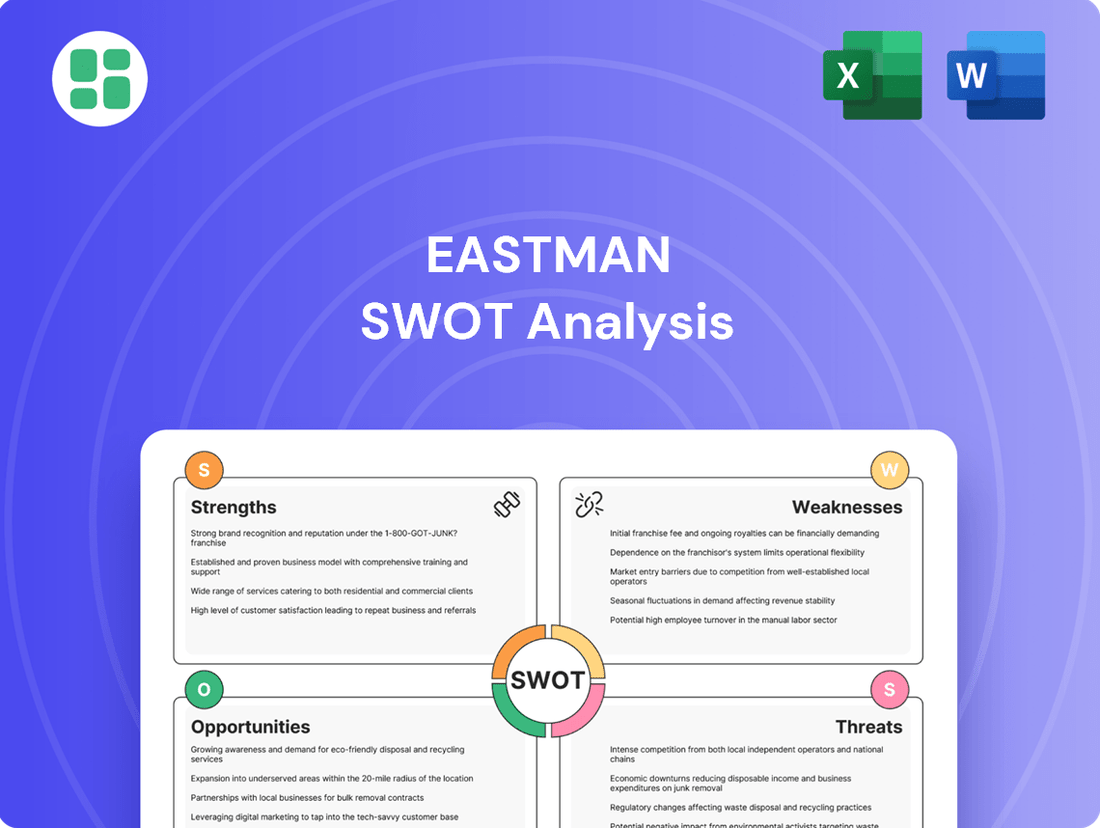

Eastman SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eastman Bundle

Eastman's robust innovation pipeline and diversified product portfolio are key strengths, but the company faces significant threats from evolving regulations and raw material price volatility. Discover the full picture behind Eastman's market position with our complete SWOT analysis.

Want the full story behind Eastman's competitive advantages, potential weaknesses, and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Eastman Chemical Company boasts a robustly diversified product portfolio, spanning advanced materials, additives, functional products, chemical intermediates, and fibers. This broad offering enables the company to cater to a wide array of end markets, including critical sectors like transportation, building and construction, and consumer goods, fostering resilience against sector-specific downturns.

The company's significant global footprint, encompassing operations in over 100 countries and more than 35 manufacturing sites, is a key strength. This extensive reach not only facilitates market penetration but also serves as a crucial risk mitigation strategy, reducing dependence on any single geographic region or industry. For instance, in 2023, Eastman reported that approximately 58% of its sales were generated outside of North America, highlighting its global diversification.

Eastman's innovation-driven growth model is a core strength, with a significant emphasis on research and development, especially in sustainable solutions and advanced materials. This focus is evident in major projects like its Kingsport methanolysis facility, a key component of its strategy to lead in circular economy solutions.

