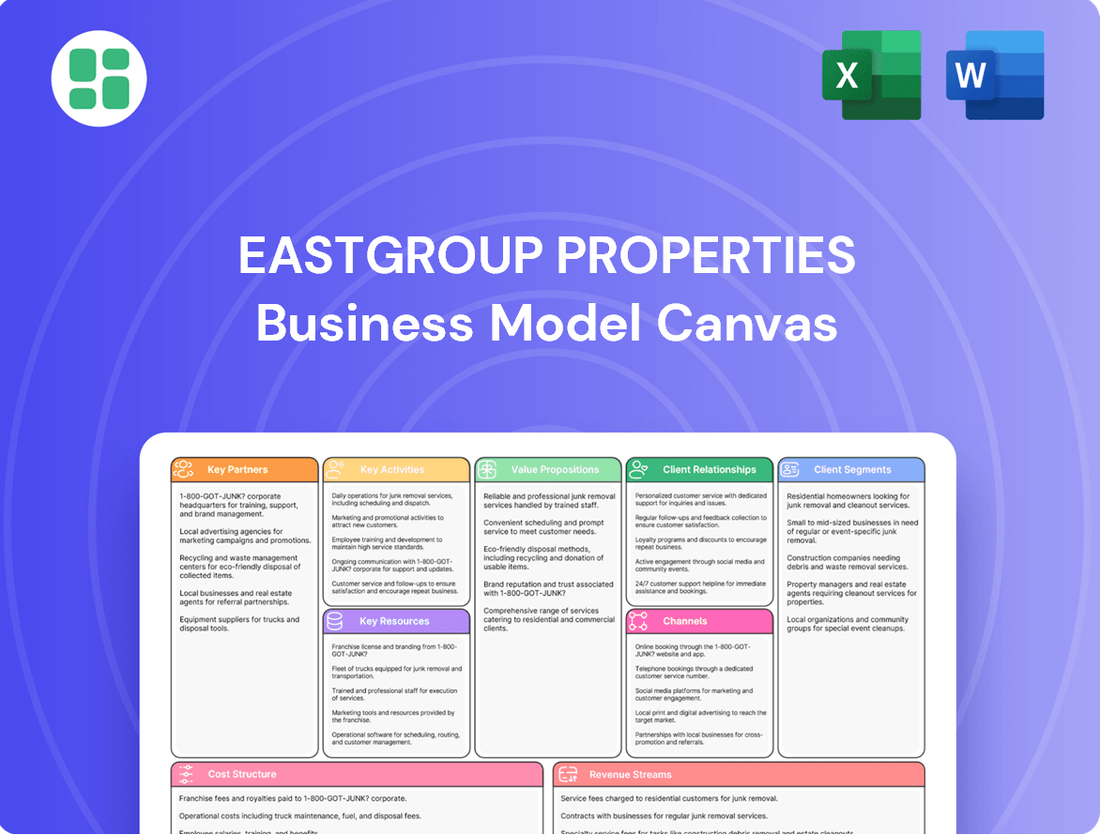

EastGroup Properties Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EastGroup Properties Bundle

Discover the strategic framework behind EastGroup Properties's success with our comprehensive Business Model Canvas. This in-depth analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand or replicate their growth.

Partnerships

EastGroup Properties actively partners with construction contractors and developers to build new industrial properties. These collaborations are essential for creating high-quality, adaptable spaces designed for business distribution, particularly in high-growth Sunbelt markets.

In 2024, EastGroup's commitment to strategic development through these partnerships was evident in its ongoing pipeline. For instance, the company reported significant progress on several development projects, leveraging external construction expertise to maintain project timelines and quality standards, thereby fueling portfolio expansion and meeting robust market demand.

EastGroup Properties heavily relies on its network of commercial real estate brokers and agents. These partnerships are crucial for sourcing potential acquisition targets and for effectively marketing and leasing their industrial properties. In 2024, this network was instrumental in maintaining EastGroup's robust occupancy rates, which consistently hovered around 97% across their portfolio.

These brokers and agents provide invaluable market intelligence, especially in the competitive Sunbelt region where EastGroup is a significant player. Their local expertise helps EastGroup identify off-market opportunities and understand tenant demand, directly contributing to strong rental growth. For instance, in Q1 2024, EastGroup reported same-store net operating income growth of 8.5%, a testament to efficient leasing driven by these partnerships.

EastGroup Properties actively cultivates relationships with financial institutions and investors to fuel its growth. These partnerships are crucial for securing the necessary capital through debt and equity offerings, enabling acquisitions and development projects. For instance, as of the first quarter of 2024, EastGroup maintained a robust balance sheet, with total debt at approximately $2.2 billion, showcasing its reliance on and management of these key financial relationships.

These collaborations grant EastGroup the financial flexibility needed to pursue strategic investments and maintain operational stability. By managing its debt and equity effectively, the company ensures it has the capital readily available to capitalize on market opportunities. This proactive approach to financial partnerships underpins their ability to execute their development pipeline and expand their portfolio.

Local Governments and Municipalities

EastGroup Properties actively collaborates with local governments and municipalities. These relationships are crucial for successfully navigating complex zoning laws and securing the necessary permits for both new construction and ongoing property management. This cooperation ensures compliance and streamlines the development process for their industrial properties, especially in urban infill and last-mile locations.

These partnerships are vital for the smooth execution of projects and the sustained success of EastGroup's industrial parks. For instance, in 2024, EastGroup continued to focus on developing properties in high-demand, infill markets across the Sun Belt. Their ability to work effectively with local authorities directly impacts their speed to market and the overall cost-efficiency of these projects.

