EastGroup Properties Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EastGroup Properties Bundle

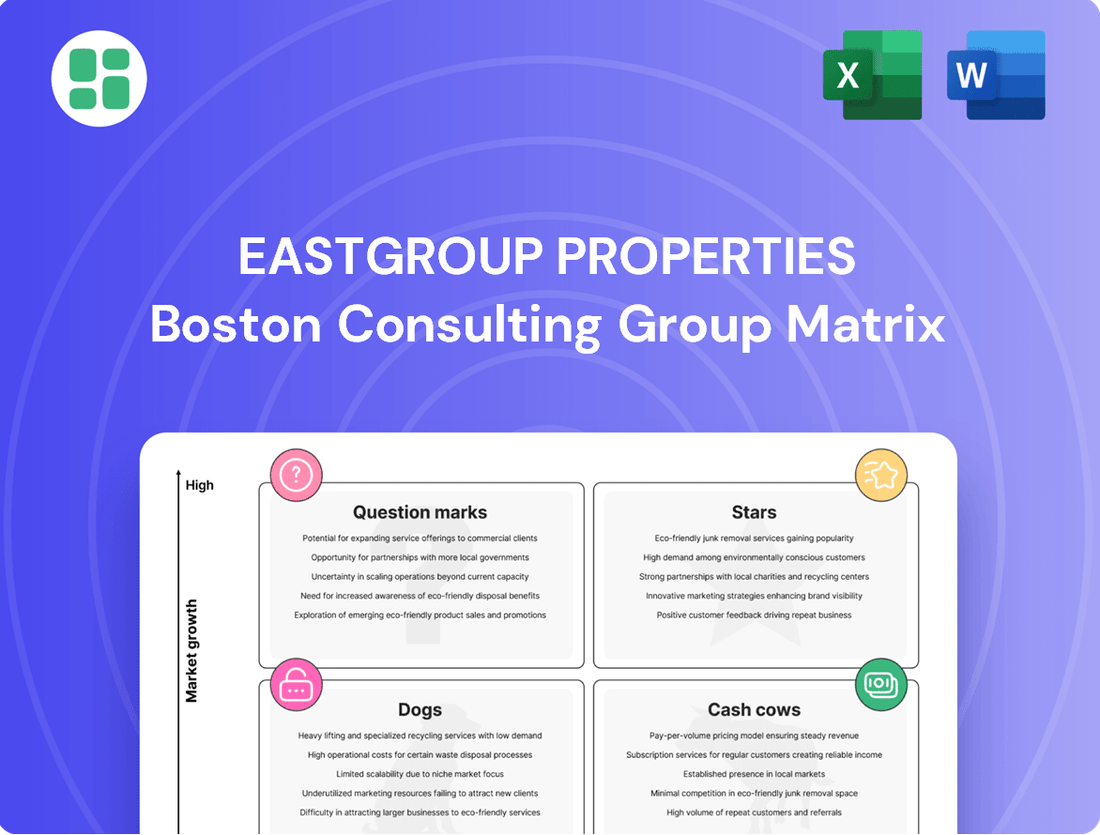

Curious about EastGroup Properties' strategic positioning? Our BCG Matrix preview highlights key insights into their portfolio, revealing which segments are driving growth and which may require a closer look. Don't miss out on the complete picture.

Unlock the full EastGroup Properties BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete report for actionable strategies and a clear roadmap to optimizing their real estate investments.

Stars

Prime Sunbelt Industrial Assets represent EastGroup Properties' most valuable holdings. These are newly developed or recently acquired, fully leased, high-quality industrial properties situated in dynamic Sunbelt markets such as Dallas-Fort Worth, Phoenix, and Florida. They are currently experiencing substantial rental rate growth, with Q2 2025 seeing an average increase of 44.4% on new and renewal leases, and maintaining robust occupancy levels due to strong demand.

EastGroup's strategic development pipeline, particularly in thriving markets like Nashville and Atlanta, positions the company for future growth. These ongoing projects are designed to meet increasing demand in areas with limited new supply. For instance, in Q2 2025, EastGroup commenced two new developments totaling 469,000 square feet in these key markets, with an estimated investment of $70 million. While these developments require capital during their construction phase, they are strategically planned to transition into high-yielding, fully leased operational assets, contributing to the company's long-term revenue generation.

EastGroup Properties excels in last-mile distribution facilities, focusing on smaller, shallow-bay industrial spaces (20,000 to 100,000 sq ft). These strategically located assets within expanding metro areas are critical for businesses needing proximity to urban centers. This specialization positions them as a key player in a high-demand sector.

