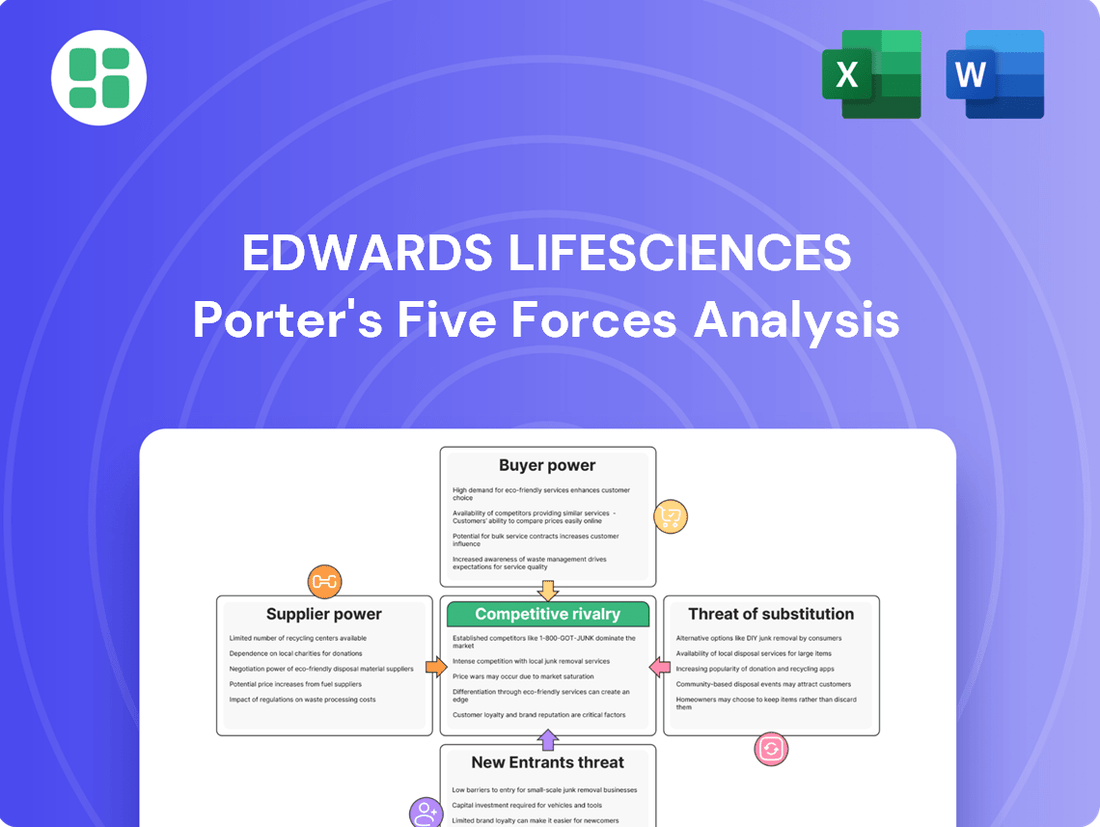

Edwards Lifesciences Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edwards Lifesciences Bundle

Edwards Lifesciences navigates a complex landscape shaped by intense rivalry and significant buyer power, particularly from healthcare providers. The threat of substitutes, while present, is often mitigated by the specialized nature of cardiac care devices. Supplier power is a crucial factor, as the quality and availability of raw materials directly impact production.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Edwards Lifesciences.

Suppliers Bargaining Power

Edwards Lifesciences' dependence on a select group of suppliers for highly specialized, biocompatible materials, crucial for its sophisticated medical devices, grants these suppliers considerable leverage. For instance, the availability of unique polymers or advanced alloys, essential for heart valve components, can be concentrated among a few providers, limiting Edwards' ability to switch. This concentration was evident in 2024, where disruptions in certain specialty chemical supply chains impacted various medical device manufacturers, including those producing implantable goods, potentially driving up costs for critical inputs.

Suppliers possessing unique technologies or patents vital for Edwards Lifesciences' groundbreaking medical devices can significantly impact pricing and contract conditions. This is particularly true in the MedTech industry where specialized manufacturing often relies on technology partners, shifting dependency from raw material providers to these key innovators.

