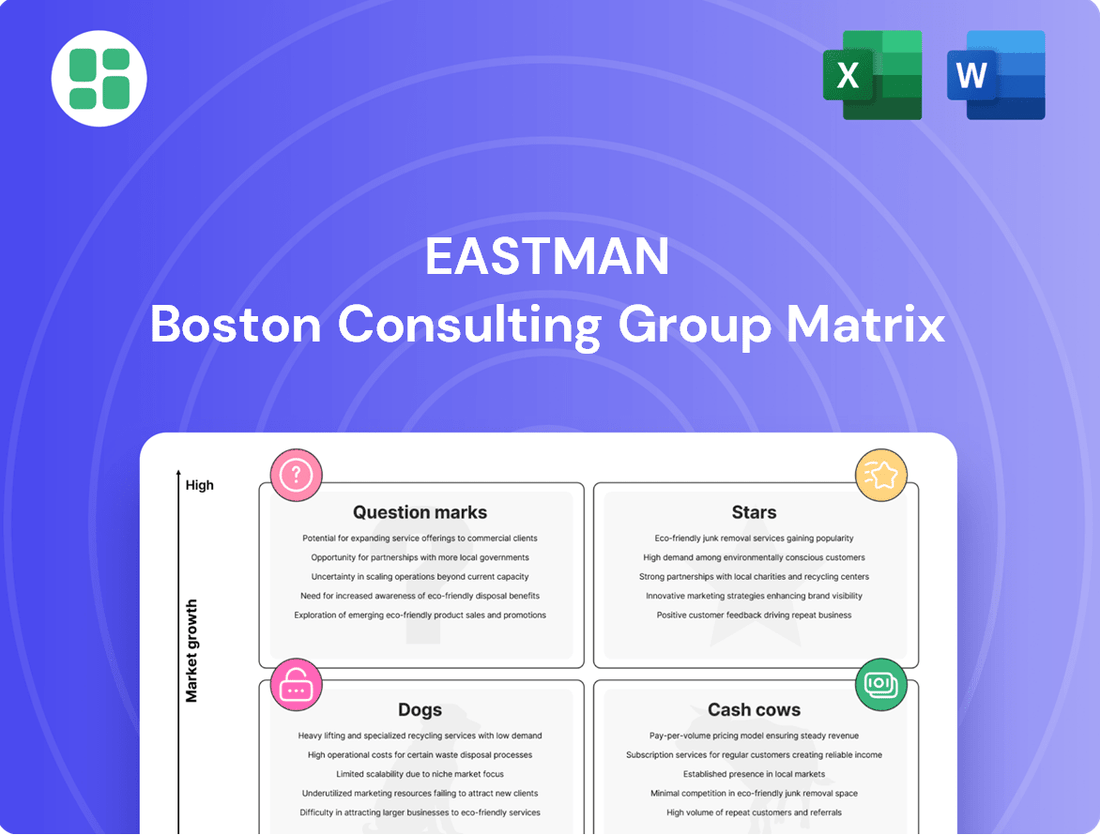

Eastman Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eastman Bundle

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix overview. See at a glance which products are driving growth, which are stable revenue generators, and which might be underperforming. Ready to transform this knowledge into actionable strategy?

Purchase the full BCG Matrix report to gain a comprehensive understanding of each product's potential and challenges. You'll receive detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investments and product development. Don't just see the picture, understand the strategy.

Stars

Eastman's molecular recycling technologies, like its methanolysis facility in Kingsport, are central to its growth strategy. This facility is performing strongly and is projected to add substantially to Eastman's EBITDA by 2025.

The company is making significant investments to grow this advanced recycling platform. This includes plans for a second facility in Longview, Texas, underscoring the rapid market expansion and Eastman's prominent position in this pioneering sector.

Eastman's commitment to sustainability is driving significant growth, particularly in its portfolio of sustainable solutions and Renew materials. These offerings are directly responding to powerful global trends pushing for more environmentally conscious products and processes across numerous sectors.

