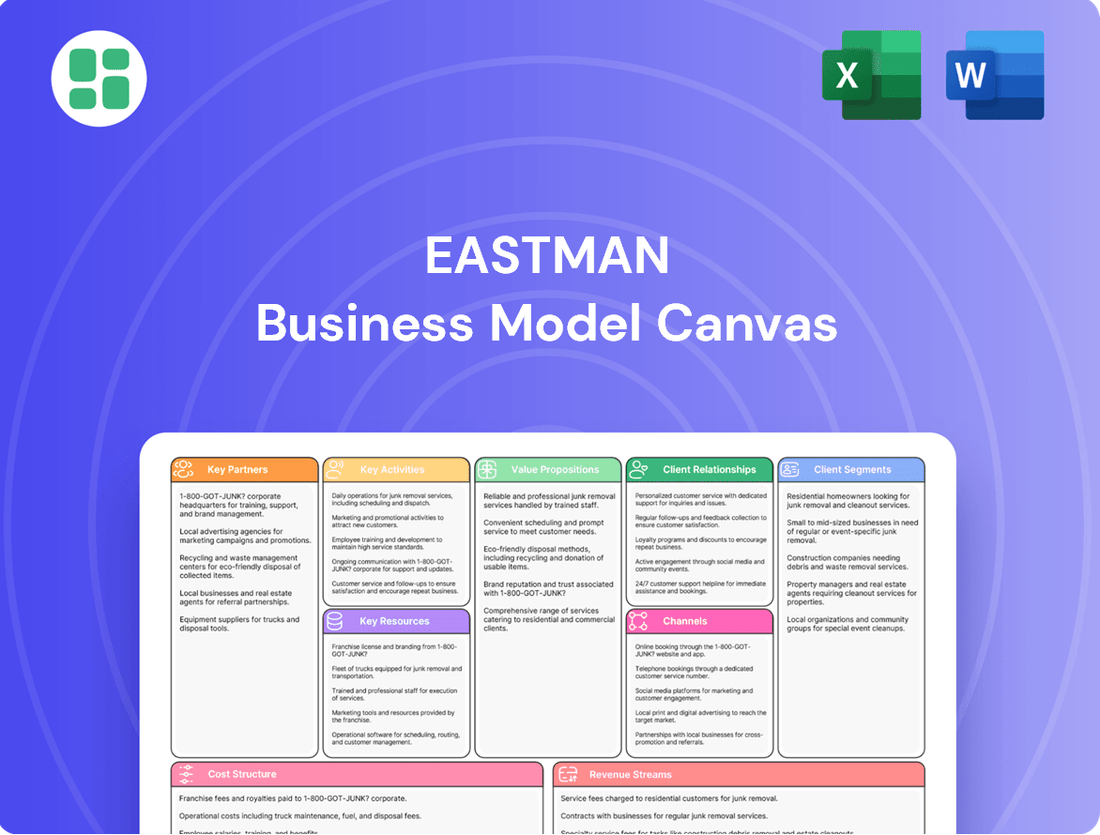

Eastman Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eastman Bundle

Curious about the engine driving Eastman's innovation and market dominance? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Unlock the strategic brilliance behind Eastman's operations with our full Business Model Canvas. This detailed analysis reveals how they build value, manage costs, and maintain a competitive edge, making it an indispensable tool for any aspiring business leader.

Ready to dissect Eastman's winning formula? Download the complete Business Model Canvas and gain immediate access to their customer segments, value propositions, and channels, empowering you to refine your own strategic vision.

Partnerships

Eastman actively partners with leading research institutions and academic bodies, including the China National Textile and Apparel Council (CNTAC) and the Beijing Institute of Fashion Technology (BIFT). These collaborations are vital for fostering sustainable innovation within the textile and fashion industries, aiming to inspire and educate the next generation of industry professionals.

These academic alliances are instrumental in pushing the boundaries of molecular science and materials technology. By working together, Eastman and its partners contribute to developing more circular material solutions, enhancing the overall lifecycle and recyclability of products.

Eastman collaborates with prominent brands such as Patagonia and PepsiCo, integrating its innovative Renew materials into their product lines. This strategic alignment with leading companies is crucial for expanding the reach of sustainable solutions and tackling the global plastic waste challenge.

These partnerships are instrumental in bringing more eco-conscious products to market, directly responding to growing consumer demand for sustainability. By working with these well-respected brands, Eastman amplifies the impact of its circular economy initiatives.

For instance, in 2024, Eastman announced a significant expansion of its molecular recycling capabilities, aiming to process even more hard-to-recycle plastic waste. These collaborations with brands are key to ensuring that this recycled material finds its way into desirable consumer goods, driving the adoption of truly circular solutions.

Eastman actively engages technology and licensing partners, a crucial element of its business model. The company licenses and sells its intellectual capital, which includes valuable patent rights, comprehensive engineering and technology transfer packages, and proprietary product formulations.

This strategic approach allows for the wider adoption of Eastman's innovative solutions across diverse markets. By leveraging its deep expertise through these partnerships, Eastman effectively extends its reach beyond its direct manufacturing capabilities, fostering growth and innovation.

Industry Associations and Initiatives

Eastman's participation in industry associations and initiatives, such as being a signatory to the Ellen MacArthur Foundation Global Commitment, is a crucial element of its business model. This commitment, shared with over 500 other organizations, highlights Eastman's dedication to fostering a circular economy for plastics, a significant global challenge.

These partnerships are not merely symbolic; they actively drive industry-wide change and provide a platform for collaborative problem-solving. By aligning with leading organizations, Eastman gains access to best practices and contributes to shaping the future of sustainable materials.

