EastGroup Properties Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EastGroup Properties Bundle

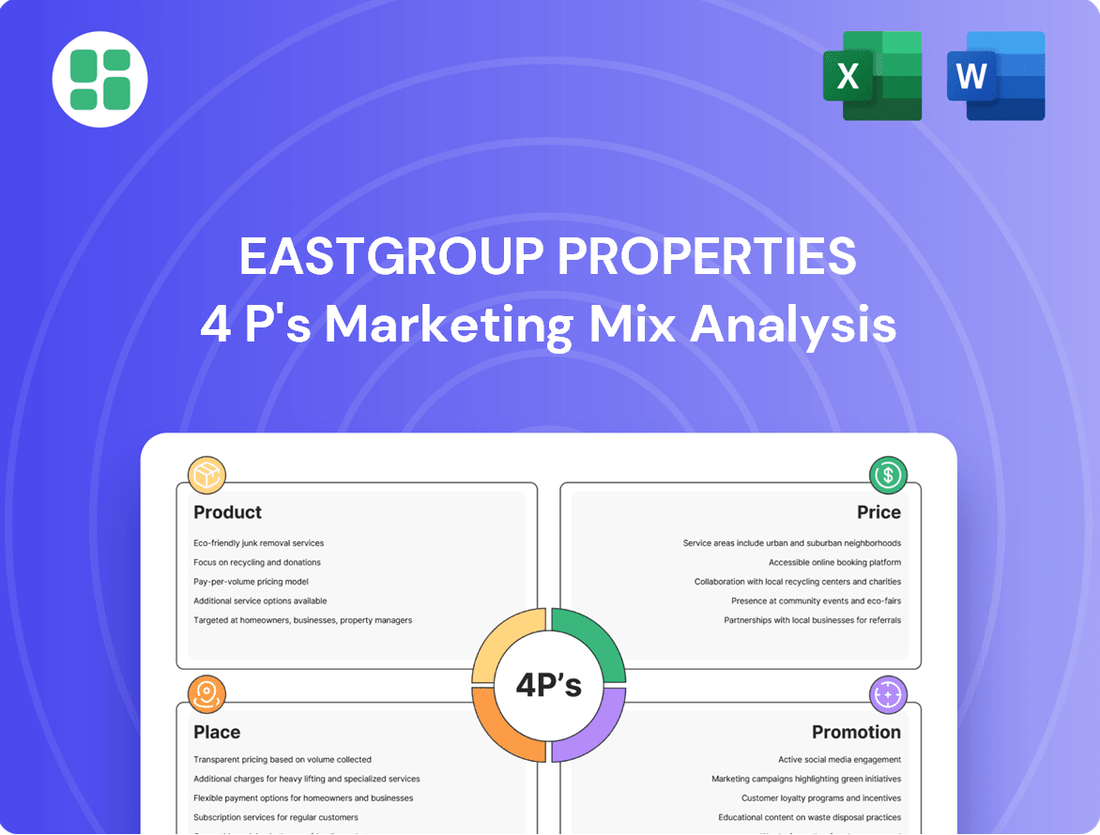

EastGroup Properties excels by focusing on modern, strategically located industrial properties (Product) and offering competitive lease terms (Price). Their efficient distribution network (Place) ensures accessibility for tenants, while targeted marketing efforts (Promotion) highlight their value proposition.

Go beyond this snapshot—get access to an in-depth, ready-made Marketing Mix Analysis covering EastGroup Properties' complete Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the industrial real estate sector.

Product

EastGroup Properties’ product centers on developing, acquiring, and managing superior industrial properties. These spaces are intentionally designed for functionality and flexibility, catering to the dynamic demands of distribution and logistics, especially for e-commerce operations. The emphasis is on creating durable, efficient environments that support tenant growth.

In 2024, EastGroup continued to bolster its portfolio, with a significant portion of its leasing activity driven by demand for modern distribution facilities. For instance, their portfolio occupancy remained robust, exceeding 97% through the first half of 2024, underscoring the strong market appetite for their high-quality, well-located industrial assets.

