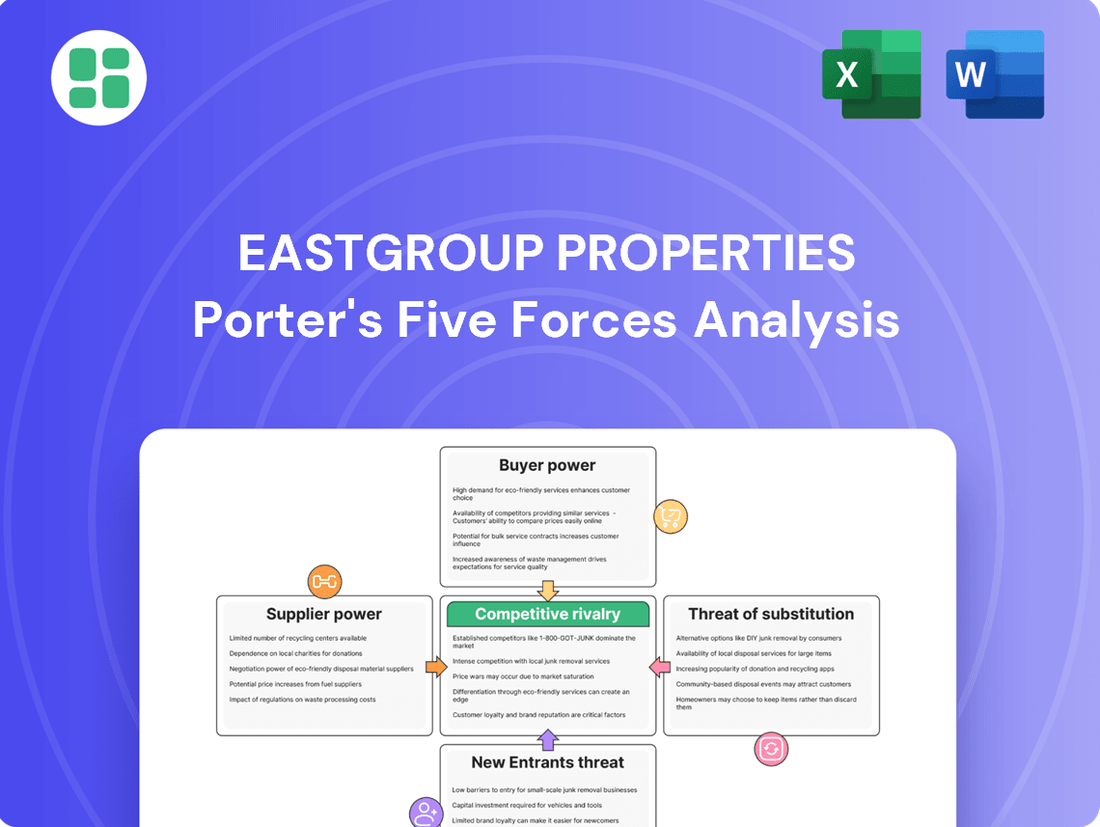

EastGroup Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EastGroup Properties Bundle

EastGroup Properties operates in a competitive industrial real estate market, where factors like buyer bargaining power and the threat of new entrants significantly shape its landscape. Understanding these dynamics is crucial for strategic planning and investment decisions.

The complete report reveals the real forces shaping EastGroup Properties’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

EastGroup Properties' reliance on a few large land developers or specialized construction firms for prime industrial land and unique building materials significantly amplifies supplier bargaining power. If these suppliers are concentrated, they can dictate terms, leading to higher acquisition and development costs for EastGroup.

Switching costs for EastGroup Properties are a key factor in understanding supplier bargaining power. These costs represent the expenses EastGroup would face if it decided to change from one supplier to another. For instance, the process of finding and onboarding a new general contractor mid-development, or securing alternative financing, can involve significant time, effort, and potential financial penalties, thereby increasing switching costs.

