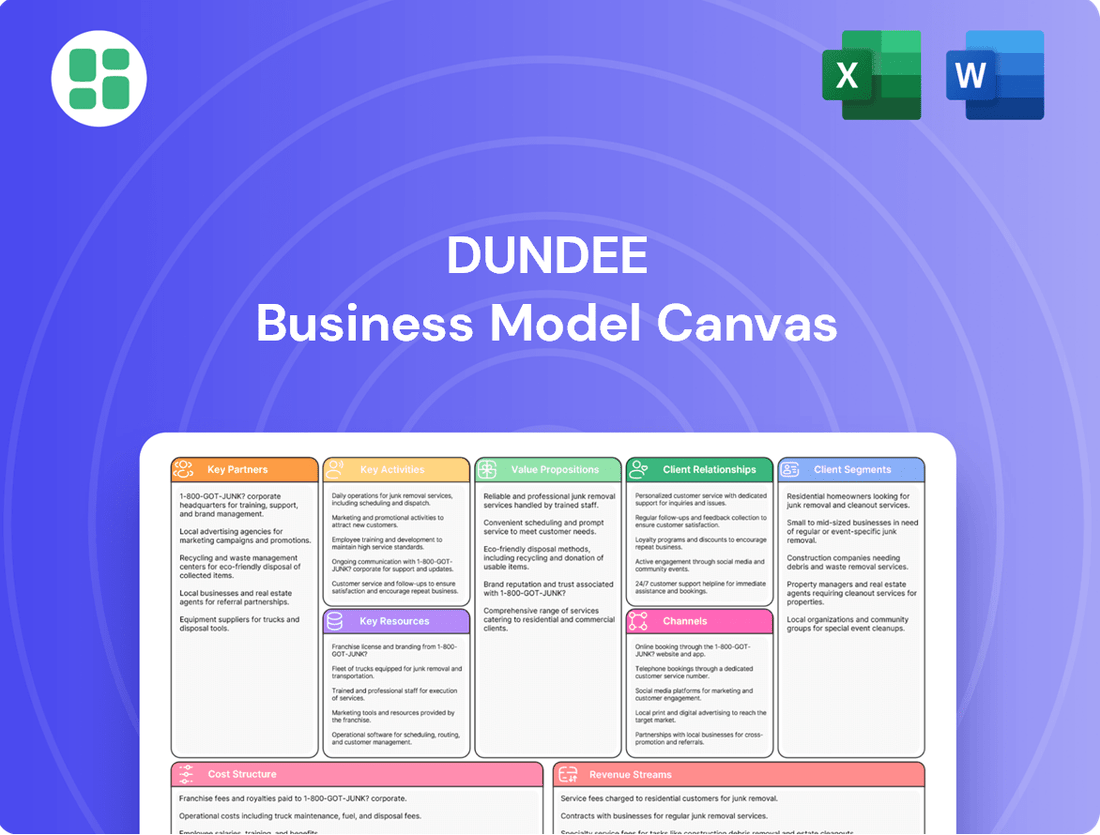

Dundee Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dundee Bundle

Curious about the engine driving Dundee's success? Our comprehensive Business Model Canvas lays bare their customer relationships, revenue streams, and key resources. Discover the strategic framework that fuels their growth and gain invaluable insights for your own ventures.

Partnerships

Dundee Precious Metals actively pursues strategic acquisitions of high-quality precious metal properties worldwide. A prime example is their proposed acquisition of Adriatic Metals in June 2025, a deal valued at roughly $1.3 billion. This move highlights Dundee's commitment to enhancing its production capabilities and broadening its geographical footprint.

The acquisition of assets like the Vareš silver-lead-zinc-gold operation in Bosnia and Herzegovina is central to this strategy. These acquisitions are designed to bolster Dundee's asset base and fuel its future growth trajectory.

Dundee Precious Metals actively cultivates robust partnerships with local communities and governments across its operational areas, including Bulgaria, Namibia, Serbia, and Ecuador. These collaborations are fundamental to obtaining and sustaining a social license to operate, streamlining permitting, and upholding responsible mining standards.

In 2024, Dundee continued to demonstrate this commitment by investing in community development projects. For instance, in Bulgaria, the company supported local infrastructure improvements and educational programs, contributing to the overall well-being of the region. These initiatives are designed to create shared value and ensure long-term operational stability.

Dundee Precious Metals (DPM) actively partners with technology and service providers to enhance its mining and processing operations. These collaborations are crucial for adopting cutting-edge exploration methods and advanced processing techniques, ensuring operational efficiency and innovation. For instance, in 2024, DPM continued to leverage specialized geological software and drone technology for more precise resource mapping, contributing to optimized mine planning and reduced exploration costs.

These strategic alliances also extend to environmental management solutions, helping DPM maintain industry-leading best practices. By working with environmental technology firms, the company aims to reduce its ecological footprint and ensure compliance with stringent regulations. In 2024, DPM invested in advanced water treatment technologies, significantly improving water recycling rates at its Chelopech operation.

Through these key partnerships, Dundee Precious Metals benefits from cost optimization and improved safety protocols. Collaborations with equipment manufacturers and maintenance service providers ensure the reliability of its fleet and processing plants. This focus on technological integration and service excellence directly supports DPM's goal of achieving safer, more efficient, and environmentally responsible mining operations.

Financial Institutions and Investors

Dundee Precious Metals cultivates robust relationships with a wide array of financial institutions and investors. These partnerships are fundamental for securing the capital needed to fuel growth, effectively manage its financial resources, and maintain healthy liquidity. For instance, in the first quarter of 2024, Dundee reported cash and cash equivalents of $165.8 million, underscoring its ability to manage its financial position.

