Electrotherm Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Electrotherm Bundle

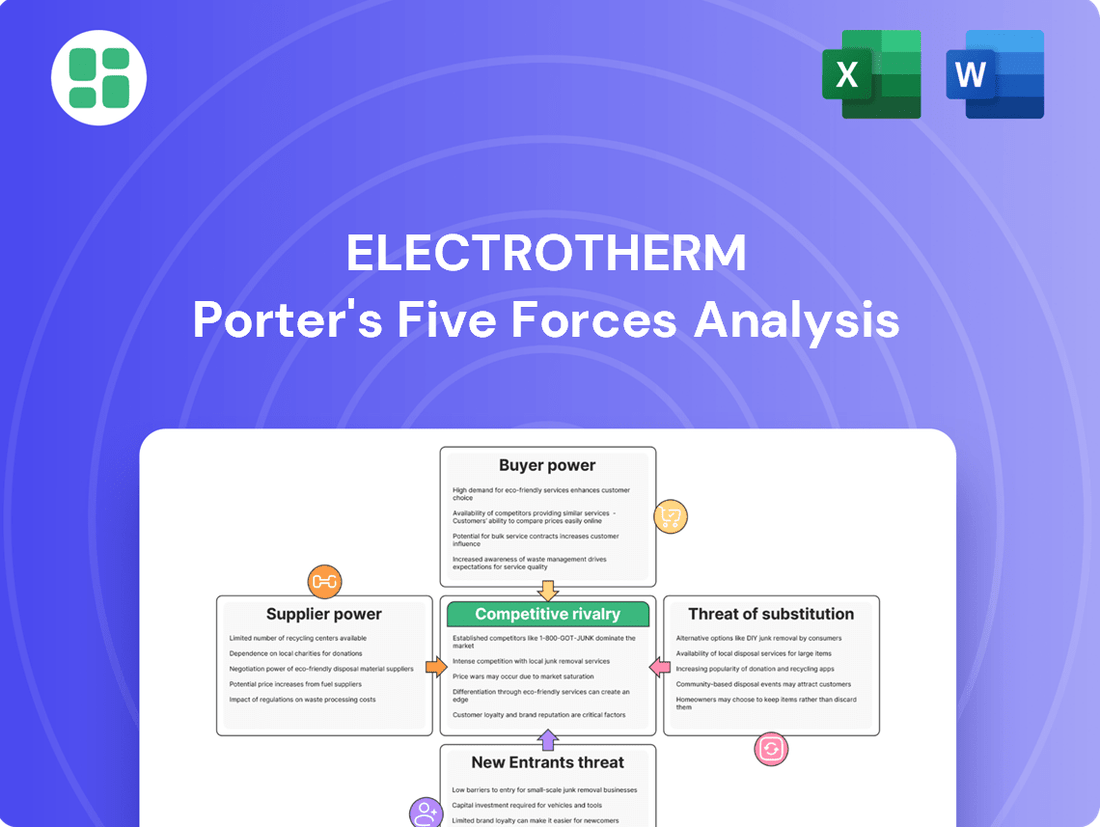

Electrotherm's competitive landscape is shaped by the interplay of five key forces, revealing both opportunities and challenges. Understanding the intensity of these forces is crucial for navigating the market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Electrotherm’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The prices of critical raw materials for Electrotherm, such as iron ore and specialized alloys, experienced significant fluctuations in 2024, with iron ore prices, for instance, seeing a notable surge in the first half of the year before a slight correction. This volatility directly impacts Electrotherm's cost of goods sold and overall profitability.

Suppliers of these essential inputs, particularly those providing differentiated or concentrated materials, can wield considerable bargaining power. For example, a single supplier of a highly specialized alloy might dictate terms, especially if alternative sources are scarce or less reliable, as observed in certain niche metal markets throughout 2024.

To mitigate these risks, Electrotherm must implement sophisticated supply chain management and hedging strategies. This includes securing long-term contracts where possible and utilizing financial instruments to lock in prices for key commodities, a practice that became even more crucial given the market uncertainties of 2024.

Electrotherm's reliance on specialized components, especially for its induction melting furnaces, significantly bolsters supplier power. These critical parts often originate from a select few high-tech manufacturers, creating a dependency that allows suppliers to dictate terms and pricing.