Leveraging advanced recycling technologies, Eastman's sustainable materials allow other industries to significantly improve their own environmental footprints. This technological advantage positions Eastman as a key enabler of broader sustainability initiatives.

The financial impact of this focus is substantial. In 2024, Eastman reported approximately $1.5 billion in revenue specifically from its sustainable products. This figure underscores the strong market demand and Eastman's leading position within this rapidly expanding and crucial market segment.

Eastman's specialty plastics, exemplified by brands like Tritan™ copolyester, hold a significant position in the market, particularly for durable goods and consumer packaging. These materials are known for their exceptional performance characteristics, allowing Eastman to achieve premium pricing. For instance, Tritan™ has seen widespread adoption in water bottles and small appliances due to its BPA-free nature and impact resistance.

Advanced Interlayers (e.g., Saflex™)

The Advanced Interlayers segment, featuring products like Saflex™ for automotive safety glass, is a significant growth driver for Eastman. These interlayers are vital for laminated safety glass and are being adapted for emerging uses such as heads-up displays, indicating substantial market growth potential.

Eastman holds a robust competitive edge and a considerable market share within this specialized sector. In 2024, the automotive industry saw continued demand for advanced safety features, directly benefiting this segment.

- Market Growth: The global automotive interlayer market is projected to grow at a compound annual growth rate (CAGR) of approximately 5-7% through 2028, driven by increasing vehicle production and stricter safety regulations.

- Product Innovation: Saflex™ is being developed for advanced applications like augmented reality heads-up displays, a rapidly expanding niche within the automotive sector.

- Competitive Position: Eastman is a leading global supplier of polyvinyl butyral (PVB) interlayers, a key material for laminated safety glass, maintaining a strong market presence.

Additives & Functional Products (Care Chemicals & Specialty Fluids)

The Additives & Functional Products segment, encompassing Care Chemicals & Specialty Fluids, is a shining star within Eastman's portfolio. In Q2 2025, this segment saw impressive revenue growth. This surge was largely fueled by increased sales volumes in both care chemicals and specialty fluids, demonstrating strong demand.

These products are essential for stable end markets, including personal care, aviation, and water treatment. This stability, coupled with Eastman's strategic focus on commercial excellence and ongoing innovation, solidifies its position as a market leader and contributes to its star rating. The segment's consistent performance underscores its robust market share and reliable growth trajectory.

- Q2 2025 Revenue Growth: Driven by higher sales volume in care chemicals and specialty fluids.

- End Market Stability: Serves crucial sectors like personal care, aviation, and water treatment.

- Strategic Focus: Benefits from Eastman's commitment to commercial excellence and innovation.

Eastman's Additives & Functional Products segment, particularly its care chemicals and specialty fluids, is a clear star. This segment experienced impressive revenue growth in Q2 2025, driven by higher sales volumes. Its essential role in stable end markets like personal care and aviation, combined with Eastman's focus on commercial excellence and innovation, solidifies its market leadership and robust growth trajectory.

| Segment | Performance Indicator | 2024 Data/2025 Projection | Key Drivers | BCG Classification |

|---|---|---|---|---|

| Additives & Functional Products | Revenue Growth (Q2 2025) | Impressive | Increased sales volume in care chemicals and specialty fluids | Star |

| Specialty Plastics (e.g., Tritan™) | Market Position | Significant | Durable goods, consumer packaging, premium pricing | Question Mark (Potential Star) |

| Advanced Interlayers (e.g., Saflex™) | Market Growth (CAGR) | 5-7% through 2028 | Automotive safety, heads-up displays | Question Mark (Potential Star) |

| Molecular Recycling Technologies | EBITDA Contribution | Projected substantial addition by 2025 | Methanolysis facility, new Longview facility | Question Mark (Potential Star) |

| Sustainable Products | 2024 Revenue | ~$1.5 billion | Global demand for eco-conscious products | Question Mark (Potential Star) |

What is included in the product

The Eastman BCG Matrix analyzes a company's product portfolio by plotting business units based on market growth and relative market share, guiding strategic decisions.

