Edwards Lifesciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

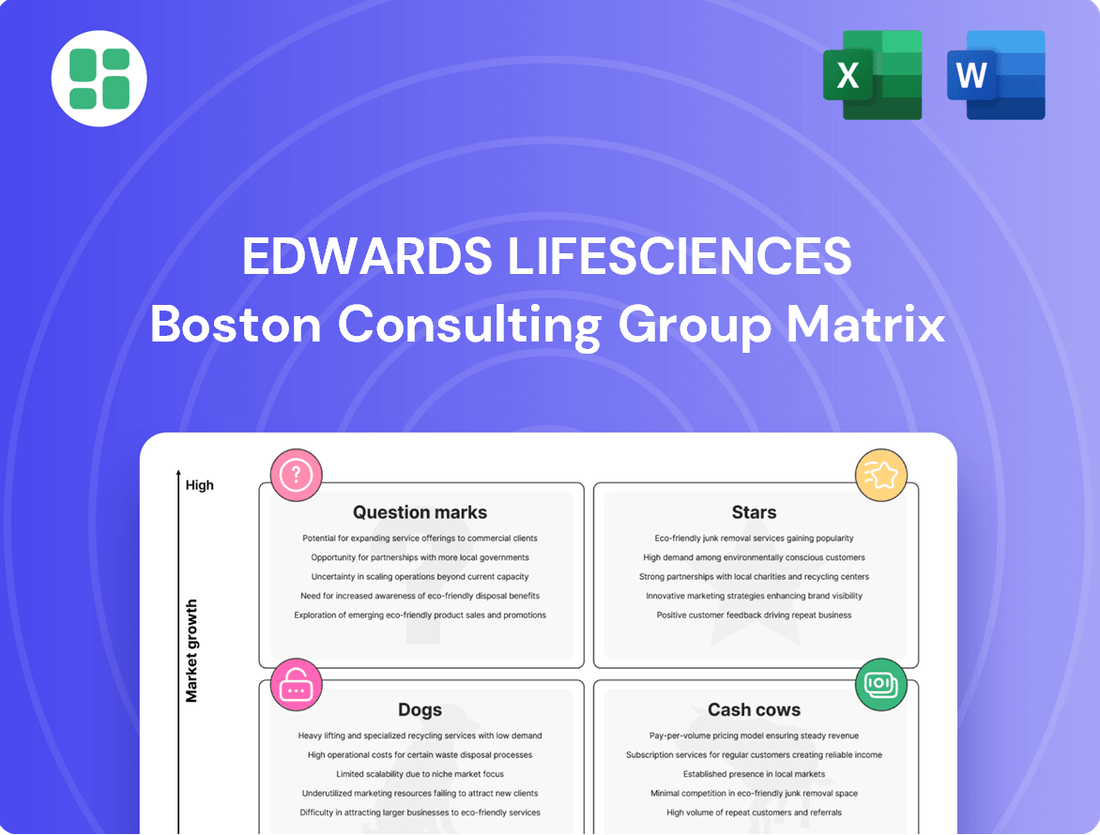

Edwards Lifesciences' product portfolio is a dynamic landscape, with some innovations poised for explosive growth and others providing steady returns. Understanding where each product falls within the BCG Matrix is crucial for strategic resource allocation.

This preview offers a glimpse into the potential of Edwards Lifesciences' offerings, but the full BCG Matrix unlocks a comprehensive view of their market position. Gain actionable insights into whether their products are Stars, Cash Cows, Dogs, or Question Marks.

Purchase the complete BCG Matrix today to receive detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investment and product strategy. Don't miss out on the opportunity to make informed decisions that drive future success.

Stars

The SAPIEN 3 Ultra RESILIA platform from Edwards Lifesciences holds a commanding position in the Transcatheter Aortic Valve Replacement (TAVR) market, boasting a significant market share. This leadership is fueled by ongoing advancements in its valve technology and delivery mechanisms, solidifying its competitive edge.

