Edwards Lifesciences Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

Edwards Lifesciences' marketing prowess is built on a foundation of innovative products, strategic pricing, targeted distribution, and impactful promotions. Their commitment to advancing cardiovascular care is evident in every aspect of their 4Ps strategy.

Discover how Edwards Lifesciences leverages its cutting-edge product portfolio, sophisticated pricing models, extensive global reach, and compelling communication strategies to maintain its leadership in the medical technology sector. Get the full analysis in an editable, presentation-ready format.

Product

Edwards Lifesciences' product strategy centers on its pioneering transcatheter heart valve replacement (TAVR) systems, notably the SAPIEN platform. This technology offers a less invasive alternative to traditional open-heart surgery for aortic valve replacement. The FDA's approval for treating asymptomatic severe aortic stenosis patients in 2024 signifies a significant expansion of its market reach, moving beyond symptomatic cases.

These advanced TAVR solutions are crucial for patients suffering from structural heart disease, providing life-saving treatment and broadening access to critical care. Edwards' commitment to expanding the use of TAVR is evident in its substantial investments in ongoing clinical trials, such as the EARLY TAVR study, which aims to solidify the advantages of early intervention for eligible patients.

Edwards Lifesciences is aggressively expanding its Transcatheter Mitral and Tricuspid Therapies (TMTT) portfolio, a key component of its product strategy. This includes the PASCAL Precision system for mitral and tricuspid regurgitation and the EVOQUE tricuspid valve. These advancements target critical unmet needs in complex valve diseases beyond the well-established aortic stenosis market.

The company projects substantial growth in the TMTT segment, driven by ongoing innovation and regulatory milestones. For instance, the recent CE Mark for the SAPIEN M3 valve is designed to further cement Edwards' leadership position in this burgeoning field. The TMTT market is expected to reach over $10 billion by 2028, according to some industry analyses, highlighting the significant commercial opportunity.

Edwards Lifesciences' surgical structural heart products, including their RESILIA tissue technology found in valves like INSPIRIS, MITRIS, and KONECT, represent a significant offering in cardiac surgery. This advanced tissue technology aims for superior durability and long-term patient outcomes, setting a new benchmark for tissue valves.

The company's commitment to addressing critical unmet needs in cardiac surgery worldwide is evident in their product development. For instance, Edwards Lifesciences reported total sales of $6.3 billion in 2023, with their Surgical business contributing significantly to this figure, underscoring the market demand for their innovative structural heart solutions.

Advanced Hemodynamic Monitoring Solutions

Edwards Lifesciences' advanced hemodynamic monitoring solutions, while historically a significant part of their offering, have been divested to focus on structural heart disease. These systems were vital in critical care, providing real-time data on cardiac output and fluid dynamics to guide treatment. For instance, their FloTrac system offered a less invasive method for monitoring, which was particularly beneficial in complex surgical cases.

The strategic shift means that innovation and investment in this area are now directed elsewhere, allowing Edwards to deepen its expertise in transcatheter aortic valve replacement (TAVR) and other structural heart interventions. This divestiture, completed in 2023, allows the company to streamline its portfolio and capitalize on growth opportunities in its primary markets. Edwards Lifesciences reported robust growth in its structural heart segment in 2024, with sales increasing by 15% year-over-year.

- Product Focus: Historically, advanced hemodynamic monitoring solutions like the FloTrac system.

- Market Impact: Crucial for critical care decision-making regarding patient hemodynamics.

- Strategic Shift: Divested to concentrate resources on structural heart disease.

- Financial Implication: Allows greater focus on high-growth structural heart business, which saw a 15% sales increase in 2024.

Innovation and Pipeline Development

Edwards Lifesciences' commitment to innovation is a cornerstone of its product strategy, evidenced by significant investments in research and development. The company consistently prioritizes the advancement of breakthrough technologies and seeks to broaden the applicability of its current therapies to reach more patients.

Edwards is actively exploring new therapeutic avenues for structural heart failure and aortic regurgitation. These efforts are supported by ongoing clinical trials, which are crucial for validating and bringing these advancements to market. For instance, in 2023, Edwards Lifesciences reported R&D expenses of $1.1 billion, highlighting their dedication to pipeline development.

- Pipeline Focus: Expanding indications for existing therapies and developing novel treatments for structural heart disease.