For instance, in 2024, the MedTech sector saw significant investment in advanced materials and manufacturing processes, often through partnerships. Companies like Edwards Lifesciences, which heavily invests in R&D, often find their competitive edge tied to these specialized technological inputs, giving those suppliers considerable leverage.

Protecting intellectual property is paramount for MedTech firms. This includes managing relationships with technology suppliers who may gain insight into proprietary manufacturing methods or sensitive product development data, underscoring the bargaining power these specialized entities hold.

Suppliers who consistently meet the demanding regulatory compliance and quality control standards inherent in the medical device sector command a more significant bargaining advantage. Edwards Lifesciences places a premium on stringent internal quality management systems and comprehensive supplier training to guarantee product safety and efficacy, underscoring the critical need for dependable and compliant suppliers.

A supplier's ability to navigate complex regulatory landscapes, such as FDA approvals and ISO certifications, directly impacts their leverage. For instance, in 2024, the medical device industry continued to see increased scrutiny on supply chain integrity, making suppliers with established compliance track records highly sought after. Edwards' reliance on these suppliers means that any disruption or non-compliance from a supplier could lead to substantial operational and financial repercussions, thereby amplifying the power of those who consistently meet these high benchmarks.

Switching Costs for Edwards

Switching suppliers in the medical device sector, particularly for critical components like those used in heart valves, involves significant hurdles for companies like Edwards Lifesciences. These hurdles include the extensive costs and time required for re-qualification of new suppliers' materials and processes, securing necessary regulatory approvals, and the inherent risk of production disruptions during the transition. In 2023, Edwards Lifesciences reported approximately $5.3 billion in revenue, highlighting the scale of operations where supplier reliability is paramount.

These substantial switching costs effectively increase the bargaining power of Edwards' existing, established suppliers. Suppliers who have already met Edwards' stringent quality and regulatory standards can leverage this entrenched position. For instance, a delay in regulatory approval for a new supplier could cost millions in lost production time and revenue, a risk Edwards aims to minimize.

To manage these dynamics and potentially secure more favorable terms, Edwards Lifesciences often focuses on building robust, long-term partnerships with its key suppliers. These strategic alliances can foster greater collaboration, improve supply chain predictability, and provide a foundation for negotiating pricing and service level agreements. Such partnerships are crucial in an industry where supply chain stability directly impacts patient care and market competitiveness.

- High Re-qualification Costs: The medical device industry necessitates rigorous testing and validation for any new material or component, which can cost hundreds of thousands of dollars per supplier change.

- Regulatory Hurdles: Obtaining approvals from bodies like the FDA for changes in the supply chain can take many months, potentially delaying product availability.

- Production Disruption Risk: A poorly managed supplier transition can lead to stock-outs, impacting Edwards' ability to meet demand for its life-saving devices.

- Supplier Leverage: Established suppliers, having already navigated Edwards' rigorous qualification processes, hold a stronger negotiating position due to the high costs and risks associated with switching.

Supplier Concentration and Consolidation

Supplier concentration significantly influences bargaining power. When a few dominant players supply critical components, they can leverage their position to demand higher prices and impose stricter terms on buyers like Edwards Lifesciences. This is a common dynamic in specialized industries.

While specific data on Edwards Lifesciences' supplier concentration isn't readily available, the broader medical device sector often depends on a limited pool of high-quality raw material and component providers. This inherent market structure naturally amplifies the leverage held by these key suppliers.

- Supplier Concentration: The medical device industry often relies on a concentrated supply base for specialized components.

- Impact on Pricing: A concentrated supplier market can lead to higher input costs for manufacturers.

- Negotiating Power: Dominant suppliers can dictate terms and conditions due to limited alternatives.

The bargaining power of suppliers for Edwards Lifesciences is substantial, primarily due to the specialized nature of its components and the high costs associated with switching. Suppliers of unique biocompatible materials or advanced manufacturing technologies for devices like heart valves often face limited competition, allowing them to command higher prices and dictate terms. This was underscored in 2024, as supply chain disruptions in specialty chemicals affected the medical device sector, potentially increasing input costs.

