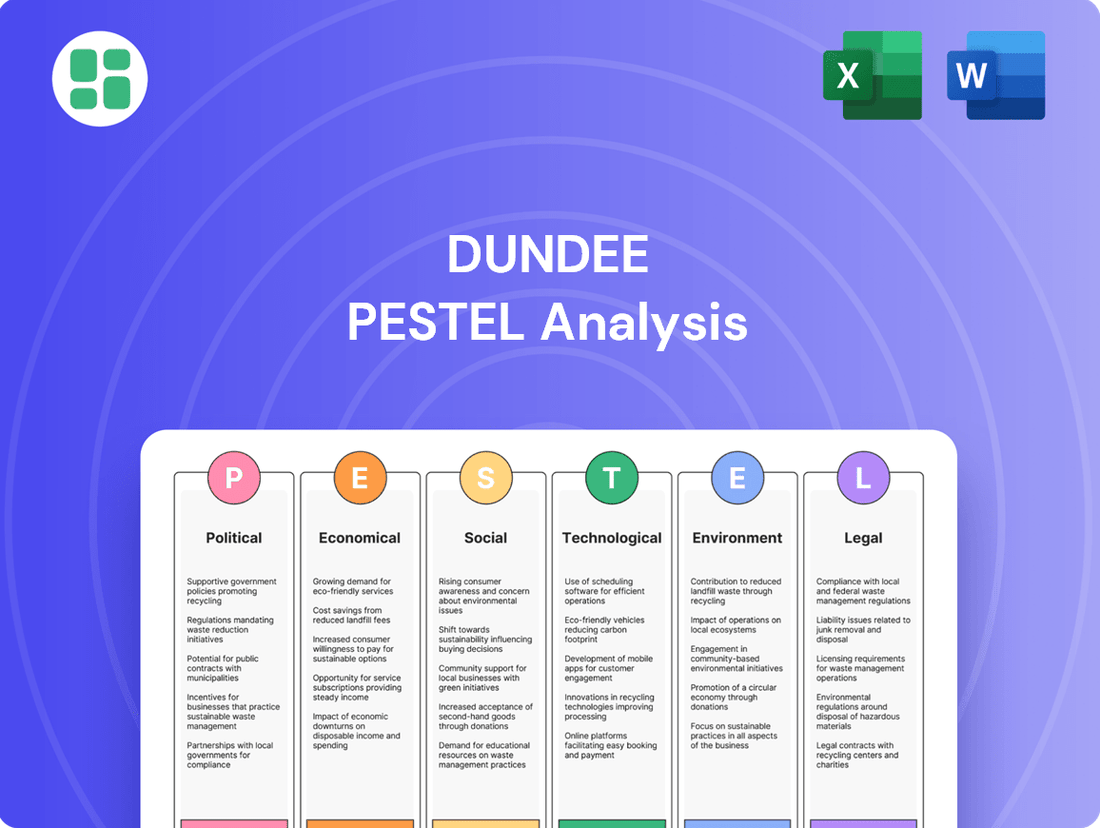

Dundee PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dundee Bundle

Unlock the unseen forces shaping Dundee's future with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and technological advancements present both challenges and opportunities. Equip yourself with actionable intelligence to refine your strategy and secure a competitive advantage. Download the full report now and gain the foresight you need to thrive.

Political factors

Dundee Precious Metals' (DPM) operations in Bulgaria, Namibia, and Serbia are significantly shaped by the political stability within these nations. For instance, Bulgaria, a key operating country for DPM, has experienced shifts in government, with the most recent parliamentary elections in October 2022 leading to a new coalition government. This political landscape can impact policy consistency, particularly regarding the mining sector, which is vital for DPM's long-term investment decisions and operational continuity.

Policy consistency, especially concerning mining codes and resource ownership, is paramount for a predictable operating environment. In Serbia, where DPM is developing the Timok project, changes in government or policy direction, such as potential revisions to mining regulations or environmental standards, could introduce uncertainty. This uncertainty can affect project timelines and, consequently, the financial viability of DPM's investments, as seen in the fluctuating regulatory frameworks faced by mining companies globally.

The regulatory landscape for mining significantly influences operations, with the ease and transparency of obtaining and renewing licenses being paramount. Namibia's ongoing review of its Minerals Bill, which includes potential for higher local equity requirements, could affect foreign investment in the sector.