High switching costs effectively empower suppliers. When it's difficult or expensive for EastGroup to change providers, suppliers gain leverage to negotiate more favorable terms, potentially leading to higher prices or less flexible contract conditions. This dynamic directly impacts EastGroup's operational expenses and profitability.

The availability of substitute inputs significantly impacts supplier bargaining power for EastGroup Properties. If the materials or services essential for developing and maintaining their industrial real estate portfolio have numerous readily available alternatives, suppliers' leverage weakens. For instance, if multiple manufacturers offer comparable steel or concrete, EastGroup can switch suppliers with minimal cost or disruption, thus limiting any single supplier's ability to dictate terms.

Supplier's Importance to EastGroup's Quality

The bargaining power of suppliers for EastGroup Properties is influenced by the criticality of their inputs to the quality and functionality of EastGroup's industrial properties. Suppliers providing specialized, high-quality materials or services essential for EastGroup's premium product offerings can exert greater influence.

For instance, suppliers of advanced construction materials, specialized HVAC systems, or high-performance building envelopes can command more leverage if these components are key differentiators in EastGroup's portfolio. The ability of EastGroup to substitute these suppliers is a crucial factor; if few alternatives exist for essential, high-quality inputs, supplier power increases.

- Criticality of Inputs: Suppliers of specialized construction materials and advanced building systems are vital for maintaining the high quality and functionality of EastGroup's industrial properties.

- Supplier Differentiation: Unique, high-quality components or services from specific suppliers enhance their bargaining power if they are essential for EastGroup's premium offerings.

- Substitution Difficulty: If EastGroup faces challenges in finding comparable alternatives for critical supplier inputs, the suppliers' negotiating position strengthens.

- Industry Standards: Adherence to stringent industry standards for materials and construction can limit the pool of qualified suppliers, thereby increasing their bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers forward integrating into industrial property development or ownership is generally low for EastGroup Properties. This is because the capital requirements and specialized knowledge needed for property development and management are significant barriers to entry for most suppliers of construction materials or services. For instance, a typical construction firm, while capable of building, may lack the financial wherewithal and market access to acquire land, finance large-scale projects, and manage ongoing property operations as a developer and owner.

Should a supplier possess the substantial capital and expertise to enter EastGroup's market, it would directly diminish EastGroup's bargaining power. However, this scenario is uncommon in the industrial real estate sector. Suppliers typically focus on their core competencies, such as manufacturing building components or providing specialized construction labor, rather than undertaking the complex and capital-intensive business of property development and leasing. This specialization allows EastGroup to maintain leverage in its supplier relationships.

- Low Likelihood of Supplier Forward Integration: The significant capital investment and specialized expertise required for industrial property development present substantial barriers for typical suppliers.

- Focus on Core Competencies: Most suppliers in the construction value chain concentrate on manufacturing or service provision, not property ownership and development.

- Impact on Bargaining Power: A credible threat of forward integration by suppliers would reduce EastGroup's leverage in negotiating terms and pricing.

The bargaining power of suppliers for EastGroup Properties is moderate, influenced by the concentration of specialized construction firms and material providers. While EastGroup benefits from a competitive market for standard building materials, the need for specialized expertise in industrial development can consolidate power among a few key players. For instance, in 2024, the demand for advanced logistics and cold storage facilities increased the reliance on suppliers with specific technological capabilities, potentially giving them more leverage.

Switching costs for EastGroup are also a factor. If a project requires highly customized components or involves lengthy integration with a specific contractor, changing suppliers mid-stream can be costly and time-consuming. This was evident in projects requiring specialized energy-efficient HVAC systems, where sourcing and installing alternatives could delay project completion and increase expenses.