Clinical data from 2024 continues to underscore the platform's exceptional patient outcomes and extended durability. These strong results are a key driver for its widespread acceptance by healthcare providers and patients alike, reinforcing its status as a market leader.

The FDA's May 2025 approval for Edwards' SAPIEN 3 platform to treat asymptomatic severe aortic stenosis marks a pivotal moment. This expansion significantly broadens the market for Transcatheter Aortic Valve Replacement (TAVR), potentially adding millions of patients to the addressable population.

This new indication is poised to be a major growth driver for Edwards' TAVR business. The EARLY TAVR trial results, showcasing better patient outcomes with earlier intervention, provide strong clinical validation for this expanded use, reinforcing the value proposition of TAVR in asymptomatic patients.

The SAPIEN M3 Transcatheter Mitral Valve Replacement System from Edwards Lifesciences is poised to be a significant player in the mitral valve disease market. With CE Mark approval anticipated mid-2025 and U.S. approval in the first half of 2026, this system addresses a substantial unmet medical need by offering a less invasive treatment option compared to traditional surgery.

This innovative technology has the potential to be a first-mover in the European market, backed by robust clinical trial data. Its anticipated market entry positions it as a key contributor to future growth for Edwards Lifesciences, especially considering the significant addressable market for mitral valve interventions.

Overall TAVR Segment Leadership

Edwards Lifesciences holds a commanding position in the Transcatheter Aortic Valve Replacement (TAVR) market. Its leadership is underscored by a projected 72.3% market share in the U.S. TAVR segment by 2025, even with the emergence of new competitors.

The overall TAVR market is experiencing robust growth, with a healthy compound annual growth rate, which bodes well for continued expansion of the segment leader. This sustained dominance is actively supported by significant ongoing investments in clinical trials and product innovation.

- Market Dominance: Edwards Lifesciences is expected to capture approximately 72.3% of the U.S. TAVR market by 2025.

- Market Growth: The TAVR sector is expanding at a healthy compound annual growth rate, providing a favorable environment for market leaders.

- Strategic Investment: Continuous investment in clinical trials and product enhancements solidifies Edwards Lifesciences' leadership position.

Continuous TAVR Innovation and Portfolio Expansion

Edwards Lifesciences' dedication to advancing its Transcatheter Aortic Valve Replacement (TAVR) technology is a key driver of its market position. The company consistently invests in developing enhanced delivery systems and next-generation valves, broadening the applicability of TAVR to a more diverse patient population. This ongoing innovation ensures their TAVR offerings remain competitive and leaders in a rapidly evolving technological landscape.

This strategic focus on continuous improvement and portfolio expansion in TAVR is crucial for maintaining Edwards Lifesciences' strong market share. By staying ahead of technological advancements, the company solidifies its leadership in a segment experiencing significant growth.

- Innovation Investment: Edwards Lifesciences has consistently allocated significant resources to research and development for its TAVR products.

- Next-Generation Valves: The company is actively developing and launching next-generation valves designed for improved patient outcomes and broader anatomical suitability.

- Delivery System Enhancements: Improvements to delivery systems aim to simplify procedures and expand TAVR accessibility to more complex patient cases.

- Market Leadership: These efforts reinforce Edwards' position as a leader in the growing TAVR market, a segment projected for continued expansion.

Edwards Lifesciences' SAPIEN 3 Ultra RESILIA platform is a clear market leader in TAVR, projected to hold a substantial 72.3% of the U.S. market by 2025. This dominance is supported by continuous innovation and strong clinical data highlighting patient benefits and durability. The recent FDA approval for treating asymptomatic patients significantly expands the addressable market, promising considerable future growth.