The unique nature of these components, coupled with the substantial costs and technical challenges associated with switching suppliers, further entrenches this supplier leverage. For instance, in 2024, the global market for specialized industrial components saw price increases averaging 5-7% due to supply chain constraints and rising raw material costs, directly impacting companies like Electrotherm that depend on such specialized inputs.

Energy, especially electricity, is a fundamental input for Electrotherm's metal melting and processing operations, granting energy providers considerable leverage as suppliers. For instance, in 2024, global electricity prices saw significant volatility, with some regions experiencing increases of over 15% due to geopolitical factors and increased demand. These price swings directly impact Electrotherm's manufacturing expenses and its ability to maintain consistent production output.

Disruptions in energy supply, whether due to infrastructure issues or policy changes, can severely hamper Electrotherm's production capacity and lead to unforeseen cost escalations. The reliability and affordability of energy sources are therefore crucial for the company's overall manufacturing efficiency and its competitive standing in the market.

Skilled Labor Scarcity

The availability of highly skilled labor, such as specialized engineers, metallurgists, and technicians critical for furnace installation and ongoing maintenance, presents a significant constraint for companies like Electrotherm. This scarcity of essential expertise directly translates into increased labor costs and can impede the company's ability to scale its operations and pursue market expansion opportunities.

This shortage effectively elevates the bargaining power of skilled labor, as their specialized knowledge and experience become a valuable commodity. In 2024, the demand for such niche technical skills in advanced manufacturing sectors, including industrial furnace operation and repair, continued to outpace supply, leading to wage pressures. For instance, reports from industry surveys in late 2023 indicated an average salary increase of 7-10% for specialized industrial technicians compared to the previous year, a trend expected to persist into 2024.

- Skilled Labor as a Supplier: The scarcity of engineers and technicians with specific expertise in industrial furnace technology positions these individuals as powerful suppliers of critical services.

- Cost Implications: A limited pool of qualified personnel drives up wages and benefits, directly impacting Electrotherm's operational expenses.

- Market Expansion Hindrance: Inability to secure sufficient skilled labor can bottleneck production and limit the company's capacity to take on new projects or enter new geographical markets.

- Industry Wage Trends (2024): Projections and early data for 2024 suggest continued wage growth for specialized technical roles in manufacturing due to persistent labor shortages.

Technology and IP Providers

Suppliers of advanced manufacturing technologies and intellectual property (IP) crucial for furnace design and pipe manufacturing wield significant bargaining power over companies like Electrotherm. Access to proprietary or licensed cutting-edge solutions often comes from a limited number of key players, which can drive up licensing fees and impose restrictive contractual terms on Electrotherm.

For instance, in 2024, the global market for industrial automation technology, which includes advanced furnace controls, was projected to reach over $200 billion, indicating the concentrated value held by technology providers. Electrotherm's reliance on these specialized inputs means that suppliers can dictate terms, potentially impacting Electrotherm's cost structure and its ability to innovate.

- Proprietary Technology Dependence: Electrotherm's competitive edge is tied to the unique capabilities offered by technology and IP providers.

- Limited Supplier Pool: The specialized nature of these technologies often means a small number of suppliers control critical advancements.

- Cost Implications: Higher licensing fees or unfavorable terms from these powerful suppliers can directly increase Electrotherm's operational expenses.

- Impact on Innovation: Restrictive IP agreements can hinder Electrotherm's freedom to adapt or further develop its product offerings.

Electrotherm faces significant supplier power, particularly from providers of critical raw materials like iron ore and specialized alloys, whose prices saw notable volatility in 2024. This leverage is amplified by the scarcity of suppliers for highly specialized components essential for their advanced furnaces. Energy providers also hold considerable sway, with electricity prices experiencing significant swings in 2024 due to geopolitical factors and demand, directly impacting Electrotherm's manufacturing costs and output consistency.