Key aspects of these partnerships include:

- Ellen MacArthur Foundation Global Commitment: Eastman is a signatory, demonstrating its pledge to advance the circular economy for plastics.

- Industry-Wide Collaboration: Participation fosters collective action to address complex sustainability issues, amplifying impact beyond individual efforts.

- Driving Innovation: Engagement with these initiatives encourages the development and adoption of new technologies and business models for a more sustainable future.

Waste Management and Recycling Partners

Eastman's commitment to circular economy principles is significantly bolstered by its strategic alliances with waste management and recycling entities. These partnerships are crucial for ensuring a consistent and high-quality supply of feedstock for its advanced molecular recycling operations.

For instance, Eastman's local collaborations in Kingsport, Tennessee, exemplify this strategy. These relationships focus on developing innovative solutions for industrial cardboard recycling. This not only diverts significant amounts of waste from landfills but also fosters local economic growth by creating new job opportunities within the recycling sector.

These partnerships are foundational to Eastman's ability to process complex waste streams and transform them back into valuable raw materials. By integrating these collaborations into its business model, Eastman is effectively building a more sustainable and resilient supply chain.

- Feedstock Security: Partnerships with waste management and recycling organizations are essential for securing the necessary materials to operate Eastman's molecular recycling facilities.

- Local Economic Impact: Collaborations, such as those in Kingsport, contribute to waste reduction and generate employment, supporting community development.

- Circular Economy Integration: These alliances are key to Eastman's strategy of closing the loop in material lifecycles, turning waste into valuable resources.

Eastman's key partnerships extend to technology and licensing collaborators, where the company strategically shares its intellectual capital. This includes valuable patent rights and comprehensive technology transfer packages, enabling wider market adoption of its innovations.

In 2024, Eastman continued to leverage these relationships to accelerate the deployment of its advanced materials technologies. By licensing its proprietary product formulations, Eastman effectively expands its market reach beyond its direct manufacturing capabilities, fostering growth and innovation across various sectors.

These licensing agreements are crucial for democratizing access to cutting-edge solutions, allowing other companies to integrate Eastman's sustainable technologies into their own product development cycles.

Eastman's strategic alliances with waste management and recycling entities are fundamental to its circular economy model. These partnerships ensure a steady supply of feedstock for its advanced molecular recycling operations. For example, in 2024, Eastman's collaborations in Kingsport, Tennessee, focused on enhancing industrial cardboard recycling, diverting waste and creating local jobs.

These collaborations are vital for securing the raw materials needed to operate Eastman's molecular recycling facilities, effectively closing the loop in material lifecycles.

| Partnership Type | Key Collaborators/Focus | Impact/Benefit | 2024 Data/Activity |

|---|---|---|---|

| Academic & Research | China National Textile and Apparel Council (CNTAC), Beijing Institute of Fashion Technology (BIFT) | Fosters sustainable innovation, educates industry professionals, advances molecular science. | Continued joint research projects on next-generation textile recycling technologies. |

| Brand Collaborations | Patagonia, PepsiCo | Integrates Renew materials, expands reach of sustainable solutions, addresses plastic waste. | Expansion of product lines featuring Eastman's recycled content, meeting growing consumer demand. |

| Technology & Licensing | Various technology providers and licensees | Wider adoption of Eastman's solutions, extends market reach, fosters innovation. | Licensing of proprietary formulations and patent rights to accelerate market penetration of new materials. |

| Waste Management & Recycling | Local entities in Kingsport, TN | Secures feedstock for molecular recycling, supports local economic growth, reduces landfill waste. | Increased processing of industrial cardboard waste, contributing to local job creation in the recycling sector. |

| Industry Initiatives | Ellen MacArthur Foundation Global Commitment | Drives industry-wide change, fosters collaborative problem-solving, promotes circular economy for plastics. | Continued commitment to ambitious plastic circularity goals alongside over 500 global organizations. |

What is included in the product

A detailed breakdown of Eastman's strategic approach, organized into the nine classic Business Model Canvas blocks. This canvas offers a clear view of their customer segments, value propositions, and operational strategies.

The Eastman Business Model Canvas offers a structured approach to pinpoint and address critical business challenges by visually mapping out key relationships.

It simplifies complex business strategies, allowing teams to quickly identify and resolve operational inefficiencies or market gaps.

Activities

Eastman dedicates significant resources to research and development, aiming to create cutting-edge materials and specialty chemicals. In 2023, the company reported R&D expenses of $347 million, underscoring its commitment to innovation, particularly in sustainable product development.

A key aspect of Eastman's R&D strategy involves integrating artificial intelligence. This technology is being used to speed up the discovery of new materials, refine manufacturing processes, and ultimately accelerate the launch of novel products into the market.

Eastman's manufacturing prowess is central to its business, involving extensive global operations. A prime example is its advanced methanolysis facility in Kingsport, Tennessee, a cornerstone of its commitment to a circular economy. This plant is designed for high efficiency, producing a wide array of materials, chemicals, and fibers.

Eastman's key activities heavily feature the scaling of its advanced circular recycling technologies. For instance, the Kingsport, Tennessee facility, utilizing methanolysis, is designed to process substantial volumes of plastic waste, turning it into new, high-quality materials. This innovation is central to their strategy.

This focus on molecular recycling is not just an environmental initiative; it's a significant growth engine. Eastman anticipates these circular economy efforts to be a substantial contributor to their future earnings before interest, taxes, depreciation, and amortization (EBITDA). This strategic pivot aims to capture value from a growing waste stream.

The company's investment in these technologies underscores a commitment to a circular economy model. By transforming materials that would otherwise be discarded, Eastman is creating a new revenue stream and reducing reliance on traditional petrochemical feedstocks, thereby enhancing its long-term sustainability and competitive advantage.