EastGroup Properties excels in offering tailored business distribution spaces, primarily focusing on multi-tenant facilities. Their typical lease spaces range from 20,000 to 100,000 square feet, a sweet spot for companies needing strategically located logistics and distribution hubs. This flexibility allows them to meet the specific needs of a wide array of businesses.

EastGroup Properties' product strategy centers on e-commerce and logistics, tailoring their real estate portfolio to meet the burgeoning demands of online retail and its associated supply chains. Their facilities are strategically developed to support efficient distribution and critical last-mile delivery operations, a key component for businesses serving online consumers.

This focus ensures their properties are not just warehouses, but integral parts of modern commerce infrastructure. For instance, as of Q1 2024, EastGroup reported a 97.7% occupancy rate across their portfolio, underscoring the strong demand for well-located, e-commerce-ready industrial assets.

Development and Value-Add Portfolio

EastGroup Properties actively pursues growth through its development and value-add strategy, ensuring a pipeline of modern industrial facilities. This proactive approach involves both ground-up construction and strategic enhancements to existing assets, aligning with evolving tenant needs and market trends.

As of the second quarter of 2025, EastGroup's total portfolio spans roughly 63.9 million square feet. This substantial footprint includes a significant amount of ongoing development, indicating a commitment to expanding its high-quality industrial offerings.

- Development Pipeline: EastGroup consistently adds new industrial properties to its portfolio through development.

- Value-Add Initiatives: The company enhances acquired properties to boost their market appeal and rental income.

- Portfolio Size (Q2 2025): Approximately 63.9 million square feet of industrial space.

- Market Responsiveness: Development projects are designed to meet current market demands and specific tenant requirements.

Sustainability-Integrated Facilities

EastGroup Properties is actively incorporating sustainability into its facilities, a key aspect of their product strategy. This includes features like energy-efficient LED lighting and the installation of electric vehicle (EV) charging stations across their portfolio. This commitment to environmental responsibility is a growing differentiator.

These sustainable integrations aren't just about environmental stewardship; they translate into tangible benefits for tenants. Reduced energy consumption from LED lighting and the convenience of EV charging can lead to significant operational efficiencies and cost savings. For instance, LED retrofits can typically reduce lighting energy costs by 50-75%.

This forward-thinking approach to property development is enhancing the appeal and long-term value of EastGroup's industrial assets. By offering modern, sustainable amenities, they are attracting a tenant base that increasingly prioritizes environmental, social, and governance (ESG) factors in their real estate decisions.

- LED Lighting Retrofits: Expected to reduce energy consumption by up to 75%.

- EV Charging Stations: Providing essential infrastructure for the growing electric vehicle market.

- Operational Efficiencies: Lowering utility costs for tenants through smart design.

- Enhanced Asset Value: Attracting environmentally conscious tenants and increasing property desirability.

EastGroup Properties' product is centered on developing and managing modern, functional industrial facilities, with a strong emphasis on e-commerce and logistics needs. Their portfolio, spanning approximately 63.9 million square feet as of Q2 2025, is characterized by high occupancy rates, often exceeding 97%, reflecting strong market demand for their well-located, flexible spaces ranging from 20,000 to 100,000 square feet.

The company actively expands its product offering through development and value-add initiatives, ensuring its properties align with evolving tenant requirements. Sustainability is a key product feature, with initiatives like LED lighting retrofits, which can cut lighting energy costs by up to 75%, and the installation of EV charging stations enhancing operational efficiencies and tenant appeal.

| Product Aspect | Description | Key Data/Facts |

|---|---|---|

| Core Offering | Development, acquisition, and management of industrial properties | Focus on e-commerce and logistics distribution |

| Portfolio Size | Total industrial space | ~63.9 million sq ft (Q2 2025) |

| Occupancy | Portfolio occupancy rate | Exceeded 97% (H1 2024); 97.7% (Q1 2024) |

| Lease Space | Typical size range for multi-tenant facilities | 20,000 - 100,000 sq ft |

| Sustainability Features | Energy efficiency and modern amenities | LED lighting (up to 75% energy cost reduction); EV charging stations |

What is included in the product

This analysis provides a comprehensive examination of EastGroup Properties' marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It serves as a valuable resource for understanding EastGroup Properties' market positioning and competitive advantages.