High-Growth Sunbelt Markets with Supply Constraints

EastGroup Properties demonstrates a strong position in high-growth Sunbelt markets, characterized by significant demand for industrial space that outpaces available supply. This concentration in areas like Texas, Florida, California, Arizona, and North Carolina, which are experiencing robust job growth and population influx, firmly places them in the 'Star' category of the BCG matrix.

These Sunbelt markets are experiencing consistent rental rate appreciation due to this imbalance. For instance, in 2024, many of these regions continued to see double-digit percentage increases in industrial rents year-over-year. EastGroup's strategic acquisitions, such as the Bell Creek Logistics Center in Tampa, Florida, which offers modern industrial facilities in a prime distribution corridor, exemplify their commitment to these Star markets.

- High Demand, Limited Supply: Sunbelt markets like Texas and Florida are seeing industrial space demand significantly exceed new construction starts in 2024.

- Job and Population Growth: These regions continue to attract businesses and residents, fueling consistent demand for industrial and logistics facilities.

- Rental Rate Growth: In 2024, average industrial rental rates in key Sunbelt markets saw year-over-year increases often ranging from 8% to 15%.

- Strategic Acquisitions: EastGroup's focus on acquiring well-located, modern industrial assets in these supply-constrained submarkets reinforces their 'Star' status.

Robust Rental Rate Growth on Renewals

EastGroup Properties is experiencing robust rental rate growth on lease renewals, a key indicator of its strong market position. In early to mid-2025, the company reported average increases of approximately 44% to 45% for both new and renewal leases. This significant jump highlights their substantial pricing power and the high demand for their industrial properties.

This consistent ability to raise rents on existing tenants, even as leases expire, demonstrates a dominant position within their operating markets. Such strong renewal increases are a testament to the high demand for EastGroup's properties and their ability to retain and attract tenants willing to pay premium rates.

- Average Renewal Rate Increases (Early/Mid-2025): 44%-45%

- Key Indicator: Strong pricing power and high market share in existing portfolio

- Demonstrates: High demand for properties and dominant market position

- Impact: Ability to consistently raise rents on existing tenants

EastGroup Properties' "Stars" are its prime Sunbelt industrial assets, characterized by high demand and limited supply, driving significant rental growth. These properties are in dynamic markets like Dallas-Fort Worth and Florida, where demand consistently outstrips new construction.

The company's strategic focus on last-mile distribution facilities and recent developments in markets like Nashville and Atlanta further solidify its Star status. This is supported by strong rental rate appreciation, with average increases of 44-45% on new and renewal leases observed in early to mid-2025.

| Market Characteristic | EastGroup's Position | BCG Matrix Category |

|---|---|---|

| High Demand, Limited Supply (Sunbelt) | Strong occupancy, significant rental growth | Star |

| Job & Population Growth | Fuels consistent demand for industrial space | Star |

| Rental Rate Appreciation (2024) | Year-over-year increases of 8%-15% in key markets | Star |

| Strategic Acquisitions (e.g., Tampa) | Reinforces focus on supply-constrained submarkets | Star |

What is included in the product

EastGroup Properties' BCG Matrix analysis categorizes its industrial properties into Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment decisions.

A clear BCG Matrix visualizes EastGroup's portfolio, easing the pain of strategic resource allocation.

Cash Cows

EastGroup Properties' mature, fully leased operating portfolio represents a classic cash cow. As of June 30, 2025, this portfolio boasted an impressive 97.1% leased rate and 96.0% occupancy, primarily situated in stable Sunbelt markets. This high occupancy translates directly into predictable and substantial cash flow, a hallmark of a cash cow.

These established properties have secured a competitive advantage, meaning they require minimal new investment for marketing or repositioning. This low reinvestment need allows the generated income to flow through to profits, further solidifying their cash cow status within EastGroup's portfolio.

EastGroup Properties' well-established properties in core markets, particularly Texas and Florida, represent its cash cows. These assets, often fully stabilized with long-term tenants, have been part of the operating portfolio for an extended period. For instance, Texas accounts for 35% of EastGroup's portfolio, and Florida makes up 25%, highlighting their significance.

These mature properties are crucial for generating consistent net operating income (NOI) for EastGroup. They require minimal new capital investment, allowing them to contribute reliably to the company's financial performance. This stability is a hallmark of a strong cash cow, providing a dependable income stream.

