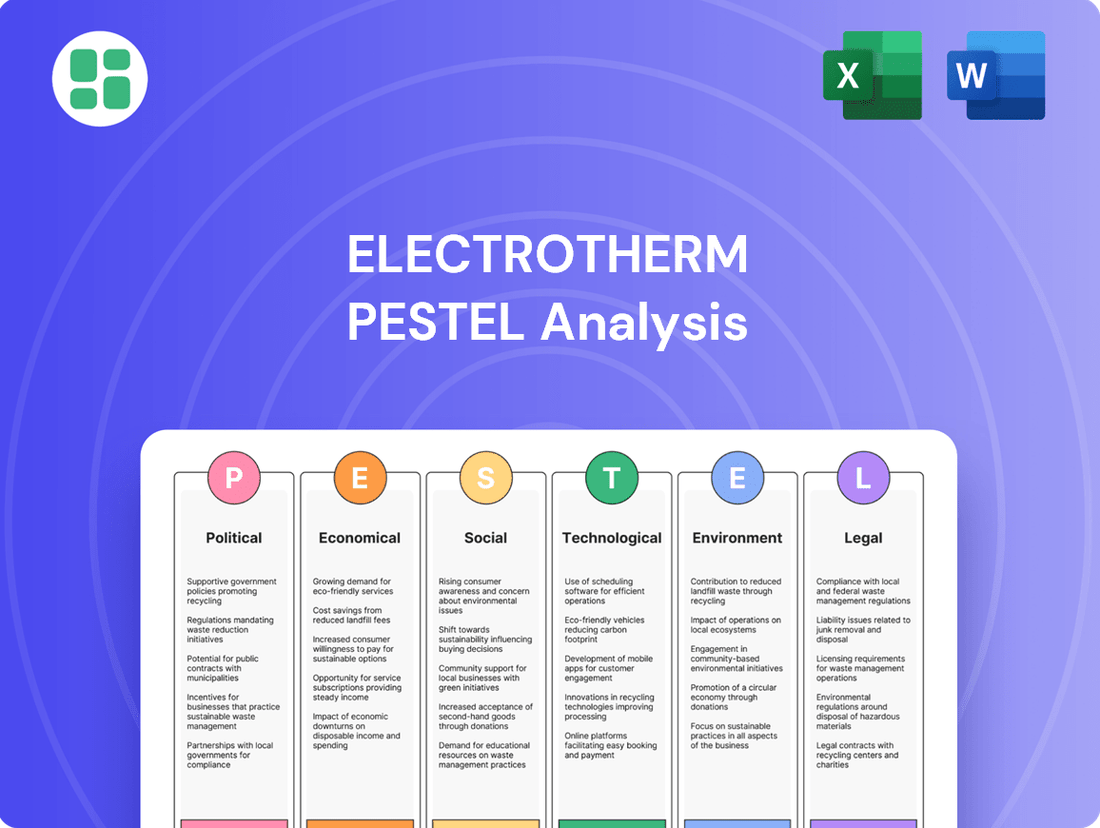

Electrotherm PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Electrotherm Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Electrotherm's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Equip yourself with actionable intelligence to make informed decisions and secure Electrotherm's future success. Download the full version now for an unparalleled competitive advantage.

Political factors

The Indian government's commitment to manufacturing remains strong, with initiatives like 'Make in India' and Production Linked Incentive (PLI) schemes actively encouraging domestic production. These policies are designed to reduce reliance on imports and boost exports, creating a favorable environment for companies such as Electrotherm.

The Union Budget 2025-26 further underscored this support by introducing the National Manufacturing Mission, aiming to provide an additional impetus to the sector. This mission is expected to drive growth and innovation within the manufacturing landscape.

Significant government capital expenditure and programmatic interventions, such as the PM Gati Shakti National Master Plan, are actively driving infrastructure development across India. This strategic push for enhanced connectivity and logistics is a major tailwind for industries like Electrotherm.

The focus on building and upgrading roads, railways, and other critical infrastructure projects directly translates into a substantial increase in demand for essential materials. For Electrotherm, this means a higher need for steel and ductile iron pipes, which are fundamental to their core business operations.

