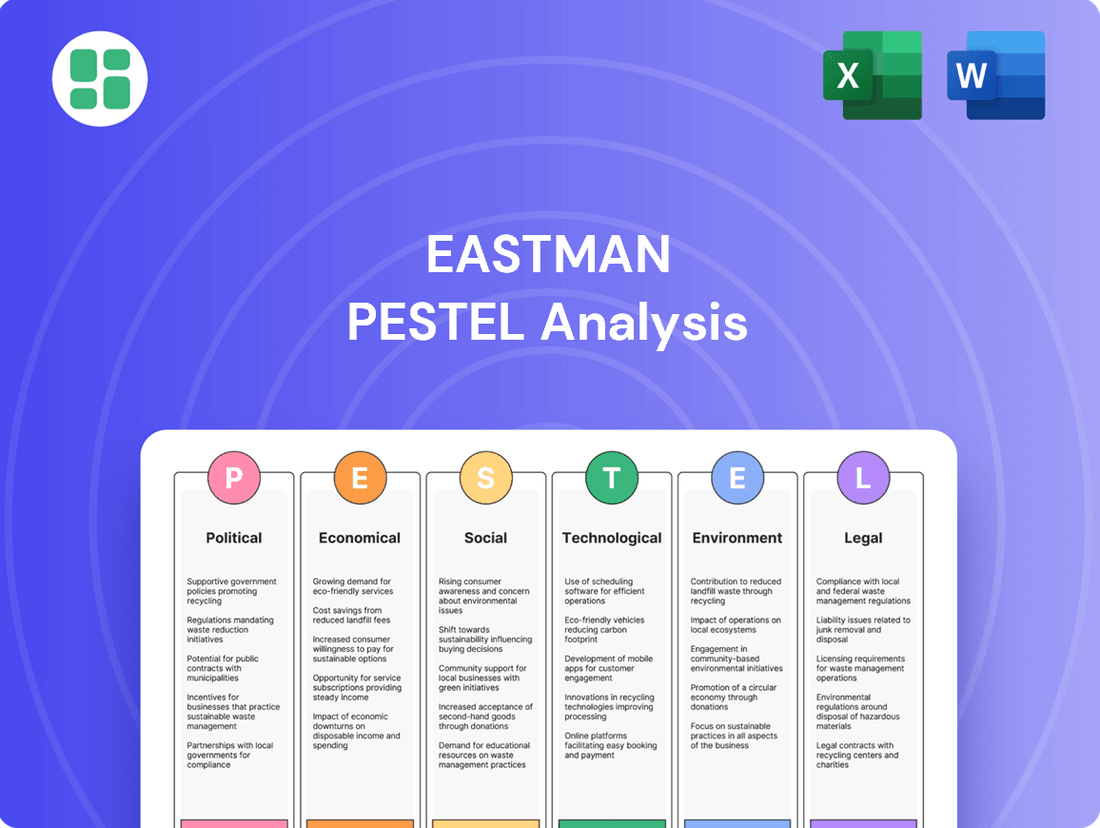

Eastman PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eastman Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Eastman's trajectory. Our comprehensive PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a strategic advantage.

Political factors

Government initiatives, like the substantial $37 billion allocated to US clean energy in 2024, directly shape Eastman's strategic direction. These programs are designed to accelerate the adoption of sustainable technologies, which is a core focus for Eastman's molecular recycling facilities.

This political backing is crucial as it not only validates Eastman's commitment to a circular economy but also opens avenues for significant financial support for its ambitious projects. Such incentives can de-risk investments and foster innovation in environmentally conscious manufacturing processes.

Ongoing trade policies and tariffs, especially U.S.-China tensions, significantly influence Eastman's import and export expenses. In 2024, these tariffs impacted an estimated 15-20% of Eastman's worldwide trade, introducing supply chain unpredictability and possibly dampening demand for specific goods.

Navigating these evolving trade dynamics is crucial for Eastman's profitability and strategic planning. For instance, increased tariffs on raw materials sourced from China could directly raise production costs for Eastman's specialty plastics and fibers.

Global geopolitical instability presents significant challenges for Eastman's diverse international operations. Events like the ongoing conflicts in Eastern Europe and the Middle East, which continued to shape the global landscape into early 2025, can disrupt vital supply chains and elevate the cost and availability of essential raw materials. For instance, disruptions to shipping routes or energy supplies directly impact manufacturing and logistics costs.

