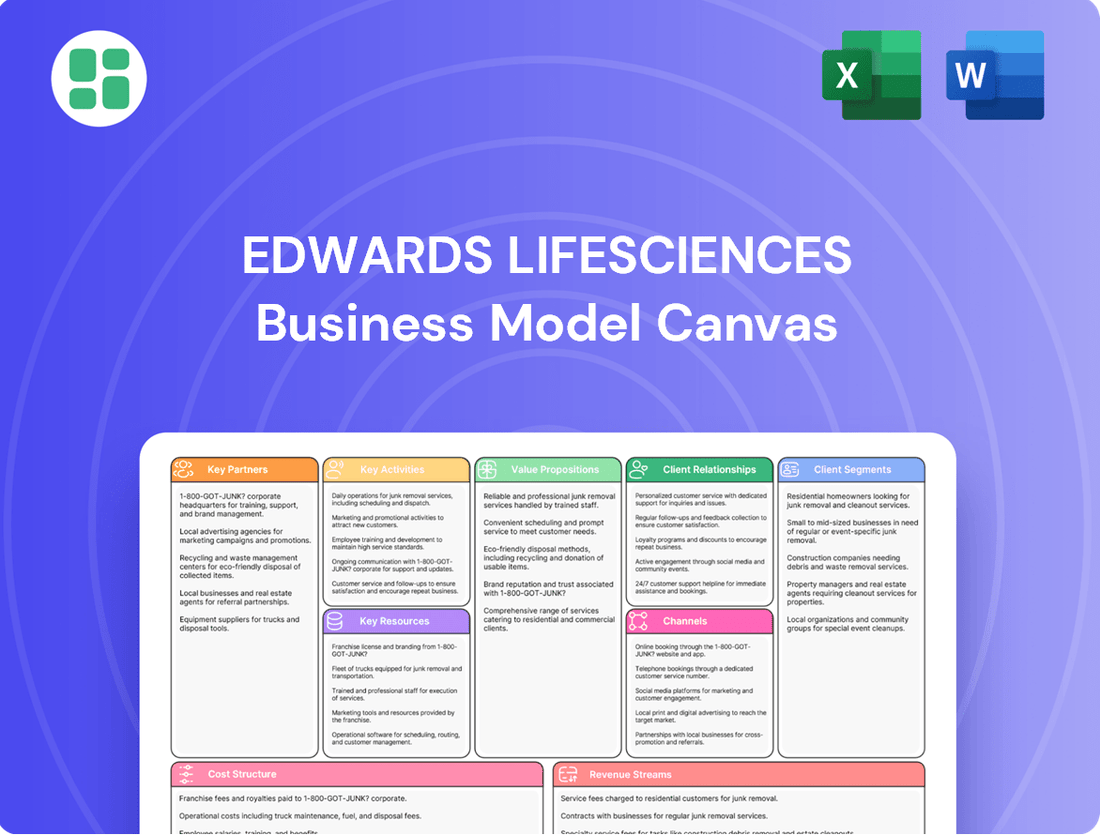

Edwards Lifesciences Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

Explore the intricate workings of Edwards Lifesciences's business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a strategic roadmap for understanding their market dominance. Download the full canvas to gain actionable insights for your own business endeavors.

Partnerships

Edwards Lifesciences' key partnerships with hospitals and healthcare systems worldwide are fundamental to its business. These institutions are where its advanced structural heart and critical care technologies are deployed to treat patients.

These collaborations are crucial for the adoption and effective use of Edwards' products, impacting patient outcomes and the company's revenue streams. For instance, in 2023, Edwards reported net sales of $5.3 billion, with a significant portion driven by the adoption of its transcatheter aortic valve replacement (TAVR) systems within hospital networks.

Partnerships often involve joint efforts in clinical trials, training healthcare professionals, and ensuring seamless integration of new medical devices into existing hospital workflows. This symbiotic relationship allows hospitals to offer cutting-edge treatments while providing Edwards with vital market access and feedback for product development.

Edwards Lifesciences deeply values its relationships with clinicians, including interventional cardiologists, cardiac surgeons, and intensivists. These professionals are crucial for the company's success, providing essential feedback and driving innovation.

These partnerships are built on robust training programs and ongoing clinical education, ensuring healthcare providers are adept with Edwards' advanced medical technologies. For example, in 2024, Edwards continued to invest in its global training centers, facilitating thousands of procedures and enhancing clinician proficiency.

The seamless integration and effective use of Edwards' life-saving devices, particularly in areas like transcatheter aortic valve replacement (TAVR), are directly influenced by the close collaboration and direct feedback from these medical experts. This collaborative approach fuels product development and refinement, ensuring patient outcomes are continually improved.

Edwards Lifesciences actively partners with prestigious academic and research institutions globally. These collaborations are fundamental for executing pivotal clinical trials, such as the EARLY TAVR study, which aimed to assess the benefits of transcatheter aortic valve replacement in lower-risk patients. This strategic alliance helps generate robust, world-class evidence supporting product innovation and expanded indications.

The company's engagement with these centers of expertise is critical for validating the long-term efficacy and safety of its advanced cardiovascular technologies. For instance, the TRISCEND II trial, conducted with academic partners, provided key data for the regulatory approval of the EVOQUE valve system in patients with severe tricuspid regurgitation. This symbiotic relationship fuels scientific progress and solidifies Edwards Lifesciences' commitment to evidence-based medicine.

Regulatory Bodies and Health Authorities

Edwards Lifesciences maintains critical partnerships with regulatory bodies like the U.S. Food and Drug Administration (FDA) and European CE Mark authorities. These collaborations are fundamental for securing approvals, which are vital for market access and ensuring patient safety for their innovative medical devices.

Navigating these intricate regulatory landscapes is a constant endeavor. In 2024, the FDA continued its rigorous review processes for novel medical technologies, with a significant focus on post-market surveillance and real-world evidence generation. Edwards actively engages with these authorities to demonstrate the safety and efficacy of its life-saving cardiovascular solutions.

- FDA Approval: Essential for U.S. market entry, requiring extensive clinical data and adherence to strict manufacturing standards.

- CE Marking: Grants access to the European Economic Area, signifying compliance with EU health, safety, and environmental protection requirements.

