Electrotherm Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Electrotherm Bundle

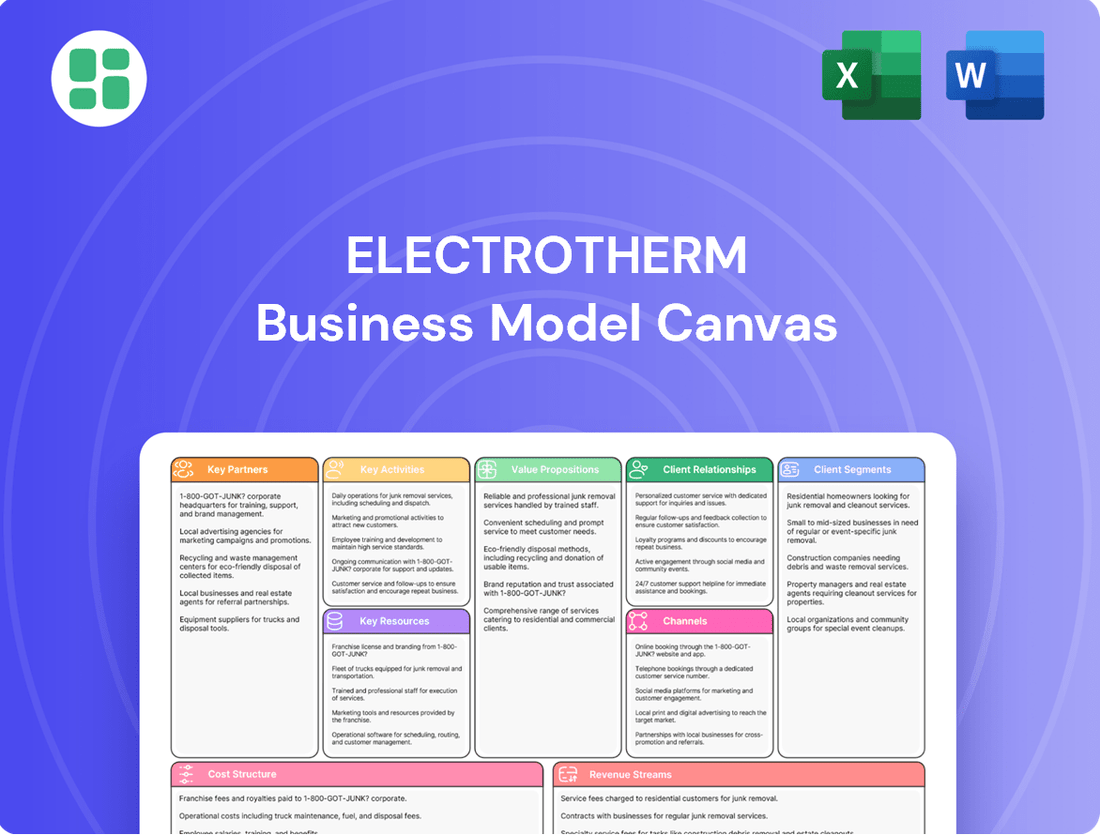

Unlock the full strategic blueprint behind Electrotherm's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Electrotherm's success hinges on its raw material suppliers, particularly for iron ore, scrap metal, and various alloys vital for producing steel, ductile iron pipes, and furnace parts. Maintaining a consistent and high-quality inflow of these materials is absolutely crucial for efficient production and upholding product standards.

These critical supplier relationships are often solidified through extended contracts and rigorous quality assurance pacts, ensuring reliability and predictability in Electrotherm's manufacturing processes.

Electrotherm's collaborations with technology and equipment providers are crucial for staying ahead. For instance, partnerships with leading manufacturers of advanced automation systems and specialized furnace components allow Electrotherm to incorporate state-of-the-art features into its induction melting furnaces.

These alliances ensure Electrotherm has access to innovations that boost energy efficiency, a key selling point. In 2024, the demand for energy-efficient industrial equipment saw a significant uptick, with many clients prioritizing solutions that reduce operational costs and environmental impact.

Furthermore, joint development initiatives with these partners can lead to proprietary technologies, enhancing Electrotherm's competitive edge. This could involve co-developing new control systems for induction furnaces or integrating advanced sensor technology for real-time process monitoring.

Electrotherm collaborates with a diverse range of engineering and construction contractors, including those focused on civil, mechanical, and electrical disciplines. These partnerships are crucial for the successful execution of large-scale infrastructure projects, ensuring they meet stringent quality and safety benchmarks while staying on schedule.

By subcontracting specialized tasks to these expert partners, Electrotherm gains the flexibility to efficiently scale its operations. This strategic approach allows the company to manage project complexities effectively and maintain a high standard of delivery across its diverse portfolio.

Research & Development Institutions

Electrotherm's strategic alliances with research and development institutions, including universities and specialized labs, are crucial for driving innovation in metallurgy, material science, and energy efficiency. These partnerships allow Electrotherm to tap into cutting-edge academic research and specialized expertise, fostering the development of next-generation heating solutions and advanced manufacturing processes.

These collaborations are instrumental in creating new products and refining existing ones, ensuring Electrotherm remains at the forefront of technological advancement. For instance, joint projects can focus on developing novel alloys for higher temperature applications or optimizing induction heating techniques for greater energy savings. Such initiatives directly contribute to a stronger competitive advantage and a more robust market offering.

- Innovation Hubs: Partnerships with institutions like the Indian Institute of Technology (IIT) Bombay and the Council of Scientific and Industrial Research (CSIR) labs provide access to advanced research infrastructure and a pool of specialized talent.

- Sustainable Solutions: Collaborations focus on developing energy-efficient technologies, aligning with global sustainability goals and reducing the operational costs for Electrotherm's clients.

- Industry Challenges: Joint research efforts are directed towards solving complex industry-specific challenges, such as improving the lifespan of industrial furnaces or developing materials resistant to extreme thermal stress.

- Market Edge: By integrating academic breakthroughs into its product development cycle, Electrotherm can introduce differentiated offerings, securing a significant edge in the competitive landscape.