EastGroup Properties boasts a remarkable 32-year history of consistent dividend payouts, demonstrating its stable and robust cash flow. This reliability is further underscored by increases in each of the past 13 years.

The company's cash cow operations directly fuel these dependable distributions. For instance, EastGroup announced a 10.2% dividend increase in 2024 and maintained a $1.40 per share quarterly dividend in Q2 2025, reflecting the strength of its underlying business.

High Occupancy in Stabilized Assets

EastGroup Properties' stabilized assets are performing exceptionally well, with occupancy rates consistently holding above 95% through 2024 and projected to remain strong into 2025. This sustained high occupancy in a mature market signifies a dominant position and robust tenant loyalty, effectively turning these properties into reliable income generators. These assets are the bedrock of the company's financial stability.

The consistent high occupancy minimizes costly vacancies and guarantees a steady stream of rental income, a hallmark of cash cow businesses. This predictable revenue allows for significant cash flow generation, supporting other growth initiatives within the company's portfolio. For instance, in Q1 2024, EastGroup reported a Same Store Net Operating Income (NOI) growth of 7.5%, underscoring the strength of these stabilized assets.

- Sustained High Occupancy: Consistently above 95% in 2024-2025 across stabilized portfolio.

- Market Dominance: Indicates a high market share in mature markets.

- Strong Tenant Retention: Contributes to minimized vacancy costs.

- Predictable Income: Ensures reliable rental income, characterizing cash cow status.

Efficient Property Management and Operations

EastGroup Properties' efficient property management and operations are clear cash cows. The company consistently achieves strong same-property net operating income (NOI) growth, with a notable 6.6% straight-line increase reported in Q2 2025. This performance underscores a low-cost, high-profit operational model.

This operational efficiency, particularly in managing its mature portfolio, translates directly into high profit margins and robust cash flow generation. These aspects are fundamental to EastGroup's status as a cash cow within its business portfolio.

- Strong Same-Property NOI Growth: Achieved 6.6% straight-line growth in Q2 2025.

- Low-Cost, High-Profit Operations: Demonstrated through efficient management practices.

- High Profit Margins: A direct result of operational excellence in a mature portfolio.

- Robust Cash Flow Generation: Underpins the cash cow status of these operations.

EastGroup Properties' established, fully leased properties are its cash cows, generating consistent and substantial cash flow. As of June 30, 2025, the company maintained a 97.1% leased rate and 96.0% occupancy, primarily in stable Sunbelt markets. This high occupancy minimizes vacancies and ensures reliable rental income, allowing these assets to contribute significantly to profits with minimal new investment.

These mature assets, particularly those in Texas (35% of portfolio) and Florida (25% of portfolio), are key drivers of EastGroup's financial stability. Their long-term tenant relationships and established market presence mean they require little in the way of marketing or repositioning, directly translating into strong, predictable net operating income (NOI).

The company's operational efficiency further solidifies these properties as cash cows, evidenced by a 6.6% straight-line same-property NOI growth in Q2 2025. This indicates a low-cost, high-profit model that fuels EastGroup's consistent dividend payouts, which saw a 10.2% increase in 2024.

| Metric | Value (as of June 30, 2025) | Significance |

|---|---|---|

| Leased Rate | 97.1% | Indicates strong demand and minimal vacancy risk. |

| Occupancy Rate | 96.0% | Confirms consistent rental income generation. |

| Same-Property NOI Growth (Q2 2025) | 6.6% (straight-line) | Demonstrates operational efficiency and profitability. |

| Dividend Increase (2024) | 10.2% | Reflects robust cash flow from mature assets. |

What You’re Viewing Is Included

EastGroup Properties BCG Matrix

The EastGroup Properties BCG Matrix preview you are viewing is the identical, fully polished document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content; you'll get the complete, professionally formatted strategic analysis ready for your immediate use. You can confidently assess the quality and depth of the insights, knowing the final product will be exactly as presented, enabling you to seamlessly integrate it into your business planning and decision-making processes. This ensures transparency and guarantees that the strategic clarity offered by the BCG Matrix for EastGroup Properties is precisely what you'll possess upon completing your transaction.

Dogs

Underperforming Legacy Assets in Non-Core Markets represent older, smaller properties situated outside EastGroup Properties' core Sunbelt focus. These assets likely exhibit slower growth and lower market share compared to the company's newer, prime locations. For instance, as of the first quarter of 2024, EastGroup's portfolio primarily consists of modern industrial assets in high-growth Sunbelt markets, indicating that any remaining non-core properties would fall into this "dog" category.

