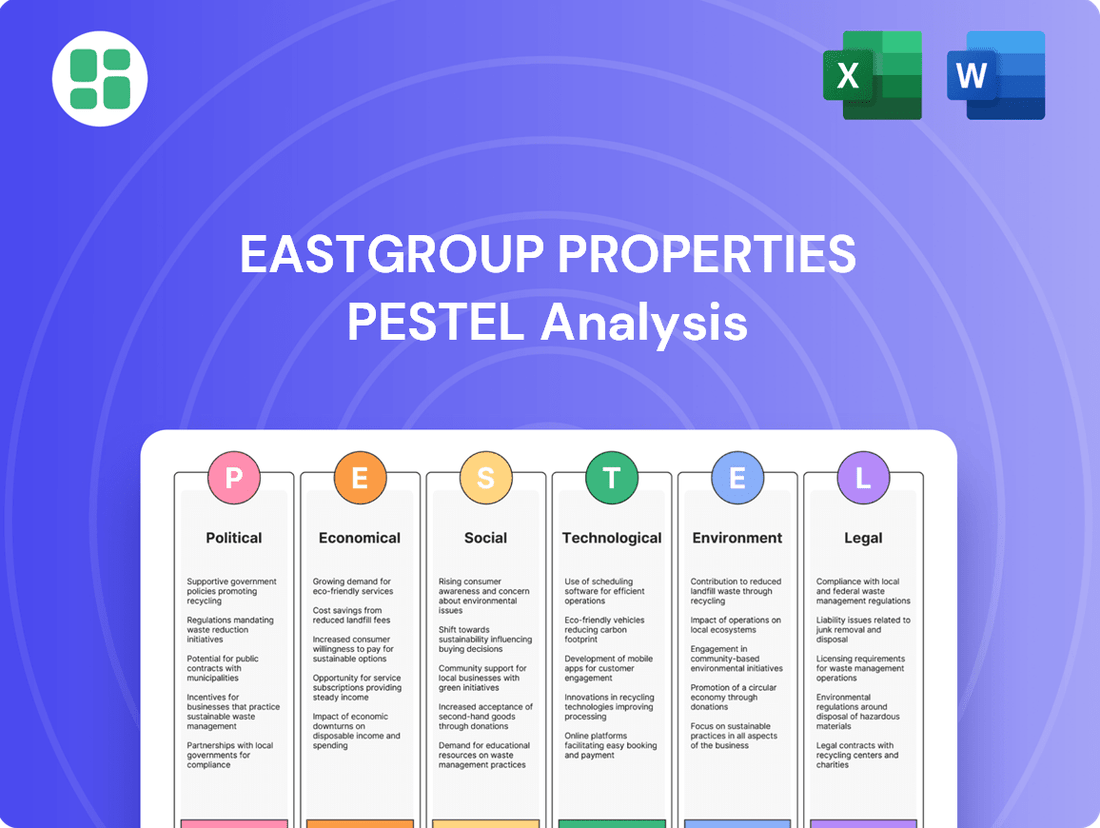

EastGroup Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EastGroup Properties Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping EastGroup Properties's trajectory. Our comprehensive PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and gain a strategic advantage.

Political factors

Shifting global trade policies, including tariffs and nearshoring/reshoring initiatives, significantly influence demand for industrial real estate in the U.S. For instance, the U.S. imposed tariffs on goods from China, prompting some companies to explore alternative sourcing and manufacturing locations within North America. This trend directly benefits EastGroup Properties by boosting demand for its industrial facilities.

EastGroup Properties stands to gain from increased domestic manufacturing and supply chain regionalization. This movement drives robust demand for distribution and manufacturing facilities, particularly in its strategically important Sunbelt markets. As of early 2024, the U.S. manufacturing sector has seen a resurgence, with new factory orders showing positive growth, signaling a healthy appetite for industrial space.

Companies are increasingly prioritizing supply chain resilience, a critical factor in today's volatile global environment. This strategic shift translates into a greater need for strategically located industrial space, such as those offered by EastGroup Properties, to support diversified and regionalized operations. The U.S. Department of Commerce reported a significant increase in construction of manufacturing facilities in 2023, underscoring this trend.

Federal and state governments are significantly increasing investments in transportation infrastructure, a trend directly benefiting industrial property demand. For instance, the Infrastructure Investment and Jobs Act, enacted in 2021, allocates over $1.2 trillion, with a substantial portion dedicated to improving highways, bridges, ports, and public transit. This focus on enhancing logistics networks makes locations like those EastGroup Properties specializes in, often near major transportation hubs, even more appealing to businesses needing efficient distribution.

Government spending on infrastructure projects directly supports the efficient movement of goods, a critical factor for businesses operating distribution centers. As of early 2024, the U.S. Department of Transportation has announced numerous grants for port modernization and freight corridor improvements, aiming to streamline supply chains. These developments enhance the operational efficiency and attractiveness of industrial properties, like those in EastGroup's portfolio, by reducing transit times and costs for their tenants.

