Eastman Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eastman Bundle

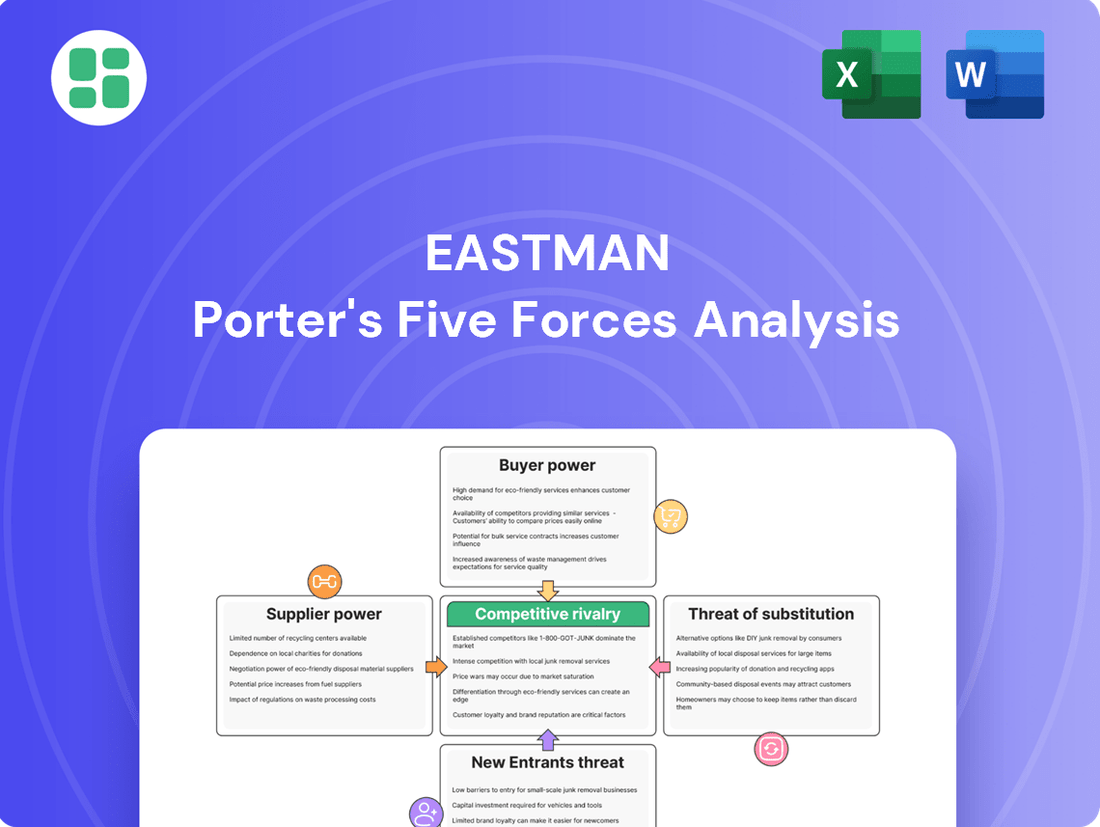

Eastman's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the ever-present threat of new entrants. Understanding these dynamics is crucial for any strategic decision-maker.

The full Porter's Five Forces Analysis dives deep into each of these pressures, revealing the intricate web of factors influencing Eastman's profitability and market position. Unlock actionable insights that go beyond this brief overview and empower your strategic planning.

Suppliers Bargaining Power

Eastman Chemical Company's bargaining power with its suppliers is notably constrained because it depends on a limited number of providers for specialized raw materials. This situation is quite common in the chemical industry, where certain inputs are not readily available from many sources.

As of 2024, the landscape of specialty chemical suppliers is quite concentrated. In fact, the top ten global providers control roughly 57% of this market segment. This means that a small number of companies wield considerable influence over the availability and cost of essential components for businesses like Eastman.

This concentration of power among a few key suppliers allows them to significantly impact pricing and negotiate terms for critical raw materials. For Eastman, this can translate into higher costs for petrochemical feedstocks and other specialized chemical inputs, directly affecting its operational expenses and profit margins.

High switching costs significantly bolster the bargaining power of Eastman's chemical suppliers. For instance, transitioning to a new supplier for a specialized chemical input can incur substantial financial burdens, with technical recertification alone averaging $1.2 million.

