Edwards Lifesciences PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

Navigate the complex external forces impacting Edwards Lifesciences with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the cardiovascular device market. Gain a strategic advantage by leveraging these insights to anticipate challenges and seize opportunities.

Ready to make informed decisions about Edwards Lifesciences? Our expertly crafted PESTLE analysis delivers actionable intelligence on everything from regulatory landscapes to environmental sustainability. Download the full version now and unlock the strategic advantage you need to excel.

Political factors

Government healthcare policies, especially those concerning medical device approval and reimbursement, are crucial for Edwards Lifesciences. These policies dictate how readily their innovative products can reach patients and how they are compensated.

Shifts in national coverage decisions for procedures like Transcatheter Aortic Valve Replacement (TAVR), or alterations in how healthcare services are funded, directly influence market access and the financial success of Edwards' therapies. For example, the Centers for Medicare & Medicaid Services (CMS) national coverage decision for TAVR in 2012 was a pivotal moment, enabling broader adoption.

The global regulatory environment for medical devices is becoming increasingly stringent. Agencies like the U.S. Food and Drug Administration (FDA) and European Union bodies are implementing more rigorous requirements. This evolving landscape, including the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), alongside the FDA's transition of its Quality System Regulation to Quality Management System Regulation (QMSR), necessitates greater transparency, comprehensive documentation, and robust post-market surveillance for companies like Edwards Lifesciences.

Edwards Lifesciences, a global player in over 100 countries, faces significant impact from international trade policies and tariffs. These can directly influence supply chain expenses and pricing decisions, affecting the company's overall financial performance. For instance, the company has noted anticipated pressure on its operating margin, partly due to a weakening dollar and the implementation of announced tariffs.

Successfully navigating these intricate trade relationships is crucial for Edwards Lifesciences to sustain its worldwide market presence and maintain competitive pricing strategies in diverse economic landscapes.

Government Support for Innovation

Government initiatives and funding for medical research and development, particularly in areas like structural heart disease and critical care, directly benefit companies like Edwards Lifesciences. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $47.4 billion to biomedical research in fiscal year 2023, with a significant portion directed towards cardiovascular health, which could indirectly support Edwards' innovation pipeline.

Incentives for adopting new medical technologies also play a crucial role. In 2024, many countries are focusing on value-based healthcare models, which reward the adoption of innovative devices that improve patient outcomes. This policy shift encourages healthcare providers to invest in advanced therapies, aligning with Edwards' mission to develop pioneering treatments.

Furthermore, government support can streamline regulatory pathways and facilitate clinical trials. For example, the U.S. Food and Drug Administration (FDA) continues to refine its pathways for breakthrough medical devices, potentially shortening the time to market for Edwards' novel technologies. This governmental focus on accelerating innovation directly impacts Edwards' ability to bring life-saving solutions to patients faster.

- Government Funding: NIH's projected $47.4 billion for biomedical research in FY2023 supports innovation in cardiovascular health.

- Value-Based Healthcare: Policies promoting value-based care in 2024 encourage adoption of advanced medical technologies.

- Regulatory Acceleration: FDA's focus on breakthrough device pathways can expedite market entry for Edwards' innovations.

Political Stability and Geopolitical Risks

Political stability in key markets is crucial for Edwards Lifesciences. For instance, the company's significant presence in Europe, which experienced a 2.1% GDP growth in 2024 according to IMF projections, relies on stable regulatory environments. Geopolitical tensions, such as those impacting global trade routes in 2024, can disrupt supply chains, potentially affecting the availability of critical medical devices and increasing logistics costs.

Disruptions stemming from political instability can directly impact patient access to care. For example, in regions facing internal conflict or significant policy shifts in healthcare, the consistent delivery of life-saving cardiovascular devices might be jeopardized. Economic uncertainty, often a consequence of political volatility, can also lead to reduced healthcare spending by governments and private insurers, directly influencing demand for Edwards Lifesciences' products.

Edwards Lifesciences' global operations necessitate a resilient supply chain. The company sources components and manufactures products across multiple continents. In 2024, a focus on supply chain diversification was evident, with investments in expanding manufacturing capabilities in regions like Singapore, aiming to mitigate risks associated with single-source dependencies or regional political instability.

Key considerations for Edwards Lifesciences regarding political factors include:

- Navigating diverse regulatory landscapes: Ensuring compliance with varying healthcare policies and device approval processes across its global markets, which saw significant updates in medical device regulations in the EU and US during 2024.

- Managing geopolitical risks: Monitoring and mitigating the impact of international trade disputes, sanctions, and regional conflicts on its operations and market access.

