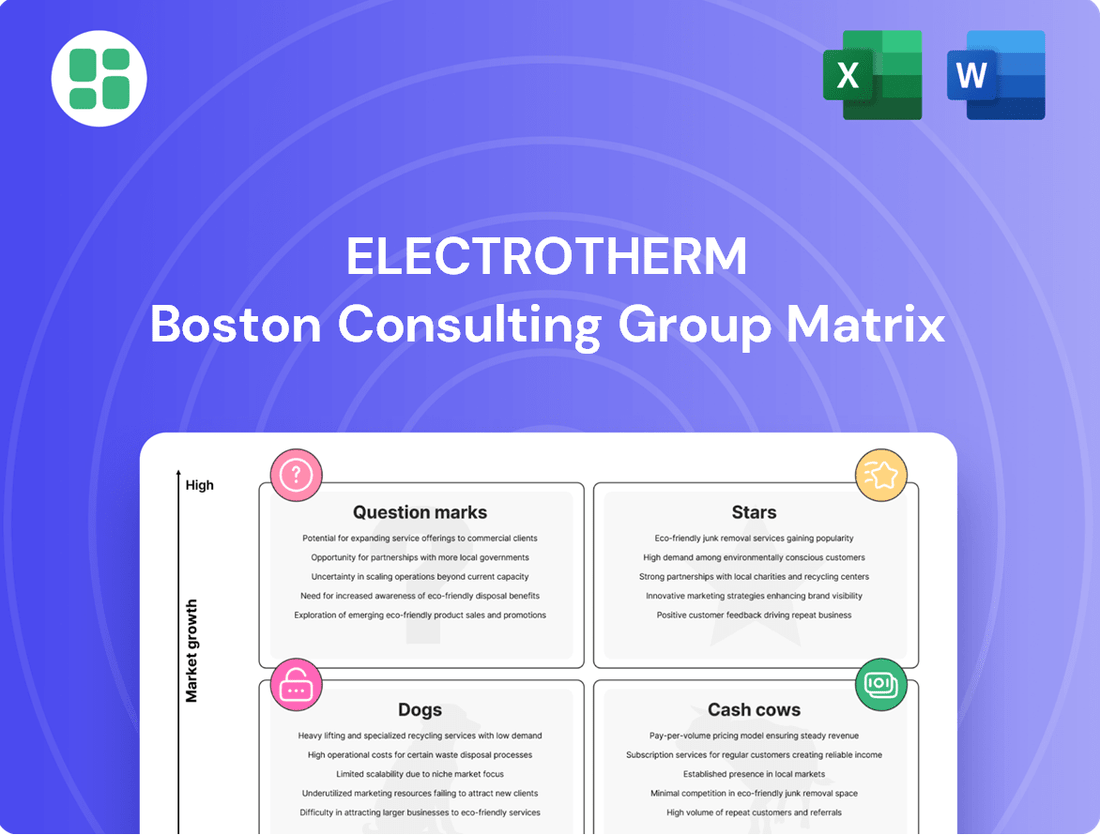

Unlock the strategic potential of Electrotherm's product portfolio with a clear view of its BCG Matrix. Understand which products are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs).

This preview offers a glimpse, but the full BCG Matrix report provides the detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimize Electrotherm's investments and product decisions for future success.

Don't miss out on gaining a competitive edge. Purchase the complete BCG Matrix for Electrotherm and receive a detailed Word report plus a high-level Excel summary, equipping you to evaluate, present, and strategize with absolute confidence.

Stars

Induction Melting Furnaces represent a significant 'Star' for Electrotherm. The company commands over 65% of the Indian steelmaking market for this equipment, a testament to its dominance.

This strong position is further bolstered by the global induction furnace market's anticipated growth. Projections indicate a compound annual growth rate (CAGR) of 5.1% between 2025 and 2032, signaling a robust expansion phase for this segment.

Electrotherm's extensive experience and established infrastructure are well-positioned to leverage this increasing demand, making its Induction Melting Furnaces a key driver of future success.