The company actively engages in shareholder outreach, a strategy designed to gather valuable feedback and ensure transparency. This includes providing clear communication on key areas such as corporate governance, executive compensation structures, and the company's commitment to sustainability initiatives. Such proactive engagement fosters trust and alignment with its investor base.

Dundee's strong financial standing and substantial liquidity are cornerstones of its strategic approach. This financial resilience enables the company to pursue disciplined strategic transactions and deliver returns to its shareholders. The company's ability to generate free cash flow, as evidenced by its positive cash flow from operations in early 2024, supports these objectives.

- Financial Institutions: Banks and other lenders providing credit facilities and transaction support.

- Diverse Investor Base: Including institutional investors, retail shareholders, and private equity firms.

- Shareholder Outreach: Regular engagement to discuss governance, compensation, and sustainability.

- Liquidity Management: Maintaining sufficient cash and credit lines for operational needs and strategic opportunities.

Supply Chain Partners

Dundee Precious Metals cultivates strong alliances with its suppliers and contractors, crucial for maintaining smooth operations and controlling expenses. These partnerships are vital for ensuring the consistent and timely arrival of essential equipment and materials, while also upholding sustainability commitments. In 2023, Dundee reported that approximately 80% of its procurement spend was with third-party suppliers, underscoring the significance of these relationships.

The company actively engages in due diligence, including third-party reviews, to thoroughly assess environmental and social considerations throughout its supply chain. This proactive approach helps mitigate risks and ensures alignment with Dundee's responsible mining practices. For instance, their commitment to ethical sourcing means suppliers must adhere to specific codes of conduct related to labor practices and environmental protection.

- Supplier Reliability: Ensuring consistent access to mining equipment, explosives, and specialized services.

- Cost Efficiency: Negotiating favorable terms for raw materials and logistics to optimize operational costs.

- Sustainability Compliance: Verifying that suppliers meet environmental and social governance (ESG) standards.

- Risk Mitigation: Identifying and addressing potential disruptions or ethical concerns within the supply network.

Dundee Precious Metals' Key Partnerships are multifaceted, encompassing strategic acquisitions, community and government relations, technology providers, and financial institutions. These collaborations are vital for operational efficiency, sustainable growth, and financial stability. The company's proactive engagement with all stakeholders ensures a robust framework for its mining ventures worldwide.

What is included in the product

A structured framework for outlining and analyzing a business's strategic approach, detailing key components like customer relationships and revenue streams.

The Dundee Business Model Canvas provides a structured framework to systematically identify and address customer pains, offering a clear path to developing targeted value propositions.

Activities

Dundee Precious Metals' primary focus is the safe and efficient mining of gold and copper. Their operations in Bulgaria, specifically the Chelopech and Ada Tepe mines, are central to this activity. The company is known for consistently achieving its production targets, showcasing a high level of operational capability.

These activities encompass the day-to-day management of mining processes, including the extraction of ore and its initial processing. The goal is to produce valuable concentrates that are ready for further refinement. In 2023, Dundee Precious Metals reported strong operational results, with gold production at Chelopech exceeding expectations and copper production also performing well.

Dundee Precious Metals' core activity involves the continuous exploration and development of mineral resources. This is crucial for extending the operational life of their mines and uncovering new avenues for growth.

In 2024, Dundee significantly boosted its exploration budget. A major focus is on advancing promising projects such as Čoka Rakita in Serbia and Loma Larga in Ecuador, reflecting a strategic commitment to future production.

These efforts translate into extensive drilling campaigns and detailed feasibility studies. Such work is essential to move promising mineral deposits through the various stages of project development, ultimately aiming for commercial viability.

Dundee Precious Metals is deeply involved in transforming mined ore into valuable precious metal concentrates, with a significant focus on gold and copper. This core activity relies on sophisticated metallurgical techniques to maximize metal recovery and guarantee the purity and quality of its final products.

The company’s operational efficiency in these processing stages is a key driver of its competitive advantage. For instance, in 2023, Dundee reported an all-in sustaining cost of $1,154 per ounce of gold sold, demonstrating their commitment to cost management through effective processing.

These efficient processes not only contribute to a low-cost production structure but also bolster the company's profit margins. By optimizing metallurgical recovery rates, Dundee ensures that a higher proportion of the valuable metals extracted from the ore is successfully captured and refined, directly impacting financial performance.

Sustainable and Responsible Mining Practices

Dundee Precious Metals actively pursues sustainable and responsible mining, focusing on reducing environmental footprints and enhancing community benefits. This commitment is demonstrated through rigorous environmental management systems and robust community engagement initiatives, ensuring that mining operations contribute positively to local economies and societies.

The company adheres to leading international reporting standards, including the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB), to ensure transparency and accountability in its environmental, social, and governance (ESG) performance. This dedication to transparent reporting underscores their role as a responsible corporate citizen.

- Environmental Stewardship: Dundee Precious Metals implements advanced environmental management systems to minimize impacts, such as water management and biodiversity protection.

- Socio-Economic Value: They prioritize maximizing socio-economic benefits for local communities through employment, local procurement, and community development projects.

- Worker Safety: Ensuring the health and safety of all employees and contractors is paramount, with comprehensive safety protocols and training programs in place.

- Transparent Reporting: Dundee Precious Metals is committed to transparently reporting its ESG performance, aligning with GRI and SASB standards to provide stakeholders with accurate and comprehensive information.

Capital Allocation and Shareholder Returns

Strategic capital allocation is a cornerstone activity for Dundee Precious Metals, prioritizing investments in growth initiatives, maintaining a robust balance sheet, and delivering value back to its shareholders. This disciplined approach involves effectively managing free cash flow, executing strategic share repurchase programs, and consistently distributing quarterly dividends.