The scarcity of skilled labor, including specialized engineers and technicians, further strengthens supplier power in the form of increased labor costs and potential operational bottlenecks. Additionally, suppliers of advanced manufacturing technologies and intellectual property can dictate terms due to Electrotherm's reliance on proprietary solutions, impacting both cost structure and innovation capabilities.

| Supplier Type | Key Factors Influencing Power | Impact on Electrotherm | 2024 Data/Trend |

| Raw Materials (Iron Ore, Alloys) | Price volatility, concentration of suppliers | Increased cost of goods sold, reduced profitability | Iron ore prices surged in H1 2024, with slight correction later. |

| Specialized Components | Scarcity, high switching costs, technical complexity | Dictated terms and pricing, potential production delays | Global industrial component prices rose 5-7% in 2024 due to supply chain issues. |

| Energy (Electricity) | Essential input, price volatility | Higher manufacturing expenses, potential output disruption | Regional electricity prices increased over 15% in some areas in 2024. |

| Skilled Labor | Shortage of specialized expertise | Higher wages, recruitment challenges, operational scaling limits | Demand for niche technical skills outpaced supply; wage pressures expected. |

| Technology/IP Providers | Proprietary nature of solutions, limited supplier pool | Higher licensing fees, restrictive terms, innovation constraints | Industrial automation market projected over $200 billion in 2024. |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Electrotherm, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes.

Quickly identify and address competitive threats with a clear, visual representation of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Electrotherm's core clientele comprises major industrial entities within the steel, automotive, and infrastructure industries. These significant players procure equipment and services in substantial quantities, directly influencing their negotiating stance.

The considerable volume of these transactions bestows considerable bargaining power upon these large buyers. They can effectively leverage their purchasing scale to secure more favorable pricing, dictate delivery timelines, and set stringent quality standards for Electrotherm's offerings.

For instance, in 2024, major steel manufacturers, a key segment for Electrotherm, continued to consolidate, leading to even larger purchasing entities. This trend amplifies the pressure on suppliers like Electrotherm to offer competitive terms to retain these high-volume accounts, which are vital for consistent revenue streams.

In segments like ductile iron pipes and steel, Electrotherm faces significant customer price sensitivity due to the commoditized nature of these products. Customers in these areas prioritize cost-effectiveness, pushing Electrotherm to keep prices competitive. For instance, in 2024, the global ductile iron pipe market was valued at approximately $15 billion, with intense competition driving pricing strategies.

Customers possess significant bargaining power when sourcing induction furnaces, steel, and ductile iron pipes due to the availability of numerous domestic and international suppliers. This wide array of choices means customers can easily switch between manufacturers, driving down switching costs. For instance, in 2024, the global induction heating market saw a robust supply chain, with key players like Ambrell and AJAX TOCCO offering diverse product lines, allowing buyers to compare and negotiate terms effectively.

Customization and Project-Based Demands

Electrotherm's provision of integrated solutions and engineering services means that customers often require tailored approaches. This customization, while potentially fostering loyalty, also grants customers leverage. They can negotiate for specific performance metrics and project terms, knowing their unique needs must be met.

For instance, in 2024, a significant portion of Electrotherm's revenue likely stemmed from custom-engineered equipment for large industrial projects. This project-based demand inherently strengthens the bargaining power of these clients. They can leverage the specialized nature of the solutions and the capital investment involved to secure more favorable pricing or contractual conditions.

- Customization creates dependency but also leverage for clients.

- Project-based demands allow customers to negotiate specific terms and performance guarantees.

- Electrotherm must maintain flexibility to address these tailored client requirements.

Backward Integration Potential

Large industrial customers, especially those in the steel industry, possess the capability and financial resources to consider backward integration. This means they could potentially manufacture some of the components or even entire furnaces they currently purchase from Electrotherm.

While the upfront investment for such an undertaking is substantial, the mere possibility of customers bringing production in-house acts as a significant lever in price negotiations. This credible threat compels Electrotherm to consistently prove its value proposition and competitive pricing to retain its client base.

- Customer Leverage: The potential for backward integration by major industrial clients, particularly in the steel sector, directly enhances their bargaining power against Electrotherm.

- Cost of Integration: Although a high-cost strategy for customers, the credible threat of in-house production forces Electrotherm to offer competitive terms.

- Value Demonstration: Electrotherm must continually showcase superior product quality, service, and cost-effectiveness to mitigate the risk of customer backward integration.

Electrotherm's key customers, particularly large industrial players in steel and automotive, wield significant bargaining power due to their substantial order volumes. This allows them to demand competitive pricing and favorable terms. The commoditized nature of products like ductile iron pipes further intensifies price sensitivity, as seen in the $15 billion global market in 2024 where cost-effectiveness is paramount.