The concentration of suppliers for critical inputs, coupled with the rigorous qualification processes in the MedTech industry, grants these suppliers significant leverage. For instance, the time and expense involved in re-validating new suppliers' materials and processes, along with potential regulatory delays from bodies like the FDA, create high switching costs for Edwards. In 2023, Edwards Lifesciences generated $5.3 billion in revenue, highlighting the scale at which supply chain stability is critical, making established suppliers with proven compliance records highly valuable and powerful.

| Factor | Impact on Edwards Lifesciences | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Reliance on a few providers for specialized components. | Suppliers can dictate terms and pricing. |

| Switching Costs | High costs and time for re-qualification and regulatory approval. | Suppliers benefit from entrenched position and reduced competition. |

| Technological Uniqueness | Dependence on suppliers with proprietary technologies. | Suppliers can influence pricing and contract terms. |

| Regulatory Compliance | Need for suppliers meeting stringent quality and regulatory standards. | Suppliers with established compliance have a stronger negotiating position. |

What is included in the product

This Porter's Five Forces analysis for Edwards Lifesciences dissects the competitive intensity within the cardiovascular medical device industry, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitutes and existing rivals.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Porter's Five Forces.

Customers Bargaining Power

Edwards Lifesciences primarily serves hospitals, clinics, and healthcare professionals, operating within a business-to-business model. Large hospital systems, in particular, wield considerable bargaining power, enabling them to negotiate favorable pricing and contract terms for medical devices, influencing Edwards' revenue streams.

The growing trend of patients opting for ambulatory surgical centers (ASCs) further amplifies competitive pricing pressures. These centers are actively seeking cost-effective medical solutions, which can lead to increased demands for price concessions from suppliers like Edwards Lifesciences.

Reimbursement policies from entities like Medicare and private insurers significantly shape the bargaining power of customers for Edwards Lifesciences. When reimbursement rates are low or coverage is limited for procedures involving Edwards' heart valves and hemodynamic monitoring systems, hospitals become more price-sensitive. This directly impacts Edwards' ability to command premium pricing, as providers are less willing to absorb costs if they aren't adequately compensated.

In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to adjust reimbursement rates for various cardiovascular procedures. For instance, changes in the Medicare Severity-Diagnosis Related Group (MS-DRG) classifications can directly affect hospital payments for surgeries utilizing transcatheter aortic valve replacement (TAVR) devices, a key product area for Edwards. If these adjustments lead to lower overall payments for TAVR procedures, hospitals will exert greater pressure on Edwards to reduce the cost of their devices.

Customers, especially physicians and healthcare providers, heavily weigh clinical outcomes and product differentiation when selecting medical devices. Edwards Lifesciences' SAPIEN platform, a leader in transcatheter aortic valve replacement (TAVR), consistently demonstrates strong patient safety and efficacy, influencing purchasing decisions. For instance, the SAPIEN 3 Ultra system has shown excellent long-term durability and reduced rates of paravalvular leak in clinical studies, reinforcing its value proposition.

The emphasis on superior clinical results and proven technology, as seen with the SAPIEN platform's expanded FDA approvals for lower-risk patient populations in 2024, allows Edwards to command a premium. This focus on value, rather than solely price, somewhat mitigates the direct bargaining power of customers who are ultimately driven by patient well-being and the reputation of the devices they use.

Availability of Alternative Treatments and Devices

The availability of alternative treatments significantly influences customer bargaining power. Even if these alternatives are less invasive or employ different methodologies, they offer patients choices, thereby strengthening their position when considering heart valve disease interventions.

Edwards Lifesciences' customers, particularly those with severe aortic stenosis, have options beyond Transcatheter Aortic Valve Replacement (TAVR). While TAVR is a prominent minimally invasive solution, traditional open-heart surgery remains a viable alternative, especially for lower-risk patients or those with complex anatomies.

The competitive landscape for heart valve disease management is evolving. Edwards' customers can weigh the benefits of TAVR against other transcatheter therapies and established surgical procedures. For instance, in 2024, the demand for minimally invasive cardiac surgery, including TAVR, continued to grow, but the established efficacy and familiarity of surgical valve replacement still provide a strong alternative for many patients and their physicians.

- Customer Choice: The existence of multiple treatment pathways, from TAVR to traditional surgery, empowers patients and clinicians to select the most appropriate option based on individual risk factors and clinical outcomes.