Sales, Marketing, and Customer Engagement

Eastman's sales and marketing efforts are centered on achieving commercial excellence. This involves sophisticated pricing strategies and fostering deep relationships with customers to ensure the perceived value of their specialty materials is maintained and enhanced. Their approach directly supports innovation-driven growth by aligning product development with market demands.

The company actively collaborates with both direct customers and downstream users. This engagement allows Eastman to co-create market-driven solutions tailored to specific application needs. For instance, in 2024, Eastman continued to invest in customer collaboration platforms to accelerate the development cycle for new materials.

- Commercial Excellence: Eastman prioritizes advanced pricing strategies and robust customer engagement to safeguard product value and fuel innovation-led expansion.

- Customer Collaboration: Direct engagement with customers and downstream partners is key to developing bespoke, market-responsive solutions.

- Innovation Drive: By understanding customer needs deeply, Eastman ensures its product pipeline is aligned with emerging market trends and requirements.

- Market Penetration: Their sales and marketing focus aims to not only retain existing customers but also to penetrate new markets with differentiated offerings.

Supply Chain Management and Optimization

Eastman's key activities heavily rely on managing its extensive global supply chain. This involves the intricate process of sourcing a diverse range of raw materials and then optimizing the logistics to ensure timely and cost-effective delivery of its specialty materials and additives to customers across the globe.

The company is proactively adapting its global supply chain strategies to navigate and mitigate the effects of ongoing trade disputes and evolving tariffs. This strategic adjustment aims to maintain supply chain resilience and ensure the uninterrupted, efficient flow of products to its international markets.

- Global Sourcing: Eastman manages the procurement of essential raw materials from various international suppliers, a critical component of its manufacturing operations.

- Logistics Optimization: The company continuously works to streamline its transportation and warehousing networks to reduce costs and improve delivery times worldwide.

- Trade Policy Adaptation: Eastman actively monitors and adjusts its supply chain in response to changing trade policies and tariffs, such as those impacting global chemical trade in 2024, to maintain competitive pricing and market access.

Eastman's key activities revolve around driving innovation through significant R&D investment, exemplified by $347 million in 2023 R&D expenses, and scaling its advanced circular recycling technologies. These activities are crucial for its strategy to transform plastic waste into high-quality materials, creating new revenue streams and enhancing its competitive edge in the circular economy.

What You See Is What You Get

Business Model Canvas

The Eastman Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete file, ensuring you know precisely what you're getting. Once your order is complete, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Eastman's intellectual property, including over 3,700 active patents globally in 2024, safeguards its cutting-edge material innovations and molecular recycling technologies. This robust patent portfolio is a cornerstone of its competitive edge, allowing Eastman to protect its proprietary processes and products from imitation.

Beyond patent protection, Eastman leverages valuable know-how and trade secrets, particularly in its advanced molecular recycling capabilities. This deep technical expertise, often not publicly disclosed, further solidifies its market position and creates barriers to entry for competitors, contributing significantly to its business model.

The company actively explores licensing opportunities for its patented technologies, generating additional revenue streams and extending the reach of its innovations. This strategic approach to intellectual property management allows Eastman to monetize its R&D investments while fostering broader industry adoption of sustainable solutions.

Eastman's advanced manufacturing facilities are a cornerstone of its business model, enabling the production of its wide array of specialty materials and chemicals. The company boasts a significant global manufacturing footprint, with key sites like its Kingsport, Tennessee facility playing a pivotal role.

The Kingsport site, for instance, houses a state-of-the-art methanolysis facility, a testament to Eastman's commitment to advanced production technologies. This facility is crucial for breaking down polyester waste into its basic components, which are then used to create new materials, supporting a circular economy approach.

In 2024, Eastman continued to invest in its manufacturing capabilities, with planned expansions aimed at increasing capacity and efficiency. These strategic investments are designed to meet growing demand for its innovative products, reinforcing its position as a leader in advanced materials.

Eastman's global workforce of roughly 14,000 individuals is a cornerstone of its business model. This team includes a significant number of scientists, engineers, and specialists in various technical fields, providing the intellectual capital necessary for the company's operations.

The deep expertise within Eastman's human capital, particularly in areas like molecular science, advanced materials, and practical application development, is what fuels the company's innovation engine. This specialized knowledge allows Eastman to tackle complex challenges and develop cutting-edge solutions for its diverse customer base.

Financial Capital

Eastman's financial capital is a cornerstone of its business model, providing the fuel for innovation and growth. Its strong financial health, evidenced by robust operating cash flow, allows for significant investments.

- Operating Cash Flow: Eastman reported approximately $1.3 billion in operating cash flow for 2024, with projections indicating around $1 billion for 2025. This consistent generation of cash is vital.

- Investment Capacity: This financial strength directly enables substantial investments in research and development, crucial for developing new materials and technologies.

- Capital Expenditures: The company allocates significant capital to growth projects, including expanding production capacity and upgrading facilities to meet market demand.

- Shareholder Returns: Eastman also utilizes its financial resources to return value to shareholders through dividends and share repurchases, reflecting confidence in its long-term strategy.

Sustainable Technologies and Feedstock Access

Eastman's molecular recycling technologies, especially its polyester renewal technology, represent a significant competitive advantage. This capability allows the company to transform complex, hard-to-recycle plastic waste into valuable new materials, a key differentiator in the circular economy space.

Access to a wide array of feedstock sources is fundamental to Eastman's operations. This includes securing diverse streams of mixed plastic waste, which are essential for both sustaining current circular economy initiatives and enabling future growth and innovation.