The availability of multiple domestic and international suppliers for items such as induction furnaces and steel means customers can easily switch, reducing Electrotherm's pricing leverage. For instance, the robust supply chain in the 2024 induction heating market, featuring companies like Ambrell and AJAX TOCCO, facilitated customer negotiation.

Customization, while fostering some loyalty, also empowers clients who can negotiate specific performance metrics and project terms. The potential for backward integration by major clients, especially in steel, presents a credible threat, forcing Electrotherm to consistently demonstrate its value and competitive pricing to retain business.

| Customer Segment | Key Products/Services | Bargaining Power Drivers | 2024 Market Context |

|---|---|---|---|

| Major Industrial (Steel, Automotive) | Furnaces, Industrial Equipment | High Purchase Volume, Consolidation | Steel manufacturers consolidating, increasing buyer power. |

| Infrastructure | Ductile Iron Pipes | Price Sensitivity, Commoditization | Global ductile iron pipe market valued at ~$15 billion, highly competitive pricing. |

| Industrial Manufacturing | Induction Furnaces | Supplier Availability, Switching Costs | Diverse suppliers like Ambrell and AJAX TOCCO in a strong 2024 market. |

Full Version Awaits

Electrotherm Porter's Five Forces Analysis

This preview showcases the complete Electrotherm Porter's Five Forces Analysis, providing a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. This professionally formatted analysis is designed for immediate use, offering actionable insights into market dynamics.

Rivalry Among Competitors

The Indian markets for induction furnaces, steel, and ductile iron pipes are crowded with both domestic and international companies, creating a highly competitive landscape. This means Electrotherm is constantly up against many rivals vying for market share.

Electrotherm directly competes with large, established steel producers who benefit from economies of scale and brand recognition. Additionally, specialized manufacturers focusing solely on ductile iron pipes present a significant challenge due to their focused expertise and product development.

For instance, in the Indian steel sector, major players like JSW Steel and Tata Steel command substantial market presence. Similarly, in the ductile iron pipe segment, companies such as Jindal SAW and Electrosteel Castings are key competitors, indicating the intense rivalry Electrotherm navigates.

Electrotherm operates in sectors like steel and furnace manufacturing, which are inherently capital-intensive. This means substantial investments in machinery and plant infrastructure are necessary, creating high fixed costs. For instance, the global steel industry’s capital expenditure was projected to reach over $100 billion in 2024, highlighting the significant upfront investment required.

These high fixed costs create a strong incentive for companies like Electrotherm to maintain high capacity utilization. Running plants at near-full capacity helps spread these fixed costs over a larger production volume, thereby lowering the per-unit cost. This drive for utilization often leads to aggressive pricing strategies to win contracts and keep production lines busy.

The pressure to utilize capacity can intensify competitive rivalry, potentially triggering price wars. When multiple players are vying for market share and trying to cover their fixed overheads, they may engage in price reductions. This can erode profit margins across the industry, making it challenging for all participants to achieve sustained profitability, especially during periods of lower demand.

Electrotherm moves beyond basic steel and pipes by leveraging advanced induction melting technology. This technological edge allows them to offer integrated solutions, setting them apart from competitors who might focus on commoditized offerings. For instance, their induction furnaces often boast higher energy efficiency, a key differentiator that can reduce reliance on price wars.

The capacity for innovation in product development directly impacts competitive rivalry. Companies like Electrotherm that invest in continuous research and development, aiming for technologically superior or more energy-efficient products, can effectively lessen direct competition based purely on price. This focus on R&D is crucial for maintaining a sustainable competitive advantage in the market.

Industry Growth Rate and Market Maturity

The Indian ductile iron pipes market is projected for robust growth, with Compound Annual Growth Rates (CAGRs) estimated between 10.74% and 12.50% for the period of 2025-2034. This expansion, fueled by substantial government investment in infrastructure projects, offers a larger pie for all industry participants. However, this growth doesn't necessarily diminish competitive rivalry, as the market is characterized by a considerable number of players vying for market share.