Beyond recertification, modifying existing infrastructure to accommodate different chemical inputs can add another layer of expense, estimated at around $3.6 million per specialized chemical. These considerable financial implications create a strong disincentive for Eastman to switch suppliers, thereby empowering existing suppliers.

Suppliers in the specialty chemical sector often need significant capital to build and maintain their production facilities. For instance, the average cost to develop infrastructure for a new chemical plant was around $78.5 million in 2024. This substantial financial commitment acts as a significant barrier, making it difficult for new players to enter the market.

Consequently, this high entry cost tends to consolidate power among established suppliers. They can leverage their entrenched positions and economies of scale to negotiate more favorable terms with companies like Eastman, potentially impacting Eastman's cost of goods sold and overall profitability.

Fluctuations in Raw Material Costs

Eastman's profitability is significantly influenced by the fluctuating costs of its primary raw materials, such as methanol and ethylene. These inputs are subject to market pressures that have demonstrated notable volatility throughout 2024 and into 2025. Such price swings directly impact Eastman's manufacturing expenses, highlighting the substantial bargaining power held by its suppliers.

- Raw Material Cost Volatility: Methanol and ethylene prices experienced significant fluctuations in 2024, impacting Eastman's cost structure.

- Supplier Influence: These price changes directly affect Eastman's production expenses and overall profitability, demonstrating supplier leverage.

- Market Dynamics: Broader market conditions and supplier-specific dynamics are key drivers behind these cost fluctuations.

Global Sourcing Strategies to Mitigate Risk

Eastman Chemical actively manages supplier bargaining power through its global sourcing approach. By diversifying its supplier base across different regions, the company aims to prevent any single supplier from dictating terms or prices, thereby strengthening its own negotiating position.

This strategy is crucial for maintaining cost stability and ensuring a reliable supply of raw materials. For instance, in 2024, Eastman's diversified sourcing for key petrochemical feedstocks allowed it to absorb some of the price volatility seen in specific geographic markets, a common challenge in the chemical industry.

- Diversified Supplier Network: Reduces reliance on any single entity.

- Cost Stabilization: Mitigates the impact of price hikes from individual suppliers.

- Supply Chain Resilience: Enhances ability to navigate disruptions.

- Negotiating Leverage: Strengthens Eastman's position in discussions with suppliers.

The bargaining power of Eastman's suppliers is significant due to industry concentration and high switching costs. In 2024, the top ten global specialty chemical providers controlled approximately 57% of the market, giving them considerable leverage over pricing for critical inputs like petrochemical feedstocks. These suppliers can dictate terms, impacting Eastman's operational expenses and profit margins.

High switching costs further empower these suppliers. The average cost for technical recertification alone is around $1.2 million, and adapting infrastructure can add another $3.6 million per specialized chemical. These substantial financial barriers make it difficult and costly for Eastman to change suppliers, reinforcing the existing suppliers' strong negotiating positions.

| Factor | Impact on Eastman | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | Limited choice, increased reliance | Top 10 global specialty chemical providers control 57% of market |

| Switching Costs (Recertification) | Financial disincentive to change suppliers | Average $1.2 million per chemical |

| Switching Costs (Infrastructure) | Significant investment required for new inputs | Estimated $3.6 million per specialized chemical |

| Raw Material Price Volatility | Direct impact on manufacturing expenses | Methanol and ethylene prices showed notable fluctuations |

What is included in the product

This analysis meticulously examines the five competitive forces impacting Eastman, providing insights into its industry structure, competitive intensity, and strategic positioning.

Easily identify and address competitive threats by visually mapping the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Eastman Chemical Company's diverse customer base, spanning transportation, building and construction, durable goods, health and wellness, agriculture, and consumables, significantly dilutes the bargaining power of any single customer. In 2024, this broad market penetration means that no single end market represented more than 20% of the company's total sales, a testament to its diversified revenue streams.

Customers are increasingly looking for specialized materials that offer unique benefits, like better performance and eco-friendly attributes. This shift means they are less likely to switch suppliers based on price alone. For instance, Eastman's investment in advanced materials, such as those derived from molecular recycling, directly addresses this demand for differentiated and sustainable solutions.

Eastman's business-to-business (B2B) model means its customers are typically other manufacturers, not individual consumers. This often translates to customers with substantial purchasing power, especially those buying in large volumes. For instance, in 2024, major automotive or construction companies, key clients for Eastman's specialty plastics and chemicals, could exert considerable influence due to their scale.