- Ongoing Compliance: Continuous monitoring and reporting are necessary to maintain product approvals and address any emerging safety concerns.

Strategic Acquisition and Technology Partners

Edwards Lifesciences actively pursues strategic acquisitions and technology partnerships to bolster its innovation pipeline and extend its market reach. For instance, the company has previously entered into agreements to acquire businesses focused on Transcatheter Aortic Valve Replacement (TAVR) devices for aortic regurgitation, though these ventures can be subject to regulatory review. These strategic alliances are crucial for driving inorganic growth and diversifying its portfolio of therapeutic solutions.

These partnerships are instrumental in accessing cutting-edge technologies and expanding market penetration. By integrating new capabilities, Edwards aims to enhance its competitive edge and address unmet patient needs across various cardiovascular conditions. The company's commitment to strategic collaborations underscores its long-term vision for growth and leadership in the medical device sector.

- Strategic Acquisitions: Edwards Lifesciences has a history of acquiring companies with promising technologies, such as those developing TAVR devices for aortic regurgitation, to accelerate product development and market entry.

- Technology Partnerships: Collaborations with technology providers allow Edwards to integrate advanced solutions and innovations into its existing product lines, fostering continuous improvement.

- Inorganic Growth Driver: Acquisitions and partnerships serve as key engines for inorganic growth, enabling the company to expand its therapeutic offerings and geographic presence more rapidly than through organic development alone.

- Regulatory Considerations: While pursuing acquisitions, Edwards must navigate regulatory approvals, which can influence the timeline and success of integrating new technologies and businesses.

Edwards Lifesciences cultivates vital partnerships with academic and research institutions to drive innovation and validate its cardiovascular technologies. These collaborations are essential for conducting pivotal clinical trials, such as the EARLY TAVR study, which provided crucial evidence for expanding the use of TAVR in lower-risk patients.

These strategic alliances enable Edwards to generate robust data supporting product advancements and new indications, reinforcing its commitment to evidence-based medicine. For example, the TRISCEND II trial, a partnership with academic centers, yielded key data for the EVOQUE valve system's approval in treating severe tricuspid regurgitation.

Edwards also maintains critical relationships with regulatory bodies like the FDA and European CE Mark authorities. These partnerships are fundamental for obtaining approvals, ensuring market access, and upholding patient safety for its advanced medical devices.

In 2024, Edwards continued to engage with regulatory agencies to demonstrate the safety and efficacy of its solutions, navigating rigorous review processes that increasingly emphasize real-world evidence.

What is included in the product

A detailed Edwards Lifesciences Business Model Canvas outlining its focus on patient care through innovative cardiovascular technologies, targeting healthcare providers and patients.

This model emphasizes Edwards' value proposition of improving patient outcomes and its channels for reaching cardiologists, surgeons, and hospitals.

Edwards Lifesciences' Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot of their strategy to address the critical needs of cardiovascular patients and healthcare providers.

It efficiently distills complex value propositions and customer segments into an actionable format, easing the process of understanding and communicating how they solve significant healthcare challenges.

Activities

Edwards Lifesciences dedicates substantial resources to research and development, a cornerstone of its strategy to innovate in structural heart disease. This commitment fuels the creation of advanced transcatheter heart valves and the sophisticated delivery systems required for their implantation, aiming to improve patient outcomes.

In 2023, Edwards Lifesciences reported R&D expenses of $1.2 billion. This investment underscores their focus on addressing critical unmet patient needs and solidifying their position as a technological leader in the cardiovascular field.

Edwards Lifesciences meticulously manufactures its intricate medical devices, prioritizing exceptional quality and unwavering reliability. This commitment involves specialized production techniques and stringent quality assurance protocols to adhere to international regulatory requirements.

In 2024, Edwards continued to invest in advanced manufacturing technologies, aiming to enhance efficiency and precision. The company's robust quality control systems are designed to minimize defects, ensuring patient safety and product efficacy across its diverse portfolio, which includes minimally invasive valve technologies.

Edwards Lifesciences' core operations revolve around conducting rigorous clinical trials to prove the safety and effectiveness of its innovative medical devices, particularly for structural heart disease and critical care monitoring. These trials are paramount for securing regulatory approvals from bodies like the FDA and for gaining the trust and adoption of healthcare professionals worldwide.

A significant focus for Edwards in 2024 and beyond is the generation of robust clinical evidence to expand the use of its transcatheter aortic valve replacement (TAVR) systems. For instance, studies like EARLY TAVR are designed to demonstrate the benefits of TAVR in lower-risk patient populations, aiming to shift treatment paradigms and improve long-term patient outcomes.

The company's commitment to evidence generation extends to post-market studies and real-world data collection, ensuring continuous learning and refinement of its product offerings. This data-driven approach not only supports regulatory compliance but also fuels physician confidence and supports reimbursement strategies, ultimately driving market penetration and patient access to life-saving technologies.

Sales, Marketing, and Professional Education

Edwards Lifesciences actively drives its business through a robust sales and marketing engine, complemented by a strong emphasis on professional education. This approach is crucial for introducing and supporting its advanced medical technologies.

The company utilizes a direct sales force, enabling close relationships with healthcare providers globally. This direct engagement facilitates the promotion of its innovative cardiovascular solutions and ensures that clinicians are well-informed about product benefits and applications. In 2023, Edwards reported total sales of $6.4 billion, demonstrating the reach of its commercial efforts.

A cornerstone of Edwards' strategy involves comprehensive marketing activities. These efforts aim to build brand awareness and educate the market about the value proposition of their products, particularly in areas like transcatheter heart valve replacement.

Crucially, Edwards invests heavily in professional education and training programs for clinicians. These programs are designed to impart essential knowledge and skills for the proper implantation of their devices and for the optimal management of patients undergoing these procedures. This commitment to education is vital for ensuring patient safety and maximizing the therapeutic outcomes of their technologies.

- Direct Sales Force: Edwards maintains a global direct sales force to engage with healthcare providers.

- Marketing Activities: Comprehensive marketing efforts promote their advanced cardiovascular solutions.

- Professional Education: Significant investment in training programs for clinicians ensures proper device use and patient management.

- 2023 Sales: The company achieved $6.4 billion in total sales in 2023, reflecting its market penetration.

