Dundee Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dundee Bundle

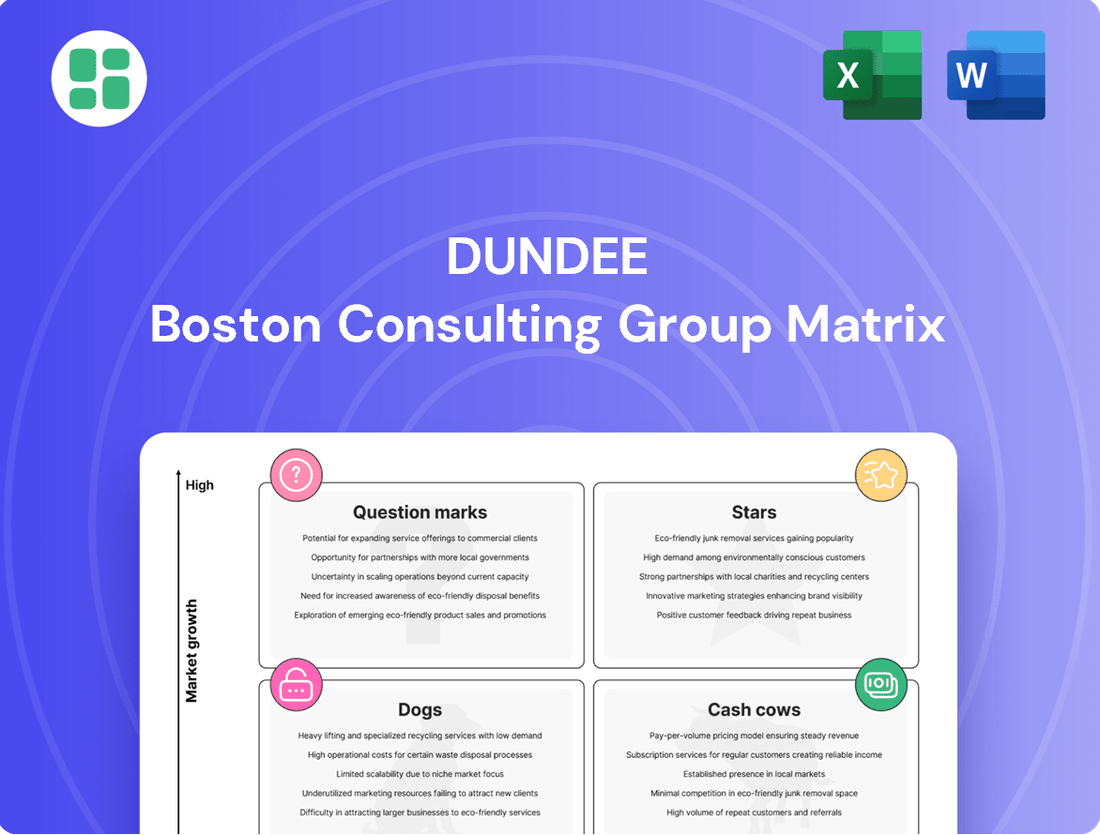

Uncover the strategic positioning of a company's product portfolio with the Dundee BCG Matrix, a powerful tool that categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This insightful framework helps identify where to invest, divest, or nurture your offerings for optimal business performance. Purchase the full Dundee BCG Matrix for a comprehensive analysis and actionable strategies to drive your business forward.

Stars

The Čoka Rakita project in Serbia is a pivotal development for Dundee Precious Metals, poised to become a significant growth engine. A feasibility study is expected to wrap up by the end of 2025, with initial production anticipated in 2028.

This project is projected to deliver around 170,000 ounces of gold per year for its first five years, boasting a remarkably low all-in sustaining cost of $644 per ounce. This strong production profile and cost efficiency firmly establish Čoka Rakita as a future star within Dundee's portfolio.

The Loma Larga gold project in Ecuador is advancing significantly, with a crucial updated feasibility study slated for completion in the second quarter of 2025. This project is a key growth engine for the company, holding an estimated 1.9 million gold ounces and 80 million pounds of copper in mineral reserves.