The SAPIEN M3 Transcatheter Mitral Valve Replacement System is also positioned for success, with anticipated CE Mark approval in mid-2025 and U.S. approval in early 2026. This product targets a large unmet need in mitral valve disease, offering a less invasive alternative and potentially establishing Edwards as a first-mover in key European markets.

| Product | Market Segment | Projected U.S. Market Share (2025) | Key Developments |

|---|---|---|---|

| SAPIEN 3 Ultra RESILIA | Transcatheter Aortic Valve Replacement (TAVR) | 72.3% | FDA approval for asymptomatic patients (May 2025), enhanced durability data. |

| SAPIEN M3 | Transcatheter Mitral Valve Replacement (TMVR) | N/A (Emerging) | CE Mark approval anticipated mid-2025, U.S. approval H1 2026. |

What is included in the product

The Edwards Lifesciences BCG Matrix categorizes its product portfolio into Stars, Cash Cows, Question Marks, and Dogs to guide strategic resource allocation.

This analysis highlights which business units warrant investment, maintenance, or divestment to optimize the company's market position.

A clear BCG Matrix visualizes Edwards Lifesciences' portfolio, easing the pain of resource allocation by highlighting growth opportunities and underperforming areas.

Cash Cows

Edwards Lifesciences dominates the established surgical aortic valve market, with its INSPIRIS RESILIA valve a prime example of their strength. This segment, though not as fast-growing as newer transcatheter options, is a significant cash generator. In 2023, Edwards reported total sales of $5.3 billion, with their Surgical Structural Heart segment contributing a substantial portion, reflecting the continued demand for these reliable devices.

Edwards Lifesciences' MITRIS RESILIA surgical mitral valve is a prime example of a Cash Cow within their portfolio. This segment benefits from a strong market position in a mature, albeit low-growth, sector, consistently delivering healthy profit margins.

The RESILIA tissue technology, a key differentiator, is seeing increasing global adoption. This trend reinforces the valve's role as a reliable revenue generator, contributing significantly to Edwards' overall financial stability.

Edwards Lifesciences' SAPIEN TAVR systems for symptomatic severe aortic stenosis in established patient populations are a clear cash cow. This segment boasts a high market share and consistent revenue generation, reflecting the widespread adoption and maturity of these core procedures. For instance, in 2023, Edwards Lifesciences reported strong performance in its TAVR segment, driven by these established indications, contributing significantly to its overall financial stability.

PERIMOUNT Aortic Products

The PERIMOUNT aortic product line from Edwards Lifesciences is a classic example of a cash cow within the company's portfolio, leveraging its established position in the mature tissue heart valve market. This segment is characterized by consistent demand and a strong market share, translating into reliable revenue generation for Edwards. The enduring quality and widespread adoption of PERIMOUNT products have cemented their status as a foundational element of the company's surgical solutions.

- Market Dominance: PERIMOUNT products contribute significantly to Edwards Lifesciences' leading position in the surgical tissue heart valve market, a segment with high barriers to entry.

- Steady Revenue: As a mature product line, PERIMOUNT offers predictable and stable revenue streams, supporting ongoing research and development in other areas of the business.

- Patient Base: The established patient base and physician familiarity with PERIMOUNT valves ensure continued demand, even in a well-penetrated market.

- Financial Contribution: While specific segment data for 2024 isn't publicly detailed by Edwards Lifesciences, the company's overall structural heart segment, where PERIMOUNT resides, has historically been a significant profit driver, contributing to robust free cash flow. For example, in 2023, Edwards Lifesciences reported total sales of $5.3 billion, with the Transcatheter Heart Valves & VADs segment, which includes surgical valves, showing strong performance.

KONECT Aortic Valved Conduit

The KONECT Aortic Valved Conduit, a key component within Edwards Lifesciences' surgical offerings, exemplifies a classic cash cow. Its recent CE Mark approval in Europe, granted in early 2024, reinforces its established position in a mature market. This regulatory milestone is expected to sustain its contribution to the company's stable surgical segment revenue, which consistently generates robust profits with minimal need for aggressive marketing spend.

As a well-established product, the KONECT conduit benefits from predictable demand. This allows Edwards Lifesciences to maintain high profit margins. For instance, in 2023, Edwards Lifesciences reported a gross profit margin of approximately 75% for its broader Surgical segment, a testament to the efficiency and market maturity of products like the KONECT.