- Adapting to healthcare policy changes: Responding to shifts in government healthcare spending, reimbursement policies, and public health initiatives that directly affect demand for cardiovascular technologies.

- Ensuring supply chain continuity: Proactively addressing potential disruptions by diversifying manufacturing and sourcing strategies in response to evolving global political and economic conditions.

Government healthcare policies, particularly those concerning device approval and reimbursement, are paramount for Edwards Lifesciences, influencing market access and financial viability. For instance, the Centers for Medicare & Medicaid Services' national coverage decisions for procedures like TAVR directly impact product adoption and revenue streams.

The global regulatory environment is intensifying, with agencies like the FDA and EU bodies implementing stricter requirements, such as the EU MDR and IVDR, and the FDA's QMSR transition, demanding greater transparency and robust post-market surveillance.

Government funding for medical research, like the NIH's projected $47.4 billion for biomedical research in FY2023, indirectly supports innovation in cardiovascular health, while value-based healthcare models promoted in 2024 incentivize the adoption of advanced medical technologies, aligning with Edwards' mission.

Political stability in key markets, such as Europe's projected 2.1% GDP growth in 2024, is vital for Edwards' operations, as geopolitical tensions can disrupt supply chains and increase logistics costs, directly impacting the availability and pricing of critical medical devices.

What is included in the product

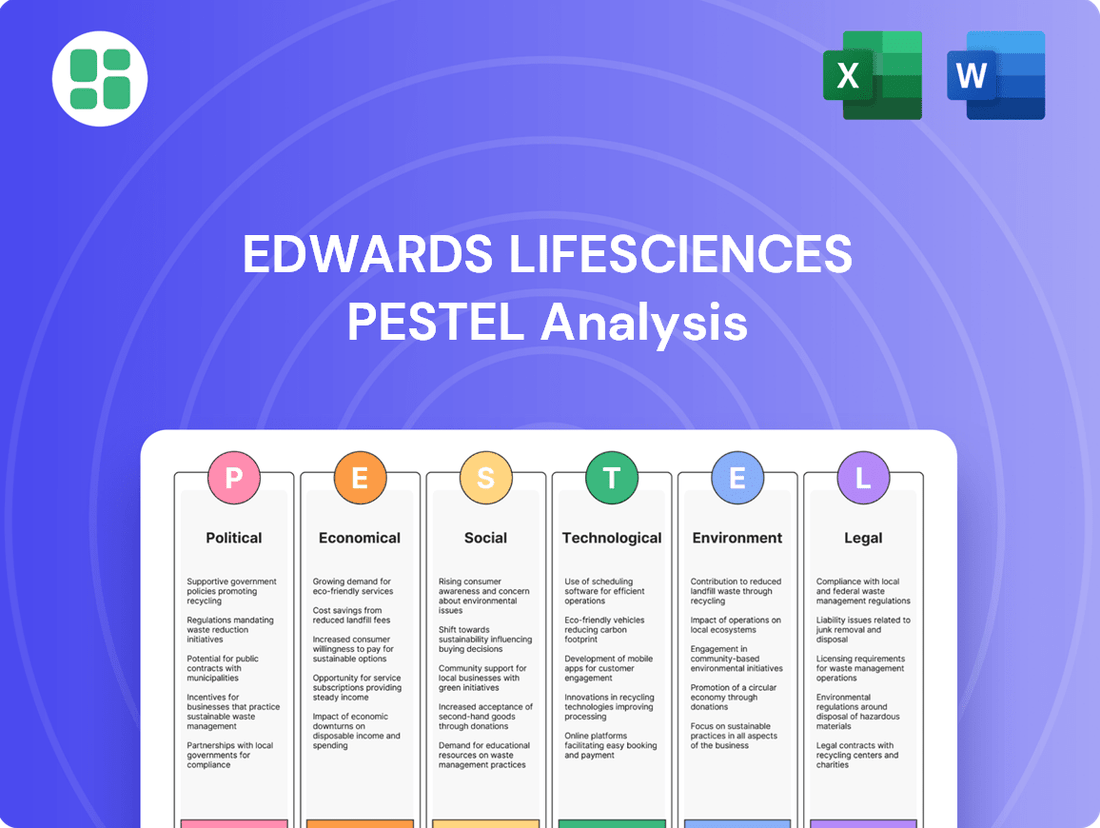

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Edwards Lifesciences, providing a comprehensive overview of the external landscape.

It equips stakeholders with actionable insights into market dynamics and regulatory shifts, fostering strategic decision-making and risk mitigation.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Edwards Lifesciences.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the political, economic, social, technological, environmental, and legal landscape affecting the company.