Regulatory Changes and Compliance

Eastman Chemical Company operates within a complex web of chemical manufacturing and environmental regulations, such as those overseen by the U.S. Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA). These regulations directly impact Eastman's operational costs and necessitate ongoing vigilance regarding hazardous substances. In 2024, the chemical industry faced increased scrutiny on per- and polyfluoroalkyl substances (PFAS), with potential new reporting and restriction requirements that could affect Eastman's product lines and require significant investment in compliance and reformulation.

Changes in health, safety, and environmental standards often translate to higher compliance expenditures for companies like Eastman. For instance, evolving emissions standards or waste disposal protocols can necessitate capital upgrades to manufacturing facilities. Eastman's commitment to global regulatory adherence means it must continuously adapt to varying international frameworks, ensuring its products and processes meet diverse legal requirements across its operating regions.

- Increased Compliance Costs: Regulatory shifts, particularly concerning chemical safety and environmental impact, can lead to substantial investments in new technologies and process modifications.

- TSCA and EPA Enforcement: Adherence to the Toxic Substances Control Act and EPA mandates is critical, with potential fines or operational disruptions for non-compliance.

- Global Regulatory Harmonization Challenges: Eastman must navigate and comply with a patchwork of international regulations, adding complexity and cost to its global operations.

- PFAS Scrutiny: Emerging regulations around PFAS compounds in 2024 and beyond pose a significant risk and compliance challenge for chemical manufacturers, potentially impacting product portfolios and requiring R&D investment.

Government Grant Reliability

The reliability of government grants, a crucial source of funding for projects like Eastman's advanced circular recycling facility, is inherently tied to political stability and policy continuity. For instance, Eastman secured a significant $375 million grant from the U.S. Department of Energy in 2024, underscoring the importance of such federal support.

However, shifts in political administrations or evolving fiscal priorities can impact the disbursement or continuation of these funds. Concerns about reducing unspent funds from legislative acts, such as the Inflation Reduction Act, could introduce uncertainty for recipients like Eastman, necessitating robust contingency planning and potential advocacy to safeguard ongoing financial commitments for vital initiatives.

- Federal Grant Dependence: Eastman's reliance on federal grants, exemplified by the $375 million DOE award in 2024, highlights both opportunity and vulnerability.

- Political Volatility: Changes in government leadership or policy direction can alter the landscape for grant funding, potentially affecting project timelines and financial stability.

- Fiscal Policy Shifts: Pledges to reduce unspent government funds, as seen in discussions around the Inflation Reduction Act, create a risk of reduced or delayed grant disbursements.

- Strategic Mitigation: Eastman must engage in proactive financial planning and potentially lobby to ensure continued support for its key sustainability projects amidst political uncertainties.

Government policies directly influence Eastman's investment in sustainable technologies, with initiatives like the 2024 US clean energy funding of $37 billion providing significant backing for its molecular recycling efforts. Political stability also underpins the reliability of crucial federal grants, such as the $375 million DOE award received by Eastman in 2024, which is vital for its advanced recycling facilities.

Trade policies and geopolitical tensions, including US-China relations, continue to impact Eastman's global trade, affecting approximately 15-20% of its worldwide transactions in 2024 and introducing supply chain volatility. Furthermore, evolving environmental regulations, such as increased scrutiny on PFAS compounds in 2024, necessitate ongoing compliance investments and potential product reformulation for Eastman.

| Policy Area | Impact on Eastman | 2024 Data/Trend |

|---|---|---|

| Sustainable Tech Incentives | Drives investment in circular economy projects | $37 billion US clean energy funding |

| Federal Grants | Supports capital-intensive facilities | $375 million DOE award for recycling |

| Trade Tariffs | Increases import/export costs, creates uncertainty | Impacted 15-20% of global trade |

| Environmental Regulations | Requires compliance spending, potential reformulation | Increased PFAS scrutiny |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Eastman across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, enabling businesses to identify and capitalize on emerging opportunities while mitigating potential threats.

Provides a clear, actionable framework to identify and address external threats and opportunities, alleviating the stress of navigating complex market dynamics.