- Molecular Recycling Technologies: Eastman's polyester renewal technology is a prime example, capable of breaking down polyester waste into its basic molecular building blocks.

- Feedstock Diversity: The company actively seeks and utilizes various feedstock pools, including post-consumer and post-industrial plastic waste, to fuel its recycling processes.

- Circular Economy Enablement: These technologies and feedstock access are the bedrock of Eastman's circular economy strategy, allowing for the creation of new products from recycled materials.

- Capacity Expansion: In 2024, Eastman continued to invest in and expand its molecular recycling capacity, aiming to process hundreds of thousands of tons of plastic waste annually.

Eastman's intellectual property, including over 3,700 active patents in 2024, safeguards its material innovations and molecular recycling technologies, forming a core competitive advantage. This deep technical expertise, coupled with trade secrets in advanced molecular recycling, creates significant barriers to entry for competitors.

The company's global manufacturing footprint, including its advanced methanolysis facility in Kingsport, Tennessee, is crucial for producing specialty materials and chemicals. Strategic investments in 2024 continued to expand production capacity and efficiency to meet growing demand.

Eastman's approximately 14,000-strong workforce, rich in scientific and engineering talent, fuels its innovation engine, enabling the development of complex solutions. Its financial strength, demonstrated by $1.3 billion in operating cash flow in 2024, supports substantial R&D and growth project investments.

Molecular recycling technologies, particularly its polyester renewal process, allow Eastman to transform plastic waste into valuable materials, a key differentiator in the circular economy. The company’s access to diverse feedstock, including post-consumer and post-industrial plastic waste, is fundamental to its operations and circular economy strategy.

| Key Resource | Description | 2024 Data/Impact |

| Intellectual Property | Patents, know-how, trade secrets | 3,700+ active patents; protects proprietary processes |

| Manufacturing Facilities | Advanced production sites, e.g., Kingsport methanolysis | State-of-the-art facilities enabling circular economy approach |

| Human Capital | Skilled workforce (scientists, engineers) | ~14,000 employees; deep expertise in material science |

| Financial Capital | Operating cash flow, investment capacity | ~$1.3 billion operating cash flow; fuels R&D and growth |

| Molecular Recycling Technologies | Polyester renewal technology | Transforms plastic waste into new materials; capacity expansion in 2024 |

| Feedstock Access | Diverse plastic waste streams | Essential for circular economy initiatives and growth |

Value Propositions

Eastman offers innovative solutions like Aventa™ compostable materials and Saflex™ advanced interlayers, providing unique performance benefits across diverse applications.

These differentiated materials directly address growing consumer demand for sustainable options and advanced functionalities, particularly in sectors like automotive and packaging.

For instance, Saflex™ is a key component in automotive windshields, enhancing safety and acoustic performance, a market segment that saw continued innovation in 2024 with a focus on lighter, more durable glass solutions.

Eastman's commitment to the circular economy is a cornerstone of its value proposition, highlighted by innovative solutions like Eastman Renew materials. These products are manufactured using advanced molecular recycling technologies, transforming hard-to-recycle plastics into high-quality materials.

By offering these sustainable alternatives, Eastman directly addresses customer needs to reduce environmental impact. For instance, the company's investments in molecular recycling facilities, such as the one in France aiming for a 2025 operational start, underscore its dedication to scaling these solutions.

These advanced materials enable customers to significantly lower their waste generation and carbon footprint. In 2023, Eastman reported that its sustainable innovations were contributing to a growing portion of its revenue, demonstrating market demand for eco-conscious products.

Eastman's specialty materials and chemicals are designed to significantly boost the performance and functionality of a vast array of products, from consumer goods to complex industrial applications. These advanced materials are crucial for achieving desired end-product characteristics.

A key aspect of this value proposition lies in high-value additives. These components, though often a small fraction of a customer's overall product cost, deliver disproportionately large improvements in performance, durability, or aesthetic appeal. For instance, in 2024, Eastman reported that its Additives & Functional Products segment, which heavily features these performance-enhancing materials, saw strong demand, contributing to the company's overall revenue growth.

Technical Expertise and Application Development

Eastman’s technical expertise is a cornerstone of its value proposition, enabling the creation of tailored solutions through advanced molecular science and materials technology. This deep knowledge allows them to not only innovate but also to actively assist clients in overcoming complex product development hurdles.

The company actively partners with customers, offering dedicated technical support to ensure seamless integration of Eastman’s specialized materials. This collaborative approach is crucial for optimizing product performance and achieving desired outcomes in diverse applications.

- Customized Solutions: Eastman leverages its proprietary technologies to engineer materials that meet unique customer specifications, driving innovation in sectors like automotive and electronics.

- Application Development Support: The company provides hands-on assistance, helping clients optimize the use of their products in new and existing applications, thereby reducing development time and costs.

- Problem Solving: Eastman's technical teams are adept at diagnosing and resolving complex material-related challenges, ensuring customer success and fostering long-term partnerships.

- Material Science Innovation: With a strong R&D focus, Eastman continuously pushes the boundaries of material science, translating scientific breakthroughs into commercially viable solutions.

Reliability and Security of Supply

Eastman's commitment to sustainability within its supply chain is a cornerstone of its value proposition, ensuring customers consistently receive high-quality materials. This integration means a more resilient and predictable flow of products, a critical factor in today's dynamic market. For instance, in 2024, Eastman continued to invest in advanced recycling technologies, bolstering the availability of circular materials and enhancing supply chain security for its partners.