Economic factors

Global healthcare spending is a significant driver for companies like Edwards Lifesciences. Projections indicate that total health spending will reach an impressive $5.6 trillion by 2025. This substantial market growth, fueled by technological advancements and new pharmaceuticals, directly translates to increased demand for innovative medical devices, such as those developed by Edwards.

Hospitals represent the largest segment within this healthcare spending, meaning Edwards' products are most likely to be utilized in these settings. While the overall market is expanding, there's also a growing emphasis on cost-effectiveness within healthcare systems. This presents both an opportunity for companies offering efficient solutions and a challenge to demonstrate the value proposition of their advanced technologies.

Inflationary pressures and rising supply chain costs directly affect Edwards Lifesciences' manufacturing expenses, potentially squeezing profitability. For instance, in Q1 2024, the company reported a gross profit margin of 73.2%, a testament to its cost management. However, ongoing global economic shifts, including a weakening dollar, could further exacerbate these cost pressures, impacting future margins.

Economic growth significantly impacts patient affordability for procedures like TAVR. In 2024, global economic growth is projected to be around 2.7%, according to the IMF, which can translate to increased disposable income and a greater willingness to invest in advanced medical treatments. Conversely, a recession could lead patients to delay or opt for less costly alternatives, directly affecting sales of high-value medical devices.

Edwards Lifesciences' sales are sensitive to healthcare spending trends, which are often tied to a nation's economic health. During periods of economic expansion, such as the anticipated moderate growth in the US in 2024, healthcare systems and patients are better positioned to adopt innovative technologies. However, economic slowdowns can constrain hospital budgets and patient out-of-pocket expenses, potentially impacting the adoption rate of procedures like transcatheter aortic valve replacement (TAVR).

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Edwards Lifesciences as a global entity. A strengthening dollar, for example, can negatively affect the reported value of overseas earnings, potentially pressuring operating margins. This was a noted factor in their Q1 2025 earnings report, where unfavorable currency movements contributed to a slight dip in profitability.

Effective management of foreign exchange risks is therefore paramount for maintaining stable financial performance and enabling accurate forecasting. The company actively employs hedging strategies to mitigate these currency exposures.

- Impact on Margins: A stronger USD can reduce the translated value of sales generated in foreign currencies, thereby impacting gross and operating margins.

- Forecasting Challenges: Volatile exchange rates introduce uncertainty into financial projections, making it harder to predict future revenue and profit.

- Hedging Strategies: Edwards Lifesciences utilizes financial instruments to lock in exchange rates for future transactions, aiming to reduce volatility.

- Q1 2025 Observation: The company specifically cited currency headwinds as a contributing factor to margin pressure in the first quarter of 2025.

Investment in Research and Development

Edwards Lifesciences' commitment to research and development (R&D) is a key economic driver, fueling its future expansion and market dominance. The company's substantial R&D expenditure underscores its dedication to innovation and staying ahead in the dynamic medical technology landscape.

In 2023, Edwards Lifesciences reported R&D expenses of approximately $1.2 billion. This significant investment is strategically allocated to developing breakthrough technologies and pioneering new therapeutic areas, ensuring a robust pipeline of future products.

- Sustained R&D Investment: Edwards Lifesciences consistently invests heavily in R&D, a critical factor for economic growth and competitive advantage.

- 2023 R&D Expenditure: The company's R&D spending reached approximately $1.2 billion in 2023, highlighting its commitment to innovation.

- Strategic Focus: This investment targets the development of breakthrough technologies and the creation of new therapeutic categories within the medical device sector.

- Market Leadership: Continued R&D investment is essential for Edwards Lifesciences to maintain its leadership position in the rapidly evolving medical technology market.

Economic factors significantly shape Edwards Lifesciences' performance, from global healthcare spending trends to inflation and currency fluctuations. The company's reliance on hospital budgets means economic downturns can constrain adoption of its advanced devices, while growth periods often correlate with increased demand. Edwards' substantial R&D investment, around $1.2 billion in 2023, is a crucial economic driver for its future, aiming to secure market leadership through innovation.

| Economic Factor | Impact on Edwards Lifesciences | Supporting Data/Observation |

|---|---|---|

| Global Healthcare Spending | Drives demand for medical devices. | Projected to reach $5.6 trillion by 2025. |

| Inflation & Supply Chain Costs | Increases manufacturing expenses, potentially impacting margins. | Gross profit margin was 73.2% in Q1 2024, showing cost management effectiveness. |

| Economic Growth | Affects patient affordability and willingness to adopt high-value procedures. | IMF projects 2.7% global economic growth for 2024. |

| Currency Exchange Rates | Impacts reported earnings from international sales. | Unfavorable currency movements cited in Q1 2025 earnings. |

| Research & Development (R&D) | Fuels future growth and market competitiveness. | Approximately $1.2 billion spent on R&D in 2023. |

Preview Before You Purchase

Edwards Lifesciences PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Edwards Lifesciences details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering deep insights into the external forces shaping Edwards Lifesciences' operations and future growth. This analysis is crucial for understanding market dynamics and potential challenges.