The threat of suppliers integrating forward into property development is generally low. The substantial capital and expertise needed for real estate ownership and management are significant barriers, allowing EastGroup to maintain its position as a developer and owner without facing direct competition from its material or service providers.

| Factor | Impact on EastGroup | 2024 Trend/Example |

| Supplier Concentration | Moderate | Increased demand for specialized construction firms in logistics sector. |

| Switching Costs | Moderate | High costs associated with specialized building systems and contractor integration. |

| Availability of Substitutes | High for standard materials, Low for specialized inputs | Readily available alternatives for concrete; limited alternatives for advanced insulation. |

| Supplier Forward Integration | Low | Barriers to entry in property development remain high for typical suppliers. |

What is included in the product

This analysis unpacks the competitive forces impacting EastGroup Properties, detailing the intensity of rivalry, buyer and supplier power, threats of new entrants and substitutes.

A clear, one-sheet summary of EastGroup's Porter's Five Forces—perfect for quickly identifying and mitigating competitive pressures in the industrial real estate market.

Customers Bargaining Power

EastGroup Properties' customer concentration is a key factor in understanding customer bargaining power. If a few large tenants represent a substantial portion of their rental income, these major clients gain significant leverage. For instance, if the top 10 tenants accounted for 35% of total rental revenue in 2023, as reported, they would have considerable power to negotiate favorable lease terms, potentially impacting EastGroup's profitability.

Customer switching costs are a significant factor in EastGroup Properties' tenant relationships. These costs represent what a tenant would have to spend to move from an EastGroup property to a competitor's. For instance, a business might face expenses related to physically moving equipment, re-establishing logistical routes, or the disruption to their operations during a relocation. These expenses can be substantial, making tenants less likely to switch providers.

High switching costs directly benefit EastGroup by diminishing the bargaining power of its customers, the tenants. When it's costly and inconvenient for a tenant to leave, they are more inclined to stay. This fosters greater tenant retention, providing EastGroup with a more stable and predictable revenue stream. In 2024, EastGroup reported a strong occupancy rate of 97.7%, underscoring the effectiveness of factors like switching costs in maintaining tenant loyalty.

The availability of substitute industrial properties significantly impacts customer bargaining power for EastGroup Properties. In markets where similar quality industrial space is plentiful, like many of the Sun Belt regions EastGroup operates in, tenants have more choices. For instance, in 2024, the industrial vacancy rate across major U.S. markets hovered around 3.5% to 4.5%, offering a competitive landscape where tenants can negotiate terms more effectively.

Customer Price Sensitivity

EastGroup Properties' customers, primarily businesses requiring industrial and logistics space, exhibit varying degrees of price sensitivity. For many, real estate costs are a significant operational expense, meaning fluctuations in rental rates can directly impact their profitability and competitiveness. This sensitivity is particularly pronounced for smaller businesses or those operating on tighter margins.

The bargaining power of these customers is amplified when alternative, comparably located industrial properties are readily available. If a business can easily relocate to a similar facility at a lower rent, EastGroup faces increased pressure to maintain competitive pricing. This dynamic is a key consideration in how EastGroup structures its lease agreements and manages its property portfolio.

- Customer Price Sensitivity: Businesses leasing industrial properties often have real estate costs as a substantial portion of their overhead, making them sensitive to rental price increases.

- Impact on Bargaining Power: High price sensitivity empowers customers to negotiate for lower rents, especially if suitable alternatives exist in the market.

- Logistics Costs: For companies where logistics and distribution are critical, the cost and efficiency of their facility location directly influence their overall operational expenses and thus their price sensitivity.

- Market Conditions: The availability of competing industrial properties in desirable locations directly correlates with customer bargaining power; a tighter market generally reduces this power.

Customer's Threat of Backward Integration

The threat of backward integration for EastGroup Properties' customers is generally low within the industrial real estate sector. Most tenants, particularly those in logistics and light manufacturing, focus on their core operations rather than investing heavily in developing and managing their own specialized industrial facilities. The capital expenditure and expertise required to acquire land, design, construct, and maintain such properties are significant deterrents.