- Market Dynamics: While TAVR adoption has surged, with global TAVR procedures projected to reach over 200,000 annually by 2025, the continued presence and refinement of surgical techniques ensure a baseline of competitive pressure.

- Price Sensitivity: The availability of alternatives can make customers more sensitive to the pricing of TAVR systems, as they can compare the overall cost-effectiveness and value proposition against other interventions.

Customer Feedback and Satisfaction

Edwards Lifesciences actively seeks customer feedback through hospital satisfaction surveys and patient preference research. This input directly influences their product development and strategic decisions, highlighting the impact of customer insights on the company's offerings.

While Edwards boasts high customer loyalty, evidenced by strong Net Promoter Scores (NPS), customers still wield influence. They can shape product evolution and set expectations for service levels, demonstrating a tangible bargaining power.

- Customer Feedback Integration: Edwards uses survey data to refine products, showing customer preferences directly impact R&D.

- Loyalty vs. Influence: Despite high loyalty, customers can still drive changes in product features and service standards.

- NPS as an Indicator: A strong NPS suggests satisfaction, but doesn't negate customers' ability to influence future offerings.

The bargaining power of customers for Edwards Lifesciences is moderated by the clinical value and differentiation of its products, particularly the SAPIEN platform. While price is a consideration, the focus on patient outcomes and proven efficacy, as demonstrated by SAPIEN's strong clinical data and expanded indications in 2024, allows Edwards to maintain pricing power. This emphasis on value, rather than pure cost, somewhat mitigates the direct leverage customers can exert through price negotiations.

The presence of alternative treatment options, such as traditional open-heart surgery, provides a baseline for customer choice and can influence price sensitivity. However, the growing preference for minimally invasive procedures like TAVR, coupled with the continuous innovation and superior clinical performance of Edwards' devices, means that customers are often willing to pay a premium for these benefits. This dynamic balances the customer's ability to seek alternatives with the inherent value proposition of Edwards' advanced offerings.

Edwards Lifesciences' commitment to incorporating customer feedback into its product development cycle, evidenced by strong Net Promoter Scores (NPS), indicates a responsive approach to market needs. While this fosters loyalty, it also means customers can influence product evolution and service expectations, thereby retaining a degree of bargaining power that shapes the company's strategic direction.

| Factor | Impact on Bargaining Power | Example/Data Point (2024) |

| Clinical Differentiation (SAPIEN) | Lowers Bargaining Power | SAPIEN 3 Ultra system shows reduced paravalvular leak rates, enhancing value proposition. |

| Alternative Treatments (Surgery) | Moderate Bargaining Power | Traditional surgery remains an option, influencing price sensitivity for TAVR. |

| Reimbursement Policies (CMS) | Increases Bargaining Power | Changes in MS-DRG for TAVR procedures can lead to hospitals demanding lower device costs. |

| Customer Feedback & Loyalty | Moderate Bargaining Power | High NPS indicates satisfaction but customers still influence product features and service. |

Same Document Delivered

Edwards Lifesciences Porter's Five Forces Analysis

This preview showcases the comprehensive Edwards Lifesciences Porter's Five Forces Analysis, detailing the competitive landscape of the medical device industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. Rest assured, there are no placeholders or mockups; you are viewing the complete, ready-to-use document that will be instantly available for your strategic planning needs.

Rivalry Among Competitors

Edwards Lifesciences enjoys a commanding presence in the U.S. Transcatheter Aortic Valve Replacement (TAVR) market, with its SAPIEN platform historically capturing 60-70% of procedures. This strong foothold is built on years of market leadership and established technology.

Despite Edwards' dominance, the TAVR landscape is intensifying. Medtronic remains a formidable competitor, holding a substantial 30-35% market share, while Abbott and Boston Scientific are strategically positioning themselves to grow their TAVR businesses. This dynamic means Edwards faces growing pressure from well-resourced rivals.

Looking ahead, Edwards projects a slight erosion of its market share. This anticipated shift is a direct consequence of new product introductions and expanded indications from competing companies, signaling a more crowded and challenging competitive environment in the TAVR sector.