Regulatory Affairs and Compliance

Edwards Lifesciences actively engages with regulatory bodies worldwide to secure approvals for its innovative cardiovascular technologies. This involves meticulous preparation and submission of extensive data packages to agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

Ensuring ongoing compliance with evolving global regulations is a core activity, covering everything from manufacturing standards to post-market surveillance and adverse event reporting. For instance, in 2023, Edwards reported spending significant resources on regulatory submissions and compliance activities to support its diverse product portfolio.

- Navigating Global Regulations: Edwards Lifesciences dedicates substantial effort to understanding and adhering to the complex and varied regulatory requirements across different countries for its medical devices.

- Product Approvals and Submissions: A key activity involves preparing and submitting comprehensive documentation to health authorities to gain clearance and approval for new products and indications.

- Post-Market Surveillance: Edwards maintains robust systems for monitoring the performance of its devices once they are on the market, reporting any adverse events and ensuring continued safety and efficacy.

- Compliance with International Standards: The company must ensure its operations and products meet diverse international quality and safety standards, a critical factor for maintaining market access and patient trust.

Edwards Lifesciences' key activities are centered on pioneering research and development, meticulous manufacturing of high-quality medical devices, conducting rigorous clinical trials, and executing effective sales and marketing strategies supported by professional education. Furthermore, navigating complex global regulatory landscapes is a critical ongoing effort.

| Key Activity | Description | 2023/2024 Data/Focus |

| Research & Development | Innovation in structural heart disease, transcatheter valves, and delivery systems. | $1.2 billion in R&D expenses in 2023; continued investment in advanced technologies in 2024. |

| Manufacturing | High-quality, reliable production of intricate medical devices with stringent quality control. | Investment in advanced manufacturing technologies in 2024 to enhance efficiency and precision. |

| Clinical Trials | Proving safety and effectiveness for regulatory approvals and market adoption. | Focus on generating evidence for TAVR systems in lower-risk patients (e.g., EARLY TAVR study). |

| Sales & Marketing / Professional Education | Direct sales engagement, brand building, and clinician training for device implantation and patient management. | $6.4 billion in total sales in 2023; ongoing investment in clinician training programs. |

| Regulatory Affairs | Securing product approvals and ensuring ongoing compliance with global regulations. | Significant resources dedicated to regulatory submissions and compliance activities in 2023. |

Full Version Awaits

Business Model Canvas

The Edwards Lifesciences Business Model Canvas preview you are currently viewing is the exact document you will receive upon purchase. This comprehensive snapshot accurately reflects the structure, content, and professional formatting of the complete file, ensuring no surprises. You can be confident that the detailed analysis of Edwards Lifesciences' operations, customer segments, value propositions, and revenue streams presented here is precisely what you will download, ready for your immediate use and adaptation.

Resources

Edwards Lifesciences holds a significant collection of intellectual property, notably patents covering its groundbreaking heart valve technologies and advanced monitoring systems. This robust IP portfolio is crucial for maintaining a competitive edge and safeguarding the substantial investments made in research and development.

In 2023, Edwards Lifesciences reported spending $978.6 million on research and development, a testament to their commitment to innovation. Protecting these valuable assets through strategic litigation is a key operational focus, ensuring their technological advancements remain exclusive and contribute to market leadership.

Edwards Lifesciences' highly skilled workforce is a cornerstone of its business model, encompassing a diverse range of specialized talent. This includes innovative engineers and scientists who develop cutting-edge medical devices, as well as clinical specialists who ensure their effective implementation and patient safety. Their collective expertise is critical for driving innovation and maintaining a competitive edge in the demanding medical technology sector.

The company's success is directly tied to the deep knowledge and experience of its employees. For instance, in 2024, Edwards Lifesciences continued to invest heavily in training and development to keep its workforce at the forefront of advancements in cardiac surgery and critical care technologies. This commitment ensures that their teams possess the specialized skills needed to conduct rigorous clinical research and provide essential support to healthcare providers globally.

Edwards Lifesciences’ advanced manufacturing and R&D facilities are the backbone of its innovation and production capabilities. These sites are equipped for the highly specialized processes needed to create sophisticated cardiovascular devices. For instance, their facilities are designed for the meticulous assembly and testing of products like transcatheter heart valves, demanding extreme precision.

The company's commitment to R&D is evident in its investment in these advanced facilities, enabling the development of next-generation medical technologies. In 2023, Edwards Lifesciences invested $1.1 billion in R&D, a significant portion of which directly supports the infrastructure and talent within these crucial centers.

These state-of-the-art facilities are not just about current production; they are essential for scaling operations to meet growing global demand and for fostering the continuous innovation that drives the company's competitive edge in the medtech industry.

Extensive Clinical Data and Evidence

Edwards Lifesciences' extensive clinical data and evidence, gathered from a multitude of clinical trials, is a foundational asset. This robust data set unequivocally validates the efficacy and positive patient outcomes of their innovative medical devices, thereby driving their widespread adoption and facilitating approvals for new indications. For instance, data from trials like the PARTNER 3 study, which demonstrated superior outcomes for their transcatheter aortic valve replacement (TAVR) systems compared to traditional surgery in low-risk patients, significantly bolstered market penetration.

This commitment to evidence-based medicine underpins Edwards' strong reputation and market leadership. The continuous accumulation and analysis of real-world evidence and clinical trial results are crucial for demonstrating value to healthcare providers, payers, and regulatory bodies. In 2023, Edwards reported significant advancements and data releases across their portfolio, reinforcing their position as a leader in structural heart disease and critical care monitoring.

- Vast repository of clinical trial data: Supports product efficacy and outcomes.

- Validation of performance: Drives product adoption and expanded approved uses.

- Evidence-based medicine reputation: Enhances trust and market credibility.

- Real-world evidence integration: Continues to refine product development and patient care strategies.

Strong Brand Reputation and Market Leadership

Edwards Lifesciences' strong brand reputation as a global leader in structural heart innovations is a cornerstone of its business model. This reputation, cultivated over decades of pioneering technologies and patient-centric solutions, acts as a significant intangible asset. It directly translates into trust from healthcare professionals and patients alike, solidifying its market leadership in crucial areas such as Transcatheter Aortic Valve Replacement (TAVR).