The technical nature of Eastman's products means its industrial customers often possess significant expertise. This knowledge allows them to thoroughly evaluate alternatives and negotiate terms based on performance and cost, potentially increasing their bargaining leverage. For example, a large electronics manufacturer seeking advanced polymer solutions would likely have a deep understanding of material specifications and pricing benchmarks.

Customer Inventory Destocking Impacts Sales Volume

Customer inventory destocking, a trend observed in early 2025 for products such as acetate tow, directly impacts Eastman's sales volume. This behavior signifies that customers possess the leverage to temporarily curtail their purchases, thereby exerting pressure on Eastman's revenue streams. It underscores the customers' capacity to actively manage their own inventory levels in reaction to prevailing market dynamics.

This ability to destock highlights a significant aspect of the bargaining power of customers. For instance, if customers reduce their orders by a substantial percentage, it forces Eastman to potentially lower production or carry excess inventory, impacting profitability.

- Customer Inventory Management: Customers can delay or reduce orders, directly affecting Eastman's sales volume.

- Price Sensitivity: Destocking can be a signal of customer price sensitivity or anticipation of future price drops.

- Market Signal: This action by customers can indicate broader market slowdowns or shifts in demand.

Impact of Macroeconomic Conditions on Customer Demand

Ongoing macroeconomic uncertainty and global trade issues, such as tariffs, have significantly dampened primary demand in crucial sectors like building and construction and automotive manufacturing. For instance, in 2024, many construction projects experienced delays or scaled-back plans due to rising material costs and financing challenges, directly impacting demand for materials and components.

This widespread weakening of demand across various customer segments inherently shifts power towards the buyers. When customers themselves are navigating market headwinds and facing their own sales pressures, they become more assertive in seeking favorable terms, potentially leading to price concessions or demands for customized solutions.

- Weakened End Markets: 2024 data indicates a notable slowdown in automotive production in several key regions, with some manufacturers reporting single-digit growth or even contractions compared to previous years, directly affecting suppliers.

- Increased Buyer Leverage: Reduced demand means fewer buyers are competing for a given product or service, giving remaining customers greater ability to negotiate better pricing and terms.

- Focus on Cost Savings: Customers facing their own economic pressures are prioritizing cost reduction, making them more sensitive to price increases and more likely to switch suppliers if better deals are available.

Eastman's diverse customer base, with no single end market exceeding 20% of sales in 2024, limits individual customer power. However, its business-to-business model means large industrial clients, like automotive manufacturers, possess significant purchasing volume and technical expertise, enabling them to negotiate effectively. Customer inventory destocking in early 2025 for items like acetate tow also demonstrates their ability to influence Eastman's sales by curtailing orders, directly impacting production and profitability.

| Customer Segment | 2024 Sales % (Approx.) | Bargaining Power Factors |

|---|---|---|

| Automotive | 15-20% | High volume, technical specifications, potential for switching |

| Building & Construction | 10-15% | Volume purchasing, price sensitivity due to project budgets |

| Electronics | 5-10% | Technical expertise, demand for specialized materials |

| Consumables | 10-15% | Brand loyalty, but potential for private label substitution |

Same Document Delivered

Eastman Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Eastman Porter's Five Forces Analysis provides a detailed examination of the competitive landscape impacting Eastman Chemical Company, covering industry rivalry, bargaining power of buyers and suppliers, threat of new entrants, and threat of substitute products. You're previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

Eastman Chemical Company faces intense rivalry in the global specialty chemicals market. This sector is crowded with many large, well-established companies, all competing vigorously for market share across a wide array of products and customer segments.

The competitive intensity is further amplified by the presence of numerous smaller, agile players who can quickly adapt to market shifts and technological advancements. For instance, in 2023, the global specialty chemicals market was valued at approximately $730 billion, with significant growth projected in the coming years, indicating a dynamic and fiercely contested environment.

Eastman Chemical Company operates in a highly competitive landscape, facing formidable rivals like BASF, Celanese, DuPont, Dow, Huntsman, LyondellBasell Industries, and Avient. These global chemical giants possess vast product offerings, substantial research and development investments, and established worldwide distribution channels, all of which amplify the intensity of competition.

Eastman's competitive rivalry is significantly shaped by its commitment to innovation and sustainability. The company actively pursues an innovation-driven growth strategy, utilizing advanced technology platforms to develop unique, high-performance materials. This focus is particularly evident in its pioneering work with molecular recycling facilities, a key differentiator in an industry increasingly prioritizing eco-friendly solutions.