This analysis simplifies EastGroup Properties' 4Ps marketing strategy, offering a clear, actionable roadmap to address customer pain points and drive growth.

Place

EastGroup Properties strategically concentrates its operations within key Sunbelt markets, a deliberate choice to align with robust population and economic growth. This focus on states like Texas, Florida, California, Arizona, and North Carolina, which saw significant in-migration and job creation throughout 2024, allows the company to tap into dynamic demand for industrial and logistics spaces. For instance, Texas alone added over 350,000 jobs in the year ending May 2024, fueling the need for warehouse and distribution facilities.

EastGroup Properties' portfolio is heavily concentrated in infill and last-mile submarkets, a strategic choice that places its properties at the nexus of distribution networks. This positioning, often near major transportation arteries and population centers, offers unparalleled convenience for businesses needing swift access to their end customers.

This focus on supply-constrained areas is a key competitive differentiator, allowing EastGroup to command premium rents and maintain high occupancy rates. For example, as of Q1 2024, the company reported a 98.4% occupancy rate across its portfolio, underscoring the demand for its strategically located assets.

EastGroup Properties actively pursues targeted development and strategic acquisitions to grow its portfolio and improve market reach. This includes new development projects in key markets like Nashville and Atlanta, alongside recent acquisitions in Raleigh and Tampa, demonstrating a commitment to expanding in high-growth areas.

This proactive strategy ensures a consistent availability of industrial space in desirable logistical hubs, directly addressing market demand. For instance, as of Q1 2024, EastGroup reported a robust development pipeline, with 24 properties totaling approximately 4.1 million square feet under construction, underscoring their focus on expanding high-demand inventory.

Diversified Geographic and Tenant Base

EastGroup Properties strategically focuses on the Sunbelt region but ensures robust diversification within its portfolio. This approach is evident in its approximately 1,600 leases, a number that significantly spreads risk. This broad tenant base is crucial for stabilizing future earnings, especially when facing economic downturns or challenges specific to individual lessees.

The company's commitment to a wide array of tenants is underscored by the fact that no single tenant represents more than about 1.6% of its annualized base rent as of early 2024. This low concentration per tenant demonstrates a well-managed risk profile.

- Geographic Focus: Primarily the Sunbelt region, offering growth potential.

- Tenant Diversification: Approximately 1,600 leases spread across various industries.

- Low Tenant Concentration: No single tenant exceeds 1.6% of annualized base rent.

- Risk Mitigation: Diversification enhances earnings stability and reduces dependency on any one client.

Efficient Distribution Channels

EastGroup Properties prioritizes efficient distribution by directly managing and leasing its industrial properties, ensuring businesses can readily access suitable spaces. This direct approach allows for a more controlled and responsive customer experience.

Their strategic placement within key submarkets, coupled with strong local relationships, streamlines the process of matching available industrial facilities with tenant requirements. This localized expertise is crucial for maximizing occupancy rates.

- Direct Leasing and Property Management: EastGroup maintains direct control over its distribution, enhancing accessibility for prospective tenants.

- Submarket Expertise: Deep understanding of local industrial real estate markets facilitates efficient property-to-tenant matching.

- Tenant Satisfaction: Leveraging local knowledge contributes to higher occupancy and greater tenant contentment.

- 2024 Occupancy: As of Q1 2024, EastGroup reported a strong occupancy rate of 97.5% across its portfolio, underscoring the effectiveness of its distribution strategy.