Local zoning and land use regulations are critical for EastGroup Properties, influencing its ability to acquire land, develop new industrial facilities, and expand existing ones. These rules dictate what can be built, where, and to what specifications, directly impacting project timelines and costs.

EastGroup's strategy relies on operating in supply-constrained markets, making adept navigation of these local governmental rules paramount. Successfully managing the permitting and approval processes is essential for unlocking development opportunities and maintaining a competitive edge.

The Sunbelt region, a key focus for EastGroup, often presents more favorable regulatory environments. For example, states like Florida and Texas have historically streamlined development processes, which can accelerate project delivery and mitigate risks for companies like EastGroup, contributing to their growth trajectory.

Political Stability and Business-Friendly Environments

Many Sunbelt states are known for their political stability and business-friendly policies. These factors are crucial for attracting companies looking to reduce operating expenses and benefit from a supportive regulatory framework. For instance, Texas, a key market for EastGroup, consistently ranks high in business-friendly environments, often citing its lack of a state income tax as a major draw. This environment directly fuels demand for industrial and commercial real estate as businesses relocate and expand.

Favorable tax structures and incentives are actively employed by these states to encourage corporate relocations and expansions. This proactive approach directly translates into increased demand for industrial space, which is EastGroup's core business. For example, in 2023, states like Florida and Texas saw significant corporate investment, with numerous companies announcing new facilities and job creation, often facilitated by state-level economic development programs.

- Political Stability: Sunbelt states generally exhibit strong political stability, providing a predictable operating environment for businesses.

- Business-Friendly Policies: States often implement policies such as lower corporate tax rates and streamlined permitting processes to attract investment.

- Economic Development Incentives: Tax credits, grants, and other incentives are commonly offered to companies establishing or expanding operations.

- Impact on Real Estate Demand: These favorable conditions directly contribute to increased demand for industrial and logistics properties as companies grow their footprint.

REIT-Specific Tax Legislation

Changes to federal and state tax laws directly influence EastGroup's financial health and attractiveness to investors. For instance, the Tax Cuts and Jobs Act of 2017, and subsequent clarifications, made significant impacts. The permanent allowance for calculating adjusted taxable income on an EBITDA basis, for example, can positively affect a REIT's distributable income.

Furthermore, the permanent 20% deduction for qualified REIT dividends, introduced by the Tax Cuts and Jobs Act, enhances the after-tax return for individual investors holding EastGroup shares. This measure aims to make REIT investments more competitive with other asset classes.

The increase in the permissible value of Taxable REIT Subsidiary (TRS) securities also offers greater structural flexibility. This allows REITs like EastGroup to engage in a broader range of business activities, potentially expanding revenue streams and operational capabilities.

- EBITDA Basis Calculation: Provides greater flexibility in calculating REIT taxable income, potentially increasing distributable income.

- Qualified REIT Dividend Deduction: A permanent 20% deduction for eligible dividends can boost after-tax returns for individual investors.

- TRS Value Increase: Enhances structural flexibility, allowing REITs to engage in a wider array of business activities.

Government policies promoting nearshoring and reshoring initiatives are a significant tailwind for industrial real estate demand. As of early 2024, the U.S. government's focus on strengthening domestic supply chains, partly in response to global disruptions, encourages companies to invest in U.S.-based manufacturing and distribution facilities. This trend directly benefits EastGroup Properties by increasing the need for its strategically located industrial assets.

Investments in infrastructure, such as the Infrastructure Investment and Jobs Act, are crucial for efficient logistics. This act, with over $1.2 trillion allocated, directly enhances the appeal of industrial properties located near improved transportation networks. By facilitating faster and more cost-effective movement of goods, these infrastructure upgrades make EastGroup's portfolio more attractive to tenants.

Favorable state-level policies, particularly in Sunbelt markets, play a vital role in attracting businesses. For instance, states like Texas and Florida often offer business-friendly tax structures and streamlined regulatory processes. These conditions, coupled with economic development incentives, drive corporate relocations and expansions, thereby boosting demand for industrial properties that EastGroup specializes in developing and managing.

Changes in tax legislation, such as the Tax Cuts and Jobs Act of 2017, continue to impact REITs. The permanent 20% deduction for qualified REIT dividends, for example, enhances the attractiveness of REIT investments for individual investors, potentially increasing capital availability for companies like EastGroup. Furthermore, the ability to calculate adjusted taxable income on an EBITDA basis offers greater financial flexibility for REITs.

What is included in the product

This PESTLE analysis of EastGroup Properties examines how political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks impact its operations and strategic decisions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling EastGroup Properties' PESTLE analysis into actionable insights for strategic decision-making.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal factors impacting EastGroup Properties.