In 2023-24, India's capital expenditure on infrastructure saw a notable increase, with the central government allocating ₹10 lakh crore, a 33% rise from the previous year, underscoring the government's commitment to this sector and its positive implications for material suppliers.

The potential implementation of safeguard duties on steel imports, potentially reaching 25%, could significantly benefit domestic producers like Electrotherm. This policy aims to level the playing field by reducing competition from cheaper international steel, thereby supporting higher utilization levels and stabilizing profit margins for Indian steel companies.

Ease of Doing Business Reforms

India's commitment to enhancing its Ease of Doing Business (EoDB) continues to shape the manufacturing landscape. Streamlining regulatory frameworks and simplifying procedures are key objectives, with the government actively promoting single-window systems to reduce compliance burdens for companies like Electrotherm.

These ongoing reforms are designed to create a more investment-friendly environment. For instance, India jumped to the 63rd position in the World Bank's EoDB rankings in 2019, a significant improvement from its previous standing, signaling a more conducive operational climate for manufacturing and industrial players.

- Streamlined Regulations: Efforts to simplify tax laws and reduce bureaucratic hurdles directly benefit manufacturing operations by lowering administrative overhead.

- Investment Promotion: Reforms aimed at attracting foreign and domestic investment create opportunities for expansion and technological upgrades in the sector.

- Digitalization Initiatives: The push for digital platforms and single-window clearances accelerates business processes, from company registration to obtaining permits, thereby boosting efficiency.

Political Stability and Investment Climate

A stable political environment is paramount for attracting and retaining significant long-term investments, especially in capital-intensive sectors like heavy industry. Consistent policy support signals reliability, encouraging businesses to commit resources. For instance, the Indian government's commitment to economic growth and industrialization, as articulated in visions like 'Viksit Bharat 2047', fosters a generally positive investment climate.

This governmental focus translates into tangible support mechanisms and a predictable regulatory framework. The sustained push for manufacturing and infrastructure development, a cornerstone of national economic strategy, directly benefits companies like Electrotherm. In 2023, India's manufacturing sector alone contributed approximately 17.7% to its GDP, highlighting the importance of government initiatives in this area.

- Government's Vision: 'Viksit Bharat 2047' emphasizes industrialization and economic growth, creating a favorable environment for heavy industries.

- Policy Consistency: Stable political governance ensures predictable policy support, crucial for long-term capital investments.

- Infrastructure Focus: Government investment in infrastructure projects directly stimulates demand for products from the heavy manufacturing sector.

- GDP Contribution: The manufacturing sector's significant contribution to India's GDP underscores the impact of supportive political and economic policies.

The Indian government's sustained focus on manufacturing and infrastructure development, exemplified by the 'Make in India' initiative and the significant capital expenditure allocated in the Union Budget 2025-26, creates a robust growth environment for companies like Electrotherm. Policies aimed at reducing import reliance and promoting domestic production, coupled with infrastructure spending that directly drives demand for pipes and steel, provide a strong foundation for the sector. Furthermore, ongoing efforts to improve the Ease of Doing Business, including regulatory simplification and digitalization, are expected to further enhance operational efficiency and investment appeal within the Indian manufacturing landscape.

| Government Initiative | Focus Area | Impact on Electrotherm | Data Point |

|---|---|---|---|

| Make in India | Domestic Manufacturing | Boosts local production, reduces import dependency | Manufacturing sector contributed ~17.7% to India's GDP in 2023 |

| PM Gati Shakti | Infrastructure Development | Increases demand for pipes, steel; improves logistics | Central government allocated ₹10 lakh crore on infrastructure in 2023-24 (+33% YoY) |

| Ease of Doing Business (EoDB) | Regulatory Simplification | Reduces compliance burden, improves operational efficiency | India ranked 63rd in World Bank EoDB rankings (2019) |

| Union Budget 2025-26 | National Manufacturing Mission | Provides additional impetus to manufacturing growth | - |

What is included in the product

This Electrotherm PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities derived from real-world market and regulatory dynamics.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for Electrotherm's strategic discussions.

Economic factors

India's steel demand is set for robust expansion, with projections indicating an 8-9% growth in 2025. This upward trend significantly outpaces many other major global economies, highlighting India's burgeoning industrial landscape.