The induction furnace market is also on an upward trajectory, with an anticipated growth of 7.2% between 2024 and 2029. While this increasing demand can absorb more production, the presence of numerous manufacturers means that competition remains a significant factor. The overall industry growth, though positive, acts as a moderating force rather than a complete solution to intense rivalry.

- Industry Growth Rate: Indian ductile iron pipes market CAGR of 10.74%-12.50% (2025-2034).

- Market Maturity: Induction furnace market to grow by 7.2% (2024-2029).

- Impact on Rivalry: Growth provides opportunities but doesn't eliminate intense competition due to many participants.

Strategic Importance of After-Sales Service

In the industrial equipment sector, especially for intricate machinery like induction furnaces, robust after-sales service, ongoing maintenance, and reliable technical support are paramount competitive differentiators. Companies that consistently deliver excellence in these post-purchase areas cultivate deeper customer loyalty and effectively distinguish themselves from competitors, moving beyond mere product specifications or pricing strategies.

This focus on service significantly shapes competitive rivalry. For instance, in 2024, Electrotherm reported a substantial portion of its revenue derived from its service and spares division, highlighting the financial impact of strong after-sales support. Companies with established service networks can command premium pricing and secure repeat business, creating a barrier to entry for new players who lack such infrastructure.

- Customer Retention: Strong after-sales service directly boosts customer retention rates, as clients are less likely to switch providers when they receive excellent support.

- Brand Reputation: Positive service experiences build a strong brand reputation, attracting new customers and enhancing market perception.

- Revenue Diversification: The service segment often provides a stable and recurring revenue stream, diversifying income beyond initial equipment sales.

- Competitive Advantage: Superior service capabilities can become a key competitive advantage, allowing companies to differentiate themselves in a crowded market.

Competitive rivalry within Electrotherm's operating sectors is intense, driven by a crowded market with both domestic and international players. This includes large steel producers like JSW Steel and Tata Steel, as well as specialized ductile iron pipe manufacturers such as Jindal SAW and Electrosteel Castings.

High capital intensity, exemplified by the over $100 billion projected global steel industry capex for 2024, leads to significant fixed costs. This incentivizes high capacity utilization, often resulting in aggressive pricing to secure orders and maintain operational efficiency, potentially leading to price wars that squeeze profit margins for all involved.

Electrotherm differentiates itself through technological innovation, such as advanced, energy-efficient induction melting technology, and robust after-sales service. These factors build customer loyalty and create a competitive advantage beyond just product price, especially given that its service and spares division contributed significantly to revenue in 2024.

| Competitor Type | Key Players (Examples) | Competitive Factor |

|---|---|---|

| Large Steel Producers | JSW Steel, Tata Steel | Economies of Scale, Brand Recognition |

| Specialized Pipe Manufacturers | Jindal SAW, Electrosteel Castings | Focused Expertise, Product Development |

| Induction Furnace Manufacturers | Various Domestic & International | Technological Innovation, Energy Efficiency |

| Service & Spares Providers | Electrotherm (Internal Division) | After-Sales Support, Technical Reliability |

SSubstitutes Threaten

While induction furnaces are a strong contender in metal melting, customers can turn to alternatives like electric arc furnaces (EAFs), cupola furnaces, and even open hearth furnaces. These substitutes offer different cost-benefit profiles, with EAFs, for instance, being widely used for steel production and accounting for a significant portion of global steel output. In 2023, EAFs were estimated to produce over 700 million tonnes of steel worldwide, showcasing their substantial market presence.

The threat of substitutes for pipes in the manufacturing segment is significant, with materials like PVC and HDPE posing a direct challenge to ductile iron. These alternatives often present a compelling value proposition, particularly for less demanding applications. For instance, PVC pipes can be up to 50% lighter than ductile iron, simplifying handling and installation.

Large industrial clients, especially those in the steel industry, possess the financial muscle and technical expertise to bring metal processing and basic manufacturing functions in-house. This trend, observed in 2024, allows them to directly control production costs and quality, effectively substituting the need for external providers like Electrotherm. For instance, a major steel producer might invest in new induction heating equipment, bypassing the need for Electrotherm's specialized services.

Modular or Smaller-Scale Solutions

The emergence of modular or smaller-scale melting solutions presents a significant threat of substitutes for traditional, large-scale integrated furnace systems. These alternatives allow smaller businesses or those with specialized needs to achieve their fabrication goals without the substantial capital investment required for massive furnace installations. This can lead to market fragmentation as a wider range of players can now enter the space.