Economic factors

Fluctuations in interest rates directly impact EastGroup Properties' borrowing costs, affecting how they finance acquisitions and development projects. A projected higher-for-longer interest rate environment into 2025, with potential cuts by year-end, suggests a period of adjustment for capital markets.

Despite this, investor confidence is strengthening due to anticipated improved buying conditions and stable debt costs, which is a positive sign for increased real estate transactions, benefiting companies like EastGroup.

Inflationary pressures significantly impact the construction sector, driving up expenses for essential materials like lumber, concrete, and steel, as well as for skilled labor. For instance, the Producer Price Index for construction materials saw a notable increase in early 2024, reflecting these broad economic trends.

Tariffs on key commodities such as steel and aluminum have exacerbated these cost increases, directly affecting the expense of erecting new industrial facilities. EastGroup Properties, like other developers, faces the challenge of absorbing or passing on these higher costs.

However, EastGroup's demonstrated ability to achieve robust rent growth, as evidenced by their strong leasing spreads in recent quarters, provides a crucial buffer. This capacity to increase rental income helps to mitigate the impact of escalating construction expenses on their development project profitability.

Sunbelt markets are demonstrating robust economic growth, with many states in this region outperforming the national average. This expansion directly translates to heightened demand for industrial properties, as businesses require more space for operations and distribution. For instance, states like Texas and Florida have consistently shown strong GDP growth, creating a fertile ground for industrial real estate investment.

The significant job creation and business expansion occurring in the Sunbelt are key drivers for the industrial sector. As companies grow and hire more employees, they necessitate larger facilities for manufacturing, warehousing, and logistics. This trend is particularly evident in sectors like e-commerce and advanced manufacturing, which are heavily concentrated in these rapidly developing areas.

The economic vitality of the Sunbelt fuels a continuous need for modern distribution and logistics facilities. As commercial operations expand and consumer demand increases, efficient supply chains become paramount. This ongoing demand supports the leasing and development of industrial properties, underscoring the positive correlation between economic activity and the industrial real estate market in these key regions.

E-commerce Growth and Supply Chain Dynamics

The relentless expansion of e-commerce is a significant force shaping industrial real estate demand, directly fueling the need for sophisticated warehousing and distribution infrastructure. This trend is a cornerstone for sectors like EastGroup Properties, which specializes in operating industrial properties. The long-term trajectory of online retail sales, even with a stabilization in leasing activity post-pandemic, continues to provide a robust foundation for the industrial property market.

Companies are increasingly prioritizing supply chain resilience, a strategic imperative that directly translates into heightened demand for well-positioned industrial facilities. This focus on creating more robust and less vulnerable supply chains means businesses are actively seeking strategically located industrial spaces for inventory management, last-mile delivery, and diversification of operations.

- E-commerce sales growth: Global e-commerce sales are projected to reach $8.1 trillion by 2026, up from an estimated $5.7 trillion in 2023, underscoring the sustained demand for logistics and warehousing.

- Industrial leasing recovery: In 2024, the industrial real estate sector saw a notable return to pre-pandemic leasing volumes, demonstrating continued investor and tenant confidence.

- Supply chain investment: Companies are allocating significant capital towards supply chain modernization and diversification, with a focus on nearshoring and reshoring strategies, boosting demand for domestic industrial facilities.

Labor Market Conditions and Consumer Spending

A robust labor market is a significant tailwind for EastGroup Properties, particularly in its core Sunbelt markets. As of May 2024, the U.S. unemployment rate held steady at 4.0%, with many Sunbelt states experiencing even lower rates and robust job creation. This healthy employment picture translates directly into increased consumer spending power.

This consumer spending, fueled by wage growth and job security, directly impacts demand for goods and, consequently, the logistics and distribution services that industrial real estate like EastGroup’s facilitates. For instance, states like Florida and Texas, key markets for EastGroup, have consistently shown strong nonfarm payroll growth through early 2024, attracting new residents and boosting economic activity.

- Job Growth: Sunbelt states are outpacing national averages in job creation, drawing in a skilled workforce.

- Wage Increases: Rising wages in these regions bolster household incomes and discretionary spending.

- Consumer Demand: Higher consumer spending directly fuels the need for efficient warehousing and distribution space.

- Economic Vibrancy: Sustained economic activity supports a thriving industrial real estate sector, benefiting EastGroup.

The economic landscape for EastGroup Properties is shaped by several key factors, including interest rate policies and inflation. While higher interest rates can increase borrowing costs, anticipated rate cuts by late 2025 could stabilize capital markets. Inflationary pressures, particularly on construction materials, remain a challenge, though strong rent growth provides a buffer.

The Sunbelt region continues to be a significant growth engine, with robust job creation and business expansion driving demand for industrial properties. E-commerce's persistent growth and companies' focus on supply chain resilience further bolster the need for well-located logistics and distribution facilities.