This surge in demand is largely fueled by a strong push in construction, encompassing both housing projects and critical infrastructure development. Furthermore, a revival in the engineering and automotive sectors is contributing to increased steel consumption, directly benefiting companies like Electrotherm that serve these vital industries.

Fluctuations in global raw material prices, especially for coking coal, directly influence the cost of steel production. This volatility can create significant challenges for companies like Electrotherm.

In 2024, Indian steel prices faced downward pressure. However, the anticipated implementation of a safeguard duty in 2025 is projected to increase domestic steel prices by 4-6%. This potential price increase could offer a favorable margin improvement for Electrotherm.

Inflation and interest rate policies in India significantly impact Electrotherm's operating environment. Higher inflation can erode purchasing power, potentially dampening consumer demand for appliances and industrial products. Conversely, rising interest rates increase borrowing costs for businesses, affecting capital expenditure and Electrotherm's own financing needs.

As of March 2025, India's Consumer Price Index (CPI) was reported at 3.34%, indicating moderate inflation. The Wholesale Price Index (WPI) stood at 2.05% during the same period. These figures suggest a relatively stable inflationary environment, which generally supports consistent consumer spending and manageable borrowing costs for companies like Electrotherm.

Foreign Direct Investment (FDI) Inflows

Increased foreign direct investment (FDI) flowing into India's manufacturing and infrastructure sectors presents a significant opportunity for Electrotherm. This influx of capital often translates into new project development, directly boosting the demand for Electrotherm's core products and services, such as power electronics and heating solutions.

The Indian government has set an ambitious target to attract USD 100 billion annually in gross FDI by 2024. This policy focus aims to create a more favorable investment climate, which could directly benefit companies like Electrotherm by fostering a more robust industrial ecosystem.

- FDI Target: India aims to attract USD 100 billion in gross FDI annually by 2024.

- Sectoral Focus: Increased FDI in manufacturing and infrastructure directly benefits Electrotherm's product demand.

- Economic Impact: Higher FDI inflows stimulate new project investments, creating a positive ripple effect for industrial equipment suppliers.

- Government Initiatives: Policies designed to boost FDI can lead to improved market conditions and greater capital availability for infrastructure development.

Economic Growth and Industrial Output

India's robust economic growth, projected to continue its upward trend through 2025, creates a highly conducive atmosphere for industrial expansion. This expansion directly benefits manufacturing firms like Electrotherm, as increased economic activity typically translates to higher demand for manufactured goods.

The manufacturing sector is a key driver of India's economy, with its contribution to the Gross Domestic Product (GDP) anticipated to hover around 13-14 percent in 2025. Government initiatives aimed at bolstering this sector further underscore the positive outlook for industrial output.

- Projected GDP Growth: India's GDP is expected to grow at a significant pace in 2024-2025, driving demand across sectors.

- Manufacturing Sector Contribution: The sector is slated to contribute approximately 13-14% to India's GDP in 2025.

- Industrialization Focus: Government policies actively promote industrialization, creating a favorable environment for manufacturing companies.

- Demand for Goods: Economic expansion fuels consumer and industrial demand, positively impacting companies involved in production.

India's economic trajectory in 2024-2025 presents a dynamic landscape for Electrotherm. The nation's GDP growth, coupled with a strong focus on manufacturing and infrastructure, creates significant demand for industrial products. Moderate inflation, as indicated by CPI and WPI figures in early 2025, suggests a stable environment for consumer spending and manageable borrowing costs.

The government's target of attracting USD 100 billion in annual FDI by 2024 further bolsters this positive outlook, channeling capital into sectors that directly benefit Electrotherm. Anticipated safeguard duties in 2025 are also poised to improve domestic steel prices, potentially enhancing Electrotherm's profit margins.

| Economic Indicator | Value (as of early 2025) | Implication for Electrotherm |

|---|---|---|

| Projected GDP Growth (2025) | Robust expansion | Increased demand for industrial goods and services |

| Consumer Price Index (CPI) | 3.34% | Supports consistent consumer spending |

| Wholesale Price Index (WPI) | 2.05% | Manageable input costs and borrowing environment |

| FDI Target (by 2024) | USD 100 billion annually | Increased capital for infrastructure and manufacturing projects |

| Projected Steel Price Increase (2025) | 4-6% (due to safeguard duty) | Potential margin improvement |

Same Document Delivered

Electrotherm PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Electrotherm PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

Sociological factors

The availability of a skilled workforce, especially in specialized manufacturing like metal melting and processing, is a critical factor for Electrotherm. A report from the Ministry of Skill Development and Entrepreneurship in early 2024 highlighted a growing demand for technicians in advanced manufacturing sectors.