Ductile iron pipes represent a significant growth opportunity for Electrotherm, fitting squarely into the 'Star' quadrant of the BCG matrix. India's ductile iron pipes market is projected to hit around USD 10.36 billion by 2034, expanding at a compound annual growth rate of 12.50% from 2025. This robust expansion is driven by increasing investments in water infrastructure and sanitation projects across the nation.

As a key manufacturer, Electrotherm is well-positioned to capitalize on this burgeoning demand. The company's capacity to supply these essential components for infrastructure development underscores the product's strong market position. Continued investment in production capacity and technological advancements will be crucial for Electrotherm to maintain its competitive edge and further solidify its 'Star' status in this dynamic market.

Electrotherm's Integrated Steel Plant Solutions are a strong performer in the BCG Matrix, fitting the 'Star' category. Their comprehensive offerings, covering everything from melting furnaces to full plant installations, directly tap into India's booming infrastructure development. This positions them to capture significant market share in a sector fueled by government initiatives and urbanization.

Advanced Induction Heating and Heat Treatment Equipment

Beyond its core melting furnaces, Electrotherm's advanced induction heating and heat treatment equipment is a key player in specialized manufacturing. This segment serves industries like automotive, requiring high-precision solutions.

The market for these advanced systems is growing, driven by the need for enhanced material properties and efficiency in production. For instance, the global induction heating market was projected to reach USD 1.6 billion by 2024, with a compound annual growth rate (CAGR) of over 5% expected in the coming years.

- Market Demand: Increasing adoption in automotive for hardening critical components.

- Technological Edge: Focus on precision and energy efficiency differentiates offerings.

- Growth Potential: Expansion into new industrial applications can fuel 'Star' status.

- Investment Focus: Continued R&D is crucial for maintaining a competitive advantage.

Global Expansion of Furnace Technology

Electrotherm's induction melting furnace technology is a clear 'Star' in the BCG matrix, driven by its significant global expansion. The company actively serves markets in 58 countries, demonstrating a robust international presence.

A key strategic focus for Electrotherm is on burgeoning markets in the Middle East and Africa. This expansion leverages their established brand reputation and technological leadership in induction melting furnaces.

The company's success in these developing regions highlights a high-growth opportunity, as their advanced furnace technology meets the increasing industrial demands. This international market penetration solidifies their global furnace sales as a 'Star' product.

- Global Reach: Electrotherm's furnace technology is present in 58 countries worldwide.

- Strategic Markets: Focus areas include the Middle East and Africa for further growth.

- Competitive Edge: Strong brand goodwill and technological supremacy drive international sales.

- Growth Potential: Expansion into developing markets represents a significant high-growth opportunity.

Electrotherm's Induction Melting Furnaces are a definitive 'Star' due to their market dominance and global expansion. The company holds over 65% of the Indian steelmaking market for these furnaces, a strong indicator of its leadership.

This segment benefits from the global induction furnace market's projected growth, with an estimated CAGR of 5.1% between 2025 and 2032. Electrotherm's established infrastructure and expertise are well-positioned to capitalize on this expanding demand, making its furnaces a key driver of future success.

The company's advanced induction heating and heat treatment equipment also shines as a 'Star'. Serving specialized manufacturing needs, particularly in the automotive sector, this segment is bolstered by the global induction heating market's projected reach of USD 1.6 billion by 2024, with a CAGR exceeding 5%.

Electrotherm's Integrated Steel Plant Solutions are another 'Star' performer, aligning with India's infrastructure boom. Their comprehensive offerings cater to the growing demand driven by urbanization and government initiatives, positioning them to secure substantial market share.

| Product Segment | BCG Category | Key Growth Drivers | Market Position | Future Outlook |

| Induction Melting Furnaces | Star | Global market growth (5.1% CAGR 2025-2032), strong domestic market share (>65%) | Dominant in India, expanding internationally | Continued leadership and growth |

| Ductile Iron Pipes | Star | Infrastructure development, water projects, 12.50% CAGR (2025-2034) | Key manufacturer in a rapidly growing market | Capitalize on infrastructure spending |

| Induction Heating & Heat Treatment | Star | Automotive demand, precision manufacturing, global market growth (>5% CAGR) | Specialized, high-precision solutions | Expansion into new industrial applications |

| Integrated Steel Plant Solutions | Star | India's infrastructure boom, government initiatives | Comprehensive offerings for a growing sector | Capture significant market share |

What is included in the product

The Electrotherm BCG Matrix provides a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which product lines to grow, maintain, or divest based on market share and growth potential.

