Dundee SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dundee Bundle

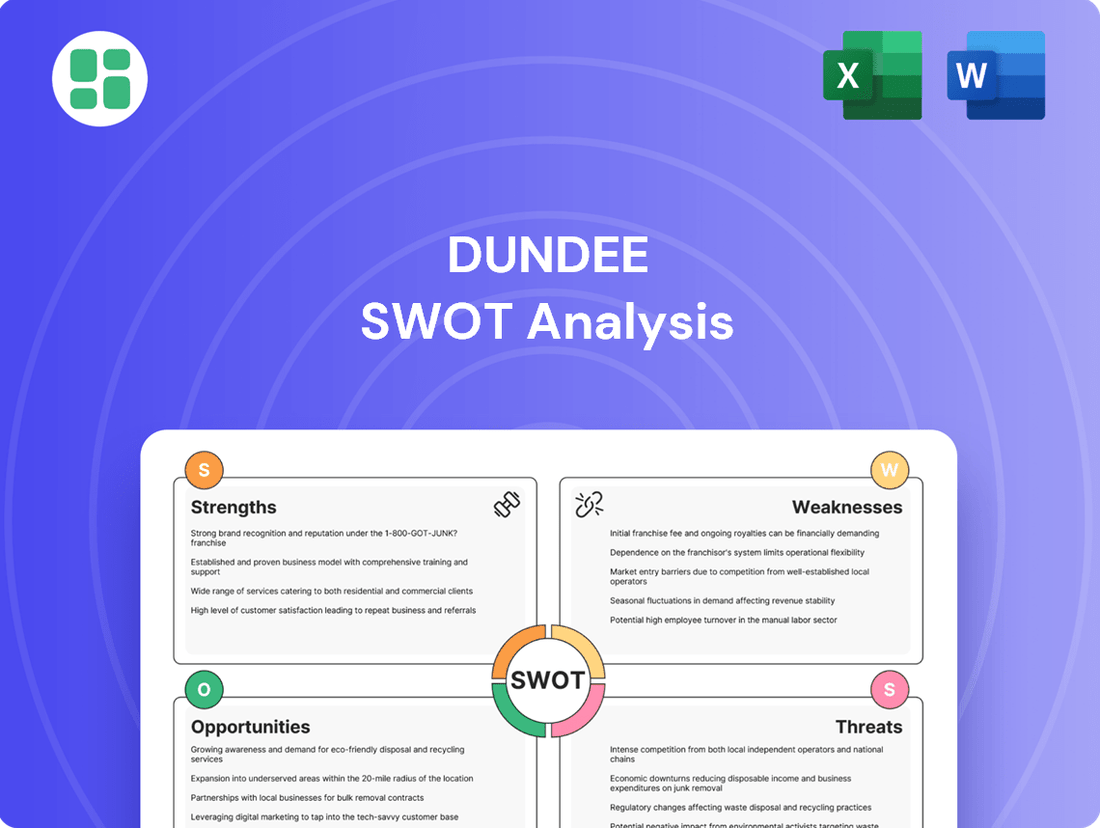

Dundee's unique blend of heritage and innovation presents compelling strengths, but understanding its potential weaknesses and the competitive landscape is crucial for strategic advantage. Our comprehensive SWOT analysis dives deep into these factors, offering a clear roadmap for navigating the market.

Want the full story behind Dundee's opportunities for growth and the threats it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and decision-making.

Strengths

Dundee Precious Metals is showing impressive financial muscle. In the first half of 2025, they generated a record $174 million in free cash flow, alongside strong adjusted net earnings. This financial health is a key strength, allowing them to consistently reward shareholders.

The company is actively returning capital to investors through a boosted share buyback program and regular dividend payments. This commitment to capital returns, backed by a solid cash position of $797 million as of June 30, 2025, highlights their financial stability and shareholder-friendly approach.

Dundee Precious Metals demonstrates remarkable operational consistency, having successfully met its gold production targets for an impressive ten consecutive years through 2024. This sustained performance underscores the company's robust operational management and execution capabilities.

The company is well-positioned to achieve its 2025 production guidance, projecting 225,000 to 265,000 ounces of gold and 28 to 33 million pounds of copper. This reliability stems from the consistent output of its key assets, the Chelopech and Ada Tepe mines.