Economic factors

Eastman's financial health is closely tied to the ebb and flow of the global economy. A noticeable slowdown persisted through 2023 and into 2024, which directly impacted demand for its diverse product portfolio and consequently, its sales figures. For instance, the company experienced a sales dip in the first quarter of 2024, a clear indicator of these prevailing economic headwinds.

Looking ahead to the first half of 2025, Eastman anticipates navigating a challenging macroeconomic landscape. However, the company remains focused on its strategic growth drivers, aiming for modest volume expansion within its specialty businesses. This strategy hinges on effectively deploying its robust innovation model to capitalize on emerging opportunities even amidst economic uncertainty.

Inflationary pressures are a significant concern for Eastman, impacting everything from energy markets to the cost of essential raw materials. These rising costs directly translate to higher operating expenses for the company.

In 2023, raw material expenses formed a substantial part of Eastman's overall revenue. This means that fluctuations in commodity prices, particularly for items like crude oil and ethylene, can lead to considerable volatility in the company's profit margins.

Eastman actively implements pricing strategies to counter these increased raw material costs. However, the company's inherent reliance on these market-sensitive commodities means it remains exposed to ongoing price swings, which can affect its financial performance.

Eastman's significant global presence, with over half of its projected 2024 sales originating outside North America, inherently exposes the company to the financial risks associated with currency exchange rate fluctuations.

The company directly experienced these impacts in the first quarter of 2025, reporting unfavorable foreign currency exchange effects that reduced its sales revenue. For instance, a strengthening US dollar against key international currencies can make Eastman's products more expensive for foreign buyers, potentially dampening demand.

Effective management of these currency volatilities is therefore paramount for Eastman to safeguard its financial stability and sustain profitability across its diverse international markets.

Investment in Growth and Capital Expenditures

Eastman's commitment to growth is evident in its substantial capital expenditure plans. The company anticipates spending approximately $800 million in 2025, with projections for 2026-2027 set to range between $800 million and $1 billion annually. These investments are strategically directed towards expanding its circular economy initiatives, particularly in molecular recycling technologies, and bolstering operational efficiency to fuel future profitability.

These capital expenditures are crucial for Eastman's long-term strategy, aiming to capitalize on the growing demand for sustainable materials and improved manufacturing processes. The focus on circular economy capabilities, such as advanced molecular recycling, positions Eastman to meet evolving market needs and regulatory landscapes.

- Projected Capital Expenditures (2025): Approximately $800 million.

- Projected Capital Expenditures (2026-2027): $800 million to $1 billion annually.

- Investment Focus: Expansion of circular economy capabilities (e.g., molecular recycling) and operational efficiency enhancements.

- Strategic Goal: Drive future earnings growth and capitalize on sustainable materials demand.

End-Market Demand Dynamics

Demand from Eastman's key end-use markets, such as transportation, building and construction, and durable goods, directly influences its sales performance. For instance, the automotive sector, a significant consumer of Eastman's coatings and materials, saw continued investment in new vehicle production in 2024, with projections indicating steady growth through 2025.

While certain segments, like consumer durables, experienced some headwinds in early 2025, Eastman's broad product range and strong customer relationships help to buffer these fluctuations. The company's ability to adapt to shifting consumer preferences and industrial needs is vital for maintaining sales stability across its diverse portfolio.

Looking ahead, the automotive coatings market and the broader construction industry are identified as critical demand drivers for Eastman. Growth in these sectors, fueled by infrastructure spending and evolving vehicle technologies, is expected to provide substantial opportunities for Eastman's specialized chemical and material solutions.

- Transportation Sector: Continued demand for automotive coatings and materials, with global automotive production expected to increase by approximately 3-4% in 2025.

- Building and Construction: Growth in residential and commercial construction projects, with the global construction market projected to expand by around 5% in 2025.

- Durable Goods: Mixed performance, with some categories facing normalization after post-pandemic demand surges, impacting Eastman's specialty plastics segment.

- Key Growth Areas: Focus on advanced materials for electric vehicles and sustainable building solutions to capitalize on evolving market needs.

Eastman's financial performance is intrinsically linked to global economic conditions, with 2024 and early 2025 marked by a noticeable economic slowdown that impacted demand and sales. The company anticipates a challenging macroeconomic environment through the first half of 2025, yet plans for modest volume growth in specialty businesses by leveraging innovation.