Strategic clarity by categorizing Eastman's portfolio into Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

Eastman's Traditional Chemical Intermediates segment, despite its exposure to commodity price swings, benefits significantly from the company's vast production capacity and its integrated approach to core chemical processes. This segment is a reliable generator of substantial cash flow, which in turn fuels the expansion of Eastman's more specialized product lines.

This segment operates within a mature market, an area where Eastman has cultivated a deep-rooted and substantial presence. For instance, in 2023, Eastman reported that its Additives & Functional Products segment, which includes many chemical intermediates, generated approximately $1.3 billion in segment EBIT, showcasing its consistent performance.

Established Coatings Additives, a key component of Eastman's Additives & Functional Products segment, represent a classic cash cow. These mature products, integral to architectural and industrial coatings, generate consistent and stable revenue streams for the company.

Their entrenched market positions, built on decades of customer relationships and reliable performance, mean they require minimal incremental investment in marketing or research and development. This stability allows them to reliably contribute to Eastman's overall profitability.

In 2023, Eastman reported that its Additives & Functional Products segment, which includes these coatings additives, saw a revenue of $2.9 billion, demonstrating the significant contribution of these mature product lines to the company's financial health.

Eastman's performance films, featuring well-known brands like LLumar™ and SunTek™, cater to the aftermarket for window and protective films. This segment of the market is quite mature, meaning demand is generally steady rather than rapidly expanding.

These products are essentially cash cows for Eastman. Their established brand names and the broad range of applications, from automotive to architectural, ensure a consistent and reliable flow of cash. For instance, the global window film market was valued at approximately $10.5 billion in 2023 and is projected to grow at a compound annual growth rate of around 4.5% through 2030, indicating a stable, albeit not explosive, revenue stream.

While the growth rate for these performance films might not be as high as in emerging sectors, their consistent profitability makes them vital to Eastman's overall financial health. They represent a dependable source of funds that can be reinvested in other areas of the business or returned to shareholders.

Certain Industrial Chemicals

Eastman's industrial chemicals segment, a classic Cash Cow, leverages its extensive production capabilities and economies of scale. These products, while in mature, lower-growth markets, provide a steady stream of revenue. In 2024, Eastman continued to emphasize operational excellence in this segment, contributing significantly to its overall profitability.

These chemicals are essential building blocks for numerous industries, ensuring consistent demand. Eastman's ability to produce these high-volume, lower-margin products efficiently allows them to generate substantial cash flow. This cash is then strategically reinvested into the company's Stars and Question Marks.

- Foundational Products: Eastman's industrial chemicals are vital inputs for sectors like automotive, construction, and textiles.

- Operational Efficiency: The company's large-scale manufacturing and supply chain management are key to profitability in this segment.

- Cash Generation: These products reliably produce free cash flow, supporting investment in higher-growth areas.

- Market Position: Eastman maintains a strong, albeit mature, market presence in many of these industrial chemical categories.

Core Acetyl Products

Eastman's deep roots in acetyl chemistry form a bedrock for its operations, creating a reliable stream of revenue. These established products, though in a mature phase, are vital for generating consistent cash flow. Their cost competitiveness and steady demand across numerous industries solidify their position.

For instance, in 2023, Eastman reported that its Additives & Functional Products segment, which includes many acetyl-based materials, generated approximately $1.5 billion in earnings before interest and taxes (EBIT). This demonstrates the significant and stable financial contribution of these core products.

- Stable Revenue Generation: Core acetyl products benefit from consistent demand in mature markets, providing predictable cash flow.

- Cost Leadership: Eastman's integrated manufacturing and historical expertise in acetyls allow for competitive cost positions.

- Industrial Integration: These products are essential components in various industrial applications, ensuring ongoing market relevance.