This market leadership is supported by impressive financial performance. For instance, in the first quarter of 2024, Edwards Lifesciences reported total sales of $1.5 billion, a 10.4% increase compared to the same period in 2023. This growth underscores the market's confidence in their innovative products and established brand.

- Market Leadership: Edwards holds a leading position in the TAVR market, a segment experiencing robust growth.

- Brand Trust: Decades of innovation and patient focus have built a strong reputation, fostering trust among clinicians and patients.

- Intangible Asset: The brand reputation is a valuable intangible asset that drives customer loyalty and market share.

- Financial Validation: Strong sales growth in 2024, reaching $1.5 billion in Q1, reflects the market's positive reception of their offerings.

Edwards Lifesciences' key resources include its extensive intellectual property portfolio, particularly patents on its advanced heart valve technologies. This IP is vital for maintaining its competitive advantage and protecting significant R&D investments. The company's commitment to innovation is further demonstrated by its substantial R&D spending, which was $978.6 million in 2023, and its strategic approach to litigation to safeguard these valuable assets.

Value Propositions

Edwards Lifesciences is dedicated to significantly improving the quality of life for individuals battling structural heart disease. Their innovative medical devices aim to provide life-changing solutions, addressing critical needs that were previously unmet.

By focusing on patient well-being, Edwards Lifesciences strives to achieve better clinical outcomes. This patient-centric approach is the driving force behind their research and development, leading to advancements that can extend and enhance lives.

In 2024, Edwards Lifesciences reported strong performance in their Transcatheter Aortic Valve Replacement (TAVR) segment, a key area for improving quality of life in patients with aortic stenosis. Their commitment to innovation in this field directly translates to better patient experiences and recovery.

Edwards Lifesciences is at the forefront of providing less invasive treatment alternatives, with Transcatheter Aortic Valve Replacement (TAVR) being a prime example. These advancements offer a significant departure from traditional open-heart surgery, aiming to shorten recovery periods and lessen patient discomfort.

The TAVR procedure has fundamentally reshaped how aortic valve stenosis is managed, becoming a new standard of care for numerous individuals. In 2023, Edwards Lifesciences reported global TAVR sales of $3.5 billion, underscoring the market's embrace of these innovative, minimally invasive solutions.

Edwards Lifesciences' commitment to pioneering and differentiated technologies is a cornerstone of its value proposition. Their SAPIEN platform for transcatheter aortic valve replacement (TAVR) and the PASCAL and EVOQUE systems for transcatheter mitral and tricuspid valve therapies (TMTT) exemplify this. These advanced devices consistently deliver superior performance and possess unique features that create a distinct competitive advantage.

These innovations are not just about new products; they represent Edwards' dedication to providing leading-edge solutions for complex cardiovascular conditions. The company's focus on research and development ensures that their offerings remain at the forefront of medical technology, addressing unmet clinical needs and improving patient outcomes. For instance, Edwards' TAVR market share was approximately 50% in 2023, underscoring the market's confidence in their differentiated technology.

Comprehensive Clinical and Educational Support

Edwards Lifesciences offers robust clinical and educational support, ensuring healthcare professionals can expertly utilize their advanced medical devices. This commitment extends to comprehensive training programs, on-site clinical specialists, and continuous technical assistance, all designed to enhance user proficiency.

This dedicated support system is crucial for achieving superior patient outcomes and driving the successful integration of innovative treatment modalities. For instance, in 2024, Edwards reported significant investment in its professional education initiatives, aiming to train thousands of clinicians globally on its latest transcatheter aortic valve replacement (TAVR) technologies.

- Extensive Training Programs: Edwards provides hands-on training and simulation-based education for its device portfolio.

- Clinical Specialist Support: Dedicated specialists offer real-time guidance during procedures and ongoing case support.

- Ongoing Technical Assistance: Ensuring continuous functionality and optimal performance of their complex devices.

- Focus on Patient Outcomes: The ultimate goal is to empower clinicians to deliver the best possible care and improve patient lives.

Addressing Unmet Patient Needs

Edwards Lifesciences prioritizes tackling significant, unsolved patient needs within structural heart disease. This includes venturing into new areas such as structural heart failure and aortic regurgitation, demonstrating a commitment to expanding care options.

The company's strategy involves consistently broadening its product offerings to meet these evolving challenges. This proactive approach ensures that Edwards can offer solutions to a wider patient population experiencing complex cardiac conditions.

For instance, in 2024, Edwards continued its focus on developing minimally invasive technologies for conditions like aortic stenosis and mitral regurgitation. Their commitment to innovation aims to address the substantial number of patients who may not be suitable candidates for traditional open-heart surgery.

- Focus on Unmet Needs: Addressing critical gaps in treatment for conditions like structural heart failure.

- Portfolio Expansion: Continuously developing solutions for a wider array of structural heart diseases.

- Minimally Invasive Solutions: Providing advanced options for patients who may not be candidates for open-heart surgery.

- Broadening Patient Access: Aiming to offer effective treatments to a larger segment of the patient population.

Edwards Lifesciences' value proposition centers on delivering life-changing, differentiated technologies that address critical unmet needs in structural heart disease. Their commitment to innovation, exemplified by their leading TAVR portfolio and expanding TMTT offerings, provides superior patient outcomes and less invasive treatment alternatives.

The company also emphasizes robust clinical and educational support, empowering healthcare professionals to effectively utilize their advanced devices and achieve the best possible patient care. This dual focus on technological advancement and user enablement solidifies their position as a leader in cardiovascular solutions.

Edwards is actively expanding its reach by developing solutions for a broader spectrum of structural heart conditions, including heart failure, thereby increasing access to advanced treatments for more patients.

| Key Value Proposition Area | Description | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Differentiated Technologies | Leading TAVR and TMTT platforms offering superior performance and unique features. | TAVR Market Share: ~50% (2023). Global TAVR Sales: $3.5 billion (2023). |

| Addressing Unmet Needs | Expanding solutions into areas like structural heart failure and aortic regurgitation. | Continued focus on developing minimally invasive technologies for complex cardiac conditions. |

| Clinical & Educational Support | Comprehensive training and ongoing assistance for healthcare professionals. | Significant investment in professional education initiatives in 2024 to train thousands of clinicians globally. |

Customer Relationships

Edwards Lifesciences cultivates direct relationships with hospitals and clinicians via its specialized sales force and clinical specialists. These experts offer crucial in-person support, training, and technical assistance during procedures, ensuring optimal device use and patient outcomes.