Inflationary pressures, particularly on energy and raw materials, continue to be a significant concern, directly increasing Eastman's operating expenses. The company's substantial reliance on commodity prices, such as crude oil and ethylene, means that price volatility can significantly affect profit margins, as seen with raw material expenses forming a large portion of revenue in 2023.

Eastman's global operations, with over half of its projected 2024 sales outside North America, expose it to currency exchange rate fluctuations. Unfavorable currency effects were reported in Q1 2025, reducing sales revenue and highlighting the need for effective currency risk management to maintain international profitability.

| Economic Factor | Impact on Eastman | Data/Trend (2024-2025) |

|---|---|---|

| Global Economic Growth | Slowdown impacting demand and sales. | Sales dip in Q1 2024; modest volume expansion anticipated in H1 2025. |

| Inflation | Increased operating expenses due to rising raw material and energy costs. | Raw material expenses were a substantial part of revenue in 2023; ongoing price swings affect profit margins. |

| Currency Exchange Rates | Unfavorable effects reduced sales revenue in Q1 2025. | Strengthening USD can make products more expensive internationally, dampening demand. |

Preview Before You Purchase

Eastman PESTLE Analysis

The Eastman PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Eastman covers all crucial aspects, providing valuable insights for strategic decision-making.

You'll gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Eastman's business.

Sociological factors

There's a noticeable shift in consumer preferences, with a growing appetite for products that are both sustainable and environmentally friendly. This is particularly evident in the chemical industry, where consumers are increasingly prioritizing green chemicals and materials made from recycled content. This trend is a significant sociological factor influencing market dynamics.

Eastman is actively addressing this by investing in the development of innovative sustainable materials and circular economy solutions. A substantial part of their product offerings now aligns with these circular economy principles, demonstrating their commitment to meeting this evolving demand. This strategic focus not only caters to consumer values but also opens up new avenues for market growth and enhances their brand reputation.

Eastman Chemical Company actively champions diversity, equity, and inclusion (DEI), striving for gender parity and leadership in racial equity within the chemical industry. This commitment is not just aspirational; it's recognized. For instance, in 2024, Eastman was lauded as a top employer for women and minority groups, highlighting tangible progress.

These DEI initiatives cultivate a more positive and innovative work environment, which in turn aids in attracting and retaining a wider pool of diverse talent. This focus on inclusivity is increasingly becoming a critical factor for stakeholder engagement and overall corporate reputation in the current business landscape.

Eastman Chemical Company actively embeds corporate social responsibility into its core business, extending support to local communities through dedicated philanthropic efforts and employee volunteer programs. In 2024 alone, the company channeled over $5 million into various community development initiatives.

This significant investment underscores Eastman's commitment to societal well-being, which in turn bolsters its corporate reputation and fosters stronger relationships with its diverse stakeholder base, demonstrating value creation beyond purely financial metrics.

Safety and Product Stewardship Commitment

Eastman places a strong emphasis on product safety and transparency, aiming to ensure its products are safe for everyone involved, from customers to the environment. This commitment is a core part of how they operate.

The company follows strict global product stewardship guidelines. This includes thorough assessments of potential hazards and making sure they source their raw materials responsibly. For instance, in 2023, Eastman reported investing significantly in safety initiatives and training programs across its global operations, reflecting this dedication.

- Product Safety Commitment: Eastman's dedication to ensuring the safety of its products for consumers, employees, and the environment is a cornerstone of its operations.

- Global Stewardship Standards: The company adheres to rigorous international product stewardship standards, encompassing detailed hazard assessments and ethical raw material procurement.

- Building Trust: This unwavering commitment to safety and responsible practices is crucial for fostering trust with consumers and maintaining positive relationships with regulatory agencies worldwide.

Shifting Workforce Demographics and Talent Attraction

Eastman, with its global workforce of roughly 14,000 employees, navigates the evolving landscape of workforce demographics, a key sociological factor influencing its operations. This demographic shift presents both challenges in talent acquisition and opportunities for innovation.

The company actively works to cultivate an inclusive and engaging work environment to attract a diverse talent pool. In 2024, Eastman continued to emphasize its commitment to employee development and well-being, recognizing the importance of a motivated workforce.