A strong labor market in the Sunbelt directly fuels consumer spending, which in turn increases demand for goods and the industrial spaces needed to store and distribute them. This economic vibrancy supports EastGroup's operational strategy and market position.

| Economic Factor | 2024/2025 Outlook | Impact on EastGroup Properties |

|---|---|---|

| Interest Rates | Projected higher-for-longer, potential cuts late 2025 | Affects borrowing costs for acquisitions/development |

| Inflation | Elevated, impacting construction material costs | Increases development expenses, mitigated by rent growth |

| Sunbelt Economic Growth | Robust GDP and job growth | Drives demand for industrial properties |

| E-commerce Growth | Continued expansion | Sustains demand for warehousing and logistics |

| Labor Market | Strong, low unemployment | Boosts consumer spending, increasing demand for goods and distribution |

Preview Before You Purchase

EastGroup Properties PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for EastGroup Properties meticulously details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain a comprehensive understanding of the external forces shaping the industrial real estate sector.

Sociological factors

The persistent migration of people to Sunbelt states presents a significant advantage for EastGroup Properties. This trend, fueled by better job prospects, appealing tax structures, a more affordable lifestyle, and an enhanced quality of life, is a powerful driver for the company’s growth.

This demographic shift directly translates into a heightened demand for essential goods and services, thereby boosting the need for the distribution and logistics facilities that EastGroup specializes in. For instance, Texas, Florida, and North Carolina are consistently experiencing robust population increases, underscoring the sustained demand in these key markets.

The persistent shift towards e-commerce, accelerated by events in recent years, has fundamentally altered consumer expectations. This trend directly fuels demand for specialized distribution facilities, particularly those supporting last-mile delivery and shallow-bay needs. For instance, e-commerce sales in the U.S. reached an estimated $1.14 trillion in 2023, a significant increase that underscores the importance of efficient logistics networks.

EastGroup Properties is strategically positioned to capitalize on this evolution. Their focus on developing functional, flexible, and high-quality business distribution spaces directly addresses the need for efficient supply chains. This includes providing properties that enable businesses to meet the growing consumer demand for faster delivery times, a critical factor in customer satisfaction and loyalty.

The availability of a skilled workforce is paramount for EastGroup's tenants, particularly those in logistics and distribution. The Sunbelt region, a key focus for EastGroup, continues to attract a growing and youthful population. For instance, in 2024, states like Texas and Florida saw significant in-migration, bolstering the available labor for industrial operations.

Changing Lifestyles and Quality of Life

The pursuit of enhanced quality of life, often encompassing more affordable housing and a less hurried existence, remains a significant driver for population migration towards the Sunbelt. This ongoing lifestyle evolution directly fuels sustained population expansion in these areas.

This demographic shift translates into a heightened demand for essential infrastructure, including industrial and logistics facilities, as more individuals and businesses establish their presence. For instance, the Sunbelt experienced robust population growth in 2024, with states like Florida and Texas leading the nation, indicating a continued influx of residents and businesses.

- Sunbelt Population Growth: States like Florida and Texas saw significant population increases in 2024, attracting new residents seeking lifestyle benefits.

- Demand for Industrial Space: This migration directly boosts the need for modern industrial properties to support expanding economic activity and supply chains.

- Affordability and Pace: The appeal of more affordable living costs and a relaxed pace of life continues to be a primary draw for individuals and families relocating.

Urbanization and Suburban Growth Trends

While EastGroup Properties strategically targets infill and last-mile industrial submarkets, broader demographic shifts like continued urbanization and suburban expansion significantly shape the demand for industrial real estate. The expansion of metropolitan areas, particularly in the Sunbelt, fuels the need for accessible distribution hubs that can efficiently serve both dense urban cores and growing outlying communities. This dynamic underscores the importance of well-located industrial parks capable of supporting the logistical demands of modern commerce.

The ongoing evolution towards live-work-play environments, a key aspect of modern urbanization, directly influences the requirements for industrial properties. As populations become more dispersed, yet still demand timely delivery of goods, the need for strategically positioned distribution centers closer to these population clusters intensifies. For instance, the U.S. Census Bureau reported that in 2023, the Sunbelt states continued to experience robust population growth, with Texas, Florida, and North Carolina leading the nation, directly impacting the demand for industrial space in these regions.

- Sunbelt Population Growth: States like Texas and Florida saw significant population increases in 2023, driving demand for logistics and distribution facilities.

- Urban Infill Demand: EastGroup's focus on infill locations caters to the need for last-mile delivery solutions in densely populated urban and suburban areas.

- Live-Work-Play Impact: The development of mixed-use communities necessitates efficient supply chains, boosting the requirement for strategically placed industrial properties.