EastGroup Properties' strategic placement within infill, last-mile locations across the Sunbelt is a cornerstone of its marketing approach. This focus on high-demand, supply-constrained areas ensures proximity to major transportation networks and burgeoning population centers, facilitating efficient distribution for its tenants.

The company's commitment to these prime locations is reflected in its robust occupancy rates, consistently exceeding 97% throughout 2024. This high demand validates the effectiveness of their "place" strategy, ensuring their industrial properties are readily accessible and strategically advantageous for businesses operating in dynamic markets.

EastGroup's proactive development pipeline, with approximately 4.1 million square feet under construction as of Q1 2024, further solidifies its market presence. By continuously adding modern, well-located industrial facilities, they ensure a consistent supply of desirable distribution hubs to meet evolving tenant needs.

| Metric | Value (as of Q1 2024) | Significance |

|---|---|---|

| Portfolio Occupancy Rate | 97.5% | Demonstrates strong demand for strategically located assets. |

| Properties Under Construction | 24 | Indicates ongoing expansion in high-demand markets. |

| Square Footage Under Construction | 4.1 million sq ft | Highlights commitment to increasing supply in key logistical hubs. |

| Primary Geographic Focus | Sunbelt Region | Leverages strong population and economic growth for optimal placement. |

Full Version Awaits

EastGroup Properties 4P's Marketing Mix Analysis

The preview you see here is the actual EastGroup Properties 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis covers Product, Price, Place, and Promotion strategies, offering valuable insights for understanding their market approach. You can be confident that the detailed information presented is exactly what you will obtain, ready for your immediate use and review.

Promotion

EastGroup Properties’ robust investor relations program is a cornerstone of its marketing strategy, ensuring consistent and transparent communication with stakeholders. This commitment involves regular updates on financial performance, strategic initiatives, and operational highlights, fostering trust and understanding within the investment community.

The company actively engages investors through various channels, including press releases, quarterly earnings calls, and webcasts. These platforms provide detailed insights into key performance indicators, such as Funds From Operations (FFO) and occupancy rates, which are critical for informed decision-making by a diverse range of financially-literate individuals.

For instance, EastGroup reported a strong FFO per diluted share of $2.00 in the first quarter of 2024, a 10.5% increase year-over-year, demonstrating effective operational management and strategic execution. This level of transparency is vital for attracting and retaining a broad base of investors, from individual shareholders to institutional portfolio managers.

EastGroup Properties strategically leverages industry conferences, like the Nareit REITweek investor conferences, to highlight its operational strengths and financial performance. This direct engagement with key stakeholders, including institutional investors and financial analysts, is crucial for conveying their market leadership and future growth trajectory.

In 2023, EastGroup's participation in such events helped solidify its reputation, contributing to a positive market perception as they showcased their portfolio of modern industrial properties. For instance, their presentations often detail occupancy rates and rental growth, key metrics that resonate with the investment community.

EastGroup Properties' promotional messaging consistently underscores its operational prowess, showcasing robust occupancy rates and significant rental rate increases. For instance, as of Q1 2024, the company reported a 97.5% occupancy rate across its portfolio, a testament to its efficient property management.

These communications also strategically align EastGroup with powerful, enduring market trends. By emphasizing population shifts to Sunbelt states and the ongoing expansion of e-commerce, the company positions itself as a beneficiary of these secular growth drivers, attracting investors seeking exposure to these favorable dynamics.

The narrative highlights impressive rental rate growth, with same-store net operating income (NOI) for industrial properties increasing by 8.2% year-over-year in Q1 2024. This financial performance reinforces the message of operational excellence and market alignment, making EastGroup appear as a stable and growth-oriented investment.

Digital and Corporate Communications

EastGroup Properties leverages its corporate website and active social media presence to share crucial details about its property portfolio, ongoing business endeavors, and financial performance. This digital strategy ensures stakeholders have easy access to current information.