Electrotherm BCG Matrix provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of indecision.

Cash Cows

Electrotherm's established pig iron production is a classic cash cow. This segment has a long history, supplying a crucial raw material to many industries. In 2024, the global pig iron market is projected to reach approximately $230 billion, demonstrating its mature and stable demand.

The pig iron business benefits from consistent revenue due to this stable demand, requiring minimal new investment to maintain its operations. This allows Electrotherm to generate substantial cash flow from this segment, which can then be strategically deployed to other areas of the business or for shareholder returns.

Electrotherm's Standard Steel TMT Bars manufacturing stands as a prime example of a Cash Cow within its BCG Matrix. The company boasts a significant production capacity for TMT bars, directly addressing the consistent demand from the construction and infrastructure industries.

Despite the TMT bar market being mature, the unwavering need for these essential building materials translates into dependable sales and stable profit margins for Electrotherm. This segment is a significant generator of cash, providing the financial resources necessary to fuel other growth initiatives within the company.

In 2024, the Indian construction sector, a key market for TMT bars, saw robust growth. For instance, government infrastructure spending, a major driver for TMT bar demand, was projected to increase significantly, with the Ministry of Road Transport and Highways alone planning substantial investments in highway development. This sustained demand underpins the Cash Cow status of Electrotherm's TMT bar business.

Electrotherm's legacy transformer manufacturing division is a classic Cash Cow. This segment, deeply embedded in power infrastructure, benefits from consistent demand for replacements and ongoing maintenance, ensuring a reliable revenue stream. In 2024, the global transformer market was valued at approximately $75 billion, with mature segments like those of Electrotherm providing essential, albeit slower, growth.

Maintenance and After-Sales Services for Furnaces

Electrotherm's maintenance and after-sales services for its vast installed base of induction melting furnaces represent a classic cash cow. This segment benefits from a highly stable and predictable revenue stream, driven by the recurring need for servicing, spare parts, and support for a significant global customer base. In 2024, the company's focus on enhancing its service network is expected to further solidify this position.

The profitability of these services is substantial, requiring minimal new capital expenditure compared to the development of new products. This allows Electrotherm to generate consistent cash flow, which is crucial for funding other business units or strategic initiatives. The company's established customer relationships are a key asset, ensuring continued demand for these essential services.

- Stable Revenue: The extensive installed base of furnaces provides a consistent demand for maintenance and spare parts.

- High Profitability: This segment typically enjoys high margins due to lower investment requirements and established operational efficiencies.

- Cash Generation: The recurring nature of the services generates reliable cash flow, supporting overall company operations and investments.

Basic Engineering and Construction Services

Electrotherm's basic engineering and construction services, especially those focused on steel melting and processing, act as a stable cash cow within its BCG matrix. These operations typically cater to established industries with predictable demand, leading to consistent, contract-driven revenue streams.

While this segment might not exhibit high growth, its foundational nature ensures reliable cash generation. For instance, in 2024, the global construction market, particularly for industrial infrastructure, is projected to see steady, albeit moderate, growth, providing a stable environment for these services. Electrotherm's expertise in this niche allows it to secure ongoing projects.

- Steady Revenue: These services generate predictable income through long-term contracts.

- Low Growth Potential: The mature nature of the industries served limits significant expansion opportunities.

- Reliable Cash Flow: Essential infrastructure projects provide consistent returns.

- Foundational Role: Supports core industrial development, ensuring continued demand.