- Established Market Presence: The KONECT aortic valved conduit has a long-standing reputation in the surgical field.

- Recent CE Mark Approval: This 2024 European approval signifies continued market access and potential for sustained sales.

- Stable Revenue Contribution: It reliably contributes to the strong and consistent revenue generated by Edwards' surgical business.

- High Profit Margins: Due to its maturity and consistent demand, the product commands healthy profit margins with limited reinvestment in promotion.

Edwards Lifesciences' surgical valve portfolio, particularly established products like the PERIMOUNT and INSPIRIS RESILIA, represents significant cash cows. These products operate in mature markets with consistent demand, generating substantial and predictable revenue for the company. Their strong market share and established physician familiarity contribute to high profit margins, allowing Edwards to fund innovation in other segments.

The SAPIEN TAVR systems for established patient populations also function as cash cows. These devices benefit from widespread adoption and a mature procedure, ensuring reliable sales. Edwards Lifesciences' overall strong performance in its structural heart segment, which includes these surgical and transcatheter valves, underscores the cash-generating power of these mature product lines.

The KONECT Aortic Valved Conduit, with its recent 2024 CE Mark approval, further solidifies its cash cow status. This product contributes to the stable revenue of Edwards' surgical business, leveraging its established presence and benefiting from high profit margins due to market maturity and consistent demand.

| Product Category | Key Products | Market Status | Revenue Contribution | Profitability |

|---|---|---|---|---|

| Surgical Valves | PERIMOUNT, INSPIRIS RESILIA | Mature, Stable Demand | Significant & Predictable | High Margins |

| Transcatheter Aortic Valve Replacement (TAVR) | SAPIEN (Established Indications) | Mature, Widespread Adoption | Consistent | Strong |

| Surgical Conduits | KONECT Aortic Valved Conduit | Mature, Established | Stable | Healthy Margins |

What You’re Viewing Is Included

Edwards Lifesciences BCG Matrix

The preview of the Edwards Lifesciences BCG Matrix you are currently viewing is the identical, fully completed document you will receive upon purchase. This means you're seeing the final, polished analysis, ready for immediate strategic application without any alterations or missing elements. Rest assured, the comprehensive insights and professional formatting are exactly as they will be delivered, ensuring you get precisely what you need for informed decision-making.

Dogs

Edwards Lifesciences divested its Critical Care product group to BD in September 2024 for $4.2 billion. This strategic move was driven by the unit's mid-single-digit growth projections, which were considered less robust compared to Edwards' core focus areas.

The Critical Care segment, despite being profitable, did not align with Edwards' long-term strategy centered on structural heart diseases. This misalignment led to its classification as a 'Dog' within the company's BCG Matrix, indicating low market share and low growth potential relative to the company's strategic priorities.

The divestiture allows Edwards Lifesciences to reallocate capital and management attention towards its high-growth structural heart business, aiming to accelerate innovation and market penetration in that segment.

Prior to its divestiture, Edwards Lifesciences' older hemodynamic monitoring solutions in the Critical Care segment likely experienced diminishing market relevance. These products, once industry standards, probably faced intensified competition from newer, more sophisticated technologies, leading to slower growth trajectories.

Consequently, these solutions would have been categorized as Dogs in the BCG matrix, characterized by low market share and low growth. The strategic decision to divest the entire Critical Care unit, which included these older monitoring systems, underscores a clear commitment to shedding these less competitive assets.

Edwards Lifesciences, a leader in heart valve technology and critical care monitoring, strategically manages its product portfolio. As part of this, the company periodically retires older or less competitive products that no longer align with evolving market demands or its forward-looking innovation strategy. These legacy items, characterized by diminishing market share and limited future growth potential, would generally be categorized as Dogs in the BCG Matrix. They have fulfilled their initial role but are not prioritized for further substantial investment.