The company's substantial manufacturing infrastructure and unwavering dedication to operational efficiency directly translate into supply security for its business partners. This robust operational backbone allows Eastman to maintain consistent production levels, even amidst market fluctuations. In 2024, Eastman reported strong performance in its manufacturing segments, underscoring its ability to deliver on customer commitments reliably.

- Reliable Material Access: Eastman's sustainable supply chain practices ensure consistent availability of high-quality products for its customers.

- Operational Excellence: Robust manufacturing capabilities and a focus on efficiency guarantee supply security for partners.

- Sustainability Integration: By embedding sustainability, Eastman strengthens its supply chain's resilience and reliability.

- 2024 Performance: Continued investments in advanced recycling and strong manufacturing output in 2024 highlight Eastman's commitment to supply chain dependability.

Eastman's value proposition centers on delivering high-performance, differentiated materials that meet evolving market needs, particularly in sustainability and advanced functionality.

The company provides customized solutions and robust application development support, leveraging deep technical expertise to help clients overcome complex challenges and reduce development time.

Eastman's commitment to the circular economy and supply chain resilience ensures reliable access to high-quality, sustainable materials, supported by strong operational performance and strategic investments in advanced recycling technologies, as evidenced by its 2024 operational focus.

| Value Proposition Area | Key Offerings | Customer Benefit | Supporting Data/Examples |

|---|---|---|---|

| Innovative Materials | Aventa™ compostable materials, Saflex™ interlayers | Unique performance, sustainability | Saflex™ enhances automotive safety and acoustics; market focus on lighter glass in 2024. |

| Sustainability & Circularity | Eastman Renew materials, molecular recycling | Reduced environmental impact, waste reduction | Investments in molecular recycling facilities (e.g., France, aiming for 2025 operation); growing revenue contribution from sustainable innovations (2023). |

| Performance Enhancement | Specialty additives, functional chemicals | Improved product functionality, durability, aesthetics | Additives & Functional Products segment saw strong demand in 2024, contributing to revenue growth. |

| Technical Expertise & Support | Tailored solutions, collaborative development | Optimized product performance, faster development | Active customer partnerships and technical assistance for seamless integration. |

| Supply Chain Reliability | Sustainable sourcing, operational efficiency | Consistent material access, supply security | Continued investment in advanced recycling (2024); strong manufacturing performance (2024). |

Customer Relationships

Eastman’s commitment to customer relationships is evident in its dedicated sales and technical support teams. This direct engagement allows them to understand unique client needs, leading to tailored solutions and seamless product integration.

In 2024, Eastman reported that over 90% of its sales interactions involved specialized teams focused on specific industries, highlighting the depth of their customer-centric approach. This focus ensures that clients receive expert advice and support, fostering strong, long-term partnerships.

Eastman cultivates enduring relationships with crucial clients, frequently partnering on new product creation and environmental efforts. These strategic alliances, exemplified by collaborations with Patagonia and PepsiCo, focus on jointly developing and implementing Eastman's forward-thinking and eco-friendly materials.

In 2024, Eastman's commitment to these partnerships is evident in its significant investments in sustainable innovation, aiming to drive mutual growth and market leadership. For instance, its advanced materials are integral to achieving the ambitious sustainability goals set by partners like Patagonia, reinforcing the value of these long-term collaborations.

Eastman actively partners with customers through co-creation initiatives, utilizing its robust application development expertise. This collaborative process allows for the fine-tuning of products to precisely meet evolving market demands and unique customer specifications.

This deep engagement ensures that Eastman's solutions are not merely supplied but are integral components within the customer's operational framework, enhancing their value chain. For instance, in 2024, Eastman reported significant growth in its specialty materials segment, partly driven by these tailored customer collaborations which directly address niche application requirements and foster stronger, more integrated partnerships.

Customer Service and Support

Eastman Chemical Company places a high value on its customer relationships, focusing on providing robust customer service and support. This commitment extends to promptly addressing inquiries and offering thorough post-sales assistance, which are crucial for fostering customer satisfaction and building lasting loyalty. By consistently delivering on these fronts, Eastman reinforces its reputation as a dependable and trusted partner in the industries it serves.

In 2024, Eastman continued to invest in digital tools and training for its customer service teams. For example, the company's customer portal saw a 15% increase in user engagement, facilitating quicker access to product information and support resources. This focus on accessible and efficient support is a cornerstone of their strategy to maintain strong customer bonds.

- Dedicated Support Channels: Offering multiple avenues for customers to seek assistance, including phone, email, and online chat, ensures accessibility.

- Post-Sales Engagement: Proactive follow-ups and readily available technical support after a sale are key to resolving issues and enhancing the customer experience.

- Customer Feedback Integration: Actively soliciting and incorporating customer feedback into service improvements helps to build trust and demonstrate responsiveness.

- Technical Expertise: Providing access to knowledgeable staff who can offer in-depth product and application support is vital for specialized industries.

Digital Engagement and Information Sharing

Eastman actively engages its stakeholders through a robust digital presence, offering comprehensive investor relations resources. These platforms are crucial for sharing financial results and detailed sustainability reports, fostering an informed and trusting relationship with its customer base.

In 2024, Eastman continued to prioritize transparency, with its investor relations website serving as a central hub for quarterly earnings calls, annual reports, and sustainability performance data. This commitment to open communication is designed to build confidence and provide valuable insights to all interested parties.

- Digital Platforms: Eastman leverages its website and dedicated investor relations portals for direct communication.

- Information Accessibility: Financial results, including 2023 net sales of $21.3 billion, and sustainability reports are readily available.

- Stakeholder Trust: This consistent sharing of information aims to build and maintain trust with customers and investors.

- Informed Base: Providing easy access to data empowers customers and stakeholders to make informed decisions.