- R&D Investment: A significant portion of revenue is allocated to research and development, with $1.1 billion spent in 2023.

- Future Growth Areas: Targeting new therapeutic areas like aortic regurgitation and advanced structural heart failure solutions.

- Clinical Trial Activity: Ongoing trials are key to validating and advancing their innovative product pipeline.

Edwards Lifesciences' product portfolio is anchored by its leading transcatheter heart valve replacement (TAVR) systems, particularly the SAPIEN platform, offering a less invasive alternative to open-heart surgery. The company is also aggressively expanding its Transcatheter Mitral and Tricuspid Therapies (TMTT) portfolio, including the PASCAL Precision and EVOQUE systems, targeting significant unmet needs in complex valve diseases. Furthermore, their surgical structural heart products, featuring RESILIA tissue technology, aim for superior durability in tissue valves, reinforcing their comprehensive approach to structural heart disease management.

| Product Category | Key Products/Technologies | Market Focus | 2023 Sales Contribution (Est.) |

|---|---|---|---|

| Transcatheter Heart Valves (TAVR) | SAPIEN Platform | Aortic Stenosis | Significant portion of $6.3B total sales |

| Transcatheter Mitral & Tricuspid Therapies (TMTT) | PASCAL Precision, EVOQUE | Mitral/Tricuspid Regurgitation | Growing segment, projected >$10B by 2028 |

| Surgical Heart Valves | RESILIA Tissue (INSPIRIS, MITRIS, KONECT) | Structural Heart Disease (Surgical) | Substantial contributor to Surgical business |

What is included in the product

This analysis provides a comprehensive examination of Edwards Lifesciences' marketing strategies, detailing their approach to Product innovation, Price considerations, Place (distribution), and Promotion efforts within the medical device industry.

Simplifies complex marketing strategies by presenting Edwards Lifesciences' 4Ps as actionable solutions to patient and physician pain points.

Provides a clear, concise overview of how Edwards Lifesciences addresses market needs through its product, price, place, and promotion strategies, easing the burden of understanding their competitive advantage.

Place

Edwards Lifesciences relies heavily on its direct sales force to connect with hospitals and healthcare institutions, ensuring their specialized cardiovascular devices reach the intended users. This direct channel fosters crucial relationships with clinicians, enabling them to provide in-depth product training and ongoing support. In 2023, Edwards reported a significant portion of its revenue generated through these direct relationships, underscoring the effectiveness of this strategy in driving adoption and ensuring proper product utilization within cardiac care settings.

Edwards Lifesciences leverages a robust global distribution network, ensuring its life-saving cardiovascular technologies are available in critical markets like the United States, Europe, and Japan. This expansive reach is fundamental to serving a broad and diverse patient base across the globe.

In 2023, Edwards reported net sales of $5.3 billion, underscoring the significant market penetration achieved through its distribution channels. The company's strategic focus continues to be on enhancing therapy adoption, particularly in emerging markets, aiming to bring its innovative solutions to millions more patients by 2025.

Edwards Lifesciences strategically positions its manufacturing operations across key global locations, including the United States, Singapore, Costa Rica, and Ireland. This diversified approach bolsters supply chain resilience, a critical factor in the medical device industry, and helps mitigate risks stemming from potential tariffs and logistical disruptions. For instance, in 2023, the company continued to leverage these hubs to ensure timely delivery of its life-saving cardiovascular devices, with a focus on efficiency and sustainability in its packaging and distribution processes.

Clinical Training and Education Centers

Edwards Lifesciences places significant emphasis on its clinical training and education centers, recognizing the critical need for healthcare professionals to be expertly trained on its advanced cardiovascular technologies. These centers are vital for ensuring the safe and effective use of complex devices like transcatheter heart valves and critical care monitoring systems.

The company's commitment to education facilitates the successful adoption of its innovative products, ultimately benefiting patient outcomes. For instance, in 2023, Edwards Lifesciences reported a strong performance driven by its TAVR (transcatheter aortic valve replacement) procedures, highlighting the importance of skilled clinicians in delivering these life-saving treatments.

Key aspects of their clinical training and education initiatives include:

- Hands-on Simulation: Providing realistic training environments for practicing surgical and interventional procedures.

- Expert-Led Workshops: Offering sessions led by experienced cardiologists and surgeons to share best practices.