Dundee Precious Metals (DPM) boasts a strategically diversified asset portfolio, with producing mines in Bulgaria and Namibia. This core production is bolstered by significant development projects in Serbia (Čoka Rakita) and Ecuador (Loma Larga), showcasing a clear growth strategy.

The proposed acquisition of Adriatic Metals plc, specifically its Vareš operation in Bosnia and Herzegovina, is a key move to further enhance this diversification. This acquisition aims to broaden DPM's geographical reach and its exposure to various metals, positioning the company for a leading growth trajectory within its peer group.

Commitment to Sustainable and Responsible Mining Practices

Dundee Precious Metals demonstrates a strong commitment to sustainable and responsible mining, embedding Environmental, Social, and Governance (ESG) principles across its operations. This dedication is evident in their transparent reporting, aligning with globally recognized frameworks like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). For 2024, the company reported a 15% reduction in water intensity compared to their 2023 baseline, a testament to their focus on resource management.

The company's adherence to international reporting standards, including the Task Force on Climate-related Financial Disclosures (TCFD), underscores a proactive approach to managing climate risks and opportunities. Dundee’s 2024 sustainability report highlighted a 10% decrease in greenhouse gas emissions intensity year-over-year, reinforcing their commitment to environmental stewardship.

- ESG Integration: Dundee actively incorporates ESG factors into its operational strategy and decision-making processes.

- Transparent Reporting: The company adheres to GRI, SASB, and TCFD standards, providing clear and verifiable sustainability data.

- Performance Metrics: In 2024, Dundee achieved a 15% reduction in water intensity and a 10% decrease in greenhouse gas emissions intensity compared to 2023.

- Stakeholder Engagement: Dundee prioritizes engagement with local communities and stakeholders to ensure responsible mining practices.

Robust Growth Pipeline with Advancing Projects

Dundee possesses a robust organic growth pipeline, underscored by the significant advancements in its key projects. The Čoka Rakita project in Serbia is on track for the completion of its feasibility study by the end of 2025, with projections indicating substantial gold production commencing in 2028. This development is a critical step towards unlocking considerable value.

Further bolstering its growth prospects, the Loma Larga project in Ecuador reached a pivotal milestone in June 2025 by securing its environmental license. This crucial approval paves the way for the project's progression, positioning Dundee to capitalize on its considerable resource potential.

These developments highlight Dundee's strategic focus on advancing its exploration and development portfolio, aiming to translate promising geological assets into tangible production and revenue streams in the coming years.

Dundee Precious Metals' financial strength is a significant advantage, evidenced by its record free cash flow of $174 million in the first half of 2025 and a healthy cash position of $797 million as of June 30, 2025. This financial stability allows for consistent shareholder returns through dividends and an active share buyback program.

The company's operational track record is exceptionally strong, having met gold production targets for ten consecutive years through 2024. This consistent performance is expected to continue, with 2025 guidance projecting 225,000 to 265,000 ounces of gold and 28 to 33 million pounds of copper, supported by its reliable Chelopech and Ada Tepe mines.

Dundee's diversified asset base, including producing mines in Bulgaria and Namibia, coupled with promising development projects in Serbia and Ecuador, forms a robust foundation for growth. The potential acquisition of Adriatic Metals' Vareš operation further enhances this diversification, positioning DPM for significant expansion.

A strong commitment to ESG principles is a key strength, with transparent reporting aligned with GRI, SASB, and TCFD standards. This is backed by tangible improvements, such as a 15% reduction in water intensity and a 10% decrease in greenhouse gas emissions intensity in 2024 compared to 2023.

The company's organic growth pipeline is robust, with the Čoka Rakita project in Serbia on track for its feasibility study completion by the end of 2025, targeting production in 2028. Additionally, the Loma Larga project in Ecuador secured its environmental license in June 2025, clearing a major hurdle for development.

| Metric | H1 2025 | 2024 (Target/Actual) | 2025 (Guidance) |

|---|---|---|---|

| Free Cash Flow | $174 million | N/A | N/A |

| Cash & Equivalents (June 30, 2025) | $797 million | N/A | N/A |

| Gold Production (2025 Guidance) | N/A | Met targets for 10 consecutive years | 225,000 - 265,000 oz |

| Copper Production (2025 Guidance) | N/A | N/A | 28 - 33 million lbs |

| Water Intensity Reduction (2024 vs 2023) | N/A | 15% | N/A |

| GHG Emissions Intensity Reduction (2024 vs 2023) | N/A | 10% | N/A |

What is included in the product

Analyzes Dundee’s competitive position through key internal and external factors.