Properties with persistent high vacancy rates, even within EastGroup's generally strong portfolio, would be classified as Dogs. These are assets that consistently underperform, requiring capital for upkeep and taxes without yielding adequate returns. For instance, if a particular industrial park in a secondary market experienced a vacancy rate exceeding 15% throughout 2024, significantly higher than the company's overall average occupancy of 97.5%, it would fit this description.

Properties that demand disproportionately high capital expenditures for maintenance, repairs, or upgrades but yield only marginal increases in rental income or occupancy would be considered Dogs within EastGroup Properties' portfolio. These assets tie up significant capital without generating substantial growth, signaling a poor return on investment in a potentially low-growth or stagnant market segment.

For instance, an older industrial park requiring extensive HVAC system overhauls and roof replacements, costing millions, but only able to command a modest rent increase of 2% annually, would fit this description. This scenario limits the company's ability to redeploy capital into more promising growth opportunities.

Divested Properties (Past )

EastGroup Properties' divestitures, such as the sale of a portfolio of properties in Jackson, Mississippi, during 2024, clearly fall into the Divested Properties category of the BCG Matrix. These transactions are strategic moves to shed assets that are likely underperforming or no longer fit the company's long-term vision. By selling these properties, EastGroup is actively managing its portfolio to focus resources on areas with higher growth potential and stronger market positions.

These sales are indicative of EastGroup's commitment to optimizing its asset base. The company is prioritizing investments in markets and property types that align with its strategy of owning and operating modern, well-located industrial properties in high-growth Sun Belt markets. This proactive approach to portfolio management ensures that capital is deployed where it can generate the most significant returns.

- 2024 Jackson, MS Portfolio Sale: EastGroup completed the disposition of a significant portion of its portfolio in Jackson, MS, in 2024, marking a clear exit from that market.

- Strategic Divestment Rationale: These sales are consistent with EastGroup's strategy to divest from assets with lower growth prospects and market share, thereby enhancing overall portfolio quality and performance.

- Focus on High-Growth Markets: The proceeds from such divestitures are typically reinvested into acquiring and developing properties in EastGroup's core, high-growth Sun Belt markets.

- Portfolio Optimization: The active management of divested properties demonstrates a commitment to maintaining a lean, efficient, and high-performing real estate portfolio.

Properties Impacted by Local Economic Downturns or Oversupply

Properties impacted by local economic downturns or oversupply, even within a generally strong Sunbelt region, could be categorized as Dogs in the BCG Matrix. These situations arise when specific submarkets or individual assets face challenges like a sudden slowdown in local job growth or an influx of new competing properties. This can lead to stagnant rental rates and a dip in occupancy, even if the broader EastGroup Properties portfolio continues to perform well.

For instance, if a particular industrial park within a Sunbelt city experiences a major employer closure, properties within that immediate vicinity might see reduced demand. This localized effect, even if temporary, could push occupancy rates down and put downward pressure on rental income. In 2024, while the overall industrial real estate market remained robust, specific pockets did experience softening due to these localized factors.

- Localized Economic Weakness: Properties in areas experiencing job losses or industry-specific contraction, impacting tenant demand.

- Oversupply Impact: Assets facing increased competition from new developments, leading to higher vacancies and suppressed rents.

- Stagnant Rental Growth: Inability to increase rental rates due to weak local market conditions or tenant affordability issues.

- Declining Occupancy: A direct consequence of reduced tenant demand or increased competition, lowering asset utilization.

Dogs within EastGroup Properties' portfolio are those industrial assets that exhibit low market share and low growth potential. These are typically older, smaller properties located outside the company's core Sunbelt markets, or those facing persistent high vacancy rates. For example, if a property in a secondary market had a vacancy rate significantly above EastGroup's average of 97.5% occupancy in 2024, it would be considered a Dog.

These underperforming assets often require substantial capital for maintenance and repairs without generating commensurate returns. An example would be an older industrial building needing major renovations, like a new roof and HVAC system, but only able to achieve a modest 2% annual rent increase. Such assets tie up capital that could be better deployed in more promising growth opportunities.

EastGroup's strategic divestitures, such as the sale of its Jackson, Mississippi portfolio in 2024, clearly illustrate the management of Dog assets. These sales allow the company to shed underperformers and reinvest proceeds into its core Sunbelt markets, optimizing the overall portfolio for higher returns and growth.

Properties affected by localized economic downturns or oversupply, even within strong Sunbelt regions, can also become Dogs. A prime example would be industrial properties in a city where a major employer closure led to reduced tenant demand and stagnant rental rates throughout 2024, pushing occupancy below the company's strong average.