For instance, a large logistics company might find it more cost-effective and operationally efficient to lease a modern distribution center from a specialized landlord like EastGroup, which can offer economies of scale in development and management. This allows the tenant to concentrate on optimizing their supply chain and delivery networks rather than real estate ownership. In 2024, the average cost to build a Class A industrial warehouse in major US markets often exceeds $150 per square foot, a substantial barrier for many potential owner-occupiers.

- Low Likelihood: Tenants typically lack the core competency and financial resources to undertake large-scale industrial property development.

- High Capital Costs: The significant upfront investment required for land acquisition and construction deters most customers from backward integration.

- Focus on Core Business: Companies generally prefer to outsource real estate needs to specialized providers like EastGroup to focus on their primary revenue-generating activities.

The bargaining power of EastGroup Properties' customers, primarily industrial and logistics tenants, is influenced by market dynamics. In 2024, the industrial vacancy rate remained low across many U.S. markets, generally between 3.5% and 4.5%, which tends to reduce tenant leverage. However, specific submarkets with higher vacancy rates or an oversupply of similar properties can empower tenants to negotiate more favorable lease terms.

Tenant retention is a critical indicator of customer bargaining power. EastGroup's strong occupancy rate of 97.7% in 2024 suggests that tenants find value and face significant switching costs, thereby limiting their ability to bargain down rents or demand concessions. These costs include relocation expenses, operational disruptions, and the potential loss of established business relationships at a specific site.

Customer price sensitivity is another key factor. Real estate is a significant operating expense for many businesses, making them attentive to rental rate changes. For instance, a 5% increase in rent on a 100,000 square foot industrial space could translate to an additional $60,000 annually in operating costs, depending on the base rent, significantly impacting a tenant’s bottom line and their willingness to negotiate.

| Factor | 2024 Impact on Customer Bargaining Power | EastGroup's Position |

|---|---|---|

| Market Vacancy Rates | Generally low (3.5%-4.5% nationally), limiting power. | Benefits EastGroup by reducing tenant leverage. |

| Switching Costs | High for tenants (relocation, disruption), reducing power. | Enhances tenant retention and revenue stability. |

| Price Sensitivity | Moderate to high, depending on tenant's operational costs. | Requires competitive pricing strategies to maintain occupancy. |

| Availability of Substitutes | Varies by submarket; more substitutes increase tenant power. | Strategic site selection in less saturated markets is crucial. |

Preview Before You Purchase

EastGroup Properties Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis for EastGroup Properties, detailing the competitive landscape and strategic positioning of the company. The document you are currently viewing is the exact, fully formatted report you will receive immediately after completing your purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The industrial real estate sector, particularly in EastGroup Properties' core Sunbelt markets, is characterized by a significant number of competitors. This includes not only publicly traded industrial REITs but also a diverse array of private developers and property owners, all vying for prime locations and tenants.

This high degree of competition intensifies rivalry, forcing companies like EastGroup to be more aggressive in securing acquisitions and attracting tenants. For instance, in 2024, the Sunbelt region continued to see robust development activity, with numerous private players and smaller REITs actively participating in land acquisition and construction, directly impacting lease rates and property valuations.

The industrial real estate market, particularly for modern distribution and logistics facilities, has experienced robust growth. In 2024, the demand for industrial space remained strong, driven by e-commerce expansion and supply chain reshoring initiatives. This rapid expansion can temper direct competitive rivalry as companies focus on developing new properties to meet surging demand rather than engaging in aggressive price wars for existing tenants.

Industrial real estate demands substantial capital, creating high fixed costs for companies like EastGroup Properties. For instance, acquiring and developing large industrial parks requires hundreds of millions in investment. These significant upfront expenses mean companies must maintain high occupancy rates to cover their costs.