This dedication to sustainable innovation allows Eastman to carve out a distinct market position. For instance, in 2024, Eastman announced significant investments in its advanced circular recycling technologies, aiming to process an additional 250,000 metric tons of hard-to-recycle plastic waste annually. Such initiatives not only address environmental concerns but also create specialized product offerings, thereby reducing direct price-based competition and fostering customer loyalty.

Industry Growth and Market Trends

The global specialty chemicals market is expanding, with projections indicating it will reach USD 1.29 trillion by 2034. This growth is propelled by strong demand from key industries such as automotive, construction, and electronics.

This expanding market landscape intensifies competitive rivalry. As opportunities arise, companies actively pursue market share expansion, leading to increased competition among established players and new entrants alike.

- Market Growth Drivers: Increasing demand from automotive, construction, and electronics sectors.

- Market Size Projection: Expected to reach USD 1.29 trillion by 2034.

- Impact on Rivalry: Growth fuels competitive activity as firms seek to capture market share.

Macroeconomic Headwinds and Cost Pressures

Ongoing macroeconomic headwinds, such as persistent inflation and the potential for increased tariffs, significantly amplify competitive rivalry. These external pressures directly impact raw material and energy costs, creating a volatile operating environment for companies like Eastman. In 2024, for instance, global energy prices have seen considerable fluctuation, directly affecting production expenses.

These cost pressures inevitably compress profit margins, forcing businesses to engage in more aggressive price-based competition. Rivals are compelled to find efficiencies and pass on costs, leading to a more intense struggle for market share. This dynamic necessitates a sharp focus on cost reduction strategies and enhancing operational efficiency across the board.

- Inflationary pressures in 2024 have raised input costs for many chemical manufacturers.

- Fluctuating energy prices directly impact the cost of production for materials like ethylene and propylene.

- Tariff uncertainties can disrupt supply chains and increase the cost of imported components, intensifying competition.

- Companies are increasingly prioritizing operational efficiency to mitigate these economic challenges and maintain competitive pricing.

Eastman Chemical Company contends with fierce competition from global giants like BASF and Dow, as well as agile smaller firms, all vying for market share in the expanding specialty chemicals sector. This rivalry is intensified by innovation and sustainability efforts, with companies like Eastman investing heavily in advanced recycling technologies to differentiate themselves and capture market share in a market projected to reach USD 1.29 trillion by 2034.

Macroeconomic factors such as inflation and fluctuating energy prices in 2024 are further escalating competitive pressures, forcing companies to focus on operational efficiency and cost management to maintain profitability amidst rising input costs.

The intensity of competition is also driven by the broad range of applications for specialty chemicals, spanning automotive, construction, and electronics, which attract significant investment and strategic maneuvering from numerous players.

| Key Competitors | 2023 Revenue (USD Billion, Approx.) | Key Differentiators |

|---|---|---|

| BASF | 68.9 | Broadest product portfolio, R&D investment |

| Dow | 47.0 | Materials science innovation, global reach |

| DuPont | 12.1 | Specialty materials, electronics & industrial focus |

| Eastman Chemical Company | 21.4 | Advanced circular recycling, sustainability focus |

SSubstitutes Threaten

The growing consumer preference for environmentally friendly goods is fueling the rise of sustainable and bio-based chemical substitutes, presenting a substantial threat. This trend directly challenges Eastman's traditional product lines as customers seek greener options.

The bio-based chemicals sector is experiencing robust expansion; it was valued at $57.14 billion in 2022 and is anticipated to reach $95.32 billion by 2030. This significant market growth indicates a clear and present danger of substitution for Eastman's existing chemical offerings.

Advancements in molecular recycling technologies, particularly Eastman's leadership in this area, present a significant threat of substitution. These innovative processes can produce recycled materials that directly compete with and potentially displace virgin feedstocks.

Eastman's Kingsport methanolysis plant, a prime example, demonstrates the capability to generate substantial recycled content. In 2023, the company announced the expansion of its molecular recycling facility in Kingsport, Tennessee, aiming to increase its capacity for producing recycled plastics. This increased output of recycled materials can directly reduce the demand for virgin polymers, impacting traditional revenue streams.