Initiatives like internal sustainability platforms and a dedicated Center of Excellence are designed to foster employee engagement and retention. These efforts aim to align individual career goals with the company's broader sustainability objectives, a crucial aspect for attracting and keeping talent in the 2024-2025 period.

- Global Workforce: Approximately 14,000 employees worldwide.

- Talent Focus: Emphasis on attracting diverse talent and fostering a positive work environment.

- Engagement Tools: Utilization of internal sustainability websites and a Center of Excellence.

- Retention Strategy: Linking employee development and engagement with sustainability goals.

Sociological factors significantly shape Eastman's operational landscape, particularly the growing consumer demand for sustainable and eco-friendly products. This trend is a powerful driver in the chemical sector, pushing for greener materials and circular economy solutions.

Eastman's proactive investment in these areas, with a substantial portion of its portfolio now aligned with circular economy principles, directly addresses this evolving consumer preference. This strategic alignment not only caters to ethical consumerism but also unlocks new market opportunities and strengthens brand loyalty.

The company's robust commitment to Diversity, Equity, and Inclusion (DEI) is a key sociological strength. Recognized in 2024 as a top employer for women and minority groups, Eastman fosters an innovative environment that attracts and retains a broad spectrum of talent, enhancing its overall corporate reputation.

Eastman's significant community investment, exceeding $5 million in philanthropic efforts in 2024, demonstrates a deep-rooted commitment to corporate social responsibility. This engagement builds strong stakeholder relationships and amplifies its positive societal impact.

Technological factors

Eastman is at the forefront of molecular recycling, particularly methanolysis, a key component of its circular economy initiatives. This technology transforms waste plastics into new, high-quality materials.

The company's Kingsport facility, which began operations in early 2024, has the capacity to process 250 million pounds of difficult-to-recycle plastic waste each year. Plans are underway for a second facility in Texas, aiming to double this processing capacity.

These advanced recycling methods allow Eastman to produce materials that are indistinguishable from virgin-grade products. This not only minimizes environmental impact by diverting waste from landfills but also unlocks significant new business opportunities by creating a sustainable, closed-loop supply chain.

Eastman is actively pursuing digital transformation and automation to boost its manufacturing and operational efficiency. In 2023 alone, the company allocated $127 million towards these technological advancements, rolling out new automated production lines across its worldwide sites.

This strategic investment in automation is designed to lower operational expenses and streamline production workflows. By embracing these technologies, Eastman aims to solidify its competitive edge in the market.

Eastman's dedication to Research and Development is a significant technological driver, evidenced by its substantial investment of $445 million in 2024. This financial commitment fuels innovation, particularly in sustainable materials and cutting-edge technologies, which are crucial for developing novel products and enhancing existing ones.

The company's strategic focus on R&D is geared towards addressing evolving customer demands and emerging market trends. By prioritizing sustainable macro trends, Eastman aims to direct 100% of its growth R&D spending towards these areas by 2030, underscoring a forward-looking approach to technological advancement.

Development of High-Performance and Sustainable Materials

Eastman's commitment to developing high-performance and sustainable materials is a key technological driver. Leveraging its deep understanding of molecular science, the company offers advanced solutions across various sectors. For instance, Aventa™ compostable materials address growing environmental concerns, while Saflex™ interlayers are crucial for the burgeoning electric vehicle market, improving safety and acoustics. Naia™ cellulosic fibers are also making waves in the sustainable fashion industry, showcasing Eastman's ability to innovate for a greener future.

These material innovations directly impact Eastman's market position and revenue streams. In 2024, the demand for sustainable and advanced materials is projected to grow significantly, driven by regulatory pressures and consumer preferences. Eastman's investment in research and development for these areas is crucial for maintaining its competitive edge. For example, the automotive sector, a key market for Saflex™, saw global EV sales reach approximately 14 million units in 2023, indicating a strong and expanding market for Eastman's interlayer solutions.

- Aventa™ Compostable Materials: Addressing the global need for biodegradable packaging solutions.

- Saflex™ Advanced Interlayers: Enhancing safety, acoustic performance, and lightweighting in automotive applications, particularly for EVs.

- Naia™ Cellulosic Fibers: Providing a sustainable and versatile option for the apparel and textile industries.

- Molecular Science Expertise: Underpinning the development of novel materials with tailored properties for diverse applications.