Eastman's customer relationships are built on a foundation of dedicated support and collaborative innovation, fostering deep partnerships. Their approach emphasizes understanding client needs through specialized teams and co-creation initiatives, driving tailored solutions and mutual growth.

In 2024, Eastman's focus on customer relationships manifested in over 90% of sales interactions involving industry-specific teams. This strategy, coupled with significant investments in sustainable innovation, directly supports partner goals, as seen with collaborations like those with Patagonia and PepsiCo, reinforcing Eastman's role as a valued, long-term partner.

Eastman prioritizes robust customer service and post-sales support, utilizing digital tools to enhance accessibility and engagement. For instance, their customer portal saw a 15% increase in user engagement in 2024, streamlining access to information and support, which is crucial for maintaining strong customer loyalty.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Dedicated Sales & Technical Support | Industry-specific teams, co-creation | Over 90% of sales interactions involved specialized teams |

| Collaborative Innovation | Joint product development, sustainability efforts | Partnerships with Patagonia and PepsiCo on eco-friendly materials |

| Digital Engagement & Support | Customer portal, accessible resources | 15% increase in customer portal user engagement |

| Transparency & Information Sharing | Investor relations, financial & sustainability reports | 2023 Net Sales: $21.3 billion |

Channels

Eastman's direct sales force acts as a crucial bridge to its major industrial clients and strategic accounts worldwide. This allows for in-depth discussions, tailored technical advice, and the creation of bespoke solutions, especially for their advanced specialty materials. For instance, in 2023, Eastman reported that its Advanced Materials segment, which heavily relies on direct sales for its high-value products, generated approximately $3.2 billion in revenue.

Eastman leverages a robust global distribution network, comprising numerous distributors, to ensure its diverse chemical products reach a wide array of customers and markets. This strategy is particularly effective for its more standardized offerings.

These distributors are instrumental in extending Eastman's market penetration, providing crucial local access to its broad portfolio of specialty materials and chemicals. For instance, in 2023, Eastman reported that its specialty plastics segment, which relies heavily on such distribution channels, continued to see demand from various end-use markets.

Eastman leverages trade shows and industry conferences as key channels to directly connect with its customer base. These events are crucial for unveiling new materials and technologies, allowing for immediate feedback and fostering deeper relationships. For instance, Eastman's presence at events like the Specialty & AgroChemicals America conference in 2024 provides a platform to demonstrate innovative solutions to a targeted audience.

Online Platforms and Digital Presence

Eastman leverages its corporate website and dedicated investor relations portal as key online platforms. These digital channels are crucial for disseminating vital information, publishing financial reports, and fostering transparent communication with stakeholders. In 2024, Eastman's investor relations website continued to be a primary source for quarterly earnings reports and annual shareholder meetings, ensuring accessible data for a broad financial audience.

The company's digital presence also serves to streamline customer inquiries and provide readily available company data. This focus on digital accessibility enhances engagement and supports informed decision-making for individual investors and financial professionals alike. For instance, Eastman's commitment to digital transparency was evident in its proactive updates regarding sustainability initiatives throughout 2024, a key concern for many investors.

- Corporate Website: Central hub for company news, product information, and corporate governance.

- Investor Relations Portal: Dedicated space for financial reports, SEC filings, and investor communications.

- Digital Information Dissemination: Facilitates timely access to earnings calls, press releases, and strategic updates.

- Customer Inquiry Support: Online tools and contact points for efficient customer service and information requests.

Technology Licensing Agreements

Eastman leverages technology licensing agreements as a key channel to expand its market reach. By granting other companies access to its patented technologies and proprietary know-how, Eastman can monetize its innovations without directly manufacturing and selling the end products. This strategy allows for wider adoption of its technological advancements across various industries.

This approach is particularly effective for specialized technologies where Eastman may not have the direct manufacturing capacity or market presence to capitalize on every opportunity. For instance, in 2024, Eastman continued to explore licensing opportunities for its advanced materials and chemical processes, aiming to create new revenue streams and foster innovation ecosystems. These agreements often involve upfront fees, royalties, and ongoing collaboration, contributing to Eastman's diverse income portfolio.

The benefits extend beyond revenue generation. Technology licensing fosters strategic alliances and can lead to faster market penetration for new technologies. It also allows Eastman to focus its resources on core competencies while still benefiting from the commercial success of its licensed intellectual property in new markets or applications. This channel plays a crucial role in Eastman's overall business model, driving growth and reinforcing its position as an innovator in the chemical industry.

- Technology Licensing: Eastman grants rights to use its patented technologies and know-how to third parties.

- Market Reach Extension: This channel allows broader market penetration for innovations without direct product sales.

- Revenue Diversification: Licensing agreements generate income through upfront fees and royalties.

- Strategic Alliances: Fosters partnerships and collaborations, accelerating technology adoption.

Eastman utilizes a multi-faceted channel strategy, blending direct engagement with indirect distribution to serve its diverse customer base. This approach ensures broad market coverage and tailored customer experiences, from high-touch industrial relationships to widespread product availability.

The company's direct sales force is key for its specialty materials, facilitating deep technical discussions and customized solutions. Complementing this, a robust global distributor network efficiently reaches a wider market for its more standardized chemical offerings. Trade shows and digital platforms further enhance customer interaction and information dissemination.