- Continuing Medical Education (CME): Delivering accredited programs that help healthcare professionals stay current with the latest advancements and maintain their certifications.

- Global Reach: Establishing training facilities and programs worldwide to support a diverse international healthcare community.

Integrated Supply Chain Management

Effective supply chain management is paramount for Edwards Lifesciences, ensuring its life-saving medical devices reach patients and healthcare providers without delay. This involves meticulous inventory control, streamlined logistics, and unwavering adherence to stringent quality and safety regulations inherent in medical device distribution. The company's commitment to a resilient supply chain underpins its ability to deliver critical products efficiently and reliably to a global healthcare network.

In 2024, Edwards Lifesciences continued to invest in supply chain resilience. For instance, the company's focus on regional distribution hubs aims to mitigate risks associated with global disruptions, ensuring product availability. This strategic approach is vital for maintaining market leadership in the rapidly evolving cardiovascular device sector.

- Inventory Optimization: Edwards Lifesciences employs advanced forecasting and inventory management systems to balance product availability with carrying costs, a critical factor in the high-value medical device market.

- Logistics Network: The company leverages a global network of logistics partners, prioritizing temperature-controlled and secure transportation to maintain product integrity from manufacturing to point-of-care.

- Quality Assurance: Supply chain processes are integrated with rigorous quality control measures, ensuring compliance with FDA and other international regulatory standards throughout the product lifecycle.

- Supplier Relationships: Edwards Lifesciences cultivates strong relationships with key suppliers, focusing on reliability, quality, and ethical sourcing to secure critical components for its innovative technologies.

Edwards Lifesciences' place strategy emphasizes direct engagement with hospitals through its sales force, ensuring specialized cardiovascular devices reach clinicians effectively. This direct approach facilitates in-depth product training and ongoing support, crucial for the adoption of complex technologies.

The company also utilizes a robust global distribution network, making its life-saving cardiovascular technologies accessible in key markets like the US, Europe, and Japan. This broad reach is essential for serving a diverse patient population worldwide.

Edwards Lifesciences' manufacturing operations are strategically located globally, including the US, Singapore, and Costa Rica, enhancing supply chain resilience. This diversification helps mitigate risks from tariffs and logistical issues, ensuring timely delivery of critical devices.

In 2023, Edwards reported net sales of $5.3 billion, demonstrating significant market penetration driven by its distribution and direct sales strategies. The company's focus remains on expanding therapy adoption, particularly in emerging markets, aiming to reach millions more patients by 2025.

| Aspect | Description | 2023 Impact |

|---|---|---|

| Direct Sales Force | Crucial for hospital relationships and product training. | Drove significant revenue through clinician engagement. |

| Global Distribution | Ensures worldwide availability of cardiovascular technologies. | Supported $5.3 billion in net sales. |

| Manufacturing Locations | Diversified sites (US, Singapore, Costa Rica) for supply chain resilience. | Mitigated logistical risks and ensured timely product delivery. |

| Clinical Education Centers | Essential for expert training on advanced devices. | Facilitated successful product adoption, supporting TAVR procedure growth. |