This hands-on approach is vital for the adoption of complex cardiovascular technologies. For instance, in 2023, Edwards Lifesciences reported that its sales force played a key role in the successful rollout of new transcatheter aortic valve replacement (TAVR) systems, contributing to a significant increase in procedures performed.

Edwards Lifesciences cultivates enduring, collaborative ties with influential figures in medicine, leading hospitals, and integrated healthcare networks. These alliances frequently encompass shared research projects, early access to novel medical devices, and strategic collaborations aimed at enhancing patient outcomes.

In 2024, Edwards Lifesciences continued to invest heavily in these key relationships, recognizing their critical role in driving innovation and market adoption. For instance, their commitment to partnering with academic medical centers for clinical trials of their latest transcatheter aortic valve replacement (TAVR) systems underscores this strategy. These deep-seated collaborations foster mutual advancement and ensure that Edwards' cutting-edge technologies are rigorously tested and readily integrated into clinical practice, ultimately benefiting patient care.

Edwards Lifesciences prioritizes equipping healthcare professionals with the knowledge to effectively utilize its advanced medical technologies. This includes comprehensive training programs designed for physicians and clinical staff, ensuring they are adept with the company's innovative solutions.

These educational efforts encompass a variety of formats, such as hands-on workshops, informative symposia, and accessible online learning modules. For instance, in 2024, Edwards conducted over 500 physician training sessions globally, impacting thousands of clinicians.

By fostering proficiency and sharing the latest clinical best practices, Edwards reinforces its position as a leader in the field, ultimately contributing to improved patient outcomes and the successful adoption of its life-saving technologies.

Responsive Technical and Customer Service

Edwards Lifesciences prioritizes responsive technical and customer service, understanding the critical role their medical devices play in patient care. This commitment ensures healthcare providers receive timely assistance, minimizing disruptions and fostering confidence in Edwards' solutions. For instance, in 2023, Edwards reported significant investment in its global support infrastructure to enhance responsiveness.

- Ensuring Device Uptime: Rapid technical support is crucial for maintaining the operational continuity of Edwards' life-sustaining technologies.

- Building Trust: Effective customer service strengthens relationships with hospitals and clinicians, reinforcing Edwards' reputation for reliability.

- 2023 Support Metrics: Edwards aimed to reduce average response times for critical technical inquiries by 15% in 2023 through enhanced digital tools and expanded support teams.

- Proactive Engagement: Beyond reactive support, Edwards also focuses on proactive customer engagement through training and educational resources to prevent issues.

Patient-Focused Culture and Advocacy

Edwards Lifesciences cultivates a deeply patient-focused culture, with employees frequently engaging with patients and their families. This direct interaction fosters a profound understanding of patient needs and experiences, directly influencing their product development and service strategies.

While Edwards does not sell directly to patients, this patient-centric ethos significantly shapes their relationships with healthcare professionals. It inspires innovation and cultivates a shared dedication to enhancing patient outcomes and quality of life.

- Patient Interaction: Employees engage with patients to understand their journey, informing product design and support.

- Clinician Collaboration: A patient-first approach strengthens partnerships with medical professionals, driving shared goals.

- Every Heartbeat Matters: This initiative underscores Edwards' commitment to patient well-being and advocacy.

Edwards Lifesciences builds strong customer relationships through a dedicated sales force and clinical specialists who provide direct, hands-on support and training to hospitals and clinicians. This approach is crucial for the adoption of their advanced cardiovascular technologies, as seen in 2023 when their sales team facilitated the successful introduction of new TAVR systems, leading to increased procedures.

The company also nurtures collaborative ties with medical leaders and healthcare networks, often involving joint research and early access to new devices. In 2024, this strategy was evident in their significant investments in partnerships with academic medical centers for clinical trials of their latest TAVR systems, ensuring rigorous testing and seamless integration into patient care.

Edwards prioritizes comprehensive training for healthcare professionals, utilizing workshops, symposia, and online modules to ensure proficiency with their technologies. In 2024 alone, they conducted over 500 global physician training sessions, impacting thousands of clinicians and reinforcing their leadership in the field.

Responsive technical and customer service is paramount, with significant investment in global support infrastructure in 2023 to enhance responsiveness and minimize disruptions for healthcare providers using their life-sustaining devices.

Channels

Edwards Lifesciences leans heavily on its direct sales force to connect with key customers in major markets such as the United States, Europe, and Japan. This approach allows for crucial face-to-face interaction with hospitals, cardiologists, and surgeons, ensuring they receive in-depth product understanding and vital clinical support.

In 2023, Edwards Lifesciences reported total sales of $5.8 billion, with a significant portion attributed to the effectiveness of their direct sales model in fostering strong customer relationships and driving market penetration for their advanced cardiovascular devices.

In specific international regions, Edwards Lifesciences leverages specialized distributors and agents to broaden its global presence. These partners are crucial for navigating complex local market conditions, understanding diverse regulatory landscapes, and accessing established distribution channels. This strategy is vital for efficient market penetration in countries where a direct presence might be less feasible.

Edwards Lifesciences directly interfaces with hospital procurement departments and larger integrated delivery networks (IDNs). These relationships are paramount for gaining access to product formularies and negotiating substantial volume contracts, which are key to market penetration.

In 2024, the healthcare supply chain continued to emphasize efficiency and cost-effectiveness, with hospitals increasingly consolidating purchasing power through IDNs. Edwards' strategy of engaging these central procurement bodies allows them to secure favorable terms and ensure their innovative cardiovascular devices are prioritized.

Cultivating robust partnerships with these administrative and purchasing functions is essential for ensuring Edwards' products are consistently available and preferred within the complex healthcare ecosystem, driving consistent revenue streams.

Clinical Training Programs and Centers

Edwards Lifesciences utilizes its clinical training programs and dedicated centers as a crucial channel for driving product adoption. These initiatives are designed to equip physicians and clinical staff with the necessary skills for the safe and effective deployment of their advanced medical devices, particularly in areas like transcatheter heart valve replacement.