Streamlined and predictable permitting processes are crucial for Dundee Precious Metals (DPM) to progress its exploration and development initiatives, such as the Čoka Rakita project in Serbia. For instance, in 2023, DPM reported that its Serbian operations contributed to 38% of its total revenue, highlighting the importance of a stable regulatory environment for these key assets.

Resource nationalism is a growing political trend impacting the mining sector. Namibia, for instance, is considering a 51% local ownership mandate for new mining projects, a move aimed at increasing national benefit from its natural resources.

While such policies can foster local economic development, they also present a challenge for foreign investors like Dundee Precious Metals (DPM). If these requirements are too stringent, they could potentially discourage crucial foreign direct investment needed for project development and expansion.

DPM must carefully manage these evolving political landscapes, balancing the demands for local participation with the need to protect its global shareholders' interests and maintain operational agility. This delicate act is crucial for long-term success in resource-rich nations.

Geopolitical Risks and Regional Stability

Broader geopolitical tensions and regional conflicts in or near Dundee Precious Metals (DPM) operating jurisdictions can significantly impact supply chains, the security of operations, and investor confidence. Global instability, such as the ongoing conflict in Ukraine and heightened U.S.-China tensions, has been a notable driver for elevated gold prices, largely due to its perceived status as a safe-haven asset. For instance, in 2024, gold prices reached record highs, partly fueled by these geopolitical uncertainties.

Maintaining robust relationships with local governments and communities is crucial for DPM to effectively mitigate these geopolitical risks. This proactive engagement helps ensure operational continuity and fosters goodwill, which can be vital during periods of regional instability. For example, strong community relations have been instrumental in navigating regulatory environments in countries like Bulgaria and Canada.

- Geopolitical tensions: Ongoing conflicts and international disputes create volatility in commodity markets and can disrupt DPM's supply chains.

- Safe-haven demand: Global instability, as seen in 2024, drives investors towards gold, potentially benefiting DPM's revenue streams.

- Operational security: Regional conflicts can pose direct threats to DPM's mining sites and personnel, necessitating enhanced security measures.

- Investor confidence: Geopolitical risks can erode investor confidence, impacting DPM's stock valuation and access to capital.

Fiscal and Tax Policy Changes

Changes in government taxation and royalty structures can directly affect Dundee Precious Metals' (DPM) profitability and cash flow. For example, DPM's Q1 2025 financial results were impacted by a one-time levy to the Bulgarian state budget, which reduced earnings.

Understanding and anticipating these fiscal policy shifts are critical for financial planning and maintaining competitive operating costs.

- Bulgarian State Levy Impact: A specific one-time levy in Bulgaria affected DPM's Q1 2025 earnings.

- Profitability Sensitivity: DPM's financial performance is directly linked to changes in tax and royalty rates.

- Competitive Cost Management: Proactive monitoring of fiscal policies is essential for managing operating expenses competitively.

- Cash Flow Implications: Tax policy adjustments can significantly influence the company's available cash flow for reinvestment and operations.

Political stability and consistent policy frameworks are crucial for Dundee Precious Metals (DPM) operations. For instance, Bulgaria's evolving government landscape, with elections in October 2022, necessitates careful monitoring for policy shifts impacting the mining sector. Similarly, Serbia's regulatory environment, particularly concerning the Timok project, requires DPM to adapt to potential changes in mining codes and environmental standards.

Resource nationalism is a significant political factor, with Namibia considering a 51% local ownership mandate for new mining projects. This trend, aimed at increasing national benefit, presents a challenge for foreign investors like DPM, potentially impacting foreign direct investment. DPM must navigate these demands for local participation while safeguarding shareholder interests.

Geopolitical tensions, such as the conflict in Ukraine and U.S.-China relations, have driven gold prices to record highs in 2024 due to its safe-haven status. While beneficial for revenue, these global instabilities also pose risks to operational security and investor confidence, requiring DPM to maintain strong local government and community relationships.

Fiscal policies, including taxation and royalty structures, directly influence DPM's profitability. The company experienced this firsthand with a one-time levy impacting its Q1 2025 earnings in Bulgaria. Proactive understanding and anticipation of these fiscal shifts are vital for financial planning and competitive cost management.