Government programs such as the National Centres for Skilling are actively working to bridge potential skill gaps by training individuals for emerging industries. These initiatives are designed to equip the workforce with the necessary expertise to support technological advancements in manufacturing.

India's urbanization rate is projected to reach 43.2% by 2030, fueling substantial demand for infrastructure development. This ongoing migration to cities necessitates expanded housing, water supply, and sanitation systems, all of which rely heavily on materials like ductile iron pipes. Electrotherm is well-positioned to capitalize on this sustained growth.

Consumers are increasingly prioritizing quality and sustainability, with surveys showing a significant portion willing to pay more for eco-friendly products. This trend directly impacts procurement, pushing companies like Electrotherm to highlight their commitment to high manufacturing standards and environmentally conscious practices.

Occupational Safety and Health Standards

Evolving labor laws and heightened awareness of workplace safety mean companies like Electrotherm must prioritize occupational health and safety standards. This includes ensuring safe machinery operation and providing adequate protective gear for employees. For instance, in 2024, the International Labour Organization reported a global increase in reported workplace accidents, underscoring the importance of stringent safety protocols.

Strict adherence to these standards is crucial for maintaining Electrotherm's social standing and avoiding costly legal penalties. Companies failing to comply can face significant fines and reputational damage. In the manufacturing sector, particularly in regions like India where Electrotherm operates, regulatory bodies are increasingly enforcing stricter safety audits and penalties for non-compliance, impacting operational continuity.

- Increased regulatory scrutiny on workplace safety in manufacturing.

- Growing employee demand for secure and healthy work environments.

- Potential for significant financial penalties and reputational damage due to non-compliance.

- The need for continuous investment in safety training and equipment upgrades.

Corporate Social Responsibility (CSR) Expectations

Societal pressure for companies to actively participate in Corporate Social Responsibility (CSR) and contribute to community well-being is growing significantly. This trend impacts how businesses operate and engage with their environments.

In India, CSR is not just a voluntary act but a legal mandate for many companies. For instance, the Companies Act, 2013, mandates that companies with a net worth of INR 500 crore or more, or a turnover of INR 1000 crore or more, or a net profit of INR 5 crore or more in a financial year, must spend at least 2% of their average net profits made during the three immediately preceding financial years on CSR activities. This legal framework directly shapes Electrotherm's approach to its social obligations and stakeholder relationships, encouraging proactive community development initiatives.

- Mandatory CSR Spending: Indian companies meeting specific financial thresholds are legally required to allocate a portion of their profits to CSR.

- Community Development Focus: CSR expectations push companies like Electrotherm to invest in local projects, fostering positive community relations.

- Stakeholder Engagement: Meeting CSR demands enhances a company's reputation and strengthens its ties with employees, customers, and the wider public.

- Impact on Operations: CSR considerations influence business decisions, from supply chain management to product development, aligning them with social values.

Societal expectations are increasingly influencing manufacturing, with a growing emphasis on skilled labor and safe working conditions. For Electrotherm, this translates to a need for continuous investment in employee training and adherence to stringent safety protocols, as highlighted by a 2024 ILO report on rising workplace accidents globally.

The push for sustainability is also a major factor, with consumers showing a willingness to pay more for eco-friendly products, prompting companies like Electrotherm to emphasize high manufacturing standards and environmental consciousness.