By offering hands-on experience, Edwards directly addresses the learning curve associated with innovative therapies. This educational approach is vital for fostering confidence and competence among healthcare providers, ultimately leading to wider acceptance and utilization of their products. For instance, in 2024, Edwards continued to expand its global training network, aiming to reach thousands of clinicians annually.

- Product Adoption Accelerator: Clinical training centers directly support the uptake of Edwards' innovative cardiovascular technologies.

- Skill Development Focus: Hands-on programs ensure healthcare professionals can safely and effectively use complex devices.

- Therapy Advancement: These centers are key to shortening the learning curve for new and evolving treatment modalities.

- Global Reach: Edwards consistently invests in its training infrastructure to support a growing international customer base.

Medical Conferences and Professional Societies

Edwards Lifesciences leverages major medical conferences, symposia, and collaborations with professional societies as crucial channels. These platforms are essential for sharing robust clinical evidence and highlighting their innovative medical technologies to a wide array of healthcare professionals.

These engagements are instrumental in influencing clinical practice and driving the adoption of new treatment paradigms. For instance, participation in events like the Transcatheter Cardiovascular Therapeutics (TCT) conference allows Edwards to directly engage with interventional cardiologists and cardiac surgeons, key decision-makers for their structural heart and critical care products.

In 2024, Edwards Lifesciences continued its strong presence at leading cardiology and cardiothoracic surgery congresses worldwide. These events serve as vital touchpoints for scientific exchange and product education, directly impacting their market reach and physician engagement strategies.

- Dissemination of Clinical Evidence: Conferences provide a platform for presenting pivotal trial results and real-world data supporting Edwards' device efficacy and patient outcomes.

- Showcasing New Technologies: Symposia and exhibit booths allow for hands-on demonstrations and detailed explanations of next-generation products to clinicians.

- Influencing Clinical Practice: Partnerships with societies facilitate discussions that can shape treatment guidelines and best practices in cardiovascular care.

- Targeted Audience Reach: These events ensure Edwards connects with the specific medical specialists who prescribe and utilize their advanced medical technologies.

Edwards Lifesciences also utilizes a robust digital presence, including educational websites and virtual events, to reach a broader audience of healthcare professionals. This complements their direct sales efforts by providing accessible information and training resources, especially for those in remote locations or seeking on-demand learning.

The company's commitment to digital engagement was evident in 2024 with expanded online educational modules and webinars, contributing to their global strategy of accessible product knowledge. This digital channel is increasingly important for reaching new clinicians and reinforcing existing relationships.

Edwards Lifesciences' approach to channels is multi-faceted, combining direct sales for deep customer engagement, distributors for international reach, direct relationships with procurement entities, and extensive clinical training and educational programs. Major medical conferences and a growing digital presence further amplify their market influence and product adoption.

Customer Segments

Interventional cardiologists represent a critical customer segment for Edwards Lifesciences, as they are the primary practitioners of minimally invasive cardiac procedures like TAVR. These specialists directly utilize Edwards' advanced valve replacement and repair technologies. In 2024, the demand for TAVR procedures continued its upward trajectory, with global TAVR procedures projected to reach over one million annually by 2028, directly impacting the volume of Edwards' key products used by this segment.

Cardiac surgeons are a cornerstone customer segment for Edwards Lifesciences, relying on their extensive portfolio of surgical heart valve repair and replacement devices. These professionals demand products that offer both durability and superior performance in complex procedures, ensuring optimal patient outcomes.

While transcatheter aortic valve replacement (TAVR) has gained prominence, traditional open-heart surgery remains essential for a significant patient population. Edwards continues to invest in and innovate within this surgical space, understanding the ongoing need for high-quality surgical valves. In 2024, Edwards' surgical valve sales, though a smaller portion of their overall revenue compared to TAVR, still represented a substantial market, underscoring the continued importance of this segment.

Hospital administrators and purchasing groups are key decision-makers for Edwards Lifesciences. These entities, including executives and Group Purchasing Organizations (GPOs), manage technology adoption and budget approvals, directly impacting Edwards' market penetration. In 2024, GPOs continued to play a significant role in negotiating pricing and access for medical devices, with many large GPOs representing substantial portions of hospital purchasing power.

Intensivists and Critical Care Professionals (Historical)

Historically, intensivists and critical care professionals represented a vital customer segment for Edwards Lifesciences, particularly for their advanced hemodynamic monitoring solutions. These professionals relied on Edwards' technology to make critical, real-time decisions in intensive care units, directly impacting patient outcomes. Their adoption of these tools was foundational to the success of Edwards' Critical Care division.

While the Critical Care business was divested to BD in 2024, this segment's historical importance cannot be overstated. For instance, prior to the divestiture, Edwards' hemodynamic monitoring products were integral to managing complex patient conditions, supporting thousands of critical care decisions daily across numerous healthcare institutions. This past contribution highlights the segment's significant role in shaping Edwards' business model.

- Historical Reliance: Intensivists and critical care nurses were primary users of Edwards' hemodynamic monitoring systems.

- Impact on Decision-Making: These professionals utilized Edwards' tools for informed patient management in high-stakes environments.

- Divestiture Context: The Critical Care business, serving this segment, was sold to BD in 2024, shifting Edwards' strategic focus.

- Current Focus: Edwards Lifesciences now concentrates exclusively on its structural heart business.

Patients (Indirect Beneficiaries)

Patients with structural heart disease represent the core, albeit indirect, customer segment for Edwards Lifesciences. Their improved quality of life and survival rates are the ultimate measure of success for the company's life-saving technologies.

Edwards Lifesciences actively engages with patient advocacy groups, recognizing their crucial role in shaping research priorities and informing product development. This focus ensures that innovations directly address the real-world needs and challenges faced by patients. For instance, the company's commitment to minimally invasive procedures, like transcatheter aortic valve replacement (TAVR), directly stems from the desire to reduce patient recovery times and improve their overall experience.