The company's commitment to molecular recycling, with planned expansions, underscores its dedication to pioneering sustainable practices. These forward-thinking initiatives are strategically designed to be a primary engine for Eastman's future earnings and to capture expanding market share in the growing sustainability sector.

Eastman showcased impressive financial resilience, reporting higher gross profit, EBIT, and net earnings in Q1 2025, even with a minor dip in sales. This indicates strong operational efficiency and effective cost management.

The company's ability to consistently generate substantial operating cash flow, with $1.3 billion in 2024 and a forecast of $1.2 billion for 2025, is a significant strength. This robust cash generation fuels strategic growth initiatives and supports shareholder value.

Operational Efficiency and Cost Discipline

Eastman's commitment to operational efficiency is a significant strength. For instance, their Kingsport methanolysis facility achieved record uptime and production quantities, showcasing robust operational execution. This focus directly contributes to their ability to manage costs effectively.

The company is actively pursuing cost reduction initiatives, aiming to optimize assets and improve yields. This strategy is crucial for enhancing gross margins and counteracting the impact of inflationary pressures, a key concern for many businesses in 2024 and 2025.

- Record Uptime: The Kingsport methanolysis facility demonstrated exceptional operational performance with record uptime.

- Cost Optimization: Eastman is implementing targeted cost reduction programs to improve efficiency.

- Yield Improvement: A focus on optimizing production yields is in place to bolster gross margins.

- Inflationary Headwinds: These initiatives are designed to offset the impact of rising costs in the current economic climate.

Strong Market Positioning in Specialty Businesses

Eastman has solidified a robust market position, particularly within its specialty segments, showcasing strong commercial acumen and favorable price-cost relationships. This resilience is a key strength, allowing the company to navigate industry fluctuations effectively.

The company's financial performance in early 2025 underscores this strength. For instance, Eastman's net income growth in Q1 2025 surpassed that of many industry peers, highlighting its adeptness at managing challenges and seizing market advantages. This outperformance suggests a strategic advantage in its specialty product lines.

- Resilient Specialty Market Share: Eastman consistently holds strong positions in niche, high-value specialty markets.

- Commercial Excellence: Demonstrated ability to maintain stable price-cost dynamics even amidst market volatility.

- Q1 2025 Performance: Net income growth outpaced key competitors, signaling effective operational strategies.

- Mitigation of Industry Pressures: Proven capacity to absorb or offset broader industry headwinds more successfully than rivals.

Eastman's diverse product range, touching transportation, building, and consumer goods, provides a stable foundation against sector-specific slumps. This broad market appeal is a significant advantage. The company's global reach, operating in over 100 countries with more than 35 manufacturing sites, mitigates regional risks, as evidenced by its 2023 sales breakdown where nearly 60% came from outside North America.

Innovation, particularly in sustainable materials and molecular recycling, is a key driver for Eastman. Projects like the Kingsport methanolysis facility highlight this commitment, positioning the company to capitalize on the growing demand for circular economy solutions. This focus is expected to fuel future earnings and market share growth.

Financially, Eastman has shown resilience. In Q1 2025, the company reported growth in gross profit, EBIT, and net earnings, despite a slight sales dip, indicating strong operational efficiency and cost management. Furthermore, consistent substantial operating cash flow, projected at $1.2 billion for 2025, provides ample resources for strategic investments and shareholder returns.

Eastman's operational execution is a clear strength, with facilities like the Kingsport methanolysis plant achieving record uptime and production. This efficiency, coupled with active cost reduction initiatives and yield improvement programs, helps to bolster gross margins and counter inflationary pressures prevalent in 2024 and 2025.

The company maintains a robust market position, especially in its specialty segments, demonstrating strong commercial capabilities and favorable price-cost dynamics. This resilience was evident in Q1 2025, where Eastman's net income growth outpaced many industry peers, showcasing its ability to effectively navigate market challenges and leverage strategic advantages.

| Metric | 2024 (Actual) | 2025 (Projected) | Significance |

|---|---|---|---|

| Operating Cash Flow | $1.3 billion | $1.2 billion | Funds growth and shareholder returns |

| International Sales (2023) | ~58% of total | N/A | Demonstrates global diversification |

| Q1 2025 Performance | Growth in Gross Profit, EBIT, Net Earnings | N/A | Indicates operational efficiency and cost management |

What is included in the product

Delivers a strategic overview of Eastman’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Eastman's profitability is considerably tied to the unpredictable swings in raw material and energy costs. These costs constituted a significant portion of the company's overall expenditures in 2024, directly impacting its bottom line.