Preview the Actual Deliverable

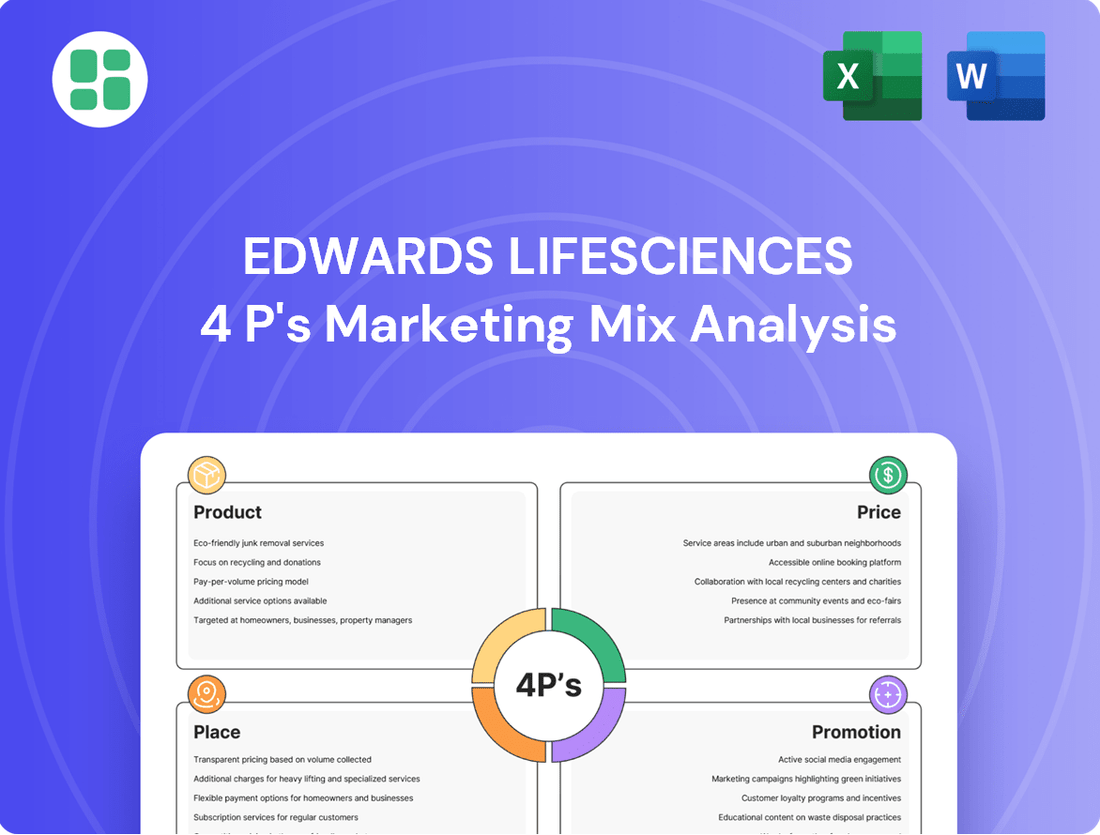

Edwards Lifesciences 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Edwards Lifesciences 4P's Marketing Mix Analysis is fully complete and ready for immediate use.

Promotion

Edwards Lifesciences champions its therapies by rigorously publishing clinical data from pivotal trials like EARLY TAVR, PARTNER II, and TRISCEND II. This scientific evidence is paramount in showcasing the effectiveness, safety, and enduring results of their innovative treatments.

The dissemination of this high-caliber evidence through respected peer-reviewed journals and leading scientific conferences forms a critical pillar of their promotional efforts. For instance, the PARTNER 3 trial, published in the New England Journal of Medicine in 2019, demonstrated Edwards' SAPIEN 3 device's non-inferiority to surgical valves in low-risk patients, a key data point influencing physician adoption.

Edwards Lifesciences prioritizes engagement at medical conferences like EuroPCR and TCT, crucial for reaching cardiologists and surgeons. In 2024, these events serve as key venues for presenting cutting-edge research and product innovations in structural heart disease. For instance, their presence at TCT 2024 likely highlighted advancements in transcatheter aortic valve replacement (TAVR) technology, directly influencing clinical adoption.

Edwards Lifesciences heavily relies on its specialized direct sales and clinical education teams for promotion. These experts offer deep product insights and crucial technical support to healthcare professionals, ensuring proper device implementation.

These teams are instrumental in fostering strong relationships within the medical community. Their focus on hands-on training and clinical understanding directly contributes to improved patient care and optimal device performance, a key differentiator for Edwards.

Patient Awareness and Advocacy Initiatives

Edwards Lifesciences actively engages in patient awareness and advocacy initiatives to combat heart valve disease. Campaigns like 'Reach for the Heart' and 'Get Heart Health Off the Sidelines' aim to educate the public about the condition and available treatments.

These efforts often involve collaborations with patient advocacy organizations and public figures to amplify their message. By encouraging early diagnosis and empowering patients to seek timely medical attention, Edwards Lifesciences seeks to improve outcomes and expand access to its life-saving therapies.

For instance, in 2023, Edwards Lifesciences reported a 9% increase in global sales for its minimally invasive TAVR (transcatheter aortic valve replacement) procedures, a testament to growing patient awareness and acceptance of advanced treatment options.

- Patient Empowerment: Initiatives focus on educating patients about heart valve disease symptoms and treatment pathways.

- Disease Awareness: Campaigns aim to destigmatize heart conditions and promote proactive health management.