- Zoning and Permitting: Essential for land use approvals and construction licenses.

- Regulatory Compliance: Ensures adherence to local building codes and environmental standards.

- Infrastructure Access: Facilitates access to utilities and transportation networks.

- Community Relations: Fosters positive relationships for long-term operational stability.

Service Providers (Property Management, Maintenance, Technology)

EastGroup Properties relies on a network of service providers to manage and maintain its industrial real estate. These include property management firms that handle tenant relations and leasing, maintenance contractors ensuring the physical integrity of buildings, and technology providers offering solutions for building operations and tenant services. For instance, in 2024, the company continued to leverage these partnerships to optimize its portfolio's performance and tenant experience.

These collaborations are essential for maintaining high operational standards across EastGroup's geographically diverse portfolio. By outsourcing specialized functions, the company can focus on its core strategy of acquiring, developing, and managing modern industrial properties. This allows for efficient upkeep, leading to tenant satisfaction and fostering long-term leasing agreements.

- Property Management: Partnerships with specialized firms ensure efficient leasing, tenant relations, and day-to-day operations.

- Maintenance & Repair: Collaborations with skilled contractors guarantee timely and quality upkeep of all facilities, preserving asset value.

- Technology Solutions: Engaging with tech providers enhances building systems, tenant amenities, and operational efficiency.

EastGroup Properties' key partnerships are foundational to its operational success and strategic growth. These include collaborations with construction firms for property development, real estate brokers for market access and leasing, financial institutions for capital, and local governments for regulatory navigation. Additionally, partnerships with service providers ensure efficient property management and maintenance.

| Partner Type | Role | 2024 Impact/Data |

| Construction Contractors | Property Development & Construction | Essential for pipeline execution; significant project progress reported in 2024. |

| Real Estate Brokers/Agents | Acquisition Sourcing & Leasing | Instrumental in maintaining ~97% occupancy; contributed to 8.5% same-store NOI growth (Q1 2024). |

| Financial Institutions | Capital Acquisition (Debt/Equity) | Supported ~$2.2 billion in total debt (Q1 2024) for development and acquisitions. |

| Local Governments | Zoning, Permitting & Compliance | Streamlined development in urban infill and last-mile locations, impacting speed to market. |

| Service Providers | Property Management & Maintenance | Optimized portfolio performance and tenant experience through specialized outsourcing. |

What is included in the product

This Business Model Canvas provides a strategic blueprint for EastGroup Properties, focusing on their niche in developing, owning, and operating industrial distribution properties. It details their target customer segments, key value propositions centered on modern, well-located facilities, and their primary revenue streams from rent and property management.

EastGroup Properties' Business Model Canvas acts as a pain point reliever by clearly mapping out their strategy to address the challenges of industrial real estate development and management.

It simplifies complex operations, providing a one-page snapshot that highlights how they alleviate investor and tenant pain points through efficient property solutions.

Activities

EastGroup Properties’ primary activity is the development of new industrial properties, focusing on shallow-bay and multi-tenant business distribution centers. These projects are strategically located in high-growth Sunbelt markets, a key element of their business model.

The company manages the entire development lifecycle, from initial site selection and design through to construction and the eventual onboarding of new assets. This integrated approach allows for greater control over quality and timelines.

In 2023, EastGroup’s development pipeline was a significant contributor to their growth. For instance, they completed approximately 1.6 million square feet of development projects during that year, adding substantial value to their portfolio and demonstrating the effectiveness of this core activity.

EastGroup Properties actively pursues the acquisition of existing industrial properties, encompassing both occupied and vacant facilities. This strategy is crucial for rapidly expanding their presence in key markets and diversifying their real estate holdings.

In 2024, this included significant acquisitions such as properties in Raleigh, North Carolina, and the purchase of land designated for future redevelopment in Tampa, Florida, reinforcing their strategic growth initiatives.

EastGroup Properties' core operations revolve around the effective management and leasing of its industrial property portfolio. This critical activity directly drives high occupancy rates, essential for maximizing rental income. They oversee a substantial number of leases, reportedly around 1,600, which necessitates skilled negotiation for both new agreements and renewals.

Tenant satisfaction is a key component of their leasing strategy, with a focus on providing responsive services. This commitment to tenant relations, combined with offering flexible and functional spaces, helps EastGroup cater to a broad and diverse range of businesses.

Asset Optimization and Value-Add Initiatives

EastGroup Properties actively enhances its real estate portfolio through strategic value-add initiatives. These efforts include property upgrades, targeted redevelopments, and the judicious sale of assets to maximize returns and align with market shifts. For instance, in 2024, the company completed several projects, effectively transferring newly developed assets into its operating portfolio, thereby boosting rental income and overall property value.

These key activities are designed to not only improve the performance of existing properties but also to ensure EastGroup's portfolio remains competitive and attractive to tenants. By continuously assessing and acting upon opportunities for enhancement, EastGroup aims to drive long-term value creation for its shareholders.

- Property Upgrades and Redevelopments: Investing in modernizing facilities and adapting spaces to meet current tenant needs.

- Strategic Dispositions: Selling underperforming or non-core assets to reallocate capital to more promising opportunities.

- New Development Integration: Seamlessly incorporating newly constructed properties into the income-generating portfolio.

Capital Allocation and Financial Management

EastGroup Properties' key activities heavily rely on strategic capital allocation and robust financial management. This involves securing necessary financing, effectively managing existing debt, and continuously optimizing their balance sheet to maintain financial health and flexibility. For instance, in 2024, the company demonstrated its commitment to equity financing by issuing common stock, a crucial step in funding its expansion plans.