Although Eastman employs various risk management strategies to mitigate these price fluctuations, they cannot entirely shield the company from market volatility. Consequently, its financial performance remains susceptible to the ebb and flow of commodity prices.

Eastman's profitability is susceptible to shifts in the global economic landscape, including slowdowns and trade tensions. For instance, the company withdrew its annual earnings guidance in early 2023 due to persistent market uncertainty, highlighting the direct impact of these macroeconomic factors on its financial outlook.

Geopolitical events and trade policies, such as tariffs, can further disrupt Eastman's operations. These disruptions can stifle demand in crucial markets and inflate operating expenses, creating a challenging environment for revenue growth and cost management.

Eastman Chemical Company reported a modest dip in its overall sales revenue for the first quarter of 2025, a trend that continued into the first half of the year. Specifically, the Advanced Materials and Fibers segments saw notable revenue declines. This suggests some headwinds in demand within these particular areas of the business.

Operational Risks and Unplanned Production Outages

Eastman’s reliance on complex manufacturing processes exposes it to significant operational risks. Mechanical failures and unscheduled downtime can disrupt production, directly impacting output and revenue streams. These events are particularly concerning in the chemical industry where continuous operation is often critical for efficiency.

The company experienced firsthand the impact of such disruptions. An unplanned outage within its Chemical Intermediates segment during the second quarter of 2025 led to a notable negative impact on the company's earnings. This incident underscores the vulnerability of Eastman’s financial performance to unforeseen operational setbacks.

Key operational risks for Eastman include:

- Mechanical Failures: The potential for equipment malfunction in its advanced manufacturing facilities.

- Unscheduled Downtime: The risk of production halts due to unforeseen issues, impacting supply commitments.

- Supply Chain Interruptions: Vulnerability to disruptions in the sourcing of raw materials or delivery of finished goods, which can cascade into operational problems.

Impact of Customer Inventory Destocking

Customer inventory destocking has been a significant headwind for Eastman, particularly impacting its fibers segment. This trend, driven by a cautious market sentiment, has led to reduced sales volumes and an unfavorable product mix. For instance, during the first quarter of 2024, Eastman reported that destocking in the consumer discretionary end-markets, such as automotive and consumer durables, contributed to a decline in sales volume.

This phenomenon creates short-term demand imbalances, as customers work through existing inventories rather than placing new orders. The fibers segment, specifically, has felt the brunt of this destocking. In the first quarter of 2024, the company noted that the fiber segment's performance was significantly affected by this customer behavior, leading to lower volumes and a less advantageous product mix compared to previous periods.

The impact of this destocking is evident in Eastman's financial reporting. For example, the company's 2023 full-year results showed a continued effect of destocking across various segments. This cautious inventory management by customers highlights broader economic uncertainties and their direct influence on Eastman's top-line performance.

Key aspects of this weakness include:

- Reduced Sales Volume: Customers are buying less as they clear out existing stock, directly lowering Eastman's sales figures.

- Unfavorable Product Mix: The types of products customers are buying during destocking periods may not be the highest-margin items, impacting profitability.

- Market Uncertainty: The trend reflects a broader economic caution, making future demand forecasting more challenging for Eastman.

- Segment-Specific Impact: The fibers segment has been particularly vulnerable, demonstrating the uneven impact of destocking across Eastman's diverse business units.

Eastman's profitability is susceptible to volatile raw material and energy costs, which represented a significant portion of expenses in 2024 and directly impacted its bottom line. Despite risk management strategies, the company remains vulnerable to market price swings, affecting its financial performance. Furthermore, global economic slowdowns and trade tensions, exemplified by Eastman withdrawing its 2023 earnings guidance due to market uncertainty, create significant headwinds.