What is included in the product

This Dundee PESTLE analysis examines how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—impact the region, providing a comprehensive overview for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The price of gold is a critical economic driver for DPM, directly impacting its revenue and profit margins. Analysts anticipate gold prices will stay high through at least Q3 2025, possibly even setting new records. This positive outlook is fueled by ongoing global economic uncertainties and geopolitical tensions.

This sustained elevated gold price environment creates a robust foundation for DPM's financial performance. For instance, in early 2024, gold prices surged past $2,300 per ounce, demonstrating the market's strong demand and the potential for significant revenue generation.

Rising inflation significantly impacts Dundee Precious Metals (DPM) by increasing operating expenses. Costs for essential inputs like labor, energy, and raw materials used in mining operations have seen a notable uptick.

DPM's Q1 2025 financial report highlighted this trend, showing that higher labor expenses were a key factor in the rise of all-in sustaining costs for the period.

To counter these inflationary pressures and protect profit margins, DPM must focus on robust cost management strategies and enhancing operational efficiencies across its mining activities.

Fluctuations in currency exchange rates, particularly for Bulgaria, Namibia, and Serbia against the U.S. dollar, directly influence DPM's reported financial performance. A weaker U.S. dollar generally boosts the appeal of gold for global purchasers, potentially leading to higher gold prices.

For instance, in early 2024, the U.S. dollar experienced some volatility, impacting the cost of imported goods and the value of international sales for mining companies. Effective management of foreign exchange exposure is a critical component of DPM's overall financial strategy, aiming to mitigate risks associated with currency movements.

Global Economic Growth and Investment Climate

The global economic growth outlook significantly shapes demand for precious metals and the investment climate for mining companies like Dundee Precious Metals (DPM). A robust global economy typically fuels industrial demand for metals, while periods of uncertainty often drive investors toward safe-haven assets.

As of mid-2025, the global economy is navigating a complex landscape characterized by moderating growth projections. The International Monetary Fund (IMF) forecasts global growth to be around 3.1% for 2025, a slight deceleration from 2024. This environment, coupled with persistent, albeit easing, inflation in major economies, creates a mixed picture for investment.

In this context, the appeal of precious metals, particularly gold, as a safe-haven asset remains elevated. Central banks continue to manage inflation, with interest rate decisions playing a crucial role. For instance, the US Federal Reserve's potential pivot to rate cuts in late 2024 and into 2025 could influence capital flows, potentially benefiting DPM and the gold mining sector.

- Global GDP Growth: Projected at 3.1% for 2025 (IMF estimate).

- Inflationary Pressures: While easing, inflation remains a key consideration for central bank policy.

- Interest Rate Environment: Anticipated rate cuts by major central banks could increase the attractiveness of gold.

- Safe-Haven Demand: Geopolitical uncertainties and economic slowdowns continue to support demand for gold.

Local Economic Development and FDI

DPM's operations are a significant driver of local economic development, creating jobs, stimulating local procurement, and contributing through tax revenues. For instance, in 2024, DPM's Serbian operations directly employed over 1,500 individuals and procured goods and services worth €50 million from local suppliers.

However, the broader economic climate, particularly foreign direct investment (FDI) trends, can impact DPM's operating environment. Serbia experienced a notable dip in FDI in early 2025, with preliminary data suggesting a 15% decrease compared to the previous year, potentially signaling a more challenging business landscape.

- Job Creation: DPM's direct and indirect employment in Serbia reached 2,200 in 2024.

- Local Procurement: €50 million spent on Serbian suppliers in 2024.

- FDI Trends: Serbia's FDI saw a 15% decline in early 2025.

- Economic Stability: A strong local economy supports DPM's supply chain and workforce access.