Question Marks

EastGroup's new development starts in emerging Sunbelt submarkets are positioned as question marks in their BCG matrix. For instance, their Q2 2025 developments in Nashville and Atlanta represent strategic bets on areas with significant future growth potential, aiming to establish a strong market presence.

EastGroup Properties' acquisition of undeveloped land, like the 66-acre Bell Creek Logistics Center site in Tampa secured in May 2025, fits the 'Question Mark' category in the BCG Matrix. These strategic land buys are bets on high future growth potential, but currently hold no market share and demand significant cash outlays for acquisition and eventual development.

The Deen Still Road Land in Florida also exemplifies this 'Question Mark' status. The success of these undeveloped land parcels is entirely dependent on their future development execution and the subsequent market demand for the completed projects. For instance, the company's 2024 portfolio included substantial investments in land banking, signaling a continued focus on this growth strategy.

EastGroup Properties' speculative development projects, those without secured tenants, represent their strategic bet on emerging market demand or innovative property designs. These ventures are inherently riskier, demanding robust marketing efforts to capture market share swiftly, especially given the competitive industrial sector. Management's cautious stance on new development starts for 2025 underscores this risk awareness.

Exploration of New Industrial Property Niche (e.g., Data Centers)

Exploring a new industrial property niche like data center conversions would position EastGroup Properties (EGP) as a Question Mark in the BCG matrix. This signifies a high-growth potential market where EGP currently holds a minimal market share.

Significant capital investment would be necessary to assess the viability and establish a presence in this burgeoning sector. The data center market, driven by increasing demand for cloud computing and digital infrastructure, is projected for substantial growth. For instance, the global data center market was valued at approximately $200 billion in 2023 and is expected to grow at a CAGR of over 15% through 2030, reaching an estimated $400 billion.

- High Market Growth: The demand for data storage and processing continues to surge, making data centers a rapidly expanding segment of real estate.

- Low Market Share: EastGroup's current portfolio likely has little to no exposure to data center properties, placing them in a low market share position.

- Investment Requirement: Developing or converting properties for data center use demands substantial upfront capital for specialized infrastructure and technology.

- Strategic Decision: EGP would need to carefully evaluate the risks and rewards, deciding whether to invest heavily to capture market share or divest from this nascent area.

Properties in Markets with Increased Competition or Supply

Properties in markets with increased competition or supply, even for a company like EastGroup that typically targets supply-constrained areas, can face challenges. If EastGroup properties are situated in Sunbelt submarkets experiencing a significant influx of new construction from competitors, their competitive advantage could be diluted.

This heightened supply can directly impact EastGroup's leasing velocity and their ability to achieve projected rental rate growth. For instance, if a submarket sees a 15% increase in industrial space delivery in 2024, as some Sunbelt markets have, EastGroup might need to offer more concessions or adjust pricing to attract tenants.

- Increased Vacancy Pressure: A surge in new supply can lead to higher overall vacancy rates in a submarket, making it harder for any single property to stand out.

- Rental Rate Stagnation: Competitors offering lower rental rates due to excess supply can put downward pressure on EastGroup's ability to push rents.

- Higher Tenant Retention Costs: To retain existing tenants in a more competitive environment, EastGroup might need to invest more in property upgrades or offer more favorable lease terms.

- Extended Lease-Up Periods: Properties in oversupplied markets may take longer to lease to full occupancy, impacting initial cash flow projections and potentially requiring additional capital for carrying costs.

EastGroup's speculative development projects, meaning those without pre-leased space, are classified as question marks. These ventures are high-growth potential bets but currently lack market share and necessitate significant capital investment, as seen in their 2024 land banking strategy.

The company's entry into new industrial property niches, such as data center conversions, also places them in the question mark category. This is due to the high growth potential of the data center market, where EGP currently holds minimal market share, requiring substantial capital for specialized infrastructure.

EastGroup's new development starts in emerging Sunbelt submarkets are positioned as question marks in their BCG matrix. For instance, their Q2 2025 developments in Nashville and Atlanta represent strategic bets on areas with significant future growth potential, aiming to establish a strong market presence.

The Deen Still Road Land in Florida also exemplifies this 'Question Mark' status. The success of these undeveloped land parcels is entirely dependent on their future development execution and the subsequent market demand for the completed projects. For instance, the company's 2024 portfolio included substantial investments in land banking, signaling a continued focus on this growth strategy.

BCG Matrix Data Sources

Our EastGroup Properties BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.