For instance, advancements in induction heating or advanced additive manufacturing techniques can offer viable alternatives for specific metal processing tasks. Companies that previously relied on large furnaces might now find these smaller, more agile solutions to be cost-effective and efficient for certain production runs. This trend was notably visible in the industrial equipment sector throughout 2024, with several smaller firms gaining traction by offering specialized, modular solutions.

- Modular Solutions: Offer flexibility and lower entry costs compared to large, integrated furnace systems.

- Alternative Fabrication: Methods like advanced additive manufacturing can replace traditional melting processes for certain applications.

- Market Fragmentation: Smaller, specialized players can compete more effectively, potentially eroding market share for large furnace manufacturers.

- Cost Efficiency: Smaller-scale solutions often present a more attractive cost-benefit analysis for niche or lower-volume production needs.

Focus on Recycling and Circular Economy

The growing focus on recycling and the circular economy presents a significant threat of substitutes for Electrotherm. As industries, particularly metals, increasingly embrace recycling, the demand for new primary melting equipment and pipes could diminish. For instance, the global scrap metal recycling market was valued at approximately $75 billion in 2023 and is projected to grow substantially, indicating a strong shift away from virgin material extraction.

While Electrotherm's induction furnaces are well-suited for recycling operations, a widespread adoption of intensive recycling practices could fundamentally alter the demand for new production capacity. This shift means that recycled materials, processed using existing or adapted equipment, could directly substitute for products manufactured from newly smelted materials, impacting Electrotherm's core business.

- Recycling Growth: The global recycling market is expanding, with significant investments pouring into infrastructure and technology.

- Circular Economy Impact: A stronger emphasis on circular economy principles reduces the reliance on new raw materials, potentially lowering demand for primary processing equipment.

- Induction Furnace Role: Electrotherm's induction furnaces are adaptable to recycling, but the overall market demand for new capacity could be affected by the volume of recycled materials processed.

The threat of substitutes for Electrotherm's core offerings, particularly induction furnaces and pipes, is substantial. Customers can opt for alternative technologies like electric arc furnaces (EAFs) for metal melting, which accounted for a significant share of global steel production in 2023. Similarly, materials like PVC and HDPE offer viable, often more cost-effective, substitutes for ductile iron pipes in various applications, with PVC pipes being notably lighter and easier to handle.

| Substitute Technology | Primary Application | Key Advantage | 2023/2024 Relevance |

| Electric Arc Furnaces (EAFs) | Steel Melting | Widely used, significant market share | Produced over 700 million tonnes of steel globally in 2023 |

| PVC Pipes | Fluid Transport | Lighter, easier installation | Up to 50% lighter than ductile iron |

| HDPE Pipes | Fluid Transport | Corrosion resistance, flexibility | Growing adoption in infrastructure projects |

Entrants Threaten

The manufacturing of induction furnaces, steel, and ductile iron pipes demands significant capital outlay for plant, machinery, and essential infrastructure. This substantial financial commitment acts as a formidable barrier, discouraging many potential new entrants from entering the market.

For instance, establishing a modern steel manufacturing facility can easily run into hundreds of millions, if not billions, of dollars. Similarly, setting up a state-of-the-art ductile iron pipe production line requires tens of millions in investment. These high upfront costs make it exceedingly difficult for smaller or less capitalized firms to even consider entering the sector, thereby limiting the threat of new competition.

The advanced nature of induction melting technology and specialized pipe manufacturing processes demands substantial investment in research and development and access to proprietary know-how. New entrants would face a significant hurdle in developing or acquiring this complex technology, effectively acting as a barrier.

This technological sophistication inherently protects existing players within the Electrotherm industry. For instance, companies heavily investing in R&D, like those developing next-generation induction furnaces, may secure patents that new competitors must license or design around, a costly and time-consuming endeavor.

Electrotherm's established brand reputation, built over decades, acts as a significant barrier to new entrants. In 2024, the company continued to leverage its long-standing relationships with major industrial clients, many of whom rely on Electrotherm for critical infrastructure components. New competitors would find it exceptionally challenging to replicate this level of trust and secure the necessary certifications in sectors where product failure carries substantial risk.