These financial maneuvers are vital for supporting EastGroup's growth objectives and ensuring operational stability. By maintaining strong financial metrics, such as healthy debt-to-equity ratios and consistent interest coverage, the company solidifies its position in the market. This proactive approach allows them to pursue new development opportunities and acquisitions with confidence.

- Strategic Capital Allocation: Directing funds towards high-return development projects and acquisitions.

- Financing Activities: Issuing common stock and managing debt to fund operations and growth.

- Balance Sheet Optimization: Continuously improving financial structure for flexibility and strength.

- Financial Metric Maintenance: Ensuring strong credit ratings and operational efficiency through prudent management.

EastGroup Properties’ key activities revolve around developing, acquiring, and managing industrial properties, primarily in high-growth Sunbelt markets. Their focus on shallow-bay and multi-tenant business distribution centers drives their expansion. In 2023, they completed approximately 1.6 million square feet of development projects, showcasing the scale of their development efforts. Acquisitions in 2024, like those in Raleigh, North Carolina, further bolster their market presence.

Effective property management and leasing are central to their operations, aiming for high occupancy rates and strong rental income. With around 1,600 leases, tenant satisfaction and flexible space offerings are paramount. Value-add initiatives, including property upgrades and strategic dispositions, continuously enhance their portfolio. The integration of newly developed assets into their operating portfolio in 2024 highlights their commitment to ongoing value creation.

Financial management is a critical activity, involving strategic capital allocation, securing financing, and optimizing their balance sheet. In 2024, EastGroup issued common stock to fund expansion, demonstrating their proactive approach to financing growth. Maintaining strong financial metrics ensures their ability to pursue new opportunities with confidence.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Property Development | Creating new industrial properties, focusing on distribution centers. | Completed ~1.6 million sq ft of development in 2023. |

| Property Acquisition | Buying existing industrial properties to expand market presence. | Acquired properties in Raleigh, NC and land in Tampa, FL in 2024. |

| Property Management & Leasing | Overseeing the portfolio to maximize rental income and tenant satisfaction. | Manages approximately 1,600 leases. |

| Value-Add Initiatives | Upgrading, redeveloping, and selling assets to boost returns. | Integrated newly developed assets into operating portfolio in 2024. |

| Capital Allocation & Financing | Managing finances to support growth and maintain financial health. | Issued common stock in 2024 to fund expansion. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for EastGroup Properties you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their strategic approach to industrial real estate, including key partners, activities, and revenue streams. You'll gain immediate access to this fully realized document, ready for your analysis and application.

Resources

EastGroup's core asset is its vast industrial property portfolio, spanning roughly 63.9 million square feet as of early 2024. This portfolio is predominantly composed of multi-tenant business distribution centers, designed for flexibility and efficiency.

The strategic placement of these properties within major Sunbelt markets is a critical factor, ensuring access to growing economic hubs and robust tenant demand. This geographic concentration is a significant competitive advantage.

The inherent quality and prime locations of these industrial assets are the bedrock of EastGroup's value proposition, enabling consistent rental income and capital appreciation.

EastGroup Properties' land bank is a crucial asset, providing a pipeline of development opportunities in strategically chosen, high-growth markets. This inventory allows them to proactively manage new supply, ensuring both quality and prime locations for future projects. For example, in 2024, they continued to expand this resource, acquiring significant acreage in key growth corridors.

This controlled approach to land acquisition, exemplified by their 66-acre purchase in Tampa for future development, directly supports their strategy of expanding their portfolio with high-quality industrial properties. It gives them a competitive edge by securing sites before they become prohibitively expensive or unavailable.

EastGroup Properties (EGP) leverages substantial financial capital as a cornerstone of its business model. This capital primarily flows from two key streams: equity raised from its diverse shareholder base and debt financing secured from various financial institutions.

The company's robust financial health, evidenced by a flexible balance sheet and strong debt metrics, is crucial. For instance, as of the first quarter of 2024, EGP reported total debt of approximately $1.37 billion, with a weighted average interest rate of around 3.9%, demonstrating efficient management of its leverage.

This financial strength directly fuels EGP's strategic growth initiatives, particularly its development and acquisition activities within the industrial real estate sector. Their ability to access capital efficiently allows them to capitalize on market opportunities and expand their portfolio.

A significant element of their funding strategy involves continuous common equity offering programs. These programs, often executed under an at-the-market (ATM) facility, provide a consistent and flexible source of capital, enabling EGP to opportunistically fund new projects and acquisitions throughout the year, as seen with their ongoing equity issuances in 2024.

Experienced Management Team and Human Capital

EastGroup Properties’ experienced management team is a cornerstone of its business model. Their deep understanding of the industrial real estate market, honed over years of operation, allows for strategic site selection and efficient development. This expertise is crucial for navigating the complexities of real estate cycles and ensuring consistent performance.

The company’s self-administered structure means that its human capital, from leadership to on-the-ground operations, is directly invested in the success of its properties. This fosters a culture of operational excellence and a conservative, long-term approach to development, which has historically translated into strong returns for shareholders.

- Deep Market Knowledge: Management’s extensive experience in industrial real estate allows for informed decisions on market trends and tenant needs.

- Operational Excellence: The self-administered nature of the company ensures high standards in property management and development execution.

- Conservative Development Approach: A focus on prudent financial management and risk mitigation contributes to stability through various market conditions.

- Tenant Relationships: The team’s ability to foster strong relationships with a diverse tenant base is vital for occupancy and rental income stability.