The company's significant investment in clinical trials, often involving thousands of patients globally, underscores the centrality of this segment. In 2023, Edwards Lifesciences reported substantial revenue growth, partly driven by the increasing adoption of its TAVR devices, directly reflecting positive patient outcomes and surgeon confidence. The company's ongoing research and development pipeline is heavily influenced by the unmet needs of patients who may not be suitable candidates for traditional open-heart surgery.

- Ultimate Beneficiaries: Patients with conditions like aortic stenosis and mitral regurgitation are the primary beneficiaries of Edwards Lifesciences' advanced cardiovascular technologies.

- Driving Innovation: Patient outcomes and evolving clinical needs are paramount in guiding Edwards Lifesciences' product development and research initiatives.

- Patient Advocacy Integration: The company actively partners with patient organizations to ensure its mission and product strategies align with patient well-being and preferences.

- Market Growth Indicator: The increasing demand for minimally invasive solutions, such as TAVR, highlights the positive impact on patient recovery and quality of life, contributing to Edwards Lifesciences' market expansion.

Healthcare providers, including hospitals and clinics, are crucial customer segments for Edwards Lifesciences, as they are the direct purchasers and implementers of its cardiovascular technologies. These institutions rely on Edwards for advanced devices that improve patient care and operational efficiency.

In 2024, the focus on value-based care continued to influence purchasing decisions, pushing hospitals to adopt technologies that demonstrate clear clinical and economic benefits. Edwards' commitment to innovation in minimally invasive procedures, like TAVR, directly addresses this trend, offering solutions that can reduce hospital stays and improve patient outcomes.

Edwards Lifesciences also serves the broader medical community through partnerships with research institutions and academic medical centers. These collaborations are vital for advancing the understanding and treatment of structural heart disease, often leading to the development of next-generation technologies. In 2024, continued investment in clinical research by Edwards supported the expansion of indications for its existing products and the development of new therapeutic options.

| Customer Segment | Key Needs/Interests | 2024 Relevance |

|---|---|---|

| Interventional Cardiologists | Minimally invasive valve solutions (TAVR), procedural efficiency | Primary users of TAVR devices, driving volume growth. Global TAVR procedures projected to exceed 1 million annually by 2028. |

| Cardiac Surgeons | Durable surgical valves, advanced repair technologies | Continued demand for high-quality surgical valves, representing a substantial, though smaller, market share. |

| Hospital Administrators/GPOs | Cost-effectiveness, technology adoption, patient outcomes | Key budget holders; GPOs significantly influence device pricing and access. |

| Patients | Improved quality of life, reduced recovery time, access to advanced treatments | Ultimate beneficiaries; their needs drive innovation and market demand for minimally invasive options. |

| Healthcare Providers (Hospitals/Clinics) | Clinical efficacy, economic value, operational integration | Direct purchasers and implementers; adoption driven by value-based care initiatives. |

Cost Structure

Edwards Lifesciences heavily invests in Research and Development, a cornerstone of its cost structure. This significant expenditure fuels the innovation pipeline for groundbreaking structural heart therapies.

In 2023, Edwards Lifesciences reported R&D expenses of $1.3 billion, representing approximately 13% of its total net sales. This investment covers extensive clinical trials, salaries for highly skilled scientific and medical personnel, and the ongoing development of next-generation technologies.

This commitment to R&D is crucial for Edwards Lifesciences to maintain its leadership position in the structural heart market and to introduce novel solutions that address unmet patient needs, thereby driving future revenue growth.

Manufacturing and production expenses are a significant driver of Edwards Lifesciences' cost structure, encompassing the procurement of specialized raw materials, skilled labor for assembly, and factory overhead. For instance, the complex nature of producing devices like TAVR and TMTT systems demands meticulous engineering and rigorous quality assurance, contributing to higher production costs.

The company's commitment to maintaining high-precision standards for its surgical heart valves and other critical medical devices directly impacts these manufacturing costs. Efficient production processes and robust quality control are paramount to managing these expenses effectively, ensuring both product integrity and cost-effectiveness in a competitive market.

Edwards Lifesciences' Sales, General, and Administrative (SG&A) expenses cover a broad range of activities crucial for their market presence. This includes the costs associated with their global sales teams, extensive marketing initiatives, and vital professional education programs for healthcare providers.

These SG&A costs are fundamental to Edwards' strategy for penetrating new markets, fostering strong relationships with customers, and ensuring the smooth operation of their worldwide business. For instance, in the first quarter of 2024, Edwards reported SG&A expenses of $350.9 million, representing 24.5% of their total sales.

The company actively works to improve the efficiency of these expenditures, aiming to reduce SG&A as a proportion of their overall sales. This focus on optimization helps maintain profitability while supporting continued growth and innovation in the cardiovascular medical device sector.

Clinical Trial and Regulatory Compliance Costs

Edwards Lifesciences faces substantial expenses related to clinical trials and regulatory compliance. These are critical for bringing innovative cardiovascular devices to market and ensuring patient safety.

The company invests heavily in patient enrollment, rigorous data collection, and the preparation of complex submissions to regulatory bodies worldwide. For instance, the development and approval of new transcatheter aortic valve replacement (TAVR) systems involve multi-year, multi-million dollar clinical studies.

Compliance with varying international regulations, such as those from the FDA in the United States and the EMA in Europe, adds ongoing operational costs. These include maintaining quality management systems and conducting post-market surveillance to monitor device performance and safety.

- Clinical Trial Expenses: Costs associated with patient recruitment, study site management, data analysis, and investigator fees for trials like the PARTNER studies.

- Regulatory Submission Fees: Payments to regulatory agencies for the review of new device applications and supplements.

- Post-Market Surveillance: Ongoing costs for monitoring device performance, adverse event reporting, and potential field actions.

- Compliance Infrastructure: Investment in quality systems, personnel, and audits to meet global regulatory standards.

Intellectual Property Management and Litigation Costs

Edwards Lifesciences allocates significant resources to managing its intellectual property, including the ongoing costs associated with maintaining a robust patent portfolio. These expenses are crucial for protecting its groundbreaking medical technologies.

The company also faces potential litigation costs to defend its innovations against infringement. For instance, in 2023, Edwards Lifesciences reported legal expenses as part of its operating costs, reflecting the proactive measures taken to secure its market leadership and technological advancements.

- Patent Maintenance Fees: Ongoing costs to keep a large portfolio of patents active globally.