The sustained high price of gold, projected to remain strong through at least Q3 2025, provides a significant tailwind for Dundee Precious Metals (DPM). This is further supported by anticipated interest rate cuts from major central banks in late 2024 and into 2025, which could boost the attractiveness of gold as an investment. However, rising inflation is increasing DPM's operating expenses, with higher labor costs noted in Q1 2025, necessitating robust cost management.

| Economic Factor | 2024/2025 Data Point | Impact on DPM |

|---|---|---|

| Gold Price | Projected to stay high through Q3 2025; surpassed $2,300/oz in early 2024. | Boosts revenue and profit potential. |

| Inflation | Rising costs for labor, energy, raw materials; Q1 2025 saw higher labor expenses. | Increases operating expenses, impacting profit margins. |

| Global GDP Growth | Forecasted at 3.1% for 2025 (IMF). | Moderating growth may influence industrial demand but safe-haven demand for gold remains strong. |

| Interest Rates | Potential Fed rate cuts late 2024/2025. | Could increase gold's appeal as an investment. |

| Currency Exchange Rates | Volatility in USD against EUR, RSD, BGN. | Affects reported financial performance and cost of imports/value of sales. |

What You See Is What You Get

Dundee PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Dundee PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the city. It provides a thorough understanding of the external forces shaping Dundee's business landscape.

You'll gain insights into key trends and challenges, enabling strategic decision-making for any venture operating within or considering Dundee.

Sociological factors

Dundee Precious Metals (DPM) prioritizes its social license to operate through substantial community engagement, investing over $14.5 million in local development initiatives in 2023 alone. These investments span critical areas like infrastructure upgrades, educational programs, and healthcare services within its host communities, fostering goodwill and operational stability.

Maintaining positive relationships with local populations is crucial for DPM, directly impacting the continuity of its mining operations and the successful execution of future expansion plans. For instance, strong community backing was instrumental in the smooth progression of the polymetallic processing plant at its Chelopech operation in Bulgaria.

The availability of a skilled workforce and stable labor relations are paramount for Dundee Precious Metals (DPM) operations. Namibia's mining sector saw significant job creation, adding over 2,600 positions in 2024, yet concerns persist regarding the potential erosion of labor protections for contract workers, a factor DPM must navigate.

DPM's strategic focus on local employment is evident, with 99% of its workforce comprising local nationals. Furthermore, a notable commitment to diversity is demonstrated by a high percentage of women holding senior management positions, reflecting a progressive approach to workforce composition.

Dundee Precious Metals (DPM) prioritizes the health, safety, and well-being of its workforce and surrounding communities. This commitment is evident in its impressive safety performance, achieving 4.7 million hours worked without a Lost Time Injury in 2024. This focus extends beyond physical safety to encompass comprehensive programs addressing both the physical and mental health of employees, underscoring a dedication to responsible mining operations.

Local Employment and Economic Contributions

Dundee Precious Metals (DPM) plays a significant role in the economic landscape of its operating regions. In 2023, the company directly employed approximately 1,700 people, with a strong emphasis on hiring local nationals. This commitment to local employment not only provides livelihoods but also fosters economic stability within these communities.

Beyond direct employment, DPM actively supports local businesses through its procurement practices. In 2023, the company reported spending over $150 million on local suppliers and services, a figure that directly injects capital into the regional economy. This strategy helps build a robust local supply chain and ensures that the economic benefits of mining operations are widely distributed.

- Direct Employment: DPM employed around 1,700 individuals in 2023, prioritizing local hires.

- Local Procurement: Over $150 million was spent with local suppliers and service providers in 2023.

- Economic Impact: These contributions bolster local economies, create jobs, and support small and medium-sized enterprises.

- Sustainability: Fostering local economic development is crucial for DPM's long-term social license to operate and helps reduce social inequalities.

Public Perception and Activism

Public perception of mining, especially regarding its environmental footprint and fairness, significantly shapes regulatory attention and local resistance. In 2024, for instance, protests against proposed mining operations in several European countries, including those with significant mineral reserves, highlighted public apprehension over water contamination and land degradation. DPM's proactive approach to transparent sustainability reporting, detailing efforts to reduce emissions and enhance biodiversity, is therefore vital for garnering public trust and mitigating potential opposition.

The growing influence of environmental activism directly translates into increased scrutiny of mining practices. Reports from 2024 indicated a rise in shareholder resolutions demanding greater environmental, social, and governance (ESG) accountability from resource companies. DPM's commitment to community engagement and equitable benefit-sharing, demonstrated through local employment initiatives and infrastructure investments, aims to build a positive social license to operate, countering negative public sentiment.

Public opinion can directly impact the financial viability of mining projects through regulatory hurdles and operational disruptions. For example, delays in permitting processes due to public outcry over environmental risks cost the industry billions globally in 2024. DPM's investment in advanced, low-impact extraction technologies and its clear communication strategy regarding environmental safeguards are essential for maintaining investor confidence and ensuring project continuity.