Exit barriers in this sector are also considerable. Divesting a large portfolio of industrial properties is often a slow and costly process, potentially leading to significant losses if forced to sell quickly. This inflexibility discourages companies from easily exiting the market, thereby intensifying competition among existing players.

Consequently, these high fixed costs and exit barriers foster intense rivalry. Companies are incentivized to operate at or near full capacity to maximize returns and cover their substantial investments, leading to a more competitive landscape where market share and operational efficiency are paramount.

Product Differentiation Among Competitors

EastGroup Properties distinguishes itself through its focus on functional, flexible, and high-quality business distribution spaces. This differentiation strategy aims to reduce direct price competition by offering superior value beyond just square footage. For instance, in 2024, EastGroup continued to emphasize properties in supply-constrained, infill locations, which inherently command higher rents due to their accessibility and convenience for tenants.

The company’s commitment to modern, adaptable building designs and enhanced tenant services further sets it apart. This approach allows EastGroup to attract and retain tenants seeking more than just basic warehousing, thereby mitigating the intensity of rivalry. By concentrating on these specific attributes, EastGroup can foster stronger tenant loyalty and command premium pricing, even when competing against larger, more diversified real estate investment trusts.

- Location Advantage: EastGroup’s strategic placement of properties in key infill markets in 2024 provides a significant competitive edge, reducing the need for extensive price wars.

- Property Quality and Flexibility: The emphasis on high-quality, adaptable building designs caters to evolving tenant needs, fostering differentiation.

- Tenant Services: Superior tenant support and relationship management contribute to customer retention and reduced direct rivalry.

Competitive Strategies Employed

EastGroup Properties operates in a market where competitors frequently engage in aggressive pricing and offer substantial tenant improvement allowances to attract and retain tenants. This dynamic is evident as industrial property owners vie for market share, often employing strategic acquisitions to expand their portfolios and geographic reach. For instance, in 2024, the industrial real estate sector saw continued consolidation, with many players actively pursuing M&A opportunities to gain scale and competitive advantages.

The intensity of competition is further amplified by a focus on niche segments within the industrial property market, such as cold storage or last-mile logistics facilities. Companies differentiate themselves by specializing in these high-demand areas, which can command premium rents. This strategic specialization allows them to capture specific market segments, though it also means facing rivals who are equally focused on these specialized niches.

- Aggressive Pricing: Competitors often undercut rivals on rental rates to secure new leases, particularly in markets with high vacancy.

- Tenant Improvement Allowances: Significant capital is invested in customizing spaces for tenants, a common tactic to win business.

- Strategic Acquisitions: Companies actively acquire existing portfolios or individual assets to grow their footprint and achieve economies of scale.

- Niche Market Focus: Specialization in sub-sectors like cold storage or e-commerce fulfillment centers allows for targeted competition.

The competitive rivalry within EastGroup Properties' industrial real estate markets, particularly in the Sunbelt, is substantial. This stems from a mix of large public REITs, private developers, and smaller players all vying for prime locations and tenants. In 2024, this dynamic meant that while demand for industrial space remained robust, driven by e-commerce and supply chain adjustments, companies had to remain sharp in their acquisition and leasing strategies. The high capital requirements and exit barriers in industrial real estate also mean that existing players are deeply invested, intensifying competition among them.

EastGroup's strategy of focusing on functional, flexible, and high-quality business distribution spaces in supply-constrained, infill locations helps to mitigate some of this direct rivalry. By offering superior value through modern designs and enhanced tenant services, EastGroup aims to differentiate itself from competitors who might engage in more aggressive pricing or tenant improvement allowances. This focus on quality and location allows EastGroup to foster tenant loyalty and potentially command premium rents, even in a crowded market.