The sustained migration to Sunbelt states, driven by lifestyle preferences and economic opportunity, directly fuels demand for EastGroup Properties' industrial and logistics facilities. This demographic trend is a cornerstone of their growth strategy, ensuring a consistent need for their specialized real estate offerings.

The increasing preference for more affordable living costs and a less hurried lifestyle in Sunbelt states continues to attract a significant influx of residents. This ongoing population expansion directly translates into a greater need for efficient distribution networks to serve these growing communities.

The demand for modern industrial spaces is amplified by the growing population in key Sunbelt markets like Texas and Florida, which experienced substantial in-migration in 2024. This influx necessitates robust supply chains and logistics infrastructure, areas where EastGroup excels.

EastGroup Properties is well-positioned to benefit from the ongoing urbanization and suburban expansion in the Sunbelt, as these trends increase the need for accessible distribution hubs. The company's focus on infill locations effectively addresses the demand for last-mile delivery solutions in these expanding metropolitan areas.

| Key Sociological Trend | Impact on EastGroup Properties | Supporting Data (2023-2024) |

| Sunbelt Migration | Increased demand for industrial and logistics space | Texas and Florida saw significant population growth in 2024; Sunbelt states led national in-migration. |

| Preference for Lifestyle/Affordability | Sustained population influx driving economic activity | Continued appeal of lower cost of living and lifestyle benefits in Sunbelt regions. |

| Urbanization & Suburban Expansion | Need for strategically located distribution centers | Growth in metropolitan areas necessitates efficient last-mile delivery infrastructure. |

Technological factors

The push for automation and robotics in warehousing is significantly reshaping how distribution centers operate. This trend means EastGroup's properties must be adaptable to house these advanced systems, often necessitating features like increased clear heights for robotic stacking and reinforced floor loads to support heavy machinery.

Companies are investing heavily in warehouse automation to boost efficiency. For instance, a 2024 report by Interact Analysis projected the global warehouse automation market to reach $11.5 billion in 2024, highlighting the rapid adoption. These technologies directly benefit tenants by reducing labor costs and accelerating picking and packing processes, making strategically located, modern facilities like EastGroup's even more valuable.

Artificial Intelligence is a significant technological driver in the logistics sector, directly impacting the utility of industrial spaces like those owned by EastGroup Properties. AI-powered predictive analytics are transforming how companies manage their supply chains. For instance, AI algorithms can analyze vast datasets to forecast demand with greater accuracy, leading to optimized inventory levels and reduced waste. This translates into more efficient operations for EastGroup's tenants, making well-located industrial facilities even more attractive.

Route optimization is another key area where AI is making strides. By considering real-time traffic, weather conditions, and delivery schedules, AI can devise the most efficient delivery routes. This not only saves fuel and time but also increases the number of deliveries a fleet can make daily. In 2024, companies are increasingly investing in AI for logistics, with the global AI in logistics market projected to reach over $10 billion by 2027, demonstrating a strong trend towards adoption.

Furthermore, AI enhances inventory management by automating tracking, optimizing stock placement within warehouses, and predicting replenishment needs. This level of efficiency is crucial for businesses operating in EastGroup's modern industrial properties. By leveraging AI-driven systems, tenants can reduce their operational costs and improve overall supply chain resilience, thereby increasing the value proposition of the high-quality industrial space EastGroup provides.

Smart building technologies and IoT integration are revolutionizing property management for industrial REITs like EastGroup. These systems allow for real-time monitoring of building performance, leading to significant energy savings and optimized operational efficiency. For instance, predictive maintenance, powered by IoT sensors, can anticipate equipment failures, reducing downtime and costly emergency repairs. This translates to more attractive, cost-effective spaces for tenants.

By adopting these advancements, EastGroup can enhance its value proposition to location-sensitive customers. Improved energy efficiency, for example, can lower operating costs for tenants, making EastGroup properties more competitive. In 2024, the global smart building market was valued at over $80 billion, with a projected compound annual growth rate of around 12% through 2030, indicating strong market demand for such integrated solutions.

Data Analytics for Operational Efficiency

The increasing sophistication of data analytics is transforming how businesses operate, particularly in sectors like logistics and real estate. Advanced analytics can pinpoint inefficiencies within supply chains, optimize inventory management, and identify operational bottlenecks, leading to significant cost savings and performance improvements. For instance, a report by McKinsey in late 2024 highlighted that companies leveraging advanced analytics saw an average of 15-20% improvement in operational efficiency.

Logistics firms are increasingly adopting data-driven strategies to enhance decision-making, thereby minimizing errors and boosting overall output. This trend is critical for companies like EastGroup Properties, which manages industrial and logistics facilities. Their ability to offer facilities that are either data-ready or can actively support tenants in their data-driven operational strategies presents a distinct competitive advantage in the market.

EastGroup's strategic positioning could be further amplified by:

- Offering smart building technology integration: Enabling tenants to easily connect their operational data systems.