Integration of Artificial Intelligence and Machine Learning

Eastman is actively exploring the integration of Artificial Intelligence (AI) and Machine Learning (ML) to significantly accelerate its innovation processes. This strategic move is designed to streamline research and development, potentially leading to faster breakthroughs in material science and new product development. By embracing these advanced technologies, Eastman aims to enhance its competitive edge and drive future growth.

The company's commitment to AI and ML is evident in its ongoing investments and pilot programs. For instance, in 2024, Eastman announced a partnership with a leading AI firm to develop predictive modeling for material performance, aiming to reduce R&D cycles by an estimated 15-20%. This focus on data-driven innovation is crucial for staying ahead in a rapidly evolving chemical industry.

- AI-driven R&D: Eastman is leveraging AI to analyze vast datasets, identify novel material compositions, and optimize experimental parameters, thereby reducing the time and cost associated with traditional research methods.

- Predictive Analytics: The company is implementing ML algorithms to forecast market trends and customer needs, enabling more agile product development and a better alignment with market demands.

- Operational Efficiency: Beyond R&D, AI is being explored to optimize manufacturing processes, improve supply chain management, and enhance overall operational efficiency, contributing to cost savings and improved sustainability.

- Talent Development: Eastman is also investing in upskilling its workforce to effectively utilize AI and ML tools, ensuring it has the necessary expertise to capitalize on these technological advancements.

Eastman's technological prowess is centered on advanced recycling, particularly methanolysis, which converts waste plastics into high-quality materials. Its Kingsport facility, operational since early 2024, processes 250 million pounds of difficult-to-recycle plastic annually, with a second facility planned for Texas to double this capacity.

The company is also heavily investing in digital transformation and automation, allocating $127 million in 2023 for new automated production lines globally to reduce operational expenses and enhance efficiency.

A significant driver is Eastman's $445 million investment in Research and Development for 2024, focusing on sustainable materials and cutting-edge technologies to meet evolving market demands and trends. This includes developing innovative products like Aventa™ compostable materials, Saflex™ interlayers for EVs, and Naia™ cellulosic fibers for sustainable fashion.

Furthermore, Eastman is integrating AI and Machine Learning to accelerate R&D, aiming to reduce development cycles by 15-20% through predictive modeling, as seen in its 2024 partnership with a leading AI firm.

| Technological Focus | Key Initiatives/Products | 2023/2024 Data/Impact |

| Advanced Recycling (Methanolysis) | Circular Economy, Molecular Recycling | Kingsport facility processing 250 million lbs/year (since early 2024) |

| Digital Transformation & Automation | Automated Production Lines | $127 million invested in 2023 |

| Research & Development | Sustainable Materials, Novel Technologies | $445 million invested in 2024; focus on Aventa™, Saflex™, Naia™ |

| AI & Machine Learning | R&D Acceleration, Predictive Modeling | Partnership for 15-20% R&D cycle reduction |

Legal factors

Eastman Chemical Company navigates a complex web of global chemical industry regulations. Key among these are the U.S. Toxic Substances Control Act (TSCA) and international accords like the Paris Climate Agreement, which dictate how chemicals are manufactured, used, and disposed of. The company's commitment to compliance involves ongoing monitoring and reporting of its material usage, a critical aspect of its operational strategy.

Failure to adhere to these stringent legal frameworks can result in substantial financial penalties and significant disruptions to Eastman's operations. For instance, in 2023, chemical companies faced an average of $1.5 million in fines for environmental regulatory violations, underscoring the financial risks associated with non-compliance.

Eastman Chemical Company places significant emphasis on intellectual property (IP) protection, a cornerstone of its competitive strategy. As of 2024, the company boasts a robust portfolio, actively holding over 3,700 active patents globally.

This extensive patent protection is vital for Eastman, as it safeguards its unique technological innovations and proprietary product formulations. By legally securing its advancements, Eastman maintains a distinct advantage in the highly competitive specialty materials sector.

Eastman is deeply committed to product safety, implementing rigorous stewardship standards across its global operations. This involves thorough hazard assessments for all products and continuous review of their intended applications to ensure consumer and environmental protection.