The content and structure shown in the preview is the same document you’ll download after payment, providing a thorough examination of the PESTLE elements relevant to Edwards Lifesciences. You'll gain a clear understanding of the macro-environmental influences.

Sociological factors

The world's population is getting older, and this is a really important factor for companies like Edwards Lifesciences. More older people means more people who are likely to develop heart conditions, especially aortic stenosis. In fact, more than 12% of people over 75 have this condition, creating a bigger market for valve replacement therapies.

This demographic shift is a major reason why the market for transcatheter aortic valve replacement (TAVR) devices is expected to see significant growth. As more individuals reach the age where these conditions are common, the demand for advanced treatments like TAVR will naturally increase, benefiting Edwards Lifesciences.

The increasing global burden of cardiovascular diseases (CVDs) directly fuels demand for Edwards Lifesciences' advanced medical devices. Despite previous progress, CVD incidence and prevalence have unfortunately begun to rise again, with projections indicating continued growth. This trend underscores the critical need for innovative solutions in structural heart repair and critical care monitoring, aligning perfectly with Edwards Lifesciences' core offerings.

Patients are increasingly seeking out less invasive medical treatments, a trend that significantly impacts the cardiovascular device market. Procedures like Edwards Lifesciences' transcatheter aortic valve replacement (TAVR) are gaining traction because they offer quicker recovery and better results than traditional open-heart surgery. This patient preference directly fuels the demand for these advanced, less invasive options.

Healthcare Access and Disparities

Societal attitudes towards healthcare access significantly impact medical device companies like Edwards Lifesciences. Growing awareness of healthcare disparities, particularly for underserved populations, creates both challenges and opportunities. Edwards Lifesciences actively addresses this by prioritizing cardiovascular care for marginalized communities, working to dismantle barriers related to regulations, geography, and cost.

Their commitment extends beyond product development. Through philanthropic efforts, such as the Every Heartbeat Matters program, Edwards Lifesciences aims to reach millions of patients globally who lack access to essential cardiovascular treatments. In 2023, this initiative supported over 1.5 million patient interventions, demonstrating a tangible impact on improving health equity.

- Healthcare Equity Focus: Edwards Lifesciences targets underserved populations to broaden access to quality cardiovascular care.

- Addressing Barriers: The company actively works to overcome regulatory, geographic, and economic obstacles hindering patient access.

- Philanthropic Impact: Initiatives like Every Heartbeat Matters aim to provide life-saving treatments to millions globally.

- 2023 Program Reach: The Every Heartbeat Matters program positively impacted over 1.5 million underserved patients in 2023.

Lifestyle Changes and Health Consciousness

Societal shifts towards healthier lifestyles and increased health consciousness are a significant driver for Edwards Lifesciences. While these trends may mitigate some traditional cardiovascular risk factors, they simultaneously fuel a growing demand for sophisticated early detection methods and advanced treatment options. This heightened awareness translates into greater patient engagement with preventive care and a stronger inclination towards adopting personalized medicine approaches, often facilitated by new technologies.

The emphasis on proactive health management and tailored medical interventions directly impacts the market for monitoring solutions and diagnostics. For instance, the global remote patient monitoring market was valued at approximately $30.4 billion in 2023 and is projected to reach $131.2 billion by 2030, showcasing a compound annual growth rate of 23.4%. This growth underscores the increasing patient and provider acceptance of technologies that enable continuous health tracking and early problem identification, areas where Edwards Lifesciences can innovate.

- Increased Demand for Early Detection: Growing health awareness drives the need for advanced diagnostic tools to identify cardiovascular issues sooner.

- Personalized Medicine Adoption: Patients are increasingly seeking tailored treatments, influencing the development of customized cardiovascular solutions.

- Patient Engagement in Health: Lifestyle changes encourage individuals to actively participate in managing their health, boosting the use of monitoring devices.

- Technological Integration: New health technologies are key enablers for preventive care and personalized medicine, creating opportunities for innovation in patient management.

The aging global population is a significant driver for Edwards Lifesciences, as the prevalence of conditions like aortic stenosis increases with age, particularly in individuals over 75. This demographic trend directly supports the growing demand for minimally invasive treatments such as TAVR. Furthermore, the rising incidence of cardiovascular diseases globally, despite prior improvements, continues to fuel the need for advanced cardiac care solutions.