Operational risks, such as mechanical failures and unscheduled downtime, pose a threat to production continuity and revenue. An unplanned outage in the Chemical Intermediates segment during Q2 2025 negatively impacted earnings, highlighting this vulnerability. Customer inventory destocking, particularly in the fibers segment, has led to reduced sales volumes and an unfavorable product mix, as seen in Q1 2024 results where consumer discretionary markets like automotive and durables contributed to lower sales volumes.

The impact of destocking is evident in Eastman's 2023 full-year results, showcasing reduced sales volume, less profitable product mix, and increased market uncertainty, especially affecting the fibers segment.

| Segment | Q1 2025 Revenue Change (vs. Q1 2024) | Key Factor |

|---|---|---|

| Advanced Materials | Notable Decline | Demand Headwinds |

| Fibers | Notable Decline | Customer Destocking |

| Chemical Intermediates | Impacted by Outage | Unscheduled Downtime |

Preview the Actual Deliverable

Eastman SWOT Analysis

The preview you see is the actual Eastman SWOT analysis document you'll receive upon purchase. You're getting a genuine look at the professional, structured content. Unlock the complete, detailed report immediately after checkout.

Opportunities

Eastman's commitment to circular economy initiatives, particularly through its advanced molecular recycling technologies, presents a significant growth opportunity. Investments in facilities like Kingsport and the planned Longview site are key to this strategy.

The company anticipates substantial incremental EBITDA growth, projected to reach $300 million by 2029 from these circular platforms. This expansion into new market segments, driven by increasing consumer and regulatory demand for sustainable products, is a major upside.

Eastman's innovation engine positions it well to capture growth in specialized markets. The company is focusing on areas like agriculture, medical applications, and advanced interlayers for electric vehicles, all of which demand high-performance and sustainable materials.

The push into sustainable packaging also represents a significant opportunity. In 2024, the global sustainable packaging market was valued at approximately $270 billion and is projected to grow substantially, offering Eastman a chance to leverage its advanced material solutions.

Eastman’s robust financial position, underscored by its strong cash flow generation, provides a solid foundation for strategic investments and acquisitions. In 2023, the company reported over $2.7 billion in cash flow from operations, enabling significant capital deployment towards both organic growth initiatives and targeted M&A activities.

These strategic acquisitions, often termed bolt-on, are crucial for enhancing Eastman’s specialty product portfolio. By integrating complementary businesses, Eastman can solidify its market leadership in existing segments and gain traction in emerging, high-value markets, such as advanced materials for electric vehicles and sustainable packaging solutions.

Further Operational Optimization and Cost Reduction

Eastman's ongoing commitment to structural cost improvements and asset optimization offers a significant opportunity to boost profitability. By streamlining operations and enhancing efficiencies, the company can expect to see improved gross margins. These efforts are projected to yield substantial benefits by 2025, solidifying Eastman's market position.

The company's strategic focus on operational efficiencies is a key driver for future financial performance. For instance, Eastman has been actively managing its manufacturing footprint and supply chain logistics, aiming to reduce overheads. These initiatives are designed to directly impact the bottom line, making the business more resilient and competitive.

- Enhanced Gross Margins: Continued focus on operational efficiencies is expected to directly translate into higher gross margins.

- Cost Reduction Initiatives: Strategic asset optimization and structural cost improvements are key to reducing overall operating expenses.

- 2025 Profitability Targets: Meaningful financial results from these optimization efforts are anticipated by 2025.

- Competitive Advantage: These operational enhancements will further strengthen Eastman's competitive edge in the chemical industry.

Leveraging Digitalization and Advanced Analytics

Eastman's strategic focus on digitalization and advanced analytics presents significant opportunities. By integrating new digital technologies, the company can streamline its production, making operations more efficient. This also extends to improving how it manages its supply chain, ensuring smoother and more cost-effective delivery of materials and products.

Advanced analytics can unlock deeper insights into Eastman's operations and market trends. This data-driven approach allows for better forecasting, risk management, and identification of new growth avenues. For instance, in 2024, companies across the chemical sector are increasingly investing in AI and machine learning to predict equipment failures and optimize chemical reaction parameters, leading to substantial cost savings and improved output quality.

- Enhanced Operational Efficiency: Digital tools can automate routine tasks and provide real-time performance monitoring, boosting overall productivity.