Technology licensing also serves as a significant channel, allowing Eastman to monetize its innovations and expand market reach without direct manufacturing. This strategy diversifies revenue and fosters strategic partnerships, amplifying the impact of its intellectual property.

| Channel | Description | Key Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Engages major industrial clients and strategic accounts. | Tailored technical advice and bespoke solutions. | Supported Advanced Materials segment revenue of ~$3.2 billion in 2023. |

| Global Distribution Network | Leverages numerous distributors for broad market access. | Efficiently reaches diverse customers with a wide product portfolio. | Crucial for extending penetration of specialty plastics and chemicals. |

| Trade Shows & Conferences | Direct interaction for unveiling new materials and technologies. | Facilitates immediate feedback and relationship building. | Platform for showcasing innovations, e.g., Specialty & AgroChemicals America 2024. |

| Digital Platforms (Website, IR Portal) | Online hub for company news, financial data, and investor communications. | Ensures transparent communication and accessible data. | Primary source for Q reports and shareholder meeting info in 2024. |

| Technology Licensing | Grants rights to patented technologies to third parties. | Monetizes innovation, expands market reach, diversifies revenue. | Continued exploration of licensing for advanced materials and processes in 2024. |

Customer Segments

Eastman is a key player in the transportation industry, supplying advanced materials like Saflex™ interlayers to automotive manufacturers. These interlayers are crucial for vehicle safety and performance, especially in the growing electric vehicle (EV) market. In 2024, the global automotive sector continued its focus on lightweighting and enhanced safety features, areas where Eastman’s materials provide significant advantages.

Eastman Chemical Company serves the building and construction sector by supplying a range of specialty materials and chemicals. These products are crucial for enhancing the durability and performance of structures, supporting everything from advanced coatings to high-strength adhesives.

In 2024, the global construction market was projected to reach over $17 trillion, highlighting the significant demand for innovative materials that improve efficiency and sustainability. Eastman's offerings, such as advanced polymers and additives, directly address these market needs, enabling the creation of more resilient and environmentally friendly buildings.

Eastman provides essential materials like advanced polymers, specialty films, and high-performance plastics that are critical for the durability and functionality of consumer electronics and a broad spectrum of durable goods. These materials are engineered to enhance product longevity and user experience in a competitive market.

In 2024, the global consumer electronics market was projected to reach over $1.1 trillion, highlighting the significant demand for the types of advanced materials Eastman supplies. Their innovations contribute to lighter, stronger, and more sustainable electronic devices, from smartphones to major appliances.

Health and Wellness

Eastman significantly serves the health and wellness sector, a critical customer segment. This includes providing advanced materials essential for medical devices, pharmaceutical packaging, and drug delivery systems, highlighting Eastman's role in sensitive healthcare applications.

The company's materials are also integral to personal care products and consumables, demonstrating their broad utility across various consumer health and hygiene markets. For instance, Eastman's specialty plastics are used in everything from cosmetic packaging to food contact materials, ensuring safety and performance.

- Medical Applications: Eastman's Tritan™ copolyester is widely adopted for medical device housings due to its durability, chemical resistance, and clarity, meeting stringent regulatory requirements.

- Pharmaceutical Packaging: The company offers advanced polymers for pharmaceutical bottles and blister packs, crucial for protecting sensitive medications and ensuring shelf life.

- Personal Care: Eastman's ingredients and polymers are found in skincare, haircare, and cosmetic products, contributing to product efficacy and aesthetic appeal.

- Consumables: In 2024, Eastman continued to supply materials for a range of health-related consumables, supporting industries focused on hygiene and well-being.

Agriculture and Animal Nutrition

Eastman provides specialized additives and functional products crucial for the agriculture and animal nutrition industries. These offerings are designed to enhance crop protection, improve animal health, and bolster overall food production efficiency.

The company's involvement in these sectors highlights its extensive market reach, contributing to the global food supply chain. For instance, in 2024, the global animal nutrition market was valued at approximately $65 billion, with additives playing a significant role in its growth.

- Crop Protection Enhancement: Eastman's solutions contribute to more effective and sustainable crop protection strategies.

- Animal Health and Well-being: The company's additives support the health and productivity of livestock and poultry.

- Food Production Efficiency: Eastman's products aid in optimizing various stages of food production, from farm to table.

- Market Penetration: These diverse applications demonstrate Eastman's broad impact across essential agricultural and nutritional segments.

Eastman Chemical Company targets a diverse array of customer segments, each with unique material needs. These segments span critical global industries, including transportation, building and construction, consumer electronics, health and wellness, and agriculture. The company’s strategy involves providing specialized materials that enhance product performance, durability, and sustainability across these varied markets.

Cost Structure

Raw material and energy costs represent a substantial component of Eastman's expenses. For instance, in 2023, the company reported that fluctuations in the cost of key feedstocks, such as natural gas and crude oil derivatives, directly impacted its operating income. Eastman actively manages these costs through strategic sourcing and hedging practices to mitigate volatility.

Operating expenses tied to manufacturing facilities, such as labor, upkeep, and energy consumption, represent a significant component of Eastman's cost structure. These costs are fundamental to producing their diverse range of chemical products.

Eastman actively pursues operational efficiency and optimizes its assets to control these manufacturing expenses. This strategic focus is crucial for maintaining competitiveness in the chemical industry.

For instance, in 2023, Eastman reported selling, general, and administrative expenses of $1.9 billion, which includes many of these operational overheads, alongside cost of sales that directly reflects production outlays.

Eastman Chemical Company dedicates substantial financial resources to Research and Development, a key driver of its innovation strategy. In 2024, the company continued to prioritize investments in cutting-edge areas such as advanced molecular recycling technologies and the integration of artificial intelligence across its operations. These forward-looking expenditures, while essential for maintaining a competitive edge and securing future revenue streams, represent a significant component of Eastman's operational cost structure.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for Eastman encompass the costs of its sales force, marketing initiatives, customer service operations, and the overall administrative backbone of the company. Eastman's strategy involves driving commercial excellence and maintaining strict cost discipline to effectively manage these overheads.