Customers are increasingly scrutinizing Eastman's offerings for better performance-to-cost ratios and enhanced sustainability. If alternative materials can deliver comparable or superior results at a lower price point, or with a greener footprint, substitution becomes a significant threat. For instance, in the automotive sector, lightweight composites are gaining traction as substitutes for traditional plastics, driven by fuel efficiency demands.

Material Innovation by Competitors and New Technologies

Competitors and new entrants are constantly innovating, introducing new materials and technologies that can replace Eastman's current products. This threat is particularly relevant as these substitutes may offer improved performance, lower costs, or unique functionalities for similar applications. For instance, advancements in bio-based polymers or high-performance composites could directly challenge Eastman's established chemical and material portfolios.

The pace of material science innovation means that what is cutting-edge today could be a commodity tomorrow, or worse, rendered obsolete by a superior substitute. For Eastman, this necessitates continuous investment in research and development to stay ahead of emerging alternatives. In 2023, the global specialty chemicals market saw significant R&D spending, with companies like Dow and BASF investing billions, highlighting the competitive pressure to innovate and counter potential substitution threats.

- Emerging Material Substitutes: Development of advanced composites, biodegradable polymers, and novel material formulations that offer comparable or superior performance to Eastman's offerings.

- Technological Advancements: New manufacturing processes or digital solutions that enable the creation of alternative products or more efficient ways to meet customer needs, potentially bypassing traditional material inputs.

- Cost-Competitiveness: Substitutes that can be produced at a significantly lower cost due to new technologies or feedstock advantages, thereby eroding the price advantage of Eastman's products.

Eastman's Proactive Investment in Circular Economy

Eastman's significant investment, totaling around $2.25 billion, in global molecular recycling facilities, including planned expansions in Longview, Texas, and France, directly tackles the threat of substitutes. By pioneering sustainable alternatives, Eastman is essentially creating its own solutions that could otherwise erode its traditional markets.

- Leading Sustainable Alternatives: Eastman's investment in molecular recycling is a strategic defense against substitutes by becoming a leader in eco-friendly materials.

- Mitigating Substitution Risk: By offering advanced recycling technologies, Eastman aims to reduce the appeal of alternative, less sustainable products.

- Future-Proofing Business: This proactive approach positions Eastman to capture demand for circular economy solutions, turning a potential threat into a competitive advantage.

The threat of substitutes for Eastman is amplified by the increasing demand for sustainable and performance-driven materials. Innovations in bio-based chemicals and advanced composites offer viable alternatives, directly challenging Eastman's established product lines. For example, the global bio-based chemicals market, valued at $57.14 billion in 2022, is projected to reach $95.32 billion by 2030, indicating a substantial shift in consumer preference and a growing competitive landscape.

Eastman's own advancements in molecular recycling, such as its Kingsport facility, represent a dual-edged sword: a proactive defense against external substitutes while simultaneously creating materials that can displace its own virgin feedstocks. This strategic move highlights the dynamic nature of material science where innovation can rapidly redefine market demands.

| Substitute Category | Key Characteristics | Market Growth/Impact on Eastman |

|---|---|---|

| Bio-based Chemicals | Environmentally friendly, renewable feedstocks | Projected to reach $95.32 billion by 2030 (from $57.14 billion in 2022); directly challenges traditional chemical products. |

| Advanced Composites | Lightweight, high strength-to-weight ratio | Gaining traction in automotive for fuel efficiency, potentially displacing plastics and impacting Eastman's polymer sales. |

| Molecularly Recycled Materials | Circular economy solutions, reduced reliance on virgin materials | Eastman's own investment ($2.25 billion) in these facilities can reduce demand for its virgin products while creating a new market. |

Entrants Threaten

The specialty chemicals and materials sector presents a significant threat of new entrants due to its substantial capital requirements. Establishing modern production facilities, which are essential for competing effectively, demands considerable financial outlay. For instance, the average infrastructure development cost for such production facilities can reach approximately $78.5 million.

This high initial investment acts as a formidable barrier, deterring potential new companies from entering the market. Consequently, it becomes exceedingly difficult for newcomers to challenge the entrenched positions of existing, well-capitalized players like Eastman, who have already made these substantial investments and possess established economies of scale.

The specialty materials sector demands substantial and ongoing investment in research and development, creating a significant hurdle for newcomers. Companies must possess deep technological know-how to succeed.