Key aspects influencing public perception for Dundee PESTLE Analysis include:

- Environmental Concerns: Public anxiety over pollution, habitat destruction, and climate change impacts from mining operations.

- Social Equity: Demand for fair distribution of benefits, respect for indigenous rights, and community well-being.

- Regulatory Scrutiny: Increased government oversight and stricter environmental regulations driven by public pressure.

- Corporate Transparency: The expectation for mining companies to openly report on their environmental and social performance.

Dundee Precious Metals (DPM) actively cultivates a positive social license to operate by investing heavily in its host communities. In 2023, the company channeled over $14.5 million into local development, covering infrastructure, education, and healthcare, which directly enhances community well-being and operational stability.

The company's commitment to local populations is a cornerstone of its strategy, directly influencing operational continuity and future growth. For instance, robust community support was a key factor in the successful advancement of DPM's polymetallic processing plant at its Chelopech operation.

DPM prioritizes local employment, with 99% of its workforce comprising nationals from its operating regions, reinforcing its dedication to community economic development. Furthermore, the company champions diversity, with a significant representation of women in senior management roles, reflecting a progressive approach to workforce composition.

Dundee Precious Metals (DPM) demonstrated a strong commitment to the well-being of its employees and surrounding communities by achieving 4.7 million hours worked without a Lost Time Injury in 2024. This focus extends to comprehensive health and safety programs, addressing both the physical and mental welfare of its workforce.

Technological factors

Technological advancements are rapidly reshaping the mining sector, with a strong emphasis on automation and digital transformation. This shift is crucial for improving safety and boosting operational efficiency. For instance, Dundee Precious Metals' (DPM) Chelopech mine is a prime example, leveraging underground Wi-Fi and autonomous drones to set new standards in digital innovation within mining operations.

The mining industry is increasingly adopting technologies like autonomous vehicles, remote operating centers, and integrated real-time data systems. These innovations are not just isolated experiments; they represent a growing trend across the entire sector, aiming to streamline processes and provide better control over complex mining environments.

Technological advancements are revolutionizing how mineral resources are found and understood. AI-driven exploration, for instance, allows for much more accurate and efficient pinpointing and defining of valuable mineral deposits. This is a game-changer for the industry, making the search for new resources faster and more cost-effective.

Dundee Precious Metals (DPM) is actively leveraging these technologies in its in-mine and brownfield exploration efforts. A prime example is their success at the Chelopech mine, where exploration programs have effectively extended its operational life through to 2032. This proactive approach ensures a more stable and predictable future production pipeline.

Continuous innovation in how ore is processed and metals are recovered is crucial for maximizing extraction and boosting operational efficiency. This ongoing advancement directly impacts profitability by ensuring more valuable material is salvaged from the earth.

Dundee Precious Metals' Chelopech operation, for instance, has demonstrated the tangible benefits of these innovations, reporting improved gold recoveries. These enhancements directly contributed to its overall production figures, showcasing the practical impact of technological upgrades in real-world mining scenarios.

Further research and development in ore processing and recovery technologies hold the potential for substantial cost reductions. By optimizing these processes, companies can achieve higher yields from their existing reserves, making operations more sustainable and financially attractive.

Predictive Maintenance and Asset Management

Technological advancements in predictive maintenance are revolutionizing the mining sector. By employing data analytics and artificial intelligence, companies can now anticipate equipment failures before they occur, significantly reducing costly downtime. These sophisticated systems analyze real-time sensor data from machinery, allowing for proactive repairs and maintenance scheduling.

Dundee Precious Metals (DPM) can harness these cutting-edge technologies to enhance its asset management strategies. Implementing predictive maintenance systems allows DPM to optimize the performance and longevity of its critical mining equipment, thereby minimizing operational disruptions and improving overall efficiency. This proactive approach is crucial for maintaining a competitive edge in the demanding mining industry.

- Data Analytics & AI: Mining companies increasingly use these to predict equipment failures, with some reporting a 20-30% reduction in unplanned downtime.

- Sensor Technology: Advanced sensors collect vital data on vibration, temperature, and pressure, feeding into AI algorithms for analysis.

- Asset Lifespan Extension: Predictive maintenance can extend the operational life of heavy mining machinery by up to 15-20% through timely interventions.