- Providing data analytics support services: Assisting tenants in leveraging the data generated within their leased spaces.

- Developing proprietary data platforms: To benchmark operational performance across their portfolio.

- Focusing on facilities in regions with high logistics density: Where data-driven optimization is most impactful.

E-commerce Infrastructure and Last-Mile Delivery Innovations

The booming e-commerce sector, projected to reach $1.7 trillion in the US by 2027, demands advanced logistics infrastructure. EastGroup's properties are strategically located within these critical 'last-mile' submarkets, facilitating faster delivery times essential for online retail growth.

Innovations like autonomous delivery vehicles and drone technology are reshaping the requirements for industrial facilities. These advancements may necessitate specialized charging stations or landing zones, influencing the design and location of future properties. For instance, companies like Amazon are actively testing drone delivery, signaling a potential shift in last-mile logistics that industrial property owners must consider.

- E-commerce Growth: US e-commerce sales are expected to grow at a compound annual growth rate (CAGR) of 9.5% between 2023 and 2027.

- Last-Mile Focus: EastGroup's portfolio is concentrated in markets with strong demand for last-mile distribution centers.

- Delivery Innovation: Investments in drone and autonomous vehicle delivery technology by major players like Amazon and Walmart are accelerating.

Technological advancements are fundamentally altering the logistics landscape, directly impacting the demand for modern industrial spaces like those owned by EastGroup Properties. Automation, AI, and data analytics are key drivers, enhancing operational efficiency for tenants and increasing the value of well-located, adaptable facilities.

The integration of smart building technologies and the Internet of Things (IoT) is crucial for optimizing property management and tenant operations, leading to significant energy savings and improved efficiency. EastGroup's ability to offer properties that support these technologies can provide a competitive edge.

The ongoing evolution of delivery methods, including autonomous vehicles and drones, will likely shape future industrial facility requirements. EastGroup's focus on last-mile locations positions it to capitalize on these emerging trends in e-commerce logistics.

| Technology Area | 2024 Market Projection/Growth | Impact on EastGroup Properties |

|---|---|---|

| Warehouse Automation | Global market projected at $11.5 billion in 2024 (Interact Analysis) | Need for higher clear heights and reinforced floor loads for robotic systems. |

| AI in Logistics | Global market projected to exceed $10 billion by 2027 | Enhances tenant operations through demand forecasting, route optimization, and inventory management. |

| Smart Building Technology | Global market over $80 billion in 2024, ~12% CAGR through 2030 | Improves energy efficiency and operational costs for tenants, increasing property attractiveness. |

| E-commerce Growth | US e-commerce sales projected to reach $1.7 trillion by 2027 | Drives demand for last-mile distribution centers, a key focus for EastGroup's portfolio. |

Legal factors

EastGroup Properties, as an equity Real Estate Investment Trust (REIT), navigates a complex tax landscape governed by IRS regulations. To maintain its favorable tax status, it must meet strict income and asset tests, ensuring a significant portion of its revenue comes from real estate and its assets are primarily real estate related.

Recent legislative developments, such as provisions within the hypothetical 'One Big Beautiful Bill Act' (OBBBA) in 2024, aim to refine tax treatments for REITs. These changes could impact areas like the qualified business income deduction and asset holding limits for taxable REIT subsidiaries, directly affecting EastGroup's financial planning and ability to distribute profits to shareholders.

EastGroup Properties must navigate a complex web of federal, state, and local building codes, safety regulations, and accessibility standards for all its developments and existing properties. These mandates, covering everything from structural integrity to fire safety and environmental health, directly influence design choices, construction expenses, and ongoing property upkeep. For instance, the International Building Code (IBC) and Americans with Disabilities Act (ADA) standards are critical benchmarks. In 2024, the average cost to comply with new building codes and accessibility upgrades for commercial properties can add 5-15% to initial construction budgets, a significant factor EastGroup must meticulously factor into its project planning and financial projections to maintain its reputation for high-quality assets.

EastGroup Properties, like any industrial property developer, must navigate a complex web of environmental regulations. These laws govern everything from air emissions and waste disposal to managing stormwater runoff at their sites. Compliance is crucial, and failure to adhere can lead to significant penalties and project delays.

Securing the necessary environmental permits for new developments or ongoing operations is often a lengthy and intricate procedure. This process can involve detailed impact assessments and consultations with various regulatory bodies, directly affecting project timelines and costs for EastGroup.

EastGroup's commitment to corporate responsibility includes a strong focus on managing environmental risks and ensuring strict compliance with all applicable regulations. This proactive approach helps mitigate potential liabilities and supports sustainable development practices within their portfolio.