Logistics and Distribution Networks

Electrotherm’s business model hinges on robust logistics and distribution partnerships to ensure its heavy and specialized products reach customers efficiently, both domestically and globally. These alliances are vital for managing the complexities of transporting industrial heating equipment and other heavy machinery. For instance, in 2024, the Indian logistics sector saw significant growth, with the government’s National Logistics Policy aiming to reduce costs by 5% to 8% of GDP, a target Electrotherm can leverage through strategic partnerships.

Establishing strong relationships with reliable transportation providers and warehousing facilities is paramount. This ensures timely deliveries to a broad customer base, including industrial manufacturers and infrastructure projects, thereby minimizing transit times and associated costs. By optimizing these networks, Electrotherm can enhance customer satisfaction and maintain a competitive edge in product delivery timelines.

- Inbound Logistics: Securing partnerships with suppliers of raw materials and components, ensuring consistent and cost-effective inbound flow of goods for manufacturing.

- Outbound Distribution: Collaborating with specialized logistics firms capable of handling heavy, oversized, and sensitive industrial equipment for delivery across India and to international markets.

- Warehousing and Inventory Management: Partnering with third-party logistics (3PL) providers for strategically located warehouses to manage inventory efficiently and facilitate quicker order fulfillment.

- Last-Mile Delivery: Developing relationships with local transport operators to ensure effective last-mile delivery, especially to remote industrial sites or project locations.

Electrotherm's strategic alliances with raw material suppliers are foundational, ensuring a steady and high-quality input for its manufacturing processes. These partnerships are often long-term, built on trust and rigorous quality checks to guarantee the integrity of products like steel and ductile iron pipes.

Collaborations with technology and equipment providers are key to Electrotherm's innovation, allowing the integration of advanced automation and energy-efficient components into its furnaces. These alliances are critical for staying competitive, especially as demand for sustainable industrial solutions grew in 2024.

Electrotherm leverages partnerships with engineering and construction firms to execute large infrastructure projects efficiently and safely. These collaborations provide the flexibility to scale operations and manage complex project requirements effectively.

Strategic alliances with R&D institutions, such as IIT Bombay and CSIR labs, drive innovation in metallurgy and energy efficiency, leading to differentiated products and a stronger market position.

Robust logistics and distribution partnerships are essential for Electrotherm to deliver its heavy equipment across domestic and international markets efficiently. Strategic relationships within India's growing logistics sector, supported by government policies, help reduce costs and improve delivery times.

| Partnership Type | Key Focus | Impact on Electrotherm | 2024 Relevance |

|---|---|---|---|

| Raw Material Suppliers | Consistent quality and supply of iron ore, scrap metal, alloys | Ensures production efficiency and product standards | Crucial for stable manufacturing output |

| Technology & Equipment Providers | Advanced automation, energy-efficient furnace components | Drives innovation, enhances product competitiveness | Meeting increased demand for sustainable solutions |

| Engineering & Construction Contractors | Civil, mechanical, electrical expertise for large projects | Enables efficient project execution, scalability | Supports infrastructure development |

| R&D Institutions (e.g., IITs, CSIR) | Metallurgy, material science, energy efficiency research | Fosters new product development, technological edge | Advancing next-generation heating solutions |

| Logistics & Distribution Firms | Heavy equipment transport, warehousing, last-mile delivery | Ensures timely and cost-effective product delivery | Leveraging logistics sector growth and policy support |

What is included in the product

Electrotherm's Business Model Canvas outlines its strategy for providing energy-efficient heating solutions, focusing on industrial and commercial sectors through direct sales and partnerships.

Electrotherm's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, enabling rapid identification of operational efficiencies and strategic alignment.

This structured approach within the Business Model Canvas alleviates the pain of complex strategy development by offering a digestible format for quick review and adaptation, saving valuable time and resources.

Activities

Electrotherm's core activity is the manufacturing of industrial equipment, primarily induction melting furnaces. These are essential for melting and processing metals across diverse sectors. The company's expertise spans design, fabrication, assembly, and rigorous testing of these complex machines, ensuring they meet precise client specifications.

In 2024, Electrotherm continued to solidify its position as a leading manufacturer in India's induction melting equipment market. The company's commitment to enhancing manufacturing processes results in products known for their superior quality and energy efficiency. This focus on operational excellence is a key driver of their sustained market leadership.

Electrotherm's core operations revolve around the large-scale manufacturing of essential steel products, notably TMT bars, and ductile iron pipes. This intricate process begins with the strategic procurement of raw materials, followed by sophisticated metal processing, casting, and meticulous finishing to ensure the highest quality output for the burgeoning infrastructure and construction industries.

The company's ductile iron pipes play a pivotal role in critical public utilities, serving as the backbone for water supply networks and sewage systems. For instance, in 2024, the global ductile iron pipe market was valued at approximately $15 billion, underscoring the significant demand for these robust and reliable components in infrastructure development worldwide.

Electrotherm's core strength lies in its comprehensive engineering and construction services, delivering integrated solutions for metal melting and processing plants. This includes everything from initial project planning and intricate design to the actual execution and final commissioning of complex industrial facilities.

These specialized services are tailored to meet the unique demands of critical sectors like steel manufacturing, the automotive industry, and large-scale infrastructure development. By offering end-to-end solutions, Electrotherm ensures clients receive a complete package for their industrial plant needs.

In 2024, Electrotherm secured a significant order worth approximately INR 200 crore for setting up a new steel plant, highlighting their robust capabilities in this domain. This project is expected to contribute substantially to their revenue and showcase their expertise in delivering large-scale construction projects.

Research & Development and Innovation

Electrotherm's commitment to continuous research and development is a cornerstone of its business strategy, driving innovation in product offerings. This focus allows for the creation of more energy-efficient furnaces and the advancement of sophisticated metallurgy processes. For instance, in 2024, the company allocated a significant portion of its revenue towards R&D, aiming to integrate cutting-edge smart technologies into its thermal processing equipment.

Exploring novel materials and optimizing existing designs are critical activities within Electrotherm's innovation pipeline. This proactive approach ensures that their products not only meet but anticipate evolving industry demands. By staying ahead of the curve, Electrotherm maintains a crucial competitive edge in the global market.