| Competitive Tactic | Description | 2024 Relevance |

|---|---|---|

| Aggressive Pricing | Competitors may lower rental rates to secure leases. | Prevalent in markets with higher vacancy, impacting lease renewal negotiations. |

| Tenant Improvement Allowances | Capital invested in customizing spaces for tenants. | A key tool for attracting new tenants, especially for specialized industrial needs. |

| Strategic Acquisitions | Companies buy portfolios or assets to grow. | Continued consolidation in 2024 as players sought scale and market share. |

| Niche Market Focus | Specializing in areas like cold storage or last-mile logistics. | Allows for differentiation but also creates competition within those specific segments. |

SSubstitutes Threaten

The threat of substitutes for EastGroup Properties' core offering of industrial distribution space is growing, driven by technological advancements in logistics. Companies are increasingly exploring non-traditional solutions that can fulfill the function of physical warehousing, potentially reducing the demand for traditional industrial real estate. For instance, sophisticated supply chain management software can optimize inventory placement and delivery routes, thereby minimizing the need for extensive storage facilities. In 2023, companies invested heavily in digital transformation, with supply chain software market size estimated to be around $20 billion globally, a figure projected to grow significantly.

Furthermore, highly efficient cross-docking operations, where goods are transferred directly from inbound to outbound transportation with minimal storage, present another viable substitute. This model streamlines the flow of goods and reduces the reliance on large, centralized warehouses. Similarly, the rise of localized manufacturing and 3D printing technologies allows businesses to produce goods closer to the point of consumption, diminishing the need for long-distance transportation and, consequently, large distribution centers. The global 3D printing market was valued at approximately $15.7 billion in 2023, indicating a strong trend towards decentralized production.

Technological advancements are reshaping the industrial real estate landscape. Innovations like advanced automation and robotics, particularly in smaller, more agile footprints, could reduce the need for vast traditional warehouse spaces. For instance, the rise of micro-fulfillment centers, enabled by robotics, allows companies to store and distribute goods closer to consumers, potentially diminishing demand for large, centralized distribution hubs that EastGroup Properties (EGP) typically serves. This shift presents a threat as these technologies offer alternative ways to manage inventory and delivery, bypassing the need for extensive industrial property leases.

The evolution of supply chain models presents a significant threat of substitution for EastGroup Properties. Trends like just-in-time inventory and distributed manufacturing can lessen the need for traditional, large-scale warehousing facilities. This shift directly challenges the demand for the industrial real estate that forms the core of EastGroup's business.

For instance, the rise of direct-to-consumer (DTC) models allows companies to bypass centralized distribution hubs, potentially reducing their footprint requirements. As of 2024, e-commerce continues its robust growth, with projections indicating further expansion in DTC strategies. This could mean less reliance on the types of modern industrial properties EastGroup specializes in, impacting rental demand and occupancy rates.

Vertical Integration by Customers

The threat of vertical integration by customers for EastGroup Properties, a real estate investment trust (REIT) specializing in industrial properties, is a significant consideration. This threat arises when EastGroup's target customers, typically businesses requiring logistics and distribution space, consider owning and managing their own facilities instead of leasing.

If companies perceive it as more cost-effective or strategically advantageous to develop and operate their dedicated logistics and distribution centers, this directly substitutes for the leasing services EastGroup provides. For instance, a large e-commerce firm might decide that the long-term capital investment in building its own distribution hubs outweighs the recurring lease payments, especially if it can achieve economies of scale or greater operational control. This decision directly impacts demand for EastGroup's leased properties.

- Customer Integration Risk: Businesses might opt to build their own logistics facilities, bypassing the need for leased industrial space.

- Cost-Benefit Analysis: The decision hinges on whether owning is cheaper or more beneficial than leasing for the customer.

- Strategic Control: Companies may seek greater operational control and customization than a leased property offers.

- Market Trends: Observing trends in self-owned logistics infrastructure by key industries EastGroup serves is crucial for assessing this threat.

Alternative Property Types for Logistics

The threat of substitutes for EastGroup Properties' industrial and logistics real estate is generally low, especially for large-scale operations. However, for smaller, urban-centric logistics needs, alternative property types could emerge.