Products with Limited Market Adoption or Niche Focus

Products with Limited Market Adoption or Niche Focus, often referred to as Dogs in the BCG Matrix, represent a challenging category for companies like Edwards Lifesciences. These are products that, despite development or acquisition efforts, have failed to capture significant market share or cater to a market that is either very small or not growing. Such offerings can become a drain on resources, diverting attention and capital away from more promising ventures.

While specific product failures are rarely disclosed publicly, one can infer that any Edwards Lifesciences product that struggled to gain traction in a competitive landscape, perhaps due to technological limitations, regulatory hurdles, or a mismatch with market needs, would fall into this Dog category. For instance, if a new device targeting a very specific, rare condition did not achieve widespread adoption due to high costs or limited physician training, it might be considered a Dog. These products typically offer low growth potential and low market share, making them candidates for careful review and potential divestment.

The financial implications of maintaining Dog products are significant. They tie up capital in research and development, manufacturing, and marketing without yielding substantial returns. In 2024, companies are increasingly scrutinized for their portfolio efficiency, and resources allocated to underperforming products could be better utilized elsewhere. For example, if a niche product generated less than 5% of total revenue and showed no signs of market expansion, it would likely be flagged for strategic reassessment.

- Limited Market Share: Products that have not penetrated a significant portion of their target market.

- Low Growth Potential: Offerings in stagnant or declining market segments.

- Resource Drain: Products that consume R&D, manufacturing, and marketing resources without commensurate returns.

- Strategic Review Candidates: Often considered for discontinuation or divestment to reallocate capital to Stars or Question Marks.

Segments Facing Strong, Entrenched Competition Without Clear Differentiation

In medical technology, particularly within segments like peripheral vascular devices where established players often dominate, products that lack a distinct advantage can find themselves in a challenging spot. These are the 'Dogs' in the BCG Matrix sense. They compete in crowded spaces against companies with deep market penetration and strong customer loyalty, making it tough to carve out a significant market share. For instance, in 2024, the peripheral vascular market, valued at approximately $7 billion globally, saw intense competition from companies with extensive product portfolios and established distribution networks. Without a clear innovation or a unique value proposition, new entrants or less differentiated offerings struggle to gain traction.

These 'Dogs' often require substantial investment to maintain even a modest presence, yielding minimal returns. This situation can drain resources that could be better allocated to more promising areas of the business. Edwards Lifesciences' strategic emphasis on structural heart disease, a segment where they hold a leading position, is a deliberate move to steer clear of these 'Dog' categories. By focusing on areas of established strength and leadership, the company aims to optimize resource allocation and drive more impactful growth.

- Peripheral Vascular Market Value: Approximately $7 billion globally in 2024.

- Competitive Landscape: Dominated by entrenched players with superior offerings and established market share.

- Strategic Imperative: Focus on areas of leadership, like structural heart disease, to avoid 'Dog' segments.

Edwards Lifesciences' Critical Care segment, divested in September 2024 for $4.2 billion, was classified as a 'Dog' due to its projected mid-single-digit growth, which was less robust than the company's core focus areas.

This classification signifies a low market share and low growth potential relative to Edwards' strategic priorities, primarily centered on structural heart diseases.

The divestiture of this segment, which included older hemodynamic monitoring solutions facing intense competition, allows Edwards to reallocate capital and focus on high-growth areas.

Products categorized as Dogs, like those in the peripheral vascular market, struggle against established players and require significant investment for minimal returns, making them candidates for divestment.

| BCG Category | Characteristics | Edwards Lifesciences Example | Strategic Implication |

| Dogs | Low Market Share, Low Growth Potential | Critical Care Segment (divested 2024) | Resource drain; candidates for divestment or discontinuation |

Question Marks

The PASCAL Precision System is a vital part of Edwards Lifesciences' TMTT business, a segment that experienced robust sales growth through 2024 and into 2025. This system is central to their strategy in the transcatheter mitral valve repair market.