Patient preference for less invasive procedures is a key factor, with TAVR offering faster recovery compared to traditional open-heart surgery. Societal awareness of healthcare disparities is also influencing the market, prompting companies like Edwards Lifesciences to focus on improving access for underserved populations through initiatives like their Every Heartbeat Matters program, which supported over 1.5 million patient interventions in 2023.

| Sociological Factor | Impact on Edwards Lifesciences | Supporting Data/Trend |

|---|---|---|

| Aging Population | Increased demand for structural heart solutions | Over 12% of people over 75 have aortic stenosis. |

| Rising CVD Incidence | Greater need for advanced cardiac treatments | Global CVD burden continues to grow. |

| Patient Preference for Minimally Invasive Procedures | Growth in TAVR market | TAVR offers quicker recovery than open-heart surgery. |

| Healthcare Equity Focus | Opportunity to expand market access and brand reputation | Every Heartbeat Matters program supported >1.5M patient interventions in 2023. |

Technological factors

Edwards Lifesciences' success is intrinsically linked to ongoing medical device technology advancements. Innovations in areas like next-generation TAVR valves, featuring enhanced durability and self-expanding designs with adaptive sealing, are vital for maintaining their market edge.

These technological leaps directly translate to better patient outcomes and the potential to treat a wider range of conditions. For instance, the company's commitment to R&D, which represented 13.7% of its sales in 2023, fuels these critical innovations, ensuring their product pipeline remains competitive.

The continuous advancement in minimally invasive surgical and interventional techniques, notably exemplified by Transcatheter Aortic Valve Replacement (TAVR), serves as a significant technological catalyst. These less invasive methods contribute to shorter hospitalizations and a lower incidence of complications, thereby expanding the accessibility of sophisticated cardiac therapies to a wider patient demographic.

Edwards Lifesciences is at the forefront of this technological evolution, consistently enhancing its transcatheter platforms. In 2023, Edwards reported TAVR sales of $4.1 billion, underscoring the market's strong adoption of these innovative, less invasive procedures.

The increasing integration of digital health and AI into medical devices is a significant technological factor for Edwards Lifesciences. AI is revolutionizing cardiovascular medicine, enhancing diagnostics and personalizing treatment plans. This trend is evident in the growing adoption of AI-powered diagnostic tools, with the global AI in healthcare market projected to reach over $187 billion by 2030, up from an estimated $15.4 billion in 2023.

Edwards' hemodynamic monitoring solutions are well-positioned to benefit from these advancements. By incorporating AI and data analytics, these systems can provide clinicians with more sophisticated insights, leading to better patient management and improved outcomes. For instance, AI algorithms can analyze complex hemodynamic data in real-time, identifying subtle changes that might otherwise go unnoticed, thereby empowering more informed clinical decisions.

Competitor Innovation and R&D

The medical technology sector is a hotbed of innovation, with competitors like Medtronic and Abbott Laboratories consistently investing heavily in research and development. For Edwards Lifesciences, this means a constant need to push boundaries in structural heart therapies. Their ability to maintain a strong, differentiated pipeline, potentially bolstered by strategic acquisitions of promising new treatments, is crucial for staying competitive. Edwards Lifesciences' commitment to pioneering new therapeutic categories is a key driver for its long-term expansion and market leadership.

For instance, Medtronic's significant R&D expenditure, which often exceeds billions annually, directly impacts the pace of innovation across the industry. Abbott Laboratories also demonstrates a robust commitment to R&D, frequently launching new cardiovascular devices. Edwards Lifesciences' own strategic investments in R&D for fiscal year 2024 were projected to be substantial, aiming to support its development of next-generation transcatheter aortic valve replacement (TAVR) and other advanced therapies.

- Medtronic's R&D Investment: Medtronic's annual R&D spending often surpasses $2 billion, creating a high bar for innovation in the medtech space.

- Abbott's Product Launches: Abbott Laboratories has a history of introducing innovative cardiovascular solutions, such as its MitraClip device, which sets benchmarks for competitors.

- Edwards Lifesciences' Pipeline Focus: Edwards Lifesciences prioritizes its structural heart portfolio, including advancements in TAVR and mitral valve repair technologies, to maintain its competitive edge.

- Acquisition Strategy: Strategic acquisitions of smaller, innovative companies or technologies are a key tactic for Edwards Lifesciences to accelerate its R&D efforts and expand its therapeutic offerings.

Cybersecurity in Medical Devices

The increasing connectivity of medical devices, including those from Edwards Lifesciences, creates a critical need for robust cybersecurity. Protecting sensitive patient data and ensuring uninterrupted device functionality are paramount. A 2024 report highlighted that 70% of connected medical devices had exploitable vulnerabilities, underscoring the urgency.