- Operational Efficiency: By minimizing breakdowns, DPM can achieve higher uptime for its assets, directly impacting production output and cost control.

Sustainable Mining Technologies

Technological advancements are crucial for Dundee Precious Metals (DPM) in achieving its sustainability goals. The company is actively implementing energy-efficient solutions, such as advanced ventilation systems and variable speed drives, to lower power consumption. For instance, in 2023, DPM reported a 5% reduction in energy intensity across its operations compared to the previous year, partly due to these technological upgrades.

Water recycling technologies are also a key focus, with DPM investing in closed-loop water systems at its mines. These systems aim to minimize freshwater intake and reduce the volume of tailings water discharged. The company's Chelopech operation in Bulgaria, for example, achieved an 85% water recycling rate in 2023, a significant improvement from 78% in 2022.

Innovations to reduce greenhouse gas emissions are being explored and implemented, including the adoption of lower-emission vehicles and exploring the potential of renewable energy sources. DPM is also piloting technologies for dust suppression and tailings management to further improve its environmental footprint. These technological investments not only bolster environmental performance but also contribute to operational cost savings and enhanced resource efficiency.

Key technological factors influencing DPM's sustainable mining practices include:

- Energy-efficient equipment: Implementation of advanced ventilation, lighting, and processing machinery to reduce electricity consumption.

- Water management systems: Deployment of water recycling and treatment technologies to minimize freshwater usage and wastewater discharge.

- Emission reduction technologies: Adoption of lower-emission vehicles, exploration of alternative fuels, and improved dust control measures.

- Digitalization and automation: Utilizing data analytics and automation for optimized resource extraction and reduced waste.

Technological advancements are crucial for Dundee Precious Metals (DPM) in achieving its sustainability goals, with a 5% reduction in energy intensity reported in 2023. The company is investing in closed-loop water systems, achieving an 85% water recycling rate at its Chelopech operation in 2023. Innovations in emission reduction and digitalization are also key to improving environmental performance and operational efficiency.

| Technology Area | DPM Initiative/Impact | 2023 Data Point | 2022 Data Point |

|---|---|---|---|

| Energy Efficiency | Advanced ventilation, variable speed drives | 5% reduction in energy intensity | N/A |

| Water Management | Closed-loop water systems | 85% water recycling rate (Chelopech) | 78% water recycling rate (Chelopech) |

| Emission Reduction | Lower-emission vehicles, dust suppression | Ongoing pilot programs | Ongoing pilot programs |

Legal factors

Dundee Precious Metals (DPM) must navigate a complex web of national mining laws across its operational regions, including Bulgaria, Namibia, and Serbia. These regulations govern everything from exploration rights to environmental protection and worker safety, requiring constant vigilance and adaptation. For instance, in Bulgaria, the Mining and Subsoil Use Act sets stringent requirements for environmental impact assessments and rehabilitation plans.

Obtaining and maintaining necessary licenses and permits is a critical legal hurdle for DPM. This includes exploration licenses, mining permits, and various environmental clearances, each with its own set of procedural and compliance demands. Failure to secure or renew these can halt operations, as seen in the past with delays in permit renewals impacting project timelines in the mining sector globally.

Non-compliance with these national mining laws carries significant risks. Penalties can range from substantial fines to the revocation of operating licenses, leading to severe operational disruptions and considerable financial losses. Furthermore, a history of non-compliance can inflict lasting reputational damage, affecting investor confidence and community relations, which is a key concern for publicly traded companies like DPM.

Environmental permitting is a critical legal factor for Dundee Precious Metals (DPM). Operations in jurisdictions like Bulgaria are governed by robust environmental legislation, such as the Environmental Protection Act, which enforces strict liability for any environmental damage caused. This means DPM must proactively manage its environmental footprint to avoid significant legal and financial repercussions.

Meeting these stringent regulations necessitates DPM securing and diligently adhering to various environmental permits for all its operational activities. The company's stated commitment to achieving zero industrial wastewater discharge and actively reducing emissions demonstrates a strategic approach to fulfilling these legal obligations and mitigating potential liabilities.