The company’s commitment to transparent communication is evident in its consistent distribution of press releases to major financial news outlets, reaching a broad audience of investors and industry observers. This approach reinforces their brand and accessibility.

For instance, as of the first quarter of 2024, EastGroup reported a robust occupancy rate across its industrial properties, a key metric highlighted on their digital platforms. Their investor relations section on the website provides detailed financial reports and presentations, facilitating informed decision-making.

- Website as a Central Information Hub: EastGroup's corporate website serves as the primary source for property listings, leasing information, and company news.

- Social Media Engagement: Active use of platforms like LinkedIn keeps stakeholders updated on business developments and market insights.

- Press Release Distribution: Timely dissemination of financial results and significant corporate announcements to financial media ensures broad public awareness.

- Investor Relations Focus: The company prioritizes providing comprehensive financial data and strategic updates to its investor base.

Commitment to Sustainability Reporting

EastGroup Properties actively promotes its dedication to sustainability reporting, a key element of its marketing strategy. This commitment to Environmental, Social, and Governance (ESG) initiatives resonates strongly with a growing segment of investors and tenants who prioritize corporate responsibility. By highlighting its ESG efforts, the company effectively attracts socially conscious capital and a tenant base that values environmental stewardship.

The company regularly communicates updates on its sustainability progress, underscoring its long-term value proposition. These updates often detail tangible achievements in green building features and the implementation of responsible operational practices. For instance, in 2024, EastGroup continued to focus on energy efficiency in its industrial portfolio, aiming to reduce its carbon footprint across its properties.

- ESG Communication: EastGroup leverages its ESG commitments to attract socially responsible investors and tenants.

- Green Building Initiatives: The company showcases its efforts in developing and managing properties with sustainable features.

- Operational Responsibility: Updates highlight practices aimed at minimizing environmental impact and promoting efficient resource use.

- Long-Term Value: Sustainability reporting demonstrates a commitment to value creation that extends beyond traditional financial metrics.

EastGroup Properties' promotional efforts center on transparent communication and highlighting operational strengths, particularly its modern industrial portfolio in Sunbelt states. They effectively convey growth drivers like population shifts and e-commerce expansion, backed by strong financial metrics.

The company's investor relations program is robust, utilizing press releases, earnings calls, and webcasts to share key performance indicators such as Funds From Operations (FFO) and occupancy rates. For instance, Q1 2024 saw an FFO per diluted share of $2.00, a 10.5% year-over-year increase.

Participation in industry conferences like Nareit REITweek allows EastGroup to showcase its market leadership and financial performance, reinforcing its reputation. In Q1 2024, their portfolio maintained an impressive 97.5% occupancy rate, with same-store net operating income for industrial properties growing 8.2% year-over-year.

EastGroup also emphasizes its commitment to ESG initiatives, attracting socially conscious investors and tenants by detailing green building features and responsible operational practices. Their digital presence, including a corporate website and social media, ensures stakeholders have accessible, up-to-date information on their progress and portfolio.

| Metric | Q1 2024 | Year-over-Year Change |

|---|---|---|

| FFO per Diluted Share | $2.00 | +10.5% |

| Portfolio Occupancy Rate | 97.5% | N/A (Snapshot) |

| Same-Store NOI Growth (Industrial) | 8.2% | N/A (Growth Rate) |

Price

EastGroup Properties demonstrates considerable pricing power, evident in its consistent achievement of substantial rental rate increases for both new and renewed leases. This strength is a testament to the high demand for their well-located, quality industrial properties in key markets.

The company's performance in Q2 2025 highlights this trend, with rental rates on new and renewal leases seeing an impressive average increase of 44.4% on a straight-line basis. Such robust growth underscores the desirability and value proposition of EastGroup's industrial portfolio.

EastGroup Properties demonstrates strong value through its high occupancy rates, a key component of its marketing mix. As of June 30, 2025, the company's operating portfolio boasts an impressive 97.1% leased and 96.0% occupied status. This consistent demand underscores the inherent value customers perceive in their strategically located industrial properties.