- Access to Care: Advocacy efforts strive to reduce barriers and improve patient access to advanced therapies.

- Partnerships: Collaborations with advocacy groups and influencers extend reach and credibility.

Digital Marketing and Integrated Communications

Edwards Lifesciences leverages digital marketing and integrated communications to connect with healthcare professionals and patients. Their strategy includes utilizing their website, LinkedIn, Facebook, Instagram, and YouTube to share product information and build relationships. This integrated approach aims to boost digital engagement and clearly articulate the benefits of their innovative medical technologies.

The company's digital presence is crucial for conveying persuasive messages about product differentiators. For instance, in 2024, Edwards Lifesciences continued to invest in digital content creation, focusing on educational materials and patient testimonials. This digital push supports their broader marketing objectives by reaching a wider audience efficiently.

- Website Engagement: Edwards Lifesciences' website serves as a primary hub for detailed product information, clinical data, and corporate news, attracting a significant number of healthcare professional visits.

- Social Media Reach: Platforms like LinkedIn are used to share company updates and engage with medical professionals, while YouTube hosts educational videos and product demonstrations.

- Targeted Content: Digital content is tailored to specific audience segments, ensuring that messages about product benefits and patient outcomes resonate effectively.

- Digital Investment: The company's ongoing commitment to digital marketing reflects its understanding of the importance of online channels in reaching key stakeholders and driving brand awareness.

Edwards Lifesciences' promotional strategy is multifaceted, focusing on robust clinical evidence, direct engagement with healthcare professionals, patient empowerment, and strategic digital outreach.

The company’s commitment to disseminating pivotal trial data, such as from the PARTNER 3 trial, published in 2019, underpins physician confidence and adoption of their TAVR technologies. This scientific validation is critical in a highly regulated medical device market.

In 2024, Edwards continued to leverage key medical conferences like TCT and EuroPCR to showcase advancements, while their specialized sales and clinical education teams provide essential product support and training, fostering strong relationships within the medical community.

Patient awareness campaigns, like those seen in 2023 with a reported 9% global sales increase for TAVR, demonstrate the effectiveness of their efforts to educate the public and encourage early diagnosis and treatment seeking.

| Promotional Tactic | Key Activities/Focus | Impact/Data Point |

|---|---|---|

| Clinical Data Dissemination | Publication in peer-reviewed journals (e.g., PARTNER 3 in NEJM, 2019), presentations at scientific conferences | Establishes efficacy and safety, influences physician adoption. |

| Medical Conferences | Presence at EuroPCR, TCT (e.g., TCT 2024 showcasing TAVR advancements) | Direct engagement with cardiologists and surgeons, product innovation showcase. |

| Sales & Clinical Education | Specialized teams offering product insights and technical support | Fosters strong medical community relationships, ensures optimal device implementation. |

| Patient Awareness & Advocacy | Campaigns like 'Reach for the Heart', collaborations with advocacy groups | Increased patient understanding and proactive health management; contributed to 9% TAVR sales growth in 2023. |

| Digital Marketing | Website, LinkedIn, YouTube for product info, education, and testimonials | Enhanced digital engagement, efficient reach to key stakeholders, clear articulation of product benefits. |

Price

Edwards Lifesciences utilizes value-based pricing for its advanced medical technologies, such as transcatheter aortic valve replacement (TAVR) systems. This approach acknowledges the significant research and development costs, intricate device engineering, and the profound improvements in patient quality of life and survival rates. For instance, TAVR procedures have shown a reduction in hospital readmissions, contributing to overall healthcare cost savings.

Edwards Lifesciences' reimbursement strategy is crucial for market access, focusing on educating healthcare providers about coding, coverage, and payment for their innovative therapies. This proactive support helps ensure that the value of their products is recognized and reimbursed by payers worldwide.

The company actively engages with payers and healthcare systems to advocate for adequate funding and patient access to their life-saving technologies, a key component in their overall pricing approach. For instance, in 2024, Edwards continued to invest in dedicated teams and resources to assist providers in navigating these complex reimbursement pathways, aiming to reduce financial barriers to adoption.

Edwards Lifesciences actively publishes health economics and outcomes research, showcasing the long-term financial benefits of their technologies. These studies aim to prove that prompt treatment with their devices, such as early TAVR, can significantly lower overall healthcare expenditures and reduce the strain on hospital resources.