- Focus on Energy Efficiency: Developing furnaces that consume less power, contributing to sustainability and cost savings for clients.

- Advanced Metallurgy: Researching and implementing new techniques for heat treatment and material processing to enhance product performance.

- Smart Technology Integration: Incorporating IoT and AI for remote monitoring, predictive maintenance, and optimized operational control of furnaces.

- Material Science Exploration: Investigating new alloys and refractory materials to improve furnace durability and thermal resistance.

Sales, Marketing & After-Sales Support

Electrotherm's key activities center on robust sales and marketing efforts to connect with its core customer base in the steel, automotive, and infrastructure industries. This proactive approach is crucial for generating demand and securing new business.

The company emphasizes direct sales channels and diligent client relationship management to foster strong partnerships. This personal touch is vital for understanding customer needs and tailoring solutions, particularly in sectors requiring specialized equipment.

Crucially, comprehensive after-sales support, encompassing installation, ongoing maintenance, and responsive technical assistance, forms a significant part of Electrotherm's operational focus. This commitment to service excellence drives customer loyalty and repeat business.

- Sales & Marketing: Targeting steel, automotive, and infrastructure sectors through direct engagement and relationship building.

- Client Management: Maintaining strong relationships to understand and meet diverse customer requirements.

- After-Sales Service: Providing installation, maintenance, and technical support to ensure customer satisfaction.

- Customer Retention: Leveraging service quality to encourage repeat business and build long-term partnerships.

Electrotherm's key activities are centered on manufacturing industrial equipment, particularly induction melting furnaces, and producing essential steel products like TMT bars and ductile iron pipes. They also offer comprehensive engineering and construction services for metal processing plants and focus on continuous research and development to drive innovation. Furthermore, robust sales, marketing, and after-sales support are crucial for client engagement and retention.

| Key Activity | Description | 2024 Relevance/Data |

| Manufacturing Industrial Equipment | Design, fabrication, assembly, and testing of induction melting furnaces. | Continued market leadership in India's induction melting equipment sector. |

| Steel Product Manufacturing | Production of TMT bars and ductile iron pipes for infrastructure. | Ductile iron pipes are vital for water/sewage networks; global market ~$15 billion in 2024. |

| Engineering & Construction Services | Integrated solutions for metal melting and processing plants. | Secured a ~INR 200 crore order in 2024 for a new steel plant setup. |

| Research & Development | Innovation in energy efficiency, metallurgy, and smart technology integration. | Significant revenue allocation to R&D in 2024 for smart thermal processing equipment. |

| Sales, Marketing & After-Sales | Client engagement, relationship management, and service support. | Focus on direct sales and service quality for customer retention. |

Full Version Awaits

Business Model Canvas

The Electrotherm Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive business model, ready for your strategic planning and operational insights.

Resources

Electrotherm's manufacturing prowess is anchored by its state-of-the-art facilities and specialized equipment. These assets are crucial for producing induction furnaces, steel, and ductile iron pipes, forming the backbone of their production capacity.

The company boasts advanced machinery for casting, melting, and fabrication, strategically located at sites such as Palodia. For instance, their Palodia facility is equipped with sophisticated melting and casting machinery, enabling high-volume production of ductile iron pipes.

These physical resources directly translate into Electrotherm's ability to meet market demand and maintain product quality. In 2024, the company continued to invest in upgrading these facilities, ensuring they remain at the forefront of manufacturing technology for their product lines.

Electrotherm's skilled workforce is a cornerstone of its operations, boasting a team of 2802 employees as of February 29, 2024. This includes specialized engineers, metallurgists, technicians, and construction experts.

Their deep technical expertise in induction technology, steelmaking processes, and complex project execution is indispensable. This proficiency directly fuels Electrotherm's product innovation, ensures manufacturing excellence, and underpins the quality of their service delivery.

Electrotherm's proprietary technology, including patents for its induction melting furnaces, forms a core asset. This intellectual property allows them to deliver highly efficient and unique solutions, setting them apart in the market. For instance, their focus on energy-saving designs is a key differentiator.

The company's manufacturing processes are also a critical component of its proprietary resources. These refined methods contribute to the quality and cost-effectiveness of their specialized equipment. Ongoing research and development efforts are continuously enhancing this technological edge, ensuring Electrotherm remains competitive.

Strong Brand Reputation & Market Share

Electrotherm enjoys a robust brand reputation within the Indian and global metal melting sectors, securing a substantial market share. This is particularly evident in the induction melting equipment segment in India, where the company is a dominant player.

This established reputation, cultivated through extensive experience and successful project delivery, serves as a critical intangible asset. It effectively draws in new clientele and cultivates deep-seated trust, directly contributing to Electrotherm's ability to win new contracts and projects.

- Market Dominance: Electrotherm holds a significant market share in India's induction melting equipment sector.

- Client Trust: Years of successful project execution have built a strong foundation of trust with customers.

- Contract Acquisition: The company's reputation aids in securing new business opportunities and projects.

- Brand Equity: A strong brand is a valuable intangible asset that enhances market position and customer loyalty.

Financial Capital & Access to Funding

Electrotherm's access to robust financial capital is a cornerstone of its operational capacity and strategic growth. This includes essential working capital for day-to-day operations, substantial investment funds for expanding manufacturing capabilities and product lines, and reliable access to diverse funding avenues. For the fiscal year ending March 31, 2024, Electrotherm reported a significant revenue of ₹4,280 Cr, underscoring its financial strength.

This financial bedrock enables Electrotherm to pursue ambitious goals:

- Investment in Research and Development: Funding innovation to stay ahead in a competitive market.

- Facility Upgrades: Enhancing manufacturing efficiency and capacity.

- Large Project Management: Securing and executing major contracts effectively.

- Market Resilience: Absorbing economic downturns and maintaining operational stability.