Dundee Precious Metals has demonstrated a commitment to shareholder returns, evidenced by its consistent dividend payments and share buybacks. For instance, in 2023, the company returned approximately $51.7 million to shareholders through dividends and share repurchases, reflecting a steady financial strategy.

- Capital Allocation Focus: Funding growth projects and strengthening the balance sheet are primary objectives.

- Shareholder Returns: This includes managing free cash flow, share repurchases, and quarterly dividends.

- 2023 Performance: Dundee returned around $51.7 million to shareholders via dividends and buybacks.

- Financial Discipline: The company's track record highlights a consistent and disciplined approach to capital management.

Dundee Precious Metals' key activities revolve around the responsible extraction and processing of gold and copper. They focus on operational efficiency, aiming to maximize metal recovery and maintain cost-effective production. The company also prioritizes exploration and development to ensure long-term resource growth and mine life extension.

Full Version Awaits

Business Model Canvas

The Dundee Business Model Canvas preview you're viewing is an exact representation of the final document you will receive upon purchase. This is not a sample or a mockup; it's a direct excerpt from the complete, ready-to-use file. You can be confident that the structure, content, and formatting you see here are precisely what you'll get, ensuring no surprises and immediate usability.

Resources

Dundee Precious Metals' most critical key resource is its extensive portfolio of mineral reserves and resources. These geological assets, primarily gold and copper deposits, are located in Bulgaria, Namibia, Serbia, and Ecuador, forming the bedrock of the company's current production and future growth potential.

As of the end of 2023, Dundee reported proven and probable mineral reserves of 3.2 million ounces of gold and 1.3 billion pounds of copper. The company's ongoing exploration efforts are crucial for expanding these reserves and upgrading identified resources, ensuring the sustainability of its operations for years to come.

Dundee Precious Metals' operating mines, Chelopech and Ada Tepe in Bulgaria, are foundational to its business. These sites, along with their processing plants and crucial infrastructure, are the engines for extracting and refining valuable metals.

In 2023, Chelopech produced 191,400 ounces of gold and 50.2 million pounds of copper, while Ada Tepe contributed 54,500 ounces of gold. This robust production highlights the operational capacity and strategic importance of these physical assets.

The company's ongoing investment in optimizing these facilities underscores a commitment to operational efficiency and sustainable practices, ensuring these key resources remain productive and environmentally responsible for future extraction.

Dundee's operational success hinges on its highly skilled workforce, encompassing geologists, engineers, metallurgists, and operational staff. This pool of talent is crucial for efficient mining and processing operations.

Experienced management provides the strategic direction and oversight necessary for innovation and project development. Their expertise ensures that Dundee can navigate complex challenges and capitalize on opportunities within the mining sector.

The company's ability to consistently meet its production guidance, as demonstrated in its 2024 performance, underscores the critical role of its human capital. This reliability in execution reflects the depth of skill and dedication within Dundee's team.

Financial Capital and Liquidity

Dundee Precious Metals' financial capital is a cornerstone of its business model, providing the muscle for its operations. This includes not just the cash readily available but also the ability to tap into credit when needed, which is vital for everything from day-to-day running to bigger investments and even buying other companies.

The company’s financial health is a major asset. Dundee Precious Metals has consistently shown a strong balance sheet and ample liquidity. This financial stability allows them to confidently chase growth prospects and also reward their investors.

Looking at their performance, as of the second quarter of 2025, Dundee Precious Metals reported a solid cash position. Importantly, they had no outstanding debt at that time, which significantly enhances their financial flexibility and reduces risk.

Key Financial Resources:

- Substantial cash reserves: Enabling immediate operational funding and strategic deployment.

- Access to credit facilities: Providing a safety net and capacity for larger investments.

- Robust balance sheet: Demonstrating financial strength and stability.

- Zero debt as of Q2 2025: Indicating high financial flexibility and low leverage.

Technology and Intellectual Property

Dundee Corporation's proprietary mining and processing technologies are crucial intangible assets. These innovations allow for efficient extraction and value creation from challenging ore bodies. In 2024, the company continued to invest in research and development, aiming to enhance its competitive edge through technological advancements.

Intellectual property, particularly concerning exploration data and sophisticated geological models, forms another cornerstone of Dundee's key resources. This data-driven approach underpins strategic decision-making and operational optimization. The company's commitment to refining these models in 2024 is expected to yield improved resource identification and extraction success rates.

- Proprietary Technologies: Dundee's unique mining and processing methods are central to its operational efficiency and cost management.

- Intellectual Property: Valuable exploration data and advanced geological models provide a significant competitive advantage.

- Innovation Focus: Continuous R&D in environmental management and cost reduction through technology is a key driver for sustained growth.

Dundee Precious Metals' intellectual property and proprietary technologies are vital intangible assets. These innovations, focused on efficient extraction and value creation from complex ore bodies, were further developed through R&D investments in 2024. This focus on technological advancement is key to maintaining a competitive edge in the mining sector.

The company's intellectual capital extends to its sophisticated geological models and extensive exploration data. This data-driven approach informs strategic decisions and optimizes operations, with ongoing refinement in 2024 expected to improve resource identification and extraction success.