Electrotherm's established pig iron production and standard steel TMT bars manufacturing are prime examples of cash cows. These segments benefit from consistent demand in mature markets, requiring minimal new investment to maintain operations. In 2024, the global pig iron market was valued at approximately $230 billion, while the Indian construction sector, a key consumer of TMT bars, experienced robust growth driven by infrastructure spending.

The legacy transformer manufacturing division and basic engineering services also function as cash cows, providing stable revenue streams from established industries and after-sales support. These areas generate reliable cash flow, essential for funding other growth initiatives within Electrotherm.

| Segment | Market Status | Cash Flow Generation | 2024 Market Context |

|---|---|---|---|

| Pig Iron Production | Mature, Stable Demand | High, Consistent | Global Market ~$230 Billion |

| Standard Steel TMT Bars | Mature, Essential Building Material | High, Reliable | Indian Construction Sector Growth |

| Transformer Manufacturing | Mature, Infrastructure Support | Consistent, Predictable | Global Market ~$75 Billion |

| Induction Furnace Services | Recurring, High Margin | Substantial, Low Investment | Focus on Service Network Enhancement |

| Basic Engineering Services | Mature, Contract-Driven | Steady, Reliable | Global Industrial Infrastructure Growth |

What You See Is What You Get

Electrotherm BCG Matrix

The Electrotherm BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, ensuring you get a professional and actionable strategic tool right away. You can trust that the analysis and presentation will be exactly as you see it now, ready for your immediate use in business planning and decision-making.

Dogs

Older models of low-speed electric two-wheelers, like Electrotherm's early YO Bykes offerings, often find themselves in the Dogs quadrant of the BCG matrix. These products, while pioneering at their inception, may struggle to compete in today's dynamic EV market. For instance, by late 2023, the average price of an electric scooter in India had dropped significantly, putting pressure on older, less feature-rich models.

These older low-speed EVs likely contribute very little to Electrotherm's overall revenue and may even be a drain on resources. Their market share has probably diminished as newer, more advanced, and often more affordable electric two-wheelers have entered the scene. This situation necessitates a strategic decision, potentially leading to their discontinuation or a complete reimagining to regain relevance.

Electrotherm's experience with ET-Elec Trans Limited, sold due to its negative net worth and operational cessation, highlights the challenge of underperforming non-core subsidiaries. These ventures often struggle to reach a critical mass or achieve profitability, draining capital and management focus without meaningful contribution to the company's overall performance.

Such underperforming assets, like ET-Elec Trans Limited, are prime examples of Dogs in the BCG matrix. Their continued existence ties up valuable resources that could be better allocated to more promising areas of the business, suggesting a strategic review for divestiture.

Obsolete or less efficient furnace models represent Electrotherm's potential 'Dogs' in the BCG matrix. As the metal melting industry advances, older, less energy-efficient induction furnaces are becoming less attractive to customers who prioritize cost savings and environmental impact. For example, while energy efficiency standards continue to tighten globally, older models might consume 15-20% more electricity than their modern counterparts, directly impacting operational costs for users.

These less competitive products may struggle to achieve profitability, potentially breaking even or even operating at a loss. In 2024, the demand for high-efficiency furnaces, particularly those with advanced control systems and lower energy consumption, has surged. This shift means Electrotherm must carefully manage its portfolio, considering strategic divestment or a focused effort to upgrade these aging product lines to avoid further financial strain.

Specific Niche Steel Products with Stagnant Demand

Within Electrotherm's steel segment, certain highly specialized steel products might be experiencing stagnant demand. This can occur if these products haven't kept pace with evolving industrial needs or changing material preferences. For instance, if a particular alloy was once critical for a specific manufacturing process that has since been phased out or significantly altered, demand for that alloy would naturally decline.

These niche products, if they hold a small and unchanging market share, could be categorized as Dogs in the BCG Matrix. They might not be generating substantial profits and could even be consuming valuable resources that could be better allocated to more dynamic parts of Electrotherm's business.

Consider a hypothetical scenario where Electrotherm produces a specialized steel grade used primarily in older automotive models. With the automotive industry's rapid shift towards lighter materials and electric vehicles, the demand for this specific steel grade could stagnate.