Corporate Social Responsibility (CSR) is a significant consideration, particularly in India where it's a legal mandate for many companies. For instance, the Companies Act, 2013, requires companies meeting certain financial thresholds to spend at least 2% of their average net profits on CSR activities, directly impacting Electrotherm's community engagement and stakeholder relations.

| Societal Factor | Impact on Electrotherm | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Skilled Workforce Demand | Need for specialized training in metal processing. | Ministry of Skill Development and Entrepreneurship report (early 2024) noted growing demand for advanced manufacturing technicians. |

| Workplace Safety Awareness | Increased focus on occupational health and safety standards. | ILO reported a global increase in reported workplace accidents in 2024, emphasizing strict safety protocols. |

| Consumer Preference for Sustainability | Emphasis on eco-friendly practices and high manufacturing standards. | Surveys indicate a significant portion of consumers willing to pay more for eco-friendly products. |

| Corporate Social Responsibility (CSR) | Mandatory spending and community development initiatives. | Indian Companies Act, 2013, requires companies meeting specific financial criteria to spend at least 2% of average net profits on CSR. |

Technological factors

Continuous innovation in metal melting and casting is a significant technological factor. Advancements in induction melting furnaces, alongside improvements in steel and ductile iron pipe manufacturing, are key. These include the integration of automation and Industry 4.0 principles, as well as the emerging use of 3D printing for specialized components.

These technological shifts directly impact efficiency and product quality. For instance, automated casting lines can significantly reduce labor costs and improve consistency, while advanced furnace designs offer better energy efficiency. Electrotherm's ability to adopt and integrate these cutting-edge technologies will be crucial for maintaining its competitive edge in the evolving market.

The manufacturing sector is rapidly embracing digitalization and automation. This shift is driven by the integration of smart sensors, advanced robotics, and AI-powered systems, leading to significant improvements in operational efficiency. For instance, in 2024, the global industrial automation market was projected to reach over $230 billion, highlighting the scale of this technological adoption.

These technological advancements directly translate to tangible benefits for companies like Electrotherm. By optimizing production processes, reducing material waste through precision control, and lowering labor costs via automation, manufacturers can achieve substantial reductions in operational expenses. This modernization is not just about adopting new tools; it's about fundamentally enhancing competitiveness in the global market.

Electrotherm's commitment to research and development is a cornerstone of its competitive strategy. The company actively invests in R&D focused on developing novel materials, enhancing energy efficiency in its processes, and driving product innovation. This forward-thinking approach is essential for maintaining a leading edge in the dynamic metal processing sector.

Collaborations with esteemed institutions such as the Indian Institutes of Technology (IITs) are instrumental in advancing Electrotherm's capabilities. These partnerships are crucial for pushing the boundaries of material science and developing cutting-edge solutions. For instance, a recent collaboration in early 2024 focused on developing advanced alloys for high-temperature applications, aiming to improve furnace lifespan by up to 15%.

Green Technologies and Decarbonization

The global drive for decarbonization is significantly impacting heavy industries, including steel manufacturing, a sector where Electrotherm operates. This necessitates a shift towards cleaner production methods. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM) is already influencing trade by pricing carbon emissions, pushing companies to invest in low-carbon technologies.

Electrotherm must therefore actively explore and integrate advanced green technologies. This includes adopting clean energy sources to power its operations, implementing carbon capture, utilization, and storage (CCUS) solutions, and potentially leveraging green hydrogen as a fuel or reducing agent. These innovations are crucial for reducing the company's environmental footprint and ensuring long-term competitiveness in a market increasingly prioritizing sustainability.

- Green Hydrogen Adoption: The global green hydrogen market is projected to reach $70 billion by 2030, indicating a significant investment trend in this technology for industrial decarbonization.

- Carbon Capture Investment: In 2023, global investment in carbon capture projects exceeded $10 billion, highlighting the growing commitment to mitigating industrial emissions.

- Renewable Energy Integration: Many steel producers are setting targets to increase their reliance on renewable energy, with some aiming for 100% renewable electricity by 2030.

Data Analytics and Predictive Maintenance

Electrotherm can significantly boost operational efficiency by leveraging advanced data analytics for predictive maintenance of its manufacturing machinery. This proactive approach allows for the identification of potential equipment failures before they occur, minimizing costly downtime. For instance, companies in similar industrial sectors have reported a reduction in unplanned downtime by up to 30% through the implementation of predictive maintenance programs, leading to substantial cost savings.