Landlord-Tenant Laws and Lease Agreements

EastGroup Properties operates within a complex legal landscape shaped by landlord-tenant laws and commercial lease agreements. These regulations dictate tenant rights, the specifics of lease terms, and the responsibilities for property upkeep, all of which directly influence EastGroup's operational stability and revenue streams. Adherence to these legal frameworks is paramount for maintaining consistent occupancy and predictable income.

The company's extensive portfolio, encompassing roughly 1,600 active leases, necessitates rigorous legal scrutiny and compliance. For instance, as of early 2024, variations in eviction moratoriums or rent control regulations across different states could impact lease enforcement and collection efforts, highlighting the need for localized legal expertise.

- Tenant Rights: Legal frameworks define tenant protections, influencing lease renewal negotiations and potential disputes.

- Lease Structures: The enforceability and clarity of lease clauses, from rent escalation to maintenance obligations, are legally critical.

- Property Maintenance: Compliance with building codes and safety regulations, often mandated by law, impacts operational costs and tenant satisfaction.

- Legal Oversight: Managing 1,600 leases requires significant resources dedicated to legal review and risk mitigation.

Data Privacy and Security Laws

EastGroup Properties navigates a complex landscape of data privacy and security laws, particularly as its operations increasingly rely on digital platforms for property management and tenant engagement. Compliance with regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which significantly impacts businesses handling California resident data, is paramount. Failure to safeguard sensitive tenant information and proprietary operational data can lead to substantial fines and reputational damage, underscoring the critical need for robust data protection strategies.

The company's commitment to strong data management practices is not just a legal necessity but also a core component of its corporate responsibility. As of 2024, the global cost of data breaches is projected to reach $10.1 trillion annually by 2026, according to Cybersecurity Ventures, highlighting the financial risks associated with inadequate security. EastGroup's proactive approach in this area builds tenant trust and mitigates potential legal liabilities.

- CCPA/CPRA Compliance: Ensuring adherence to evolving data privacy rights for California residents.

- Cybersecurity Investments: Allocating resources to protect sensitive tenant and operational data from breaches.

- Tenant Data Protection: Implementing policies for the secure collection, storage, and use of tenant information.

- Regulatory Scrutiny: Staying abreast of new and updated data protection legislation across all operating jurisdictions.

EastGroup Properties must adhere to evolving landlord-tenant laws and commercial lease regulations across its operating states, impacting everything from lease renewals to dispute resolution. With approximately 1,600 active leases as of early 2024, the company faces varied state-specific rules on issues like eviction moratoriums and rent control, demanding localized legal expertise to ensure consistent revenue collection and property management.

The company's compliance with building codes and safety standards, such as the International Building Code and ADA, is critical for its developments and existing properties. These regulations directly influence construction costs, with compliance for new commercial properties in 2024 potentially adding 5-15% to initial budgets, a significant factor in EastGroup's financial planning.

Navigating data privacy laws like CCPA/CPRA is essential for EastGroup, given its reliance on digital platforms for tenant engagement. The projected global cost of data breaches reaching $10.1 trillion annually by 2026 underscores the financial and reputational risks of inadequate data security, prompting significant cybersecurity investments.

| Legal Area | Key Considerations | Impact on EastGroup | 2024/2025 Relevance |

|---|---|---|---|

| Landlord-Tenant Law | Lease enforceability, tenant rights, eviction procedures | Revenue stability, operational efficiency | State-specific variations in moratoriums and rent control |

| Building Codes & Safety | Structural integrity, fire safety, accessibility | Construction costs, property value, tenant satisfaction | 5-15% cost increase for compliance in new commercial builds |

| Data Privacy | CCPA/CPRA, data breach prevention | Reputational risk, potential fines, tenant trust | Projected $10.1T annual cost of data breaches by 2026 |

Environmental factors

Industrial properties, particularly those in Sunbelt markets favored by EastGroup Properties, are increasingly exposed to climate change risks. These include the growing threat of extreme weather events such as hurricanes, floods, and prolonged periods of high temperatures, which can disrupt operations and damage assets. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, underscoring the escalating frequency and cost of such events.

EastGroup is actively assessing the resilience of its extensive industrial property portfolio to these climate-related threats. The company is implementing proactive mitigation and adaptation strategies to safeguard its assets and ensure business continuity. This commitment extends to integrating thorough climate-related due diligence into its investment decision-making process, aiming to protect long-term asset value and investor returns in a changing environmental landscape.

The commercial real estate sector, including industrial properties like those owned by EastGroup Properties, is experiencing a significant push towards sustainability and energy efficiency. This trend is fueled by increasing tenant demand for environmentally conscious spaces, investor preferences for ESG (Environmental, Social, and Governance) compliant assets, and evolving government regulations aimed at reducing carbon footprints. For instance, a 2024 report by JLL indicated that 70% of surveyed tenants prioritize sustainability in their real estate decisions.