- Stagnant Demand: Niche steel products may see demand plateau or decline due to shifts in industrial requirements.

- Small Market Share: Products with a limited and unchanging portion of the market are candidates for the Dog category.

- Resource Diversion: These products can divert capital and attention from more profitable or growing segments.

- Adaptation Lag: Failure to adapt to new material trends or technological advancements often leads to demand stagnation.

Underutilized Manufacturing Capacity for Certain Products

When manufacturing lines or entire facilities sit idle because demand for their specific products is low, it creates a significant drain on resources. This underutilization means capital is tied up in assets that aren't producing adequate returns, essentially becoming a financial burden.

In the context of the BCG Matrix, products or business units with underutilized manufacturing capacity, especially if they operate in a low-growth market, often fall into the Dogs category. This is because their inefficiency and lack of profitability can negatively impact the company's overall financial health.

- Example: A hypothetical electronics manufacturer in 2024 might find its specialized component production lines operating at only 30% capacity due to a decline in demand for older models.

- Financial Impact: This could translate to millions in lost revenue and increased per-unit costs for the few units produced, making the product line unprofitable.

- BCG Classification: If this component is for a product in a mature or declining market (low growth), it's a clear candidate for the Dogs quadrant.

Dogs represent products or business units with low market share in a low-growth industry. For Electrotherm, this could include older, less competitive furnace models or niche steel products with stagnant demand. These segments often consume resources without generating significant returns, potentially leading to financial strain.

By 2024, the push for energy efficiency in industrial equipment means older furnace designs might be seen as Dogs due to higher operating costs for users. Similarly, specialized steel grades not aligned with current industry trends, such as the shift towards EVs and lighter materials, also fit this classification.

Managing these 'Dogs' requires careful consideration, possibly involving divestiture or a strategic overhaul to either improve performance or redirect capital to more promising areas of Electrotherm's business.

The challenge lies in recognizing these underperforming assets and making timely decisions to prevent them from becoming a persistent drag on overall company performance and profitability.

| Product/Segment Example | Market Share | Industry Growth | BCG Classification | Potential Strategy |

| Older Low-Speed Electric Two-Wheelers | Low | Low (for older models) | Dogs | Discontinue or Revitalize |

| Less Energy-Efficient Furnace Models | Low | Low (for older technology) | Dogs | Upgrade or Divest |

| Niche Steel Products (e.g., for older automotive) | Low | Low (due to industry shifts) | Dogs | Phase out or Find New Applications |

Question Marks

Electrotherm's planned product launches in 2025 are positioned as Question Marks within the BCG Matrix. These new ventures are entering markets with significant growth potential, but their current market share is negligible.

The company anticipates substantial investment will be necessary for these nascent product lines, covering areas like marketing, research and development, and scaling up production. This investment is crucial to establish a foothold and validate their market viability.

The ultimate trajectory for these products remains uncertain; they could evolve into high-performing Stars or falter into Dogs. For instance, if Electrotherm's new smart home energy management system, slated for a 2025 release, captures even a modest 1% of the projected $50 billion global smart home market by 2027, it would represent a significant revenue stream, justifying the initial investment.

The high-speed electric two-wheeler segment is a dynamic, high-growth area driven by swift technological progress and fierce competition. Electrotherm's presence here, while promising, likely positions it as a Question Mark within the BCG matrix.

This classification stems from Electrotherm's probable lower market share in this premium, innovation-intensive segment compared to its established product lines. The rapid evolution of battery technology and motor efficiency demands substantial, ongoing investment to maintain competitiveness and secure a more significant foothold.

For instance, by the end of 2024, the global electric two-wheeler market, particularly the high-speed segment, is projected to see continued robust expansion, with analysts anticipating a compound annual growth rate exceeding 15% through 2030. Electrotherm will need to allocate considerable capital towards research and development, advanced manufacturing capabilities, and aggressive market penetration strategies to capitalize on this trend.