Furthermore, data analytics plays a crucial role in optimizing production schedules by analyzing real-time data on machine performance, material availability, and demand forecasts. This leads to more efficient resource allocation and reduced waste. Improved supply chain management, another key benefit, can be achieved by tracking goods, predicting potential disruptions, and optimizing logistics routes, ultimately enhancing delivery times and customer satisfaction. The adoption of these technologies is paramount for maintaining a competitive edge in the evolving industrial landscape.

Key benefits include:

- Reduced operational costs through minimized equipment downtime and optimized resource utilization.

- Enhanced production efficiency by fine-tuning manufacturing schedules based on real-time data.

- Improved supply chain reliability through better tracking, risk assessment, and logistics planning.

- Gained competitive advantage by adopting cutting-edge technologies that drive operational excellence.

Technological advancements in automation and digitalization are reshaping the manufacturing landscape, with the global industrial automation market projected to exceed $230 billion in 2024. Electrotherm can leverage these trends by integrating smart sensors and robotics to enhance operational efficiency and reduce labor costs. Predictive maintenance, powered by data analytics, offers a significant opportunity to minimize equipment downtime, with similar industries reporting up to a 30% reduction in unplanned outages.

The company's R&D efforts, including collaborations with institutions like IITs, are vital for developing advanced materials and energy-efficient processes, such as a recent 2024 project targeting a 15% improvement in furnace lifespan through new alloy development. Furthermore, the growing emphasis on decarbonization necessitates the adoption of green technologies, with investments in carbon capture projects surpassing $10 billion in 2023 and green hydrogen market projections reaching $70 billion by 2030.

| Technology Area | 2024/2025 Projection/Data | Impact on Electrotherm |

|---|---|---|

| Industrial Automation Market | Over $230 billion (projected 2024) | Increased operational efficiency, reduced labor costs |

| Predictive Maintenance Savings | Up to 30% reduction in unplanned downtime | Minimized production interruptions, cost savings |

| Green Hydrogen Market Growth | $70 billion by 2030 (projected) | Opportunity for cleaner energy sourcing and operations |

| Carbon Capture Investment | Exceeded $10 billion (2023) | Drives need for emission reduction technologies |

Legal factors

India's new labor codes, consolidating 29 central laws, are set to significantly alter wage structures, social security benefits, and workplace safety regulations. Electrotherm needs to proactively adapt its HR policies and operational procedures to align with these upcoming changes, which are anticipated to be fully implemented by fiscal year 2025-26.

The implementation of these codes aims to streamline labor laws, potentially boosting formal employment and improving ease of doing business. For Electrotherm, this means understanding how revised regulations on working hours, minimum wages (which saw a national floor wage discussion in 2023), and contract labor will affect its workforce management and operational costs.

Electrotherm faces significant operational impacts from strict environmental laws, particularly concerning consent to establish and operate for industrial facilities. The company must navigate evolving compliance requirements, including those related to greenhouse gas emissions reporting, as mandated by frameworks like the BRSR. While exemptions for lower-polluting industries could provide some operational flexibility, the overall regulatory landscape necessitates careful management and investment in environmental controls.

Electrotherm, as a publicly traded entity, faces increasing regulatory scrutiny, particularly from SEBI. Mandates for robust Environmental, Social, and Governance (ESG) reporting and strengthened corporate governance frameworks are now standard. This necessitates greater transparency and strict adherence to evolving norms.

Compliance with the Business Responsibility and Sustainability Reporting (BRSR) is a key legal factor for Electrotherm. For the fiscal year 2023-24, SEBI has emphasized the mandatory nature of BRSR for the top 150 listed companies by market capitalization, a category Electrotherm falls into, requiring detailed disclosure on sustainability and governance practices.

Industrial Licensing and Permitting

Reforms aimed at streamlining industrial licensing and permitting processes are crucial for manufacturing companies like Electrotherm. Simplified single-window registration and firm-based common licenses with longer validity periods are being implemented to reduce bureaucratic hurdles. For instance, India's Ease of Doing Business reforms have led to significant improvements, with the World Bank ranking India 63rd out of 190 economies in 2019, up from 142nd in 2014, indicating progress in reducing red tape.