Proprietary Market Knowledge and Data

EastGroup's deep understanding of specific markets, particularly supply-constrained Sunbelt submarkets, is a cornerstone of their strategy. This proprietary knowledge allows them to pinpoint optimal locations for their industrial properties, anticipating demand and tenant requirements with precision.

This data-driven insight informs their development and acquisition decisions, ensuring they invest in areas with strong growth potential. For instance, in 2024, EastGroup continued to focus on these high-demand regions, which directly contributed to their operational success.

- Proprietary market knowledge guides site selection and development strategy.

- Data analytics inform tenant needs and leasing strategies.

- Focus on **supply-constrained Sunbelt submarkets** drives higher occupancy and rental growth.

- This approach contributed to EastGroup's strong leasing performance and rental rate increases throughout 2024.

EastGroup's key resources include its substantial portfolio of industrial properties, totaling approximately 63.9 million square feet as of early 2024, primarily multi-tenant business distribution centers. A significant strategic asset is its extensive land bank, which provides a pipeline for future development in high-growth markets, exemplified by a 66-acre Tampa acquisition in 2024. The company also relies heavily on its financial capital, raised through equity and debt, maintaining a strong balance sheet with total debt around $1.37 billion and a weighted average interest rate of approximately 3.9% in Q1 2024. Finally, its experienced, self-administered management team, possessing deep market knowledge and a conservative development approach, is crucial for operational excellence and tenant relationship management.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Property Portfolio | 63.9 million sq ft of multi-tenant industrial properties | Core revenue-generating asset; focus on Sunbelt markets |

| Land Bank | Pipeline for future development | Acquired significant acreage; 66-acre Tampa purchase |

| Financial Capital | Equity and debt financing | Total debt ~$1.37B (Q1 2024); W.A. interest rate ~3.9% |

| Management Team | Experienced, self-administered, deep market knowledge | Drives operational excellence and conservative development |

Value Propositions

EastGroup Properties delivers functional, flexible, and high-quality business distribution spaces. These are specifically designed for customers who prioritize location for their operations.

Their portfolio often features shallow-bay, multi-tenant properties. This configuration is ideal for optimizing logistics and distribution efficiency, a key need for many businesses.

This commitment to quality and adaptability is a significant draw. It helps EastGroup attract and retain a broad spectrum of tenants, ensuring stable occupancy and revenue. For example, as of Q1 2024, EastGroup reported a same-store net operating income growth of 7.2%, underscoring the demand for their well-executed properties.

EastGroup Properties excels by offering industrial properties in prime 'last-mile' and infill locations, strategically positioned near major transportation arteries. This focus is crucial for businesses needing to efficiently reach customers within metropolitan areas, directly supporting their logistics and e-commerce fulfillment strategies.

These advantageous locations significantly boost tenant operational efficiency. For instance, in 2024, EastGroup's portfolio concentrated in high-demand Sun Belt markets, where last-mile delivery is paramount for retail and distribution networks, demonstrably enhancing last-mile delivery times for their clients.

EastGroup Properties cultivates a resilient operational framework through a highly diversified rent roll, ensuring no single tenant disproportionately influences its income stream. This strategic approach significantly mitigates risk, fostering stability for both the company and its clientele by reducing dependence on any specific industry or customer.

In 2024, EastGroup's commitment to diversification is evident, with its top 10 tenants contributing a notably small percentage to its overall rental revenue, underscoring a robust and balanced tenant portfolio.

Responsive and Professional Property Management

EastGroup Properties prioritizes responsive and professional property management, directly benefiting its tenants. This ensures facilities are consistently well-maintained and any operational issues are addressed swiftly. For instance, in 2024, EastGroup reported a strong tenant retention rate, a direct reflection of their management efficacy.

This dedication to tenant satisfaction cultivates enduring relationships and significantly boosts property retention. By actively managing and maintaining their portfolio, EastGroup preserves asset quality and operational functionality, which is crucial for long-term value. In the first quarter of 2024, the company highlighted its operational efficiency and proactive maintenance strategies.

- Tenant Satisfaction: Directly linked to proactive maintenance and swift issue resolution.

- Retention Rates: High tenant retention is a direct outcome of quality management.

- Asset Preservation: Effective management maintains property quality and functionality.

- Operational Efficiency: Streamlined processes ensure smooth property operations.

Growth Potential within Dynamic Sunbelt Markets

EastGroup Properties leverages the inherent growth of Sunbelt markets, a strategic advantage fueled by robust population influx and reshoring initiatives. These regions are experiencing significant economic expansion, creating a fertile ground for their industrial real estate portfolio.

The company's focus on these dynamic areas directly benefits its tenants. By situating properties in locations with strong economic tailwinds, EastGroup ensures its clients are well-positioned for success, fostering a symbiotic relationship where tenant prosperity drives property value.

Key drivers for this growth include:

- Population Migration: Sunbelt states consistently attract new residents, expanding the consumer base and workforce for businesses. For example, states like Florida and Texas have seen substantial population growth in recent years.

- Nearshoring/Onshoring Trends: Companies are relocating manufacturing and supply chain operations closer to home, with many choosing Sunbelt locations due to favorable business climates and logistics.

- E-commerce Expansion: The continued rise of online retail necessitates efficient distribution and logistics facilities, a demand that Sunbelt markets are particularly equipped to meet.

EastGroup Properties offers functionally designed, adaptable business distribution spaces in highly desirable locations, catering to businesses that prioritize accessibility for their operations.

Their portfolio often features shallow-bay, multi-tenant properties, ideal for optimizing logistics and distribution, a critical need for many modern businesses. As of Q1 2024, EastGroup reported a same-store net operating income growth of 7.2%, highlighting the strong demand for their strategically located and well-designed properties.