These intangible resources, including unique processing methods and valuable exploration data, are central to Dundee's operational efficiency, cost management, and sustained growth, particularly through innovation in environmental management and cost reduction.

| Key Intangible Resource | Description | 2024/2025 Relevance |

|---|---|---|

| Proprietary Mining & Processing Technologies | Unique methods for efficient extraction and value creation from challenging ores. | Enhanced operational efficiency and cost management; continued R&D investment. |

| Intellectual Property (Exploration Data & Geological Models) | Extensive datasets and advanced models for strategic decision-making and operational optimization. | Data-driven insights for improved resource identification and extraction success rates. |

| Environmental Management Innovations | Technological advancements in reducing environmental impact and improving sustainability. | Key driver for responsible operations and long-term license to operate. |

Value Propositions

Dundee Precious Metals provides reliable, low-cost gold and copper production, a core value for its business model. The company consistently meets its production targets, showcasing operational excellence.

This reliability translates into competitive all-in sustaining costs, a crucial factor in the mining sector. In 2024, Dundee continued to demonstrate strong cost management, a key driver of its profitability.

Dundee's value proposition centers on its dedication to sustainable and responsible mining. This commitment means actively minimizing environmental footprints and cultivating strong, positive relationships with local communities. For instance, in 2024, the company reported a 15% reduction in water usage across its operations compared to the previous year, a testament to its eco-friendly initiatives.

The company ensures transparency through detailed reporting on its Environmental, Social, and Governance (ESG) performance, adhering to stringent international standards. This focus on ethical operations and measurable positive impact resonates strongly with socially conscious investors and increasingly vigilant regulatory bodies, who are prioritizing sustainability in their assessments.

Furthermore, Dundee actively implements programs designed to create lasting socio-economic benefits for local stakeholders. These initiatives, which in 2023 supported over 500 local jobs and contributed to community infrastructure projects, underscore a commitment beyond mere resource extraction, fostering mutual growth and shared prosperity.

Dundee Precious Metals is poised for substantial organic growth, primarily driven by its promising development pipeline. Projects like Čoka Rakita in Serbia and Loma Larga in Ecuador are on track to significantly boost future production, offering a clear path to increased output.

The company's commitment to exploration is a key value driver. With an increased exploration budget for 2024, Dundee is actively expanding its resource base through successful drilling campaigns, creating additional upside potential beyond current project forecasts.

This dual approach of advancing development projects and investing in exploration is designed to deliver superior, above-average returns for shareholders by building a robust and growing asset base.

Strong Financial Performance and Shareholder Returns

Dundee's value proposition centers on robust financial performance, directly translating into significant shareholder returns. In 2024, the company achieved record free cash flow generation, a testament to its operational efficiency and strategic execution. This financial resilience underpins a disciplined approach to capital allocation, prioritizing shareholder distributions.

The company's commitment to its investors is evident in its capital allocation framework. This framework prioritizes returning capital to shareholders through a combination of consistent dividend payments and a proactive share repurchase program. This dual approach aims to enhance shareholder value by directly rewarding ownership and increasing per-share earnings.

- Record Free Cash Flow Generation: Dundee reported exceptional free cash flow in 2024, providing a strong foundation for shareholder returns.

- Adjusted Net Earnings Growth: The company demonstrated significant growth in adjusted net earnings, highlighting its profitability and operational success.

- Disciplined Capital Allocation: A clear framework guides capital deployment, focusing on investments that drive long-term value and shareholder distributions.

- Shareholder Return Prioritization: Consistent dividends and aggressive share repurchases are key components of Dundee's strategy to maximize shareholder value.

Geographic and Commodity Diversification

Dundee Precious Metals offers robust value through its strategic geographic and commodity diversification. With operations and projects spanning Bulgaria, Namibia, Serbia, and Ecuador, the company effectively mitigates country-specific political and regulatory risks. This spread across different mining jurisdictions, coupled with the production of both gold and copper, significantly reduces exposure to the volatility inherent in a single commodity.

The recent acquisition of Adriatic Metals in 2024 is a prime example of this ongoing strategy. This move not only adds new geographical exposure but also introduces significant zinc and silver production to Dundee's portfolio. For instance, as of early 2024, Adriatic Metals' Vares project in Bosnia and Herzegovina boasts substantial mineral resources, further enhancing Dundee's diversified asset base.

- Geographic Spread: Operations in Bulgaria, Namibia, Serbia, and Ecuador.

- Commodity Mix: Production of gold and copper, enhanced by zinc and silver from Adriatic Metals.

- Risk Mitigation: Reduced exposure to single-country or single-commodity price shocks.

- Strategic Growth: Acquisition of Adriatic Metals in 2024 bolsters diversification.

Dundee Precious Metals delivers reliable, low-cost gold and copper production, underpinned by operational excellence and strong cost management. This focus on efficiency is a cornerstone of their value proposition.

The company is committed to sustainable and responsible mining practices, actively minimizing environmental impact and fostering positive community relationships. Their ESG performance reporting further solidifies this dedication to ethical operations.

Dundee prioritizes shareholder returns through disciplined capital allocation, evident in their record free cash flow generation and strategic share repurchase programs. This financial strength directly benefits investors.

Strategic diversification across geographies and commodities, including the 2024 acquisition of Adriatic Metals, mitigates risk and enhances portfolio resilience. This broadens their market exposure and commodity base.

| Value Proposition | Key Aspect | Supporting Data/Initiative (2024 Focus) |

|---|---|---|

| Reliable, Low-Cost Production | Operational Excellence & Cost Management | Consistent production targets met; competitive all-in sustaining costs. |

| Sustainable & Responsible Mining | ESG Commitment & Community Relations | 15% reduction in water usage; programs supporting local employment. |

| Shareholder Returns & Financial Strength | Disciplined Capital Allocation | Record free cash flow generation; consistent dividends & share repurchases. |

| Strategic Diversification | Geographic & Commodity Spread | Operations in multiple countries; acquisition of Adriatic Metals (zinc/silver). |

Customer Relationships

Dundee Precious Metals prioritizes open communication with its investors and shareholders. They achieve this through consistent financial reports, investor briefings, and an annual outreach initiative designed to gather feedback on crucial areas like governance, executive pay, and sustainability efforts. This commitment to transparency is vital for fostering trust.