- Litigation Expenses: Costs incurred for defending patents or pursuing infringement cases.

- Legal Counsel and Expert Witnesses: Fees associated with specialized legal services.

- Strategic IP Protection: Investments in safeguarding competitive advantages derived from innovation.

Edwards Lifesciences' cost structure is heavily influenced by its substantial investments in research and development, manufacturing, and sales, general, and administrative (SG&A) expenses. These areas are critical for maintaining its leadership in the structural heart market and driving innovation.

In 2023, R&D spending reached $1.3 billion, approximately 13% of net sales, underscoring the company's commitment to new product development and clinical trials. SG&A expenses for the first quarter of 2024 were $350.9 million, or 24.5% of sales, reflecting investments in global sales teams and marketing efforts.

Beyond these core areas, significant costs are incurred for clinical trials and regulatory compliance, essential for market access and patient safety. The company also dedicates resources to intellectual property protection, including patent maintenance and potential litigation, to safeguard its technological advancements.

| Cost Category | 2023 (Approximate) | Key Drivers |

| Research & Development | $1.3 Billion | New product innovation, clinical trials, scientific personnel |

| Manufacturing & Production | Significant portion of COGS | Raw materials, skilled labor, quality control for complex devices |

| Sales, General & Administrative (SG&A) | $350.9 Million (Q1 2024) | Global sales force, marketing, professional education |

| Clinical Trials & Regulatory | Multi-million dollar investments | Patient enrollment, data collection, regulatory submissions, compliance |

| Intellectual Property | Ongoing operational costs | Patent maintenance, legal defense, IP protection strategies |

Revenue Streams

Edwards Lifesciences' primary revenue source is the global sale of its Transcatheter Aortic Valve Replacement (TAVR) systems, notably the SAPIEN platform. This segment is the company's largest contributor to overall sales, demonstrating its critical importance.

In 2023, Edwards Lifesciences reported TAVR sales of $4.2 billion, representing a significant portion of its total revenue. This growth is fueled by wider patient access, new applications for TAVR, and continuous innovation in valve technology.

Sales of transcatheter mitral and tricuspid valve repair and replacement systems, such as the PASCAL and EVOQUE devices, represent a rapidly expanding revenue source for Edwards Lifesciences. The company's substantial investment in this segment signals strong confidence in the future growth driven by increasing adoption of these minimally invasive therapies.

Edwards Lifesciences derives substantial revenue from its established surgical heart valve repair and replacement products. This segment includes a robust offering of both tissue heart valves and various repair components, forming a cornerstone of their business.

Products like the RESILIA tissue valve technology represent a significant and consistent revenue contributor, underscoring the enduring importance of their surgical structural heart portfolio within the company's overall financial structure. For instance, in 2023, Edwards reported total sales of $5.3 billion, with their Surgical Structural Heart segment contributing a substantial portion, demonstrating the continued strength of these core offerings.

Sales of Hemodynamic Monitoring Solutions (Prior to Divestiture)

Historically, the Critical Care segment, featuring sophisticated hemodynamic monitoring systems, was a significant contributor to Edwards Lifesciences' revenue. These solutions provided vital data for managing critically ill patients.

In a strategic pivot, Edwards Lifesciences divested its Critical Care business to Becton, Dickinson and Company (BD) in June 2024. This move allowed the company to sharpen its focus on its core competency: structural heart disease solutions.

- Historical Revenue Contribution: The Critical Care segment, prior to its sale, generated substantial revenue for Edwards Lifesciences, reflecting the demand for advanced patient monitoring technology.

- Divestiture Impact: The sale of this segment in June 2024 marked a significant strategic shift, streamlining Edwards Lifesciences' business operations.

- Focus on Structural Heart: Post-divestiture, Edwards Lifesciences now dedicates its resources and innovation efforts exclusively to the structural heart disease market.

Ancillary Product Sales and Licensing

Edwards Lifesciences generates additional revenue through the sale of ancillary products that complement their primary medical devices. These include items like catheters and various accessories essential for the effective use of their core offerings. While these sales are secondary to their main product lines, they contribute to overall revenue diversification.

Furthermore, Edwards Lifesciences may also realize minor revenue streams from licensing its proprietary technologies or intellectual property. This typically occurs in specialized situations where third parties can leverage Edwards' innovations, providing a supplementary income source without direct product sales.

For instance, in 2023, Edwards Lifesciences reported total net sales of $5.3 billion. While specific figures for ancillary product sales and licensing are not itemized separately in their primary financial reporting, these smaller revenue streams play a role in their comprehensive business model.

- Ancillary Product Sales: Revenue from catheters, accessories, and other complementary items used with primary devices.

- Technology Licensing: Income generated from granting rights to use specific technologies or intellectual property to third parties.

- Revenue Contribution: These streams, while less substantial than core product sales, contribute to overall financial performance and diversification.

- 2023 Performance: Edwards Lifesciences achieved $5.3 billion in total net sales in 2023, with ancillary and licensing revenues forming a supporting component.

Edwards Lifesciences' revenue is primarily driven by its innovative structural heart solutions, with Transcatheter Aortic Valve Replacement (TAVR) systems, particularly the SAPIEN platform, leading the way. The company also generates significant income from its surgical heart valve repair and replacement products, including those featuring RESILIA tissue technology. Additionally, Edwards is expanding its revenue from transcatheter mitral and tricuspid valve repair and replacement systems like PASCAL and EVOQUE.

| Revenue Stream | 2023 Contribution (Approximate) | Key Products/Segments |

| Transcatheter Aortic Valve Replacement (TAVR) | $4.2 billion | SAPIEN platform |

| Surgical Structural Heart | Significant portion of $5.3 billion total sales | Tissue heart valves, repair components, RESILIA technology |

| Transcatheter Mitral & Tricuspid Therapies | Growing segment | PASCAL, EVOQUE devices |

| Ancillary Products & Licensing | Supporting component | Catheters, accessories, technology licensing |

Business Model Canvas Data Sources

The Edwards Lifesciences Business Model Canvas is built upon a foundation of comprehensive market research, internal financial reports, and extensive clinical trial data. These sources ensure each block is populated with accurate, actionable insights into patient needs and market opportunities.