Eastman Chemical Company, a key player in this space, demonstrated this commitment by investing $445 million in R&D during 2024. This substantial outlay was directed towards developing advanced materials and sustainable solutions, effectively building a knowledge-based barrier to entry for potential competitors.

The chemical industry faces a significant hurdle for newcomers due to complex regulatory compliance and the need for numerous certifications. For instance, in 2024, navigating REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe alone can cost millions of euros per substance, a substantial upfront investment.

These stringent environmental, health, and safety regulations, covering everything from emissions to product safety, demand extensive documentation and adherence. Obtaining necessary permits and certifications can be a lengthy and costly process, effectively deterring many potential new entrants who lack the resources or expertise.

Established Distribution Channels and Customer Relationships

Eastman Chemical Company benefits significantly from its deeply entrenched global distribution channels and long-standing customer relationships, cultivated over many years within its business-to-business model. New companies entering the market would find it exceedingly difficult and expensive to replicate these extensive networks and earn the confidence of Eastman's broad industrial clientele, which spans over 100 countries.

The barriers to entry are substantial due to these established connections.

- Established Global Reach: Eastman's presence in over 100 countries provides immediate access to diverse markets, a feat requiring significant time and capital for new entrants to replicate.

- Deep Customer Loyalty: Decades of consistent service and product delivery have fostered strong loyalty among Eastman's industrial customers, making it challenging for newcomers to displace existing suppliers.

- B2B Network Advantage: The complex and often specialized nature of B2B relationships means that trust and proven reliability are paramount, creating a high hurdle for unproven new entrants.

Strong Intellectual Property and Patent Portfolios

Eastman's substantial intellectual property, boasting over 3,700 active patents globally in 2024, acts as a significant barrier to entry. This extensive patent portfolio safeguards their unique technologies and product innovations.

These patents make it exceptionally challenging for potential new competitors to legally replicate Eastman's offerings. New entrants would likely face substantial hurdles, either through costly licensing agreements or the risk of infringement lawsuits, effectively deterring market entry.

- Extensive Patent Portfolio: Eastman held over 3,700 active patents worldwide as of 2024.

- Protection of Proprietary Technology: Patents shield Eastman's unique technologies and product formulations.

- Deterrent to New Entrants: Replicating offerings without licensing is difficult and legally risky.

- High Barrier to Entry: Significant investment in R&D and legal expertise is required to overcome patent protections.

The threat of new entrants in the specialty chemicals sector is significantly mitigated by the immense capital required for establishing operations. Building state-of-the-art production facilities alone can cost upwards of $78.5 million, a substantial deterrent for potential newcomers. This high initial investment favors established players like Eastman, who have already amortized these costs and benefit from economies of scale.

Furthermore, the sector demands continuous and substantial investment in research and development, coupled with deep technological expertise. Eastman's 2024 R&D investment of $445 million underscores this need, creating a knowledge-based barrier that is difficult for new firms to surmount.

Complex regulatory landscapes, including stringent environmental and safety standards, add another layer of difficulty. Navigating regulations like REACH in Europe can incur millions of euros per substance in 2024, requiring significant financial and expert resources that new entrants often lack.

Eastman also leverages deeply entrenched global distribution networks and strong, long-standing customer relationships built over years in its B2B model. Replicating these extensive networks and gaining the trust of Eastman's broad industrial client base, which spans over 100 countries, presents a formidable challenge for any new market entrant.

Finally, Eastman's extensive intellectual property, evidenced by over 3,700 active patents globally in 2024, acts as a powerful barrier. These patents protect proprietary technologies and innovations, making it legally and financially prohibitive for new competitors to replicate Eastman's product offerings without costly licensing or facing infringement risks.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High initial investment for production facilities. | Average infrastructure development cost: ~$78.5 million. |

| R&D and Technology | Need for continuous innovation and deep technical know-how. | Eastman's 2024 R&D investment: $445 million. |

| Regulatory Compliance | Complex and costly environmental, health, and safety regulations. | REACH compliance costs can reach millions of euros per substance (2024). |

| Distribution & Customer Relationships | Established global networks and long-term B2B client trust. | Eastman serves customers in over 100 countries. |

| Intellectual Property | Protection of unique technologies and product innovations through patents. | Eastman held over 3,700 active patents globally in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including financial statements, analyst reports, industry-specific market research, and publicly available company filings. This comprehensive approach ensures a thorough understanding of competitive pressures.