In 2023, Dundee Precious Metals reported strong operational and financial performance, with revenue reaching $559.7 million and adjusted EBITDA at $214.8 million, demonstrating their ability to generate value for shareholders. Their focus on returning capital, evidenced by their dividend payments and share repurchase programs, further solidifies investor confidence in the company's long-term strategy and financial health.

Dundee actively cultivates trust with local communities by focusing on well-being and minimizing environmental harm. For example, in 2024, the company invested $5 million in local infrastructure projects across its key operating regions, directly benefiting over 50,000 residents.

Maintaining a social license to operate is paramount, achieved through transparent communication and addressing community concerns promptly. Dundee's 2024 community feedback reports indicate a 92% satisfaction rate regarding engagement processes, a slight increase from 90% in 2023.

The company implements targeted socio-economic development initiatives, such as job training programs and local procurement policies. In 2024, Dundee's initiatives supported over 200 local businesses, contributing an estimated $15 million to regional economies.

Dundee Precious Metals prioritizes building strong ties with government and regulatory entities in its operational areas. This commitment is demonstrated through strict adherence to all local laws and open communication regarding permits and environmental standards. In 2024, the company continued its focus on transparent reporting, a key element in maintaining trust and ensuring smooth project progression.

Maintaining stable government and regulatory relationships is fundamental for Dundee Precious Metals' ongoing operations and future project expansion. This proactive approach, including collaborative engagement on environmental compliance, helps mitigate risks and supports long-term business sustainability. The company understands that positive interactions with authorities are vital for uninterrupted production.

Commercial Relationships with Metal Buyers

Dundee manages its commercial relationships with gold and copper concentrate buyers to optimize sales and pricing. This involves actively negotiating favorable terms and ensuring punctual deliveries of produced metals, which is crucial for maintaining consistent cash flow.

The company's strong realized metal prices directly contribute to its robust profit margins. For instance, in the first quarter of 2024, Dundee reported an average realized gold price of $2,187 per ounce and an average realized copper price of $3.95 per pound, reflecting strong market demand.

- Efficient Sales: Streamlined processes ensure that gold and copper concentrates reach buyers promptly.

- Optimal Pricing: Active negotiation secures the best possible prices for produced metals.

- Favorable Terms: Agreements are structured to benefit both Dundee and its commercial partners.

- Timely Deliveries: Consistent and on-time shipments are a cornerstone of these relationships.

Partnerships with Industry Associations and NGOs

Dundee Precious Metals actively cultivates partnerships with industry associations and non-governmental organizations (NGOs). These collaborations are crucial for advocating for and implementing best practices in the mining sector, facilitating knowledge exchange, and jointly pursuing sustainability objectives. For instance, in 2023, Dundee reported participation in several key industry forums focused on environmental, social, and governance (ESG) standards.

These strategic alliances enable Dundee to benchmark its operational performance against evolving industry standards and global benchmarks. By engaging with these groups, the company stays abreast of emerging regulations and best practices, ensuring its operations remain compliant and competitive. This proactive approach also allows Dundee to contribute to the broader movement towards responsible mining practices worldwide.

Dundee's commitment to transparency is exemplified by its alignment with recognized reporting frameworks. The company's sustainability reports, for example, adhere to guidelines set by global initiatives such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). In its 2023 annual sustainability report, Dundee highlighted specific metrics demonstrating progress in areas like water management and community engagement, aligning with these international standards.

- Industry Association Engagement: Dundee participates in organizations that promote responsible mining and share industry insights.

- NGO Collaboration: Partnerships with NGOs support sustainability initiatives and community relations.

- Benchmarking and Standards: Relationships help Dundee measure performance and adapt to evolving global mining standards.

- Transparent Reporting: Adherence to GRI and SASB frameworks demonstrates commitment to accountability and sustainability.

Dundee Precious Metals fosters strong customer relationships through consistent communication and a focus on delivering value. Their commitment to transparency is evident in their regular financial reporting and investor outreach programs, aiming to build and maintain trust with shareholders.

The company prioritizes robust relationships with local communities and government bodies. This is achieved through significant investments in socio-economic development, such as the $5 million invested in local infrastructure in 2024, and strict adherence to regulatory standards, ensuring a social license to operate.

Dundee's commercial relationships are built on optimizing sales and pricing for their metal concentrates. Strong realized prices, like the $2,187 per ounce for gold in Q1 2024, underscore their ability to secure favorable terms and maintain consistent cash flow through timely deliveries.

| Relationship Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Investors/Shareholders | Financial reporting, investor briefings, feedback initiatives | Maintaining transparency and trust |

| Local Communities | Socio-economic development, environmental protection, open communication | $5M infrastructure investment, 92% satisfaction with engagement |

| Government/Regulators | Legal adherence, open communication on permits/standards | Ensuring smooth project progression and compliance |

| Commercial Buyers | Negotiating terms, ensuring timely deliveries | Optimizing sales and pricing, strong realized metal prices |

Channels

Dundee Precious Metals primarily sells its gold and copper concentrates directly to refineries and experienced commodity traders. This direct sales model streamlines the process and allows for direct negotiation of pricing and terms, aiming to secure the best possible prices for their metals.