Competitive rivalry in the cardiovascular device sector, particularly for transcatheter aortic valve replacement (TAVR), is intense and fueled by relentless innovation. Companies are pouring significant resources into research and development to create advanced medical technologies and broaden the applications of their existing products. This drive for next-generation devices means the market is always evolving.

Edwards Lifesciences, a key player, is actively enhancing its TAVR offerings and strategically acquiring companies like JenaValve and JC Medical in 2024 to strengthen its product pipeline. The crucial factor for staying ahead is the capacity to introduce new, effective, and minimally invasive treatments to patients. Success hinges on this ability to innovate and deliver superior patient outcomes.

Competitive rivalry in the structural heart market is heating up as companies like Edwards Lifesciences target new patient groups, including lower-risk and asymptomatic individuals for transcatheter aortic valve replacement (TAVR). This expansion into broader patient populations naturally intensifies competition as more players vie for market share in these growing segments.

Edwards is strategically positioning itself to capitalize on these expansion opportunities, but it faces robust competition from rivals also developing advanced therapies for other heart valves, such as mitral and tricuspid. For instance, advancements in transcatheter mitral valve repair (TMVR) and transcatheter tricuspid valve replacement (TTVR) systems by competitors create new battlegrounds where market share will be fiercely contested.

Pricing Pressures and Reimbursement Landscape

Edwards Lifesciences faces significant pricing pressures, largely driven by global healthcare systems' ongoing efforts to control costs. Reimbursement policies from payers, including government programs and private insurers, directly impact the revenue potential for their innovative cardiovascular devices.

The competitive rivalry is heightened by the increasing adoption of ambulatory surgical centers (ASCs), which often prioritize lower-cost procedures. This trend, coupled with the emergence of new market entrants, can compel companies like Edwards to carefully balance the value of their advanced technologies against the demand for more affordable alternatives.

- Pricing Pressure: Healthcare systems globally are focused on cost containment, impacting device pricing.

- Reimbursement Policies: Payer reimbursement rates are critical determinants of profitability for cardiovascular devices.

- Competitive Entry: New competitors entering the market can intensify price competition.

- Shift to ASCs: The move towards ambulatory surgical centers favors cost-effective solutions, potentially pressuring prices for premium devices.

Intellectual Property and Regulatory Hurdles

Edwards Lifesciences' competitive rivalry is significantly shaped by intellectual property and the stringent regulatory environment. A robust patent portfolio is paramount in the medical technology sector, acting as a crucial defense against competitors and a foundation for market exclusivity. For instance, as of early 2024, Edwards Lifesciences held thousands of active patents globally, covering its transcatheter heart valve technologies and surgical solutions, which are vital for maintaining its competitive edge.

The path to market for medical devices is fraught with complex and often lengthy regulatory approvals, notably from bodies like the U.S. Food and Drug Administration (FDA). These hurdles serve as substantial barriers to entry for new players, favoring established companies with proven experience in navigating these processes. In 2023, the FDA continued to emphasize rigorous review of cardiovascular devices, impacting the speed at which new innovations can reach patients and thus influencing competitive dynamics.

- Intellectual Property Strength: Edwards Lifesciences possesses a vast and defensible patent portfolio, crucial for protecting its innovative transcatheter and surgical heart valve technologies.

- Regulatory Barriers: The demanding FDA approval process, a consistent challenge in 2023 and continuing into 2024, creates significant hurdles for new entrants, benefiting companies with established regulatory expertise.

- Competitive Advantage: Companies like Edwards, with a history of successful regulatory submissions and strong IP protection, gain a distinct advantage in the MedTech landscape.

The competitive rivalry in the TAVR market is intense, with Edwards Lifesciences, holding a dominant 60-70% share historically, facing increasing pressure from rivals like Medtronic (30-35%) and emerging players such as Abbott and Boston Scientific. This dynamic is driven by continuous innovation and strategic expansions into new patient groups, including lower-risk individuals.

Companies are investing heavily in R&D to develop next-generation TAVR devices and expand their indications, as evidenced by Edwards' 2024 acquisitions of JenaValve and JC Medical to bolster its pipeline. This race for technological superiority and broader patient access intensifies competition, particularly in nascent markets like transcatheter mitral and tricuspid valve repair and replacement.