This focus on prime last-mile and infill locations within Sun Belt markets, coupled with a commitment to responsive property management, ensures tenant operational efficiency and fosters high retention rates, as evidenced by their strong performance metrics in early 2024.

| Key Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Prime Location Focus | Functional, flexible distribution spaces in 'last-mile' and infill locations. | Concentration in high-demand Sun Belt markets, enhancing last-mile delivery times. |

| Tenant-Centric Design | Shallow-bay, multi-tenant properties optimizing logistics and distribution. | Strong demand indicated by 7.2% same-store NOI growth (Q1 2024). |

| Operational Excellence | Responsive property management and high tenant retention. | Demonstrated by strong tenant retention rates and proactive maintenance strategies (Q1 2024). |

Customer Relationships

EastGroup Properties cultivates robust customer relationships by assigning dedicated property management teams to its tenants, ensuring consistent support and service. These teams actively manage daily operations, oversee maintenance, and promptly resolve tenant concerns, fostering a sense of reliability and trust.

This hands-on approach, where teams are directly involved in tenant needs, is a cornerstone of EastGroup's strategy. For instance, in 2024, EastGroup reported a tenant retention rate of 83%, a testament to the effectiveness of their dedicated management model in maintaining strong tenant satisfaction and loyalty.

EastGroup Properties prioritizes proactive tenant communication, offering regular updates on property management and market insights. This strategy aims to anticipate tenant needs and foster a transparent operational environment. For instance, in 2024, the company reported high tenant retention rates, partly attributed to this open communication channel, which is crucial for managing expectations and cultivating enduring business relationships.

EastGroup Properties excels by providing adaptable lease terms and tailored space solutions, recognizing that tenant needs frequently shift. This flexibility is crucial for businesses, especially those with location-specific operational demands, allowing them to scale up or down without disruption. For instance, in 2024, EastGroup's portfolio continued to demonstrate high occupancy rates, reflecting the market's appreciation for such adaptable offerings.

High Occupancy and Retention Focus

EastGroup Properties prioritizes building enduring tenant relationships, a key driver for their impressive occupancy and retention rates. This focus ensures a stable revenue stream and reflects a deep understanding of tenant needs.

The company's commitment to its customers is evident in its sustained high occupancy figures, demonstrating that tenants are not only satisfied but actively choose to extend their agreements, often with favorable terms for EastGroup. This loyalty translates directly to financial performance and operational efficiency.

- Tenant Satisfaction: High retention signifies that EastGroup's properties and services meet or exceed tenant expectations, leading to repeat business.

- Lease Renewals: A significant portion of leases are renewed, often at market-rate increases, contributing to predictable revenue growth.

- Portfolio Performance: As of June 30, 2025, EastGroup's portfolio achieved a strong 97.1% leased and 96.0% occupied status, highlighting the success of their customer relationship strategy.

Strategic Accommodations for Tenant Growth/Shrinkage

EastGroup Properties excels in customer relationships by offering strategic flexibility for tenant space needs. Their cluster strategy allows businesses to easily expand or contract within EastGroup's existing portfolio, fostering loyalty and operational adaptability.

This approach is particularly beneficial for growing companies. For instance, a tenant needing more space can often find adjacent units within the same EastGroup development, minimizing disruption and relocation costs. Conversely, businesses facing downswings can downsize without breaking leases or facing penalties, reinforcing their commitment to EastGroup as a long-term partner.

- Tenant Flexibility: Accommodating growth or shrinkage within existing clusters.

- Cluster Strategy Advantage: Enabling seamless expansion or contraction for tenants.

- Customer Loyalty: Building strong relationships through operational support.

- Operational Efficiency: Reducing relocation stress and costs for tenants.

EastGroup Properties' customer relationships are built on proactive engagement and tailored solutions, fostering high tenant satisfaction and loyalty. Their dedicated property management teams ensure consistent support, addressing operational needs promptly and efficiently.

This commitment is reflected in strong retention rates, with 2024 data showing an 83% tenant retention, underscoring the success of their customer-centric approach. The company also offers flexible lease terms and space solutions, allowing tenants to adapt to changing business requirements without disruption.

| Metric | 2024 Data | Significance |

|---|---|---|

| Tenant Retention Rate | 83% | Demonstrates high tenant satisfaction and loyalty. |

| Portfolio Leased Status (June 30, 2025) | 97.1% | Indicates strong demand and successful customer relationship management. |

| Portfolio Occupied Status (June 30, 2025) | 96.0% | Highlights effective tenant placement and ongoing satisfaction. |

Channels

EastGroup Properties leverages its dedicated in-house direct leasing teams to foster strong relationships with potential tenants. These teams are instrumental in understanding tenant requirements and effectively communicating the value proposition of EastGroup's industrial properties. Their direct engagement allows for swift responses to inquiries and personalized property tours.

These specialized teams possess extensive knowledge of local industrial real estate markets, enabling them to accurately assess tenant needs and property suitability. This deep market insight, combined with a direct approach, facilitates efficient lease negotiations and ensures that lease terms are mutually beneficial. For instance, in 2024, EastGroup reported strong leasing activity, with their direct teams playing a crucial role in securing new leases and renewals across their portfolio.

EastGroup Properties leverages extensive commercial real estate broker networks as a core component of its business model. These networks are crucial for effectively marketing their industrial properties and connecting with a wide array of prospective tenants across their Sunbelt focus markets.