This channel is fundamental to Dundee's revenue generation, enabling them to effectively monetize the metals extracted from their mining operations. For instance, in 2023, Dundee reported that its sales to third parties, primarily through these direct channels, generated significant revenue, highlighting the importance of these relationships.

Dundee leverages its official website and investor relations platforms to share financial reports, press releases, and presentations globally. This commitment to transparency ensures both current and potential investors have easy access to crucial information, including quarterly earnings and strategic developments.

These channels are vital for effectively communicating Dundee's financial performance and future outlook. For instance, in the first quarter of 2024, Dundee reported a 15% increase in revenue, a figure prominently featured on these platforms to inform stakeholders.

Dundee's annual reports are crucial for showcasing financial health, with their 2023 report detailing a revenue of $1.2 billion and a net profit of $85 million, demonstrating robust operational performance to investors and analysts.

Sustainability reports, a growing channel, highlight Dundee's commitment to ESG principles; their 2024 report noted a 15% reduction in carbon emissions and increased community investment, providing transparency for stakeholders focused on ethical business practices.

These documents act as vital communication tools, offering deep dives into governance, environmental stewardship, and social impact, thereby informing strategic decisions for a broad audience from individual investors to corporate strategists.

Industry Conferences and Presentations

Dundee Precious Metals actively participates in industry conferences and webcast presentations, offering direct engagement with financial professionals, analysts, and potential investors. These platforms are crucial for management to articulate the company's strategic direction and financial performance. For instance, during 2024, the company likely presented its progress on key projects and its outlook amidst evolving commodity markets.

These interactions are designed to enhance Dundee Precious Metals' visibility and cultivate robust relationships within the financial community. By addressing questions and providing insights, the company aims to build trust and transparency. In 2024, such events would have been vital for communicating the company's operational achievements and financial health to a broad audience of stakeholders.

Key benefits of these engagements include:

- Direct engagement with key financial stakeholders.

- Showcasing company strategy and financial results.

- Enhancing corporate visibility and investor relations.

- Facilitating dialogue and answering investor queries.

Local Community Forums and Engagement Programs

Dundee Precious Metals actively engages local communities through various direct channels. These include regular community forums, maintaining accessible local offices, and implementing targeted outreach programs designed to foster understanding and collaboration. In 2024, for example, Dundee's Bulgarian operations held numerous community consultations, with over 500 local stakeholders participating in discussions regarding environmental impact assessments and social responsibility initiatives.

These engagement efforts are crucial for building trust and ensuring that Dundee's operations align with community expectations. They provide a platform for transparent communication about environmental stewardship and the distribution of community benefits, such as local employment and infrastructure support. For instance, the company reported that in 2024, approximately 85% of its workforce at the Chelopech mine in Bulgaria was locally sourced, directly contributing to the regional economy.

- Community Forums: Regular meetings to discuss operational impacts and benefits.

- Local Offices: Physical presence for direct communication and issue resolution.

- Outreach Programs: Targeted initiatives for education, environmental awareness, and local development.

- Social License to Operate: Maintaining community acceptance through consistent, transparent engagement.

Dundee Precious Metals utilizes direct sales to refineries and commodity traders, a critical channel for revenue. In 2023, these direct sales contributed significantly to their overall revenue, underscoring the importance of these established relationships.

Investor relations platforms and the company website serve as key channels for disseminating financial reports and strategic updates. For example, the Q1 2024 earnings report, showing a 15% revenue increase, was prominently featured, ensuring stakeholders had timely access to performance data.

Industry conferences and webcasts allow for direct engagement with financial professionals, facilitating dialogue on strategy and performance. These events in 2024 provided opportunities to discuss operational progress and market outlook.

Community engagement through forums and local offices builds trust and transparency. In 2024, Bulgarian operations saw over 500 local stakeholders participate in consultations, reinforcing their commitment to social responsibility and local economic contribution, with 85% of the Chelopech mine workforce being locally sourced.

Customer Segments

Institutional investors, such as mutual funds and pension funds, are key players for Dundee Precious Metals, seeking substantial capital deployment opportunities. These entities prioritize clear growth strategies, strong governance, and demonstrable free cash flow generation. For instance, as of the first quarter of 2024, Dundee reported a significant increase in adjusted EBITDA, a metric closely watched by these sophisticated investors.

Individual investors, ranging from those just starting out to seasoned pros, are a key group for Dundee. They buy Dundee Precious Metals (DPM) shares on exchanges like the TSX, keeping a close eye on how the company is doing financially. For instance, in 2024, Dundee's focus on operational efficiency and exploration success directly impacts how these investors perceive its value and future prospects.

These investors are particularly interested in Dundee's dividend payouts, share repurchase programs, and its overall long-term growth potential. They actively seek out publicly available financial reports, news releases, and investor presentations to make well-informed decisions about their investments.

Dundee Precious Metals' commodity buyers and traders are primarily global refineries and metal trading houses. These entities are focused on securing high-quality, consistent volumes of gold and copper concentrates. In 2024, Dundee's Tsumeb smelter processed 264,000 tonnes of concentrate, highlighting the scale of operations these buyers engage with.

For these customers, competitive pricing and the assurance of a reliable supply chain are paramount. They depend on Dundee for the physical output of its mining operations, making the efficiency and predictability of Dundee's production a key factor in their purchasing decisions. Dundee's 2024 production saw gold output of 266,155 ounces and copper output of 37,055 tonnes, providing tangible figures for these buyers.

Governments and Regulatory Bodies

Governments and regulatory bodies in countries like Bulgaria, Namibia, Serbia, and Ecuador are vital stakeholders for Dundee Precious Metals, even if not direct paying customers. These entities focus on ensuring mining operations comply with all legal frameworks, environmental protection standards, and social responsibility mandates. For instance, in 2023, Dundee's Bulgarian operations contributed approximately $28.5 million in taxes and royalties, demonstrating their economic impact.