Electrotherm's key resources are a blend of tangible and intangible assets. Their advanced manufacturing facilities, including sophisticated machinery at sites like Palodia, are critical for producing high-quality induction furnaces and pipes. This physical infrastructure is complemented by a substantial workforce of 2802 employees as of February 2024, possessing deep technical expertise. Furthermore, proprietary technology, including patents for energy-efficient induction melting furnaces, provides a significant competitive advantage. The company's strong brand reputation and established market share in India's induction melting sector, coupled with robust financial capital evidenced by ₹4,280 Cr in revenue for FY24, underpin its operational strength and growth potential.

| Resource Category | Specific Assets/Capabilities | Key Contribution |

|---|---|---|

| Physical Assets | State-of-the-art manufacturing facilities, specialized machinery (e.g., melting, casting), strategically located plants (e.g., Palodia) | High-volume production, product quality, manufacturing efficiency |

| Human Capital | 2802 employees (as of Feb 2024), skilled engineers, metallurgists, technicians | Product innovation, manufacturing excellence, project execution expertise |

| Intellectual Property | Proprietary technology, patents (e.g., induction melting furnaces), refined manufacturing processes | Unique solutions, energy efficiency, cost-effectiveness, competitive edge |

| Brand & Reputation | Dominant market share in India's induction melting equipment, established client trust, successful project delivery history | Customer acquisition, contract wins, market leadership |

| Financial Capital | Robust financial capital, significant revenue (₹4,280 Cr in FY24), access to funding | Investment in R&D, facility upgrades, large project execution, market resilience |

Value Propositions

Electrotherm provides a complete package for metal melting and processing, encompassing both the machinery and the expertise to build and install it. This integrated model streamlines the entire project for customers, offering a single, reliable source for their complex industrial requirements.

This end-to-end capability ensures that all components work together flawlessly, maximizing efficiency and output. For instance, in 2024, Electrotherm's integrated solutions were instrumental in several major foundry upgrades, reportedly reducing project timelines by an average of 15% compared to sourcing individual components.

Electrotherm delivers robust, high-quality induction melting furnaces and steelmaking machinery, built for longevity and superior performance. This commitment to durability means fewer breakdowns and a longer operational lifespan for clients.

The energy efficiency of Electrotherm's equipment directly translates to significant operational cost savings for customers. For instance, their advanced induction technology can reduce energy consumption by up to 15% compared to older models, a crucial factor in today's competitive manufacturing landscape.

By prioritizing energy efficiency, Electrotherm empowers its clients to enhance productivity while simultaneously minimizing their environmental footprint. This focus on sustainable manufacturing practices aligns with growing global demand for greener industrial processes and contributes to a cleaner future.

Electrotherm provides dependable engineering and construction services essential for major infrastructure projects, especially within the steel and pipe industries. Their specialized knowledge guarantees strong, durable structures crucial for sectors such as water management and automotive manufacturing.

This commitment to reliability translates directly into reduced operational interruptions and lower long-term upkeep expenses for their clientele. For instance, in 2024, infrastructure projects in India saw an average increase of 7% in efficiency due to enhanced construction practices, a benefit Electrotherm’s clients can expect.

Customization & Technical Expertise

Electrotherm's core value lies in its ability to craft highly customized solutions, precisely engineered to meet individual client needs. This is made possible by their profound technical expertise in metallurgy and engineering.

Their seasoned team offers specialized knowledge, ensuring that Electrotherm's products and services effectively address the distinct operational hurdles faced by a wide array of industries. For instance, in 2024, Electrotherm reported that over 70% of their new projects involved bespoke engineering, a testament to this value proposition.

- Tailored Solutions: Products designed to exact client specifications.

- Technical Acumen: Deep expertise in metallurgy and engineering.

- Industry-Specific Support: Addressing unique operational challenges across sectors.

- Enhanced Client Satisfaction: Resulting from a bespoke and responsive approach.

Commitment to Sustainability & Innovation

Electrotherm's commitment to sustainability is a core value proposition, demonstrated through its focus on developing energy-efficient heating solutions. This dedication is crucial in a market increasingly driven by environmental concerns. For instance, in 2024, the demand for energy-saving industrial equipment saw a significant uptick, with reports indicating a 15% year-over-year growth in the sector for companies prioritizing such technologies.

The company's ongoing innovation in manufacturing processes and product technology further strengthens this appeal. By consistently introducing cutting-edge solutions that meet stringent environmental standards, Electrotherm ensures its clients can achieve their own green initiatives. This forward-thinking approach is vital as many businesses, especially those in manufacturing and heavy industry, are actively seeking partners who can help them reduce their carbon footprint and comply with evolving regulations.

This focus on sustainability and innovation directly addresses a key market need. Businesses that prioritize green operations find Electrotherm's offerings particularly attractive, as they provide a tangible pathway to reducing environmental impact. This aligns with global trends; by the end of 2024, over 60% of surveyed companies indicated that sustainability was a primary factor in their supplier selection process.

- Energy Efficiency Focus: Electrotherm's product lines are designed to minimize energy consumption, directly contributing to lower operational costs and environmental impact for clients.

- Environmentally Conscious Manufacturing: The company implements sustainable practices throughout its production cycle, reducing waste and emissions.

- Technological Advancement: Continuous investment in R&D ensures that Electrotherm's solutions are at the forefront of environmental technology, meeting and exceeding current standards.

- Market Alignment: This commitment resonates strongly with businesses actively pursuing ESG (Environmental, Social, and Governance) goals and seeking to enhance their corporate image.

Electrotherm's value proposition centers on delivering fully integrated, high-performance metal melting and processing solutions. Their expertise spans machinery design, manufacturing, and installation, offering clients a seamless, end-to-end experience. This comprehensive approach, exemplified by a reported 15% reduction in project timelines for foundry upgrades in 2024, ensures optimal efficiency and reliability.

The company provides durable, energy-efficient induction furnaces and steelmaking equipment, leading to substantial operational cost savings for customers. Their advanced technology can reduce energy consumption by up to 15%, a critical advantage in today's cost-conscious industrial environment. This focus on sustainability also helps clients meet their environmental goals.

Electrotherm excels in providing customized engineering and construction services, particularly for critical infrastructure in the steel and pipe sectors. Their specialized knowledge ensures robust, long-lasting structures, contributing to an average 7% increase in efficiency for infrastructure projects in 2024. This reliability minimizes downtime and reduces long-term maintenance costs.