New FDA guidance, released in late 2023, mandates a risk-based approach to cybersecurity for medical devices. This requires manufacturers to implement comprehensive cybersecurity management plans and continuous monitoring throughout a device's lifecycle. For instance, the guidance emphasizes proactive threat modeling and post-market surveillance.

- FDA's focus on risk-based cybersecurity management for connected devices.

- The necessity for continuous monitoring and vulnerability management.

- Edwards Lifesciences' commitment to patient safety through secure device design.

Technological advancements are a cornerstone of Edwards Lifesciences' strategy, particularly in minimally invasive cardiac procedures like TAVR. Their significant R&D investment, which was 13.7% of sales in 2023, fuels innovation in areas like next-generation valve technologies and digital health integration. The company's TAVR sales reached $4.1 billion in 2023, demonstrating strong market adoption of these advanced, less invasive treatments.

The increasing integration of AI and data analytics into medical devices presents a substantial opportunity. AI is enhancing diagnostics and personalizing treatment plans, with the global AI in healthcare market projected to exceed $187 billion by 2030. Edwards' hemodynamic monitoring solutions are poised to leverage these trends, offering clinicians more sophisticated insights for improved patient management.

The competitive landscape necessitates continuous innovation, with rivals like Medtronic and Abbott Laboratories making substantial R&D investments. Edwards Lifesciences' focus on its structural heart portfolio and potential strategic acquisitions are crucial for maintaining its market leadership and expanding therapeutic offerings.

Cybersecurity for connected medical devices is a critical technological factor, especially given that 70% of connected devices had exploitable vulnerabilities in 2024. New FDA guidance emphasizes robust cybersecurity management plans and continuous monitoring, a requirement Edwards Lifesciences addresses through secure device design.

| Factor | Description | Impact on Edwards Lifesciences | Key Data/Trend |

| Advancements in TAVR Technology | Development of more durable, self-expanding valves with enhanced sealing. | Maintains market leadership and improves patient outcomes. | TAVR sales: $4.1 billion (2023) |

| Digital Health & AI Integration | Incorporating AI for diagnostics, personalized treatment, and enhanced hemodynamic monitoring. | Improves patient management and clinical decision-making. | AI in Healthcare Market: Projected >$187 billion by 2030 |

| Competitive R&D Spending | Competitors' significant investments in cardiovascular device innovation. | Requires continuous R&D and strategic pipeline development/acquisitions. | Edwards' R&D: 13.7% of sales (2023) |

| Medical Device Cybersecurity | Ensuring the security of connected devices and patient data. | Mandates robust cybersecurity management and continuous monitoring. | 70% of connected devices had exploitable vulnerabilities (2024) |

Legal factors

Edwards Lifesciences navigates a complex web of medical device regulations, with the U.S. Food and Drug Administration (FDA) and the European Union's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) being paramount. These frameworks dictate everything from initial product design and rigorous clinical testing to manufacturing standards and ultimately, market approval. For example, the EU MDR, fully implemented in 2021, significantly increased pre-market scrutiny and ongoing post-market surveillance requirements compared to its predecessor, the Medical Device Directive.

Compliance with these evolving regulations is not merely a procedural hurdle but a critical determinant of market access and ensuring patient safety. The increased emphasis on transparency and robust post-market data collection under frameworks like the EU MDR means companies must invest heavily in demonstrating ongoing product safety and efficacy throughout the product lifecycle. Failure to meet these exacting standards can lead to product recalls, market withdrawal, and substantial financial penalties, impacting revenue streams and brand reputation.

Product liability and patient safety laws are paramount for Edwards Lifesciences, a leader in medical technology. Recent regulatory shifts are increasingly encompassing software and AI in medical devices, placing a greater onus on manufacturers. This means Edwards must meticulously document every stage of development and rigorously manage potential risks.

The evolving legal landscape means liability can now extend to the software powering medical devices, including AI-driven diagnostics and treatment recommendations. This necessitates an even higher standard for validation, cybersecurity, and ongoing monitoring of these digital components. For instance, the FDA's continued focus on Software as a Medical Device (SaMD) guidance, updated in 2023, underscores this trend, demanding robust pre-market review and post-market surveillance.

Edwards Lifesciences must therefore maintain exceptionally high standards in quality control and proactive vigilance to minimize exposure to product liability claims. This includes comprehensive testing, transparent reporting of any adverse events, and a robust risk management framework that anticipates potential issues, especially with the increasing integration of complex digital technologies into their life-saving products.