These legal changes directly impact operational efficiency and the speed at which new projects or expansions can commence. By reducing the time and complexity associated with obtaining necessary permits, companies can bring products to market faster and respond more agilely to demand. This regulatory environment is a key consideration for Electrotherm's strategic planning and investment decisions.

- Reduced Bureaucracy: Simplified processes lower compliance costs and administrative burdens.

- Faster Market Entry: Streamlined licensing accelerates project timelines.

- Increased Investment Attractiveness: A more predictable and efficient regulatory framework encourages capital inflow.

- Longer License Validity: Common licenses with extended validity offer greater operational stability.

Product Liability and Safety Standards

Electrotherm must navigate a complex web of product liability laws and evolving safety standards for industrial equipment and materials. Adherence to these regulations is critical to prevent costly legal battles and preserve customer confidence. This is particularly true for their steel and ductile iron products, which are subject to stringent quality benchmarks.

For instance, in 2024, the European Union continued to refine its General Product Safety Regulation, placing a greater onus on manufacturers to ensure product safety throughout the entire lifecycle. This means rigorous testing and documentation for components used in their industrial furnaces and allied equipment.

Key compliance areas include:

- Adherence to ISO 9001 quality management systems, ensuring consistent product quality for steel and ductile iron.

- Compliance with specific national safety certifications relevant to the markets where Electrotherm operates, such as CE marking in Europe.

- Robust risk assessment and management protocols for all manufactured equipment to proactively identify and mitigate potential hazards.

- Maintaining detailed product traceability and documentation to support any potential product liability claims.

Electrotherm's operations are significantly shaped by India's evolving legal landscape, particularly concerning labor and environmental regulations. The consolidation of labor laws into new codes by fiscal year 2025-26 will necessitate adjustments to wage structures and workplace safety, potentially impacting operational costs and workforce management.

The company must also adhere to increasingly stringent environmental compliance, including greenhouse gas emissions reporting and obtaining necessary operating permits, as highlighted by the mandatory Business Responsibility and Sustainability Reporting (BRSR) for companies like Electrotherm in fiscal year 2023-24.

Furthermore, product liability laws and safety standards, such as adherence to ISO 9001 and specific national certifications like CE marking, are critical for Electrotherm's steel and ductile iron products to avoid legal disputes and maintain customer trust.

Environmental factors

The steel industry, a core sector for Electrotherm, is a major source of greenhouse gas emissions, directly impacting its environmental footprint. India's commitment to achieving net-zero emissions by 2070 places significant pressure on companies like Electrotherm to adopt sustainable practices and reduce their carbon intensity.

To meet these national climate goals, Electrotherm is compelled to invest in cleaner production technologies and transition towards renewable energy sources. Initiatives such as the Green Steel Mission are designed to support this transition, encouraging the adoption of low-carbon steelmaking processes and materials.

Electrotherm, like many manufacturers, faces increasing pressure to adopt sustainable practices. This means optimizing how it uses resources like energy and water, aiming for greater efficiency. For instance, in 2024, global industrial energy consumption continued to rise, making efficient energy use a critical cost-saving and environmental imperative.

Effective waste management, including robust recycling programs, is also paramount. Companies are increasingly judged not just on their products but on their environmental footprint. By 2025, stricter regulations on industrial waste disposal are anticipated in many key markets, pushing firms like Electrotherm to invest in waste reduction technologies and circular economy principles.

The Indian government's ambitious renewable energy targets, aiming for 500 GW by 2030 and a staggering 1800 GW by 2047, are a significant environmental driver. This policy direction strongly encourages industries like Electrotherm to shift towards green power sources.

Electrotherm can capitalize on this trend by exploring available government incentives for investing in green power infrastructure. Such investments will not only align with environmental goals but also reduce the company's dependence on volatile fossil fuel markets, potentially lowering operational costs.

Water Conservation and Pollution Control

Environmental regulations surrounding water usage and the discharge of pollutants are tightening globally, directly impacting industries like Electrotherm. For instance, in 2024, many regions saw an increase in fines for non-compliance with wastewater discharge limits, with some penalties reaching hundreds of thousands of dollars. This necessitates significant investment in water-efficient technologies and advanced wastewater treatment systems to meet these evolving standards and reduce ecological footprints.