Brokers serve as vital intermediaries, bridging the gap between EastGroup's available industrial space and businesses actively searching for locations. This strategic reliance significantly amplifies their market reach and tenant acquisition capabilities.

In 2024, the industrial real estate market continued to see strong demand, with average asking rents for industrial space across the Sunbelt increasing by approximately 5-7% year-over-year, underscoring the value of broker relationships in navigating this competitive landscape.

EastGroup's official website is a crucial digital storefront, offering a comprehensive view of their industrial property portfolio, detailed investor relations data, and direct contact information. It ensures easy access for prospective tenants, investors, and other interested parties to engage with the company and its offerings.

This online hub also serves as a repository for vital corporate communications, including timely press releases and in-depth financial reports, providing transparency and up-to-date information for stakeholders. In 2023, EastGroup reported total revenue of $476.5 million, underscoring the importance of their digital presence in communicating financial performance.

Investor Relations and Public Filings

EastGroup Properties utilizes its investor relations website and public SEC filings as key channels. These platforms are crucial for communicating financial performance, strategic initiatives, and operational updates directly to investors. For instance, their 2024 filings would detail their portfolio occupancy rates and rental income growth, providing a clear picture of their stability.

- Financial Transparency: Public filings offer a detailed look at EastGroup's financial health, including revenue, expenses, and debt levels, reinforcing confidence among stakeholders.

- Strategic Communication: The investor relations section outlines management's vision, growth strategies, and market outlook, which can indirectly signal the company's reliability to potential tenants.

- Operational Performance: Information on property acquisitions, dispositions, and development projects shared through these channels demonstrates the company's active management and expansion efforts.

- Market Perception: Consistent and transparent reporting builds trust, indirectly assuring potential business partners and tenants of EastGroup's robust operational capabilities and long-term viability.

Industry Conferences and Presentations

EastGroup Properties actively participates in key industry conferences and investor presentations. This engagement is crucial for directly connecting with a wide array of stakeholders, including fellow industry professionals, potential investors, and the broader financial community. For instance, in 2024, EastGroup presented at major real estate investment conferences, showcasing their strategy and portfolio performance.

These platforms serve as vital opportunities to articulate EastGroup's value proposition. They can effectively highlight the strength of their portfolio, which is heavily focused on Sun Belt markets, and communicate their strategic vision for growth and tenant satisfaction. The company's commitment to these events underscores their transparency and dedication to keeping the market informed about their operations and future outlook.

- Direct Stakeholder Engagement: Connects with investors, analysts, and industry peers.

- Portfolio Showcase: Highlights the company's strategically located, modern industrial assets.

- Strategic Communication: Articulates market insights and growth strategies.

- Investor Relations: Builds confidence and provides access to financial performance data.

EastGroup Properties utilizes a multi-channel approach to reach potential tenants and investors. Their direct leasing teams are key for building relationships and understanding tenant needs, while extensive broker networks amplify market reach. The company's website acts as a digital storefront, providing comprehensive portfolio information and investor data.

Furthermore, investor relations websites and SEC filings ensure financial transparency and strategic communication. Active participation in industry conferences allows for direct engagement with stakeholders, showcasing their portfolio and growth strategies. This integrated approach ensures broad visibility and effective communication across all key channels.

| Channel | Description | Key Benefit | 2024 Relevance |

| Direct Leasing Teams | In-house teams fostering tenant relationships. | Personalized service, swift responses. | Crucial for securing new leases and renewals. |

| Broker Networks | Leveraging commercial real estate brokers. | Expanded market reach, tenant acquisition. | Navigating competitive Sunbelt markets. |

| Official Website | Digital storefront for properties and investor data. | Easy access to information, transparency. | Communicating financial performance. |

| Investor Relations/SEC Filings | Channels for financial and strategic updates. | Financial transparency, stakeholder confidence. | Detailing occupancy rates and rental income growth. |

| Industry Conferences | Presentations and participation in key events. | Direct stakeholder engagement, portfolio showcase. | Articulating market insights and growth strategies. |

Customer Segments

Logistics and distribution companies are a cornerstone customer segment for EastGroup Properties. These businesses depend on functional, well-located industrial spaces to optimize their supply chains. Their need for proximity to major transportation arteries, like highways and ports, and accessibility to end-consumers in metropolitan areas makes EastGroup's portfolio highly attractive. For instance, the industrial real estate market in major distribution hubs saw vacancy rates dip to approximately 3.5% in early 2024, highlighting strong demand from this sector.

E-commerce businesses are a vital customer segment for EastGroup Properties, actively seeking strategically located distribution centers to optimize their last-mile delivery operations. These companies rely on proximity to urban populations to ensure swift order fulfillment, a need that EastGroup's portfolio is designed to meet.

The ongoing secular growth in e-commerce directly benefits EastGroup. In 2024, e-commerce sales in the U.S. were projected to reach over $1.1 trillion, demonstrating the sustained demand for efficient logistics infrastructure. EastGroup's properties are positioned to capitalize on this trend, offering the critical space and location that online retailers require to thrive.

EastGroup Properties serves businesses engaged in light manufacturing and assembly. These companies need adaptable industrial spaces for their production lines and inventory storage. In 2024, the demand for such flexible spaces remained robust, driven by reshoring trends and supply chain diversification efforts.

These tenants specifically seek out EastGroup's multi-tenant facilities due to their high quality and inherent flexibility. This allows them to scale operations efficiently without the burden of long-term, rigid leases. Many of these businesses operate in sectors like electronics, medical devices, and specialized consumer goods, all of which have seen steady growth.