Pricing pressures are also a significant factor, influenced by global cost containment efforts and reimbursement policies. The growing preference for ambulatory surgical centers (ASCs), which favor cost-effectiveness, further compounds this pressure, forcing companies to balance advanced technology with affordability.

Edwards Lifesciences' competitive standing is further solidified by its robust intellectual property portfolio, featuring thousands of active patents as of early 2024, and its experience navigating stringent regulatory pathways, such as the FDA's rigorous review processes, which remain a substantial barrier to entry for new competitors.

SSubstitutes Threaten

While Edwards Lifesciences is a leader in transcatheter aortic valve replacement (TAVR), a minimally invasive procedure, traditional open-heart surgery still exists as a substitute for heart valve repair and replacement. For certain patients, especially those with more complex conditions or who need other heart surgeries done at the same time, open-heart surgery might be the best or only choice available.

However, TAVR procedures are increasingly favored due to benefits such as shorter hospital stays and quicker recovery times. For instance, studies have shown TAVR patients often go home significantly sooner than those undergoing open-heart surgery, making it a more appealing option for a growing number of individuals.

For early-stage heart valve disease, medical management and lifestyle adjustments can indeed act as substitutes for invasive procedures. These methods, focusing on symptom control and condition management, are often the first line of defense. For instance, medications to manage blood pressure or heart rhythm, coupled with dietary changes and exercise, can stabilize patients for a period. In 2024, it's estimated that millions of individuals worldwide manage mild to moderate valvular conditions through these conservative approaches.

However, the threat of substitution diminishes significantly as heart valve disease progresses. For conditions requiring mechanical correction, such as severe stenosis or regurgitation, medications and lifestyle changes cannot repair the physical defect of the valve. Edwards Lifesciences primarily targets these more advanced stages where their interventional devices offer a direct solution to the underlying mechanical problem, a segment where non-interventional substitutes are largely ineffective.

The landscape of structural heart disease treatment is evolving rapidly with innovations in non-surgical and minimally invasive therapies. These advancements offer alternatives to traditional surgical approaches, directly impacting the market segments served by companies like Edwards Lifesciences.

Transcatheter edge-to-edge repair (TEER) for conditions like mitral regurgitation, exemplified by devices such as Abbott's MitraClip and TriClip, is a prime example of a substitute therapy. The growing adoption of TEER procedures, with the global TEER market projected to reach approximately $6.4 billion by 2028, signifies a significant shift that could influence demand for surgical valve replacements.

Furthermore, the development of transcatheter therapies for other heart valves presents a broader array of substitute options. As these less invasive techniques become more refined and widely accepted, they pose a considerable threat to existing surgical interventions and established market positions.

Pharmacological Innovations and Gene Therapies

The threat of substitutes for Edwards Lifesciences' core business, particularly in the realm of heart valve replacement, is evolving. While mechanical and bioprosthetic valves are the current standard, future innovations in pharmacological treatments and gene therapies could emerge as non-interventional alternatives for certain heart valve conditions.

These advancements, while not yet direct substitutes for existing mechanical valve issues, represent a nascent but potential long-term threat. Ongoing research in regenerative medicine and advanced drug therapies might eventually lessen the demand for traditional device-based interventions.

- Emerging Therapies: Focus on non-device based treatments for valvular heart disease.

- Regenerative Medicine: Potential for biological repair or replacement without mechanical implants.

- Pharmacological Advancements: Development of drugs that could manage or reverse valve dysfunction.

- Long-Term Impact: These substitutes are a future consideration, not an immediate widespread threat.

Preventative Measures and Early Diagnosis

The threat of substitutes for Edwards Lifesciences' structural heart devices is influenced by advancements in preventative care and early diagnosis. Increased awareness and improved diagnostic tools, such as advanced echocardiography and CT scanning, are enabling earlier detection of cardiovascular diseases. For instance, the CDC reported in 2024 that heart disease remains the leading cause of death in the US, highlighting the ongoing need for interventions. However, early diagnosis can sometimes lead to less invasive or non-device-based management strategies, potentially reducing the demand for certain high-end structural heart devices.