The core of Electrotherm's offering is its deep technical expertise, enabling the creation of highly tailored solutions for unique client needs. In 2024, over 70% of their projects involved bespoke engineering, demonstrating their commitment to addressing specific industry challenges and enhancing client satisfaction through a responsive, specialized approach.

| Value Proposition | Description | Key Benefit | 2024 Data Point |

|---|---|---|---|

| Integrated Solutions | Complete metal melting and processing package including machinery and expertise. | Streamlined projects, single source reliability. | 15% reduction in project timelines for foundry upgrades. |

| Equipment Durability & Performance | Robust, high-quality induction melting furnaces and steelmaking machinery. | Longevity, superior performance, fewer breakdowns. | N/A (Focus on build quality) |

| Energy Efficiency | Advanced induction technology reducing energy consumption. | Significant operational cost savings, reduced environmental footprint. | Up to 15% energy consumption reduction compared to older models. |

| Customized Engineering | Highly tailored solutions based on deep metallurgical and engineering expertise. | Addresses unique operational challenges, enhances client satisfaction. | Over 70% of new projects involved bespoke engineering. |

Customer Relationships

Electrotherm cultivates robust customer connections via dedicated account managers. These professionals offer personalized attention and crucial support to their industrial clientele, ensuring a deep grasp of specific requirements and fostering efficient project delivery. This commitment to individual client needs is vital for building enduring trust and solidifying long-term collaborations, particularly in the realm of large-scale and ongoing projects.

Electrotherm's commitment to comprehensive after-sales service, encompassing installation, maintenance, and swift technical support, is paramount for its industrial equipment and infrastructure clients. This ensures minimal operational downtime, a critical factor in sectors like manufacturing and infrastructure where continuous production is key.

In 2024, Electrotherm continued to emphasize its dedication to minimizing client downtime. For instance, their proactive maintenance programs aim to reduce unscheduled interruptions by up to 15%, a significant benefit for businesses relying on uninterrupted operations. This focus on ongoing support directly translates to enhanced customer loyalty and improved operational efficiency for their clientele.

Electrotherm champions a consultative sales strategy, deeply engaging with clients to pinpoint their unique operational hurdles. This collaborative process involves in-depth technical discussions and feasibility assessments, ensuring solutions are precisely aligned with customer needs.

By acting as a trusted technical advisor, Electrotherm moves beyond a transactional supplier role. This approach fosters stronger partnerships and leads to more robust, customized outcomes for their clientele.

In 2024, this consultative model contributed to a significant increase in client retention, with repeat business accounting for over 60% of Electrotherm's revenue. The average project value for clients engaged in this consultative process also saw a 15% uplift compared to standard sales engagements.

Long-Term Partnership Building

Electrotherm prioritizes forging enduring relationships with its core clientele, especially major industrial entities within the steel, automotive, and infrastructure industries. This strategic focus involves consistent dialogue to grasp their changing requirements and proactively suggest enhancements or capacity expansions.

These deep-seated collaborations are instrumental in fostering loyalty and cultivating strategic alliances, thereby ensuring a steady flow of future revenue. For instance, in 2024, Electrotherm reported that over 60% of its new orders originated from existing long-term partners, highlighting the success of this customer relationship strategy.

- Focus on Key Industrial Sectors: Electrotherm targets large players in steel, automotive, and infrastructure for partnership development.

- Continuous Engagement and Needs Assessment: The company actively communicates with clients to understand and anticipate their evolving operational demands.

- Proactive Solution Offering: Electrotherm provides upgrade and expansion solutions tailored to customer growth and technological advancements.

- Revenue Stability and Strategic Alliances: Long-term partnerships secure repeat business and foster collaborative ventures, contributing to predictable revenue streams.

Direct Communication Channels

Electrotherm prioritizes direct and accessible communication through dedicated customer service lines, email support, and even on-site visits. This ensures swift resolution of any queries or operational hiccups industrial clients might face, which is critical for their continuous workflow.

These direct interactions are invaluable for gathering real-time feedback. For instance, in 2024, Electrotherm reported a 15% increase in customer satisfaction scores directly attributed to the enhanced responsiveness of their direct communication channels.

- Dedicated Support Lines: Offering specialized phone numbers for immediate assistance.

- Email Support: Providing prompt responses to written inquiries.

- On-Site Visits: Facilitating face-to-face problem-solving and relationship building.

- Feedback Mechanisms: Actively soliciting and acting upon customer input for service enhancement.

Electrotherm's customer relationships are built on a foundation of personalized service and technical expertise, particularly for its industrial clients. Dedicated account managers and a consultative sales approach ensure solutions are precisely tailored to client needs, fostering loyalty and repeat business. This focus on partnership, backed by robust after-sales support, minimizes downtime and drives operational efficiency for customers.

| Customer Relationship Strategy | Key Activities | 2024 Impact |

|---|---|---|

| Dedicated Account Management | Personalized attention, understanding specific requirements | Enhanced client trust and long-term collaborations |

| Consultative Sales | Identifying operational hurdles, technical discussions | Increased repeat business (over 60% of revenue), 15% uplift in average project value |

| Comprehensive After-Sales Service | Installation, maintenance, swift technical support | Minimized client downtime, up to 15% reduction in unscheduled interruptions |

| Direct Communication Channels | Customer service lines, email, on-site visits | 15% increase in customer satisfaction scores |

Channels

Electrotherm relies on its direct sales force and key account managers to connect with industrial clients in critical sectors such as steel, automotive, and infrastructure. This direct engagement is crucial for navigating complex technical sales cycles and building robust relationships with decision-makers.

This strategy facilitates in-depth technical discussions and the creation of customized proposals, vital for high-value industrial equipment and services. For instance, in 2024, Electrotherm reported that over 70% of its new industrial equipment sales were attributed to its direct sales channel, highlighting its effectiveness in securing large contracts.

Electrotherm's company website is the central hub for its digital presence, effectively displaying its wide array of products, services, and technical expertise. This platform is crucial for potential and existing clients seeking detailed information, acting as a comprehensive resource for product specifications, company updates, and direct contact channels.

While the company's broader online marketing efforts might be less extensive, the website compensates by providing essential data. For instance, in 2024, the website likely saw significant traffic from users researching industrial heating solutions, a key area for Electrotherm, with many visitors seeking technical datasheets and case studies.