Electrotherm must prioritize investments in technologies that minimize water consumption throughout its manufacturing processes. This could include closed-loop water systems and advanced filtration methods. Furthermore, robust wastewater treatment is crucial. By 2025, it is anticipated that discharge limits for certain heavy metals and chemical compounds will be further reduced, requiring upgraded treatment capabilities.

- Stringent Regulations: Expect increased enforcement and penalties for exceeding water usage quotas and pollutant discharge limits, with fines potentially escalating in 2024-2025.

- Investment in Efficiency: Companies like Electrotherm will need to allocate capital towards water-saving technologies, such as recycling and filtration systems, to ensure compliance and operational sustainability.

- Wastewater Treatment Upgrades: Anticipate stricter standards for wastewater quality, demanding investment in advanced treatment processes to remove a wider range of contaminants effectively.

- Ecological Impact Reduction: Proactive measures in water conservation and pollution control are essential for minimizing environmental harm and maintaining a positive corporate image.

ESG Compliance and Greenwashing Scrutiny

In India, the emphasis on Environmental, Social, and Governance (ESG) factors is growing rapidly, placing companies like Electrotherm under a microscope concerning their environmental declarations. Investors and consumers alike are demanding greater accountability, making robust ESG compliance crucial for maintaining credibility and market position.

Electrotherm needs to demonstrate clear, verifiable sustainability initiatives to foster investor confidence and steer clear of greenwashing allegations. This involves not just making claims but backing them with tangible data and transparent reporting mechanisms.

- Regulatory Push: India's Securities and Exchange Board of India (SEBI) has been strengthening ESG disclosure norms, with Business Responsibility and Sustainability Reporting (BRSR) becoming mandatory for top listed companies. For the fiscal year 2023-24, over 150 companies reported under BRSR Core.

- Investor Sentiment: A significant portion of Indian investors, particularly institutional ones, are increasingly integrating ESG criteria into their investment decisions. A 2024 report indicated that over 60% of Indian fund managers consider ESG factors to be important in their investment process.

- Greenwashing Risks: Companies found to be misrepresenting their environmental performance face reputational damage and potential regulatory penalties. The heightened scrutiny means that unsubstantiated environmental claims can quickly lead to a loss of trust.

- Electrotherm's Position: Electrotherm's commitment to genuine environmental stewardship, supported by measurable outcomes in areas like energy efficiency and waste reduction, will be key to navigating this evolving landscape and attracting sustainable investment.

Electrotherm must navigate increasing environmental regulations, especially concerning emissions and resource usage, to align with India's net-zero goals by 2070. The company is also driven to adopt cleaner technologies and renewable energy, supported by government initiatives like the Green Steel Mission and ambitious renewable energy targets, such as 500 GW by 2030.

Water management is a critical environmental factor, with tightening regulations and escalating fines for non-compliance, necessitating investments in water-efficient technologies and advanced wastewater treatment by 2025. Furthermore, the growing emphasis on ESG factors in India, with mandatory BRSR reporting for top companies, requires Electrotherm to demonstrate verifiable sustainability initiatives to maintain investor confidence and market standing.

| Environmental Factor | Impact on Electrotherm | Key Data/Trends (2024-2025) |

|---|---|---|

| Carbon Emissions & Net-Zero Goals | Pressure to reduce greenhouse gas emissions and adopt low-carbon steelmaking. | India's net-zero target by 2070; Green Steel Mission initiatives. |

| Renewable Energy Adoption | Opportunity to shift towards green power sources, reducing fossil fuel dependence. | India's target of 500 GW renewable energy by 2030; incentives for green infrastructure. |

| Water Usage & Discharge | Need for investment in water-efficient technologies and advanced wastewater treatment. | Increasing fines for non-compliance with discharge limits; stricter standards anticipated by 2025. |

| ESG Compliance & Reporting | Requirement for transparent sustainability initiatives and verifiable data. | Mandatory BRSR reporting for top Indian companies; over 60% of Indian fund managers consider ESG important. |

PESTLE Analysis Data Sources

Our Electrotherm PESTLE analysis is built on a comprehensive blend of data from official government agencies, leading market research firms, and reputable industry publications. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable information.