Despite facing established competition, the PASCAL system is gaining traction, with Edwards actively expanding its site activations. This suggests a strong future growth trajectory for the product in the dynamic mitral repair landscape, where it currently holds approximately 25% of the transcatheter mitral valve repair market share.

The EVOQUE Tricuspid Valve Replacement System from Edwards Lifesciences is a prime example of a Star or Question Mark, depending on market penetration and future growth projections. Its recent U.S. FDA approval in February 2024 and CE Mark in Europe in October 2023 highlight its innovation in a previously underserved market for tricuspid regurgitation. This positions EVOQUE for significant growth.

EVOQUE is currently experiencing rapid adoption, significantly contributing to the accelerated growth of the Transcatheter Mitral and Tricuspid Therapies (TMTT) segment. Edwards Lifesciences anticipates substantial sales expansion driven by EVOQUE, indicating its potential to become a market leader in this emerging therapeutic area.

The SAPIEN M3 transcatheter mitral valve replacement system is positioned as a Question Mark in the BCG Matrix for Edwards Lifesciences. This innovative technology addresses a significant unmet need in the transcatheter mitral valve therapy (TMTT) market, a segment projected for substantial long-term growth.

While still navigating regulatory pathways, with a CE Mark anticipated mid-2025 and U.S. approval in the first half of 2026, SAPIEN M3 holds high growth potential. Its success hinges on its ability to capture market share in a burgeoning field, making its future trajectory uncertain but promising.

JenaValve Trilogy System (Transcatheter Aortic Regurgitation Therapy)

The JenaValve Trilogy System, acquired by Edwards Lifesciences, represents a significant 'Question Mark' in their portfolio, aiming to address severe aortic regurgitation (AR), a condition lacking a transcatheter therapy. This innovative system targets a substantial $2 billion underserved market, with FDA approval anticipated in late 2025.

Early clinical trial results have demonstrated promising outcomes in high-risk patients, suggesting strong future growth potential. However, its current market share is minimal, reflecting its status as an emerging technology.

- High Potential: Addresses a critical unmet need in AR treatment.

- Market Size: Targets a $2 billion market.

- Regulatory Pathway: FDA approval expected late 2025.

- Current Position: Nascent market share, high investment required.

Cordella System (Implantable Heart Failure Management)

The Cordella System, an implantable device for managing heart failure, was approved in 2024. This marks Edwards Lifesciences' strategic move into a rapidly expanding therapeutic area. Its ability to monitor pulmonary artery pressure directly addresses a key challenge in heart failure treatment.

The system's potential to significantly reduce hospitalizations for heart failure patients is a major driver of its classification as a Question Mark. Early indications and projected national coverage by CMS in early 2025 further bolster its future market prospects. While still establishing its footprint, the Cordella System is poised for substantial growth.

- Market Entry: Edwards Lifesciences entered the heart failure management market with the Cordella System in 2024.

- Key Benefit: The system is designed to reduce heart failure hospitalizations through implantable pulmonary artery pressure monitoring.

- Future Potential: Expected national coverage by CMS in early 2025 positions the Cordella System as a high-growth opportunity.

- BCG Classification: Its status as a new entrant in a high-growth area with uncertain but significant future potential places it in the Question Mark category.

The SAPIEN M3 transcatheter mitral valve replacement system and the JenaValve Trilogy System are key Question Marks for Edwards Lifesciences. Both target large, growing markets with unmet needs, but require significant investment and face regulatory hurdles before achieving widespread adoption. Their future success, and thus their eventual classification as Stars or Dogs, remains uncertain.

| Product | BCG Category | Market | Growth Potential | Current Status |

|---|---|---|---|---|

| SAPIEN M3 | Question Mark | Transcatheter Mitral Valve Therapy (TMTT) | High, significant unmet need | CE Mark anticipated mid-2025, US approval H1 2026 |

| JenaValve Trilogy | Question Mark | Severe Aortic Regurgitation (AR) | High, $2 billion underserved market | FDA approval anticipated late 2025 |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, industry growth projections, and competitor analysis to provide a clear strategic overview.