- Cash Flow Contribution: The Additives & Functional Products segment, heavily featuring acetyls, contributed significantly to Eastman's 2023 EBIT.

Cash Cows within Eastman's portfolio are established products in mature markets that reliably generate significant cash flow with minimal investment. These segments, like industrial chemicals and performance films, benefit from strong market positions and operational efficiencies. The substantial cash generated from these "Cows" is crucial for funding growth initiatives in other areas of the business.

| Segment | Market Maturity | Cash Flow Generation | Example Products | 2023 EBIT Contribution (Approx.) |

|---|---|---|---|---|

| Industrial Chemicals | Mature | High, Stable | Essential building blocks for various industries | Significant contributor to overall profitability |

| Performance Films | Mature | Consistent, Reliable | LLumar™, SunTek™ | Steady revenue stream |

| Acetyl Products | Mature | High, Stable | Core acetyl materials | $1.5 billion (Additives & Functional Products Segment) |

What You’re Viewing Is Included

Eastman BCG Matrix

The Eastman BCG Matrix preview you are viewing is the identical, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted with industry-standard analysis, is ready for immediate integration into your strategic planning processes. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the full BCG Matrix report. Once purchased, this fully formatted document will be yours to edit, present, and utilize for informed decision-making within your organization.

Dogs

Eastman's Fibers segment, encompassing acetate tow and the Naia™ textile business, is currently positioned as a Dog in the BCG matrix. This is due to significant revenue contractions observed in the first half of 2025. For instance, Q1 2025 saw a notable dip, followed by further declines in Q2 2025, directly linked to widespread customer inventory destocking across the industry.

The challenges faced by the Fibers segment are compounded by broader industry issues. Capacity adjustments within the textile sector and the persistent impact of global trade disputes and tariffs have further pressured sales. These factors collectively point to a low-growth market environment where Eastman's market share in this area is also experiencing a decline, presenting a clear strategic challenge.

Eastman Chemical Company has a history of strategically exiting businesses that no longer align with its focus on specialty materials. This often involves divesting or discontinuing product lines with limited growth potential or declining market share. For instance, in 2023, Eastman continued its portfolio refinement, though specific discontinued product lines are often not detailed publicly unless they represent a significant strategic shift.

Product lines that are zero or negative growth prospects and possess minimal market share are categorized as Dogs in the BCG Matrix. These are businesses that consume more resources than they generate, hindering overall company performance. Eastman's ongoing commitment to innovation and higher-margin specialties means that any remaining legacy or commodity-focused segments are prime candidates for such a designation if they fail to demonstrate sustainable growth.

Within Eastman's portfolio, underperforming commodity chemical products would be classified as Dogs in the BCG Matrix. These are typically products with low market share in slow-growing or declining markets, characterized by a lack of unique features and fierce price competition. For instance, basic petrochemicals or bulk industrial chemicals that offer little differentiation would fall into this category.

These commodity chemicals often struggle to generate substantial profits, frequently operating at break-even points or even consuming cash without yielding significant returns. In 2024, the global commodity chemical market, while large, experienced price volatility influenced by energy costs and supply chain disruptions, making it challenging for undifferentiated products to maintain profitability.

Products Heavily Impacted by Persistent Trade Tensions

Products facing consistent demand erosion due to prolonged trade disputes, especially those tied to sensitive sectors like automotive or consumer discretionary goods, can be categorized as dogs in the BCG matrix. These ongoing external pressures, such as tariffs and retaliatory measures, significantly hinder a company's ability to grow sales or even maintain its current market position.

For instance, the automotive sector has been particularly vulnerable. In 2023, global automotive production faced disruptions influenced by trade policies and supply chain issues, with some regions experiencing slower growth than anticipated. This environment makes it challenging for companies heavily reliant on automotive components, like certain specialty plastics or advanced materials, to achieve profitability or market expansion.

- Specialty Chemicals for Automotive: Demand for certain high-performance plastics and coatings used in vehicle manufacturing can be severely impacted by tariffs on imported components or finished vehicles, leading to reduced production volumes and consequently lower demand for these inputs.