Electrotherm's renewable energy solutions portfolio falls into the Question Mark category within the BCG Matrix. This sector is booming, with global renewable energy capacity expected to reach over 7,000 GW by 2030, a significant jump from around 3,000 GW in 2023. While Electrotherm has a presence, its market share and specific product dominance in this rapidly expanding field are still developing.

This segment requires substantial investment in research and development, as well as aggressive market penetration strategies. The potential for high future returns is considerable, but the path to achieving them is uncertain, mirroring the characteristics of a Question Mark. For instance, the solar energy market alone is projected to grow at a compound annual growth rate of over 20% in the coming years, presenting both opportunity and competitive challenges.

Advanced Transmission Line Tower Projects

Advanced transmission line tower projects in India, particularly those involving complex engineering or significant scale, position Electrotherm within the Stars quadrant of the BCG Matrix. This segment of the infrastructure sector is experiencing robust growth, driven by the nation's increasing demand for electricity and grid modernization. For instance, India's power transmission sector is projected to see substantial investment, with the Central Electricity Authority (CEA) forecasting the addition of over 100,000 circuit kilometers (ckm) of transmission lines by 2027-28, indicating a strong market for advanced tower solutions.

These projects often demand specialized capabilities and considerable capital outlay, aligning with the characteristics of Stars. Electrotherm's involvement in such ventures signifies a strategic move to build expertise and establish a commanding market presence in a high-growth area. The company's ability to undertake these challenging projects suggests a strong competitive advantage and the potential for significant future returns.

- High Growth Potential: The Indian transmission sector is expanding rapidly, with significant investments planned in new lines and upgrades.

- Capital Intensive: Advanced projects require substantial upfront investment in technology, manufacturing, and skilled labor.

- Capability Building: Engaging in complex projects allows Electrotherm to enhance its technical expertise and operational efficiency.

- Market Leadership: Success in these advanced projects can solidify Electrotherm's position as a leader in the transmission tower market.

Digitalization and Automation Solutions for Foundries/Steel Plants

The global push towards Industry 4.0 has opened a significant opportunity for advanced digitalization and automation solutions within foundries and steel plants, positioning this as a high-growth, emerging market. If Electrotherm is actively developing or has recently launched such offerings, their current market share in this nascent space would likely be minimal.

This segment fits squarely into the Question Mark category of the BCG matrix. It demands substantial investment to cultivate and capture a meaningful share of this transformative market, which is projected to see considerable expansion as more plants adopt smart manufacturing technologies.

- Market Potential: The global industrial automation market, which includes solutions for foundries and steel plants, was valued at approximately $150 billion in 2023 and is forecast to grow at a CAGR of over 8% through 2030.

- Electrotherm's Position: As a relatively new entrant or developer in this specific niche, Electrotherm's current market share is expected to be low, reflecting the early stage of adoption and competitive landscape.

- Investment Requirement: Significant capital expenditure will be necessary for research, development, sales, and marketing to establish a strong foothold and compete effectively in this rapidly evolving sector.

- Strategic Focus: Prioritizing innovation and strategic partnerships will be crucial for Electrotherm to navigate this Question Mark, aiming to transition these solutions into Stars as market adoption accelerates.

Electrotherm's expansion into electric vehicle charging infrastructure represents a classic Question Mark. While the market is experiencing exponential growth, driven by government incentives and increasing EV adoption, Electrotherm's current market share is likely minimal.

Significant investment is required to build out charging networks and develop advanced charging technologies to compete effectively. The success of these ventures hinges on rapid market penetration and technological innovation, with the potential to become Stars or falter into Dogs.

For example, the global EV charging market was valued at approximately $25 billion in 2023 and is projected to exceed $100 billion by 2030, with a CAGR of over 20%. Electrotherm needs to secure a substantial portion of this growth to justify its investment.

| Product/Service | BCG Category | Market Growth | Market Share | Investment Need | Potential |

| EV Charging Infrastructure | Question Mark | Very High | Low | High | High (if successful) |

BCG Matrix Data Sources

Our Electrotherm BCG Matrix leverages robust data from financial statements, industry growth reports, and competitor market share analysis to provide strategic clarity.