These evolving diagnostic capabilities and preventative strategies can impact the market for transcatheter aortic valve replacement (TAVR) and other structural heart interventions. If conditions are identified at very early stages, medical management or less complex procedures might be favored over advanced device implantation. This shift could represent a substitute threat by offering alternative pathways to manage structural heart conditions, thereby impacting the volume and type of devices required.

- Reduced Incidence: Preventative measures, if highly effective, could lower the overall number of patients progressing to severe structural heart disease requiring device intervention.

- Alternative Treatments: Earlier diagnosis may allow for medical management or less invasive surgical options that do not involve advanced cardiac devices.

- Diagnostic Sophistication: Improvements in imaging technology, like 3D echocardiography, enhance the ability to detect and monitor conditions, potentially delaying or obviating the need for device therapy.

- Patient Pathways: A greater emphasis on non-device-based care for early-stage conditions presents an alternative pathway that competes with the market for structural heart devices.

While Edwards Lifesciences dominates the TAVR market, traditional open-heart surgery remains a viable substitute, particularly for complex cases or when combined with other cardiac procedures. However, the trend favors TAVR due to its less invasive nature, leading to shorter hospital stays and quicker recovery, making it increasingly attractive to patients. In 2024, the preference for TAVR over surgical valve replacement continues to grow, driven by these patient benefits.

For early-stage heart valve disease, medical management and lifestyle changes serve as substitutes, often being the initial approach. These methods, including medications and exercise, can stabilize patients, with millions globally managing mild to moderate conditions conservatively in 2024. This segment represents a threat by delaying or potentially avoiding the need for interventional devices.

The threat of substitutes is amplified by emerging transcatheter edge-to-edge repair (TEER) technologies for conditions like mitral regurgitation. The global TEER market is expected to reach approximately $6.4 billion by 2028, indicating a significant shift towards less invasive alternatives that could impact demand for traditional valve replacements.

Advancements in preventative care and early diagnosis also pose a threat. Improved diagnostic tools allow for earlier detection, potentially leading to less invasive management strategies. While heart disease remains a leading cause of death in the US as of 2024, earlier intervention might steer patients away from advanced device therapies.

| Substitute | Description | Impact on Edwards Lifesciences |

|---|---|---|

| Open-Heart Surgery | Traditional surgical valve repair/replacement | Still a viable option for complex cases, but TAVR offers advantages. |

| Medical Management & Lifestyle Changes | Medications, diet, exercise for early-stage disease | Delays or avoids device intervention for mild to moderate conditions. |

| Transcatheter Edge-to-Edge Repair (TEER) | Minimally invasive repair for valve regurgitation | Growing market ($6.4B by 2028 projection) offers an alternative to valve replacement. |

| Preventative Care & Early Diagnosis | Improved screening and lifestyle interventions | Could reduce the overall patient pool requiring advanced device therapies. |

Entrants Threaten

Entering the highly regulated medical device sector, particularly for advanced products like artificial heart valves, demands immense upfront capital. Companies must invest heavily in research, rigorous clinical trials, and sophisticated manufacturing facilities, often running into hundreds of millions of dollars. For instance, bringing a new cardiovascular device to market can easily cost over $100 million, a figure that significantly deters smaller players.

The stringent regulatory approval process, particularly the FDA's Premarket Approval (PMA) for high-risk medical devices, presents a significant hurdle for potential entrants into Edwards Lifesciences' market. This process is inherently complex, demanding extensive clinical trials and data, which can stretch for years and incur substantial costs. For instance, the average PMA approval time can exceed 24 months, with associated fees potentially running into hundreds of thousands of dollars, creating a formidable barrier to entry.

Edwards Lifesciences, like other leading medical technology firms, benefits from robust intellectual property and extensive patent portfolios. These patents, covering everything from device design to manufacturing techniques, act as significant deterrents for potential newcomers. For instance, in 2023, the medical device industry saw continued investment in R&D, with companies like Edwards actively protecting their innovations. Navigating this landscape requires either substantial investment in developing unique, non-infringing technologies or securing costly licensing agreements, both of which pose considerable challenges for new entrants.