Edwards Lifesciences heavily relies on its robust intellectual property portfolio, particularly patents safeguarding its pioneering transcatheter heart valve technologies and advanced hemodynamic monitoring solutions. These patents are crucial for maintaining market exclusivity and recouping significant research and development expenditures, which often run into hundreds of millions of dollars annually.

The legal landscape surrounding patent protection directly impacts Edwards Lifesciences' ability to prevent competitors from replicating its innovations, thereby securing its competitive edge. For instance, ongoing patent litigation and the negotiation of licensing agreements are constant strategic considerations, influencing market access and revenue streams.

Data Privacy Regulations

Strict data privacy regulations, like HIPAA in the U.S. and GDPR in Europe, significantly impact medical device manufacturers such as Edwards Lifesciences, especially concerning their critical care monitoring solutions. These laws mandate robust protection for sensitive patient data, with non-compliance leading to substantial penalties. For instance, GDPR fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

Edwards Lifesciences must ensure that its devices and systems maintain secure communication channels and implement comprehensive data protection measures. This includes safeguarding data both in transit and at rest to prevent breaches and maintain patient trust. The company's adherence to these evolving legal frameworks is paramount for its ongoing operations and market reputation.

- HIPAA (Health Insurance Portability and Accountability Act): Governs the privacy and security of protected health information (PHI) in the United States.

- GDPR (General Data Protection Regulation): Enforces strict data privacy and security rules for personal data of individuals in the European Union.

- Data Breach Penalties: Non-compliance can result in significant financial penalties, reputational damage, and legal liabilities. For example, under GDPR, fines can be up to 4% of global annual revenue.

- Device Security Requirements: Manufacturers are increasingly responsible for ensuring the cybersecurity of their connected medical devices to protect patient data.

Anti-Kickback and Anti-Corruption Laws

Edwards Lifesciences operates globally, necessitating strict adherence to anti-kickback and anti-corruption statutes like the U.S. Foreign Corrupt Practices Act (FCPA) and similar international regulations. These laws are designed to prevent any financial inducements that could sway healthcare professionals' or institutions' prescribing or purchasing decisions.

To navigate this complex legal landscape, Edwards Lifesciences has implemented robust anti-bribery and anti-corruption controls. These include comprehensive policies, detailed procedures, and regular training programs for employees to foster ethical conduct and ensure compliance across all business interactions.

- Compliance Focus: The company's commitment to ethical business practices is paramount, especially given the sensitive nature of healthcare and the potential for regulatory scrutiny.

- Risk Mitigation: Proactive measures in anti-corruption are crucial for mitigating legal risks, financial penalties, and reputational damage.

- Global Standards: Adherence to international anti-corruption standards ensures fair competition and maintains trust with stakeholders worldwide.

Edwards Lifesciences faces stringent regulatory oversight, particularly from the FDA and EU MDR/IVDR, impacting product development and market access. Compliance with these evolving frameworks, which demand robust pre-market testing and ongoing post-market surveillance, is critical. For instance, the EU MDR, fully implemented in 2021, significantly increased scrutiny, requiring extensive clinical data and rigorous quality management systems.

Product liability and patient safety laws are paramount, with recent regulatory shifts extending to software and AI in medical devices, such as the FDA's updated SaMD guidance in 2023. This necessitates meticulous documentation and risk management for digital components. Failure to comply can lead to recalls, market withdrawal, and substantial financial penalties, impacting revenue and brand reputation.

The company's intellectual property, especially patents for transcatheter heart valves, is vital for market exclusivity and recouping R&D investments, which can exceed hundreds of millions annually. Legal battles and licensing agreements are constant strategic considerations, directly influencing market access and revenue streams.

Data privacy regulations like GDPR, with potential fines up to 4% of global annual turnover, mandate robust protection of patient data, impacting critical care monitoring solutions. Edwards must ensure secure communication and comprehensive data protection measures to prevent breaches and maintain patient trust.

Environmental factors

Edwards Lifesciences is actively enhancing its sustainable manufacturing practices, recognizing the growing influence of environmental regulations and stakeholder demands. The company's commitment to responsible waste management and reducing its ecological footprint is a key component of its corporate social responsibility strategy.

In line with these efforts, Edwards Lifesciences is making significant strides in operational sustainability. For instance, they are increasing their reliance on renewable energy sources and implementing robust waste recycling programs to minimize environmental impact.

These initiatives are crucial as the company aims to achieve ambitious environmental goals. Edwards Lifesciences is on track to reach carbon neutrality and meet its science-based targets by the year 2030, demonstrating a clear dedication to a more sustainable future.

Edwards Lifesciences actively manages energy consumption within its manufacturing operations, recognizing its impact on greenhouse gas (GHG) emissions. The company has achieved a notable 17% reduction in absolute Scope 1 and 2 GHG emissions compared to its 2021 baseline, demonstrating a commitment to environmental stewardship.