Offers a structured framework to identify and address potential roadblocks, transforming uncertainty into actionable insights.

Weaknesses

Dundee Precious Metals, as a miner of gold and copper, faces significant risks from price swings in these commodities. For instance, if gold prices were to drop by 10% from their current levels, it could directly impact Dundee's revenue streams. This sensitivity means that a downturn in global commodity markets could severely affect the company's earnings and cash generation capabilities, even if current prices are strong.

Dundee Precious Metals (DPM) faces a challenge with its all-in sustaining costs (AISC), which have risen unexpectedly. For the first half of 2025, AISC reached $1,118 per ounce of gold sold, significantly exceeding the company's own reconfirmed 2025 guidance range of $780 to $900 per ounce.

This cost escalation, despite DPM's objective to be a low-cost producer, was influenced by factors such as reduced production volumes and mark-to-market adjustments related to share-based compensation during the period.

Dundee Precious Metals faced operational hurdles in early 2025, leading to a dip in production. Specifically, gold sales were down in the first quarter, largely because of decreased gold output at their Ada Tepe mine. This reduction was attributed to lower gold grades and a smaller volume of ore being processed.

Adding to these challenges, copper production also experienced a decline during the same period. The primary driver for this decrease was lower copper grades encountered, which consequently impacted the overall volume of copper produced when compared to the previous year's figures.

High Capital Expenditure Requirements for Growth

Dundee's aggressive expansion plans, particularly the development of the Čoka Rakita and Loma Larga projects, demand significant upfront capital. This inherent capital intensity presents a considerable hurdle for sustained growth and operational flexibility.

The company's financial reports underscore this challenge; for instance, sustaining and growth capital expenditures saw a notable increase in the first quarter of 2025. This surge directly correlates with the substantial financial outlays required to progress these large-scale mining ventures.

- Significant Capital Outlay: The advancement of major projects like Čoka Rakita and Loma Larga requires substantial financial investment.

- Increased Q1 2025 Expenditures: Sustaining and growth capital expenditures rose significantly in Q1 2025, highlighting the capital-intensive nature of operations.

- Growth Pipeline Demands: The company's ambitious growth pipeline is a primary driver for these high capital expenditure requirements.

Geopolitical and Regulatory Risks in Operating Jurisdictions

Dundee Precious Metals (DPM) faces significant headwinds due to its operations across a diverse international footprint. Countries like Bulgaria, Namibia, Serbia, and Ecuador, along with the upcoming expansion into Bosnia and Herzegovina, each present unique geopolitical and regulatory landscapes. These variations create inherent uncertainties for the company's strategic planning and financial forecasting.

Changes in mining policies and taxation are a constant concern. For instance, Bulgaria implemented a one-time state budget levy in the first quarter of 2025, impacting DPM's financial performance. Such unforeseen levies or shifts in fiscal regimes can directly affect profitability and the economic viability of existing and future projects.

The company must also navigate varying environmental regulations and permitting processes across its operating jurisdictions. Delays or stricter requirements in one country can impact production schedules and capital expenditure plans. This complexity necessitates robust compliance frameworks and proactive engagement with local authorities.

- Exposure to diverse geopolitical risks across Bulgaria, Namibia, Serbia, Ecuador, and Bosnia and Herzegovina.

- Potential for adverse changes in mining policies and taxation impacting profitability.

- Risk of unforeseen levies, as demonstrated by Bulgaria's Q1 2025 state budget levy.

- Navigating complex and varying regulatory environments for permitting and operations.

Dundee Precious Metals (DPM) faces significant cost pressures, with all-in sustaining costs (AISC) for the first half of 2025 at $1,118 per ounce, exceeding its 2025 guidance of $780-$900 per ounce. This escalation was driven by lower production volumes and mark-to-market adjustments. Operational challenges in early 2025, including reduced gold grades and processing volumes at Ada Tepe, contributed to a dip in gold sales and copper production, impacting overall output compared to the previous year.

The company's ambitious growth projects, such as Čoka Rakita and Loma Larga, require substantial upfront capital, increasing the capital intensity of operations. This is evidenced by a notable rise in sustaining and growth capital expenditures in Q1 2025, directly linked to the financial demands of these large-scale ventures.