Consideration is given to whether other real estate classes, or even underutilized commercial spaces, might be adapted for logistics functions. While not ideal for extensive warehousing, these non-traditional spaces could serve niche, last-mile delivery needs.

- Urban Infill & Repurposing: The trend towards urban logistics means even retail or office spaces in dense areas could be partially repurposed for smaller distribution hubs, though this is less efficient for bulk storage.

- E-commerce Fulfillment Centers: While these are often purpose-built logistics facilities, the underlying need for fulfillment can sometimes be met by highly automated, smaller footprint facilities that might leverage different building types.

- Data Centers & Specialized Storage: For certain types of goods requiring specific environmental controls, data centers or other specialized storage facilities might be considered substitutes if they offer comparable conditions, though this is highly specific.

The threat of substitutes for EastGroup Properties' industrial distribution space is moderate, driven by evolving supply chain strategies and technological advancements. While large-scale, modern industrial facilities remain essential, certain trends can reduce the demand for traditional warehousing. For example, advancements in supply chain software and automation are enabling more efficient inventory management and distribution, potentially decreasing the need for extensive physical storage. In 2023, global investment in supply chain technology reached an estimated $22 billion, highlighting this trend.

Furthermore, the rise of decentralized manufacturing and direct-to-consumer (DTC) models can also act as substitutes. Localized production reduces the need for large, centralized distribution centers, and DTC strategies often bypass traditional warehousing networks. As of 2024, e-commerce continues its expansion, with DTC sales projected to grow by over 10% annually, impacting the demand for traditional logistics real estate.

While the threat of substitutes for large-scale industrial distribution is generally low, alternative solutions may emerge for smaller, urban logistics needs. These could include repurposed commercial spaces or highly automated micro-fulfillment centers, though they are less suited for bulk storage. The increasing focus on last-mile delivery in urban areas could see some adaptation of these alternative spaces, impacting demand for traditional industrial properties in specific submarkets.

| Substitute Category | Description | Impact on EastGroup Properties | 2023/2024 Data Point |

|---|---|---|---|

| Supply Chain Technology | Software optimizing inventory, route planning, reducing storage needs. | Moderate reduction in demand for large warehouses. | Global supply chain software market valued at ~$22 billion (2023). |

| Decentralized Manufacturing | Producing goods closer to consumers, reducing need for central distribution. | Lower demand for large, long-haul logistics facilities. | Global 3D printing market ~$15.7 billion (2023), enabling localized production. |

| Direct-to-Consumer (DTC) Models | Bypassing traditional distribution hubs, direct shipping. | Reduced reliance on large fulfillment centers. | E-commerce DTC sales projected to grow >10% annually (2024). |

| Urban Micro-Fulfillment Centers | Smaller, automated facilities for last-mile delivery. | Potential substitution for niche urban logistics needs. | Increased investment in last-mile logistics infrastructure. |

Entrants Threaten

The significant capital requirements to enter the industrial real estate market act as a substantial barrier. Developing or acquiring a portfolio of properties, especially for a Real Estate Investment Trust (REIT) like EastGroup Properties, demands immense financial backing. For instance, in 2024, the average cost to construct a modern industrial warehouse can range from $80 to $150 per square foot, meaning a modest 100,000 square foot facility could easily cost $8 million to $15 million before land acquisition. This high investment threshold effectively deters many potential new entrants who lack access to such considerable funding, thereby protecting established players.

EastGroup Properties operates in major Sunbelt markets, where prime industrial land is a limited and costly resource. This scarcity directly impacts the threat of new entrants, as acquiring suitable locations is a significant hurdle. For instance, in 2024, industrial land prices in many of these sought-after Sunbelt regions continued their upward trajectory, making it increasingly expensive for newcomers to establish a competitive presence.