This focus on reducing emissions is intrinsically linked to the company's broader goal of achieving carbon neutrality. By addressing climate-related risks and capitalizing on sustainability opportunities, Edwards Lifesciences aligns its business practices with evolving global environmental targets, which can also bolster its brand reputation among stakeholders.

Edwards Lifesciences acknowledges the environmental footprint of its global supply chain, encompassing everything from sourcing raw materials to delivering finished medical devices. This impact is a key consideration in their sustainability initiatives, aiming to reduce carbon emissions and waste across all stages of production and logistics.

The company actively engages with its suppliers and distributors to promote environmentally responsible practices, understanding that a truly sustainable operation extends beyond its own facilities. This collaborative approach is crucial for achieving their broader environmental goals and ensuring accountability throughout the value chain.

Building a resilient and environmentally conscious supply chain is not just about ecological responsibility; it also serves as a strategic advantage. By proactively addressing environmental risks, such as climate-related disruptions or resource scarcity, Edwards Lifesciences can better mitigate operational challenges and ensure the consistent availability of its life-saving products.

Climate Change Impact on Operations

Climate change poses a significant operational risk for Edwards Lifesciences, with extreme weather events like floods or heatwaves potentially disrupting manufacturing facilities or supply chains. For instance, the increasing frequency of severe storms in regions where critical components are sourced or manufactured could lead to production delays and increased costs. Edwards Lifesciences, like many global manufacturers, must proactively assess these climate-related risks to ensure long-term operational stability and resilience.

Building resilience involves evaluating various climate-related scenarios and their potential impact on business continuity. This includes understanding how rising sea levels might affect coastal distribution hubs or how prolonged droughts could impact water availability for manufacturing processes. A robust strategy would incorporate contingency plans and potentially diversify sourcing and distribution networks to mitigate these environmental factors.

- Supply Chain Disruption: Extreme weather events in 2024, such as prolonged heatwaves in Asia and severe flooding in Europe, have already impacted global logistics, potentially affecting the timely delivery of raw materials and finished medical devices for companies like Edwards Lifesciences.

- Operational Costs: Increased energy costs due to climate-related policies or the need for climate-controlled infrastructure in manufacturing can directly impact operational expenses.

- Resource Scarcity: Potential future water scarcity in key manufacturing regions could necessitate significant investments in water management and recycling technologies.

Corporate Social Responsibility (CSR) and Environmental Reporting

Edwards Lifesciences' dedication to corporate social responsibility (CSR) and clear environmental reporting is vital for attracting investors and talent, while also building public trust. Their annual Corporate Impact Report highlights environmental, social, and governance (ESG) initiatives, underscoring their commitment to a sustainable future for patients and the broader community.

This transparent reporting reinforces accountability and reflects a comprehensive view of their business impact. For instance, in their 2023 Corporate Impact Report, Edwards Lifesciences reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible progress in their environmental stewardship.

Key aspects of their environmental reporting include:

- Water Stewardship: Efforts to reduce water consumption in manufacturing operations, with a goal to decrease water intensity by 10% by 2025 from a 2021 baseline.

- Waste Management: Initiatives focused on reducing non-hazardous waste generation and increasing recycling rates across their facilities.

- Sustainable Packaging: Exploring and implementing more eco-friendly packaging solutions for their medical devices.

- Energy Efficiency: Investments in energy-efficient technologies and renewable energy sources to power their global operations.

Edwards Lifesciences is actively addressing environmental factors by focusing on reducing its carbon footprint and enhancing operational sustainability. The company's commitment is evident in its progress towards carbon neutrality and science-based targets by 2030.

Their proactive approach includes a 17% reduction in absolute Scope 1 and 2 GHG emissions as of 2023 compared to a 2021 baseline, showcasing tangible environmental stewardship.

Furthermore, Edwards Lifesciences is implementing water stewardship initiatives, aiming for a 10% reduction in water intensity by 2025 from a 2021 baseline, alongside waste management and sustainable packaging efforts.

| Environmental Focus Area | Target/Goal | Progress/Status |

|---|---|---|

| GHG Emissions Reduction (Scope 1 & 2) | Carbon Neutrality by 2030 | 17% reduction from 2021 baseline achieved (as of 2023) |

| Water Intensity | 10% reduction by 2025 (from 2021 baseline) | Progressing towards goal, specific 2023 data pending release |

| Renewable Energy Usage | Increased reliance | Ongoing investment in renewable energy sources for global operations |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Edwards Lifesciences is built on a robust foundation of data from leading financial institutions, regulatory bodies, and esteemed market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the medical device industry.