DPM's international operations expose it to diverse geopolitical and regulatory risks across countries like Bulgaria, Namibia, Serbia, and Ecuador. Unforeseen policy shifts, such as Bulgaria's Q1 2025 state budget levy, can negatively impact financial performance and project viability. Navigating varying environmental regulations and permitting processes across these jurisdictions adds further complexity and potential for delays.

| Metric | H1 2025 Actual | 2025 Guidance Range | Variance |

|---|---|---|---|

| All-in Sustaining Costs (AISC) per ounce of gold | $1,118 | $780 - $900 | Exceeded guidance |

| Gold Sales (Q1 2025) | Decreased | N/A | Lower output |

| Copper Production (Q1 2025) | Decreased | N/A | Lower grades |

What You See Is What You Get

Dundee SWOT Analysis

This is the actual Dundee SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Dundee Precious Metals' acquisition of Adriatic Metals plc presents a compelling opportunity to significantly enhance its growth trajectory and diversify its asset base. This move is poised to integrate the high-grade Vareš silver-lead-zinc-gold operation, bolstering Dundee's overall portfolio with a valuable, multi-commodity asset.

The strategic rationale behind this acquisition is to cultivate a 'peer-leading growth profile' for Dundee. By expanding its operational footprint and diversifying revenue streams, the company aims to optimize capital allocation across a more robust and varied collection of mining assets, ultimately driving shareholder value.

The global precious metal market is exceptionally strong. Gold prices have hit record highs, with the yellow metal trading above $2,300 per ounce for much of 2024, driven by persistent inflation concerns and geopolitical instability. This robust environment presents Dundee Precious Metals with a significant opportunity to benefit from elevated realized prices and enhance its profitability.

Dundee's strategic focus on advancing high-potential projects offers significant organic growth. The Čoka Rakita project in Serbia is a prime example, with its feasibility study slated for completion by the end of 2025 and a target for first production in 2028. This project is expected to deliver low all-in sustaining costs, a key driver for profitability.

Further development is bolstered by securing the environmental license for Loma Larga in Ecuador. This crucial step allows Dundee to move forward with the project, unlocking its potential and contributing to the company's overall growth trajectory. These advancements highlight Dundee's commitment to expanding its operational footprint and capitalizing on promising resource opportunities.

Potential for New Discoveries through Aggressive Exploration

Dundee Precious Metals (DPM) is doubling down on exploration, a strategy that could unlock substantial new value. Their ongoing, aggressive investment in finding more gold and copper is a key opportunity.

This focus is particularly evident in their established Chelopech and Ada Tepe sites, but also extends to promising areas in Serbia, like the Dumitru Potok and Valja Saka prospects. These efforts aim to not only prolong the life of their current operations but also to unearth entirely new, high-grade deposits.

For instance, in 2023, DPM reported significant exploration success, including:

- Discovery of new zones at Chelopech, potentially extending its mine life.

- Advancement of drilling programs at Ada Tepe, indicating further resource potential.

- Positive initial results from Serbian targets, suggesting the possibility of new discoveries.

These continued exploration endeavors are crucial for Dundee's long-term growth, offering the potential for impactful new discoveries that could significantly boost their resource base and future profitability.

Strengthening ESG Performance to Attract Investment and Enhance Reputation

Dundee Precious Metals can significantly boost its attractiveness to investors by enhancing its Environmental, Social, and Governance (ESG) performance. This focus is crucial as the global sustainable investment market continues its rapid expansion, with assets under management projected to reach $50 trillion by 2025. By transparently reporting on its sustainability efforts, Dundee can tap into this growing capital pool.

Strengthening ESG practices also bolsters Dundee's social license to operate. This can lead to smoother permitting processes and cultivate more robust relationships with local communities, which is vital for long-term operational stability and growth. Companies with strong ESG credentials often experience lower capital costs and greater operational resilience.

- Growing ESG Investment: The sustainable investment market is a significant and expanding source of capital, with a substantial portion of global assets now managed with ESG considerations.

- Enhanced Investor Appeal: Demonstrating continuous improvement in sustainable practices and transparent reporting directly appeals to this growing investor segment.

- Social License to Operate: Strong ESG performance strengthens community relations and can expedite regulatory approvals, reducing operational risks.