Further bolstering its development, the project secured its environmental license in the second quarter of 2025, a critical step towards unlocking its potential. Loma Larga’s substantial resource base and strategic importance align perfectly with the company's goal of expanding its portfolio of high-quality assets.

Dundee Precious Metals is making significant strides in exploration, notably at its Čoka Rakita camp. A substantial 55,000-meter scout drilling program is underway, targeting areas with high potential for new discoveries.

Early findings from prospects such as Dumitru Potok and Frasen are particularly encouraging. These results suggest a strong possibility of expanding existing mineral resources, which could pave the way for substantial future production growth for the company.

Strategic Acquisition Pipeline

Dundee Precious Metals (DPM) actively manages its strategic acquisition pipeline to bolster mineral reserves and production. A key element of this strategy involves evaluating external opportunities that can complement its organic growth. For instance, the proposed acquisition of Adriatic Metals in 2024 exemplifies DPM's approach to potentially adding high-growth assets to its portfolio, aiming to enhance its overall market position and future production capabilities.

This disciplined approach to strategic transactions is crucial for DPM's long-term vision. By identifying and pursuing acquisitions like Adriatic Metals, DPM seeks to ensure a robust pipeline of development projects and operating mines. The company's focus remains on assets that align with its operational expertise and financial objectives, ensuring that each potential acquisition contributes meaningfully to shareholder value and sustainable growth.

The strategic acquisition pipeline is a vital component of DPM's business model, directly impacting its ability to expand its resource base and increase output. As of early 2024, the company's ongoing evaluation of potential targets underscores its commitment to proactive portfolio management. This includes assessing the geological potential, operational synergies, and economic viability of prospective acquisitions to maintain a competitive edge in the precious metals sector.

- Strategic Objective: Support growth in mineral reserves and production through disciplined strategic transactions.

- Key Transaction Example: Proposed acquisition of Adriatic Metals in 2024.

- Pipeline Management: Evaluating external opportunities to complement organic growth.

- Portfolio Enhancement: Potential to add more high-growth assets to the company's portfolio.

Optimized Production Profile

Dundee Precious Metals anticipates an optimized production profile, with higher output expected in the latter half of 2025. This strategic approach is designed to meet their 2025 gold production guidance, which ranges from 225,000 to 265,000 ounces. The company is leveraging effective mine sequencing and anticipating grade enhancements to drive this growth trajectory.

This focus on an optimized production profile positions Dundee Precious Metals for robust performance.

- 2025 Gold Production Guidance: 225,000 to 265,000 ounces.

- Production Trend: Higher output planned for the second half of 2025.

- Key Drivers: Strategic mine sequencing and expected improvements in grades.

- Growth Trajectory: Indicates a strong upward trend for overall gold output.

The Čoka Rakita project is positioned as a future star for Dundee Precious Metals, with initial production projected for 2028 and an estimated 170,000 ounces of gold annually in its first five years. Its low all-in sustaining cost of $644 per ounce further solidifies its star status. The Loma Larga project, with its substantial mineral reserves of 1.9 million gold ounces and 80 million pounds of copper, is also a key growth driver and a strong candidate for star status, especially after securing its environmental license in Q2 2025.

| Project | Status/Milestone | Estimated Production (First 5 Years) | Estimated AISC | Potential Classification |

|---|---|---|---|---|

| Čoka Rakita | Feasibility Study by end of 2025, Production 2028 | 170,000 oz gold/year | $644/oz | Star |

| Loma Larga | Updated Feasibility Study Q2 2025, Environmental License Q2 2025 | (Not specified, but substantial reserves) | (Not specified) | Star |

What is included in the product

Strategic insights into Dundee's product portfolio, categorized into Stars, Cash Cows, Question Marks, and Dogs.

The Dundee BCG Matrix provides a clear, visual overview of your business portfolio, instantly highlighting areas needing attention.

Cash Cows

The Chelopech mine in Bulgaria stands as a reliable performer for Dundee, showcasing consistent gold and copper output. Its established operational history underscores its importance as a stable contributor to the company's portfolio.