New entrants in the industrial real estate sector, like EastGroup Properties, encounter significant regulatory hurdles. These include intricate zoning laws, rigorous environmental impact assessments, and lengthy permitting processes that vary by municipality. For instance, in 2024, the average time to obtain development permits in major U.S. markets often stretched for months, sometimes exceeding a year, adding substantial upfront costs and delays.

Economies of Scale and Experience Curve

Established players like EastGroup Properties benefit from significant economies of scale in property management, leasing, and financing. This allows them to spread fixed costs over a larger asset base, leading to lower per-unit operating expenses. For instance, in 2024, EastGroup's operational efficiency, driven by its scale, contributed to its ability to maintain competitive leasing rates.

Furthermore, EastGroup has developed an experience curve in market analysis and development through years of operation. This accumulated knowledge provides an edge in site selection, tenant negotiation, and navigating complex development processes, which new entrants will struggle to replicate quickly. Their expertise helps mitigate risks and optimize returns, a crucial advantage in the competitive industrial real estate sector.

- Economies of Scale: Lower per-unit operating costs due to larger asset base.

- Experience Curve: Enhanced market analysis, site selection, and development expertise.

- Cost Disadvantage for New Entrants: Lack of scale and experience leads to higher initial costs.

- Operational Inefficiencies: New entrants face challenges in matching established operational efficiencies.

Brand Reputation and Tenant Relationships

While brand reputation and tenant relationships might not be as dominant a barrier in industrial real estate as in consumer goods, they still play a significant role for EastGroup Properties. A strong track record of providing reliable, high-quality industrial properties and fostering enduring relationships with a diverse tenant base creates a subtle but effective barrier to entry for newcomers. New entrants must invest considerable time and resources to cultivate trust and establish a verifiable history of successful tenant management, which is crucial for attracting and retaining a stable occupancy.

For instance, EastGroup Properties, as of Q1 2024, reported a robust occupancy rate of 97.6% across its portfolio, underscoring the loyalty and satisfaction of its existing tenants. This high occupancy is a direct reflection of the trust and value tenants place in EastGroup's management and property offerings. New competitors would need to demonstrate comparable reliability and tenant-centric services to even begin chipping away at this entrenched loyalty, a process that is inherently slow and capital-intensive.

- Tenant Retention: EastGroup's focus on tenant satisfaction contributes to high retention rates, making it harder for new entrants to secure a foothold.

- Property Quality: A reputation for well-maintained and strategically located properties attracts and keeps tenants, a standard new players must meet.

- Relationship Building: The time and effort required to build strong, trust-based relationships with industrial tenants present a significant hurdle for emerging competitors.

- Market Trust: Established players like EastGroup benefit from market-wide trust, a factor that new entrants must painstakingly earn over time.

The threat of new entrants for EastGroup Properties is generally considered moderate to low. The substantial capital required for land acquisition and development, coupled with stringent regulatory processes and the need for established economies of scale, creates significant barriers. For example, in 2024, industrial property development costs remained high, with a 100,000 sq ft warehouse potentially costing over $10 million. Furthermore, securing prime locations in sought-after Sunbelt markets in 2024 presented a considerable challenge due to limited availability and rising land prices.

| Barrier Type | 2024 Impact on New Entrants | EastGroup Advantage |

|---|---|---|

| Capital Requirements | High (e.g., $8M-$15M for a 100k sq ft warehouse) | Access to significant financing and established credit lines |

| Land Scarcity | Increasingly expensive in Sunbelt markets | Strategic land bank and long-term relationships with landowners |

| Regulatory Hurdles | Lengthy permitting and zoning processes (months to over a year) | Experienced in navigating complex regulatory environments |

| Economies of Scale | New entrants lack operational efficiencies | Lower per-unit operating costs and competitive leasing rates |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EastGroup Properties is built upon comprehensive data from industry-specific market research reports, publicly available financial statements and SEC filings, and insights from real estate analytics firms.