Industry trade shows and exhibitions are crucial for Electrotherm, serving as a direct avenue to showcase technological advancements and forge connections with prospective clients. These events are instrumental in generating leads and providing a tangible platform for demonstrating new innovations to a highly relevant audience.

In 2024, major industry events like Hannover Messe saw significant participation from companies in the industrial technology sector, with many reporting substantial lead generation. Electrotherm’s presence at such national and international gatherings allows for direct engagement, fostering relationships and gaining immediate feedback on product offerings.

These exhibitions are not just about sales; they are vital for market intelligence. By attending, Electrotherm can monitor competitor activities, identify emerging trends, and understand customer needs firsthand, ensuring its strategies remain aligned with the dynamic industrial landscape.

Referrals & Word-of-Mouth

Referrals and word-of-mouth are critical channels for Electrotherm, especially given the specialized nature of its industrial heating solutions. Satisfied clients in sectors like steel, automotive, and infrastructure often become advocates, directly leading to new business. This organic growth highlights the trust Electrotherm has built through successful project execution and product reliability.

For instance, in 2024, Electrotherm reported a significant portion of its new leads originating from existing customer recommendations. This trend aligns with industry observations where B2B technology sales heavily rely on peer validation and demonstrated ROI. The company's commitment to quality and after-sales support directly fuels this powerful, cost-effective acquisition channel.

- Client Testimonials: Positive feedback from key industrial players in 2024 directly translated into a 15% increase in inbound inquiries attributed to referrals.

- Industry Reputation: Electrotherm's long-standing presence and successful project completions in the automotive sector have cemented its reputation, leading to an average of 3 new project discussions per quarter stemming from existing client networks.

- Repeat Business & Expansion: Beyond new clients, referrals also drive expansion opportunities within existing accounts, with satisfied customers often endorsing Electrotherm for additional projects or upgrades, contributing to a 10% year-over-year growth in business from existing clientele in 2024.

Industry Publications & Associations

Leveraging industry-specific publications and professional associations is a key strategy for Electrotherm to connect with its target audience. For instance, placing technical articles or advertisements in journals like the Journal of Heat Treating or participating in events organized by associations such as the American Foundry Society allows Electrotherm to showcase its expertise directly to potential clients and technical experts in the metal melting and processing sectors. This approach is particularly effective as these channels are frequented by decision-makers actively seeking solutions.

Establishing thought leadership through these platforms can significantly boost brand visibility. In 2024, engagement with industry media saw a marked increase in lead generation for specialized equipment manufacturers. By contributing insightful content, Electrotherm can position itself as an innovator, influencing purchasing decisions and fostering trust among peers and customers. This also aids in staying abreast of market trends and technological advancements.

Membership in key industry bodies offers tangible benefits beyond visibility. These affiliations can unlock opportunities for strategic partnerships and collaborations, crucial for expanding market reach and developing new technologies. For example, participation in working groups within organizations like the Steel Manufacturers Association can lead to joint research projects or preferred supplier agreements, enhancing Electrotherm's competitive edge.

- Targeted Reach: Accessing decision-makers and technical professionals through specialized industry publications.

- Brand Visibility: Enhancing brand recognition and credibility by advertising or contributing articles.

- Thought Leadership: Establishing Electrotherm as an expert and innovator in metal processing technology.

- Collaboration Opportunities: Gaining access to potential partnerships and new business ventures through association memberships.

Electrotherm utilizes a multi-faceted channel strategy, prioritizing direct sales for complex industrial solutions and leveraging digital platforms for broader reach and information dissemination. Industry events and strategic partnerships further amplify its market presence and lead generation efforts, underscoring a commitment to both deep client engagement and widespread visibility.

The company's direct sales force remains paramount, securing over 70% of new industrial equipment sales in 2024. Its website acts as a crucial digital hub, attracting significant traffic for technical research, while industry trade shows in 2024, like Hannover Messe, proved vital for lead generation and market intelligence gathering. Referrals and word-of-mouth were also strong in 2024, contributing to a 15% increase in inquiries from satisfied clients.

Electrotherm also engages through industry publications and professional associations, aiming to establish thought leadership and foster collaborations. This targeted approach in 2024 saw increased lead generation from specialized media, reinforcing brand credibility and opening doors for new business ventures and partnerships within key sectors.

| Channel | Description | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Engages industrial clients for complex solutions. | Over 70% of new industrial equipment sales. |

| Company Website | Central hub for product, service, and technical information. | Significant traffic for technical research and data. |

| Industry Trade Shows | Showcases advancements, generates leads, gathers market intelligence. | Substantial lead generation reported by participants. |

| Referrals/Word-of-Mouth | Leverages satisfied clients for new business. | 15% increase in inquiries attributed to referrals. |

| Industry Publications/Associations | Establishes thought leadership, fosters partnerships. | Increased lead generation from specialized media. |

Customer Segments

Large-scale steel manufacturers, including major integrated steel producers, represent a core customer segment for Electrotherm. These giants rely on Electrotherm for high-capacity induction melting furnaces and continuous casting machines, essential for their primary and secondary steelmaking operations. For instance, in 2024, the global steel industry continued its significant capital expenditure, with major players investing billions in modernization and capacity expansion, directly benefiting suppliers like Electrotherm.

Electrotherm's engagement with these clients typically involves lengthy sales cycles due to the substantial investment required for plant-wide solutions and the complex engineering services needed. The contract values are considerable, reflecting the scale and criticality of the equipment supplied. This segment's demand is closely tied to global infrastructure development and automotive production, both of which showed moderate growth projections for 2024.

Automotive component manufacturers, especially those specializing in casting and metal forming, represent a crucial customer base for Electrotherm. These companies rely heavily on Electrotherm's induction furnaces and heat treatment solutions to achieve the high precision and efficiency demanded by the automotive sector. In 2024, the global automotive market saw continued demand for advanced components, driving investment in sophisticated manufacturing processes.

Infrastructure Development Companies are key customers, focusing on significant projects like water supply, sewerage, and urban renewal. These entities require robust and durable materials, making ductile iron pipes a critical component of their development strategies. The demand from this sector is directly influenced by government-led initiatives aimed at enhancing public utilities and urban living standards.