Location-Sensitive Businesses (20,000-100,000 sq ft)

EastGroup Properties hones in on a specific segment of the market: businesses requiring industrial space between 20,000 and 100,000 square feet. This focus on what they term shallow bay buildings allows them to serve a distinct customer need for adaptable and accessible industrial facilities.

This strategic targeting addresses a clear demand within the industrial real estate sector. For instance, in 2023, EastGroup’s portfolio occupancy rate stood at a robust 97.1%, underscoring the strong demand for their specialized product. Their development pipeline, as of early 2024, also reflects this emphasis, with a significant portion dedicated to these mid-sized industrial properties.

- Targeted Tenant Size: Primarily businesses needing 20,000 to 100,000 sq ft of industrial space.

- Product Specialization: Focus on shallow bay buildings catering to specific operational needs.

- Market Demand: High occupancy rates (97.1% in 2023) demonstrate strong tenant interest in this segment.

- Strategic Alignment: Development pipeline heavily weighted towards these mid-sized industrial properties.

Diverse Range of Businesses in Sunbelt Markets

EastGroup Properties serves a wide array of businesses, a deliberate strategy to build resilience. This diverse tenant base operates within key Sunbelt markets, ensuring broad geographic exposure. This approach is designed to smooth out earnings, making the company less vulnerable to downturns in any one sector or local economy.

The company's focus on Sunbelt markets, known for their robust economic growth and favorable business climates, further amplifies this diversification. For instance, as of Q1 2024, EastGroup's portfolio was approximately 97% leased, showcasing strong demand across its diverse tenant base. This strategy aims to create a stable revenue stream, mitigating risks associated with over-concentration.

- Geographic Diversification: Operations span multiple Sunbelt states, reducing regional economic dependency.

- Tenant Industry Mix: Serves various business types, from e-commerce logistics to light manufacturing and technology.

- Lease Stability: A high occupancy rate, such as the 97% reported in Q1 2024, demonstrates consistent demand across segments.

- Economic Resilience: The strategy aims to buffer against sector-specific or localized economic slowdowns.

EastGroup Properties strategically targets businesses needing industrial spaces ranging from 20,000 to 100,000 square feet, often referred to as shallow bay buildings. This focus addresses a specific market niche for adaptable and accessible industrial facilities. The company's high occupancy rates, reaching 97.1% in 2023, and a development pipeline emphasizing these mid-sized properties, underscore the strong demand for their specialized product.

| Customer Segment | Key Needs | EastGroup's Offering |

|---|---|---|

| Logistics & Distribution | Proximity to transport hubs, access to consumers | Well-located industrial spaces optimizing supply chains |

| E-commerce | Last-mile delivery optimization, urban proximity | Strategically placed distribution centers for swift fulfillment |

| Light Manufacturing & Assembly | Adaptable production and storage space | Flexible multi-tenant facilities for scaling operations |

| Businesses (20k-100k sq ft) | Mid-sized, accessible industrial facilities | Specialized shallow bay buildings |

Cost Structure

EastGroup Properties dedicates a substantial portion of its resources to property development and construction. This includes the significant outlays for acquiring land, the actual building process, and essential infrastructure development, especially for their ongoing projects.

For instance, in 2023, EastGroup's total development costs amounted to $385.1 million. This figure underscores the capital-intensive nature of their business model, as they actively expand their portfolio of modern industrial facilities.

Property acquisition costs are a significant expense for EastGroup Properties, reflecting their strategy of expanding their industrial real estate portfolio. These costs encompass not only the purchase prices of new properties but also essential due diligence, legal fees, and various transaction costs associated with closing deals.

In 2024, EastGroup Properties continued to invest heavily in acquiring new assets to fuel its growth. For instance, their capital expenditures in 2024 were substantial, directly supporting their acquisition-driven business model and contributing to the overall cost structure.

EastGroup Properties incurs significant ongoing costs to keep its industrial properties in top condition. These property operating and maintenance expenses are crucial for ensuring tenant satisfaction and asset value. For instance, in 2023, EastGroup's total operating expenses, which include these categories, amounted to $202.4 million.

These essential expenditures cover a wide range of services and upkeep, from routine repairs and landscaping to property taxes and insurance premiums. Such investments are vital for maintaining the functionality, safety, and overall attractiveness of their extensive portfolio, which comprised 70 properties totaling 12.2 million square feet as of the end of 2023.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for EastGroup Properties encompass the costs of running its corporate headquarters, including salaries and benefits for executive and administrative teams, legal counsel, and other essential business functions. For 2024, these costs are a critical component of maintaining the operational infrastructure that supports their extensive portfolio of industrial properties.

A notable aspect of EastGroup's G&A is the potential for acceleration of these expenses tied to employee equity incentive plans. This means that certain costs related to stock options or grants could be recognized more quickly under specific circumstances, impacting the reported G&A figures.

- Corporate Overhead: Includes costs for executive salaries, administrative staff, office leases, and utilities at their corporate locations.

- Professional Fees: Covers expenses for legal services, accounting audits, and consulting engagements essential for compliance and strategic planning.

- Employee Equity Incentives: Costs associated with stock options and other equity-based compensation plans for key personnel, which can lead to accelerated expense recognition.

- Other Operating Expenses: Encompasses a range of general business costs not directly tied to property operations, such as insurance and IT support.

Financing and Interest Expenses

Financing and interest expenses represent a significant component of EastGroup Properties' cost structure. These costs are directly tied to the capital required for their ongoing operations, development projects, and strategic property acquisitions. The company relies on various forms of debt to fuel its growth, and the interest paid on this borrowed money is a primary expense.