- Supply Chain Optimization: Predictive analytics can help manage inventory levels, anticipate demand fluctuations, and reduce logistics costs.

- Accelerated Innovation: Advanced analytics can speed up research and development by simulating material properties and predicting product performance, shortening time-to-market for new solutions.

- Improved Customer Engagement: Digital platforms and data analysis can lead to more personalized customer experiences and better understanding of market needs.

Eastman's expansion into circular economy solutions, particularly through its advanced molecular recycling technologies, offers substantial growth potential. The company's strategic investments, such as those in its Kingsport and planned Longview facilities, are central to this strategy. By 2029, Eastman anticipates an incremental EBITDA of $300 million from these circular platforms, driven by increasing demand for sustainable products across various markets.

The company's innovation in specialized markets, including agriculture, medical applications, and electric vehicle interlayers, positions it to capitalize on high-performance material needs. Furthermore, the burgeoning sustainable packaging market, valued at approximately $270 billion in 2024 and projected for significant growth, presents a prime opportunity for Eastman to deploy its advanced material solutions.

Eastman's robust financial health, evidenced by over $2.7 billion in cash flow from operations in 2023, empowers strategic investments and acquisitions. These bolt-on acquisitions are vital for enhancing its specialty product portfolio, solidifying market leadership, and penetrating high-value emerging markets like EV materials and sustainable packaging.

Operational efficiency gains through structural cost improvements and asset optimization are expected to boost profitability and enhance gross margins by 2025. Digitalization and advanced analytics also present opportunities to streamline production, optimize supply chains, and accelerate innovation, as seen with industry-wide investments in AI and machine learning for cost savings and output improvements in 2024.

| Opportunity Area | Key Initiatives | Projected Impact/Market Value | Supporting Data |

|---|---|---|---|

| Circular Economy | Molecular Recycling Technologies | $300M incremental EBITDA by 2029 | Kingsport & Longview facility investments |

| Specialized Markets | Agriculture, Medical, EV Interlayers | Growth in high-performance materials | Increasing demand for specialized solutions |

| Sustainable Packaging | Advanced Material Solutions | $270B market value (2024) | Projected significant market growth |

| Operational Efficiency | Cost Improvements, Asset Optimization | Enhanced Gross Margins by 2025 | Streamlining operations, supply chain management |

| Digitalization & Analytics | AI, Machine Learning, Data Insights | Improved efficiency, cost savings | Industry-wide investment trend in 2024 |

Threats

Eastman faces a formidable challenge in the global specialty chemicals arena, a sector anticipated to expand robustly. The market is characterized by fierce rivalry from both long-standing industry giants and agile new entrants, creating a dynamic landscape where differentiation is paramount.

This intensifying competition, particularly in high-growth segments, poses a significant threat to Eastman's market share and profitability. For instance, the advanced materials sector, a key focus for Eastman, is seeing increased investment and innovation from competitors, potentially impacting pricing power and margins if Eastman's offerings don't maintain a clear competitive edge.

Global economic uncertainties remain a significant threat for Eastman. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.7% in 2024, down from 3.0% in 2023, indicating persistent headwinds. This slowdown directly impacts consumer discretionary spending and industrial output, key markets for Eastman's diverse product portfolio.

Abrupt demand shifts in these sectors create volatility that can erode sales volumes and pricing power. A prolonged economic downturn could disproportionately affect Eastman's specialty materials segment, which relies on robust industrial activity and consumer confidence, potentially leading to reduced earnings and impacting its ability to invest in growth initiatives.

Increased tariffs and potential retaliatory trade actions pose a significant threat to Eastman. These measures can directly inflate the cost of essential raw materials and impact logistics expenses, squeezing profit margins. For instance, the ongoing trade disputes between major economies in 2024 and early 2025 continue to create uncertainty, potentially increasing Eastman's cost of goods sold.

Disruptions to global supply chains are another major concern. Tariffs can force companies to reconfigure their sourcing strategies, leading to longer lead times and increased complexity. This can affect Eastman's ability to reliably obtain necessary components and deliver finished products to its customers worldwide, impacting production schedules and inventory management.