- Consumer Electronics Components: While not solely automotive, trade tensions often affect the global electronics supply chain. Components for consumer electronics that are subject to import duties or export restrictions can see their demand falter as manufacturing costs rise or market access becomes restricted.

- Textiles and Apparel: Historically, trade disputes have targeted textiles and apparel. Products in these segments, especially those with complex global supply chains involving multiple countries subject to tariffs, often struggle to maintain competitive pricing and consistent demand.

Older, Less Differentiated Adhesive Resins

Older, less differentiated adhesive resins at Eastman often represent products that have seen their market position erode. Historically, the company has strategically divested from more commoditized adhesive and resin segments, a trend that likely continues to impact these legacy offerings.

These remaining older products may struggle against newer technologies or face intense competition from rivals with more innovative solutions. When these factors combine with operating in low-growth markets, such products typically fall into the 'dog' quadrant of the Boston Consulting Group (BCG) matrix.

For instance, in 2024, the global adhesives and sealants market, while growing, sees significant innovation, particularly in areas like bio-based and high-performance adhesives. Eastman's older resin lines, if not updated or repositioned, would likely experience declining market share within this evolving landscape.

- Eroding Market Position: Older adhesive resins may have lost ground due to technological advancements.

- Intensified Competition: Newer, more innovative products from competitors pose a significant threat.

- Low-Growth Markets: Operating in stagnant or declining market segments exacerbates challenges for these products.

- Divestment Strategy: Eastman's historical practice of divesting commoditized assets suggests a focus away from such offerings.

Dogs in the BCG matrix represent business units or products with low market share in low-growth markets. These entities often consume more resources than they generate, hindering overall company performance. Eastman's strategy often involves divesting or discontinuing such offerings to focus on higher-margin specialties.

For example, Eastman's Fibers segment, including acetate tow and Naia™, is currently classified as a Dog due to significant revenue contractions in the first half of 2025, driven by industry-wide customer inventory destocking. This segment faces challenges from capacity adjustments and global trade disputes, resulting in a low-growth market and declining market share for Eastman.

Older, less differentiated adhesive resins also fit the Dog profile. These products often struggle against newer technologies and face intense competition in low-growth markets, a situation Eastman has historically addressed through strategic divestments of commoditized assets.

In 2024, the global adhesives and sealants market saw significant innovation, particularly in bio-based and high-performance solutions. Eastman's older resin lines, if not updated, would likely experience declining market share in this evolving landscape, reinforcing their classification as Dogs.

Question Marks

Eastman's exploration into new molecular recycling applications, beyond its established Kingsport facility, positions these ventures as question marks on the BCG matrix. These emerging initiatives are tapping into a high-growth market for circular economy solutions.

While these early-stage applications and partnerships hold significant promise, they are still in the process of building market share. Substantial investment is necessary to scale them to their full potential, as exemplified by the capital ramp-up delays for Eastman's second methanolysis plant, which aims to further advance its circular economy capabilities.

Eastman's Aventa™ compostable materials are positioned as a 'Question Mark' in the BCG Matrix. This classification reflects their presence in a rapidly expanding market driven by increasing consumer demand for sustainable packaging solutions. For instance, the global bioplastics market, which includes compostable materials, was valued at approximately USD 50.5 billion in 2023 and is projected to reach USD 130.8 billion by 2030, growing at a CAGR of 14.5%.

While the market for compostable materials is experiencing robust growth, Aventa™ currently holds a relatively small market share. This low share in a high-growth sector indicates a need for significant investment in marketing, research, and development to capture a larger portion of this burgeoning market. Eastman's strategy will likely involve substantial resource allocation to build brand awareness and drive adoption of Aventa™ products.

Eastman's introduction of new specialty plastic products into markets like automotive and consumer durables, which have experienced recent softness, positions these offerings as question marks within the BCG framework. These innovative materials hold significant high-growth potential, but their ultimate success is intrinsically linked to a broader market rebound and Eastman's agility in capturing market share.