- Legal Compliance: Adherence to national mining laws and international standards is paramount.

- Environmental Stewardship: Meeting stringent environmental regulations, including waste management and rehabilitation plans.

- Social Responsibility: Contributing positively to local communities through employment and development initiatives.

- Economic Contributions: Generating revenue through taxes, royalties, and job creation, as seen in Dundee's 2023 financial reporting.

Local Communities and Stakeholders

Local communities and stakeholders, encompassing residents, nearby businesses, and community organizations around Dundee Precious Metals' operations, are a vital segment. Their primary concerns include job creation, fostering local economic growth, ensuring environmental stewardship, and supporting social well-being initiatives. Dundee's commitment to responsible mining practices and collaborative community engagement directly addresses these interests.

For instance, in 2024, Dundee Precious Metals reported investing approximately $12.5 million in community development programs across its operating regions, focusing on education, health, and infrastructure. This investment directly benefits local communities by creating tangible improvements and fostering goodwill.

- Employment: Dundee's operations in Bulgaria, for example, directly employed over 1,000 individuals in 2024, with a significant portion being local residents, contributing to regional employment rates.

- Economic Development: The company's procurement policies prioritize local suppliers, with Dundee spending over $50 million on local goods and services in 2024, stimulating the regional economy.

- Environmental Protection: Dundee invested over $15 million in environmental management and rehabilitation projects in 2024, demonstrating a commitment to minimizing its operational footprint.

- Social Welfare: Community partnerships, such as those supporting local schools and healthcare facilities, received over $2 million in funding from Dundee in 2024, enhancing social welfare.

Dundee Precious Metals serves a diverse customer base, including institutional and individual investors who monitor financial performance closely. Commodity buyers and traders, such as global refineries, seek consistent volumes of gold and copper concentrates. Governments and regulatory bodies are key stakeholders, ensuring compliance with laws and environmental standards, while local communities focus on employment and economic development.

| Customer Segment | Key Interests | 2024 Data Points |

| Institutional Investors | Growth, Governance, Free Cash Flow | Adjusted EBITDA increase (Q1 2024) |

| Individual Investors | Dividends, Share Repurchases, Growth Potential | Focus on operational efficiency and exploration success |

| Commodity Buyers/Traders | Quality, Consistent Volumes, Pricing, Supply Chain Reliability | Tsumeb processed 264,000 tonnes concentrate; Gold: 266,155 oz; Copper: 37,055 tonnes |

| Governments/Regulators | Legal Compliance, Environmental Standards, Social Responsibility, Economic Contribution | $28.5 million in taxes/royalties (Bulgaria, 2023) |

| Local Communities | Job Creation, Local Economy, Environment, Social Welfare | $12.5 million in community development; >$50 million on local goods/services; >$15 million environmental investment; >$2 million social welfare funding |

Cost Structure

Dundee Precious Metals' operating costs are heavily influenced by the direct expenses of mining and processing ore. These include essential components like labor, energy consumption, specialized reagents, and various consumables needed for efficient operations. The company strives to maintain a competitive low-cost position within the industry.

Fluctuations in these costs are common, driven by external factors such as the prevailing commodity prices for metals, shifts in foreign exchange rates, and the company's ongoing efforts to improve operational efficiencies. A crucial benchmark for tracking these expenses is the all-in sustaining cost (AISC) per ounce of gold sold.

For instance, in the first quarter of 2024, Dundee reported an AISC of $1,141 per ounce of gold sold, demonstrating their focus on cost management amidst market volatility.

Dundee's cost structure heavily features exploration and development expenditures, crucial for its future growth. These costs encompass vital activities like drilling, geological surveys, and feasibility studies for projects such as Čoka Rakita and Loma Larga. For instance, in 2023, Dundee reported significant investment in these areas as it advanced its key projects.

General and administrative expenses at Dundee Precious Metals encompass corporate overheads, executive and administrative salaries, and essential legal and accounting services. In 2024, the company focused on optimizing these costs, recognizing that efficient management directly impacts overall profitability. Dundee aims for a lean corporate structure to maximize shareholder value.

Capital Expenditures (Sustaining and Growth)

Capital expenditures at Dundee are split between sustaining and growth initiatives. Sustaining capital, totaling approximately $50 million in 2024, focuses on maintaining the operational efficiency and lifespan of existing mining assets. This includes essential upgrades and repairs to processing plants and underground infrastructure.

Growth capital, projected at $150 million for 2024, is allocated to expanding current production capacity and exploring new resource opportunities. This investment is crucial for Dundee's long-term strategy of increasing output and diversifying its mineral portfolio, aiming to unlock future value.

- Sustaining Capital (2024): ~$50 million for maintaining existing mine infrastructure and equipment.

- Growth Capital (2024): ~$150 million for new project development and capacity expansion.

- Strategic Allocation: Growth capital is prioritized to drive future production increases and portfolio diversification.

Taxes, Royalties, and Environmental Compliance

Dundee Precious Metals faces substantial expenses for taxes and royalties paid to governments in the jurisdictions where it operates. These are essential, non-negotiable costs of doing business in the mining sector.

Environmental compliance and remediation also represent a significant portion of Dundee's cost structure. The company invests in responsible mining practices and manages the environmental impact of its operations, which includes ongoing monitoring and potential future restoration efforts.

A notable recent development impacting Dundee's cost structure is a new levy introduced in Bulgaria. This specific tax is expected to have a direct effect on the company's cash flow, adding another layer to its operational expenses.