Dundee Precious Metals (DPM) must rigorously adhere to Namibia's labor laws, encompassing worker rights, health, safety, and employment conditions. Recent reports from Namibia indicate that some mining firms are circumventing labor protections for contract workers, despite laws mandating equal treatment with permanent employees. This underscores the critical need for DPM to ensure its employment practices are fully compliant with national legislation and align with international standards to avoid legal repercussions and maintain a positive workforce.

Taxation and Royalty Regimes

The legal framework surrounding taxation and royalty payments is a critical determinant of Dundee Precious Metals' (DPM) financial health. Fluctuations in these government-imposed levies directly influence the company's profitability and operational costs.

For instance, the introduction of a one-time levy in Bulgaria during the first quarter of 2025 serves as a prime example of how shifts in fiscal policy can immediately impact DPM's cost structure. Such changes necessitate careful financial planning and a proactive approach to compliance.

- Taxation and Royalty Impact: Government levies directly affect DPM's net income and cash flow.

- Bulgarian Levy Example: A one-time levy in Bulgaria in Q1 2025 illustrates the immediate financial consequences of regulatory changes.

- Financial Planning Necessity: Adapting to evolving tax and royalty regimes is essential for robust financial forecasting and stability.

International and Regional Legal Frameworks

Dundee Precious Metals (DPM) navigates a complex web of international and regional legal frameworks, significantly influenced by its operations within Bulgaria. The European Union's directives, for instance, play a crucial role in shaping national legislation related to environmental standards, worker safety, and corporate accountability. These overarching regulations can impose stringent requirements on mining and processing activities, impacting operational costs and compliance strategies.

Bulgaria, as an EU member state, must align its national laws with EU directives. For DPM, this means adhering to regulations concerning:

- Environmental Protection: EU environmental legislation, such as the Water Framework Directive and the Industrial Emissions Directive, sets benchmarks for pollution control and waste management, directly affecting DPM's mining and smelting operations. In 2024, Bulgaria continued to implement stricter environmental monitoring protocols aligned with EU standards, requiring significant investment in emissions reduction technologies.

- Human Rights and Labor Standards: International conventions and EU social policies dictate standards for employee rights, health, and safety. DPM must ensure its labor practices comply with these frameworks, which are increasingly focused on fair wages, safe working conditions, and preventing forced labor.

- Corporate Governance: EU directives on corporate governance, transparency, and financial reporting influence how DPM structures its management and discloses its financial performance. Compliance with these regulations is essential for maintaining investor confidence and market access.

Dundee Precious Metals (DPM) must navigate evolving legal landscapes, particularly concerning environmental compliance and taxation. In 2024, Bulgaria, an EU member, continued to implement stricter environmental monitoring, impacting DPM's operational costs as it invested in emissions reduction technologies. Furthermore, a one-time levy introduced in Bulgaria in Q1 2025 demonstrates the immediate financial impact of regulatory shifts, underscoring the need for robust financial planning and adaptation to tax and royalty regimes.

Environmental factors

Dundee Precious Metals (DPM) is proactively managing its environmental impact, particularly concerning climate change and greenhouse gas (GHG) emissions. The company has established clear targets and is actively implementing strategies to shrink its carbon footprint.

Demonstrating tangible progress, DPM achieved a significant reduction of over 25% in absolute Scope 1 and 2 GHG emissions from its mining operations in 2024, measured against a 2020 baseline. This achievement underscores a commitment to environmental stewardship and aligns with broader governmental objectives, such as Bulgaria's pledge to attain climate neutrality by 2050.

Water is a critical resource for mining operations, and its sustainable management is an environmental priority for Dundee Precious Metals (DPM). In 2024, DPM achieved a significant milestone by recycling 42% of the water consumed across its operations, showcasing a robust approach to water conservation.

Furthermore, DPM successfully maintained zero industrial wastewater discharge at its mine sites in 2024. This accomplishment underscores the company's strong commitment to responsible water stewardship and minimizing its environmental footprint.

Dundee Precious Metals (DPM) acknowledges that mining operations inherently affect local biodiversity and land use. This necessitates comprehensive environmental management plans to mitigate these impacts. For instance, DPM's 2023 Sustainability Report highlights a commitment to biodiversity conservation, though specific land reclamation figures for 2024/2025 are still being developed as part of their ongoing strategy.

While detailed land reclamation metrics for the upcoming period are not yet public, DPM's overarching sustainability framework emphasizes minimizing environmental footprints. This strategic focus suggests proactive measures in biodiversity protection and land rehabilitation, aligning with industry best practices and regulatory expectations for 2024 and 2025.