EastGroup Properties' dedication to consistent dividend increases is a cornerstone of its shareholder value proposition. The company boasts an impressive 32-year streak of maintaining or growing its dividend, with a notable 13 consecutive years of actual increases. This sustained commitment highlights financial strength and a reliable income stream for investors.

As of Q2 2025, the annualized dividend rate stands at $5.60 per share. This figure not only reflects the company's ability to generate consistent earnings but also offers an attractive yield, making EastGroup an appealing option for income-focused investors seeking dependable returns.

Disciplined Capital Allocation and Financial Strength

EastGroup Properties' pricing strategy is built on a foundation of exceptional financial strength. Their commitment to disciplined capital allocation is evident in a remarkably low debt-to-total market capitalization of just 14.2% as of June 30, 2025. This conservative leverage, coupled with robust interest coverage ratios, provides significant flexibility.

This financial prudence directly supports their ability to pursue value-enhancing acquisitions and developments. By maintaining a strong balance sheet, EastGroup can invest strategically without taking on excessive risk, ultimately enabling competitive and sustainable pricing for their industrial properties.

- Low Leverage: Debt-to-total market capitalization stood at 14.2% on June 30, 2025.

- Financial Flexibility: Strong interest coverage ratios bolster their capacity for strategic investments.

- Accretive Growth: The balance sheet supports the pursuit of value-adding acquisitions and developments.

- Sustainable Pricing: Financial health underpins competitive and stable pricing models.

Funds From Operations (FFO) Growth

EastGroup Properties demonstrates robust Funds From Operations (FFO) growth, a critical metric for real estate investment trusts. For instance, the company reported a 7.8% increase in FFO per diluted share in the second quarter of 2025. This consistent expansion in FFO underscores EastGroup's strong operational performance and its capacity to generate substantial cash flow from its portfolio.

This healthy FFO growth directly supports EastGroup's ability to sustain and potentially increase its dividend payments to shareholders. Furthermore, it bolsters the underlying value of the company's real estate assets, positively influencing investor sentiment and contributing to the stock's valuation. The trend suggests a reliable income stream and a solid foundation for future capital appreciation.

- Consistent FFO Growth: EastGroup achieved a 7.8% year-over-year increase in FFO per diluted share in Q2 2025.

- Profitability Indicator: Strong FFO growth signals effective property management and operational efficiency.

- Dividend Support: The increasing FFO provides a solid base for maintaining and growing dividend payouts.

- Intrinsic Value Driver: Enhanced FFO contributes to a higher perceived intrinsic value of the company's real estate assets.

EastGroup Properties' pricing strategy is deeply intertwined with its ability to command premium rental rates, a direct result of its high-quality, well-located industrial properties. The company's success in achieving substantial rental increases on both new and renewed leases, as seen with a 44.4% average increase on a straight-line basis in Q2 2025, highlights its pricing power. This strength is further validated by consistently high occupancy rates, with the operating portfolio at 97.1% leased and 96.0% occupied as of June 30, 2025, indicating strong market demand and customer willingness to pay for EastGroup's offerings.

| Metric | Value (as of Q2 2025) | Significance |

|---|---|---|

| Average Rental Rate Increase (New/Renewal Leases) | 44.4% (Straight-line basis) | Demonstrates strong pricing power and demand for properties. |

| Occupancy Rate (Operating Portfolio) | 96.0% | Indicates high demand and customer satisfaction, supporting premium pricing. |

| Leased Rate (Operating Portfolio) | 97.1% | Shows strong future revenue visibility and sustained demand. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for EastGroup Properties is grounded in a comprehensive review of publicly available information. This includes SEC filings, investor relations materials, company press releases, and detailed property portfolio data. We also incorporate insights from industry reports and competitive analysis to provide a well-rounded view of their marketing strategies.