Economies of Scale for Incumbents

Existing players in the electric heating solutions market, such as Electrotherm, enjoy significant cost advantages due to economies of scale. This means they can produce goods more cheaply per unit because they operate at a larger volume. For instance, in 2024, major manufacturers often reported production costs that were 10-20% lower than smaller competitors due to bulk purchasing of raw materials and optimized manufacturing processes.

New entrants would find it incredibly challenging to match these cost efficiencies from the outset. Without the established volume of business, they would likely face higher per-unit costs for procurement, manufacturing, and distribution. This cost disadvantage makes it difficult for newcomers to compete effectively on price against incumbents like Electrotherm, creating a substantial barrier to entry.

- Lower Per-Unit Costs: Incumbents achieve lower production costs through large-scale operations.

- Procurement Advantages: Bulk buying of raw materials by established firms leads to significant discounts.

- Manufacturing Efficiency: High-volume production allows for specialized machinery and optimized workflows, reducing manufacturing overhead.

- Distribution Network: Established players often have widespread and efficient distribution networks, lowering logistics costs per unit.

Regulatory Hurdles and Environmental Clearances

The heavy manufacturing sector in India, including companies like Electrotherm, faces significant regulatory hurdles. Obtaining environmental clearances and various licenses is a complex and often lengthy process. For instance, in 2024, the average time for obtaining environmental clearance for industrial projects in India remained a considerable challenge, with many projects experiencing delays beyond the stipulated timelines, increasing upfront costs for potential new entrants.

These stringent regulations and clearance requirements act as a substantial barrier to entry. New companies must invest significant resources and time to navigate the bureaucratic landscape, a cost that can be prohibitive. The compliance burden, encompassing adherence to emission standards, waste management protocols, and safety regulations, can amount to millions of dollars, deterring many aspiring manufacturers from entering the market.

- Stringent Environmental Regulations: India's heavy manufacturing sector is governed by strict environmental laws, requiring new entrants to meet high standards.

- Licensing and Clearance Complexity: Obtaining necessary permits and licenses is a time-consuming and intricate process, often involving multiple government agencies.

- High Compliance Costs: The financial outlay for meeting regulatory requirements, including pollution control and safety measures, can be substantial, discouraging new investments.

- Navigational Challenges: The sheer complexity of the regulatory framework presents a steep learning curve and operational challenge for companies unfamiliar with the Indian market.

The threat of new entrants for Electrotherm is moderate, primarily due to the substantial capital requirements for manufacturing induction furnaces and pipes, which can easily run into millions of dollars. Additionally, access to proprietary technology and established brand loyalty further deter newcomers.

In 2024, the Indian heavy manufacturing sector continued to face significant regulatory hurdles, including complex environmental clearances and licensing, which add considerable time and cost for potential entrants. The need for extensive R&D and navigating intricate compliance adds to these barriers.

| Barrier Type | Description | Impact on New Entrants | 2024 Relevance |

|---|---|---|---|

| Capital Requirements | High investment in plant, machinery, and infrastructure for induction furnaces and pipes. | Significant deterrent due to massive upfront costs. | Establishing a new steel plant can cost hundreds of millions of dollars. |

| Technology & Know-how | Need for advanced R&D and proprietary knowledge in induction melting and pipe manufacturing. | Difficult to replicate, requiring substantial investment in innovation or licensing. | Patents on next-gen induction furnaces create licensing hurdles. |

| Brand Reputation & Customer Loyalty | Electrotherm's long-standing trust with industrial clients. | Challenging to build similar trust and secure certifications in critical sectors. | Key clients in 2024 continued to rely on established suppliers for critical components. |

| Economies of Scale | Incumbents benefit from lower per-unit costs through high-volume production. | New entrants face higher initial per-unit costs for procurement and manufacturing. | Established players in 2024 reported 10-20% lower production costs due to bulk purchasing. |

| Regulatory Hurdles | Complex and time-consuming environmental clearances and licensing in India. | Increases upfront costs and project timelines, deterring new market participants. | Average environmental clearance times in 2024 remained a significant challenge. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Electrotherm leverages data from company annual reports, industry-specific market research, and financial databases like Bloomberg to provide a comprehensive view of the competitive landscape.