EastGroup actively participates in this shift by incorporating energy-efficient upgrades and sustainable design principles into its development pipeline. This includes investments in features like high-performance insulation, LED lighting systems, and advanced HVAC technologies. The company has also made efforts to guide its operational practices, publishing resources such as energy and water efficiency guides to establish clear performance benchmarks and encourage conservation across its portfolio.

Environmental, Social, and Governance (ESG) factors are now a cornerstone of investment decisions, with a growing demand for clear performance metrics. Investors are scrutinizing companies' environmental impact, pushing for more sustainable operations and transparent reporting. This trend significantly influences how companies like EastGroup Properties are evaluated and valued in the market.

EastGroup actively participates in recognized ESG assessments, such as the Global Real Estate Sustainability Benchmark (GRESB). Their reporting adheres to internationally accepted frameworks including the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). This dedication to robust ESG disclosure demonstrates responsible environmental stewardship and bolsters investor confidence.

In 2023, for instance, the real estate sector saw a substantial increase in ESG-focused capital allocation, with many institutional investors explicitly stating ESG criteria as a prerequisite for investment. EastGroup's commitment to these standards positions them favorably to attract this capital, as demonstrated by their consistent inclusion in sustainability indices and positive ratings from ESG data providers.

Water Conservation and Waste Management

EastGroup Properties is actively pursuing responsible resource management, with water conservation and waste reduction being key components of its sustainability strategy. The company has established water efficiency guides and is focused on broadening its data collection for these critical environmental metrics.

Efficient waste management not only supports environmental stewardship but also presents opportunities for operational cost savings. For instance, many companies in the industrial real estate sector are seeing tangible benefits from improved recycling programs and reduced landfill waste.

- Water Efficiency Initiatives: EastGroup is developing and implementing water efficiency guides to promote responsible water usage across its properties.

- Data Expansion: The company is working to increase the scope and accuracy of its data related to water consumption and conservation efforts.

- Waste Reduction Programs: Efficient waste management practices are in place to minimize environmental impact and achieve operational cost efficiencies.

- Operational Cost Savings: Implementing robust waste management can lead to reduced disposal fees and potential revenue from recycling, contributing to the bottom line.

Green Building Certifications and Standards

EastGroup Properties, like many in the industrial real estate sector, is increasingly influenced by the adoption of green building certifications and standards. Pursuing certifications such as LEED (Leadership in Energy and Environmental Design) signals a dedication to sustainable construction and operational practices. While not always a direct mandate for every development, integrating eco-friendly design elements into new projects is becoming an industry standard. This strategic approach can appeal to tenants who prioritize environmental responsibility, thereby enhancing the marketability and differentiation of EastGroup's property portfolio.

The demand for green-certified spaces is on the rise. For instance, a 2024 report indicated that buildings with LEED certification can command higher rental rates, with some studies suggesting premiums of 3-5% compared to non-certified properties. This trend suggests that EastGroup's investment in sustainable features could translate into improved financial performance and a competitive edge. Furthermore, as regulatory frameworks around environmental performance evolve, adherence to these standards can mitigate future compliance risks.

Key considerations for EastGroup regarding green building standards include:

- LEED Certification: The potential for increased rental income and tenant attraction by achieving LEED certification for new developments and existing properties.

- Sustainable Design Integration: Incorporating energy-efficient HVAC systems, water-saving fixtures, and recycled materials into construction to align with evolving environmental expectations.

- Tenant Demand: Recognizing that a growing segment of the tenant market, particularly larger corporations with their own ESG (Environmental, Social, and Governance) goals, actively seeks out green-certified facilities.

- Market Differentiation: Using green building credentials as a way to stand out in a competitive industrial real estate market and attract environmentally conscious occupiers.

The increasing focus on climate change and environmental sustainability directly impacts industrial real estate. EastGroup Properties faces risks from extreme weather, as evidenced by the 28 billion-dollar weather disasters in the U.S. in 2023 according to NOAA. Simultaneously, tenant demand for green-certified spaces, with 70% prioritizing sustainability in 2024 according to JLL, drives adoption of energy-efficient designs and certifications like LEED, potentially increasing rental income by 3-5%.

| Environmental Factor | Impact on EastGroup Properties | Supporting Data/Trend |

|---|---|---|

| Climate Change & Extreme Weather | Asset damage, operational disruption, increased insurance costs | 28 U.S. billion-dollar weather disasters in 2023 (NOAA) |

| Sustainability & Energy Efficiency Demand | Tenant attraction, potential for higher rental rates, market differentiation | 70% of tenants prioritize sustainability (JLL, 2024) |

| Green Building Certifications (e.g., LEED) | Enhanced marketability, potential rental premiums (3-5%) | Growing tenant preference for certified spaces |

PESTLE Analysis Data Sources

Our PESTLE analysis for EastGroup Properties is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading real estate market research reports. This approach ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic positioning.