Waste Management and Tailings Storage Facilities

Effective waste management, especially for mining tailings, remains a critical environmental concern for companies like Dundee Precious Metals (DPM). While DPM divested its Tsumeb smelter in March 2024, prior investments in environmental performance, such as reducing sulfur dioxide emissions, highlight the industry's focus on mitigating impacts. The ongoing responsible stewardship of mine waste facilities, exemplified by Ada Tepe's integrated approach, underscores the necessity of robust containment and monitoring systems to prevent environmental contamination.

Dundee's commitment to responsible waste management is a key environmental consideration. For instance, the company's Ada Tepe mine in Bulgaria features an integrated mine waste facility, designed to manage tailings and waste rock in a single, contained unit. This approach aims to minimize the footprint and potential for environmental release.

- Tsumeb Smelter Divestment: Dundee Precious Metals completed the sale of its Tsumeb smelter in Namibia in March 2024, shifting its operational focus.

- Environmental Investments: Prior to the sale, DPM made substantial investments in environmental upgrades at Tsumeb, including significant reductions in sulfur dioxide emissions, demonstrating a past commitment to improving performance.

- Ada Tepe Integrated Facility: The Ada Tepe mine in Bulgaria utilizes an integrated mine waste management facility, consolidating tailings and waste rock to enhance environmental control and reduce land disturbance.

- Ongoing Compliance: Continued adherence to stringent environmental regulations for tailings storage facilities is paramount for maintaining operational licenses and stakeholder trust in the mining sector.

Pollution Control and Environmental Impact Assessments

DPM's operations are significantly shaped by stringent pollution control regulations and the necessity for comprehensive environmental impact assessments. In Bulgaria, for instance, the Environmental Protection Act enforces strict liability for any environmental damage caused, highlighting the critical need for effective pollution prevention strategies.

These regulations necessitate substantial investment in pollution control technologies and ongoing monitoring. For example, in 2024, environmental compliance costs for mining operations globally are projected to increase, with specific investments in air quality management and water treatment technologies being paramount.

DPM's past actions, such as its efforts to reduce arsenic exposure at the Tsumeb smelter prior to its divestment, demonstrate a commitment to mitigating harmful emissions. This proactive approach is crucial, as companies face increasing scrutiny and potential financial penalties for environmental non-compliance. By 2025, the trend towards stricter enforcement and higher fines for environmental violations is expected to continue, making robust environmental management a key business imperative.

- Environmental Regulations: DPM must adhere to strict pollution control measures and environmental impact assessments, particularly in jurisdictions like Bulgaria with its Environmental Protection Act.

- Liability and Prevention: The Bulgarian Act imposes strict liability, underscoring the importance of proactive pollution prevention to avoid significant financial and legal repercussions.

- Historical Commitment: DPM's prior work on reducing arsenic emissions at the Tsumeb smelter showcases a history of addressing environmental concerns, a practice vital for current and future operations.

- Investment in Compliance: Global environmental compliance costs for mining are rising, with significant capital allocation directed towards air and water quality management systems.

Dundee Precious Metals (DPM) is actively managing its environmental footprint, with a notable 25% reduction in Scope 1 and 2 GHG emissions in 2024 compared to a 2020 baseline. The company also achieved a significant water conservation milestone, recycling 42% of its water consumption in 2024 and maintaining zero industrial wastewater discharge at its mine sites. While specific land reclamation data for 2024/2025 is still being developed, DPM's strategy emphasizes biodiversity conservation and minimizing its overall environmental impact.

The company's environmental management is further shaped by strict pollution control regulations, such as Bulgaria's Environmental Protection Act, which imposes strict liability for environmental damage. This necessitates ongoing investment in pollution control technologies and monitoring, with global environmental compliance costs for mining projected to rise. DPM's historical commitment to reducing harmful emissions, like arsenic at the Tsumeb smelter prior to its 2024 divestment, highlights the critical importance of robust environmental stewardship in the face of increasing regulatory scrutiny and potential penalties.

PESTLE Analysis Data Sources

Our Dundee PESTLE Analysis is meticulously constructed using data from official Scottish government publications, local council reports, and reputable economic and social research institutions. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in accurate, region-specific information.