- Sales and Marketing: Costs related to promoting products and reaching customers.

- General and Administrative: Expenses for managing the business, including executive salaries and legal fees.

- Customer Support: Investments in ensuring customer satisfaction and retention.

- Cost Discipline: Eastman's focus on efficiency to control SG&A spending.

In 2024, Eastman reported SG&A expenses of approximately $2.0 billion, reflecting its ongoing commitment to operational efficiency and strategic market engagement. This figure is managed through continuous evaluation of marketing ROI and streamlining of administrative processes.

Capital Expenditures for Growth Projects

Eastman's commitment to its circular economy strategy necessitates substantial capital expenditures for growth projects. A prime example is the significant investment in its methanolysis facility in Kingsport, Tennessee, designed to process hard-to-recycle plastics. This facility represents a major upfront cost for a long-term growth initiative.

These capital outlays are crucial for scaling up innovative technologies and expanding Eastman's capacity in sustainable materials. The company has allocated considerable resources to these projects, anticipating future revenue streams and market leadership in the circular economy space.

Key capital expenditures for growth projects include:

- Investment in the Kingsport methanolysis facility to process polyester waste.

- Funding for potential future circular economy plants to meet growing demand.

- Development and scaling of advanced recycling technologies.

Eastman's cost structure is heavily influenced by raw material and energy expenses, with 2023 seeing significant impact from feedstock price volatility. Operating expenses for manufacturing, including labor and energy, are also substantial, with the company actively pursuing efficiency to manage these costs. In 2023, Selling, General, and Administrative (SG&A) expenses were reported at $1.9 billion, reflecting overheads and production outlays.

| Cost Category | 2023 Expense (Approx.) | Key Drivers |

|---|---|---|

| Raw Materials & Energy | Significant portion of Cost of Sales | Crude oil, natural gas derivatives, feedstock price fluctuations |

| Manufacturing Operating Expenses | Fundamental to production | Labor, energy consumption, facility upkeep |

| Sales, General & Administrative (SG&A) | $1.9 billion (2023) | Sales force, marketing, customer service, administrative functions |

| Research & Development (R&D) | Prioritized investment in 2024 | Advanced molecular recycling, AI integration |

| Capital Expenditures (Growth Projects) | Substantial for circular economy initiatives | Methanolysis facility in Kingsport, new plant development |

Revenue Streams

Eastman generates revenue through the sale of advanced materials. These include specialized polymers, films, and plastics designed for demanding applications across diverse sectors.

In the second quarter of 2025, the Advanced Materials segment alone brought in $777 million. This highlights the significant financial contribution of these high-value products to Eastman's overall business.

Eastman's Additives & Functional Products segment is a key revenue driver, bringing in $769 million in the second quarter of 2025. This diverse segment supplies essential materials across various industries, including food, animal feed, agriculture, personal care, and the transportation sector.

Eastman's Chemical Intermediates segment is a significant revenue driver, providing essential building blocks for various industries. This includes key products like olefin and acetyl derivatives, ethylene, and commodity solvents, crucial for manufacturing processes worldwide.

In the second quarter of 2025, this vital segment generated $463 million in revenue, underscoring its importance to Eastman's overall financial performance and market position.

Sales of Fibers

Eastman's Fibers segment is a significant contributor, generating revenue through the sale of cellulose acetate tow, yarns, and staple fibers. These products are primarily utilized in filtration media, such as cigarette filters, and in the textile industry.

In the second quarter of 2025, the Fibers segment demonstrated its financial importance, reporting revenues of $274 million. This figure highlights the segment's consistent performance and its role in Eastman's overall revenue generation.

- Primary Products: Cellulose acetate tow, yarns, and staple fibers.

- Key Markets: Filtration media (e.g., cigarette filters) and textiles.

- Q2 2025 Revenue: $274 million.

Licensing and Technology Transfer

Eastman generates revenue by licensing its advanced technologies and selling its intellectual capital, which includes valuable patent rights and proprietary know-how. This approach allows the company to monetize its significant investments in research and development, leveraging its extensive patent portfolio.

In 2024, Eastman continued to focus on these strategic licensing agreements, capitalizing on its innovation pipeline. The company’s strong R&D foundation, evidenced by its consistent patent filings, underpins the value of this revenue stream.

- Technology Licensing: Eastman earns income by granting other companies the right to use its patented processes and technologies.

- Intellectual Property Sales: Revenue is also derived from the direct sale of patent rights and proprietary knowledge.

- R&D Leverage: This stream directly benefits from Eastman's substantial and ongoing investments in research and development.

- Market Expansion: Licensing allows Eastman to extend the reach of its innovations into new markets and applications without direct capital expenditure.

Eastman's revenue streams are diverse, encompassing the sale of specialized materials, essential chemical products, and fibers, alongside income from technology licensing. These segments collectively contribute to the company's financial performance, with specific segments showing robust revenue generation in recent periods.

| Segment | Q2 2025 Revenue (Millions USD) | Key Products/Markets |

|---|---|---|

| Advanced Materials | 777 | Specialized polymers, films, plastics; demanding applications |

| Additives & Functional Products | 769 | Essential materials for food, agriculture, personal care, transportation |

| Chemical Intermediates | 463 | Olefin and acetyl derivatives, ethylene, commodity solvents |

| Fibers | 274 | Cellulose acetate tow, yarns, staple fibers; filtration media, textiles |

Business Model Canvas Data Sources

The Business Model Canvas is built using a combination of internal financial reports, customer feedback surveys, and competitive landscape analysis. These data sources provide a comprehensive view of Eastman's operations and market position.