With an anticipated mine life extending to 2032, Chelopech offers long-term revenue predictability. For 2025, the mine is projected to produce between 160,000 and 185,000 ounces of gold, reinforcing its role as a significant cash flow generator.

The Ada Tepe mine in Bulgaria stands out as a prime example of a cash cow for Dundee Precious Metals (DPM). This high-grade, open-pit operation has been a consistent generator of significant gold production and free cash flow since its launch in 2019.

Despite facing some operational hurdles in the first quarter of 2025, Ada Tepe's production is projected to nearly double in the latter half of the year. This anticipated surge in output will solidify its role as a robust contributor to DPM's overall financial performance.

Dundee Precious Metals truly shines in its ability to generate robust free cash flow. In 2024, the company achieved a remarkable record of $305.1 million in free cash flow. This strong performance continued into 2025, with the first half alone bringing in $174 million.

This consistent and substantial cash generation is a key indicator of Dundee's financial strength. It signifies that the company is bringing in far more cash than it needs to spend on its operations and capital expenditures. This surplus cash provides significant flexibility for future strategic moves.

The excess cash flow allows Dundee to confidently invest in promising growth projects that can further enhance its long-term value. Furthermore, it provides the financial capacity to reward shareholders, whether through dividends or other return mechanisms, underscoring the company's commitment to its investors.

Sustainable Shareholder Returns

Dundee Precious Metals (DPM) demonstrates a strong commitment to shareholder returns, a key characteristic of a Cash Cow within the BCG Matrix. The company actively manages its capital, prioritizing distributions to its investors. This approach is evident in its consistent capital allocation strategy.

DPM's disciplined capital allocation framework ensures significant capital is returned to shareholders. This is achieved through a sustainable quarterly dividend and proactive share repurchase programs. These actions directly benefit shareholders by increasing their ownership stake and providing direct income.

Reinforcing its dedication to value creation, DPM returned a record $90.4 million to shareholders in the first quarter of 2025. This substantial figure highlights the company's ability to generate strong cash flows and its commitment to sharing that success.

- Sustainable Quarterly Dividend: DPM maintains a consistent dividend payout, providing a reliable income stream for investors.

- Aggressive Share Repurchases: The company actively buys back its own stock, reducing the number of outstanding shares and potentially boosting earnings per share.

- Record Q1 2025 Distributions: In the first quarter of 2025, DPM returned $90.4 million to shareholders, underscoring its robust financial performance and shareholder focus.

- Disciplined Capital Allocation: DPM operates with a clear strategy for deploying capital, ensuring that returns to shareholders are a priority.

Strong Balance Sheet and Liquidity

Dundee Precious Metals demonstrates exceptional financial strength, a key characteristic of a Cash Cow. The company concluded 2024 with a robust cash position exceeding $800 million and maintained a debt-free status. This strong balance sheet and significant liquidity are foundational, enabling Dundee to comfortably fund ongoing operations and pursue new growth opportunities without the burden of external debt.

This financial resilience is crucial for a Cash Cow, allowing for consistent returns and strategic flexibility. Dundee's ability to self-fund its projects means it is not reliant on costly borrowing, which enhances profitability and operational stability.

- Cash Reserves: Over $800 million at the end of 2024.

- Debt Levels: Zero debt reported for 2024.

- Financial Flexibility: Substantial liquidity for growth and stability.

The Chelopech and Ada Tepe mines in Bulgaria are Dundee Precious Metals' primary Cash Cows, consistently generating substantial free cash flow. These operations are characterized by established production, long mine lives, and efficient resource extraction, ensuring predictable revenue streams.

Dundee's robust financial health, evidenced by over $800 million in cash reserves and a debt-free status at the end of 2024, further solidifies the Cash Cow classification. This financial stability allows for significant shareholder returns, including dividends and share repurchases, with a record $90.4 million returned in Q1 2025.

| Mine | Status | Projected 2025 Gold Production (oz) | Key Contribution |

|---|---|---|---|

| Chelopech | Established Producer | 160,000 - 185,000 | Stable Gold & Copper Output, Long-Term Revenue |

| Ada Tepe | High-Grade, Open-Pit | Significant (projected doubling in H2 2025) | Consistent Gold Generation, Free Cash Flow |

Delivered as Shown

Dundee BCG Matrix

The Dundee BCG Matrix preview you're examining is the identical, fully prepared document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally formatted strategic analysis ready for immediate application in your business planning.