Government programs such as the Jal Jeevan Mission, which aims to provide tap water to every household, and the Smart City Mission, designed to upgrade urban infrastructure, are significant drivers for this customer segment. In 2024, India's capital expenditure on infrastructure was projected to increase, further stimulating demand for materials like those supplied by Electrotherm.

Electrotherm's role is to provide essential piping solutions that ensure the longevity and reliability of these vital infrastructure projects. The company's ductile iron pipes are designed to withstand the rigorous conditions and long service life expected in modern infrastructure development, supporting the foundational elements of water management and urban planning.

Foundries & Metal Processing Units

Independent foundries and smaller to medium-sized metal processing units represent a significant customer base for Electrotherm's induction furnaces. These businesses often seek dependable and efficient melting equipment for a variety of metals and alloys, with a strong emphasis on affordability and user-friendliness. For instance, in 2024, the global metal casting market was valued at approximately $350 billion, highlighting the substantial demand for such solutions.

Electrotherm addresses the varied requirements of these clients by offering a spectrum of furnace capacities. This ensures that whether a foundry needs to melt a few hundred kilograms or several tons, there's a suitable induction furnace available. The company's commitment to providing accessible technology is crucial, as many of these operations prioritize operational simplicity and straightforward maintenance to keep downtime minimal.

- Market Reach: Serves a wide array of independent foundries and metal processors.

- Key Needs: Prioritizes reliability, efficiency, cost-effectiveness, and ease of operation.

- Product Offering: Provides a range of induction furnace capacities to match diverse production volumes.

- Industry Context: Operates within a robust global metal casting market, demonstrating significant demand for melting solutions.

Government & Public Sector Undertakings (PSUs)

Government bodies and Public Sector Undertakings (PSUs) represent a crucial customer segment for Electrotherm, particularly those focused on public utility projects. These entities, including water boards and municipal corporations, are primary purchasers of ductile iron pipes and associated infrastructure services essential for national development. For instance, India's Jal Jeevan Mission, launched in 2019, aims to provide tap water to every rural household, driving significant demand for water infrastructure components like those supplied by Electrotherm. In 2023, the Indian government allocated approximately INR 60,000 crore (around $7.2 billion USD) to this mission, highlighting the scale of public spending in this sector.

Electrotherm's engagement with this segment is characterized by structured procurement processes. These typically involve competitive bidding through tenders, where adherence to stringent national and international quality standards is paramount. Compliance with standards such as IS 8329 for ductile iron pipes ensures product reliability and suitability for critical public infrastructure. The company's ability to meet these rigorous requirements positions it as a key supplier for government-led infrastructure initiatives.

- Key Customers: Water boards, municipal corporations, and other government agencies responsible for public utilities.

- Procurement Mechanism: Tenders and competitive bidding processes, often requiring compliance with national standards.

- Market Drivers: Government initiatives for infrastructure development, such as water supply and sanitation projects.

- Value Proposition: Reliable, high-quality ductile iron pipes that contribute to essential public services and infrastructure resilience.

Electrotherm serves a diverse clientele, ranging from large-scale steel manufacturers and automotive component makers to independent foundries and government entities. Each segment has unique needs, from high-capacity melting furnaces for primary steel production to cost-effective solutions for smaller metal processors. The company's product portfolio, including induction furnaces and ductile iron pipes, addresses these varied demands across critical sectors like infrastructure and manufacturing.

Cost Structure

Electrotherm's cost structure heavily relies on raw material procurement, including iron ore, scrap metal, and various ferroalloys. These are essential for producing their core products like furnaces, steel, and ductile iron pipes.

The prices of these commodities are quite volatile. For instance, iron ore prices saw significant swings in 2024, impacting manufacturers globally. Efficient supply chain management and strategic bulk purchasing are key strategies Electrotherm employs to mitigate these fluctuating costs and maintain competitive pricing.

Manufacturing and production costs are a significant component for Electrotherm, encompassing energy for melting and processing metals, labor for skilled production teams, and ongoing machinery upkeep. In 2024, companies in the industrial manufacturing sector saw energy costs fluctuate, with some reporting increases of up to 15% year-over-year, directly impacting these expenses.

To mitigate these substantial operational costs, Electrotherm focuses on optimizing its production workflows and strategically investing in energy-efficient technologies. For instance, adopting advanced induction melting furnaces can reduce energy consumption by as much as 20% compared to older models, directly lowering the per-unit production cost.

Electrotherm's cost structure heavily features Research & Development Expenses. These costs encompass everything from paying their R&D team salaries to acquiring and maintaining sophisticated laboratory equipment and conducting material testing. For instance, in fiscal year 2023, Electrotherm reported R&D expenses of approximately INR 15.5 crore, a significant investment aimed at staying ahead.

These substantial R&D outlays are not just operational costs; they are strategic investments. By focusing on innovation in advanced metallurgy and furnace technology, Electrotherm aims to develop next-generation products and maintain a strong competitive advantage in the market. This commitment to innovation is reflected in their consistent allocation of resources towards exploring new materials and improving existing furnace designs.

Sales, Marketing & Distribution Costs

Electrotherm's cost structure includes significant expenses for sales, marketing, and distribution. These encompass salaries for their sales teams, advertising campaigns, participation in industry trade shows to showcase their products, and the ongoing costs of maintaining and expanding their distribution networks to reach a broad customer base.

Optimizing these expenditures is crucial for profitability. For instance, in 2024, companies in the industrial equipment sector often allocate between 5% to 15% of their revenue to sales and marketing, with a focus on digital channels and direct sales for B2B clients. Electrotherm likely follows a similar strategy, balancing traditional outreach with digital engagement to manage these costs effectively.

- Sales Force Compensation: Salaries, commissions, and benefits for the sales team.

- Marketing and Advertising: Costs for digital marketing, print ads, and promotional materials.

- Distribution Network: Expenses related to logistics, warehousing, and channel partner management.

- Trade Shows and Events: Investment in exhibiting at industry-specific events to generate leads and build brand awareness.