For instance, data from 2024 indicates that patients receiving early TAVR experienced a reduction in hospital readmissions by up to 15% compared to those managed medically, directly impacting cost savings. This evidence is crucial for justifying the pricing of their advanced medical devices by demonstrating their value proposition beyond initial acquisition costs.

Competitive Market Positioning

Edwards Lifesciences navigates a highly competitive medical device landscape by leveraging its differentiated technologies, which generally command stable pricing. This strategic pricing approach meticulously balances market share objectives with crucial profitability goals, always factoring in competitor strategies and prevailing market demand. The company's confidence in the inherent value of its innovations helps it weather regional pricing pressures effectively.

For instance, in 2023, Edwards Lifesciences reported total sales of $6.4 billion, reflecting the market's acceptance of its value-driven product portfolio. Their commitment to innovation, particularly in transcatheter aortic valve replacement (TAVR) systems, allows them to maintain a strong market position. The company's pricing power is evident in its gross profit margin, which remained robust throughout 2023.

- Stable Pricing: Edwards Lifesciences generally maintains stable pricing for its innovative medical devices, a testament to their technological differentiation.

- Strategic Balance: Pricing decisions are carefully calibrated to consider competitor pricing and market demand, aiming for an optimal mix of market penetration and profitability.

- Value Proposition: The company remains confident in the superior value its technological advancements offer, enabling it to withstand pricing challenges in various regions.

- 2023 Performance: With $6.4 billion in sales in 2023, Edwards Lifesciences demonstrates the market's willingness to pay for its differentiated solutions.

Impact of R&D and Regulatory Costs on Pricing

Edwards Lifesciences' commitment to pioneering new cardiovascular technologies necessitates substantial investment in research and development. This innovation pipeline, essential for future growth, directly impacts product pricing. For instance, in the first quarter of 2024, the company reported R&D expenses of $260.2 million, a testament to its ongoing dedication to advancing medical solutions.

Navigating complex regulatory landscapes, including securing approvals from bodies like the FDA and obtaining CE Marks for European markets, adds another layer of cost. These rigorous processes ensure product safety and efficacy but also contribute to the overall expense of bringing life-saving devices to market. Edwards' robust pipeline and its ability to gain regulatory clearance for new products are key drivers of its premium pricing strategy.

The company's financial guidance often reflects these considerable R&D and regulatory expenditures. For the full year 2024, Edwards projected total sales between $6.7 billion and $7.0 billion, with a focus on investing in innovation and global expansion. This strategic allocation of capital underscores the importance of these costs in maintaining their competitive edge and delivering value to shareholders.

- R&D Investment: Q1 2024 R&D expenses reached $260.2 million, highlighting continuous innovation.

- Regulatory Hurdles: Stringent FDA and CE Mark approvals are integral to product development costs.

- 2024 Sales Outlook: Projected sales of $6.7 billion to $7.0 billion reflect investments in R&D and market expansion.

Edwards Lifesciences' pricing strategy is deeply intertwined with the significant value their innovations bring to patients and the healthcare system. Their focus on value-based pricing, especially for TAVR systems, acknowledges substantial R&D costs and the improved quality of life and survival rates achieved by patients. This approach is supported by ongoing research demonstrating cost savings through reduced hospital readmissions, a key factor in justifying their premium pricing.

The company's 2023 sales reached $6.4 billion, reflecting market acceptance of their differentiated technologies. For 2024, Edwards projected total sales between $6.7 billion and $7.0 billion, with continued investment in innovation and market expansion. This outlook underscores their confidence in maintaining stable pricing due to technological superiority, balancing market share with profitability.

| Metric | Value | Year |

|---|---|---|

| Total Sales | $6.4 billion | 2023 |

| Projected Total Sales | $6.7 billion - $7.0 billion | 2024 |

| Q1 2024 R&D Expenses | $260.2 million | 2024 |

4P's Marketing Mix Analysis Data Sources

Our Edwards Lifesciences 4P's Marketing Mix Analysis is built on a foundation of comprehensive data, including official company reports, investor communications, and industry-specific market research. We meticulously examine product portfolios, pricing strategies, distribution channels, and promotional activities to provide an accurate representation of their market approach.