Dogs

Dundee Precious Metals' Tsumeb smelter, a former specialty facility in Namibia, was divested in March 2024 for $49 million to Sinomine Resource Group. This move aligns with the company's strategy to focus on its core precious metals mining operations, shedding an asset that demanded substantial capital and managerial resources. The sale effectively categorizes the Tsumeb smelter as a 'Dog' within the BCG matrix for Dundee, as it represented a business with low growth potential and market share that was no longer strategically aligned with the company's future direction.

Dundee Precious Metals' decision to sell its Tsumeb smelter exemplifies non-core asset streamlining within the BCG framework. This divestiture allows the company to concentrate capital and management attention on its primary gold mining operations, aiming for enhanced efficiency and profitability in its core business. For instance, in 2023, Dundee Precious Metals reported total revenue of $687.6 million, with its gold segment being the dominant contributor.

Dundee Precious Metals (DPM) has strategically divested assets like the Tsumeb smelter, a move that significantly reduces its exposure to legacy environmental liabilities. This divestiture, completed in 2023, allows DPM to focus on its core mining operations, thereby streamlining environmental management and concentrating resources on areas with more manageable risks.

Focus on Core Gold Mining

Dundee Precious Metals' decision to divest its Tsumeb smelter signifies a deliberate move to sharpen its focus on core gold mining operations. This strategic realignment aims to bolster profitability by concentrating resources on the entire gold value chain, from exploration to processing.

This enhanced concentration on gold acquisition, exploration, development, mining, and processing is designed to leverage Dundee's expertise and maximize returns. By streamlining its business, the company anticipates a more efficient and profitable operation.

- Strategic Divestment: The sale of the Tsumeb smelter highlights Dundee Precious Metals' commitment to its core gold mining business.

- Focus on Core Competencies: This move allows Dundee to concentrate its efforts and capital on its primary strengths in precious metals production.

- Maximizing Returns: By divesting non-core assets, Dundee aims to improve overall financial performance and shareholder value.

- Streamlined Operations: The strategic shift is expected to lead to more efficient and focused operations across the gold mining lifecycle.

Avoidance of High-Cost, Low-Return Operations

Dundee Precious Metals (DPM) strategically divested its Tsumeb smelter in 2022. This action aligns with the company's focus on high-margin gold production, moving away from operations that did not fit its core precious metals strategy.

The Tsumeb smelter, though capable of processing complex concentrates, represented a significant capital commitment that was not contributing substantially to DPM's primary objectives. By shedding this asset, DPM avoids locking up valuable capital in ventures with potentially lower returns relative to its strategic goals.

- Divestment of Tsumeb Smelter: DPM sold the Tsumeb smelter in 2022.

- Strategic Alignment: The move supports DPM's focus on high-margin gold production.

- Capital Allocation: Avoids tying up capital in non-core, potentially lower-return operations.

Dundee Precious Metals' divestment of the Tsumeb smelter in March 2024 for $49 million clearly positions it as a 'Dog' in the BCG matrix. This asset exhibited low growth prospects and a declining market position, diverting resources from the company's core precious metals operations. The sale allows Dundee to reallocate capital and management focus to its more promising gold assets.

The Tsumeb smelter, a legacy asset, did not align with Dundee's strategic pivot towards high-margin gold production. Its sale for $49 million reflects a strategic decision to shed a business unit with limited future potential and significant capital demands. This move supports a more efficient allocation of resources towards the company's core mining and exploration activities.

By divesting the Tsumeb smelter, Dundee Precious Metals effectively removed a 'Dog' from its portfolio. This action streamlines operations and allows for greater investment in its gold mining segment, which generated the bulk of its $687.6 million revenue in 2023. The company's focus is now on maximizing returns from its core, high-growth assets.

| Asset | BCG Category | Strategic Rationale | Transaction Details |

|---|---|---|---|

| Tsumeb Smelter | Dog | Low growth, non-core asset | Divested March 2024 for $49 million |

| Core Gold Operations | Stars/Cash Cows | High growth, strategic focus | Dominant revenue contributor in 2023 |

Question Marks

Dundee Precious Metals is actively exploring early-stage targets, notably in Serbia at locations such as Dumitru Potok and Frasen. These sites are yielding encouraging high-grade intercepts, indicating significant potential.