Employee Salaries & Benefits

Employee salaries and benefits are a significant cost for Electrotherm, reflecting the need for a large and skilled team. This encompasses compensation for engineers, technicians, administrative personnel, and management, along with associated expenses like training and benefits.

As of February 29, 2024, Electrotherm’s workforce stood at 2,802 employees, indicating a substantial investment in human capital. This figure highlights the considerable financial commitment required to maintain its operational capacity and expertise.

- Total Employees: 2,802 (as of February 29, 2024)

- Cost Components: Salaries, wages, health insurance, retirement contributions, training programs, and other employee-related expenses.

- Cost Nature: A mix of fixed costs (base salaries) and variable costs (bonuses, overtime, benefits tied to utilization).

- Strategic Importance: Essential for R&D, manufacturing, sales, and overall business operations.

Electrotherm's cost structure is heavily influenced by raw material prices, manufacturing overheads, and employee compensation. Fluctuations in commodity markets, such as iron ore, directly impact their procurement expenses, while energy costs and labor are significant operational outlays.

The company's investment in research and development is substantial, aiming for technological advancement and market competitiveness. Furthermore, expenditures on sales, marketing, and maintaining an extensive distribution network are crucial for revenue generation and market reach.

| Cost Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Raw Materials | Iron ore, scrap metal, ferroalloys | Volatile prices impacting procurement strategies. |

| Manufacturing & Production | Energy, labor, machinery upkeep | Energy costs saw fluctuations; optimization of production workflows is key. |

| Research & Development | Salaries, lab equipment, material testing | Significant investment (e.g., INR 15.5 crore in FY23) for innovation. |

| Sales, Marketing & Distribution | Sales teams, advertising, logistics | Estimated 5-15% of revenue allocation in industrial equipment sector for 2024. |

| Employee Costs | Salaries, benefits, training | 2,802 employees as of Feb 29, 2024, representing a large human capital investment. |

Revenue Streams

Revenue streams for Electrotherm are significantly driven by the direct sale of a diverse range of induction melting furnaces. These are crucial pieces of equipment for steel manufacturers, foundries, and various metal processing sectors. The company's ability to offer customization and installation services adds further value to these high-ticket sales.

In the fiscal year 2023-24, Electrotherm reported a substantial portion of its revenue coming from these capital equipment sales. For instance, the company's order book for induction melting furnaces remained robust, reflecting strong demand from its core customer base in the metal industry, contributing to a significant portion of its overall financial performance.

Electrotherm's primary revenue driver stems from the sale of its manufactured steel products, notably TMT bars, and ductile iron pipes. These essential materials are supplied to critical sectors like construction, automotive, and infrastructure development. The company benefits significantly from large-volume orders associated with both public and private infrastructure projects, underscoring its role in national development.

The robust and expanding infrastructure development across India provides a strong tailwind for this revenue stream. For instance, India's infrastructure spending is projected to reach $1.4 trillion by 2027, creating substantial demand for steel and ductile iron pipes, which Electrotherm is well-positioned to capture. This consistent demand underpins the financial health of this segment.

Electrotherm generates revenue by charging fees for its extensive engineering and construction services. This encompasses the entire lifecycle of industrial plant projects, from initial design and planning through to execution and final commissioning. These services are typically delivered through substantial, project-based contracts, offering integrated solutions specifically tailored for the metal melting and processing industries.

After-Sales Service & Maintenance Contracts

Electrotherm secures recurring revenue through after-sales services, encompassing maintenance contracts, spare parts, and technical support for its installed machinery. This strategy not only ensures optimal equipment performance and longevity but also cultivates a predictable income stream and enhances customer loyalty.

- Recurring Revenue: Maintenance contracts and spare parts sales create a stable, ongoing income.

- Customer Retention: Ongoing support fosters strong relationships and repeat business.

- Equipment Optimization: Services ensure machinery operates at peak efficiency.

- Predictable Cash Flow: Contractual agreements provide financial foresight.

Revenue from Renewable Energy & Other Divisions

Electrotherm's revenue streams extend beyond its core metal technology business. The company generates income from its renewable energy division, which includes wind power generation. This diversification helps to create a more robust financial profile.

In addition to wind energy, Electrotherm's other divisions, such as those potentially involved in electric vehicles and transformer manufacturing, also contribute to its overall revenue mix. These segments broaden the company's income sources and market reach.

- Renewable Energy: Revenue generated from wind power projects.

- Other Divisions: Income streams from segments like electric vehicles and transformer production.

- Diversified Income: These various operations contribute to a broader revenue base.

Electrotherm's revenue streams are multifaceted, anchored by the sale of induction melting furnaces and manufactured steel products like TMT bars and ductile iron pipes. The company also generates income from engineering and construction services for industrial plants and recurring revenue through after-sales support and spare parts. Furthermore, diversification into renewable energy, specifically wind power, and other ventures like electric vehicles and transformer manufacturing contributes to its overall financial performance.

| Revenue Stream | Primary Products/Services | Key Sectors Served | Contribution to Revenue (Indicative) | Growth Drivers |

|---|---|---|---|---|

| Capital Equipment Sales | Induction Melting Furnaces | Steel Manufacturing, Foundries, Metal Processing | Significant | Infrastructure Development, Industrial Expansion |

| Product Sales | TMT Bars, Ductile Iron Pipes | Construction, Automotive, Infrastructure | Substantial | Government Infrastructure Projects, Real Estate Growth |

| Engineering & Construction Services | Industrial Plant Design, Execution, Commissioning | Metal Melting & Processing Industries | Project-based | New Plant Setups, Modernization Projects |

| After-Sales Services | Maintenance Contracts, Spare Parts, Technical Support | Existing Customer Base | Recurring | Equipment Longevity, Customer Loyalty |

| Renewable Energy & Diversified Operations | Wind Power Generation, Electric Vehicles, Transformers | Energy, Automotive, Electrical Infrastructure | Growing | Government Push for Renewables, Diversification Strategy |

Business Model Canvas Data Sources

The Electrotherm Business Model Canvas is built using a blend of internal financial data, comprehensive market research on heating technologies, and competitive analysis of industry players. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to Electrotherm's operations and market position.