The company may also struggle to pass on these elevated costs to consumers, especially in markets where price sensitivity is high. This could lead to reduced sales volumes or a decline in market share if competitors are better positioned to absorb or mitigate tariff impacts, potentially affecting Eastman's revenue streams in key segments.

Regulatory and Environmental Compliance Risks

Eastman faces increasing threats from tightening environmental regulations, especially concerning chemicals that persist in the environment or are deemed hazardous. These regulations can translate into significant compliance costs and impose operational restrictions, potentially impacting manufacturing processes and supply chains.

The company's existing and future product portfolios are at risk of being affected by new or evolving regulations. For instance, the ongoing scrutiny of certain plasticizers and flame retardants could necessitate costly reformulation or phase-outs if Eastman doesn't proactively invest in and develop safer, more sustainable alternatives. This proactive approach is crucial for maintaining market access and profitability.

- Increased Compliance Costs: Eastman's 2023 sustainability report highlights ongoing investments in environmental control technologies to meet evolving standards.

- Product Portfolio Risk: Potential new regulations on specific chemical classes, such as certain phthalates or PFAS, could impact key product lines.

- Operational Restrictions: Stricter emissions or waste disposal regulations could lead to higher operational expenditures or require modifications to manufacturing facilities.

- Market Access: Non-compliance with environmental standards in key markets could result in market access limitations or penalties.

Supply Chain Disruptions and Raw Material Availability

Eastman faces significant threats from ongoing supply chain disruptions and the availability of key raw materials. Beyond just price fluctuations, the company is vulnerable to physical shortages and delays in receiving essential components, which can directly hinder production schedules and fulfillment capabilities. For instance, the global semiconductor shortage, which extended well into 2024, impacted various manufacturing sectors, and similar pressures can affect Eastman's access to specialized chemicals or intermediates. These disruptions can force production slowdowns, escalate operational expenses, and ultimately limit the company's capacity to satisfy customer orders, thereby negatively impacting its financial performance and market position.

The company's reliance on a complex global network means that geopolitical events, natural disasters, or logistical bottlenecks in one region can have cascading effects on its operations. In 2024, continued geopolitical instability in Eastern Europe and the Middle East, coupled with port congestion issues that lingered from previous years, presented ongoing challenges for many industrial manufacturers. These factors can lead to increased lead times for critical inputs, forcing Eastman to absorb higher transportation costs or seek alternative, potentially more expensive, suppliers. The inability to secure a consistent and timely supply of raw materials directly translates to lost sales opportunities and can erode customer trust if delivery commitments are consistently missed.

- Supply Chain Vulnerability: Geopolitical tensions and logistical challenges in 2024 continued to pose risks to the timely delivery of essential raw materials for Eastman.

- Production Delays: Shortages or delayed shipments of key inputs can force production halts, impacting output volume and increasing per-unit manufacturing costs.

- Cost Escalation: Sourcing alternative materials or paying premiums for expedited shipping due to disruptions can significantly raise operating expenses.

- Impact on Revenue: Inability to meet customer demand due to supply constraints directly leads to lost revenue and potential market share erosion.

Eastman faces significant threats from intense global competition, particularly in its high-growth specialty materials segments. The International Monetary Fund's projection of a global economic slowdown to 2.7% in 2024 highlights potential headwinds impacting consumer spending and industrial output, key markets for Eastman's products. Furthermore, escalating tariffs and trade disputes, evident throughout 2024 and into early 2025, increase raw material and logistics costs, potentially squeezing profit margins if these costs cannot be passed on to price-sensitive customers.

The company's vulnerability to supply chain disruptions remains a critical concern. Geopolitical instability and lingering logistical bottlenecks in 2024 impacted the timely delivery of essential raw materials, forcing production slowdowns and increasing operational expenses. For instance, the continued reliance on global sourcing exposes Eastman to risks from events like port congestion and regional conflicts, which can lead to production delays and lost sales opportunities.

Increasingly stringent environmental regulations present another substantial threat. Compliance with evolving standards for chemicals, such as potential restrictions on certain plasticizers or flame retardants, could necessitate costly product reformulation or phase-outs. For example, the ongoing scrutiny of specific chemical classes could affect key product lines, requiring proactive investment in sustainable alternatives to maintain market access and profitability.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Eastman's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and insightful assessment.