However, these promising prospects necessitate considerable continued investment and extensive drilling. The primary goal is to thoroughly assess their economic feasibility and successfully convert defined resources into commercially viable reserves.

Dundee Precious Metals' brownfield exploration at Chelopech is a key component of their strategy, with a projected investment of $6 million to $7 million for 2025. These efforts are specifically targeting areas close to the existing mine to find new resources that could extend its operational life.

This focus on near-mine targets signifies a strategic bet on high growth potential, as successfully proving new reserves could significantly boost the mine's longevity and profitability. However, these initiatives are inherently risky, with outcomes remaining uncertain and requiring substantial capital outlay.

DPM is exploring cutting-edge technologies like advanced ore sorting at its Chelopech mine. This innovation aims to extract value from ore bodies previously considered uneconomical, potentially boosting production and lowering costs.

While the commercial viability and full impact of these technologies are still under evaluation, early assessments suggest they could significantly enhance future operational efficiency. For instance, successful implementation could lead to a substantial reduction in waste material, directly impacting processing costs.

Potential Future Acquisitions

Dundee Precious Metals actively explores acquisitions to bolster its mineral reserves and production. These potential targets, while offering significant growth upside, are classified as question marks due to the inherent risks. Integration challenges, accurate resource estimation, and market acceptance are key hurdles that need to be overcome before these ventures can be considered stars.

For instance, in early 2024, the company was reportedly evaluating several exploration-stage projects in Latin America. These projects, while possessing promising geological indicators, require substantial capital investment for exploration and development. The success of these acquisitions hinges on drilling results and the ability to secure permits, making their future performance uncertain.

- Acquisition Targets: Exploration-stage projects in Latin America being evaluated in early 2024.

- Growth Potential: Significant upside in mineral reserves and production if successful.

- Inherent Risks: Integration challenges, resource estimation accuracy, and market acceptance.

- De-risking Factors: Successful drilling results and obtaining necessary permits are crucial.

Resource Conversion and Mine Life Extension

Dundee Precious Metals (DPM) actively works to extend the life of its mines by converting inferred and indicated mineral resources into proven and probable reserves. This is a crucial strategy for long-term sustainability.

At its Chelopech and Ada Tepe operations, DPM is making significant investments in exploration drilling and detailed technical studies. These efforts are designed to de-risk and upgrade the resource base, ultimately aiming to prolong profitable mining operations beyond initial projections.

The success of resource conversion is directly linked to ongoing capital allocation for exploration and geological evaluation. While the potential upside is substantial, the conversion rates can fluctuate, making it a dynamic aspect of mine planning and life extension.

- Resource Conversion Focus: DPM's strategy includes converting lower confidence inferred and indicated resources into higher confidence proven and probable reserves.

- Key Projects: Chelopech and Ada Tepe are primary targets for these mine life extension initiatives.

- Investment Drivers: Continuous investment in drilling programs and comprehensive technical studies are essential for this conversion process.

- Potential vs. Reality: While conversion offers high potential for future production, the success rate can vary, impacting the certainty of extended mine lives.

Question Marks in Dundee Precious Metals' portfolio represent early-stage exploration targets and potential acquisitions. These ventures, while holding the promise of significant future growth, are characterized by high uncertainty and require substantial investment to determine their economic viability.

For example, in early 2024, DPM was actively evaluating exploration-stage projects in Latin America. These projects, though showing promising geological indicators, demand considerable capital for exploration and development, making their future performance a question mark until drilling results and permitting are secured.

The success of these question marks hinges on de-risking factors such as positive drilling outcomes and the ability to obtain necessary permits. Without these, the significant growth potential remains unrealized, and the inherent risks of integration challenges and accurate resource estimation persist.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and industry growth forecasts, ensuring a robust and accurate strategic overview.