Brand Reputation and Clinical Endorsement

Established players like Edwards Lifesciences leverage strong brand recognition and deep-rooted relationships with key opinion leaders, making it difficult for newcomers to gain traction. Securing the trust and endorsement of hospitals, cardiologists, and surgeons is paramount, a feat new entrants struggle to achieve against incumbents with extensive, proven clinical data. For instance, Edwards Lifesciences' commitment to research and development, evidenced by its significant R&D spending, builds credibility that new entrants must painstakingly replicate.

The high barrier to entry is further amplified by the need for new entrants to generate their own substantial clinical data and navigate complex regulatory pathways, a process that is both time-consuming and capital-intensive. This contrasts sharply with Edwards Lifesciences, which already possesses a wealth of peer-reviewed studies and established clinical protocols.

- Brand Loyalty: Decades of successful product use foster significant loyalty among medical professionals.

- Clinical Validation: Extensive clinical trial data and real-world evidence support existing products.

- Key Opinion Leader (KOL) Influence: Strong relationships with influential cardiologists and surgeons are critical for adoption.

- Reputational Risk: Hospitals are hesitant to adopt unproven technologies due to patient safety concerns.

Access to Distribution Channels and Supply Chains

Edwards Lifesciences' success hinges on its robust distribution channels, a significant barrier for newcomers. Building and maintaining an effective global sales force and distributor network, especially for specialized medical devices, requires substantial investment and time. For instance, in 2023, the medical device industry saw significant consolidation, making it even harder for new players to secure shelf space or partnerships.

New entrants face the daunting task of replicating Edwards Lifesciences' established relationships with hospitals and healthcare providers. This access is not easily bought; it's earned through years of reliable service, product efficacy, and trust. The cost and complexity of establishing a comparable distribution infrastructure, including logistics and sales support, are immense.

- Distribution Network: New entrants must invest heavily in building their own global distribution networks or securing partnerships with existing players, which can be difficult given established loyalties.

- Supply Chain Integration: Replicating Edwards Lifesciences' optimized supply chain, ensuring timely delivery and product availability worldwide, presents a significant logistical and financial hurdle.

- Regulatory Hurdles: Navigating diverse international regulatory requirements for medical device distribution adds another layer of complexity and cost for potential new entrants.

- Market Access: Gaining access to key markets and healthcare providers requires significant sales efforts and relationship building, areas where incumbents like Edwards Lifesciences have a distinct advantage.

The threat of new entrants for Edwards Lifesciences is considerably low due to several formidable barriers. High capital requirements for research, development, and regulatory compliance, often exceeding $100 million for a single cardiovascular device, deter smaller players. Furthermore, the lengthy and complex FDA approval process, averaging over 24 months for Premarket Approval (PMA) with significant associated fees, acts as a substantial deterrent.

Edwards Lifesciences also benefits from strong intellectual property protection, with extensive patent portfolios safeguarding their innovations. Navigating this requires either significant R&D investment to develop unique technologies or costly licensing, both challenging for newcomers. Established brands and deep relationships with key opinion leaders in cardiology further solidify Edwards' market position, as hospitals prioritize proven technologies and trusted suppliers.

The company's established distribution networks and supply chain integration present another significant hurdle for potential entrants. Building a comparable global sales force and ensuring timely product delivery requires immense investment and time, especially in a consolidated market. Gaining market access and building trust with healthcare providers is a long-term endeavor where incumbents like Edwards have a distinct advantage.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment for R&D, clinical trials, and manufacturing. | Bringing a new cardiovascular device to market can cost over $100 million. |

| Regulatory Hurdles | Stringent FDA approval processes (e.g., PMA) and international compliance. | Average PMA approval time can exceed 24 months; associated fees can be hundreds of thousands of dollars. |

| Intellectual Property | Extensive patent portfolios protecting device design and manufacturing. | Continued R&D investment in 2023 by medical device firms to protect innovations. |

| Brand & Relationships | Strong brand recognition and deep ties with Key Opinion Leaders (KOLs). | Edwards' commitment to R&D builds credibility that new entrants must replicate. |

| Distribution & Market Access | Established global sales forces and trusted relationships with hospitals. | Market consolidation in 2023 made it harder for new players to secure partnerships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Edwards Lifesciences is built upon a foundation of data from SEC filings, annual reports, and investor presentations, providing direct insights into the company's strategic positioning and financial health.