The company actively complies with global hazard communication standards, such as the Globally Harmonized System of Classification and Labelling of Chemicals (GHS). This ensures clear and consistent information is provided regarding the potential hazards of their chemical products, a critical aspect of legal compliance and responsible business practice.

Eastman's dedication to product liability also encompasses responsible sourcing of raw materials, ensuring that upstream suppliers meet stringent safety and quality benchmarks. This proactive approach minimizes legal risks associated with product defects or non-compliance with evolving safety regulations, which can impact market access and brand reputation.

Global Trade Compliance

Eastman’s extensive global footprint, operating in over 100 countries, necessitates meticulous adherence to a complex web of global trade compliance regulations. This includes navigating the intricacies of international trade provisions and potential scrutiny under laws such as the U.S. Foreign Corrupt Practices Act. The company’s dedicated legal organization actively manages these challenges, which is crucial for maintaining seamless multinational operations and mitigating legal risks.

The company’s legal framework is designed to address the dynamic landscape of international commerce. This involves proactive management of:

- Tariffs and duties: Monitoring and complying with evolving tariff structures across various jurisdictions.

- Trade tensions: Adapting to geopolitical shifts and trade disputes that can impact supply chains and market access.

- International trade provisions: Ensuring compliance with agreements and regulations governing cross-border transactions.

Cybersecurity Risk Management and Governance

Eastman Chemical Company, in its February 2025 10-K filing, detailed its cybersecurity risk management and governance processes. This is critical as the company navigates increasing digital integration.

The legal landscape surrounding data protection and cybersecurity is constantly evolving, requiring companies like Eastman to maintain rigorous compliance. Failure to adhere to these regulations can result in significant fines and reputational damage.

Key legal considerations for Eastman include:

- Data Privacy Laws: Compliance with global regulations such as GDPR and CCPA, which govern the collection, processing, and storage of personal data.

- Cybersecurity Mandates: Adherence to industry-specific cybersecurity standards and government mandates designed to protect critical infrastructure and sensitive information.

- Intellectual Property Protection: Legal frameworks aimed at safeguarding proprietary technologies and trade secrets from cyber theft.

- Incident Response and Reporting: Legal obligations related to the timely notification of data breaches to affected individuals and regulatory bodies.

Eastman's legal obligations extend to robust intellectual property protection, with over 3,700 active patents globally as of 2024. This safeguards its innovations, crucial in the competitive specialty materials market.

The company also prioritizes product safety and stewardship, adhering to global standards like the Globally Harmonized System of Classification and Labelling of Chemicals (GHS) for hazard communication. This commitment minimizes legal risks associated with product liability and ensures market access.

Navigating over 100 countries requires strict adherence to international trade compliance, including tariffs, duties, and geopolitical trade tensions. Eastman’s legal team actively manages these complexities to ensure seamless multinational operations.

Furthermore, Eastman's February 2025 10-K filing highlights its focus on cybersecurity and data privacy, complying with regulations like GDPR and CCPA to protect sensitive information and avoid significant fines.

Environmental factors

Eastman is actively pursuing climate change mitigation, aiming for a one-third reduction in its Scope 1 and 2 greenhouse gas emissions by 2030, with a long-term goal of achieving carbon neutrality by 2050. The company has made substantial headway, already accomplishing roughly two-thirds of its 2030 emission reduction target.

Key strategies driving this progress include enhancing energy efficiency across operations, undertaking significant process transformations, and deploying advanced molecular recycling technologies. These efforts are designed to directly lower the company's carbon footprint and contribute to a more sustainable future.

Eastman is aggressively pursuing circular economy initiatives, targeting the recycling of over 500 million pounds of plastic waste annually by 2030 through its advanced molecular recycling technologies. This ambitious goal is supported by a 2025 interim target of 250 million pounds.

The company's strategy hinges on operationalizing its Kingsport methanolysis facility and developing a second site in Texas. These facilities are designed to tackle difficult-to-recycle plastic waste, transforming it into valuable new materials.

Eastman is actively pursuing renewable energy adoption as a core component of its climate strategy. The company has set an ambitious target to source 100% of its purchased electricity in North America and Europe from renewable sources by 2030.

To achieve this, Eastman is integrating innovative zero-carbon energy technologies, such as thermal batteries paired with solar energy systems, into its new facilities. This strategic move is designed to significantly decarbonize its operational footprint and reduce dependence on traditional fossil fuels.