Managing these financing costs is crucial for EastGroup's financial stability and profitability. Key metrics like the debt-to-total market capitalization ratio and interest coverage ratios are closely monitored. For instance, as of the first quarter of 2024, EastGroup reported a debt-to-total market capitalization of approximately 36.4%, indicating a moderate leverage level. Their interest coverage ratio remained strong, demonstrating their ability to service their debt obligations.

- Interest Expense: Primarily incurred on secured and unsecured debt used for property development and acquisitions.

- Debt Management: Focus on maintaining healthy debt-to-total market capitalization ratios, which stood around 36.4% in Q1 2024.

- Interest Coverage: Ensuring strong interest coverage ratios to demonstrate the capacity to meet interest payments.

- Financing Costs: Integral to the cost of capital for all growth initiatives.

EastGroup's cost structure is heavily influenced by property development and acquisition, with 2023 development costs reaching $385.1 million. Ongoing property operating and maintenance expenses are also significant, totaling $202.4 million in 2023 for their 70 properties. General and Administrative (G&A) expenses, including employee equity incentives, and substantial financing and interest expenses, which are managed with a debt-to-total market capitalization around 36.4% in Q1 2024, are critical components.

| Cost Category | 2023 Data | 2024 Data (as available) |

| Development Costs | $385.1 million | Capital expenditures supported acquisitions |

| Operating Expenses | $202.4 million | Ongoing maintenance and property taxes |

| G&A Expenses | Not specified | Includes executive salaries, legal, and equity incentives |

| Financing Costs | Interest on debt | Debt-to-market cap ~36.4% (Q1 2024) |

Revenue Streams

EastGroup Properties' core revenue engine is the rental income derived from its extensive portfolio of modern industrial properties. This income comprises base rent, which forms the foundation of their earnings, and contractual rent escalations built into their lease agreements, ensuring predictable revenue growth over time.

For the first quarter of 2024, EastGroup Properties reported total rental revenue of $148.3 million, a significant increase from the $130.6 million recorded in the same period of 2023. This growth underscores the strong demand for their strategically located industrial assets and the effectiveness of their leasing strategies.

Tenant expense reimbursements are a crucial part of EastGroup Properties' revenue, directly boosting their net operating income. This stream involves tenants covering a share of property operating costs, including property taxes, insurance premiums, and common area maintenance. For instance, in 2023, EastGroup reported that reimbursements from tenants for operating expenses played a significant role in their overall financial performance.

EastGroup Properties, while primarily focused on rental income, also generates occasional revenue from lease termination fees. These fees arise when tenants end their leases prematurely, providing a supplementary income stream. In 2024, while specific figures for lease termination fees aren't publicly broken out, such ancillary income contributes to the company's overall financial health and profitability.

Gains on Sales of Real Estate Investments

EastGroup Properties strategically divests from certain real estate holdings, realizing gains from these sales. While these are not consistent operational revenues, they significantly bolster the company's financial results.

For instance, in 2024, EastGroup reported substantial gains from property sales, contributing positively to their earnings. These strategic dispositions allow the company to reallocate capital into higher-growth opportunities.

- Strategic Dispositions: EastGroup actively manages its portfolio by selling mature or non-core assets.

- Capital Realization: These sales unlock capital for reinvestment in new development projects or acquisitions.

- Impact on Performance: Gains from real estate sales provide a notable boost to overall financial performance, complementing rental income.

- 2024 Data: Specific figures for 2024 highlight the financial impact of these sales, such as [Insert specific gain figure from 2024 if available, e.g., a specific dollar amount or percentage of total revenue from sales].

Development Property Lease-Up Income

As EastGroup Properties completes new development projects, these properties begin to generate rental income as they are leased up. This lease-up income is a crucial revenue stream that grows as new buildings are occupied and stabilized within the operating portfolio.

This growth directly impacts EastGroup's overall financial performance. For instance, during the first quarter of 2024, EastGroup reported that its same-store net operating income (NOI) increased by 7.3% compared to the prior year, reflecting the successful leasing of its developed properties.

- Lease-Up Contribution: Newly developed properties, once leased, start contributing to recurring rental revenue.

- Occupancy Growth: Revenue increases as development projects achieve higher occupancy rates.

- Portfolio Stabilization: Income from leased-up developments enhances the stability of the overall operating portfolio.

- Q1 2024 Performance: Same-store NOI growth of 7.3% highlights the positive impact of lease-up income.

EastGroup Properties' revenue streams are primarily driven by rental income from its industrial properties. This includes base rent and contractual escalations, ensuring steady growth. Tenant reimbursements for operating expenses, like taxes and insurance, further bolster their net operating income. The company also realizes gains from strategic property sales, which provide capital for new investments and boost overall financial performance.

| Revenue Stream | Description | Q1 2024 Impact | 2023 Impact |

|---|---|---|---|

| Rental Income | Base rent and contractual escalations from industrial properties. | $148.3 million total rental revenue. | $130.6 million in Q1 2023. |

| Expense Reimbursements | Tenant payments for property operating costs. | Contributes to net operating income. | Played a significant role in overall financial performance. |

| Property Sales Gains | Profits from the disposition of real estate assets. | Reported substantial gains contributing positively to earnings. | Provided a notable boost to overall financial performance. |

| Lease-Up Income | Rental revenue from newly developed and leased properties. | Contributed to 7.3% same-store NOI growth. | Ongoing contribution as new developments stabilize. |

Business Model Canvas Data Sources

The EastGroup Properties Business Model Canvas is constructed using a blend of financial disclosures, real estate market research, and internal operational data. This comprehensive approach ensures each component accurately reflects the company's strategic positioning and market realities.