- Reputational Benefits: A commitment to ESG enhances Dundee's overall reputation, potentially attracting talent and fostering positive stakeholder engagement.

The acquisition of Adriatic Metals plc is a significant opportunity, integrating the high-grade Vareš operation and bolstering Dundee's growth profile. The strong global precious metal market, with gold prices consistently above $2,300 per ounce in 2024, offers favorable realized prices and enhanced profitability. Dundee's focus on advancing projects like Čoka Rakita, with feasibility expected by end-2025 and production targeted for 2028, alongside securing the Loma Larga environmental license, provides substantial organic growth potential.

Threats

The gold market, while experiencing elevated prices in early 2024, remains inherently volatile. For instance, gold prices saw significant swings in 2023, with the yellow metal reaching highs around $2,000 per ounce and experiencing dips. This unpredictability directly threatens Dundee Precious Metals, as a substantial price correction could significantly reduce revenue and cash flow, impacting the company's financial stability and expansion plans.

Similarly, copper prices have demonstrated considerable fluctuation. In 2024, copper prices have traded in a range, influenced by global demand and supply dynamics. A sharp decline in copper prices, a key commodity for Dundee, would directly impact its profitability and could hinder its capacity to finance ongoing operations and future development projects, posing a considerable risk to its financial performance.

The mining sector, including companies like Dundee, faces escalating regulatory scrutiny, particularly concerning environmental impact. New or tightened regulations in 2024 and 2025 are likely to increase compliance costs, potentially affecting project timelines and profitability. For instance, stricter emissions standards or waste management protocols could necessitate significant capital investment in new technologies. Failure to adapt can lead to substantial fines, legal battles, and a tarnished public image, impacting investor confidence and operational continuity.

Dundee Precious Metals operates in diverse international locations like Bulgaria, Namibia, Serbia, Ecuador, and Bosnia and Herzegovina. This global footprint inherently exposes the company to geopolitical instability. Events such as political unrest, sudden shifts in government regulations, or even the risk of asset nationalization in these countries can significantly disrupt operations and negatively affect financial performance.

Rising Operational Costs and Inflationary Pressures

Dundee's profitability is under pressure from escalating operational costs. These include higher expenses for labor, energy, and essential consumables, directly impacting the bottom line.

Broader inflationary trends exacerbate these challenges. For instance, Dundee reported increased labor costs and sustained capital expenditures in Q1 2025, indicating a rising cost base that needs careful management to avoid margin compression.

- Rising Labor Expenses: Increased wages and benefits contribute to higher operational overheads.

- Energy Price Volatility: Fluctuations in energy markets directly affect production and distribution costs.

- Consumable Cost Increases: The price of raw materials and other necessary supplies has seen an upward trend.

- Inflationary Impact: General price increases across the economy erode purchasing power and increase the cost of doing business.

Intense Competition for Resources and Talent

The global mining industry is fiercely competitive, with many players seeking the same limited resources. Dundee Precious Metals faces challenges in securing new mineral deposits, attracting skilled workers, and obtaining necessary capital. This intense rivalry can escalate the costs of acquiring new projects and raise labor expenses, potentially hindering Dundee's capacity to grow its resource base and retain its competitive standing in the market.

For instance, in 2024, the demand for critical minerals like copper and gold, essential for renewable energy and technology sectors, has driven up exploration and acquisition costs significantly. Companies are increasingly looking at advanced exploration techniques and strategic partnerships to gain an edge, a trend expected to continue through 2025.

- Resource Scarcity: Limited availability of high-grade mineral deposits globally.

- Talent Acquisition: Shortage of experienced geologists, engineers, and mine operators.

- Capital Markets: Intense competition for investment capital in a sector with long lead times and high upfront costs.

- Acquisition Premiums: Increased prices paid for promising exploration assets and existing mines.

The volatile nature of gold and copper prices presents a significant threat, as price downturns directly impact Dundee's revenue and profitability. Escalating operational costs, driven by inflation and rising expenses for labor, energy, and consumables, further squeeze margins. Geopolitical instability in operating regions and intense competition for resources and talent also pose substantial risks to Dundee's financial health and growth prospects.

SWOT Analysis Data Sources

This Dundee SWOT analysis is built upon a robust foundation of data, drawing from official council reports, economic development statistics, and public consultation feedback to ensure a comprehensive and representative assessment.