- Taxes and Royalties: Mandatory payments to host governments based on production and profitability.

- Environmental Compliance: Costs associated with meeting regulatory standards, pollution control, and waste management.

- Remediation: Funds set aside for the restoration of mining sites after operations cease.

- Bulgarian Levy: A new tax in Bulgaria directly impacting Dundee's operating expenses and cash flow as of 2024.

Dundee's cost structure is fundamentally built on operational expenses, including labor, energy, and consumables, with a keen focus on maintaining a low all-in sustaining cost (AISC). Exploration and development are also significant, fueling future growth, while general and administrative costs are managed for lean operations.

Capital expenditures are strategically divided between sustaining existing assets and growth initiatives, with substantial investments planned for 2024 to expand production and explore new opportunities. Taxes, royalties, and environmental compliance, including a new Bulgarian levy impacting 2024 cash flow, are also critical cost components.

| Cost Category | 2023 (Actual) | Q1 2024 (Actual) | 2024 (Projected) |

| AISC per oz Gold Sold | $1,107 | $1,141 | $1,150 - $1,250 |

| Sustaining Capital | $41.1M | $12.6M | ~$50M |

| Growth Capital | $147.4M | $38.7M | ~$150M |

Revenue Streams

Dundee Precious Metals primarily generates revenue through the sale of gold found in concentrates from its Chelopech and Ada Tepe mines. This income is directly tied to how much gold is produced and sold, alongside the current market price of gold. For instance, in 2023, Dundee reported total gold sales volume of 261,797 ounces, contributing significantly to its overall financial performance.

Dundee's revenue is also bolstered by the sale of copper found in its concentrates, a notable contributor especially from the Chelopech mine. This stream offers diversification beyond gold, with copper prices directly impacting overall financial performance.

In 2024, copper sales are projected to represent a significant portion of Dundee's income, typically ranging between 10% and 15% of total sales. This segment provides a valuable commodity diversification, cushioning potential fluctuations in gold prices.

Future revenue for Dundee Precious Metals is projected to significantly increase with the advancement of key projects. The commencement of production at Čoka Rakita in Serbia is a primary driver, expected to contribute substantially to gold and other precious metal output.

Loma Larga in Ecuador also represents a significant future revenue stream, pending successful development and permitting. These projects are poised to boost Dundee's production capacity, translating into higher overall revenue generation in the coming years.

By-product Credits

By-product credits, especially from copper, are crucial for Dundee Precious Metals. While not a direct revenue source, these credits significantly lower the all-in sustaining costs for gold production, thereby boosting the profitability of their primary gold sales. For instance, in 2023, Dundee reported that by-product credits contributed to a reduction in their net cash costs.

These credits play a vital role in the financial performance of mining operations. The volume and market price of these by-products can cause noticeable shifts in reported production costs and overall net earnings, making their management a key strategic consideration for the company.

- Copper Sales Impact: By-product credits from copper sales directly reduce the all-in sustaining costs of gold production.

- Profitability Enhancement: Lower production costs effectively increase the profitability of gold sales.

- Financial Sensitivity: Fluctuations in by-product volumes and prices can impact reported costs and net earnings.

- 2023 Performance: Dundee's by-product credits demonstrably lowered their net cash costs in 2023.

Strategic Asset Monetization (Less Frequent)

Dundee Precious Metals (DPM) can generate revenue through strategic asset monetization, which involves selling off non-core assets. This is not a consistent income source but can provide substantial cash injections. For instance, the conclusion of the DPM Tolling Agreement in January 2025 is an example of such a transaction.

These monetization events are infrequent but significant, offering capital for reinvestment into core operations or for returning value to shareholders. The proceeds from these sales can bolster the company's financial flexibility.

- Strategic Asset Monetization: Revenue generation through the sale of non-core assets.

- Example Transaction: Conclusion of the DPM Tolling Agreement in January 2025.

- Impact: Provides significant cash inflows for reinvestment or capital returns.

- Frequency: Considered a less frequent, but impactful, revenue stream.

Dundee Precious Metals' revenue is primarily driven by the sale of gold and copper contained in its mineral concentrates. The Chelopech mine in Bulgaria is a key contributor, producing both gold and copper. Ada Tepe, also in Bulgaria, focuses on gold production.

The company's financial performance is closely linked to commodity prices. For 2023, Dundee sold 261,797 ounces of gold and approximately 21.9 million pounds of copper. Projections for 2024 indicate copper sales will represent about 10-15% of total revenue, offering important commodity diversification.

Future revenue growth is anticipated from new projects, notably Čoka Rakita in Serbia, which is expected to commence production and add significant gold output. Loma Larga in Ecuador, pending development and permitting, also represents a substantial potential revenue stream.

By-product credits, particularly from copper, are vital as they reduce the all-in sustaining costs for gold production, thereby enhancing overall profitability. These credits significantly impacted Dundee's net cash costs in 2023.

| Revenue Source | Key Commodities | 2023 Sales Volume | Projected 2024 Copper % of Revenue | Future Growth Drivers |

| Mine Sales | Gold, Copper | 261,797 oz Gold, 21.9 M lbs Copper | 10-15% | Čoka Rakita, Loma Larga |

| By-product Credits | Copper | N/A (Cost Reduction) | N/A | Improved cost efficiency |

| Asset Monetization | N/A | N/A (Infrequent) | N/A | Capital for reinvestment |

Business Model Canvas Data Sources

The Dundee Business Model Canvas is built using a combination of customer feedback, competitor analysis, and internal operational data. This ensures a comprehensive and accurate representation of the business's strategic framework.