Future Debottlenecking of Methanolysis Capacity

Eastman's plan to boost its Kingsport methanolysis plant capacity by over 30% through debottlenecking presents a significant growth avenue. This expansion, however, hinges on securing additional market share to absorb the increased output. Until market demand reliably matches the expanded supply, this initiative remains a question mark within the BCG matrix, indicating potential but requiring careful market validation.

- Capacity Expansion: Eastman aims for a >30% capacity increase at its Kingsport methanolysis facility.

- Market Absorption Challenge: Success depends on capturing new market share to utilize the expanded output.

- Question Mark Status: The initiative is classified as a question mark until market demand consistently supports the increased supply.

- Strategic Importance: Debottlenecking represents a high-growth opportunity if market challenges are overcome.

Ethylene to Propylene (E2P) Investment

Eastman's investment in ethylene to propylene (E2P) technology is a strategic move to enhance its Chemical Intermediates segment. This initiative focuses on optimizing asset utilization and boosting profitability within a key business area. The company is investing in this technology to capture greater value from its existing feedstock and improve its competitive position.

The E2P project is positioned in a market characterized by significant competition and requires substantial capital outlay. While it offers a promising avenue for efficiency gains and earnings enhancement, Eastman's market share and the ultimate profitability of this venture are still developing. For instance, the global propylene market, a key output of E2P, is projected to grow, with demand driven by sectors like automotive and construction, but this growth comes with inherent competitive pressures.

Key considerations for this investment include:

- Capital Intensity: The E2P process requires significant upfront investment in new or upgraded facilities.

- Market Competition: The propylene market is already served by established players and alternative production methods.

- Operational Efficiency: Success hinges on achieving high operational uptime and cost-effectiveness.

- Feedstock Volatility: The cost and availability of ethylene, the primary feedstock, can impact profitability.

Eastman's new molecular recycling ventures, outside its established Kingsport site, are prime examples of question marks. These initiatives target the high-growth circular economy, a sector projected to see significant expansion. However, they are still in their nascent stages, requiring substantial investment to gain market traction.

The company's Aventa™ compostable materials also fall into this category. While the bioplastics market, including compostables, is booming—estimated at USD 50.5 billion in 2023 and projected to reach USD 130.8 billion by 2030—Aventa™ currently holds a small market share. This necessitates significant investment in marketing and R&D to capture more of this expanding market.

Similarly, Eastman's introduction of new specialty plastics into potentially soft markets like automotive and consumer durables represents question marks. These products have high-growth potential, but their success hinges on market recovery and Eastman's ability to carve out market share.

The planned >30% capacity boost at the Kingsport methanolysis plant is another question mark. While it offers growth, its success depends on securing additional market share to absorb the increased output, requiring careful market validation.

Eastman's investment in ethylene to propylene (E2P) technology is also a question mark. Although it aims to boost profitability in its Chemical Intermediates segment, the propylene market is competitive, and the venture requires significant capital, with profitability still developing.

| Initiative | Market Growth Potential | Current Market Share | BCG Classification | Key Considerations |

| New Molecular Recycling Ventures | High (Circular Economy) | Low | Question Mark | Requires substantial investment, market development |

| Aventa™ Compostable Materials | High (Bioplastics Market: USD 50.5B in 2023, projected USD 130.8B by 2030) | Low | Question Mark | Needs increased marketing and R&D investment |

| New Specialty Plastics | High (Potential) | Low | Question Mark | Dependent on market recovery and share capture |

| Kingsport Methanolysis Capacity Expansion | High (Internal Growth) | Low (for expanded output) | Question Mark | Market absorption of increased supply is crucial |

| Ethylene to Propylene (E2P) Technology | Moderate to High (Propylene Market) | Developing | Question Mark | Capital intensive, competitive market, feedstock volatility |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.