Sustainable Raw Material Sourcing

Eastman is committed to sustainable raw material sourcing, integrating it directly into its innovation processes. This commitment is underscored by its pursuit of independent, third-party certifications for its products, demonstrating a dedication to responsible procurement practices. This strategy aligns with Eastman's broader chemical management policy, emphasizing a comprehensive approach to safeguarding both people and the environment.

The company's focus on sustainable sourcing is crucial in navigating evolving environmental regulations and consumer expectations. For instance, by 2023, Eastman reported that 90% of its new product development projects had sustainability as a key design element, reflecting a tangible shift towards eco-conscious materials. This proactive stance helps mitigate risks associated with resource scarcity and environmental impact, positioning Eastman favorably in a market increasingly valuing corporate environmental stewardship.

- Third-Party Certifications: Eastman actively seeks certifications like ISCC PLUS for its advanced circular materials, validating the sustainable origins of its feedstocks.

- Responsible Procurement: The company's chemical management policy guides the sourcing of raw materials, ensuring they meet stringent environmental and social standards.

- Innovation Integration: Sustainability is embedded in product development, with a significant percentage of new products designed with environmental considerations at their core.

Water Usage and Waste Management

Eastman Chemical Company is actively addressing its environmental impact, with a particular focus on water usage and waste management. The company has established ambitious goals to significantly reduce its water consumption across its global operations. This commitment is driven by its sustainability center of excellence, which is tasked with pinpointing and resolving challenges related to water efficiency and waste reduction.

Their strategy involves implementing innovative solutions and fostering cross-functional collaboration to achieve these environmental targets. Eastman's efforts are geared towards minimizing waste generation, lowering emissions, and optimizing energy consumption throughout its manufacturing processes. For instance, in 2023, Eastman reported a reduction in its total waste generated, with specific initiatives targeting water recycling and reuse.

- Water Reduction Targets: Eastman has set aggressive goals for decreasing its water footprint, aiming for a specific percentage reduction by 2030.

- Waste Minimization Initiatives: The company actively pursues strategies to reduce landfill waste and increase recycling rates, with data showing year-over-year improvements.

- Sustainability Center of Excellence: This dedicated team spearheads research and development for water efficiency and waste management solutions.

- Operational Efficiency: Investments in new technologies and process improvements are key to achieving both water and waste reduction objectives.

Eastman is making significant strides in reducing its environmental impact, particularly concerning greenhouse gas emissions and plastic waste. By 2030, the company aims to cut its Scope 1 and 2 emissions by one-third and recycle over 500 million pounds of plastic waste annually through advanced molecular recycling. These targets are supported by substantial progress, with the company already achieving two-thirds of its 2030 emission reduction goal.

Key initiatives include enhancing energy efficiency, transforming manufacturing processes, and adopting renewable energy sources, targeting 100% renewable electricity in North America and Europe by 2030. Eastman is also embedding sustainability into its product development, with 90% of new projects in 2023 featuring sustainability as a core design element.

Furthermore, Eastman is focused on responsible water usage and waste management, setting ambitious reduction targets and implementing innovative solutions. These efforts are guided by a dedicated sustainability center of excellence, aiming to minimize waste and optimize resource consumption across operations.

| Environmental Focus | Target/Goal | Progress/Status (as of latest available data) | Key Strategies |

|---|---|---|---|

| Greenhouse Gas Emissions (Scope 1 & 2) | One-third reduction by 2030; Carbon Neutrality by 2050 | Achieved ~two-thirds of 2030 reduction target. | Energy efficiency, process transformation, molecular recycling. |

| Plastic Waste Recycling | Over 500 million pounds annually by 2030; 250 million pounds by 2025 | On track to meet interim 2025 target. | Molecular recycling technologies (methanolysis). |

| Renewable Energy Sourcing (Purchased Electricity) | 100% in North America & Europe by 2030 | Actively integrating zero-carbon energy technologies. | Solar energy systems, thermal batteries. |

| Sustainable Product Development | Sustainability as key design element in new products | 90% of new product development projects in 2023 | Integrating sustainable raw material sourcing. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Eastman is built on a robust foundation of data from leading financial institutions like the IMF and World Bank, alongside industry-specific market research and government regulatory updates. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.